- Roku is a publicly traded company, but control is centralized. Founder and CEO Anthony Wood owns 11.6% of Roku’s outstanding shares and controls more than 50% of total voting power through Class B super-voting shares, giving him decisive authority over the board and long-term strategy.

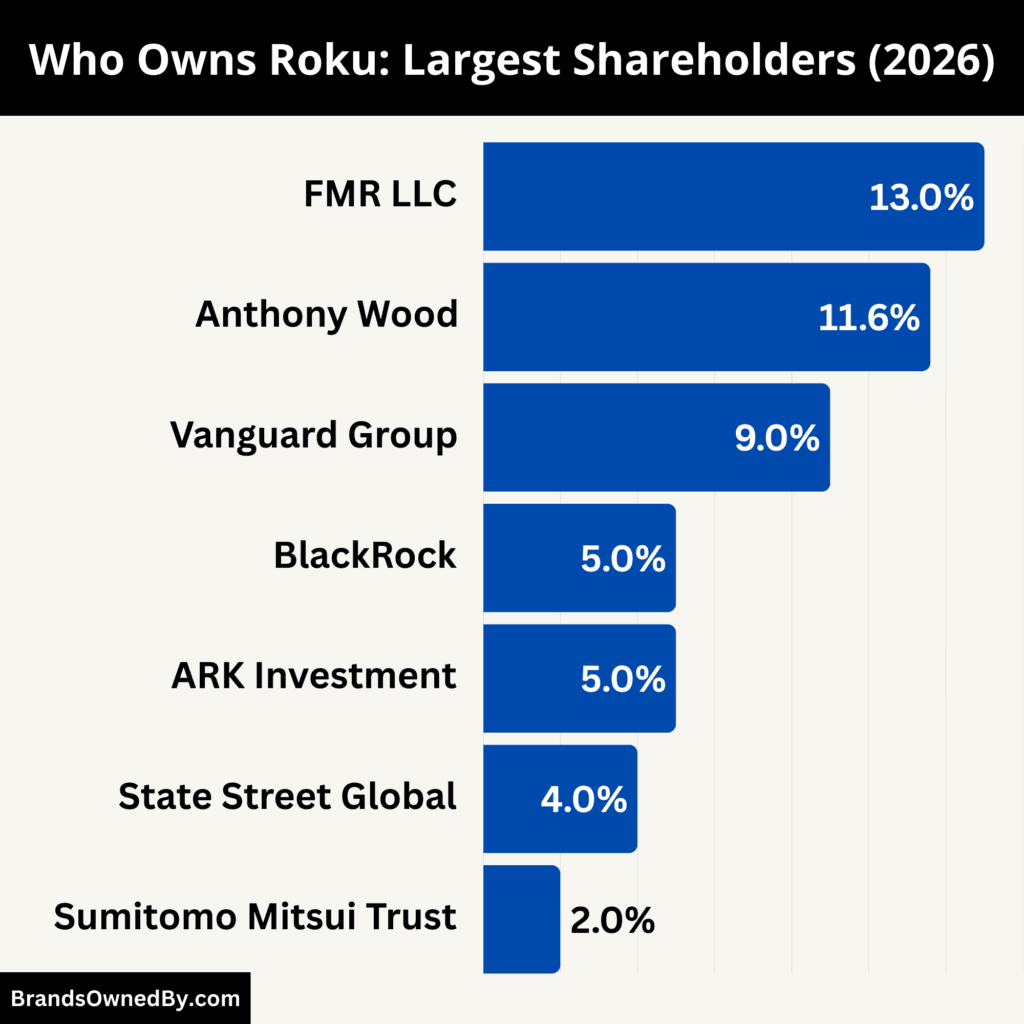

- Institutional investors collectively own approximately 43% of Roku’s equity. Fidelity is the largest institutional shareholder with 13%, followed by Vanguard at 9% and BlackRock at 5%. These shareholders provide capital and stability but do not control governance.

- Retail and other public shareholders hold about 32% of Roku shares. This ownership is highly fragmented across individuals and smaller funds, limiting coordinated influence on corporate decisions.

- In summary, Roku’s ownership separates economics from control. While over 75% of the company is owned by institutions and public investors, effective control remains firmly with the founder, enabling long-term platform and advertising-focused decision-making.

Roku is a US-based streaming platform company. It was founded in 2002. The company is headquartered in San Jose, California.

Roku was created to simplify TV streaming. It started with set-top boxes. Over time, it shifted toward becoming a platform-first business. The Roku OS now powers millions of smart TVs globally.

A major milestone came in 2017. Roku went public on NASDAQ under the ticker ROKU. Since then, advertising and platform revenue have become its core growth engines.

Another key milestone was the rapid expansion of Roku TV licensing. TV manufacturers adopted Roku OS as a default smart TV system. This move scaled the company faster than hardware sales alone.

Ownership Snapshot (as of 2026)

Roku is a publicly traded company, but its ownership structure is not evenly balanced. While millions of shares are held by institutions and public investors, control is concentrated in the hands of its founder through a dual-class share system.

Anthony Wood, the founder and CEO, owns roughly 15% of Roku’s outstanding shares. This represents his economic stake. His real influence comes from Class B shares, which carry enhanced voting rights. Because of this structure, he controls a majority of the company’s voting power. This allows him to shape board composition, approve major transactions, and guide long-term strategy without opposition from other shareholders.

Institutional investors collectively own around 40% to 45% of Roku’s shares. The largest positions are held by firms such as Vanguard Group, BlackRock, and State Street Global Advisors. These firms hold Class A shares with standard voting rights. Their ownership provides market stability and liquidity but does not translate into control over the company.

Retail investors and smaller funds own the remaining 35% to 40% of shares. This portion represents the public float. Ownership in this group is widely dispersed, which limits its influence in corporate governance matters.

Overall, Roku’s ownership combines broad public participation with founder-led control. Economic ownership is diversified across institutions and individuals. Voting power remains centralized. This structure enables Roku to prioritize long-term platform growth while insulating leadership from short-term market pressure.

Ownership History and Structural Background

The ownership structure of Roku did not emerge by accident. It was shaped deliberately as the company evolved from a startup into a publicly traded platform business. Each stage of Roku’s growth added new shareholders, but control mechanisms were preserved from the beginning.

Founder Ownership at Formation

Roku was founded in 2002 by Anthony Wood with a clear long-term vision. In the early years, ownership was tightly held. The founder, early engineers, and a small group of insiders owned most of the equity. There was no public market pressure at this stage.

Anthony Wood maintained a large ownership stake through the formative period. More importantly, he retained governance authority. This allowed Roku to make product-led decisions, including early bets on streaming devices and later on operating system licensing, without external interference.

Venture Capital and Early Institutional Involvement

As Roku began to scale, outside capital became necessary. Venture capital firms and strategic investors joined the shareholder base to fund hardware expansion, platform development, and international reach. These investors received equity in exchange for growth capital.

Despite multiple funding rounds, dilution was carefully managed. No single investor or group gained control. The founder’s influence remained intact. Board representation was granted, but voting authority stayed aligned with management. This ensured that financial backers supported growth without dictating strategy.

IPO and Introduction of Dual-Class Shares

Roku’s 2017 initial public offering marked a structural turning point. Public shareholders gained access to the company’s equity. However, Roku did not open control to the market.

The IPO introduced two classes of stock. Class A shares were sold to public investors and carry standard voting rights. Class B shares were retained by insiders and carry enhanced voting power. This design separated ownership economics from governance control.

The dual-class structure allowed Roku to raise capital, increase visibility, and improve liquidity while preserving leadership stability. It also signaled to investors that the company would be founder-led after going public.

Post-IPO Ownership Evolution

After the IPO, ownership broadened significantly. Large institutional investors entered the stock through index inclusion and long-term fund allocations. Trading volume increased, and the public float expanded.

Despite these changes, voting control did not shift. The Class B structure remained unchanged. No major conversion of high-vote shares occurred. As a result, the founder continued to control board elections and major corporate actions even as economic ownership became more diversified.

Strategic Rationale Behind the Ownership Structure

Roku’s ownership design supports its platform-first business model. Streaming ecosystems require long-term investment in software, advertising infrastructure, and data capabilities. Short-term earnings volatility is common in this sector.

By maintaining founder control, Roku insulated itself from activist investors and takeover attempts. Management can prioritize user growth, advertising scale, and operating system partnerships without reacting to quarterly market pressure.

Who Owns Roku: Largest Shareholders

Roku’s ownership structure combines broad public investment with concentrated insider control. While the company is publicly traded on the NASDAQ, control over major strategic decisions does not rest purely with the public. Instead, the governance framework gives disproportionate influence to its founder through a dual-class share system. This setup allows Roku to access capital markets and attract institutional investors while preserving leadership continuity and long-term strategy focus.

Below is a list of the major shareholders of Roku as of January 2026:

| Shareholder | Approx. Ownership (%) | Share Class | Shareholder Type | Role in Company | Level of Control |

|---|---|---|---|---|---|

| Anthony Wood | 11.5–12% | Class B (super-voting) | Founder / Insider | Founder, Chairman, CEO | Majority voting control due to enhanced voting rights |

| FMR LLC (Fidelity) | 12–13% | Class A | Institutional Investor | Long-term capital provider | Economic influence only, no control |

| Vanguard Group | 8–9% | Class A | Institutional Investor | Index and mutual fund holder | Passive governance influence |

| BlackRock | 5% | Class A | Institutional Investor | ETF and asset manager | Passive, votes on governance matters |

| ARK Investment Management | 4–5% | Class A | Active Institutional Investor | Growth-focused fund investor | No control, higher trading activity |

| State Street Global Advisors | 3–4% | Class A | Institutional Investor | Index fund provider | Passive governance role |

| Sumitomo Mitsui Trust Holdings | 2–3% | Class A | Institutional Investor | Global asset manager | No operational control |

| Other Institutional Investors | 10–15% | Class A | Institutions / Hedge Funds | Portfolio-based investors | Fragmented, limited influence |

| Retail & Public Shareholders | 25–35% | Class A | Individual / Public Investors | Public float holders | No coordinated control |

| Other Insiders & Executives | 1–2% | Mostly Class A | Company Management | Alignment with shareholders | Minimal governance impact |

Anthony Wood: Founder and Controlling Shareholder

Anthony Wood is the founder, Chairman, and CEO of Roku. He also remains the most influential individual shareholder. Wood’s direct economic ownership in the company sits at around 11.6% of total shares outstanding.

What distinguishes his position, however, is that his holdings are primarily in Class B shares that carry enhanced voting rights. These high-voting shares give him control over a majority of the company’s voting power, despite a minority stake economically.

This arrangement allows him to influence board elections, corporate governance decisions, and long-term strategic direction without dilution from public trading activity. Wood has occasionally sold small amounts of shares through planned transactions, but he retains governance control through the dual-class structure.

FMR LLC

FMR LLC, the parent company of Fidelity Investments, is one of the largest institutional owners of Roku’s publicly traded shares. It holds roughly 13% of the outstanding Class A stock, making it the largest institution on the shareholder register by economic stake.

Fidelity’s ownership reflects confidence in Roku’s long-term growth prospects, particularly in the advertising and platform revenue segments. As a major mutual fund operator, FMR’s stake is spread across various funds and accounts, and it participates actively in governance matters through proxy voting. Its involvement adds credibility and liquidity to Roku’s stock in institutional markets.

The Vanguard Group

The Vanguard Group is another leading institutional investor in Roku. It owns around 9% of the company’s publicly traded shares. Vanguard primarily holds this stake through index funds and broad-market mutual funds.

Its investment reflects passive long-term positioning rather than active strategic control. Vanguard’s participation ensures a significant voting presence on key governance issues, although it does not approach the founder’s control level due to the dual-class voting structure. Its holdings are among the most stable and consistently reported institutional positions in Roku.

ARK Investment Management LLC

ARK Investment Management, led by Cathie Wood (no relation to Anthony Wood), holds approximately 5% of Roku’s publicly traded shares. ARK’s stake is typically associated with its innovation-focused funds, which target high-growth technology companies with disruptive business models.

ARK’s investment perspective emphasizes Roku’s potential to transform television advertising and streaming engagement. Its ownership position can fluctuate with fund rebalancing, but ARK remains a visible supporter of Roku’s growth trajectory.

BlackRock, Inc.

BlackRock, the world’s largest asset manager, holds close to 5% of Roku’s public stock. Its stake is spread across multiple funds, including exchange-traded funds and institutional accounts. BlackRock takes a fiduciary role, voting on governance matters and supporting shareholder value strategies.

Like other institutions, BlackRock’s influence is primarily economic rather than operational. Its diversified investment portfolio ensures that Roku is just one of many technology and media holdings, but its position remains significant in terms of market presence.

State Street Global Advisors

State Street Global Advisors is one of the largest institutional shareholders of Roku. It owns approximately 4% of the company’s outstanding shares, primarily through index funds and exchange-traded funds that track major US equity benchmarks.

State Street’s stake represents passive, long-term ownership rather than active control. Its shares are held as Class A stock, which carries standard voting rights. As a result, State Street does not influence Roku’s strategic direction or management decisions. Its role is limited to proxy voting on matters such as board appointments, executive compensation, and governance policies.

Like other large index managers, State Street provides liquidity and stability to Roku’s shareholder base. However, due to Roku’s dual-class share structure, State Street’s voting power is significantly outweighed by the founder’s super-voting shares.

Sumitomo Mitsui Trust Holdings

Sumitomo Mitsui Trust Holdings is a significant institutional shareholder of Roku, holding approximately 2% of the company’s outstanding shares.

The firm’s investment reflects long-term exposure to global technology and media platforms. Its stake is held in Class A shares, which carry standard voting rights. As a result, Sumitomo Mitsui Trust does not exert control over Roku’s governance or strategic direction.

Its role is primarily financial. It contributes to institutional stability and global investor diversification rather than operational influence.

Other Institutional Investors

Beyond Roku’s largest disclosed shareholders, a wide range of institutional investors collectively own approximately 15% of the company’s outstanding shares. This group includes large asset managers, pension funds, and diversified investment firms such as Capital Group, T. Rowe Price, Northern Trust, and Invesco, among others.

These institutions typically hold relatively small individual positions compared to Roku’s top shareholders. Their stakes are spread across multiple funds and investment vehicles and are adjusted periodically based on portfolio rebalancing, index changes, and market conditions. Because ownership within this group is highly fragmented, these shareholders do not act in a coordinated manner.

All of these investors hold Class A shares with standard voting rights. As a result, their governance influence is limited. Even collectively, they remain structurally subordinate to the founder’s super-voting shares. Their primary role is providing liquidity, capital support, and market depth rather than influencing Roku’s strategic or operational decisions.

Retail and Other Public Investors

Beyond institutional holders, retail investors and smaller public entities hold a significant portion of Roku’s stock. Estimates suggest that retail and miscellaneous holders account for roughly 20% to 35% of total shares.

These investors include individual traders, private investment accounts, and smaller funds that choose Roku for its growth narrative. Although they collectively represent a large economic share, their influence on governance is limited because their holdings are dispersed and lack coordination.

Insider and Executive Ownership

Other than Anthony Wood, a small percentage of shares are held by executives and board members. Insider ownership in Roku is modest compared to institutional holdings, comprising around 0.6% to 2% of total shares.

This includes current executives, non-employee directors, and employee equity plans. These holdings align management interests with shareholders but do not meaningfully shift governance power away from the founder or major institutions.

Ownership Dynamics and Voting Structure

Roku’s dual-class share system is central to understanding its ownership dynamics. Class A shares, held by public investors and institutions, generally carry one vote per share. Class B shares, held largely by the founder and early insiders, carry enhanced voting power.

This structure ensures that, despite wide economic distribution, strategic control remains concentrated. It protects leadership continuity and enables a long-term strategic focus even as institutional and retail ownership grows.

Competitor Ownership Comparison

Ownership and control play a critical role in shaping how streaming and smart TV platforms compete. Different governance models influence decision-making speed, risk tolerance, capital allocation, and long-term strategy. When comparing Roku with its closest competitors, clear differences emerge in how control is distributed between founders, institutions, families, and corporate groups.

These structural differences help explain why companies pursue distinct approaches to hardware pricing, operating system licensing, advertising, and content investment.

Amazon / Fire TV

Amazon Fire TV is a product line of Amazon.com, Inc., a publicly traded technology and retail conglomerate. Amazon’s equity is widely held by institutional investors, with large index managers such as Vanguard and BlackRock holding substantial economic positions.

Jeff Bezos remains the largest individual shareholder, holding roughly a single-digit percentage of total shares, which nevertheless represents a very large economic stake.

Governance at Amazon is typical for a large public company: board elections and corporate policy are determined by votes from a broad base of Class A shares held by institutions and retail investors; no single individual holds the sort of super-voting control seen at some dual-class companies.

Alphabet / Google (Chromecast & Google TV)

Google’s parent, Alphabet, operates Chromecast hardware and Google TV software. Alphabet uses a multi-class share structure that concentrates voting power in the founders’ hands through Class B shares.

Founders and early insiders—most notably Larry Page and Sergey Brin—retain a disproportionate share of voting power even though their economic stakes are smaller than the aggregated institutional float. Institutional owners provide economic scale and liquidity, but major strategic control effectively rests with founder-aligned voting blocs.

This governance arrangement gives Alphabet stability and the ability to pursue long-term product and platform investments.

Apple (Apple TV)

Apple sells the Apple TV device and operates the tvOS platform, but Apple itself is a broadly held public company.

Large institutional investors such as Vanguard, BlackRock, and Berkshire Hathaway are prominent economic owners. Corporate control is exercised through the board and typical shareholder voting processes rather than a founder super-voting model. Executive leadership is accountable to an independent board and institutional shareholders.

Apple’s ownership profile means strategic decisions reflect a blend of executive vision and institutional governance rather than concentrated personal control.

Samsung Electronics (Tizen)

Samsung supplies many of the world’s smart TVs and runs the Tizen platform on its TVs. Samsung Electronics is publicly traded but exists inside a family-controlled conglomerate structure in which the founding family (the Lees) and related trusts exert influence disproportionate to their direct equity percentages.

Family members hold relatively small direct equity stakes but exercise influence through cross-shareholdings, group corporate governance, and board appointments.

In recent years, Samsung has also used buybacks and executive compensation plans to align management incentives, while foreign institutional ownership provides significant economic scale. This hybrid of family influence plus large public ownership gives Samsung a distinct governance profile compared with pure public companies.

LG Electronics (webOS)

LG’s smart-TV platform (webOS) is part of LG Electronics, which in turn sits within the broader LG corporate group. LG Corp (the parent or holding company in the conglomerate) is a major direct shareholder of LG Electronics and controls a significant portion of the economic and governance interest.

This vertical group ownership concentrates influence within the corporate family rather than with dispersed retail holders. Institutional investors and national pension funds are also active shareholders, but the parent-group ownership model gives LG more centralized strategic control than a fully dispersed public firm.

Comcast / Xumo & Peacock

Comcast owns multiple streaming assets that compete for TV attention, including Xumo (in streaming software/licensing) and Peacock (streaming service). Comcast is publicly listed, and its executive family retains meaningful influence over corporate direction.

The company’s CEO and executive chair have held positions that give them notable voting clout relative to their economic stake, and large institutional holders provide the bulk of the public float.

The result is governance that mixes executive influence with institutional oversight, producing a structure more centralized than pure index-fund ownership but less founder-dominated than dual-class firms.

How These Ownership Models Compare with Roku’s Control Model

Roku sits in a distinct governance category when compared with the competitors above. Roku is publicly traded and benefits from institutional ownership and retail liquidity.

However, its dual-class share structure assigns enhanced voting rights to insider Class B shares held by the founder and certain insiders. That structure concentrates decision-making power with Anthony Wood and insiders, even while economic ownership is broadly distributed.

In contrast, companies such as Amazon and Apple operate under broad institutional ownership with no single founder holding decisive voting power, Alphabet concentrates control through founder Class B stock but at a much larger scale of revenue and assets, and Samsung or LG achieve control through corporate group and family structures.

Roku’s model, therefore, allows one person to set long-term strategy and steer platform investments in a way that most purely public competitors cannot.

Ownership and control shape how each company allocates capital and time horizons for strategic bets. Firms with dispersed institutional ownership tend to face stronger near-term market accountability.

Founder- or family-controlled firms often pursue longer-term platform plays or vertical integration that may take years to show returns. For Roku, founder control enables sustained investment in the platform and ad-tech stack despite quarterly market pressures.

For Amazon, Apple, Alphabet, Samsung, and LG, governance structures drive different balances of risk tolerance, M&A appetite, and product prioritization. This difference in governance is a key factor behind why each competitor approaches device subsidies, OS licensing, content deals, and advertising monetization differently.

Who Controls Roku?

Control at Roku is not determined by share count alone. It is shaped by voting power, board authority, and executive leadership. While Roku is publicly traded, effective control remains concentrated rather than distributed across shareholders.

Founder Control Through Voting Power

Anthony Wood is the controlling figure at Roku. Although he owns a minority percentage of total outstanding shares, his holdings are primarily in Class B stock. These shares carry super-voting rights, giving him majority control over shareholder votes.

This voting dominance allows him to approve or block major corporate actions. These include board elections, mergers and acquisitions, changes to governance policies, and long-term strategic initiatives. No institutional investor or shareholder group has enough voting power to override his position.

Dual-Class Share Structure as the Control Mechanism

Roku’s dual-class share structure is the foundation of its control framework. Public investors and institutions hold Class A shares with standard voting rights. Insiders hold Class B shares with enhanced voting power.

This structure separates economic ownership from governance authority. Even if institutional investors collectively own more shares than insiders, they cannot outvote the founder. This design ensures continuity in leadership and protects the company from external control attempts.

Board of Directors and Governance Oversight

Roku’s board of directors operates under a founder-controlled governance model. Board members are elected through shareholder voting, where Class B shares carry greater weight.

As a result, the board largely reflects management’s strategic vision. Independent directors provide oversight, regulatory compliance, and risk management. However, ultimate authority over board composition rests with the controlling shareholder.

The board advises on capital allocation, executive compensation, and long-term planning. It does not function as a counterbalance to founder control.

Executive Management and Operational Control

Day-to-day operations at Roku are managed by the executive leadership team under the CEO. Anthony Wood plays a central role in product strategy, platform development, and advertising ecosystem expansion.

Senior executives oversee areas such as platform monetization, content partnerships, and international growth. These executives report directly to the CEO. Strategic alignment flows from the top down, reinforcing centralized control.

Limited Influence of Institutional Investors

Large institutional shareholders hold significant economic stakes. However, their influence is largely advisory. They engage through proxy votes, governance discussions, and shareholder feedback.

Because they hold Class A shares, their voting power is limited. They cannot force leadership changes or strategic shifts without insider approval. Their primary leverage is market-based, not governance-based.

Protection Against Takeovers and Activism

Roku’s control structure makes hostile takeovers highly unlikely. Any acquisition would require approval from the controlling shareholder. Activist investors face similar limitations.

This protection allows Roku to pursue long-term investments in advertising technology and operating system expansion. It reduces exposure to short-term profit pressure but also limits shareholder intervention.

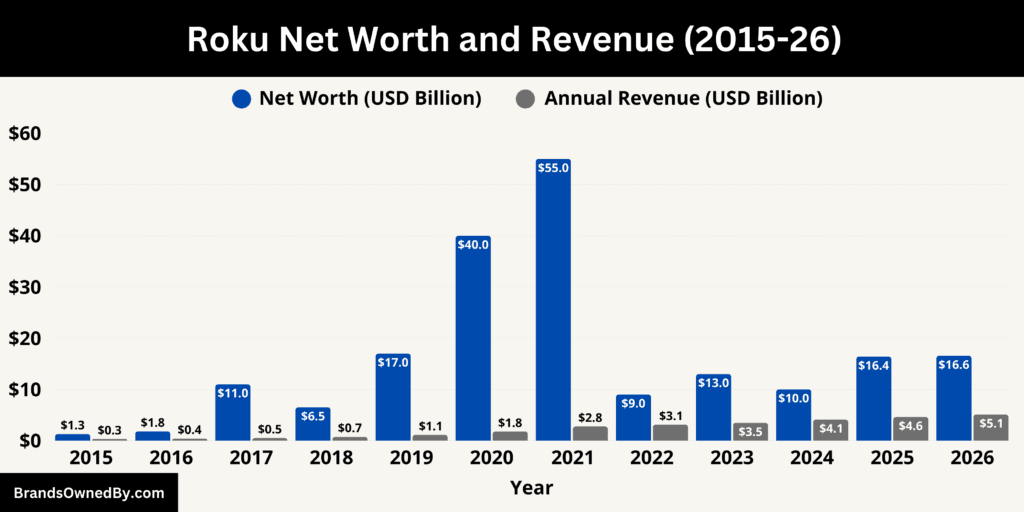

Roku Annual Revenue and Net Worth

As of January 2026, Roku’s estimated annual revenue is approximately $5.10 billion, with an estimated net worth of about $16.57 billion. These figures build on a decade of expanding platform monetization and ongoing investor reassessment of streaming economy prospects.

Historical Revenue Growth

Roku’s revenue trajectory over the past decade shows consistent expansion. In its early years as a private company, revenue was under $500 million annually, reflecting a focus on set-top box sales and emerging platform services.

After going public in 2017 with $0.51 billion in revenue, Roku accelerated growth through advertising monetization and licensing its operating system to smart TV manufacturers.

By 2020, revenue had nearly doubled from 2019, exceeding $1.7 billion, and continued rising to over $2.7 billion in 2021 as platform revenue became the largest contributor.

Revenue crossed the $3 billion mark in 2022 and remained on an upward path through 2024.

The 2025 results indicated continued momentum, and estimates for 2026 place annual revenue near $5.10 billion as Roku’s platform services, advertising technology, and content distribution gain scale with increased user engagement.

Year-by-Year Revenue Detail

Roku’s revenue reflects its strategic focus on platform growth. The early years saw modest gains tied to hardware unit sales. After pivoting toward advertising and operating system licensing, revenue expanded significantly.

From 2017 through 2021, annual revenue more than quadrupled. Growth continued through 2024 and 2025, with 2026 projected to mark the highest revenue in company history. This sustained rise underscores Roku’s ability to convert user engagement into recurring revenue streams.

Net Worth

Net worth, expressed through Roku’s market capitalization, tells a story of market enthusiasm tempered by broader economic conditions.

At the time of its IPO in 2017, Roku’s market worth was estimated at about $11.0 billion, representing a strong valuation for a company transitioning from hardware to platform leadership.

In subsequent years, Roku’s valuation fluctuated with investor sentiment and streaming sector dynamics. Roku’s net worth peaked during the market enthusiasm of 2020 and 2021 at approximately $40 billion and $55 billion, respectively, reflecting expectations for dominant platform growth.

However, rising interest rates and technology valuation re-rating led to a contraction in 2022, with Roku’s market worth declining significantly.

By 2023 and 2024, Roku’s valuation stabilized as investors balanced long-term opportunity with near-term execution challenges.

In 2025, Roku’s market capitalization recovered to approximately $16.41 billion. As of early 2026, Roku’s net worth stands at $16.57 billion, supported by stronger revenue performance and clearer evidence of consistent platform monetization gains.

Comparative Perspective on Revenue and Net Worth

Over the last decade, Roku’s revenue has shown predictable growth year-over-year. Net worth, by contrast, has been more variable, reflecting shifting market conditions and investor valuation models for high-growth technology platforms.

The net worth figures in 2025 and 2026 align with a maturing view of Roku’s long-term opportunity in advertising, content distribution, and smart TV operating system licensing.

The 2026 revenue estimate of $5.10 billion represents Roku’s strongest operational performance to date. At the same time, the approximate $16.57 billion market capitalization illustrates how the market values Roku’s future potential relative to its current scale.

Together, these metrics offer a comprehensive view of Roku’s financial standing and valuation as it approaches the mid-2020s.

Brands Owned by Roku

As of 2026, Roku operates a focused ecosystem rather than a large conglomerate structure. Roku’s strategy centers on owning platform-critical brands, content entities, and technology assets that strengthen its advertising, operating system, and streaming distribution business. The company generally avoids unrelated acquisitions and instead targets assets that reinforce its core platform.

Below is a list of the major brands owned by Roku as of January 2026:

| Company / Brand / Entity | Ownership Type | Year Introduced / Acquired | Core Function | Strategic Importance |

|---|---|---|---|---|

| Roku Streaming Devices | Fully owned internal brand | 2008 | Streaming hardware (players, sticks) | User acquisition and ecosystem entry point |

| Roku TV | Licensed platform brand | 2014 | Smart TV operating system licensing | Largest driver of active accounts and ad inventory |

| Roku OS | Proprietary technology | 2008 | Operating system for TVs and devices | Core platform controlling user experience and data |

| The Roku Channel | Fully owned streaming service | 2017 | Free ad-supported streaming (FAST) | High-margin advertising and first-party data |

| Roku Originals | Owned content brand | 2021 | Exclusive original programming | Viewer engagement and platform differentiation |

| Quibi Content Library | Acquired content assets | 2021 | Short-form premium content catalog | Cost-efficient owned content expansion |

| OneView Advertising Platform | Proprietary ad-tech platform | 2020 | Ad buying, targeting, measurement | Full-stack TV advertising infrastructure |

| Dataxu | Acquired subsidiary | 2019 | Programmatic advertising technology | Foundation for OneView and advanced ad targeting |

| Roku Smart Home | Owned consumer electronics brand | 2022 | Smart cameras, plugs, lighting, doorbells | Ecosystem expansion beyond television |

| Roku Audio | Owned hardware brand | 2019 | Soundbars and TV audio products | Living-room ecosystem deepening |

| Roku International Subsidiaries | Wholly owned operating entities | Ongoing | Regional operations and ad sales | International growth and localization |

Roku Streaming Devices

Roku Streaming Devices are the company’s original and most recognizable product line. This includes streaming players, streaming sticks, and audio-related hardware designed to connect televisions to streaming services. While hardware margins are relatively low, these devices play a strategic role. They drive user acquisition, expand active accounts, and feed Roku’s higher-margin platform and advertising business.

The devices are tightly integrated with Roku OS, allowing the company to control user experience, data collection, and content discovery. Hardware remains a gateway rather than a profit center.

Roku TV

Roku TV is one of Roku’s most important brands and operating models. Instead of manufacturing televisions itself, Roku licenses Roku OS to television manufacturers. These partners sell TVs branded as Roku TVs.

Roku TV has become a dominant smart TV platform in the US and several international markets. The model allows Roku to scale rapidly without bearing manufacturing costs. Roku controls the software layer, advertising inventory, and data, while partners handle production and distribution. This licensing-first approach is central to Roku’s long-term growth strategy.

Roku OS

Roku OS is the proprietary operating system that powers Roku devices and Roku TVs. It is a core asset fully owned and developed by Roku. The operating system manages content aggregation, advertising delivery, user accounts, and system updates.

Roku OS is designed to be neutral and service-agnostic. This neutrality allows Roku to partner with nearly every major streaming service while monetizing attention through ads and subscriptions. Continuous updates and platform improvements make Roku OS one of the company’s most valuable intellectual properties.

The Roku Channel

The Roku Channel is Roku’s owned and operated streaming service. It offers free, ad-supported content along with premium subscription options. The channel includes movies, TV shows, live TV, and original programming.

The Roku Channel is a major driver of advertising revenue. Because Roku owns the distribution and ad inventory end-to-end, margins are higher than third-party channels. It also provides Roku with first-party viewer data, which strengthens its advertising platform.

Roku Originals

Roku Originals is a content brand created after Roku acquired the Quibi content library. This brand includes exclusive series and shows that are available primarily through The Roku Channel.

Roku Originals are designed to attract users and increase viewing time rather than compete directly with subscription-heavy studios. The focus is on ad-supported engagement and platform differentiation, not blockbuster content spending.

Quibi Content Library (Acquired Assets)

Roku acquired the Quibi content library and underlying content rights. These assets were integrated into Roku Originals. The acquisition gave Roku immediate access to professionally produced, exclusive content at a relatively low cost.

This acquisition strengthened Roku’s owned-content strategy without requiring the creation of a large production studio. Roku continues to monetize this content through advertising rather than subscriptions.

OneView Advertising Platform

OneView is Roku’s proprietary advertising and data platform. It was built through internal development and strategic acquisitions. OneView allows advertisers to plan, buy, and measure ads across Roku’s ecosystem.

The platform integrates first-party data, measurement tools, and cross-device targeting. OneView is a critical component of Roku’s shift toward becoming a full-stack advertising technology company rather than just a streaming platform.

Dataxu (Acquired Advertising Technology)

Dataxu is an advertising technology company acquired by Roku. Its technology was integrated into Roku’s advertising stack and helped form the foundation of OneView.

The acquisition expanded Roku’s capabilities in programmatic advertising, data-driven targeting, and campaign measurement. Dataxu’s technology strengthened Roku’s appeal to large advertisers and agencies seeking advanced TV ad solutions.

Roku Smart Home

Roku Smart Home is an extension of the Roku brand into connected home devices. This includes smart cameras, doorbells, lighting products, and plugs. These products are branded and marketed under Roku but produced through partnerships.

The smart home segment is designed to expand the Roku ecosystem beyond the television. Integration with Roku OS and the Roku app reinforces brand engagement, though smart home remains a secondary business line compared to streaming and advertising.

Roku Audio Products

Roku Audio includes soundbars, speakers, and wireless audio accessories designed to integrate seamlessly with Roku TVs. These products enhance the TV viewing experience and deepen ecosystem lock-in.

Like streaming devices, audio products are not the primary revenue driver. Their strategic value lies in expanding Roku’s presence in the living room and increasing time spent within the Roku ecosystem.

International Operating Entities

Roku operates through multiple wholly owned subsidiaries that manage international markets, advertising sales, and platform partnerships. These entities support localized content, regulatory compliance, and regional advertising operations.

International expansion remains selective. Roku focuses on markets where advertising-supported streaming and smart TV penetration can scale efficiently.

Conclusion

So, who owns Roku?

The company is publicly owned but firmly controlled by its founder. Anthony Wood remains the central figure through equity and voting power.

Institutional investors provide financial backing and market credibility. Operational control stays with management. This structure allows Roku to focus on long-term platform dominance in the streaming economy.

FAQs

Which company owns Roku?

Roku is not owned by another company. Roku operates as an independent, publicly traded company listed on NASDAQ under the ticker ROKU.

Where was Roku founded?

Roku was founded in San Jose, California, United States. The company has remained headquartered in California since its founding.

Who is the largest shareholder of Roku?

Anthony Wood is the largest shareholder and the controlling figure at Roku. He owns about 11.6% of the company’s shares and controls the majority of voting power through super-voting shares.

Who owns Roku TV?

Roku TV is owned and operated by Roku. The televisions themselves are manufactured by partner brands, but the Roku TV platform, software, advertising, and user experience are fully controlled by Roku.

Is Roku an American company?

Yes. Roku is an American company. It was founded in the United States, is headquartered in California, and operates primarily under US corporate governance and regulations.

Who owns Roku company?

Roku is owned by a combination of its founder, institutional investors, and public shareholders. Control rests with Anthony Wood, while firms such as Fidelity, Vanguard, and BlackRock hold significant equity stakes.

Who manufactures Roku brand TV?

Roku does not manufacture TVs. Roku TVs are produced by licensed partners such as TCL, Hisense, Sharp, and other television brands. Roku supplies the operating system and platform, not the hardware manufacturing.

Is Roku associated with Amazon?

No. Roku is not associated with Amazon. The two companies compete directly in the streaming device and smart TV platform market.

Is Roku a Chinese brand?

No. Roku is not a Chinese brand. It is an American company headquartered in the United States. Some manufacturing partners may operate globally, but Roku itself is US-based.

Are Amazon Stick and Roku the same?

No. Amazon Fire TV Stick and Roku streaming devices are competing products. They run on different operating systems, are owned by different companies, and use different ecosystems.

Are Roku TVs made by Samsung?

No. Samsung does not manufacture Roku TVs. Samsung uses its own smart TV platform, Tizen. Roku TVs are made by licensed partners such as TCL and Hisense.

Why did TCL switch from Roku to Google?

TCL did not completely abandon Roku. Instead, TCL expanded its offerings to include Google TV alongside Roku TV. This decision allowed TCL to serve different markets, price segments, and consumer preferences rather than replacing Roku entirely.

Is Roku owned by Disney Plus?

No. Disney Plus does not own Roku. Disney Plus is a streaming service that operates on Roku’s platform as an app, not as an owner.

Who is Roku’s biggest competitor?

Roku’s biggest competitors include Amazon Fire TV, Google TV, and Apple TV. Among these, Amazon Fire TV is often considered the closest competitor in the US streaming device and smart TV platform market.

Is Roku owned by Walmart?

No. Walmart does not own Roku. The companies have partnered in advertising and commerce integrations, but ownership remains separate.

Is Roku owned by Amazon?

No. Roku is not owned by Amazon. Amazon operates Fire TV as a competing platform.

Is Roku owned by Disney?

No. Roku is not owned by Disney. Disney distributes content through Roku but has no ownership stake in the company.