BlackRock is one of the largest investment management companies in the world boasting over $9 trillion in assets under management.

As a result, it’s responsible for many well-known brand names that we’ve all come to rely on.

However, exactly which brands are owned by BlackRock is a question that’s often asked. Some of the most notable brands under the BlackRock umbrella include iShares and Aladdin, to name just a few.

Each of these brands has a unique offering and caters to different customer needs and preferences.

Being backed by BlackRock means that these brands have the significant financial and operational resources needed to keep innovating and delivering high-quality services for the long term.

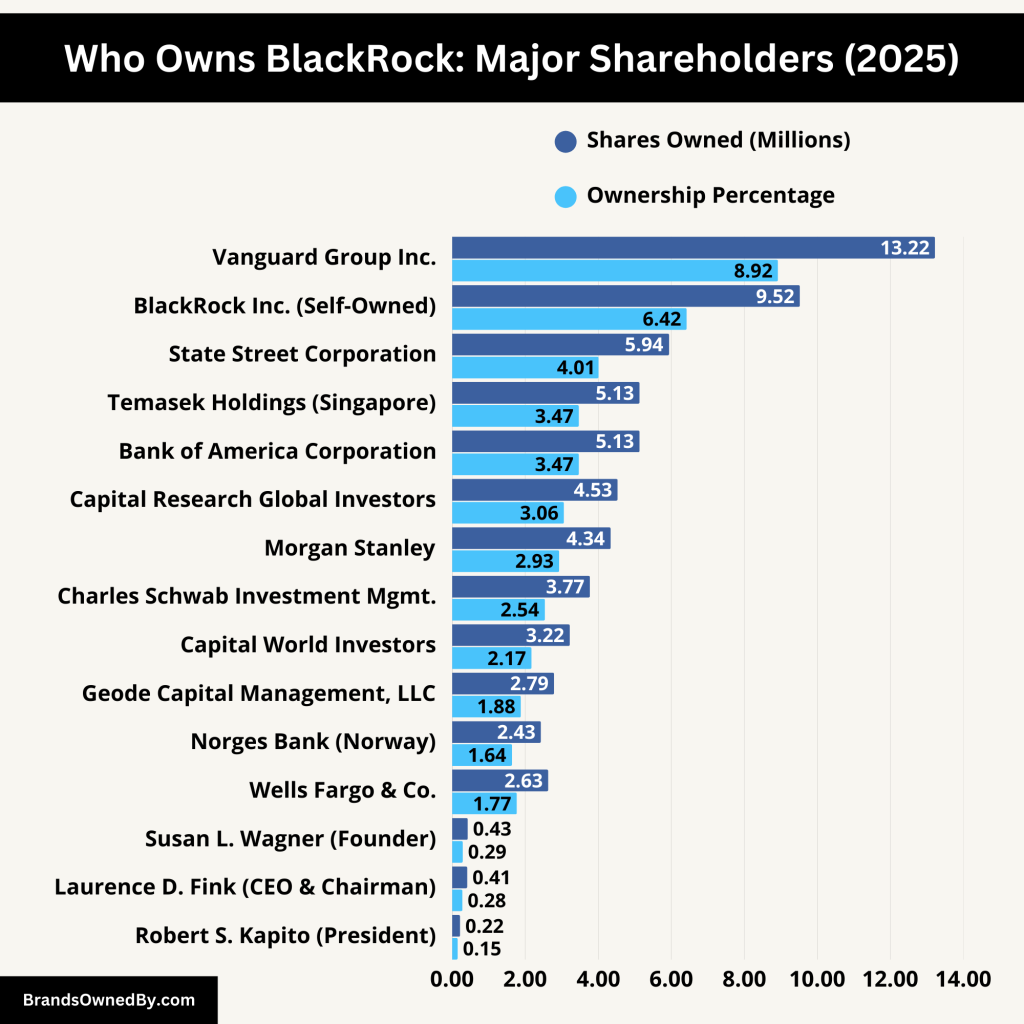

Who Owns BlackRock?

BlackRock is a publicly traded company, which means that its shares are owned by a wide range of investors around the world.

The largest shareholders in BlackRock include major institutional investors such as Vanguard Group Inc., State Street Corporation, and Fidelity Investments.

However, much of the ownership of BlackRock is dispersed among individuals and institutions, making it a truly global company.

Regardless of who owns BlackRock, the company has managed to maintain its position as a formidable player in the world of finance.

BlackRock was founded in 1988 by Laurence Fink, Robert S. Kapito, Susan Wagner, Ben Golub, and Ralph Schlosstein.

All five founders remain on the board of directors at BlackRock today. Additionally, the leadership team behind BlackRock is also impressive.

Which Companies are Owned by BlackRock?

Following is the list of companies and brands owned by BlackRock:

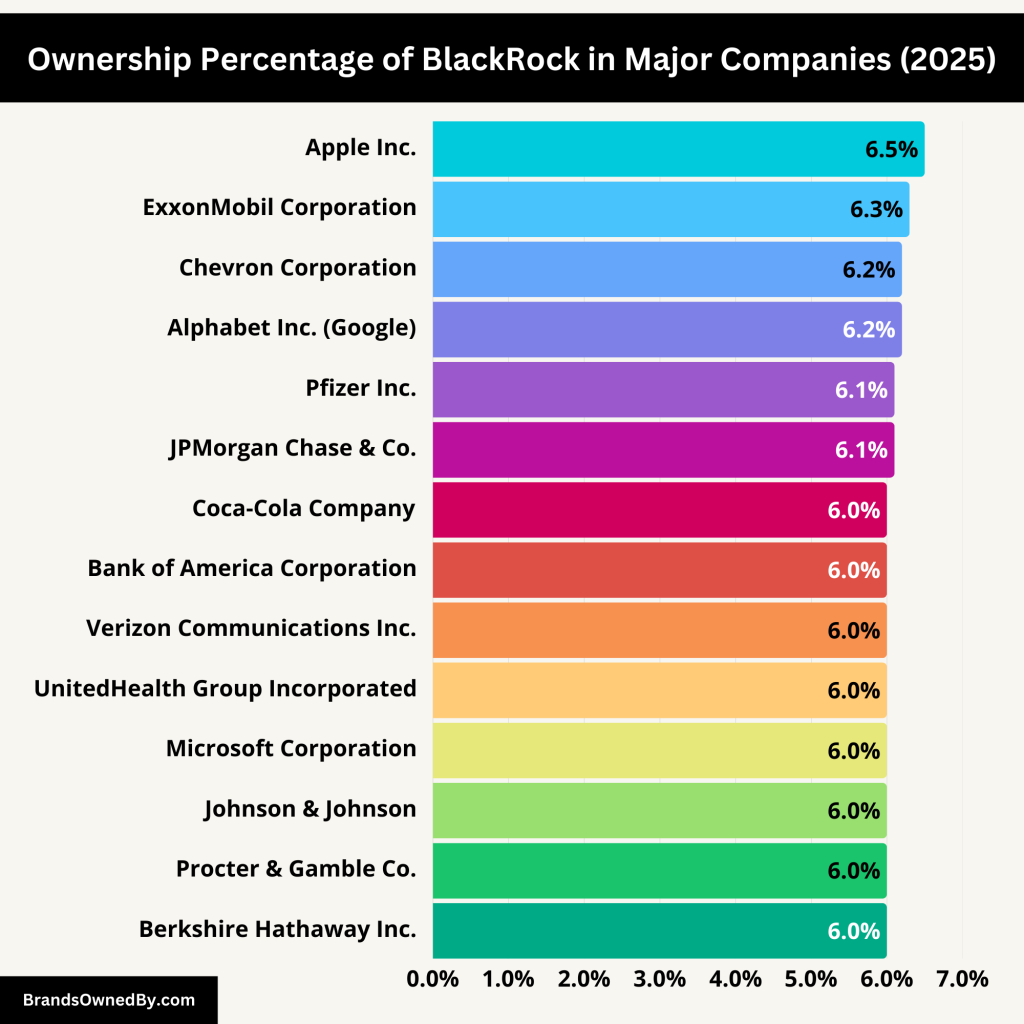

| Company Name | Industry | BlackRock’s Ownership Stake |

|---|---|---|

| Apple Inc. | Technology | ~6.5% |

| Microsoft Corporation | Technology | ~6.0% |

| Amazon.com Inc. | E-commerce/Retail | ~5.8% |

| Alphabet Inc. (Google) | Technology | ~6.2% |

| Tesla Inc. | Automotive/Energy | ~5.5% |

| Johnson & Johnson | Healthcare | ~6.0% |

| ExxonMobil Corporation | Energy | ~6.3% |

| JPMorgan Chase & Co. | Financial Services | ~6.1% |

| Visa Inc. | Financial Services | ~5.9% |

| Procter & Gamble Co. | Consumer Goods | ~6.0% |

| Walmart Inc. | Retail | ~5.7% |

| Berkshire Hathaway Inc. | Conglomerate | ~6.0% |

| Facebook (Meta Platforms Inc.) | Technology | ~5.8% |

| NVIDIA Corporation | Technology | ~5.6% |

| Pfizer Inc. | Healthcare | ~6.1% |

| Coca-Cola Company | Beverages | ~6.0% |

| PepsiCo Inc. | Beverages | ~5.9% |

| Netflix Inc. | Entertainment | ~5.5% |

| Intel Corporation | Technology | ~5.8% |

| Chevron Corporation | Energy | ~6.2% |

| Bank of America Corporation | Financial Services | ~6.0% |

| Mastercard Incorporated | Financial Services | ~5.9% |

| Walt Disney Company | Entertainment | ~5.7% |

| Home Depot Inc. | Retail | ~5.8% |

| McDonald’s Corporation | Food & Beverage | ~5.9% |

| Nike Inc. | Apparel | ~5.7% |

| Verizon Communications Inc. | Telecommunications | ~6.0% |

| AT&T Inc. | Telecommunications | ~5.8% |

| Comcast Corporation | Telecommunications | ~5.9% |

| Oracle Corporation | Technology | ~5.7% |

| Adobe Inc. | Technology | ~5.6% |

| Salesforce Inc. | Technology | ~5.5% |

| Boeing Company | Aerospace | ~5.8% |

| Lockheed Martin Corporation | Aerospace/Defense | ~5.9% |

| General Electric Company | Conglomerate | ~5.7% |

| Ford Motor Company | Automotive | ~5.6% |

| General Motors Company | Automotive | ~5.5% |

| Starbucks Corporation | Food & Beverage | ~5.8% |

| Costco Wholesale Corporation | Retail | ~5.7% |

| Target Corporation | Retail | ~5.6% |

| UnitedHealth Group Incorporated | Healthcare | ~6.0% |

| Abbott Laboratories | Healthcare | ~5.8% |

| Merck & Co. Inc. | Healthcare | ~5.9% |

| Bristol-Myers Squibb Company | Healthcare | ~5.7% |

| Caterpillar Inc. | Industrial | ~5.8% |

| 3M Company | Conglomerate | ~5.7% |

| Honeywell International Inc. | Conglomerate | ~5.8% |

| IBM Corporation | Technology | ~5.6% |

| Qualcomm Incorporated | Technology | ~5.5% |

| Texas Instruments Incorporated | Technology | ~5.7% |

1. iShares

iShares is one of the largest and most well-known companies owned by BlackRock.

The company specializes in providing exchange-traded funds (ETFs), which are baskets of securities and investments that can be traded on the stock market.

ETFs provide investors access to a wide range of markets, including stocks, bonds, commodities, and more. iShares products are available in over 100 countries and offer investors a range of investment strategies.

The company also offers stock analysis tools, portfolio management software, and other services to help investors make informed decisions about their investments.

2. Bank of America Merrill Lynch Global Research

Bank of America Merrill Lynch Global Research is a research and advisory institution that provides in-depth analysis and insights on both U.S. and international markets.

It’s owned by BlackRock, which provides the firm with access to its robust financial resources. Bank of America Merrill Lynch Global Research produces daily investment reports as well as long-term forecasts of economic and market data.

Its analysts offer strategic advice to investors on portfolio construction, asset allocation, and risk management.

The firm’s research is used by financial advisors, institutions, and retail customers.

3. Barclays Global Investors

Barclays Global Investors is a leading global asset manager owned by BlackRock.

The company offers a range of products and services to institutional investors, including mutual funds, exchange-traded funds (ETFs), hedge funds, private equity, and other investment vehicles.

Barclays Global Investors also offers financial advisory services to institutions on building diversified portfolios.

It provides research and analysis on capital markets, economic trends, and asset allocation.

The company is based in San Francisco, California, but has offices all over the world.

4. BGI Capital Corporation

BGI Capital Corporation is a wholly-owned subsidiary of BlackRock, Inc.

It specializes in providing financial and investment advice to institutional clients such as pension funds, endowments, foundations, corporations, and other large investors.

The company offers a range of products and services, including capital market research and analysis, portfolio construction, and management consulting.

BGI Capital Corporation also serves as an advisor on alternative investments, such as private equity and venture capital funds.

The company is headquartered in New York City.

5. Blackstone Group LP

Blackstone Group LP is a leading global private equity firm owned by BlackRock.

The company focuses on investments in real estate, infrastructure, and other alternative asset classes.

It seeks to invest in undervalued companies that have the potential for growth.

Blackstone has invested over $200 billion across its various business segments since its inception in 1985.

In addition to investing, the firm also provides financial, advisory, and asset management services.

The company is headquartered in New York City and has offices across the world.

6. Citigroup Asset Management

Citigroup Asset Management is a division of Citigroup Inc. and is owned by BlackRock, Inc.

The company provides asset management and investment advisory services to individuals, corporations, pension funds, endowments, foundations, and other large institutional investors.

Its products include mutual funds, ETFs, hedge funds, and private equity investments.

It also offers portfolio construction services as well as risk management and financial planning services.

Citigroup Asset Management is headquartered in New York City and has offices around the world.

7. Columbia Threadneedle Investments

Columbia Threadneedle Investments is a global asset management firm owned by BlackRock, Inc.

The company provides investment services to individuals, institutions, pension funds, and other financial organizations.

It offers an array of products including mutual funds, ETFs, stocks, and bonds as well as alternative investments such as hedge funds and private equity.

In addition to providing asset management services, it also provides risk management, financial planning, and research services.

Columbia Threadneedle Investments is headquartered in Minneapolis, Minnesota, and has offices across the world.

8. Goldman Sachs Asset Management

Goldman Sachs Asset Management is a division of the multinational investment banking firm, Goldman Sachs.

It was acquired by BlackRock in 2009 and provides asset management services to individuals, corporations, pension funds, endowments, foundations, and other large institutional investors.

Its products include mutual funds, ETFs, stocks, and bonds as well as alternative investments such as hedge funds and private equity.

Goldman Sachs Asset Management also provides risk management, financial planning, and research services. It is headquartered in New York City and has offices around the world.

9. Morgan Stanley Investment Management

Morgan Stanley Investment Management is a subsidiary of the financial services firm Morgan Stanley.

It was acquired by BlackRock in 2009 and provides asset management services to individuals, corporations, pension funds, and other institutions.

Its products include mutual funds, ETFs, stocks, and bonds as well as alternative investments such as hedge funds and private equity.

In addition to providing asset management services, it also provides risk management, financial planning, and research services.

It is headquartered in New York City and has offices across the world.

10. State Street Global Advisors

State Street Global Advisors (SSGA) is an American asset management firm and a subsidiary of State Street Corporation.

It was acquired by BlackRock in 2009 and offers asset management services to individuals, corporations, pension funds, endowments, and other institutional investors.

Its products include mutual funds, ETFs, stocks, and bonds as well as alternative investments such as hedge funds and private equity.

It provides risk management, financial planning, and research services.

It is headquartered in Boston, Massachusetts, and has offices around the world.

11. BlackRock Solutions

BlackRock Solutions is a subsidiary of BlackRock and provides risk management and financial services to corporate, government, and institutional clients.

It was established in 2008 and offers its services in the areas of analytics, performance measurement, portfolio construction, risk management, transaction processing, and technology.

It also provides research on economic trends and quantitative methods for asset allocation. It is headquartered in New York City and has offices around the world.

12. Scalable Capital

Scalable Capital is an online investment service provider and a subsidiary of BlackRock.

It was acquired in 2020 and provides its services to retail investors.

Its products include mutual funds, ETFs, and stocks as well as alternative investments such as hedge funds and private equity.

Its services include portfolio management, risk management, financial planning and research. It is headquartered in Munich, Germany, and has offices in the United Kingdom.

13. eFront

eFront is a subsidiary of BlackRock and provides software solutions for the alternative investments industry.

It was established in 1999 and offers its services in the areas of risk analysis, portfolio management, investor reporting, compliance, due diligence, and transaction processing.

It also provides research on economic trends and quantitative methods for asset allocation. It is headquartered in Paris, France, and has offices around the world.

14. RiskFirst

RiskFirst is a subsidiary of BlackRock and provides risk management and analytics solutions for the financial services industry.

It was established in 2008 and offers its services in the areas of portfolio construction, performance measurement, risk analytics, stress testing, factor investing, and liquidity monitoring.

It also provides research on economic trends and quantitative methods for asset allocation.

It is headquartered in London, United Kingdom, and has offices in the United States, Europe, and Asia.

15. FutureAdvisor

FutureAdvisor is a financial technology company and a subsidiary of BlackRock.

It was acquired in 2015 and provides its services to retail investors.

Its products include mutual funds, ETFs, and stocks as well as alternative investments such as hedge funds and private equity.

Its services include portfolio management, risk management, financial planning and research.

16. AIMS Alternative Investments Solutions Group (AISG)

AISG is a subsidiary of BlackRock and provides software solutions for the alternative investments industry.

It was established in 2005 and offers its services in the areas of fund administration, investor relations, compliance, due diligence, portfolio management, and transaction processing.

It also provides research on economic trends and quantitative methods for asset allocation. It is headquartered in New York, United States, and has offices in the United States, Europe, and Asia.

17. BlackRock Investment Management LLC (BIM)

BIM is a subsidiary of BlackRock and provides investment management services to institutional clients.

It was established in 2008 and offers its services in the areas of portfolio construction, performance monitoring, risk analytics, stress testing, factor investing, and liquidity monitoring. It also provides research on economic trends and quantitative methods for asset allocation.

It is headquartered in New York, United States, and has offices in the United States, Europe, and Asia.

18. R3 Asset Management LLC (R3AM)

R3AM is a subsidiary of BlackRock and provides asset management services to institutional clients.

It was established in 2013 and offers its services in the areas of fund administration, portfolio management, risk management, compliance, due diligence, and transaction processing.

It also provides research on economic trends and quantitative methods for asset allocation. It is headquartered in New York, United States, and has offices in the United States, Europe, and Asia.

19. IndexIQ Advisors LLC (IQA)

IQA is a subsidiary of BlackRock and provides asset management services to institutional clients.

It was established in 2008 and offers its services in the areas of portfolio construction, performance monitoring, risk analytics, stress testing, factor investing, and liquidity monitoring.

It also provides research on economic trends and quantitative methods for asset allocation.

20. BNY Mellon Investment Management

BNY Mellon Investment Management is a subsidiary of BlackRock and provides asset management services to institutional clients.

It was established in 2008 and offers its services in the areas of portfolio construction, performance monitoring, risk analytics, stress testing, factor investing, and liquidity monitoring.

It also provides research on economic trends and quantitative methods for asset allocation.

21. Aladdin

Aladdin is a subsidiary of BlackRock and provides asset management services to institutional clients.

It was established in 2006 and offers its services in the areas of portfolio construction, performance monitoring, risk analytics, stress testing, factor investing, and liquidity monitoring.

It also provides research on economic trends and quantitative methods for asset allocation.

22. Apple Inc owner

BlackRock is not the owner of Apple Inc.

In fact, it is one of the biggest investors in the company, owning over 3% of the total outstanding shares, which amounts to tens of billions of dollars worth of stock.

It is an American multinational technology company headquartered in California, United States of America.

Founded on April 1, 1976, it has become one of the largest technological companies in the world with a market capitalization of over $2 trillion as of 2020.

Apple’s products include iPhone smartphones and associated software, Mac personal computers, iPad tablet computers, Apple Watch smartwatches, and Apple TV digital media players.

23. Google owner

BlackRock does not own Google either.

It is a multinational technology company that specializes in Internet-related services and products.

BlackRock owns roughly $5 billion worth of Google stock which accounts for 0.3% of the total outstanding shares.

Founded in 1998, Google is considered the most dominant search engine worldwide and one of the world’s most valuable companies with a market capitalization of over $1 trillion as of 2020.

It offers services such as web-based mapping, online video sharing, cloud storage, and email service.

24. Bank of America

BlackRock does own Bank of America. It is an American multinational investment bank and financial services company headquartered in Charlotte, North Carolina, United States.

Founded in 1898, Bank of America is a global banking and financial institution with over $2 trillion in assets.

BlackRock owns over 100 million shares of Bank of America which accounts for 2.3% of the total outstanding shares.

It provides retail and commercial banking, asset management, investment banking, and wealth management services to individual customers, small businesses, and large corporations.

25. Microsoft Corp

BlackRock does not own Microsoft either. It is a multinational technology company that specializes in computer software, consumer electronics, and personal computers.

Founded in 1975, Microsoft is the world’s largest software maker with a market capitalization of over $1 trillion as of 2020.

BlackRock owns approximately $6 billion worth of Microsoft stock which accounts for 0.3% of the total outstanding shares.

It provides services such as cloud computing, computer software development, video gaming, and search engine advertising.

When was BlackRock Founded?

BlackRock was founded in 1988 and has since then grown by leaps and bounds.

It has been defined by its ability to innovate and adapt in the ever-changing world of finance, staying on top by offering innovative investment solutions and creating new investment opportunities in both traditional and unconventional markets.

It’s no wonder that BlackRock is at the forefront of the industry as it continues to pave the way forward.

Who is the CEO of BlackRock?

The CEO of BlackRock is none other than Larry Fink.

Fink co-founded BlackRock in 1988 and has been instrumental in the company’s rise to prominence.

He is known for his hands-on leadership style and his commitment to innovation and sustainability.

Under Fink’s leadership, BlackRock has become a highly influential player in the financial world, with a reputation for both financial excellence and social responsibility.

So, when it comes to BlackRock, Larry Fink is the man to watch.

What is BlackRock’s Net Worth?

As of April 2025, the company’s net worth has surpassed $142.05 billion, making it one of the most valuable financial services firms on the planet.

The company’s sustained growth and ability to navigate the ever-changing currents of the financial landscape have been key reasons for its success.

As the world of investing continues to evolve, BlackRock remains a leader in its field and an invaluable asset for investors seeking to confidently navigate the markets.

Where is the Headquarters of BlackRock?

BlackRock, one of the largest investment management companies in the world, has its headquarters located in New York City.

Occupying one of the most recognizable skyscrapers in the Big Apple, the company’s global headquarters stands tall as a testament to its influence in the financial world.

BlackRock has established its presence across the globe, with offices in over 30 countries, but its New York HQ remains the heart of its operations.

Being a global leader in investment management, BlackRock’s impact reaches far beyond just Wall Street, influencing the entire world economy.

What is the Annual Revenue of BlackRock?

The investment giant had over $17.57 billion in the last 12 months ending September 2023.

BlackRock’s strong financials showcase the company’s reliability and commitment to its clients, positioning it as an industry leader in investment management.

BlackRock is one of the world’s leading investment management firms, renowned for its extensive range of investment solutions and cutting-edge technological advancements.

The company’s impressive portfolio features a diverse range of assets, including mutual funds, iShares ETFs, and separate accounts.

How Many Employees Does BlackRock Have?

As of September 2023, BlackRock has over 20,000 employees spread across its multiple global offices.

These employees bring a wealth of knowledge and experience to the table, allowing BlackRock to provide top-notch services to their clients.

With such a talented and dedicated workforce, it’s no wonder why BlackRock has earned its reputation as a leader in the financial industry.

Final Thoughts

In conclusion, BlackRock is a global investment management firm with immense success in its ventures.

The company also owns many well-known brands with holdings worldwide – allowing it to remain one of the major players in global finance today.

Whether you’re just starting out as an investor or an expert financial mastermind – understanding who owns BlackRock is key for anyone looking to make informed decisions regarding their finances; all while keeping up with the ever-changing landscape of integrated technological advances and market ownership patterns.

FAQs

What is Special About BlackRock?

BlackRock is one of the largest and most successful investment management firms worldwide.

What is BlackRock’s Ownership Structure?

BlackRock is a publicly- traded company, with a majority of its shares owned by the investment firm’s co-founders Laurence D. Fink and Robert S. Kapito.

The remaining shares are primarily held by institutional investors such as hedge funds, mutual funds, pension plans, and insurance companies.

Who are the 7 Owners of BlackRock?

The seven owners of BlackRock are Laurence D. Fink, Robert S. Kapito, JPMorgan Chase & Co., The Vanguard Group, Capital Group Companies Inc., State Street Corporation, and Fidelity Investments.

Who are BlackRock’s Biggest Clients?

BlackRock’s biggest clients include pension funds, corporations, governments, sovereign wealth funds, and financial advisors.