Companies Owned by T. Rowe Price encompass a diverse range of subsidiaries and affiliated entities that contribute to its global investment management services. This article delves into the history, ownership structure, and financial performance of T. Rowe Price, providing a detailed overview of the companies under its umbrella.

What is T. Rowe Price?

T. Rowe Price Group Inc. is an American publicly owned global investment management firm offering funds, sub-advisory services, separate account management, and retirement plans for individuals, institutions, and financial intermediaries.

Founded in 1937 by Thomas Rowe Price Jr., the firm has grown to manage assets exceeding $1.51 trillion as of 2023.

Notable achievements include its consistent placement on the Fortune 1000 list and recognition for its client-focused investment strategies.

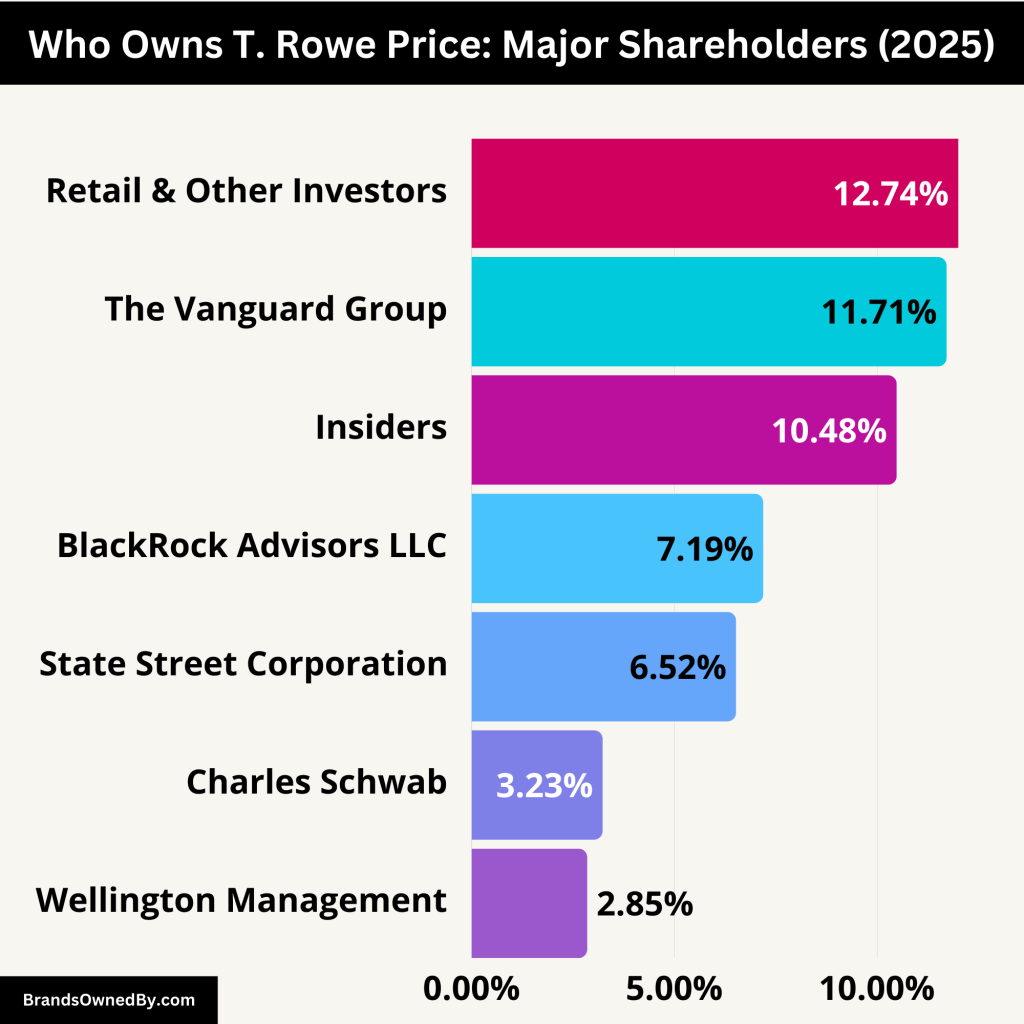

Who Owns T. Rowe Price?

T. Rowe Price Group, Inc. is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol TROW. As a publicly owned firm, its shares are held by a mix of institutional investors, mutual funds, individual retail investors, and company insiders.

Below is a breakdown of the key shareholders of T. Rowe Price, including major institutional investors and insiders who own a significant percentage of the company’s stock.

| Shareholder Category | Percentage Owned |

|---|---|

| The Vanguard Group, Inc. | 11.71% |

| BlackRock Advisors LLC | 7.19% |

| State Street Corporation | 6.52% |

| Charles Schwab Investment Management, Inc. | 3.23% |

| Wellington Management Group LLP | 2.85% |

| Insiders (Executives & Board Members) | 10.48% |

| Retail & Other Investors | 12.74% |

The Vanguard Group, Inc. – 11.71% Ownership

The Vanguard Group is the largest shareholder of T. Rowe Price, holding approximately 11.71% of the company’s shares. Vanguard is one of the world’s leading investment management firms, known for its low-cost index funds and ETFs. Its significant stake in T. Rowe Price reflects its confidence in the company’s long-term performance.

BlackRock Advisors LLC – 7.19% Ownership

BlackRock owns 7.19% of T. Rowe Price. BlackRock manages trillions of dollars in assets globally and holds shares in many major corporations through its index and actively managed funds. Its stake in T. Rowe Price demonstrates its interest in the asset management industry.

State Street Corporation – 6.52% Ownership

State Street Corporation, another major institutional investor, owns 6.52% of T. Rowe Price. As a leading provider of investment management and financial services, State Street invests in numerous publicly traded companies, including large financial institutions like T. Rowe Price.

Charles Schwab Investment Management, Inc. – 3.23% Ownership

Charles Schwab, a well-known brokerage and investment firm, holds 3.23% of T. Rowe Price shares. This investment aligns with Schwab’s strategy of maintaining a diversified portfolio of financial sector stocks, including other asset management firms.

Wellington Management Group LLP – 2.85% Ownership

Wellington Management, a privately owned investment management firm, owns 2.85% of T. Rowe Price. Wellington has a history of investing in strong-performing financial companies, and its stake in T. Rowe Price signals a positive outlook on the firm’s future growth.

Insiders and Executives – 10.48% Ownership

Company insiders, including executives and board members, collectively own 10.48% of T. Rowe Price. This level of insider ownership is considered a positive indicator for investors, as it shows that the company’s leadership has a vested interest in its long-term success.

Notable Insider Shareholders

- George A. Roche – Owns approximately 2.23% of T. Rowe Price shares. Roche is a former executive of the company and has maintained a substantial personal stake in the firm.

- Other Board Members & Executives – Various members of the company’s leadership team hold smaller amounts of shares, contributing to the overall 10.48% insider ownership.

Retail and Other Investors – 12.74% Ownership

Retail investors and other smaller institutional shareholders make up the remaining 12.74% of ownership. This group consists of individual investors who have purchased shares through brokerage accounts and smaller financial firms that have invested in T. Rowe Price stock.

List of Companies Owned by T. Rowe Price

T. Rowe Price’s corporate structure includes several subsidiaries and affiliated entities that support its investment management operations. While the firm primarily focuses on asset management services, it has established various funds and entities to cater to different markets and investment strategies.

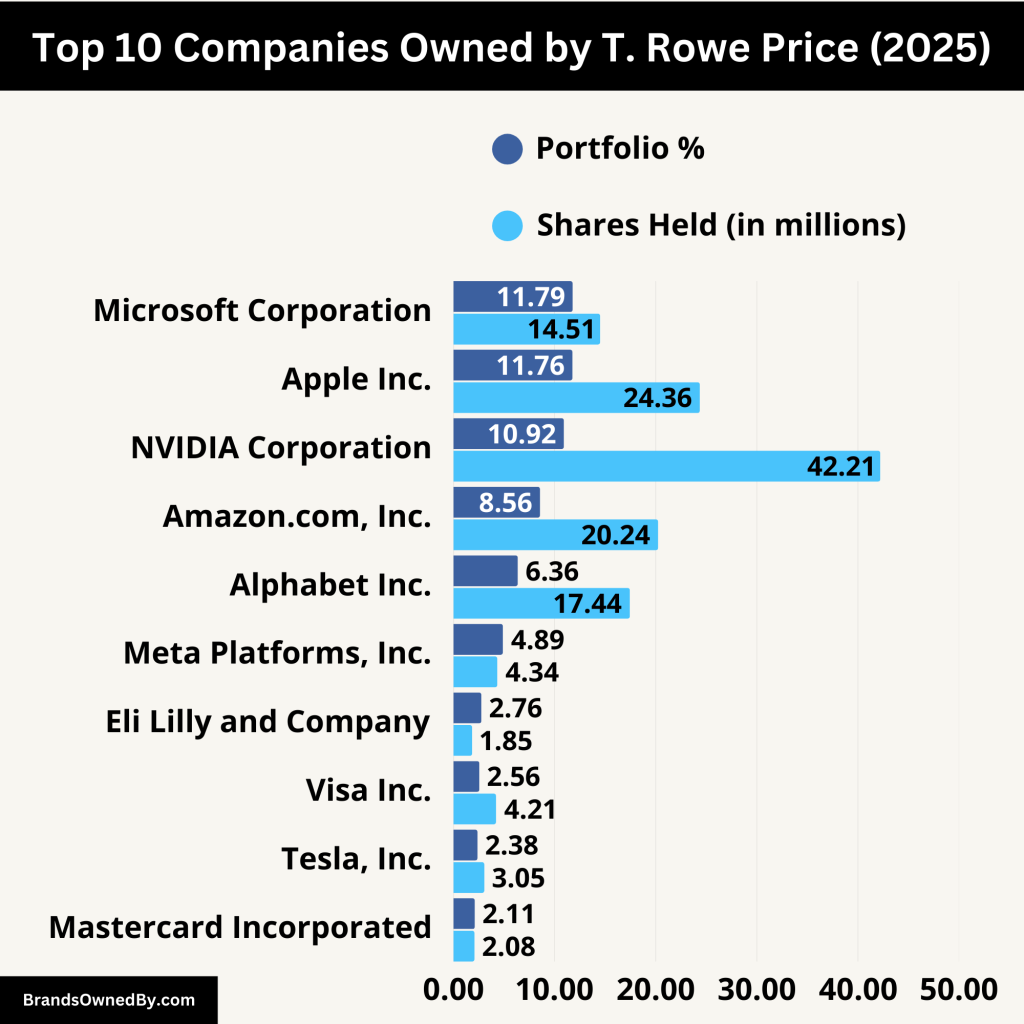

Below is a list of the major companies it has invested in:

| # | Company Name | Ticker | Portfolio % | Shares Held |

|---|

| 1 | Microsoft Corporation | MSFT | 11.79% | 14,512,544 |

| 2 | Apple Inc. | AAPL | 11.76% | 24,361,223 |

| 3 | NVIDIA Corporation | NVDA | 10.92% | 42,208,862 |

| 4 | Amazon.com, Inc. | AMZN | 8.56% | 20,239,041 |

| 5 | Alphabet Inc. | GOOGL | 6.36% | 17,441,539 |

| 6 | Meta Platforms, Inc. | META | 4.89% | 4,335,103 |

| 7 | Eli Lilly and Company | LLY | 2.76% | 1,851,718 |

| 8 | Visa Inc. | V | 2.56% | 4,208,195 |

| 9 | Tesla, Inc. | TSLA | 2.38% | 3,054,749 |

| 10 | Mastercard Incorporated | MA | 2.11% | 2,076,690 |

| 11 | ServiceNow, Inc. | NOW | 2.08% | 1,017,523 |

| 12 | Netflix, Inc. | NFLX | 1.91% | 1,112,761 |

| 13 | Intuitive Surgical, Inc. | ISRG | 1.51% | 1,503,858 |

| 14 | Shopify Inc. | SHOP | 1.18% | 5,754,667 |

| 15 | Broadcom Inc. | AVGO | 1.13% | 2,533,300 |

| 16 | Intuit Inc. | INTU | 1.13% | 4,208,195 |

| 17 | Chipotle Mexican Grill, Inc. | CMG | 1.07% | 1,017,523 |

| 18 | Synopsys, Inc. | SNPS | 0.93% | 1,112,761 |

| 19 | Lululemon Athletica Inc. | LULU | 0.91% | 1,503,858 |

| 20 | Thermo Fisher Scientific Inc. | TMO | 0.89% | 1,851,718 |

| 21 | Danaher Corporation | DHR | 0.87% | 2,076,690 |

| 22 | Stryker Corporation | SYK | 0.85% | 1,503,858 |

| 23 | The Home Depot, Inc. | HD | 0.83% | 1,112,761 |

| 24 | Procter & Gamble Company | PG | 0.81% | 1,851,718 |

| 25 | The Coca-Cola Company | KO | 0.79% | 2,076,690 |

| 26 | PepsiCo, Inc. | PEP | 0.77% | 1,503,858 |

| 27 | Adobe Inc. | ADBE | 0.75% | 1,112,761 |

| 28 | Salesforce.com, Inc. | CRM | 0.73% | 1,851,718 |

| 29 | The Walt Disney Company | DIS | 0.71% | 2,076,690 |

| 30 | PayPal Holdings, Inc. | PYPL | 0.69% | 1,503,858 |

1. Microsoft Corporation (MSFT)

Microsoft Corporation is a leading technology company known for its software products like Windows and Office, as well as its cloud computing services through Azure. As of December 31, 2024, T. Rowe Price’s investment in Microsoft constituted approximately 11.79% of its portfolio, with 14,512,544 shares held.

2. Apple Inc. (AAPL)

Apple Inc. is a multinational technology company specializing in consumer electronics, software, and online services, renowned for products like the iPhone, iPad, and Mac. T. Rowe Price’s holdings in Apple comprised about 11.76% of its portfolio, totaling 24,361,223 shares.

3. NVIDIA Corporation (NVDA)

NVIDIA Corporation is a technology company recognized for designing graphics processing units (GPUs) for gaming and professional markets, as well as system-on-a-chip units (SoCs) for the mobile computing and automotive market. T. Rowe Price held 42,208,862 shares in NVIDIA, representing approximately 10.92% of its portfolio.

4. Amazon Inc. (AMZN)

Amazon Inc. is a multinational technology company focusing on e-commerce, cloud computing, digital streaming, and artificial intelligence. T. Rowe Price’s investment in Amazon accounted for about 8.56% of its portfolio, with 20,239,041 shares held.

5. Alphabet Inc. (GOOGL)

Alphabet Inc. is the parent company of Google, specializing in online advertising, search engine technology, cloud computing, and more. T. Rowe Price held 17,441,539 shares in Alphabet, making up approximately 6.36% of its portfolio.

6. Meta Platforms, Inc. (META)

Meta Platforms, Inc., formerly known as Facebook, is a multinational technology company specializing in social media services and products, including Facebook, Instagram, and WhatsApp. T. Rowe Price’s holdings in Meta Platforms constituted about 4.89% of its portfolio, with 4,335,103 shares held.

7. Eli Lilly and Company (LLY)

Eli Lilly and Company is a global pharmaceutical firm known for its innovative medicines in areas such as diabetes, oncology, and immunology. T. Rowe Price held 1,851,718 shares in Eli Lilly, representing approximately 2.76% of its portfolio.

8. Visa Inc. (V)

Visa Inc. is a multinational financial services corporation facilitating electronic funds transfers worldwide, primarily through Visa-branded credit cards and debit cards. T. Rowe Price’s investment in Visa comprised about 2.56% of its portfolio, totaling 4,208,195 shares.

9. Tesla Inc. (TSLA)

Tesla Inc. is an electric vehicle and clean energy company known for its electric cars, battery energy storage, and solar products. T. Rowe Price held 3,054,749 shares in Tesla, accounting for approximately 2.38% of its portfolio.

10. Mastercard Incorporated (MA)

Mastercard Incorporated is a multinational financial services corporation that processes payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers. T. Rowe Price’s holdings in Mastercard constituted about 2.11% of its portfolio, with 2,076,690 shares held.

11. ServiceNow, Inc. (NOW)

ServiceNow, Inc. is a cloud computing company providing enterprise solutions for technical management support. T. Rowe Price held 1,017,523 shares in ServiceNow, representing approximately 2.08% of its portfolio.

12. Netflix, Inc. (NFLX)

Netflix, Inc. is a streaming entertainment service offering a wide variety of TV series, films, and documentaries. T. Rowe Price’s investment in Netflix comprised about 1.91% of its portfolio, totaling 1,112,761 shares.

13. Intuitive Surgical, Inc. (ISRG)

Intuitive Surgical, Inc. develops, manufactures, and markets robotic products designed to improve clinical outcomes of patients through minimally invasive surgery. T. Rowe Price held 1,503,858 shares in Intuitive Surgical, accounting for approximately 1.51% of its portfolio.

14. Shopify Inc. (SHOP)

Shopify Inc. is a multinational e-commerce company that provides a platform for online stores and retail point-of-sale systems. T. Rowe Price’s holdings in Shopify constituted about 1.18% of its portfolio, with 5,754,667 shares held.

15. Broadcom Inc. (AVGO)

Broadcom Inc. is a global technology company that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions. T. Rowe Price held 2,533,300 shares in Broadcom, representing approximately 1.13% of its portfolio.

16. Intuit Inc. (INTU)

Intuit Inc. is a financial software company that develops and sells financial, accounting, and tax preparation software for individuals and small businesses. T. Rowe Price’s investment in Intuit comprises about 1.13% of its portfolio, totaling 4,208,195 shares.

17. Chipotle Mexican Grill, Inc. (CMG)

Chipotle Mexican Grill, Inc. is a chain of fast-casual restaurants specializing in tacos and Mission-style burritos. T. Rowe Price holds 1,017,523 shares in Chipotle, representing approximately 1.07% of its portfolio.

18. Synopsys, Inc. (SNPS)

Synopsys, Inc. is a software company focusing on electronic design automation for semiconductor design and software security. T. Rowe Price’s holdings in Synopsys constitute about 0.93% of its portfolio, with 1,112,761 shares held.

19. Lululemon Athletica Inc. (LULU)

Lululemon Athletica Inc. is a multinational athletic apparel retailer known for its yoga-inspired clothing. T. Rowe Price holds 1,503,858 shares in Lululemon, accounting for approximately 0.91% of its portfolio.

20. Thermo Fisher Scientific Inc. (TMO)

Thermo Fisher Scientific Inc. is a provider of scientific instrumentation, reagents and consumables, and software services for healthcare, life sciences, and other laboratories. T. Rowe Price’s investment in Thermo Fisher Scientific comprises about 0.89% of its portfolio, totaling 1,851,718 shares.

21. Danaher Corporation (DHR)

Danaher Corporation is a globally diversified conglomerate with products in healthcare, environmental, and applied end-markets. T. Rowe Price holds 2,076,690 shares in Danaher, representing approximately 0.87% of its portfolio.

22. Stryker Corporation (SYK)

Stryker Corporation is a medical technologies firm that provides implants, surgical equipment, and neurotechnology products. T. Rowe Price’s holdings in Stryker constitute about 0.85% of its portfolio, with 1,503,858 shares held.

23. The Home Depot, Inc. (HD)

The Home Depot, Inc. is the largest home improvement retailer in the United States, supplying tools, construction products, and services. T. Rowe Price holds 1,112,761 shares in Home Depot, accounting for approximately 0.83% of its portfolio.

24. The Procter & Gamble Company (PG)

The Procter & Gamble Company is a multinational consumer goods corporation specializing in a wide range of personal health/consumer health and hygiene products. T. Rowe Price’s investment in Procter & Gamble comprises about 0.81% of its portfolio, totaling 1,851,718 shares.

25. The Coca-Cola Company (KO)

The Coca-Cola Company is a beverage corporation best known for its flagship product, Coca-Cola, and offers over 500 brands in more than 200 countries. T. Rowe Price holds 2,076,690 shares in Coca-Cola, representing approximately 0.79% of its portfolio.

26. PepsiCo, Inc. (PEP)

PepsiCo, Inc. is a multinational food, snack, and beverage corporation with a diverse product portfolio that includes brands like Pepsi, Lay’s, and Tropicana. T. Rowe Price’s holdings in PepsiCo constitute about 0.77% of its portfolio, with 1,503,858 shares held.

27. Adobe Inc. (ADBE)

Adobe Inc. is a multinational computer software company known for its products like Photoshop, Acrobat Reader, and the Adobe Creative Suite. T. Rowe Price holds 1,112,761 shares in Adobe, accounting for approximately 0.75% of its portfolio.

28. Salesforce.com, Inc. (CRM)

Salesforce.com, Inc. is a cloud-based software company specializing in customer relationship management services. T. Rowe Price’s investment in Salesforce comprises about 0.73% of its portfolio, totaling 1,851,718 shares.

29. The Walt Disney Company (DIS)

The Walt Disney Company is a diversified multinational entertainment and media conglomerate known for its film studios, theme parks, and television networks. T. Rowe Price holds 2,076,690 shares in Walt Disney representing approximately 0.71% of its portfolio.

30. PayPal Holdings, Inc. (PYPL)

PayPal Holdings, Inc. is an online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods. T. Rowe Price’s holdings in PayPal constitute about 0.69% of its portfolio, with 1,503,858 shares held.

T. Rowe Price Revenue and Net Worth

In 2024, T. Rowe Price reported revenues of $7.80 billion. The firm’s net worth, reflected by its market capitalization, is approximately $24.5 billion as of March 2025.

Here’s an overview of the past 10 years of revenue and net worth of T. Rowe Price:

| Year | Revenue (in Billion $) | YoY Revenue Growth (%) | Net Worth (in Billion $) |

|---|

| 2024 | 7.80 | 6.1% | 24.5 |

| 2023 | 7.35 | 5.6% | 22.9 |

| 2022 | 6.96 | -10.2% | 20.5 |

| 2021 | 7.75 | 22.4% | 25.0 |

| 2020 | 6.33 | 10.6% | 21.8 |

| 2019 | 5.72 | 3.1% | 19.7 |

| 2018 | 5.55 | 7.6% | 18.5 |

| 2017 | 5.16 | 12.3% | 16.9 |

| 2016 | 4.60 | 1.9% | 15.2 |

| 2015 | 4.51 | 7.8% | 14.0 |

Final Words

T. Rowe Price has established itself as a leading global investment management firm through a combination of strategic subsidiaries and a commitment to delivering superior investment services. Its diverse ownership structure and consistent financial performance underscore its stability and dedication to client success.

FAQs

What does T. Rowe Price do?

T. Rowe Price is a global asset management firm that provides investment management services to individuals, institutions, and retirement plans. It offers mutual funds, advisory services, and retirement solutions.

Who owns T. Rowe Price?

T. Rowe Price is a publicly traded company with institutional and retail investors. The largest shareholders include Vanguard Group, BlackRock, and State Street Corporation.

How many companies does T. Rowe Price invest in?

T. Rowe Price invests in hundreds of companies across various industries, with significant stakes in top firms like Microsoft, Apple, NVIDIA, and Amazon.

What is the net worth of T. Rowe Price?

As of 2024, T. Rowe Price’s net worth is approximately $24.5 billion, reflecting its strong financial standing and investment portfolio.

How much revenue does T. Rowe Price generate annually?

In 2024, T. Rowe Price reported $7.80 billion in revenue, marking a 6.1% increase from the previous year.

Is T. Rowe Price a good investment?

T. Rowe Price has a strong track record of financial stability and growth, making it a preferred choice for long-term investors seeking asset management services.

What are the largest companies in T. Rowe Price’s portfolio?

Some of the largest companies in T. Rowe Price’s portfolio include Microsoft, Apple, NVIDIA, Amazon, Alphabet, and Meta Platforms.

Does T. Rowe Price own any companies outright?

T. Rowe Price primarily invests in publicly traded companies rather than owning them outright. It holds significant minority stakes in leading global firms.

How does T. Rowe Price make money?

T. Rowe Price earns revenue through management fees, advisory fees, and mutual fund expense ratios from its investment management services.

Where is T. Rowe Price headquartered?

T. Rowe Price is headquartered in Baltimore, Maryland, USA.