Capital Research and Management Company (CRMC) is a prominent investment management firm known for its stewardship of various mutual funds and investment portfolios. While CRMC primarily serves as an investment adviser, it also holds ownership in several subsidiaries that support its operations and services.

This article explores the list of companies owned by Capital Research and Management along with other key details.

Let’s roll.

What is Capital Research and Management?

CRMC was founded in 1931 by Jonathan Bell Lovelace during the depths of the Great Depression. The firm was established on the principle that deep, fundamental research leads to better investment outcomes. This long-term and research-driven philosophy remains at the core of its operations today.

Over time, CRMC became a key part of Capital Group, which now ranks among the oldest and largest investment management organizations in the world. While many financial institutions shifted focus over the decades due to short-term market pressures or M&A activity, CRMC has remained independent and privately held, allowing it to maintain a long-term investment horizon.

What CRMC Does?

At its core, Capital Research and Management Company manages investment portfolios, primarily through its advisory role with American Funds. These funds cover a range of asset classes including equities, bonds, balanced strategies, target-date funds, and global investment products. The clients served by CRMC include:

- Individual investors using retirement accounts and personal brokerage accounts

- Institutional clients such as pension funds, endowments, foundations, and governments

- Financial advisors who use American Funds in client portfolios

CRMC provides the research, portfolio construction, and ongoing management for these mutual funds. Its investment professionals — including analysts, portfolio managers, and strategists — conduct in-depth analysis of industries, companies, and macroeconomic trends to make informed investment decisions.

The Capital System — A Unique Investment Approach

One of CRMC’s most distinctive characteristics is its use of The Capital System™, a unique investment approach that divides each fund among several portfolio managers, each managing their own portion independently. This system is designed to reduce key-person risk and create more consistent long-term results through diversification of investment perspectives.

Global Reach and Capabilities

Though headquartered in the U.S., CRMC has a truly global presence. Through its affiliates and subsidiaries under Capital Group, it has research and investment offices in Europe, Asia, and Latin America, allowing it to cover markets worldwide. It manages trillions in assets across international equities, fixed income, emerging markets, and global balanced funds.

CRMC is known for:

- Active management — choosing investments based on fundamental research

- Long-term focus — making decisions with 5-, 10-, or even 20-year horizons

- Low costs — American Funds often have expense ratios below the industry average

- Stability — senior portfolio managers often have decades of tenure with the firm

Key Achievements

- One of the largest investment advisers in the U.S., with over $2.9 trillion in assets under management as of 2024

- Oversees some of the most widely held mutual funds in the country (such as American Funds’ Growth Fund of America and EuroPacific Growth Fund)

- Built a reputation for strong long-term performance, especially among retirement investors

- Maintains low turnover among investment professionals, contributing to stable investment leadership.

Who Owns Capital Research and Management Company?

Capital Research and Management Company (CRMC) is not publicly traded, so it does not have the typical shareholder structure of companies listed on stock exchanges. Instead, it is a privately held firm operating as a subsidiary of The Capital Group Companies, Inc. This ownership structure is deliberately designed to foster long-term thinking and avoid the short-term performance pressures associated with public markets.

Parent Company: The Capital Group Companies, Inc.

CRMC is 100% owned by The Capital Group Companies, Inc. — a large, privately held financial services organization founded in 1931. Capital Group is one of the largest investment management firms globally, with offices across North America, Europe, Asia, and Australia.

Capital Group’s Unique Ownership Structure

What sets Capital Group apart from many of its peers is its employee-owned structure. The company is primarily owned by its senior investment professionals, management team members, and long-tenured associates. This creates a strong alignment between those managing client money and the long-term success of the company.

Key Characteristics of Ownership

1. Privately Held

Capital Group, and by extension CRMC, does not issue shares to the public. It does not have outside investors like hedge funds or private equity backers. This ensures the company maintains complete autonomy in decision-making.

2. Employee Ownership

Ownership stakes are held by a select group of senior associates, many of whom are portfolio managers or company executives. New ownership is typically granted based on long-term performance and commitment to the firm. This model:

- Encourages long-term thinking

- Minimizes conflicts of interest

- Fosters a strong internal culture

3. No Dominant Shareholder

Unlike public companies where a single investor can control large voting blocks, ownership at Capital Group is distributed across multiple individuals. No single person or entity has control over the company, reducing the concentration of power and improving governance.

Key Individuals Associated with Leadership (Not Shareholders)

While Capital Group does not disclose specific ownership percentages, some individuals have been publicly recognized in leadership roles:

- Tim Armour – Chairman and CEO of Capital Group. He joined in 1983 and has worked across multiple parts of the business.

- Rob Lovelace – Vice Chairman of Capital Group and portfolio manager, and a third-generation member of the Lovelace family, which has deep ties to the firm’s origins.

- Martin Romo – President of Capital Research and Management Company and a seasoned investment professional at the firm.

While they are not publicly identified as shareholders, individuals in these leadership positions typically hold ownership stakes as part of their long tenure and leadership roles.

No Institutional or External Ownership

Capital Group and CRMC do not have any outside institutional ownership, such as stakes held by private equity firms, investment banks, or other financial entities. This further supports their long-term investment philosophy without pressure from quarterly earnings or activist investors.

List of Companies Owned by Capital Research and Management Company

While CRMC itself does not directly own other companies, it operates within a network of affiliates and subsidiaries under The Capital Group Companies, Inc. These entities collaborate to provide a wide array of investment services:

| Company Name | Founded | Primary Function | Headquarters/Location |

|---|---|---|---|

| Capital International, Inc. (CII) | 1965 | International investment management and research | Los Angeles, California |

| Capital Guardian Trust Company (CGTC) | 1968 | Fiduciary, trust, and custodial services | Los Angeles, California |

| Capital Bank and Trust Company (CB&T) | 1987 | Custodial and recordkeeping for retirement plans | San Antonio, Texas |

| Capital International Research, Inc. (CIRI) | 1984 | Global investment research | Los Angeles, California |

| Capital International Limited (CIL) | 1969 | Investment management and client servicing (Europe/Asia) | London, United Kingdom |

| Capital Strategy Research, Inc. (CSR) | 1984 | Macroeconomic and strategic investment research | San Francisco, California |

| Capital International Sàrl (CISA) | 1963 | Investment services in continental Europe | Geneva, Switzerland |

| Capital Investment Research Services (CIRS) | 2008 | Investment research and analytics support | Hyderabad & Mumbai, India |

| Capital Management Services, Inc. (CMS) | 1963 | Internal operations and administrative support | Los Angeles, California |

| American Funds Distributors, Inc. (AFD) | 1986 | Distribution and promotion of American Funds | Los Angeles, California |

| Capital Group Investment Management Ltd. | Various | APAC-region investment management | Sydney, Australia & regional offices |

| Capital International Asset Mgmt (Canada) | — | Investment products and services for Canadian market | Toronto, Canada |

Capital International, Inc. (CII)

Founded: 1965

Location: Los Angeles, California

Capital International, Inc. is the international investment division of Capital Group. It plays a vital role in managing non-U.S. portfolios and strategies. CII provides research, portfolio management, and analysis for institutional clients around the globe. Its team of investment professionals focuses on companies and sectors in developed and emerging markets outside of North America.

Capital Guardian Trust Company (CGTC)

Founded: 1968

Location: Los Angeles, California

Capital Guardian Trust Company provides fiduciary, custodial, and trust services, especially for institutional clients such as pension plans, endowments, and foundations. CGTC also supports private wealth management and estate planning solutions for high-net-worth individuals. It operates under strict compliance and fiduciary responsibility standards.

Capital Bank and Trust Company (CB&T)

Founded: 1987

Location: San Antonio, Texas

CB&T is the custodial and trustee division of Capital Group. It provides recordkeeping, custodial, and administrative services for retirement plans, IRAs, and 401(k)s. It works closely with financial advisors and employers to manage retirement assets, primarily through American Funds investments.

Capital International Research, Inc. (CIRI)

Founded: 1984

Location: Los Angeles, California

CIRI is the global research subsidiary responsible for in-depth, fundamental research on public and private companies, macroeconomic trends, and sector performance. The insights produced by CIRI directly feed into CRMC’s investment decisions. It is staffed with experienced analysts who often specialize in specific regions or industries.

Capital International Limited (CIL)

Founded: 1969

Location: London, United Kingdom

Capital International Limited handles investment management and client servicing in Europe and Asia. It serves institutional investors and operates in multiple jurisdictions including the UK, Germany, and Asia-Pacific countries. CIL enables Capital Group to provide localized expertise with global standards.

Capital Strategy Research, Inc. (CSR)

Founded: 1984

Location: San Francisco, California

CSR conducts macroeconomic, policy, and strategic investment research to help the firm identify long-term trends that impact markets globally. This includes research on central bank policy, global trade dynamics, inflation trends, and economic cycles.

Capital International Sàrl (CISA)

Founded: 1963

Location: Geneva, Switzerland

CISA focuses on investment management and client servicing in continental Europe, with a strong presence in Switzerland, France, and Germany. It manages both institutional and private client relationships and is instrumental in navigating EU financial regulations.

Capital Investment Research Services Private Limited (CIRS)

Founded: 2008

Location: Hyderabad and Mumbai, India

CIRS is Capital Group’s India-based investment research arm. It supports the firm with equity and fixed-income research, financial modeling, and analytics. The expansion into India allows Capital Group to tap into the region’s talent pool and expand its emerging market research.

Capital Management Services, Inc. (CMS)

Founded: 1963

Location: Los Angeles, California

CMS is an internal support arm providing administrative, operational, and technical services to all Capital Group subsidiaries. It handles tasks like compliance, HR, operations management, IT infrastructure, and facilities, ensuring that the investment teams can focus on portfolio management.

American Funds Distributors, Inc. (AFD)

Founded: 1986

Location: Los Angeles, California

AFD is the distribution arm of American Funds. It works with financial professionals, retirement plan providers, and institutional partners to distribute and promote Capital Group’s mutual funds. AFD supports sales, marketing, and client education, focusing on long-term investing principles.

Capital Group Investment Management Ltd.

Founded: Various (under global registrations)

Location: Sydney, Australia and other locations

This subsidiary supports Asia-Pacific and Oceania-based operations, offering investment products and services in Australia, Japan, Hong Kong, and Singapore. It plays a key role in complying with regional regulations and expanding client relationships in fast-growing markets.

Capital International Asset Management (Canada), Inc.

Location: Toronto, Canada

This Canadian entity enables Capital Group to serve Canadian institutions and individual investors with investment products, including mutual funds and institutional mandates tailored to the regulatory framework of Canada. It promotes Capital’s philosophy of active, long-term investing in the Canadian market.

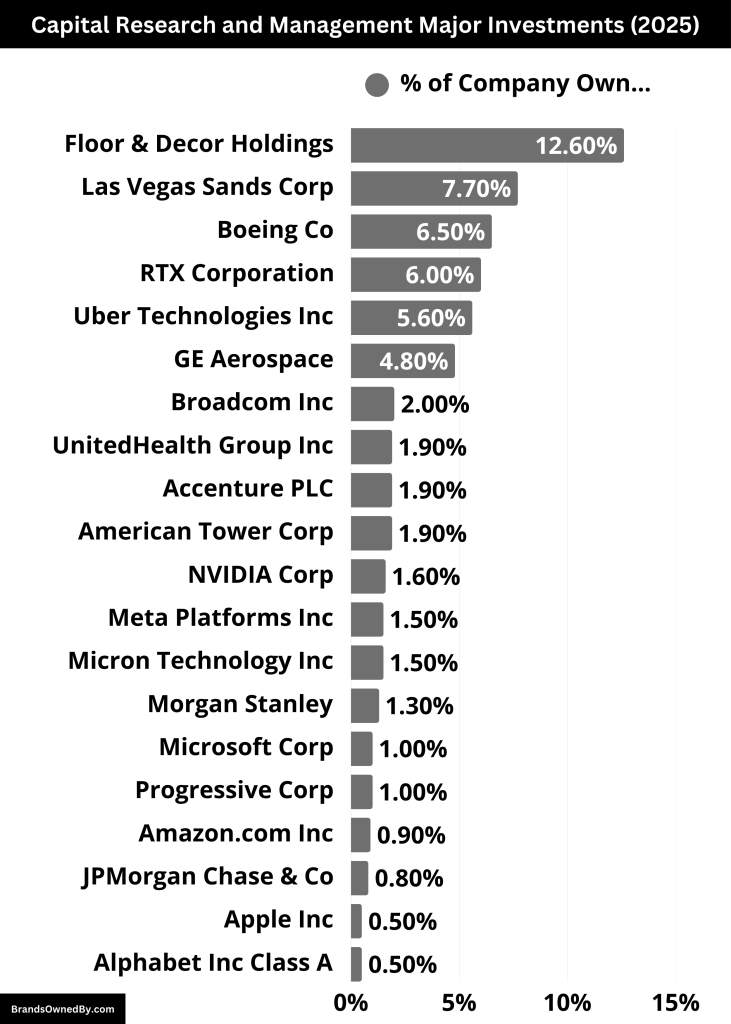

Major Investments of Capital Research and Management Company

Capital Research and Management Company (CRMC), through its affiliate Capital Research Global Investors, holds significant positions in various prominent companies.

Below is a detailed breakdown of top companies Capital Research and Management has invested in:

| Company | Ticker | Shares Held | % of Company Owned | Investment Value |

|---|---|---|---|---|

| Microsoft Corp | MSFT | 76.4 million | 1.0% | $31.7 billion |

| Meta Platforms Inc | META | 37.4 million | 1.5% | $21.8 billion |

| Amazon.com Inc | AMZN | 92.6 million | 0.9% | $19.5 billion |

| Apple Inc | AAPL | 72.2 million | 0.5% | $18.1 billion |

| Broadcom Inc | AVGO | 92.5 million | 2.0% | $17.7 billion |

| Alphabet Inc Class A | GOOGL | 72.0 million | 0.5% | $11.2 billion |

| NVIDIA Corp | NVDA | 63.9 million | 1.6% | $9.1 billion |

| UnitedHealth Group Inc | UNH | 18.0 million | 1.9% | $8.9 billion |

| GE Aerospace | GE | 52.6 million | 4.8% | $10.1 billion |

| RTX Corporation | RTX | 79.5 million | 6.0% | $9.2 billion |

| Uber Technologies Inc | UBER | 118.0 million | 5.6% | $7.13 billion |

| Boeing Co | BA | 38.7 million | 6.5% | $6.84 billion |

| JPMorgan Chase & Co | JPM | 22.8 million | 0.8% | $5.48 billion |

| Morgan Stanley | MS | 21.8 million | 1.3% | $2.74 billion |

| Las Vegas Sands Corp | LVS | 58.8 million | 7.7% | $3.02 billion |

| Accenture PLC | ACN | 12.3 million | 1.9% | $4.33 billion |

| American Tower Corp | AMT | 8.56 million | 1.9% | $1.57 billion |

| Micron Technology Inc | MU | 16.3 million | 1.5% | $1.37 billion |

| Floor & Decor Holdings | FND | 13.3 million | 12.6% | $1.33 billion |

| Progressive Corp | PGR | 6.06 million | 1.0% | $1.45 billion |

Microsoft Corporation (MSFT)

Capital Research holds approximately 76.4 million shares in Microsoft, which equates to around 1.0% of the company’s total shares. This investment is valued at approximately $31.7 billion. Microsoft, headquartered in Redmond, Washington, is a global leader in software, cloud computing, and hardware. It is known for products like Windows, Office Suite, Azure cloud services, and its Surface devices. With its steady cash flow, strong brand presence, and expanding ventures into artificial intelligence, Microsoft continues to be a significant player in the tech industry, making it an attractive long-term investment for CRMC.

Meta Platforms Inc. (META)

Capital Research has invested in Meta Platforms, owning 37.4 million shares, or 1.5% of the company’s total shares, valued at $21.8 billion. Meta, headquartered in Menlo Park, California, is a leading technology company that operates some of the world’s most popular social media platforms, including Facebook, Instagram, and WhatsApp. In addition to its social media services, Meta is heavily investing in virtual reality (VR) and augmented reality (AR), along with its vision of the metaverse. With its vast user base and continuous innovation, Meta remains a key holding in CRMC’s portfolio.

Amazon.com Inc. (AMZN)

Capital Research owns 92.6 million shares of Amazon, representing 0.9% ownership, valued at approximately $19.5 billion. Amazon, headquartered in Seattle, Washington, is one of the largest e-commerce companies in the world, as well as a leader in cloud computing through its Amazon Web Services (AWS) division. Over the years, Amazon has also expanded into entertainment (Amazon Prime Video), logistics, and grocery services. Its diversified business model, coupled with its constant innovation in technology, makes Amazon a critical part of CRMC’s investment strategy.

Apple Inc. (AAPL)

Capital Research holds 72.2 million shares of Apple, representing 0.5% ownership of the company, valued at around $18.1 billion. Apple, based in Cupertino, California, is a leader in consumer electronics, software, and services. Its flagship products, including the iPhone, iPad, Mac, and Apple Watch, have garnered immense global market share. Additionally, Apple’s expansion into services like iCloud, Apple Music, and the App Store adds to its ever-growing revenue streams. Its loyal customer base and strong brand equity make it an attractive investment for CRMC.

Broadcom Inc. (AVGO)

Capital Research has a significant stake in Broadcom, owning 92.5 million shares, or 2.0% of the company, with a value of around $17.7 billion. Headquartered in San Jose, California, Broadcom is a global leader in semiconductors, supplying products for a variety of industries, including telecommunications, networking, and consumer electronics. The company’s aggressive acquisition strategy has bolstered its portfolio, and its chips are critical to the functioning of devices like smartphones and data centers. Broadcom’s dominance in the semiconductor space ensures that it remains a top investment in CRMC’s tech-heavy portfolio.

Alphabet Inc. (GOOGL)

Capital Research holds 72.0 million shares of Alphabet, or 0.5% ownership, valued at around $11.2 billion. Alphabet, the parent company of Google, is a leader in digital advertising, cloud computing, and emerging technologies like artificial intelligence and self-driving cars. Headquartered in Mountain View, California, Alphabet’s core business is centered around Google, the world’s most popular search engine. The company also owns YouTube, Google Cloud, and the autonomous driving company Waymo, among other assets. Its ability to dominate search advertising and expand into new technologies makes Alphabet a vital part of CRMC’s investment portfolio.

NVIDIA Corporation (NVDA)

Capital Research owns 63.9 million shares of NVIDIA, which represents 1.6% ownership of the company, valued at $9.1 billion. NVIDIA, headquartered in Santa Clara, California, is a leader in the design and production of graphics processing units (GPUs), which are essential for gaming, artificial intelligence (AI), and data center operations. Its GPUs power everything from video games to cloud-based AI services, and the company’s dominance in AI and deep learning technologies makes it a strategic and high-growth investment for CRMC.

UnitedHealth Group Inc. (UNH)

Capital Research holds 18.0 million shares of UnitedHealth, representing 1.9% ownership, with an investment value of $8.9 billion. UnitedHealth, based in Minnetonka, Minnesota, is one of the largest healthcare companies in the world. It operates in two segments: Optum, which provides healthcare services, and UnitedHealthcare, which offers insurance plans. The company has benefited from the growing demand for healthcare and its ability to offer a range of services across the health insurance and medical sectors. Its scale and consistent growth make it a solid investment choice for CRMC.

GE Aerospace (GE)

Capital Research owns 52.6 million shares of GE, representing 4.8% ownership, valued at $10.1 billion. General Electric’s aerospace division is a key player in the aviation industry, providing jet engines and other aerospace technologies to commercial and military sectors. The company has a rich history in engineering and innovation and has recently spun off its healthcare and energy divisions, focusing on aviation and defense. GE Aerospace’s expertise and long-term contracts with airlines and governments ensure that it remains a valuable investment for CRMC.

RTX Corporation (RTX)

Capital Research holds 79.5 million shares in RTX Corporation, which represents 6.0% ownership, with an investment value of $9.2 billion. Headquartered in Arlington, Virginia, RTX is a major aerospace and defense company formed from the merger of Raytheon and United Technologies. RTX designs and manufactures advanced systems for military and commercial aerospace, including avionics, missile defense, and space exploration technologies. Its strong presence in defense and aerospace industries makes it a key part of CRMC’s portfolio.

Uber Technologies Inc. (UBER)

Capital Research owns 118.0 million shares of Uber, translating to 5.6% ownership, valued at $7.13 billion. Uber, based in San Francisco, California, is a global leader in ride-hailing, food delivery, and mobility solutions. The company’s platforms, including Uber Rides, Uber Eats, and Uber Freight, offer diverse services that continue to evolve as the company explores autonomous vehicles and global expansion. Uber’s market leadership in urban mobility and its innovation in logistics make it a significant part of CRMC’s portfolio.

The Boeing Company (BA)

Capital Research holds 38.7 million shares of Boeing, or 6.5% ownership, valued at $6.84 billion. Headquartered in Arlington, Virginia, Boeing is one of the world’s largest aerospace companies and a key supplier to the global aviation and defense industries. Despite recent production challenges, Boeing remains a leader in the commercial aircraft and defense sectors. Its Boeing 737 and 787 aircraft are used by airlines worldwide, and the company’s defense products are integral to various military operations. Boeing’s strategic importance in aviation and defense makes it a valuable long-term investment for CRMC.

JPMorgan Chase & Co. (JPM)

Capital Research holds 22.8 million shares of JPMorgan Chase, representing 0.8% ownership, valued at $5.48 billion. JPMorgan Chase is one of the largest financial institutions globally, offering a wide range of services in investment banking, asset management, and consumer banking. Headquartered in New York City, JPMorgan plays a critical role in global financial markets. Its broad portfolio of services and dominant position in the banking industry make JPMorgan a key investment for CRMC, particularly in the financial sector.

Morgan Stanley (MS)

Capital Research owns 21.8 million shares of Morgan Stanley, representing 1.3% ownership, valued at $2.74 billion. Morgan Stanley, headquartered in New York City, is a leading global investment bank and wealth management firm. The company offers investment advisory, asset management, and institutional securities services. Morgan Stanley has a strong presence in both the retail and institutional investment sectors, which provides stability and growth opportunities for CRMC’s portfolio.

Las Vegas Sands Corp. (LVS)

Capital Research holds 58.8 million shares of Las Vegas Sands, translating to 7.7% ownership, with a market value of $3.02 billion. Las Vegas Sands, based in Las Vegas, Nevada, is a global leader in the hospitality and gaming industries, with major properties in Macau and Singapore. The company owns and operates iconic casino resorts like The Venetian and Marina Bay Sands. As global travel and tourism continue to recover, Las Vegas Sands is positioned for growth, making it an important part of CRMC’s portfolio.

Accenture PLC (ACN)

Capital Research owns 12.3 million shares of Accenture, representing 1.9% ownership, with an investment value of $4.33 billion. Accenture, headquartered in Dublin, Ireland, is a global consulting and professional services company that helps organizations with digital transformation, technology, and strategy. With its strong foothold in AI, cloud computing, and data analytics, Accenture continues to be a critical player in helping businesses navigate complex technology challenges. Its diverse client base and continuous growth make it an attractive investment for CRMC.

American Tower Corporation (AMT)

Capital Research holds 8.56 million shares of American Tower, translating to 1.9% ownership, valued at $1.57 billion. American Tower, based in Boston, Massachusetts, is a real estate investment trust (REIT) that focuses on owning and operating cell towers. As demand for wireless communication continues to grow, American Tower’s infrastructure is key to supporting mobile networks globally. Its focus on high-margin lease revenue and international expansion makes it a strong long-term investment for CRMC.

Micron Technology Inc. (MU)

Capital Research owns 16.3 million shares of Micron, or 1.5% ownership, with a market value of $1.37 billion. Micron, based in Boise, Idaho, is a global leader in semiconductor memory products, including DRAM and NAND flash memory. With the increasing demand for data storage in cloud computing, mobile devices, and artificial intelligence, Micron is well-positioned for growth. Its innovation in memory technology ensures it remains a valuable part of CRMC’s tech-focused portfolio.

Floor & Decor Holdings, Inc. (FND)

Capital Research holds 13.3 million shares of Floor & Decor, or 12.6% ownership, valued at $1.33 billion. Headquartered in Atlanta, Georgia, Floor & Decor operates a large chain of specialty flooring retailers in the U.S. The company’s strong growth in both its retail stores and e-commerce platform makes it an appealing investment for CRMC. With its competitive pricing and broad product selection, Floor & Decor continues to capture market share in the home improvement space.

The Progressive Corporation (PGR)

Capital Research holds 6.06 million shares of Progressive, representing 1.0% ownership, with a value of $1.45 billion. Progressive, based in Mayfield, Ohio, is one of the largest auto insurers in the United States. Known for its innovative pricing and marketing strategies, Progressive has grown significantly over the years. The company also offers home and renters insurance and continues to expand its customer base. Progressive’s solid business model and steady growth make it a reliable investment for CRMC.

Capital Research and Management Revenue and Net Worth

As of the six months ended June 30, 2024, CRMC reported total assets under management (AUM) of approximately $1.569 trillion, comprising equity, fixed income, multi-asset, and alternative investments. This reflects a net increase of $124.6 billion during the period, driven by net market appreciation and gains.

While specific net worth figures for CRMC are not publicly disclosed, its substantial AUM and position as a subsidiary of The Capital Group Companies, Inc. indicate a strong financial standing. The wealth management market, in which CRMC operates, is projected to grow from $1.957 trillion in 2024 to $2.091 trillion in 2025, reflecting a compound annual growth rate (CAGR) of 6.9%.

This growth is attributed to factors such as the rise in wealthy individuals, increased digitization, and broader internet penetration. CRMC’s strategic initiatives, including its focus on personalized services and technological advancements, position it well to capitalize on these industry trends.

Final Words

The companies owned by Capital Research and Management Company expanded a lot and the share percentage and ownership percentage of its investments keep changing.

Capital Research and Management Company, through its affiliation with The Capital Group Companies, Inc., has established a robust presence in the global investment management industry. Its commitment to research-driven strategies and client-focused services continues to drive its success and growth in the financial sector.

FAQs

What services does Capital Research and Management Company offer?

CRMC provides investment advisory services, managing a range of mutual funds and investment portfolios for individual and institutional clients.

Is Capital Research and Management Company publicly traded?

No, CRMC is a privately held company and a wholly-owned subsidiary of The Capital Group Companies, Inc.

How does CRMC differ from other investment management firms?

CRMC distinguishes itself through its long-term, research-driven investment approach and a focus on delivering consistent value to clients without the pressures of public market expectations.

What is the relationship between CRMC and American Funds?

CRMC serves as the investment adviser to the American Funds family of mutual funds, managing their investment strategies and operations.

Where is Capital Research and Management Company located?

CRMC is headquartered at 333 South Hope Street, 55th Floor, Los Angeles, California 90071.