The question “who owns Vanguard” comes up often due to the company’s massive presence in global finance. Despite managing trillions in assets, Vanguard is not owned in the traditional corporate sense. Instead, its unique ownership structure sets it apart in the investment world.

History of Vanguard

Vanguard’s history is deeply tied to innovation in the investment world. The firm helped redefine how financial services operate by focusing on investor ownership, low fees, and passive investing.

The Founding Vision: John C. Bogle’s Revolutionary Idea

Vanguard was founded in 1975 by John Clifton Bogle, a Princeton University graduate who believed there was a better way to serve investors. After working for Wellington Management, Bogle saw how traditional fund managers were profiting at the expense of their clients through high fees and active trading.

His solution was bold: create a company owned by the very investors it served. No outside shareholders. No profit motive beyond serving the client.

The firm was named The Vanguard Group, inspired by the HMS Vanguard, a British naval ship that represented leadership and progress. Bogle’s vision was to lead a financial revolution grounded in trust and transparency.

Launch of the First Index Fund

In 1976, Vanguard launched the First Index Investment Trust, later renamed the Vanguard 500 Index Fund. It was the first index mutual fund available to individual investors, tracking the performance of the S&P 500.

At the time, the concept was controversial. Critics called it “Bogle’s folly,” believing passive investing couldn’t compete with actively managed funds. However, over time, the index fund outperformed most actively managed funds due to its low fees and market-matching returns.

This product laid the foundation for Vanguard’s massive success. It also popularized passive investing across the entire industry.

Early Growth and Industry Disruption

Throughout the 1980s and 1990s, Vanguard grew steadily as investors increasingly recognized the power of index investing. Its mutual ownership structure allowed it to continually lower fees.

While other investment firms were focused on profit and active trading strategies, Vanguard emphasized low-cost, long-term investing. This approach appealed to retirement savers, institutions, and cost-conscious investors.

Vanguard also introduced a range of bond index funds, international funds, and balanced funds during this period to broaden its offerings.

Expansion into ETFs and Global Markets

In 2001, Vanguard entered the exchange-traded fund (ETF) market with the launch of Vanguard Total Stock Market ETF (VTI). Unlike some competitors, Vanguard structured its ETFs as separate share classes of existing mutual funds, giving investors more flexibility while maintaining tax efficiency and cost advantages.

ETFs helped Vanguard attract a new wave of investors, especially younger and more active traders looking for low-cost market exposure.

By the 2010s, Vanguard expanded globally. It opened offices in Europe, Asia, Canada, and Australia, serving institutions and retail clients in over 170 countries.

Leadership Transitions and Continued Growth

John Bogle stepped down as CEO in 1996, but his principles remained embedded in the company’s DNA. He continued to speak out for investors as an author and industry critic until his death in 2019.

Following Bogle, Jack Brennan and later F. William McNabb III led Vanguard through periods of massive growth. In 2018, Tim Buckley became CEO, continuing the company’s commitment to low costs and client-first service.

Under Buckley, Vanguard embraced digital platforms, launched more ETFs, and developed advisory services like Vanguard Personal Advisor Services and Vanguard Digital Advisor.

Today: A Global Investment Giant

As of 2024, Vanguard manages over $8.5 trillion in assets and serves tens of millions of investors worldwide. It is the second-largest asset manager globally, behind only BlackRock.

Despite its size, Vanguard remains privately owned by its fund investors. Its history continues to shape the investment industry, and its model has become a benchmark for transparency, accountability, and investor alignment.

Who Owns Vanguard: Ownership Structure

Vanguard’s ownership structure is unlike any other large financial institution. The company is owned by its U.S.-based mutual funds and ETFs, which are in turn owned by individual investors. No outside shareholders, private equity firms, or institutions own equity in Vanguard. However, some of its largest funds collectively shape the governance of the company due to their size and capital weight.

Here’s a breakdown of the Vanguard’s ownership structure and major shareholders:

| Fund / ETF Name | Approx. AUM (2024) | Fund Type | Ownership Role |

|---|---|---|---|

| Vanguard Total Stock Market Index Fund | $1.3 trillion | Mutual Fund | Largest shareholder fund; broad U.S. equity exposure; core owner of Vanguard |

| Vanguard 500 Index Fund | $900 billion | Mutual Fund | Tracks S&P 500; one of the most influential shareholder funds |

| Vanguard Total Bond Market Index Fund | $300+ billion | Mutual Fund | Fixed-income exposure; contributes to diversified ownership |

| Vanguard Institutional Index Fund | $400 billion | Mutual Fund | Used by institutions; high AUM gives it substantial ownership weight |

| Vanguard Growth Index Fund | $150 billion | Mutual Fund | Growth-stock focused; adds diversity to Vanguard’s ownership base |

| Vanguard Value Index Fund | $110+ billion | Mutual Fund | Large-cap value fund; contributes to Vanguard’s fund-based ownership |

| Vanguard Developed Markets Index Fund | $150 billion | Mutual Fund | International equity fund; global investor representation |

| Vanguard Mid-Cap Index Fund | $100+ billion | Mutual Fund | Mid-cap equity exposure; smaller but still influential in ownership |

| Vanguard Small-Cap Index Fund | $80+ billion | Mutual Fund | Small-cap focus; part of the mutual ownership structure |

| Vanguard S&P 500 ETF (VOO) | $350+ billion | ETF (Index) | ETF version of the 500 Index Fund; shares class structure with mutual fund |

| Vanguard Total Stock Market ETF (VTI) | $350+ billion | ETF (Index) | ETF class of the Total Stock Market Fund; large share of investor ownership |

| Vanguard Total Bond Market ETF (BND) | $100+ billion | ETF (Bond Index) | Bond ETF; represents passive fixed-income investors in Vanguard’s ownership |

Vanguard Total Stock Market Index Fund

This is Vanguard’s largest mutual fund, with over $1.3 trillion in assets under management as of 2024. It offers investors exposure to the entire U.S. equity market. It includes large-cap, mid-cap, and small-cap stocks.

As the largest fund within Vanguard, it indirectly holds a significant share of the company’s ownership. Investors in this fund collectively have considerable weight in decisions that affect Vanguard’s operations through their ownership of the fund.

Vanguard 500 Index Fund

This is one of the oldest and most iconic Vanguard funds. It tracks the S&P 500 index and holds about $900 billion in assets. It represents large-cap U.S. stocks and is widely used by both retail and institutional investors.

Because of its size and long-standing influence, it plays a major role in Vanguard’s internal structure. The fund’s shareholders are part of the broader investor base that owns Vanguard.

Vanguard Total Bond Market Index Fund

This fund holds over $300 billion in assets and offers broad exposure to the U.S. bond market. It includes government, corporate, and mortgage-backed securities.

Its position as a major fixed-income fund gives it indirect ownership over Vanguard. The bond fund investors share ownership in the company, just like investors in Vanguard’s equity funds.

Vanguard Institutional Index Fund

With nearly $400 billion in assets, this fund serves large institutions like pension funds, endowments, and retirement plans. It also tracks the S&P 500 index but is offered with ultra-low expense ratios.

Institutional investors in this fund also contribute to Vanguard’s mutual ownership structure. While they don’t have special control privileges, their large investments represent significant voting power within the company.

Vanguard Growth Index Fund

This fund manages around $150 billion and tracks large-cap U.S. growth stocks. Though smaller than Vanguard’s core funds, it contributes to the mutual ownership model and provides growth-oriented investors a stake in the company.

Vanguard Value Index Fund

With over $110 billion in assets, this fund focuses on large-cap U.S. value stocks. Like other index funds, it gives its investors ownership rights over Vanguard through the fund structure.

Vanguard Developed Markets Index Fund

Managing approximately $150 billion, this fund gives investors exposure to international developed markets, including Europe, Japan, and Australia. It broadens Vanguard’s investor base outside the U.S., and those investors share in ownership.

Vanguard Mid-Cap Index Fund

This fund manages over $100 billion and offers access to U.S. mid-sized companies. Though smaller in comparison to top-tier funds, it plays a role in Vanguard’s diversified ownership network.

Vanguard Small-Cap Index Fund

This fund manages about $80 billion and tracks small-cap U.S. companies. The investors in this fund also form part of the collective shareholder base of Vanguard.

Vanguard ETFs

In addition to mutual funds, Vanguard’s ETFs—like Vanguard S&P 500 ETF (VOO) and Vanguard Total Stock Market ETF (VTI)—also contribute significantly to ownership. These ETFs are structured as share classes of mutual funds, meaning their investors are part of the same mutual ownership model.

- VOO: Over $350 billion in assets

- VTI: Over $350 billion in assets

- BND (Total Bond Market ETF): Over $100 billion in assets

All these ETFs share the same structure: fund investors are also indirect owners of Vanguard itself.

No External or Institutional Shareholders

It’s important to note that Vanguard has no external shareholders, private owners, or institutional equity investors. There is no single entity—not even Vanguard insiders, board members, or the CEO—that owns stock in Vanguard itself.

Every investor in a Vanguard fund, from retirees to institutions, shares in ownership. But no single investor or fund has disproportionate control.

Who Controls Vanguard?

Although Vanguard is owned by its mutual funds and, ultimately, by investors in those funds, the day-to-day decisions and long-term strategy are handled by a structured leadership team. Control is exercised through a Board of Directors, a Chief Executive Officer, and various executive committees, all operating with the core mission of serving investors.

Board of Directors: The Ultimate Oversight Body

Vanguard’s Board of Directors plays a central role in governing the company. This board oversees management decisions, sets policies, and ensures that Vanguard stays aligned with its core purpose—acting in the best interests of its fund shareholders.

Most members of the board are independent directors, meaning they have no financial ties to the company apart from their role on the board. This helps ensure objectivity and limits conflicts of interest.

The board selects the CEO, approves major corporate strategies, and represents the millions of investors who own Vanguard’s funds. While shareholders don’t vote directly on corporate matters, the board acts as their voice at the highest level.

CEO: Tim Buckley’s Role in Vanguard

Vanguard is led by Mortimer J. “Tim” Buckley, who became Chairman and Chief Executive Officer in January 2018. Buckley has been with Vanguard since 1991, starting as an assistant to the founder, John Bogle.

He has held multiple leadership roles over his three-decade career, including:

- Chief Information Officer (CIO)

- Head of the Retail Investor Group

- Chief Investment Officer (CIO) before becoming CEO

As CEO, Buckley is responsible for:

- Setting strategic priorities

- Overseeing Vanguard’s 20,000+ global employees

- Leading Vanguard’s push toward digital transformation and scalable client services

- Ensuring Vanguard stays focused on low-cost investing and client alignment

Buckley’s background in technology and investing has influenced the firm’s focus on digital advisory services, improved investor access, and expansion of ETF offerings.

He is also a strong advocate of long-term investing, encouraging investors to ignore market noise and focus on disciplined strategies. Under his leadership, Vanguard has doubled down on automation, data-driven portfolio management, and global accessibility.

Executive Leadership Team: Operational Control

Supporting the CEO is a Global Executive Team made up of leaders across various business functions, including:

- Chief Financial Officer (CFO)

- Chief Investment Officer (CIO)

- Chief Legal Officer

- Chief Technology Officer (CTO)

- Head of International Division

- Chief Marketing Officer

This leadership team meets regularly to plan business operations, regulatory compliance, fund performance, and technology development.

They ensure that Vanguard’s services—whether in personal investing, retirement accounts, ETFs, or institutional management—operate efficiently and align with client expectations.

Committees and Fiduciary Responsibility

Vanguard also operates through specialized committees that manage different areas, such as:

- Audit and Risk Committee

- Investment Strategy Group

- Sustainability and Stewardship Committee

- Compliance and Ethics Committee

These groups help enforce transparency, regulatory alignment, and risk controls. They also guide how Vanguard exercises proxy voting power as a major shareholder in thousands of companies worldwide.

Even though Vanguard doesn’t seek to control other firms, its corporate stewardship team votes on behalf of fund shareholders in board elections, compensation plans, and ESG issues. These votes influence boardroom decisions at top global companies like Apple, Microsoft, and Amazon.

Control Without Conflicts: Investor-First Philosophy

Unlike public firms or hedge funds, Vanguard is not beholden to external shareholders or private equity owners. This allows its leadership to focus entirely on investor outcomes.

The firm’s control structure is purpose-built to eliminate conflicts of interest. There are no outside dividends, stock bonuses, or equity incentives for executives. Instead, compensation is aligned with long-term fund performance and client satisfaction.

Annual Revenue and Net Worth of Vanguard

As of January 31, 2025, Vanguard manages approximately $10.4 trillion in global assets under management (AUM), solidifying its position as one of the world’s leading investment management companies.

In terms of revenue, Vanguard’s earnings primarily stem from the management fees charged on its vast array of mutual funds and ETFs. While specific revenue figures for 2024 are not publicly disclosed, Vanguard’s significant share of the U.S. fund industry suggests substantial earnings. For instance, as of the end of 2024, Vanguard led all fund families with an estimated 28% of U.S. fund industry assets under management.

Regarding net worth, it’s important to note that Vanguard operates under a unique ownership structure where the company is owned by its funds, which in turn are owned by the investors. This mutual ownership model means that Vanguard does not have a traditional net worth figure like publicly traded companies. However, the value of the assets it manages and its influence in the financial industry underscore its substantial economic footprint.

Vanguard’s commitment to low-cost investing and its mutual ownership structure continue to attract investors globally, contributing to its growth and stability in the financial sector.

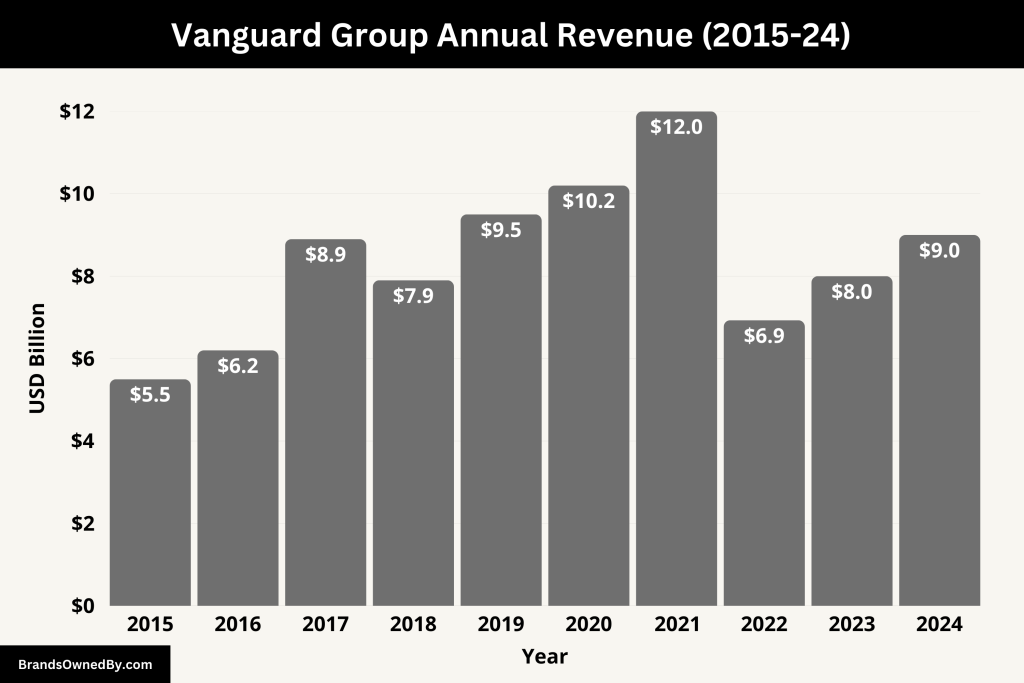

Vanguard Group – Estimated Annual Revenue and Net Worth (2015–2024)

| Year | Estimated Revenue (USD) | Estimated Net Worth (USD) |

|---|---|---|

| 2015 | $5.5 billion | $282 million |

| 2016 | $6.2 billion | $310 million |

| 2017 | $8.9 billion | $338 million |

| 2018 | $7.9 billion | $366 million |

| 2019 | $9.5 billion | $394 million |

| 2020 | $10.2 billion | $451 million |

| 2021 | $12.0 billion | $507 million |

| 2022 | $6.93 billion | $563 million |

| 2023 | $8.0 billion | $620 million |

| 2024 | $9.0 billion (est.) | $680 million (est.) |

Companies Owned by Vanguard

Vanguard holds significant stakes in thousands of public companies through its index funds and ETFs. These positions do not grant Vanguard control in the traditional ownership sense, but they do give it enormous influence over the global economy through voting power and investment exposure.

Here are some of the largest and most notable companies in which Vanguard holds major ownership stakes:

| Company | Vanguard’s Estimated Stake (%) | Estimated Value of Stake (USD) |

|---|---|---|

| Apple Inc. | 7.5% | $250 billion |

| Microsoft Corporation | 8% | $200 billion |

| Amazon.com, Inc. | 6.7% | $130 billion |

| Alphabet Inc. (Google) | 7% | $120 billion |

| NVIDIA Corporation | 6% | $100 billion |

| Tesla, Inc. | 6.9% | $75 billion |

| Meta Platforms, Inc. (Facebook) | 6.5% | $65 billion |

| Berkshire Hathaway Inc. | 9% | $90 billion |

| JPMorgan Chase & Co. | 8% | $60 billion |

| Johnson & Johnson | 8% | $50 billion |

| Exxon Mobil Corporation | 8.1% | $40 billion |

| UnitedHealth Group | 7.5% | $45 billion |

| Visa Inc. | 8.3% | $45 billion |

| Procter & Gamble (P&G) | 8% | $35 billion |

| Home Depot | 7.5% | $30 billion |

| Chevron Corporation | 8.4% | $35 billion |

| Mastercard Inc. | 7.9% | $40 billion |

| PepsiCo, Inc. | 7.8% | $28 billion |

| Bank of America | 7.9% | $32 billion |

| The Coca-Cola Company | 7.6% | $25 billion |

| Pfizer Inc. | 8% | $20 billion |

| AbbVie Inc. | 7.7% | $22 billion |

| Comcast Corporation | 8.2% | $20 billion |

| Intel Corporation | 7.4% | $15 billion |

| Netflix Inc. | 7.5% | $13 billion |

| Adobe Inc. | 8% | $16 billion |

| Walmart Inc. | 7.6% | $30 billion |

Apple Inc.

Vanguard is one of the top shareholders of Apple, often second only to BlackRock. As of 2025, Vanguard owns approximately 7.5% of Apple’s total outstanding shares, valued at over $250 billion.

This ownership is spread across funds like:

- Vanguard Total Stock Market Index Fund

- Vanguard 500 Index Fund

- Vanguard Growth ETF (VUG)

Although Vanguard does not control Apple, it plays a key role in proxy voting and long-term investment strategy.

Microsoft Corporation

Vanguard owns around 8% of Microsoft, making it one of the tech giant’s most significant shareholders. This stake is valued at over $200 billion as of early 2025.

Vanguard funds like VFIAX (500 Index Fund Admiral Shares) and VTI (Total Stock Market ETF) have large allocations in Microsoft, reflecting the company’s weighting in the S&P 500 and Nasdaq.

Amazon.com, Inc.

As a major tech holding, Vanguard owns about 6.7% of Amazon, with its holdings valued at more than $130 billion. Amazon is featured prominently in Vanguard’s growth-oriented and broad-market funds.

Vanguard’s influence includes participation in shareholder meetings and key proxy decisions affecting executive pay and corporate strategy.

Alphabet Inc. (Google)

Through various share classes (GOOGL and GOOG), Vanguard owns around 7% of Alphabet, with combined holdings worth over $120 billion.

Alphabet is a top holding in both domestic and international Vanguard funds, due to its role in global digital infrastructure, advertising, and AI development.

NVIDIA Corporation

Vanguard holds a stake of over 6% in NVIDIA, valued at more than $100 billion as of 2025. The GPU and AI chipmaker has become one of the highest-weighted companies in Vanguard’s growth and innovation-focused funds.

The fund manager has also played a key role in governance issues like ESG and board elections at NVIDIA.

Tesla, Inc.

Vanguard owns roughly 6.9% of Tesla, valued at around $75 billion. Tesla is among the top holdings in Vanguard’s growth funds and ESG funds that focus on renewable and electric technologies.

This stake gives Vanguard significant voting power on matters like shareholder proposals, sustainability, and leadership structure.

Meta Platforms, Inc. (Facebook)

Vanguard holds a 6.5% stake in Meta, amounting to an investment of over $65 billion. Meta is part of the top holdings in many of Vanguard’s large-cap equity funds.

Despite not having direct control, Vanguard participates in major decisions regarding Meta’s governance, including privacy, content moderation, and executive compensation.

Berkshire Hathaway Inc.

Vanguard owns approximately 9% of Berkshire Hathaway’s Class B shares, making it one of the top institutional holders. The holding reflects Buffett’s diversified portfolio, which Vanguard finds favorable for long-term investing.

While Warren Buffett’s firm is not tech-focused, its consistency and stability make it a valuable anchor in many Vanguard funds.

JPMorgan Chase & Co.

Vanguard holds about 8% of JPMorgan Chase, America’s largest bank by assets. This stake, worth over $60 billion, makes Vanguard a critical institutional investor in the financial sector.

It features prominently in funds that track the S&P 500, large-cap financials, and dividend-focused portfolios.

Johnson & Johnson

Vanguard owns around 8% of Johnson & Johnson, a blue-chip pharmaceutical and consumer goods company. With a value over $50 billion, this investment supports Vanguard’s focus on stable dividend-paying firms with long-term growth.

It also reflects Vanguard’s exposure to the healthcare sector through diversified funds.

Exxon Mobil Corporation

In the energy sector, Vanguard is one of the largest investors in ExxonMobil, owning about 8.1% of the company. The stake, worth over $40 billion, reflects its role in Vanguard’s value and income funds, which hold legacy energy producers.

Vanguard has recently used its shareholder voting power to influence Exxon on issues related to climate risk and board composition.

UnitedHealth Group

Vanguard owns approximately 7.5% of UnitedHealth, the largest U.S. health insurer by market cap. This translates to a stake worth over $45 billion, held across several large Vanguard funds.

UnitedHealth offers consistent earnings and is viewed as a key player in defensive sectors like healthcare.

Visa Inc.

Vanguard owns around 8.3% of Visa, with a stake valued at more than $45 billion. Visa is a core component in many of Vanguard’s growth, technology, and financial sector funds. As a leading payment technology company, Visa provides consistent earnings and long-term capital appreciation.

Procter & Gamble (P&G)

Vanguard holds about 8% of P&G, amounting to a stake worth $35 billion. P&G is one of the most stable consumer goods companies, making it a common holding in Vanguard’s dividend and value-focused funds like the Vanguard Dividend Growth Fund.

Home Depot

Vanguard owns approximately 7.5% of Home Depot, valued at over $30 billion. Home Depot is a key holding in broad market and consumer discretionary funds. It provides exposure to the U.S. housing and retail sectors, known for steady returns and dividend growth.

Chevron Corporation

In the energy sector, Vanguard owns around 8.4% of Chevron, worth about $35 billion. Chevron appears in many income and value-oriented Vanguard funds. Its reliable dividends and global operations make it a pillar in energy sector ETFs.

Mastercard Inc.

Vanguard has a stake of 7.9% in Mastercard, worth over $40 billion. Like Visa, Mastercard is a major holding in tech and finance-focused index funds. Its global transaction infrastructure supports strong long-term growth trends.

PepsiCo, Inc.

Vanguard holds about 7.8% of PepsiCo, a stake valued at around $28 billion. PepsiCo’s diverse portfolio, which includes Frito-Lay, Gatorade, and Tropicana, provides stable returns across Vanguard’s defensive and dividend funds.

Bank of America

Vanguard owns around 7.9% of Bank of America, one of the largest banks in the U.S., with a position worth over $32 billion. The bank plays a big role in Vanguard’s financial services sector ETFs and large-cap funds.

The Coca-Cola Company

Vanguard holds approximately 7.6% of Coca-Cola, amounting to a stake worth $25 billion. As a globally recognized brand with consistent earnings, Coca-Cola appears in several dividend and consumer staples funds.

Pfizer Inc.

Vanguard owns about 8% of Pfizer, valued at over $20 billion. Pfizer’s pharmaceutical success and its role during the COVID-19 pandemic strengthened its weight in healthcare and large-cap ETFs.

AbbVie Inc.

Vanguard has a 7.7% stake in AbbVie, valued at approximately $22 billion. AbbVie is a major pharmaceutical company known for drugs like Humira and Rinvoq, making it a key asset in Vanguard’s healthcare and dividend-focused funds.

Comcast Corporation

Vanguard owns around 8.2% of Comcast, worth nearly $20 billion. Comcast is a top media and telecom conglomerate. It appears in Vanguard’s communication sector ETFs and broad-market holdings.

Intel Corporation

Vanguard has a 7.4% stake in Intel, valued at about $15 billion. Intel is featured in several Vanguard technology and value funds, offering exposure to semiconductors and computing hardware.

Netflix Inc.

Vanguard holds about 7.5% of Netflix, a stake valued at over $13 billion. As a high-growth digital streaming platform, Netflix is part of Vanguard’s technology and consumer discretionary ETFs.

Adobe Inc.

Vanguard owns roughly 8% of Adobe, a stake worth more than $16 billion. Adobe’s recurring software revenue model and leadership in creative tools make it a strong presence in growth-focused Vanguard funds.

Walmart Inc.

Vanguard owns about 7.6% of Walmart, amounting to a stake worth over $30 billion. Walmart’s dominance in retail and e-commerce makes it a dependable company across Vanguard’s value and dividend strategies.

Conclusion

Vanguard is a unique financial powerhouse. It isn’t owned by a billionaire, a family, or shareholders. The answer to who owns Vanguard is simple: the investors in its funds. Its mutual ownership structure drives its mission to serve clients rather than external owners.

With trillions in assets and a client-first philosophy, Vanguard has redefined what it means to own a financial institution. Its influence on global markets is immense, but its structure ensures alignment with everyday investors.

FAQs

Who is the largest shareholder of Vanguard?

Vanguard has no external shareholders. Its funds, like the Total Stock Market Index Fund and the 500 Index Fund, own the company. These are, in turn, owned by millions of investors.

Does Vanguard have any private or institutional owners?

No. Vanguard is not owned by any private investors or institutions. Its mutual ownership model ensures all ownership lies within its funds and fund investors.

Can you buy stock in Vanguard?

No, you cannot buy Vanguard stock. It is not a publicly traded company. Investors can buy shares in Vanguard mutual funds and ETFs, but not in the company itself.

Who controls Vanguard’s decisions?

The Board of Directors and the CEO manage the company. They are accountable to fund investors and make decisions in their best interests.

Is Vanguard a public or private company?

Vanguard is a private company. But it’s not privately owned in the traditional sense. Its mutual ownership model sets it apart from other private firms.

Are Vanguard and BlackRock the same company?

No, Vanguard and BlackRock are not the same company. They are two separate entities that both operate in the asset management industry but have different ownership structures and business models. Vanguard operates under a unique mutual ownership model, where the company is owned by its funds and ultimately by the investors in those funds. BlackRock, on the other hand, is a publicly traded company with shareholders. While both are leading asset managers, Vanguard is known for its index funds and lower fees, while BlackRock offers a wider array of investment products, including more actively managed funds.

Who is the founder of Vanguard?

Vanguard was founded by John C. Bogle in 1975. Bogle is widely regarded as the father of index investing and is credited with revolutionizing the investment management industry by introducing the concept of low-cost index funds. His vision for Vanguard was to create a company that was owned by the funds it managed, which would ultimately benefit investors by reducing costs.

Who are the owners of Vanguard?

Vanguard is owned by its funds, which are in turn owned by the investors who hold shares in those funds. This unique ownership structure means Vanguard does not have external shareholders like publicly traded companies. Instead, the investors in Vanguard’s mutual funds and ETFs are the ultimate owners of the company. The company operates as a mutual, meaning its profits are reinvested into the business or returned to fund shareholders through lower fees.

Who is the CEO of Vanguard?

As of 2025, the CEO of Vanguard is Tim Buckley. He became the CEO in January 2018, succeeding Bill McNabb. Buckley has been with Vanguard since 1991 and has held various leadership roles within the company. Under his leadership, Vanguard has continued to grow as one of the largest investment management firms in the world, focusing on low-cost investing and expanding its global footprint.

Is BlackRock or Vanguard richer?

While both BlackRock and Vanguard are among the largest asset managers in the world, BlackRock is generally considered the richer of the two in terms of total assets under management (AUM). BlackRock manages over $9 trillion in assets, while Vanguard’s AUM is around $10.4 trillion as of 2025. However, BlackRock is publicly traded and has a diversified revenue stream that includes fees from a wide range of financial products, including actively managed funds. Vanguard, on the other hand, focuses heavily on low-cost index funds and operates with a unique mutual ownership structure, which allows it to pass savings on to its investors. BlackRock’s ability to generate additional revenue from active management gives it an edge in terms of profitability.