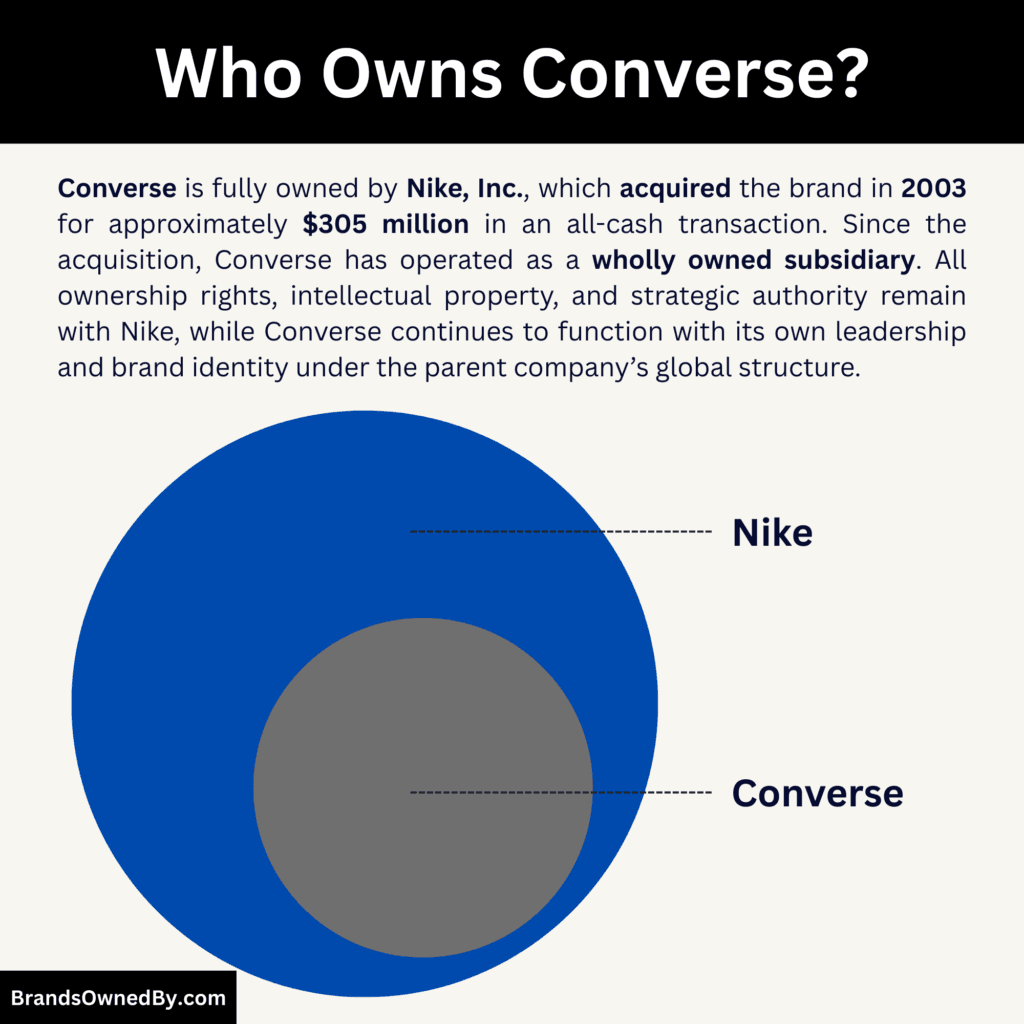

- Converse is a wholly owned subsidiary with 100% ownership held by Nike, Inc., meaning there are no public shareholders, minority investors, or independent equity holders at the Converse brand level.

- All ownership rights, voting power, and strategic authority over Converse rest entirely with its parent company, while Converse itself does not issue shares or trade publicly.

- Nike’s full ownership structure allows Converse to operate with creative autonomy in products and branding, while major financial and strategic decisions remain centrally controlled by the parent company.

Converse is an American footwear and lifestyle brand known for its iconic sneakers and casual apparel. The company was founded in 1908 in Malden, Massachusetts, by Marquis Mills Converse. It originally focused on rubber-soled footwear and boots. Over time, Converse evolved into a leading maker of athletic and casual shoes, apparel, and accessories. Its product lines include Chuck Taylor All Stars, Cons, One Star, and Jack Purcell, among others.

Converse operates globally and its products are sold in numerous countries and through many retail channels. Since 2003, it has been a wholly owned subsidiary of Nike, Inc. while maintaining its own creative and brand identity.

Converse Founders

Converse was founded by Marquis Mills Converse, whose vision laid the foundation for one of the most enduring footwear brands in history. While not a founder, Charles Chuck Taylor played a transformative role in shaping the brand’s identity, cultural relevance, and global recognition. Together, their contributions defined Converse’s early direction and long-term legacy.

Marquis Mills Converse

Marquis Mills Converse founded the Converse Rubber Shoe Company in 1908 in Malden, Massachusetts. He was an experienced footwear entrepreneur who identified growing demand for durable rubber-soled shoes. His initial focus was on functional footwear such as galoshes and winter boots. These products were designed for practicality rather than sport or fashion.

Marquis Converse emphasized manufacturing efficiency and product durability. Under his leadership, the company quickly scaled production. Within a few years, Converse was producing thousands of pairs annually. His willingness to explore new categories led the company into athletic footwear, setting the stage for its later dominance in basketball shoes. Although he did not witness the brand’s cultural peak, his early strategic decisions established the company’s long-term foundation.

Charles “Chuck” Taylor

Charles “Chuck” Taylor was not a founder, but his influence on Converse was profound. He joined the company in the early 1920s as a salesman. At the time, he was also a semi-professional basketball player and coach. Taylor immediately recognized the potential of Converse’s basketball shoe, the All Star.

He traveled across the United States conducting basketball clinics. During these tours, he promoted Converse shoes directly to athletes, coaches, and schools. Taylor also provided feedback that led to design improvements, including better ankle support and flexibility. His contributions were so significant that Converse added his name to the shoe’s ankle patch in 1932. The Chuck Taylor All Star became one of the most recognizable sneakers in history.

Taylor’s role extended beyond sales. He helped embed Converse into basketball culture and youth sports. Over time, his name became inseparable from the brand itself.

Ownership Snapshot

Converse is not an independent or publicly listed company. It operates as a wholly owned subsidiary of Nike, Inc.. Nike holds 100 percent ownership of Converse. There are no minority shareholders, public investors, or external equity partners involved in the brand.

Because of this structure, Converse does not issue shares. It does not have its own stock ticker. All equity ownership is consolidated under Nike.

Subsidiary Status Within Nike

Converse functions as a standalone brand within Nike’s corporate portfolio. It has its own internal teams covering design, marketing, product development, and brand strategy. Despite this operational independence, legal ownership and ultimate authority rest entirely with Nike.

Nike treats Converse as a strategic lifestyle brand. It complements Nike’s performance-focused footwear and apparel lines. This positioning influences investment priorities, product focus, and long-term planning.

No Public or Institutional Shareholders

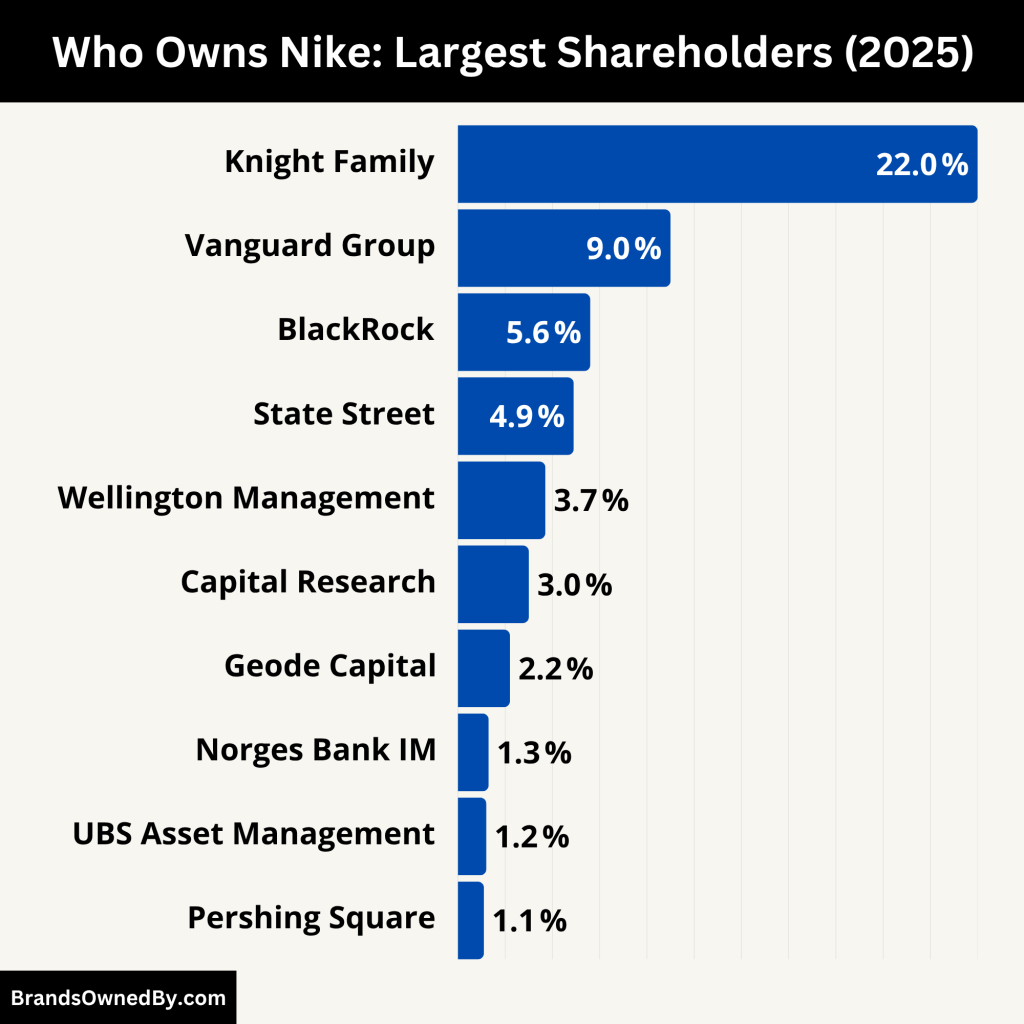

Unlike many global footwear brands, Converse does not have institutional investors, hedge funds, or retail shareholders at the brand level. Any institutional ownership applies only to Nike, not Converse directly.

This means decisions about Converse are not influenced by shareholder votes specific to the brand. Instead, Converse’s future is shaped internally by Nike’s executive leadership and board of directors.

Acquisition-Based Ownership Model

Nike acquired Converse outright rather than taking a partial stake. This full acquisition model eliminated fragmented ownership. It also allowed Nike to restructure Converse without external approval.

Since the acquisition, ownership has remained unchanged. Converse has not been spun off, partially sold, or listed publicly. Nike continues to view Converse as a long-term brand asset rather than a short-term investment.

Strategic Importance of Ownership

Nike’s full ownership provides Converse with financial backing, global infrastructure, and supply chain access. It also allows Converse to take creative risks without the pressure of independent financial reporting.

At the same time, Nike’s ownership ensures brand consistency, operational discipline, and alignment with broader corporate objectives. This balance defines Converse’s ownership snapshot today.

Ownership History

Converse’s ownership history reflects the full lifecycle of a legacy American brand. It began as a founder-led manufacturing company, evolved into a publicly traded corporation, struggled under competitive pressure, and ultimately became part of a global sportswear group. Each ownership phase shaped how Converse operated, positioned its products, and responded to market changes. Understanding this timeline explains why Converse looks and functions the way it does today.

| Period | Ownership Type | Owner(s) | Ownership Structure | Key Characteristics |

|---|---|---|---|---|

| 1908 – Early 20th Century | Private | Founders and early private investors | Closely held private ownership | Founder-led company focused on rubber footwear and early athletic shoes. Centralized decision-making with long-term product focus. |

| Mid-20th Century – 1990s | Public | Public shareholders and institutional investors | Publicly traded company | Rapid growth and dominance in basketball footwear. Increased pressure from shareholders and rising global competition. |

| Late 1990s – 2001 | Public (Distressed) | Public shareholders | Public ownership under financial strain | Declining market share, fragmented licensing, weak innovation, and structural inefficiencies. |

| 2001 – 2003 | Bankruptcy Phase | Bankruptcy court oversight | Restructuring under Chapter 11 | Shareholder value eroded. Assets and brand value preserved for acquisition. |

| 2003 – Present | Wholly Owned Subsidiary | Nike, Inc. | 100% private ownership | Full acquisition. Centralized ownership. Global scale, licensing control, and long-term brand repositioning. |

Founder-Led and Privately Owned Era

When Converse was founded in 1908, ownership was entirely private. The company was controlled by its founder and early backers who were focused on manufacturing efficiency and regional distribution. Decisions were centralized and conservative. The business model revolved around producing durable rubber footwear for everyday use.

As athletic footwear demand increased, Converse gradually expanded into sports shoes. Ownership during this period remained closely held. This allowed the company to pivot into basketball footwear without shareholder pressure. The introduction of the All Star shoe marked a critical shift. Converse became increasingly tied to sports culture while remaining privately owned.

Growth and Transition to Public Ownership

As Converse expanded nationally and internationally, it transitioned into a publicly traded company. Going public allowed Converse to raise capital to scale production, invest in marketing, and expand distribution. Ownership became dispersed among institutional investors and public shareholders.

Public ownership coincided with Converse’s dominance in basketball footwear. For decades, the brand held a commanding position in the U.S. market. However, being public also exposed Converse to rising competition and shareholder expectations. Innovation cycles slowed. Competitors invested more aggressively in technology, endorsements, and performance marketing.

Competitive Pressure and Structural Weaknesses

By the 1990s, Converse’s ownership structure became a liability. Public investors expected growth, but the brand struggled to compete with faster-moving rivals. Licensing agreements fragmented international control. Manufacturing inefficiencies increased costs. Product innovation lagged behind industry standards.

Shareholder-driven decision-making limited long-term reinvestment. Instead of deep restructuring, Converse relied on brand nostalgia. This approach failed to reverse declining performance. Public ownership amplified financial stress rather than solving it.

Bankruptcy and End of Public Ownership

In 2001, Converse filed for bankruptcy protection. This event effectively ended its era as an independent public company. Existing shareholders were wiped out or severely diluted. The brand’s intellectual property and core assets remained valuable, but the company lacked the capital and infrastructure to recover on its own.

Bankruptcy created an opportunity for acquisition. Converse required a parent company with global scale, strong distribution, and operational discipline to survive.

Acquisition by Nike and Full Buyout

In 2003, ownership transferred entirely to Nike, Inc. through a full acquisition. Nike purchased 100 percent of Converse. No minority stakes were retained. Converse was taken private and delisted from public markets.

This acquisition fundamentally changed Converse’s trajectory. Nike absorbed Converse into its corporate structure while preserving brand autonomy. Nike regained control of licensing. It integrated Converse into its global supply chain and retail network. The ownership shift marked a clean break from Converse’s fragmented past.

Long-Term Ownership Stability Under Nike

Since the acquisition, Converse has remained fully owned by Nike. There have been no partial sales, spin-offs, or public listing attempts. Nike treats Converse as a long-term brand asset rather than a short-term financial play.

Ownership stability allowed Converse to reposition itself. The brand moved away from performance athletics and leaned into lifestyle, streetwear, and cultural relevance. This strategy would have been difficult under public ownership due to quarterly earnings pressure.

Present Ownership Status

As of 2026, Converse remains a wholly owned subsidiary of Nike. All brand assets, trademarks, and strategic authority sit with Nike. Converse does not have independent shareholders. Its ownership history has reached a stable phase defined by centralized control, global scale, and long-term brand management.

This evolution explains why Converse today operates with creative freedom but within a disciplined corporate framework.

Who Owns Converse?

Converse is fully owned and controlled by Nike, Inc.. The brand operates as a wholly owned subsidiary, meaning Nike holds 100 percent ownership of Converse. There are no public shareholders, minority investors, or external partners at the Converse level. All equity, strategic authority, and long-term control sit entirely with Nike, shaping how Converse is funded, managed, and positioned globally.

Parent Company: Nike, Inc.

Nike, Inc. is the direct parent company of Converse and one of the most influential sportswear corporations in the world. Nike operates a multi-brand strategy that separates performance-driven athletic products from lifestyle and heritage brands. Converse sits firmly within the lifestyle category.

Nike provides Converse with access to global manufacturing partners, logistics networks, digital commerce platforms, and retail infrastructure. This support enables Converse to operate at scale without duplicating core corporate functions. At the same time, Nike allows Converse to retain its own brand voice, creative direction, and cultural positioning.

From a strategic perspective, Nike uses Converse to reach audiences that prioritize self-expression, fashion, and subculture rather than performance sports. This prevents overlap with Nike-branded footwear and reduces internal competition. Converse benefits from Nike’s financial strength while remaining creatively distinct.

Acquisition Insights

Nike acquired Converse in 2003. The acquisition followed Converse’s bankruptcy filing in 2001, which left the brand financially distressed but still culturally powerful. Nike identified Converse as an undervalued asset with strong global recognition but weak operational foundations.

The acquisition was completed as a full buyout. Nike purchased 100 percent of Converse’s equity, taking the brand private and ending its existence as a publicly traded company.

Nike acquired Converse for approximately $305 million in an all-cash transaction. The deal included Converse’s trademarks, intellectual property, product lines, and global operations. There were no stock swaps or earn-out clauses tied to future performance.

By acquiring Converse outright, Nike eliminated fragmented ownership and avoided ongoing shareholder obligations. The all-cash structure also allowed for immediate restructuring without regulatory or investor resistance.

Strategic Rationale Behind the Acquisition

Nike did not acquire Converse to compete directly in performance basketball footwear. Instead, Nike saw Converse as a heritage and lifestyle brand with long-term cultural value. At the time of acquisition, Converse lacked the capital, supply chain control, and global coordination needed to compete independently.

Nike’s strategy focused on stabilizing the brand, regaining control over international licensing, and repositioning Converse as a fashion-driven sneaker label. This approach allowed Converse to grow without requiring heavy investment in sports technology or athlete endorsements.

Post-Acquisition Integration

After the acquisition, Nike integrated Converse into its corporate systems while preserving brand autonomy. Manufacturing was optimized. Distribution channels were expanded. Licensing agreements were renegotiated or brought back under central control.

Converse leadership continued to operate the brand, but within Nike’s governance framework. This integration improved operational efficiency while allowing Converse to remain culturally authentic.

Long-Term Ownership and Stability

Since 2003, Converse’s ownership has not changed. Nike has not sold any stake, invited external investors, or pursued a public listing for the brand. Converse remains a permanent part of Nike’s brand portfolio.

This long-term ownership structure has allowed Converse to focus on brand longevity rather than short-term financial cycles. The result is a stable ownership environment where creative strategy and cultural relevance take precedence over quarterly performance pressures.

Competitor Ownership Comparison

Understanding who owns Converse becomes clearer when it is compared with the ownership structures of its closest competitors. While Converse is fully owned by a single global corporation, competing brands operate under a mix of public, private, and family-controlled ownership models. These differences directly influence brand strategy, investment priorities, and long-term positioning.

| Brand | Parent Company / Owner | Ownership Type | Ownership Structure | Strategic Implications |

|---|---|---|---|---|

| Converse | Nike, Inc. | Wholly owned subsidiary | 100% owned by a single corporate parent | Full control, long-term brand investment, strong global infrastructure, no public shareholder pressure at brand level |

| Vans | VF Corporation | Public conglomerate ownership | Owned by a diversified, publicly traded apparel group | Capital and focus shared across multiple brands, fashion-led portfolio management |

| Adidas Originals | Adidas AG | Public company brand division | Lifestyle line within a publicly traded parent | Strong scale but less brand autonomy compared to a standalone subsidiary |

| Puma | Puma SE (controlled by Kering) | Public with controlling shareholder | Publicly listed with strategic control by a luxury group | Hybrid strategy blending sport and fashion, influenced by controlling shareholder priorities |

| New Balance | Davis family | Private family ownership | Fully private, family-controlled business | Long-term decision-making, high independence, limited external capital support |

| Reebok | Authentic Brands Group | Brand management ownership | Owned by a licensing-focused brand management firm | Emphasis on licensing and monetization rather than direct product development |

Converse vs Vans

Converse competes most directly with Vans in the lifestyle and streetwear sneaker segment. Vans is owned by VF Corporation, a publicly traded apparel group that manages multiple brands across footwear, clothing, and accessories.

Unlike Converse, which sits within a sportswear-focused parent, Vans operates inside a diversified fashion conglomerate. VF Corporation balances capital and attention across many brands. Converse, by contrast, benefits from being part of a narrower, sports-led ecosystem under Nike, which allows deeper focus on footwear culture and sneaker-driven storytelling.

Converse vs Adidas Originals

Adidas Originals is the lifestyle division of Adidas AG, a publicly traded multinational corporation. Adidas AG owns and controls the Originals brand internally rather than operating it as a separate subsidiary.

In this case, ownership is similar in scale but different in structure. Converse operates as a distinct subsidiary with its own leadership, while Adidas Originals is a line within a larger brand. Converse’s standalone brand governance allows clearer identity separation, whereas Adidas Originals must align closely with Adidas’ overall brand narrative and shareholder expectations.

Converse vs Puma

Puma is owned and controlled by Puma SE, a publicly listed company. Its largest shareholder is Kering, which holds a significant controlling stake.

This structure places Puma in a hybrid position. While it is publicly traded, strategic influence comes from a luxury-focused parent group. Converse differs by being fully absorbed into a sportswear corporation rather than influenced by fashion or luxury shareholders. This impacts brand tone, pricing strategy, and collaboration focus.

Converse vs New Balance

New Balance stands apart from most competitors because it remains privately owned by the Davis family. There is no public shareholder pressure, and control remains within a single family.

This ownership model offers long-term stability similar to Converse under Nike. However, New Balance operates independently without a parent company. Converse benefits from Nike’s scale and infrastructure, while New Balance relies on internal capital and organic growth. The trade-off is independence versus global corporate support.

Converse vs Reebok

Reebok has undergone multiple ownership changes. It is currently owned by Authentic Brands Group, a brand licensing and management firm.

This ownership model differs sharply from Converse. Authentic Brands Group focuses on licensing rather than direct product development and manufacturing. Converse, under Nike, remains deeply involved in product creation, design, and distribution. As a result, Converse maintains tighter control over brand execution and long-term identity.

The core difference lies in ownership concentration and strategic intent. Converse is 100% owned by Nike, with no external shareholders or licensing-driven control. Many competitors answer to public markets, family owners, or brand management firms.

Nike’s ownership allows Converse to prioritize brand equity and cultural relevance without the pressure of independent financial reporting. Competitors with public ownership often face quarterly performance expectations. Others with licensing-based ownership may prioritize short-term brand monetization.

Overall Competitive Ownership Position

Converse occupies a unique ownership position in the sneaker market. It combines the stability of full corporate ownership with creative autonomy at the brand level. Compared to competitors, Converse benefits from long-term backing, centralized control, and access to one of the most advanced global sportswear infrastructures. This ownership structure continues to shape how Converse competes, innovates, and evolves within the global footwear landscape.

Who Controls Converse?

Control of Converse is shaped by a layered governance structure. While Converse operates with its own leadership and brand teams, ultimate authority sits with its parent company. Understanding who controls Converse requires looking at corporate oversight, executive leadership, and how decisions are made inside the organization.

Ultimate Control by the Parent Company

Converse is fully controlled by Nike, Inc., which owns 100 percent of the brand. Nike holds all voting rights, ownership interests, and legal authority. This means final approval over major strategic decisions rests with Nike’s senior leadership and board of directors.

Nike determines long-term priorities for Converse. This includes capital allocation, global expansion, leadership appointments, and brand positioning within Nike’s broader portfolio. Converse does not have an independent board that can override Nike’s decisions.

Brand-Level Executive Leadership

Day-to-day control of Converse is handled by its internal executive team. The brand is led by a Chief Executive Officer who oversees operations, product strategy, marketing, and global growth. As of recent years, the CEO of Converse has been Jared Carver.

The CEO is responsible for executing Nike’s strategic vision while maintaining Converse’s distinct brand identity. This role acts as the bridge between Converse’s creative culture and Nike’s corporate governance.

Supporting the CEO are senior leaders across product, design, merchandising, digital commerce, and regional markets. These executives manage operational decisions without requiring constant parent-company approval.

Decision-Making Structure

Converse operates under a semi-autonomous model. Routine decisions such as product design, seasonal collections, collaborations, and marketing campaigns are made internally by Converse leadership.

However, high-impact decisions follow a different path. Major investments, global restructurings, leadership changes, and long-term strategic shifts require coordination with Nike. In these cases, Converse leadership presents proposals that must align with Nike’s corporate objectives.

This structure allows Converse to move quickly in creative areas while maintaining financial discipline and strategic consistency at the group level.

Role of Nike’s Senior Leadership

Nike’s senior executives play a direct role in overseeing Converse’s performance. Converse leadership regularly reports financial results, growth metrics, and brand performance to Nike’s executive committee.

Nike’s CEO and top management influence Converse’s direction indirectly through portfolio strategy. If Nike decides to emphasize lifestyle footwear or digital-first retail, Converse is expected to align with those priorities.

This oversight ensures Converse supports Nike’s overall growth strategy without competing directly with Nike-branded products.

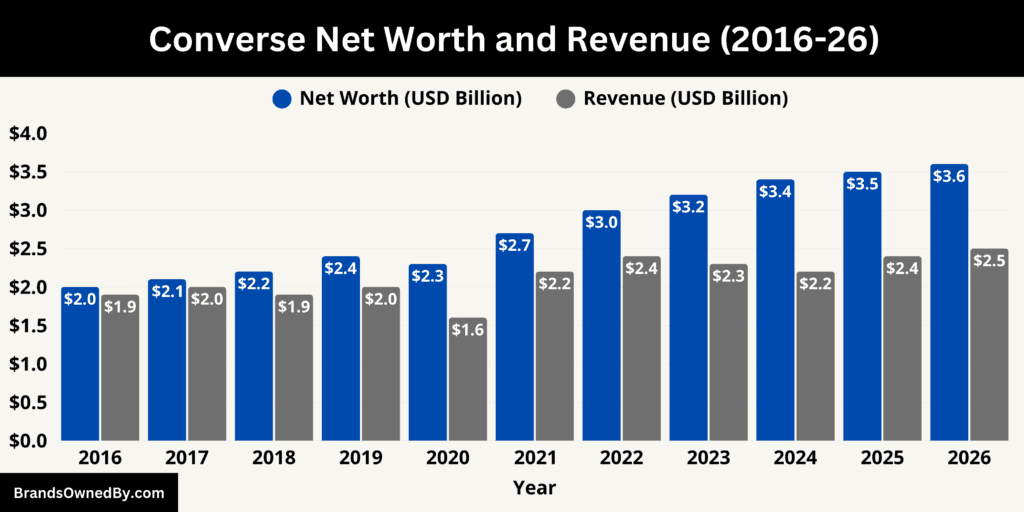

Converse Annual Revenue and Net Worth

Converse continues to be one of the most valuable lifestyle footwear brands under Nike, Inc.. As of 2026, Converse generates an estimated annual revenue of around $2.5 billion and carries an estimated brand net worth of approximately $3.6 billion as of January 2026. These figures reflect Converse’s position as a mature yet culturally relevant brand with stable global demand and strong long-term brand equity.

Revenue Breakdown

Converse’s $2.5 billion revenue in 2026 reflects an estimated year-over-year growth of around 4%. Footwear remains the core business, contributing roughly 85% of total revenue. Apparel and accessories account for the remaining 15%, supported mainly by seasonal drops and evergreen basics.

From a distribution standpoint, direct-to-consumer channels now contribute approximately 45% of total revenue. This includes Converse-owned e-commerce platforms and physical retail stores. Wholesale and third-party retailers generate the remaining 55%. The gradual shift toward direct sales has strengthened margins and reduced reliance on discount-driven volume.

Regionally, North America represents about 40% of total revenue. Europe contributes close to 25%. Asia-Pacific accounts for approximately 30% and remains the fastest-growing region, supported by urban youth demand and sneaker culture. The remaining 5% comes from emerging markets across Latin America, the Middle East, and Africa.

Profitability Context Within Revenue

Despite modest revenue growth, Converse benefits from a favorable cost structure. Its product lineup relies heavily on timeless designs with long production cycles. Core models such as the Chuck Taylor All Star require minimal reengineering, supporting manufacturing efficiency.

Operating margins are estimated to fall in the low-to-mid teens as a percentage of revenue. This margin profile allows Converse to generate consistent cash flow without aggressive pricing or overextension into high-cost performance technology.

Net Worth and Brand Valuation

Converse’s estimated net worth of $3.6 billion as of January 2026 represents brand value rather than standalone corporate equity. This valuation is driven by global recognition, emotional consumer attachment, and long-term earning potential.

Approximately 60% of Converse’s brand value is attributed to the Chuck Taylor franchise alone. The remaining 40% is spread across other footwear lines, apparel extensions, and the broader Converse brand ecosystem. Collaborations, resale visibility, and cultural relevance further reinforce valuation without materially increasing operational complexity.

Nike’s ownership enhances this valuation by enforcing disciplined distribution and protecting Converse from brand dilution. The absence of public-market pressure allows the brand to prioritize longevity over short-term sales spikes.

Future Revenue and Net Worth Forecast (2027–2032)

Based on current performance trends, global footwear market dynamics, and long-term brand strategy, Converse is projected to follow a steady, disciplined growth trajectory. Revenue and brand value are expected to rise gradually, driven by digital expansion, Asia-Pacific demand, and controlled global distribution.

2027 Forecast

- Expected revenue: ~$2.6 billion

- Expected brand net worth: ~$3.75 billion

- Growth drivers: Continued direct-to-consumer expansion, stronger online conversion, and growing youth demand in Asia.

2028 Forecast

- Expected revenue: ~$2.7 billion

- Expected brand net worth: ~$3.9 billion

- Growth drivers: Increased brand collaborations, retail footprint optimization, and stronger penetration in Southeast Asia and India.

2029 Forecast

- Expected revenue: ~$2.8 billion

- Expected brand net worth: ~$4.1 billion

- Growth drivers: Higher digital contribution, improved supply-chain efficiency, and expanded global e-commerce reach.

2030 Forecast

- Expected revenue: ~$2.9 billion

- Expected brand net worth: ~$4.25 billion

- Growth drivers: Premium pricing strategy, stronger sustainability positioning, and higher repeat customer rates.

2031 Forecast

- Expected revenue: ~$3.0 billion

- Expected brand net worth: ~$4.4 billion

- Growth drivers: Mature DTC ecosystem, expansion of apparel share, and emerging market growth.

2032 Forecast

- Expected revenue: ~$3.1 billion

- Expected brand net worth: ~$4.6 billion

- Growth drivers: Long-term brand compounding, expanded lifestyle positioning, and stable global demand.

Over these six years, Converse’s revenue is projected to grow at a compound annual growth rate of approximately 3.7%, while brand net worth is expected to expand at a faster pace of around 4.5%–5% annually. This reflects Converse’s identity as a brand-first business, where valuation growth is powered more by cultural influence, global recognition, and long-term loyalty than by short-term sales acceleration.

This forward outlook assumes continued strategic support from Nike, Inc., disciplined distribution, controlled collaboration strategies, and stable consumer demand across global markets.

Brands Owned by Converse

As of 2026, Converse operates as a single-brand company. It does not own independent companies, subsidiaries, or legally separate businesses. Instead, Converse manages a portfolio of internally developed product brands and lines that exist under the Converse brand itself. These brands are not separate legal entities. They are product families, design platforms, and sub-brands fully controlled and operated by Converse.

Below is a breakdown of all major brands, lines, and entities owned and managed directly by Converse:

Chuck Taylor All Star

Chuck Taylor All Star is the most important and valuable brand owned by Converse. It is not a licensed or external brand. It is fully owned, controlled, and operated by Converse.

This line represents the core identity of Converse. Chuck Taylor All Stars account for a majority of Converse’s global footwear sales and an estimated 60% of total brand value. The product line includes high-top and low-top silhouettes, platform versions, seasonal colorways, and limited-edition collaborations.

Chuck Taylor is positioned as a timeless lifestyle sneaker rather than a performance product. Its consistency and global recognition make it the financial and cultural backbone of Converse.

Chuck 70

Chuck 70 is a premium extension of the Chuck Taylor line. It is fully owned and operated by Converse and designed to offer higher-quality materials, improved cushioning, and elevated finishes.

This line targets consumers willing to pay a premium for durability and design authenticity. Chuck 70 carries higher margins than standard Chuck Taylor models and plays a key role in Converse’s premium positioning.

The line is also frequently used for high-profile collaborations and fashion-forward releases.

One Star

One Star is another proprietary Converse brand originally rooted in basketball footwear. Today, it functions as a lifestyle and streetwear-focused line.

Converse owns full rights to the One Star name, design, and distribution. The brand is positioned toward youth culture, skate-influenced fashion, and casual wear. While smaller than Chuck Taylor, One Star remains strategically important for diversification and trend relevance.

Converse CONS

Converse CONS is the company’s skateboarding-focused brand. It is fully owned and operated by Converse and serves as its primary connection to the skate community.

CONS products are designed with performance upgrades tailored to skateboarding, including reinforced materials and specialized soles. This line allows Converse to participate in action sports culture without repositioning its core lifestyle products.

CONS also supports Converse’s credibility in skateboarding through athlete partnerships and skate-specific product design.

Jack Purcell

Jack Purcell operates as a brand owned by Converse but originally originated as a separate name. Converse controls design, manufacturing, and global distribution.

The Jack Purcell line is positioned as a minimalist, premium casual sneaker with a more refined aesthetic. It appeals to consumers seeking understated design rather than bold streetwear.

While smaller in scale, Jack Purcell plays a role in Converse’s premium and lifestyle diversification strategy.

Converse Apparel and Accessories

Converse also owns and operates its apparel and accessories business directly under the Converse name. This includes t-shirts, hoodies, jackets, backpacks, socks, and headwear.

These products are designed to complement footwear sales rather than function as standalone fashion brands. Apparel and accessories contribute approximately 15% of Converse’s total revenue and help increase average order value across direct-to-consumer channels.

All apparel and accessory lines are fully controlled by Converse and are not licensed to third parties.

Collaborations and Limited Collections

Converse regularly releases collaborative collections with designers, artists, musicians, and cultural institutions. These collaborations are not acquisitions or joint ventures. Converse retains ownership of all intellectual property related to the core products.

Collaborators provide creative input, branding, or design inspiration, but Converse maintains full operational control. These collections enhance brand equity without altering ownership structure.

Conclusion

Understanding who owns Converse provides clarity on how the brand functions today. Converse is fully owned by Nike. This ownership rescued the brand from bankruptcy and enabled global growth.

Converse maintains creative independence. Financial and strategic control remains with Nike. This structure allows Converse to stay relevant while benefiting from corporate scale. The result is a legacy brand with modern reach.

FAQs

When did Nike buy Converse?

Nike acquired Converse in 2003. The purchase followed Converse’s bankruptcy filing and was completed as a full buyout, transferring 100% ownership to Nike, Inc..

Who owns Converse shoes?

Converse shoes are owned by Nike. Converse operates as a wholly owned subsidiary, and all Converse footwear is produced, distributed, and controlled under Nike’s ownership structure.

Is Converse owned by Nike?

Yes. Converse is fully owned by Nike. There are no public shareholders or minority investors at the Converse brand level.

Who owned Converse before Nike?

Before Nike’s acquisition, Converse was an independent, publicly traded company. Prior to that, it operated as a privately owned business for many decades after its founding.

Is Converse still owned by Nike?

Yes. Converse remains 100% owned by Nike as of 2026. The ownership structure has not changed since the 2003 acquisition.

Does Chuck Taylor own Converse?

No. Chuck Taylor did not own Converse. He was a basketball player and salesman whose influence was so significant that the iconic sneaker was named after him, but he never held ownership in the company.

Who is the CEO of Converse?

As of 2026, the CEO of Converse is Jared Carver. He oversees global operations and brand strategy while reporting to Nike’s corporate leadership.

Is Converse Japan owned by Nike?

Yes. Converse Japan operates under licensing and corporate structures ultimately controlled by Nike. While local operations may have regional management, brand ownership and intellectual property rights remain with Nike.

Which country owns Converse?

Converse is owned by a U.S.-based company. Nike, its parent company, is headquartered in the United States, making Converse an American-owned global brand.