Walmart, one of the world’s largest retailers, is a household name known for its vast network of stores and affordable prices. But who owns Walmart?

The answer lies in its ownership structure, which is primarily driven by the Walton family. This article explores the history, ownership, control, and market presence of Walmart, along with its major shareholders and competitors.

Walmart History

Walmart was founded in 1962 by Sam Walton in Rogers, Arkansas. Sam Walton’s vision was to offer low prices to help customers save money. The company grew rapidly, opening its first Walmart Supercenter in 1988.

Today, Walmart operates over 10,500 stores worldwide and serves millions of customers daily. Its success is rooted in its efficient supply chain, focus on customer satisfaction, and ability to adapt to changing market trends.

Here’s a breakdown of full Walmart history:

1962

Sam Walton opened the first Walmart Discount City store in Rogers, Arkansas. His vision was to offer low prices to help customers save money, which became the foundation of Walmart’s success.

1967

Walmart expanded to 24 stores across Arkansas, generating $12.7 million in sales. The company’s focus on rural areas allowed it to tap into underserved markets.

1969

Walmart officially incorporated as Wal-Mart Stores, Inc. This marked the beginning of its formal corporate structure.

1970

Walmart went public, listing its shares on the New York Stock Exchange (NYSE) under the ticker symbol “WMT.” The IPO helped raise funds for further expansion.

1972

Walmart expanded beyond Arkansas, opening stores in Missouri and Oklahoma. By the end of the year, the company operated 51 stores with $78 million in sales.

1975

Walmart implemented its first computerized inventory system, improving efficiency and reducing costs. This innovation set the stage for its future supply chain dominance.

1980

Walmart reached $1 billion in annual sales, becoming one of the fastest-growing retailers in the U.S. The company operated 276 stores and employed 21,000 associates.

1983

Walmart launched Sam’s Club, a membership-based warehouse club, to cater to small businesses and bulk shoppers. The same year, the company introduced its first private-label brand, Great Value.

1987

Walmart installed the largest private satellite communication network in the U.S., connecting stores and improving inventory management. This technology gave Walmart a competitive edge.

1988

The first Walmart Supercenter opened in Washington, Missouri. Supercenters combined general merchandise with a full grocery store, offering customers a one-stop shopping experience.

1990

Walmart became the largest retailer in the U.S. by revenue, surpassing Sears. The company continued to expand its store network and improve operational efficiency.

1991

Walmart expanded internationally, opening its first store in Mexico City. This marked the beginning of its global presence.

1997

Walmart celebrated its first $100 billion in annual sales. The company also launched Walmart.com, entering the e-commerce space.

1999

Walmart acquired ASDA, a UK-based supermarket chain, further expanding its international footprint.

2002

Walmart entered the Japanese market by acquiring a stake in Seiyu, a local retailer.

2005

Walmart introduced its $4 generic prescription drug program, making healthcare more affordable for millions of customers.

2009

Walmart launched its Sustainability Index, committing to reduce waste and improve energy efficiency across its operations.

2010

Walmart acquired Vudu, a digital streaming service, to compete in the growing online entertainment market.

2015

Walmart announced a $20 billion share buyback program, reflecting its strong financial performance.

2016

Walmart acquired Jet.com for $3.3 billion to strengthen its e-commerce capabilities and compete with Amazon.

2018

Walmart launched Walmart+, a subscription service offering benefits like free delivery and fuel discounts.

2020

Walmart’s revenue surpassed $500 billion, driven by increased online sales during the COVID-19 pandemic.

2023

Walmart continued to innovate, investing in automation and expanding its global e-commerce presence. The company remains a leader in retail, with over 10,500 stores worldwide.

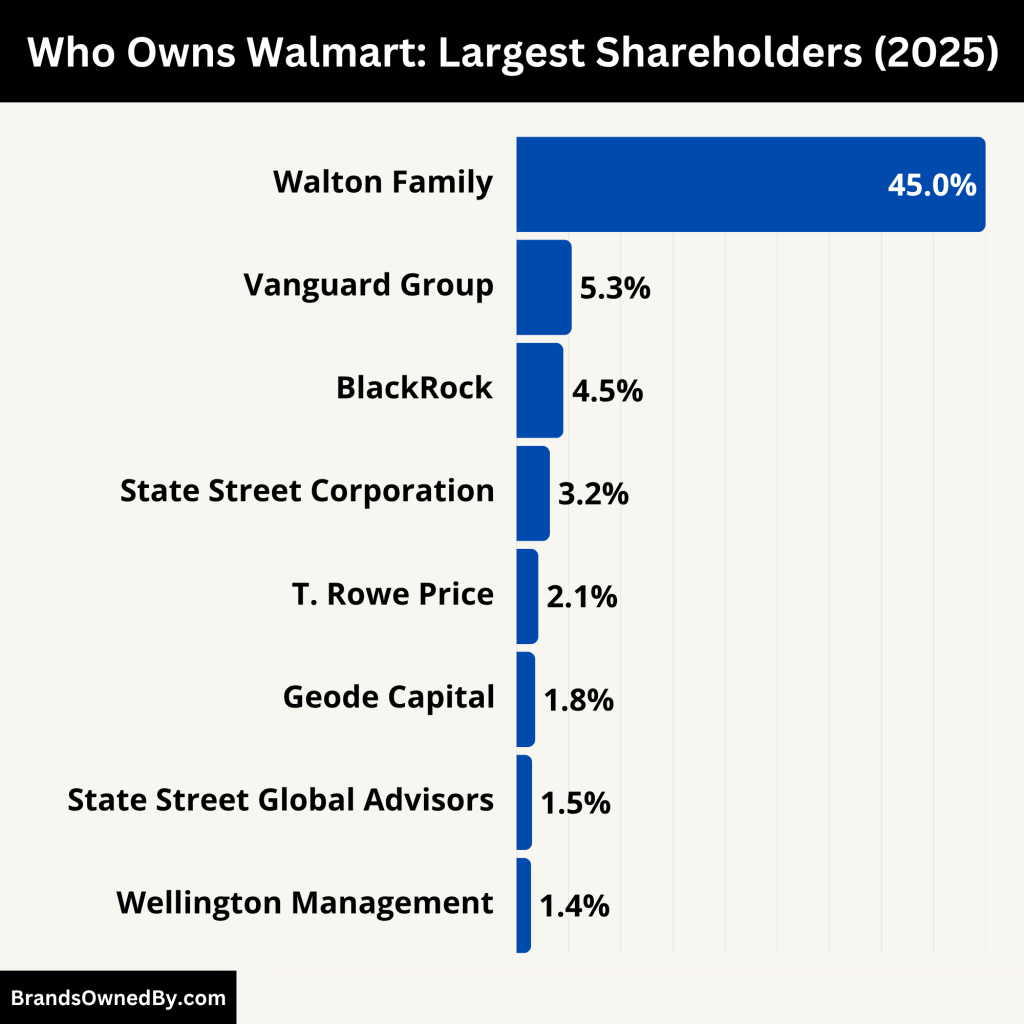

Who Owns Walmart: Top Shareholders

Walmart is a publicly traded company listed on the New York Stock Exchange under the ticker symbol “WMT.” While it has numerous shareholders, the largest and most influential owners are the Walton family. The family’s ownership stems from their connection to Sam Walton, the founder.

Walmart Shareholders and Investors

| Shareholder | Ownership Percentage | Role/Description |

|---|

| Walton Enterprises LLC | 37.3% | The primary investment entity of the Walton family, holding approximately 3.00 billion shares. Managed collectively by family members, it serves as the main vehicle for their Walmart holdings. |

| Walton Family Holdings Trust | 8.1% | A trust overseen by Alice, Jim, and Rob Walton, holding about 652 million shares. This structure aids in estate planning and consolidates family control. |

| Jim Walton | 0.4% | Youngest son of founder Sam Walton, holding approximately 31.5 million shares individually. |

| Alice Walton | 0.3% | Daughter of Sam Walton, possessing around 20.2 million shares individually. |

| Rob Walton | 0.09% | Eldest son of Sam Walton, owning about 7 million shares individually. |

| The Vanguard Group | 5.3% | One of the world’s largest investment management companies, holding approximately 412.5 million shares. |

| BlackRock Inc. | 4.5% | A leading global asset manager, owning about 293.9 million shares. |

| State Street Corporation | 4.4% | A major financial services and asset management company, with holdings of approximately 184.3 million shares. |

| John T. Walton Estate Trust | 21.07% | Trust established for the estate of John T. Walton, son of founder Sam Walton, holding approximately 1.69 billion shares. |

| Vanguard Total Stock Market Index Fund | 0.94% | A mutual fund managed by Vanguard, holding about 28.8 million shares. |

| BlackRock Fund Advisors | 0.77% | A subsidiary of BlackRock Inc., managing funds that collectively hold approximately 23.6 million shares. |

| Dodge & Cox Inc. | 0.71% | An investment management firm, owning about 21.8 million shares. |

| Bank of America Corporation | 0.65% | A multinational investment bank and financial services company, holding approximately 20.1 million shares. |

| Bank of New York Mellon Corporation | 0.57% | An investment banking services holding company, with holdings of about 17.6 million shares. |

| Northern Trust Corporation | 0.57% | A financial services company, owning approximately 17.6 million shares. |

| State Farm Mutual Automobile Insurance Co. | 0.55% | A large group of insurance and financial services companies, holding about 16.8 million shares. |

| SPDR S&P 500 ETF Trust | 0.52% | An exchange-traded fund that tracks the S&P 500 Index, owning approximately 16 million shares. |

1. The Walton Family

The Walton family is the largest and most influential shareholder of Walmart. Collectively, they own approximately 45% of the company’s shares. This significant stake is held through Walton Enterprises LLC and the Walton Family Holdings Trust.

The family’s ownership stems from their connection to Sam Walton, the founder of Walmart.

- Walton Enterprises LLC (37.3%): This entity holds about 3.00 billion shares. Managed collectively by Alice, Jim, Rob Walton, and the John T. Walton Estate Trust, Walton Enterprises LLC serves as the primary investment vehicle for the Walton family’s Walmart holdings.

- Walton Family Holdings Trust (8.1%): Co-trustees Alice, Jim, and Rob Walton oversee approximately 652 million shares through this trust, further consolidating family control over the company.

- Individual Holdings

- Jim Walton: Holds around 31.5 million shares (0.4%).

- Alice Walton: Possesses approximately 20.2 million shares (0.3%).

- Rob Walton: Owns about 7 million shares (0.09%).

The Walton family plays a crucial role in shaping Walmart’s strategic direction. They hold key positions on the company’s board of directors, ensuring that Walmart’s operations align with Sam Walton’s original vision of offering low prices and exceptional customer service.

Rob Walton, Sam Walton’s eldest son, served as chairman of the board for over two decades. His successor, Greg Penner, is also a member of the Walton family. The family’s influence extends beyond ownership, as they actively participate in corporate governance and decision-making processes.

2. Vanguard Group

Vanguard Group is one of the largest institutional shareholders of Walmart, owning approximately 5.3% of the company’s shares. As a leading investment management firm, Vanguard holds Walmart shares on behalf of its clients, including individual investors and retirement funds.

Vanguard’s role is primarily that of a passive investor. However, as a major shareholder, it has a voice in corporate governance matters. Vanguard often votes on key issues such as executive compensation, board appointments, and sustainability initiatives. Its large stake ensures that Walmart’s management remains accountable to its shareholders.

3. BlackRock

BlackRock owns approximately 4.5% of Walmart’s shares. Like Vanguard, BlackRock is an investment management firm that holds shares on behalf of its clients.

BlackRock’s influence lies in its ability to engage with Walmart’s management on environmental, social, and governance (ESG) issues. The firm has been vocal about the importance of sustainability and corporate responsibility, pushing companies like Walmart to adopt more sustainable practices. BlackRock’s voting power also allows it to influence key decisions at shareholder meetings.

4. State Street Corporation

State Street Corporation owns approximately 4.1% of Walmart’s shares. It is a financial services and bank holding company that manages investments for institutional clients.

State Street’s role is similar to that of Vanguard and BlackRock. It acts as a passive investor but uses its voting power to influence corporate governance. State Street has been proactive in advocating for greater diversity on corporate boards, including Walmart’s.

5. Other Institutional Investors

In addition to the top three institutional investors, Walmart has several other institutional shareholders, including Fidelity Investments, Capital Research & Management, and Geode Capital Management. These firms collectively own smaller percentages of Walmart’s shares but still play a role in shaping the company’s governance.

These institutional investors often collaborate on key issues, such as executive compensation and sustainability. Their combined influence ensures that Walmart’s management remains focused on long-term value creation for shareholders.

6. Individual Shareholders

While the majority of Walmart’s shares are held by institutional investors and the Walton family, individual shareholders also own a portion of the company. These include retail investors who purchase shares through brokerage accounts.

Individual shareholders typically have limited influence over corporate decisions due to their smaller stake sizes. However, they can participate in shareholder meetings and vote on key issues.

Who Controls Walmart?

The Walton family controls Walmart through their substantial ownership stake. They also hold key positions on the company’s board of directors. Rob Walton, Sam Walton’s eldest son, served as chairman for over two decades.

His successor, Greg Penner, is also a member of the Walton family. The family’s influence ensures that Walmart’s operations align with Sam Walton’s original vision.

Day-to-day operations are managed by the executive team, led by the CEO, who reports to the board.

Ownership Structure

The Walton family holds a dominant position in Walmart’s ownership:

- Walton Family Holdings: The family owns approximately 46% of Walmart’s shares, valued at around $345 billion.

- Institutional Investors: Major institutions like Vanguard Group and BlackRock also hold significant stakes in Walmart.

Board of Directors

Walmart’s Board of Directors is responsible for overseeing the company’s strategic direction:

- Greg Penner: Chairman of the Board and General Partner of Madrone Capital Partners.

- Doug McMillon: President and CEO of Walmart Inc.

- Other Members: The board includes individuals with diverse backgrounds in technology, finance, and retail.

Executive Leadership

The executive team manages Walmart’s daily operations:

- Doug McMillon: President and CEO.

- John R. Furner: President and CEO of Walmart U.S.

- Judith McKenna: President and CEO of Walmart International.

- Kathryn McLay: President and CEO of Sam’s Club.

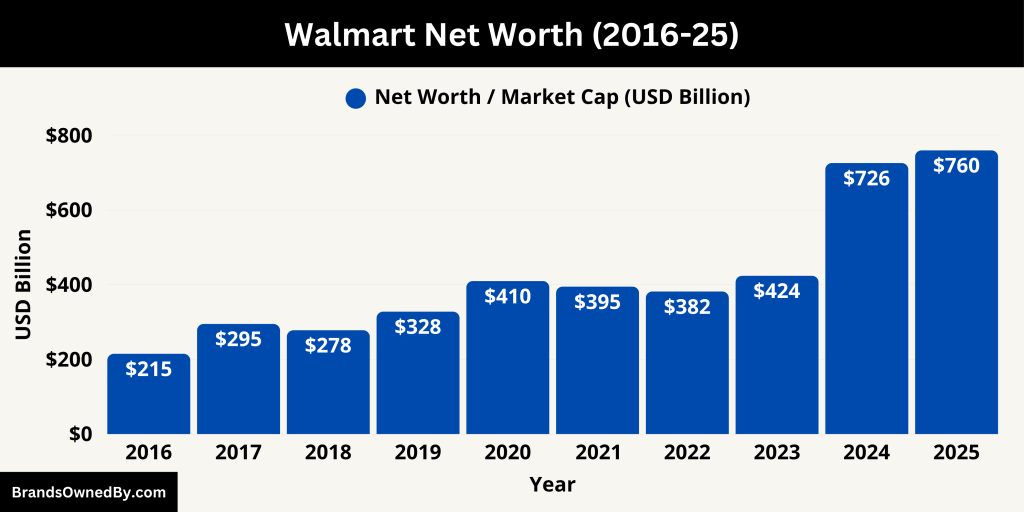

Walmart Annual Revenue and Net Worth

In the fiscal year ending January 31, 2024, Walmart Inc. reported robust financial performance, reflecting its strong market position and operational efficiency.

Walmart’s total revenue for FY2024 reached $648.125 billion, marking a 6.03% increase from the previous fiscal year.

This growth can be attributed to several key factors:

- Walmart U.S.: The domestic segment remained the largest contributor, with net sales of approximately $393.25 billion.

- Walmart International: This division generated around $115 billion in net sales, reflecting a slight increase from the prior year.

- Sam’s Club: The membership-based warehouse segment reported net sales of about $86.2 billion.

Net Income and Profitability

Walmart’s net income for FY2024 was $15.511 billion, a substantial 32.8% increase compared to the previous year.

This rise in profitability underscores effective cost management and strategic initiatives that enhanced operational efficiency.

Walmart’s Net Worth

As of June 2025, Walmart’s market capitalization, representing its net worth, stood at approximately $752.49 billion.

This valuation underscores the company’s dominant position in the global retail market.

Below is a detailed overview of Walmart’s revenue and net income over the past decade, including year-over-year (YoY) percentage changes:

| Fiscal Year | Revenue (in billions) | YoY Revenue Growth | Net Income (in billions) | YoY Net Income Growth |

|---|---|---|---|---|

| 2015 | $485.651 | – | $16.363 | – |

| 2016 | $482.130 | -0.73% | $14.694 | -10.20% |

| 2017 | $485.873 | 0.78% | $13.643 | -7.15% |

| 2018 | $500.343 | 2.98% | $9.862 | -27.71% |

| 2019 | $514.405 | 2.82% | $6.670 | -32.36% |

| 2020 | $523.964 | 1.86% | $14.881 | 123.14% |

| 2021 | $559.151 | 6.72% | $13.706 | -7.89% |

| 2022 | $572.754 | 2.43% | $13.673 | -0.24% |

| 2023 | $611.289 | 6.72% | $11.680 | -14.58% |

| 2024 | $648.125 | 6.03% | $15.511 | 32.80% |

Market Share and Competitors

Walmart holds approximately 10% of the U.S. retail market, making it the largest retailer in the country. Globally, Walmart’s market share is estimated at around 2.5%, reflecting its strong presence in international markets like Mexico, Canada, and the UK. The company’s success is driven by its ability to offer low prices, a wide product assortment, and a seamless omnichannel shopping experience.

Walmart’s market share is particularly strong in the grocery sector, where it accounts for nearly 25% of all U.S. grocery sales. Its e-commerce platform has also grown significantly, capturing a 6% share of the U.S. online retail market. Despite intense competition, Walmart continues to innovate and expand, ensuring its position as a retail leader.

Walmart’s Major Competitors

Here’s a list of the major competitors of Walmart with their market shares:

Amazon

Amazon is Walmart’s biggest competitor, especially in the e-commerce space. With a 38% share of the U.S. online retail market, Amazon dominates the digital shopping landscape. The company’s strengths include its vast product selection, fast delivery options (like Amazon Prime), and advanced technology, such as AI-driven recommendations.

While Walmart has been investing heavily in its e-commerce platform to compete with Amazon, the latter’s focus on innovation and customer convenience keeps it ahead in the online space. However, Walmart’s physical store network gives it an edge in omnichannel retail, where customers can shop online and pick up in-store.

Costco

Costco is a major competitor in the warehouse club segment. With a 2.5% share of the U.S. retail market, Costco focuses on bulk sales and membership-based shopping. The company’s business model emphasizes low prices, high-quality products, and a unique shopping experience.

Costco’s membership fees contribute significantly to its revenue, allowing it to maintain competitive pricing. While Walmart’s Sam’s Club competes directly with Costco, the latter’s loyal customer base and efficient operations make it a formidable rival.

Target

Target is another key competitor, holding a 2% share of the U.S. retail market. Known for its trendy product offerings and affordable prices, Target appeals to a slightly different demographic than Walmart. The company has successfully integrated its online and offline channels, offering services like same-day delivery and curbside pickup.

Target’s focus on private-label brands and partnerships with popular designers has helped it differentiate itself from Walmart. While Target’s store count is smaller than Walmart’s, its strong brand identity and customer loyalty make it a significant competitor.

Kroger

Kroger is the largest supermarket chain in the U.S. and a major competitor in the grocery sector. With a 7% share of the U.S. grocery market, Kroger operates over 2,700 stores and has a strong presence in both urban and rural areas.

Kroger’s strengths include its focus on fresh produce, private-label brands, and digital initiatives like home delivery and pickup services. Walmart’s aggressive pricing strategy in the grocery sector has put pressure on Kroger, but the latter’s emphasis on quality and customer experience helps it maintain a competitive edge.

Home Depot

Home Depot is a leading competitor in the home improvement and hardware sector. With a 2% share of the U.S. retail market, Home Depot caters to both DIY customers and professional contractors.

While Walmart offers home improvement products, its selection is limited compared to Home Depot’s specialized offerings. Home Depot’s focus on customer service, extensive product range, and in-store expertise make it a strong competitor in this niche market.

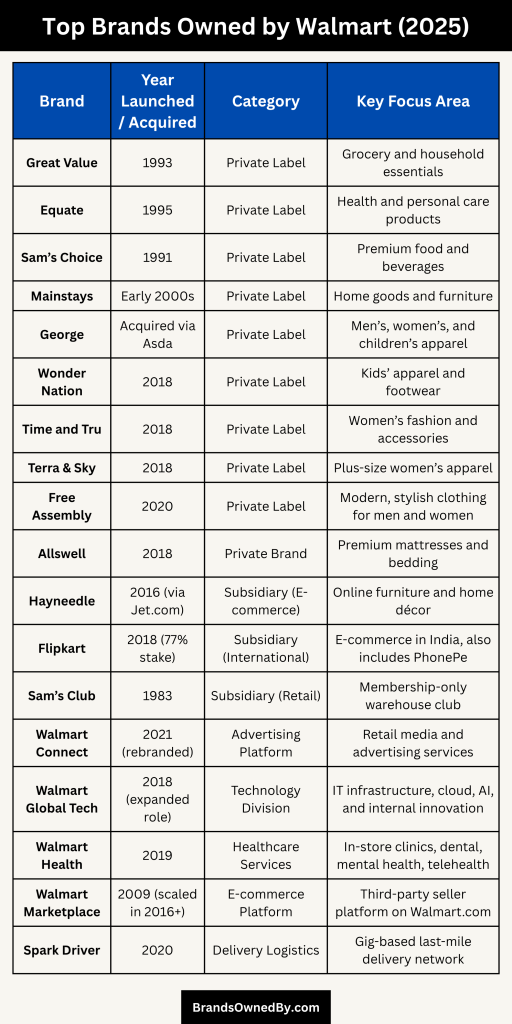

Brands Owned by Walmart

Walmart owns several brands that cater to different market segments. Some of its major brands include:

Sam’s Club

Sam’s Club is a membership-based warehouse club founded by Walmart in 1983. It operates over 600 locations in the U.S. and offers bulk products at discounted prices. Sam’s Club caters primarily to small businesses and bulk shoppers, providing a wide range of merchandise, including groceries, electronics, and home goods.

The brand is a direct competitor to Costco and has carved out a niche by offering exclusive benefits to its members, such as cash rewards and free shipping. Sam’s Club also operates an e-commerce platform, allowing members to shop online and pick up in-store.

Jet.com

Jet.com was an e-commerce platform acquired by Walmart in 2016 for $3.3 billion. Initially launched as a competitor to Amazon, Jet.com focused on offering lower prices through a unique pricing algorithm that reduced costs based on shopping behavior.

While Walmart has since integrated Jet.com’s technology into its own e-commerce operations, the acquisition played a crucial role in strengthening Walmart’s online presence. Jet.com’s innovative approach helped Walmart compete more effectively in the digital retail space.

Great Value

Great Value is Walmart’s private-label brand for groceries and household products. Launched in 1993, it offers a wide range of items, including snacks, beverages, cleaning supplies, and pantry staples. Great Value products are known for their affordability and quality, often serving as a cheaper alternative to national brands.

The brand is a key driver of Walmart’s grocery sales, contributing significantly to its market share in the food retail sector. Great Value products are exclusively available at Walmart stores and online.

Equate

Equate is Walmart’s private-label brand for health and wellness products. It includes over-the-counter medications, vitamins, personal care items, and beauty products. Equate is designed to provide affordable alternatives to name-brand health products, making it a popular choice among budget-conscious consumers.

The brand’s extensive product range and competitive pricing have made it a staple in Walmart’s health and wellness category. Equate products are available in Walmart stores and online.

MoDRN

MoDRN is a private-label furniture brand owned by Walmart. It offers modern, stylish furniture and home decor at affordable prices. The brand targets younger consumers looking for trendy yet budget-friendly options to furnish their homes.

MoDRN’s product line includes sofas, dining sets, bedroom furniture, and decorative accessories. The brand is available exclusively on Walmart’s website, making it a key player in the company’s e-commerce strategy.

Allswell

Allswell is a direct-to-consumer bedding and mattress brand launched by Walmart in 2018. It offers high-quality mattresses, bedding, and sleep accessories at competitive prices. Allswell operates primarily online, with products available through its website and Walmart’s e-commerce platform.

The brand aims to disrupt the mattress-in-a-box market by combining affordability with premium features. Allswell’s success reflects Walmart’s ability to tap into growing consumer trends, such as online shopping for home goods.

Bonobos

Bonobos is a men’s clothing brand acquired by Walmart in 2017. Known for its high-quality apparel and personalized shopping experience, Bonobos operates both online and through physical “guideshops” where customers can try on clothes before purchasing.

While Bonobos operates independently, its acquisition allowed Walmart to enter the premium apparel market and attract a more upscale customer base. The brand’s focus on fit, style, and customer service sets it apart in the competitive fashion industry.

Hayneedle

Hayneedle is an online retailer specializing in home furniture and decor. Acquired by Walmart in 2018, Hayneedle offers a wide range of products, including indoor and outdoor furniture, rugs, and lighting.

The brand complements Walmart’s existing home goods offerings and strengthens its position in the e-commerce space. Hayneedle’s extensive product selection and competitive pricing make it a popular choice for online shoppers.

Shoes.com

Shoes.com was an online footwear retailer acquired by Walmart in 2017. Although Walmart later shut down the Shoes.com website, the acquisition helped Walmart enhance its footwear offerings and expand its online product catalog.

The move reflected Walmart’s strategy to compete with online retailers like Zappos and Amazon in the footwear category.

Vudu

Vudu is a digital streaming service acquired by Walmart in 2010. It offers a wide range of movies and TV shows for rental or purchase, as well as ad-supported free content. Vudu competes with platforms like Netflix and Hulu, providing Walmart with a foothold in the digital entertainment market.

The service is integrated into Walmart’s ecosystem, allowing customers to access entertainment options alongside their shopping experience.

Conclusion

Walmart’s ownership is primarily controlled by the Walton family, who have maintained the company’s core values since its founding. With a strong market presence, diverse brand portfolio, and consistent financial performance, Walmart continues to be a leader in the retail industry. Its ability to adapt to changing consumer preferences ensures its relevance in a competitive market.

FAQs

Who owns Walmart?

Walmart is a publicly traded company, but the majority of its shares are owned by the Walton family. The family owns approximately 45% of Walmart’s shares through Walton Enterprises LLC and the Walton Family Holdings Trust.

How much of Walmart does the Walton family own?

The Walton family owns around 45% of Walmart’s shares, making them the largest and most influential shareholders.

Is Walmart owned by China?

No, Walmart is not owned by China. It is an American multinational retail corporation headquartered in Bentonville, Arkansas. While Walmart operates stores in China and sources many products from Chinese manufacturers, its ownership remains primarily with the Walton family and institutional investors.

Who is the CEO of Walmart?

As of 2023, the CEO of Walmart is Doug McMillon. He has been with the company for over 30 years and has played a key role in Walmart’s growth and transformation.

Is Walmart owned by Amazon?

No, Walmart is not owned by Amazon. Walmart and Amazon are separate companies and are actually competitors in the retail and e-commerce industries.

Who founded Walmart?

Walmart was founded by Sam Walton in 1962. The first store opened in Rogers, Arkansas, and the company has since grown into one of the largest retailers in the world.

What percentage of Walmart does Vanguard own?

Vanguard Group, one of Walmart’s largest institutional shareholders, owns approximately 5.3% of the company’s shares.

Does the Walton family still control Walmart?

Yes, the Walton family still controls Walmart through their significant ownership stake and presence on the company’s board of directors. They play a key role in shaping Walmart’s strategic direction.

How much is Walmart worth?

As of 2025, Walmart’s market capitalization is approximately $760 billion, making it one of the most valuable companies in the world.

What other brands does Walmart own?

Walmart owns several brands, including Sam’s Club, Great Value, Equate, Bonobos, Jet.com, and MoDRN. These brands cater to different market segments and contribute to Walmart’s diverse product offerings.

Is Walmart a publicly traded company?

Yes, Walmart is a publicly traded company. Its shares are listed on the New York Stock Exchange (NYSE) under the ticker symbol WMT.

Who are Walmart’s biggest competitors?

Walmart’s biggest competitors include Amazon, Costco, Target, Kroger, and Alibaba. These companies compete with Walmart in various retail categories, including e-commerce, groceries, and general merchandise.

How many stores does Walmart have worldwide?

As of 2023, Walmart operates over 10,500 stores worldwide across 24 countries. This includes Walmart Supercenters, Sam’s Club locations, and smaller-format stores.

What is Walmart’s annual revenue?

Walmart’s annual revenue exceeds $600 billion, making it one of the highest-earning companies globally.

Does Walmart own Jet.com?

Yes, Walmart acquired Jet.com in 2016 for $3.3 billion. Although Jet.com’s operations have since been integrated into Walmart’s e-commerce platform, the acquisition played a key role in strengthening Walmart’s online presence.

What is Walmart’s market share in the U.S.?

Walmart holds approximately 10% of the U.S. retail market, making it the largest retailer in the country. In the grocery sector, its market share is nearly 25%.

Does Walmart own any streaming services?

Yes, Walmart owns Vudu, a digital streaming service that offers movies and TV shows for rental, purchase, or free ad-supported viewing.

Who are Walmart’s major shareholders?

Walmart’s major shareholders include the Walton family, Vanguard Group, BlackRock, and State Street Corporation. These entities hold significant stakes in the company and influence its governance.

What is Walmart’s net worth?

Walmart’s net worth is estimated at around $400 billion, reflecting its strong financial performance and market position.

Does Walmart own any international brands?

Yes, Walmart owns several international brands, including ASDA in the UK and Flipkart in India. These brands help Walmart expand its global presence and cater to local markets.