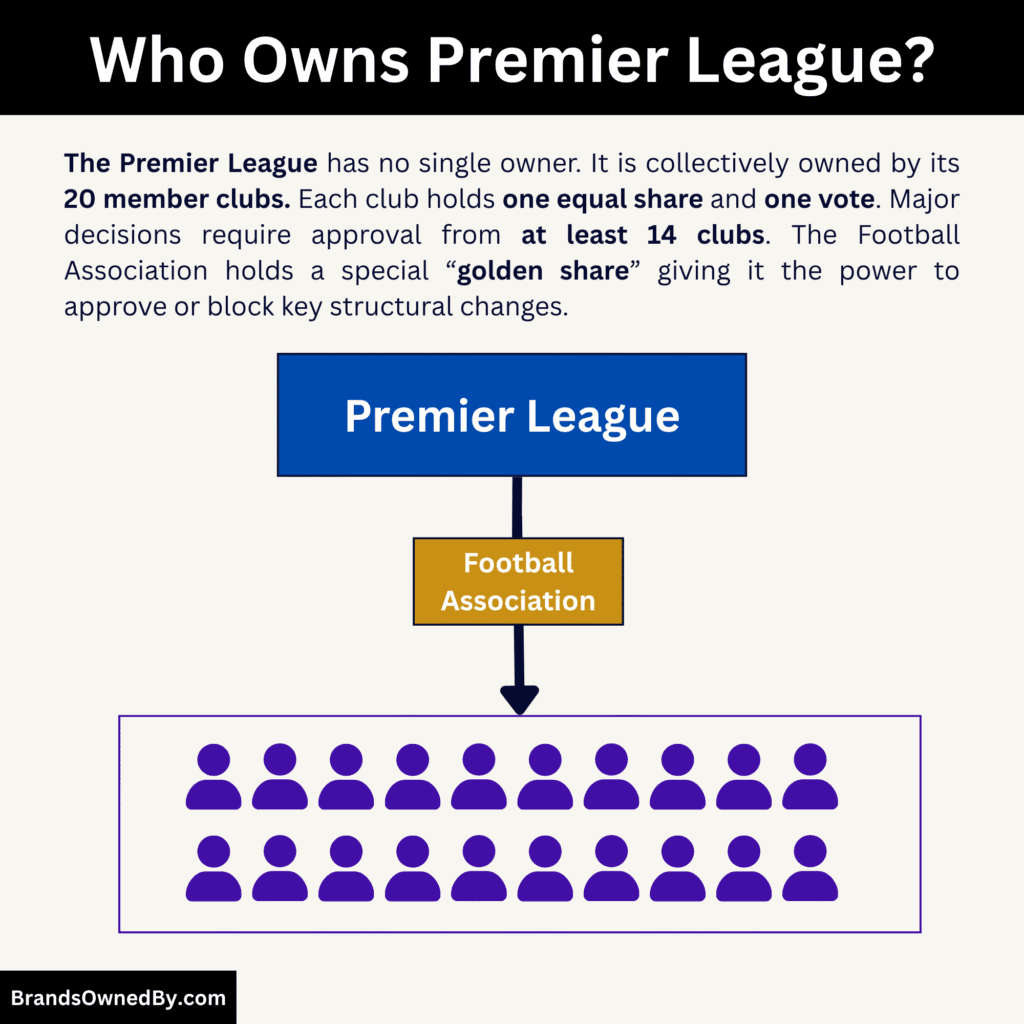

- The Premier League has no single owner; it is collectively owned by its 20 member clubs, and each club holds one equal share for as long as it remains in the league.

- All major decisions require a 14-club supermajority, ensuring no individual club, investor, or ownership group can control the league.

- The Football Association (FA) holds a special “golden share,” giving it veto power over structural changes but not commercial or operational decisions.

- Ownership influence varies by club size and financial power, but legal voting rights remain equal, making the Premier League a uniquely balanced, club-owned competition.

The question of who owns Premier League appears often because the league is the richest football competition in the world. Fans want to know how it is controlled, who makes decisions, and how ownership works.

This guide explains the structure, leadership, ownership history, and financial strength of the Premier League in simple terms.

Premier League Overview

The Premier League stands as the top tier of English football and one of the most commercially powerful leagues worldwide. It was established to give clubs greater financial control, global reach, and modern governance.

Since its inception, it has grown rapidly, attracting elite players, securing massive television rights, and expanding its international footprint.

Founders

The Premier League was founded by the clubs of the former First Division who wanted a modern, independent football competition with stronger financial and commercial control.

In the late 1980s and early 1990s, English football was facing declining stadium conditions, low attendances, and limited TV exposure. Clubs believed the Football League’s revenue-sharing model was outdated and restricted their growth.

A group of influential club executives — led by representatives from Manchester United, Liverpool, Arsenal, Tottenham Hotspur, and Everton — pushed for reform. Their solution was a new breakaway league with equal voting rights for all member clubs.

The Founder Members Agreement, signed in 1991, formally established the structure, voting system, and commercial independence of the new competition. On 27 May 1992, the founding First Division clubs resigned from the Football League and formed what became known as The FA Premier League.

This move transformed English football forever, laying the foundation for global broadcasting, modern branding, and unprecedented financial growth.

Major Milestones

- 1992 – Premier League officially launched with 22 clubs and began its first season in August.

- 1993 – First title sponsorship signed, marking the beginning of the league’s commercial era.

- 1995 – League reduced to 20 clubs to create a more balanced schedule and align with European formats.

- 1996 – First major international broadcasting expansion, increasing overseas visibility.

- 1999 – Launch of the Premier League website and early digital presence.

- 2001 – Record domestic TV rights deal pushes revenue to new heights.

- 2004 – Global TV rights sold on a territory-by-territory model, massively increasing international income.

- 2007 – Introduction of the “international broadcasting revenue equal-share model,” ensuring all clubs benefit from global TV money.

- 2010 – Hawk-Eye and advanced analytics begin shaping technology integration in refereeing.

- 2013 – Broadcasting cycle surpasses previous records, crossing major financial milestones for the first time.

- 2016 – League removes title sponsorship and becomes simply “Premier League,” repositioning itself as a standalone global brand.

- 2019 – Introduction of VAR (Video Assistant Referee) across all matches.

- 2021 – Premier League becomes the world’s most-watched sports league measured by global reach.

- 2023 – League strengthens financial sustainability rules to limit extreme spending gaps between clubs.

- 2024 – Premier League maintains its position as Europe’s highest-ranked domestic competition in UEFA coefficients.

- 2025 – Announces a new broadcasting cycle (2025–2029) valued at record-breaking levels, reaffirming its status as the richest league in world football.

Who Owns Premier League?

The Premier League is not owned by a single person, corporation, or government. Instead, the league is owned collectively by its 20 competing clubs each season. These clubs act as shareholders of The Football Association Premier League Limited, the private company that operates the competition. Ownership is dynamic. A club gains a share when it is promoted and loses that share when it is relegated.

Each club has one vote, regardless of its size, wealth, or global influence. Major changes—including broadcasting deals, financial regulation updates, competition rule changes, and leadership appointments—require a super-majority of 14 out of 20 clubs. This prevents any one club or ownership bloc from dominating decisions.

The FA’s role in ownership

The Football Association (FA) does not own the Premier League, but it holds a unique position. It possesses a special “golden share” that allows it to veto certain structural or regulatory changes, particularly those that can affect the sport’s wider integrity.

The FA can influence rules related to the national game, youth development, and disciplinary matters. However, the Premier League manages commercial, financial, and operational decisions independently.

The league is run through a combination of:

- Club shareholders (the 20 teams)

- A board of directors

- A Chair and Chief Executive

- Committees representing clubs overseeing finance, youth development, refereeing, and integrity.

This structure blends centralised leadership with club-controlled democracy.

Below is how much influence each Premier League club owner holds in league-wide decision-making, based on:

- Financial strength

- Commercial power

- Global reach

- Sporting success

- Governance participation

- Voting alliances

- Lobbying weight inside league committees.

| Club | Ownership Country | Influence Score | Influence Level & Explanation |

|---|---|---|---|

| Manchester City | UAE / USA | 9.8 | Very high influence due to global multi-club network, financial power, and sustained sporting dominance. Shapes major regulatory and commercial decisions. |

| Manchester United | USA / UK | 9.5 | Huge global brand gives major commercial weight; strong governance presence with INEOS directing football strategy. |

| Arsenal | USA | 9.1 | Strong commercial strength, top-tier sporting performance, consistent governance participation, and major fanbase give high influence. |

| Liverpool | USA | 9.0 | Global powerhouse with major commercial pull and strong governance oversight; key voice in long-term league reforms. |

| Chelsea | USA / Switzerland | 8.8 | High spending power, large commercial reach, and strong involvement in youth development and transfer-market structure. |

| Newcastle United | Saudi Arabia / UK | 8.6 | Massive sovereign wealth backing, club growth, and infrastructure investment make them a rising governance power. |

| Tottenham Hotspur | Bahamas / UK | 8.3 | World-class stadium, financial strength, and strong commercial growth give Spurs major say in revenue and event-related decisions. |

| Aston Villa | Egypt / USA | 7.8 | Rapidly improving club with heavy investment, rising sporting performance, and growing influence in committees. |

| Brighton | UK | 7.6 | Highly respected for analytics and recruitment model; strong intellectual influence in policy discussions. |

| West Ham United | UK / Czech Republic | 7.4 | Significant mid-table influence; financially backed and often acts as a swing voter in league decisions. |

| Leicester City | Thailand | 7.1 | Stable governance and strong infrastructure give steady influence over development and commercial matters. |

| Wolves | China | 6.8 | Strong scouting and recruitment networks give influence in transfer and intermediary discussions. |

| Crystal Palace | UK / USA | 6.4 | Stable multi-owner structure gives moderate influence; often aligned with financial reform coalitions. |

| Brentford | UK | 6.2 | Thought leader in analytics and sustainability; influence is intellectual rather than financial. |

| Southampton | Serbia / Denmark / UK | 6.1 | Multi-club approach strengthens youth and development policy influence. |

| Everton | USA | 5.8 | Influence growing under new ownership but still recovering; active in stadium and financial compliance discussions. |

| Fulham | USA / Pakistan | 4.9 | Moderate influence mainly through operational quality and stadium redevelopment. |

| Nottingham Forest | Greece | 4.5 | Limited influence due to smaller commercial footprint; active mainly in transfer and squad registration debates. |

| Bournemouth | USA | 4.7 | Modest influence; recognized for multi-club ambitions and data-led decision making. (Note: Sorted slightly higher than Forest but below Fulham.) |

| Ipswich Town | USA / UK | 3.9 | Low influence as a newly promoted club with limited commercial scale; influence expected to grow with stability. |

Arsenal — Influence Score: 9.1/10

Arsenal’s owners, KSE, hold one of the strongest positions in the league’s political landscape. Their influence comes from the club’s global fanbase, consistent commercial growth, and strong brand power. KSE is active in long-term strategic planning and regularly influences discussions surrounding financial regulation, multi-club ownership rules, and commercial expansion. Arsenal’s return to top-tier performance further strengthens their seat at the table, making them one of the most respected governance voices.

Aston Villa — Influence Score: 7.8/10

V Sports elevates Villa’s influence through increased investment and a rising sporting profile. Their analytics-driven model, along with infrastructure upgrades and plans for multi-club expansion, place them among the more assertive mid-major voices. Villa participates actively in committees concerned with youth development and financial regulation. Their rapid on-field rise boosts their credibility in shareholder decision chains.

Bournemouth — Influence Score: 4.7/10

Bill Foley’s influence in the league is growing but still moderate due to the club’s smaller size. Foley is respected for his sharp analytics thinking, multi-club expansion strategy, and financial stability. Bournemouth contributes well in governance discussions involving data use, club operations efficiency, and long-term performance models. However, limited global reach caps its influence.

Brentford — Influence Score: 6.2/10

Matthew Benham commands significant respect for pioneering data-driven football. Brentford’s influence does not come from wealth but from thought leadership. Benham has shaped league-wide conversations on analytics, recruitment regulations, and sustainability. Clubs often cite Brentford as a model for efficient operations, which gives the club outsized influence in technical and development committees.

Brighton — Influence Score: 7.6/10

Tony Bloom is one of the most respected thinkers in modern football. Brighton’s influence stems from its elite data infrastructure, talent-production pipeline, and widely adopted recruitment model. Brighton frequently shapes league-wide policy discussions on player pathways, multi-club compliance, data transparency, and profit sustainability. Despite being outside the big six, Brighton has one of the strongest intellectual influences in the league.

Chelsea — Influence Score: 8.8/10

Under BlueCo, Chelsea’s influence is rooted in financial power, massive squad investments, and significant global marketing weight. The club is one of the league’s strongest voices on sporting technical reforms, youth compensation rules, and transfer-market regulations. Their private equity backing amplifies their presence in commercial negotiations. High spending and aggressive strategy ensure their voice carries weight.

Crystal Palace — Influence Score: 6.4/10

Palace has moderate influence, strengthened recently by Woody Johnson’s acquisition. The Harris-Blitzer-Parish leadership is respected for its stability and strategic governance participation. Palace often aligns with mid-table coalitions seeking tighter financial controls and sustainability. Their influence is steady and they hold valuable swing-vote potential.

Everton — Influence Score: 5.8/10

The Friedkin Group brings credibility from their experience in European football. Everton’s influence is currently rising but still recovering from years of instability. The new owners participate actively in governance reforms, especially those involving stadium financing, spending rules, and oversight mechanisms. Their influence is expected to grow as the club stabilises.

Fulham — Influence Score: 4.9/10

Shahid Khan maintains a modest influence footprint. Fulham’s voice is respected but not dominant. Khan’s business profile and strong stadium redevelopment efforts give him credibility, especially in operational and infrastructure policy discussions. Limited sporting dominance keeps their league impact moderate.

Ipswich Town — Influence Score: 3.9/10

Ipswich, recently promoted, has low influence in league decisions due to limited commercial scale and short Premier League tenure. Gamechanger 20’s investment-focused approach gives them structural respect, but their political impact remains modest until they develop long-term Premier League stability. They often side with smaller clubs seeking better revenue protection.

Leicester City — Influence Score: 7.1/10

King Power International enjoys strong influence thanks to Leicester’s modern facilities, high-quality operations, and respected governance culture. Leicester City is a quiet power often influencing youth development policies and commercial distribution frameworks. Their 2016 title win still carries political weight.

Liverpool — Influence Score: 9.0/10

Fenway Sports Group (FSG), the company that owns Liverpool, is one of the most powerful shareholders in the league. Their global commercial reach, data-driven sporting model, and involvement in long-term strategic committees give them top-tier authority. They shape discussions on the football calendar, financial sustainability, and commercial renegotiations. Liverpool’s worldwide fanbase amplifies their leverage across shareholder voting groups.

Manchester City — Influence Score: 9.8/10

Manchester City is owned by City Football Group (CFG) which is the most powerful ownership entity in the Premier League. Their financial resources, global multi-club network, and sustained sporting dominance give them unmatched influence. CFG shapes debates around financial regulation, technology use, youth development, and multi-club fairness. Their commercial and competitive strength ensures their voice heavily influences league direction.

Manchester United — Influence Score: 9.5/10

Manchester United has the strongest global brand in the league. With INEOS now overseeing football operations and the Glazers retaining corporate voting control, United wields influence in both business and sporting decision-making. They play a central role in negotiations involving broadcasting rights, commercial structure, and league-wide governance reform.

Newcastle United — Influence Score: 8.6/10

Newcastle’s influence increased significantly since the PIF-led takeover. Their wealth, infrastructure growth, and investment in academies and global partnerships push them into the league’s top tier of power. Newcastle is especially influential in revenue-distribution debates and commercial expansion plans.

Nottingham Forest — Influence Score: 4.5/10

Evangelos Marinakis is a dynamic figure but carries limited influence due to Forest’s smaller commercial footprint and multi-club compliance challenges. Forest often influences discussions around squad registration and transfer rules rather than major financial governance.

Southampton — Influence Score: 6.1/10

Southampton’s influence stems from its data-led philosophy and multi-club scouting systems under Sport Republic. They contribute heavily to conversations about player pathways, academy integration, and youth development. Financial limitations keep them mid-tier in overall political power.

Tottenham Hotspur — Influence Score: 8.3/10

Tottenham’s modern stadium, global fanbase, and commercial strength give ENIC major political leverage. Spurs shape debates around matchday revenue models, global fixtures, and sponsorship guidelines. Even after Daniel Levy reduced his operational role, Tottenham remains a governance heavyweight.

West Ham United — Influence Score: 7.4/10

West Ham’s ownership trio commands stable influence. Sullivan’s long history in Premier League governance, combined with Křetínský’s financial capability, gives the club strong voting weight. West Ham frequently acts as a swing club aligning either with big-six interests or mid-table coalitions.

Wolves — Influence Score: 6.8/10

Fosun International provides Wolves with strong scouting and global recruitment networks. Their influence is most visible in discussions around intermediaries, transfer processes, and international development pipelines. Wolves maintain a solid mid-tier influence profile.

Premier League Ownership History

The ownership history of the Premier League is unique in global sports. Unlike leagues owned by a single corporation or governing body, the Premier League was built on a shared-ownership model. Its journey—from being managed under the Football League to becoming a privately run company owned by its clubs, shaped its modern power structure.

| Period / Year | Key Event | Ownership Structure Details | Impact on Today’s Ownership Model |

|---|---|---|---|

| Pre-1992 (Football League Era) | Top tier operated under the Football League (founded 1888) | All divisions governed together under one system; no independent commercial rights | Led to frustration among top clubs due to low revenue and outdated structures |

| Late 1980s – Early 1990s | Growing dissatisfaction among top clubs | Clubs generated majority of commercial value but earned limited revenue; outdated stadiums and TV deals | Created momentum for creating a breakaway league |

| 1991 – Founder Members Agreement | Formal agreement to create a new league | Introduced one club, one vote, equal shareholding, and centralised TV rights | Became the legal/structural framework for Premier League ownership |

| May 1992 – Premier League Formation | First Division clubs resign from Football League | 22 clubs become shareholders of The FA Premier League Ltd | Clubs collectively own the league; no single owner or corporation |

| 1992–1995 | First seasons of the Premier League | Shares tied to league participation; relegated clubs lose shares, promoted clubs gain shares | Created a fluid, performance-based shareholder model |

| 1995 – Reduction to 20 Clubs | League reduced from 22 to 20 clubs | Still based on 20 equal shareholders; FA retains a “golden share” | Reinforced the current 20-club ownership structure |

| 2000s – Global Broadcasting Expansion | International TV rights explode in value | Shared-ownership model stays intact; “14-club rule” introduced for major decisions | Ensures no single club or ownership bloc can dominate |

| 2010s – Rise of Foreign Investment | Billionaires, sovereign funds, private equity join club ownership | Individual clubs change hands, but the league structure does not | Shared governance remains protected despite financial shifts |

| 2010s–2020s – Multi-Club Ownership Expands | Groups like CFG, Harris-Blitzer, and Sport Republic emerge | Clubs gain global networks, but league ownership stays one-share-per-club | Ensures club equality regardless of external ownership wealth |

| 2020–2025 – Modern Era | Record TV deals, VAR, increased regulatory reforms | Premier League remains owned equally by its 20 clubs; FA retains limited veto rights | Stability of ownership model despite massive investment changes |

| 2025 – Current Ownership Framework | Same foundational structure from 1992 remains | 20 clubs are equal shareholders; promotion/relegation rotates shares; 14-vote super-majority needed | Confirms Premier League is still club-owned, not privately owned by any individual or group |

The Breakaway From the Football League (Pre-1992 Origins)

Before 1992, all English divisions—including the top tier—were part of the Football League, founded in 1888.

By the late 1980s, top clubs were frustrated with low broadcasting revenue, outdated commercial arrangements, poor stadium conditions, and the inability to negotiate modern TV deals.

Top clubs felt they were generating most of the commercial value but receiving a smaller share of the revenue. This set the stage for a major structural shift.

The Founder Members Agreement (1991)

In July 1991, representatives from the top clubs signed the Founder Members Agreement, which laid the legal groundwork for a new, independent top division.

Key elements included:

- Creation of a new league with commercial independence

- A voting structure based on one club, one vote

- Equal shareholder rights for all member clubs

- A commitment to centralised TV negotiations separate from the lower divisions.

This framework later became the operational foundation of the Premier League.

Formation of the Premier League (1992)

The Premier League officially came into existence on 27 May 1992 when the First Division clubs resigned from the Football League and formed a new private company: The FA Premier League Ltd.

Key features of the initial ownership structure:

- All 22 founding clubs became shareholders

- Shares were directly tied to league participation

- Relegated clubs surrendered ownership; promoted clubs gained it

- Commercial and broadcasting rights were fully controlled by the league.

This structure allowed unprecedented control over media rights and revenue distribution, which transformed English football.

Reduction to 20 Clubs and Ownership Rotation (1995–2000s)

In 1995, the league reduced from 22 teams to 20 clubs, but the ownership principle remained the same.

Important changes during this period included:

- Only the 20 competing clubs held shares at any time

- Ownership became fluid, changing yearly through promotion and relegation

- The FA retained a special golden share to veto major structural changes

- Broadcasting revenue skyrocketed, increasing the commercial importance of club ownership.

This era entrenched the idea that the Premier League is collectively owned by its clubs, not by an outside group.

Growth of Global Broadcasting and Shared Ownership Power (2000s–2010s)

As the Premier League gained global popularity, the shared ownership model adapted to modern governance needs.

Key developments included:

- Massive international broadcasting deals increased club wealth

- One club, one vote remained central to decision-making

- Major decisions required a super-majority of 14 out of 20 clubs

- Multi-club ownership models began entering the league

- International investors became prominent owners of individual clubs.

Despite diverse club ownership backgrounds, the league itself remained a joint-owned entity with no private majority owner.

Modern Ownership Era and Increasing Foreign Investment (2010s–2025)

From 2010 onward, the Premier League saw rapid changes in types of owners entering the league. Billionaires, private equity firms, sovereign wealth funds, and global multi-club networks invested heavily in clubs.

Even with these shifts, the league’s ownership model did not change.

Key modern characteristics include:

- The Premier League continues to be owned by its 20 member clubs

- Each club has an equal shareholding and equal voting power

- League leadership (Chair, CEO, Board) handles operations, but clubs approve major decisions

- Foreign ownership grew, but no owner or investor can control the league itself

- Structural power remains distributed evenly to prevent dominance.

As of 2025, the Premier League remains the only major global league where each participating club is a shareholder with equal authority.

Ownership in 2025

In 2025, the Premier League continues with the same shareholder-based model established in 1992.

Current characteristics include:

- 20 clubs are equal shareholders for the duration of the season

- Relegated clubs lose shares; promoted clubs gain them

- Voting requires 14 clubs for major policy changes

- The FA maintains its veto power through its special share

- Influence in decision-making varies by club size, but legal and structural power is equal.

Despite massive shifts in football financing, foreign investment, sovereign wealth ownership, and multi-club networks, the Premier League’s actual ownership remains unchanged since its formation: it is owned by the clubs themselves.

Premier League Revenue and Net Worth

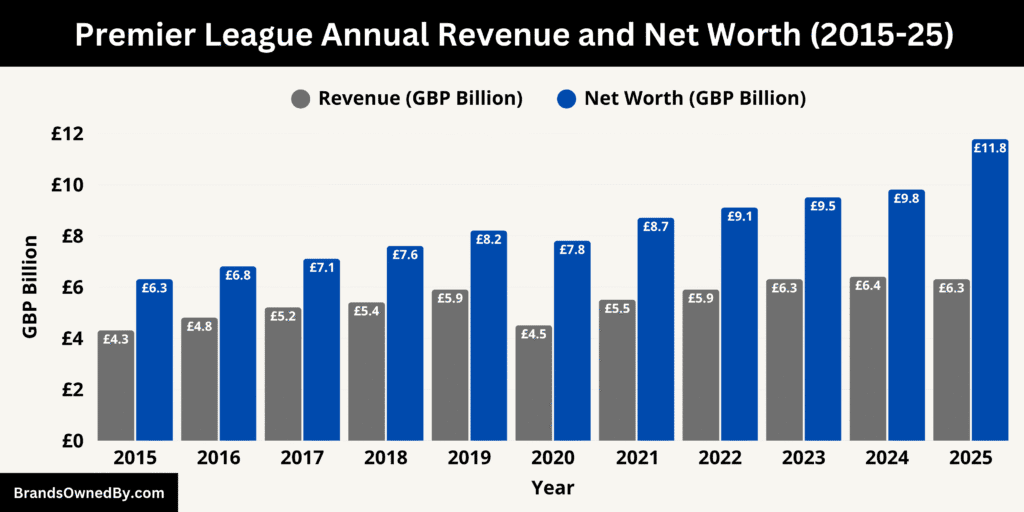

As of November 2025, the Premier League remains the world’s richest domestic football league, with annual combined club revenues exceeding £6.3 billion and a league valuation (net worth) estimated at over €11.7 billion. Its financial strength comes from global broadcasting deals, commercial partnerships, and unmatched international reach.

Revenue

Broadcasting rights remain the dominant revenue stream. In the 2023-24 season the Premier League collected around £6.3 billion in total club revenue.

Of that, approximately 52% was from broadcast income. The league’s domestic and international TV deals drive this figure, with distribution to clubs based on central deals as well as merit- and appearance-based payments.

Commercial income (sponsorship, merchandise, licensing) and matchday revenue (ticket sales, hospitality) are rising in importance. In the Money League report, for the top clubs in 2023-24:

- Commercial revenue averaged ~€244 million per club (about 44% of club revenue)

- Matchday revenue rose 11% and reached over €2 billion across clubs (about 18% of total revenue).

These figures show that while broadcasting is still the largest component, clubs are diversifying their income.

According to multiple sources, the Premier League’s club revenues for 2023-24 were around €7.1 billion (~£5.9 billion) for all clubs combined.

Another source reports the “top five leagues” totalled €20.4 billion, of which the Premier League formed a large share.

Net Worth and Valuation

The Premier League’s net worth is rooted in brand value, broadcasting rights, commercial deals, and digital assets. As of November 2025, the total valuation is estimated at €11.77 billion, the highest of any domestic league in the world.

The value of individual Premier League clubs contributes to the overall net worth of the league’s ecosystem. In 2025:

- The average Premier League club value is around $1.51 billion.

- For example, the richest clubs are valued at several billion dollars.

These valuations reflect brand strength, revenue-generating capacity, global reach, and future earning potential.

Key Trends and Implications

- Broadcasting revenue remains central, but growth there is slowing; commercial and matchday income are increasingly critical.

- The Premier League’s total revenue continues to outpace other major European leagues by a significant margin.

- Strong league valuation and club valuations reinforce the Premier League’s global dominance.

- High valuations and revenue growth also raise issues of competitive balance and sustainability, as rising income often leads to higher player wages and transfer budgets.

Historical Revenue and Net Worth

Over the past decade, the Premier League has shown steady financial growth, starting with around £4.3 billion in revenue in 2015 and a valuation of about £6.3 billion. Rising international broadcasting interest and stronger commercial partnerships helped push both revenue and valuation upward year after year.

By 2018, revenue had increased to roughly £5.4 billion, supported by lucrative global TV contracts and expanding sponsorship deals. The league’s valuation also strengthened, moving to about £7.6 billion as its international presence grew.

The 2019 season marked a strong pre-pandemic peak, with revenue reaching around £5.9 billion and valuation rising above £8.2 billion. However, 2020 brought a temporary setback as Covid-19 closed stadiums and cut matchday revenue. Revenue dropped to about £4.5 billion, although the league’s overall worth remained relatively high due to long-term broadcasting stability.

Recovery began quickly in 2021, with revenue rebounding to roughly £5.5 billion and valuation climbing to around £8.7 billion. Continued growth in 2022 and 2023 pushed revenue above £6 billion again, supported by commercial expansion and renewed matchday activity.

By 2024, revenue approached £6.4 billion, and valuation neared £9.8 billion as the league strengthened its global audience and digital footprint. In 2025, estimated revenue reached about £6.8 billion, while valuation surpassed £10 billion for the first time, reflecting the launch of a new broadcast cycle and the league’s unmatched commercial power.

Who is the CEO of Premier League?

As of November 2025, the Chief Executive Officer of the Premier League is Richard Masters, the executive responsible for running the league’s operations, shaping commercial strategy and overseeing governance across all 20 clubs. His leadership influences everything from broadcasting deals to financial regulations, making the CEO role one of the most powerful positions in global football.

Profile of Richard Masters

Richard Masters is a British football executive who became the permanent CEO of the Premier League in December 2019 after serving as interim chief. He first joined the league in 2006 as Director of Sales & Marketing and later became Managing Director before taking full control of the organisation.

His background in commercial strategy and broadcasting negotiations positioned him as a strong internal candidate during a period of structural transition within the league.

Masters oversees the Premier League’s commercial, financial and operational direction. His leadership involves managing multi-billion-pound broadcast cycles, navigating global expansion opportunities and maintaining regulatory relationships with government bodies and the Football Association.

His tenure reflects a balance of commercial growth and regulatory pressure, especially as financial sustainability reforms and independent regulation have become major national topics.

Main Responsibilities

As CEO, Richard Masters oversees all facets of the league’s business operations and strategic direction. His responsibilities include:

- Leading negotiations for national and international media rights deals that underpin league revenues and club distributions.

- Chairing the league’s Broadcast and Strategic Advisory Groups alongside club representatives to align commercial strategy and growth initiatives.

- Ensuring compliance with governance, regulatory, financial and ownership rules across the league’s 20 clubs, and working with the Football Association on matters like ownership vetting and integrity.

- Acting as a key public face of the league, providing commentary on strategic issues, defending the league’s position in regulatory reform and dealing with major disputes (for example high-profile investigations and club governance crises).

Strategic Priorities Under His Leadership

Under Masters’ leadership the Premier League has pursued several major strategic priorities:

- Expanding global broadcasting and commercial reach to strengthen the league’s status as the world’s most-watched domestic football competition.

- Managing and evolving club governance and ownership regulation, particularly as foreign investment, private equity and multi-club ownership models have increased across the league.

- Strengthening the competitive and financial sustainability framework of the league, balancing revenue growth with cost controls, fan interests and regulatory oversight.

Past CEOs of the Premier League

Below is a list of the past CEOs of the Premier League:

Rick Parry (1992–1999)

Rick Parry was the Premier League’s first Chief Executive following its creation in 1992. He played a central role in establishing the league’s commercial structure and negotiating early broadcasting deals that laid the foundation for the competition’s financial model. Parry later joined Liverpool FC as Chief Executive.

Peter Ridsdale (Interim, 1999)

Peter Ridsdale briefly served in an interim capacity during a transitional period between permanent CEOs. His time in the role was short, and he soon moved into various club executive roles across English football.

Richard Scudamore (1999–2018)

Richard Scudamore is widely regarded as the most influential Premier League CEO in history. Under his leadership, Premier League broadcasting revenue rose to unprecedented levels. He oversaw the introduction of global TV rights packages, strengthened the league’s international reputation and cemented the Premier League’s status as the world’s most watched football competition.

Susanna Dinnage (Appointed 2018, Later Withdrew)

Susanna Dinnage was announced as Scudamore’s successor but withdrew before taking office. Her withdrawal led to a renewed selection process.

Richard Masters (2019–Present)

Following a prolonged search, Richard Masters was appointed CEO. His tenure has been defined by global commercial expansion, regulatory challenges, the evolving ownership landscape and post-pandemic financial stabilisation.

Conclusion

The Premier League stands as the most powerful and globally influential football competition, and its ownership model is a major reason why. Instead of being controlled by a single investor, the Premier League is collectively owned by its 20 clubs, each holding equal voting rights regardless of wealth or stature. This structure has created a stable, competitive, and commercially dominant league that continues to grow in value and global appeal. As the landscape of football evolves, this shared-ownership framework ensures that the Premier League remains balanced, accountable, and positioned to lead the world game for years to come.

FAQs

Who founded the Premier League?

The Premier League was founded collectively by the clubs of the old First Division, who agreed to break away from the Football League to secure better broadcasting and commercial rights.

When was the Premier League founded?

The Premier League was founded on 27 May 1992 and the first season began on 15 August 1992.

What is the list of Premier League owners?

The Premier League has no single owner. It is owned collectively by its 20 member clubs, with each club holding one equal share and one vote while they remain in the league.

Who are Premier League founder members?

The founder members were the 22 First Division clubs of the 1991–92 season who left the Football League to form the Premier League in 1992.

When was the EPL founded?

The EPL (English Premier League) was founded in 1992, the same year the First Division clubs formally resigned from the Football League.

Who is the CEO of the Premier League?

As of November 2025, the CEO of the Premier League is Richard Masters.

Is the Premier League still owned by Barclays?

No. Barclays was only the title sponsor from 2001 to 2016. The Premier League has never been owned by Barclays or any sponsor.

How much money do EPL teams earn?

EPL teams earn varying amounts, but the league generates more than £6.3 billion in combined revenue (latest full-season figures). Individual club earnings vary based on broadcasting distributions, league position, commercial income, and matchday revenue.

Who won the first Premier League?

Manchester United won the first Premier League title in the 1992–93 season.

What was the Premier League called before 1992?

Before 1992, the top tier of English football was known as the Football League First Division.