So, who owns TJX Companies?

Let’s find out.

TJX Companies, Inc. is one of the largest off-price retail corporations in the world, operating popular brands such as T.J. Maxx, Marshalls, HomeGoods, and Sierra. As a publicly traded company, TJX’s ownership consists of institutional investors, retail shareholders, and company insiders.

This article provides a detailed overview of who owns TJX companies, it’s structure, financial standing, market position, and other details.

History of TJX Companies

TJX Companies was founded in 1956 as Zayre Corporation, a discount department store chain. In 1987, the company rebranded as TJX Companies and shifted focus to off-price retailing. Over the years, TJX expanded through acquisitions, launching brands such as HomeGoods and acquiring Marshalls in 1995. Today, TJX operates over 4,800 stores across multiple countries, making it a dominant player in the retail industry.

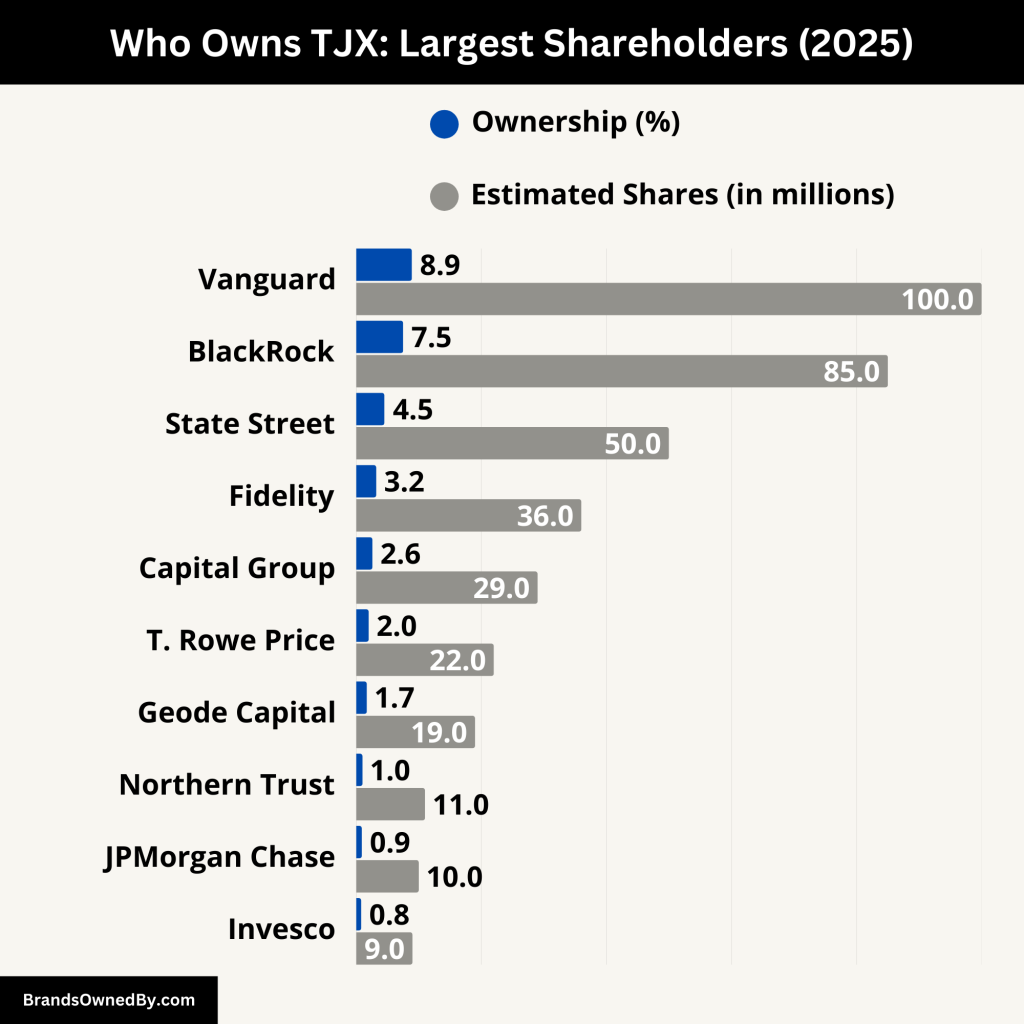

Who Owns TJX: Largest Shareholders

TJX Companies is a publicly traded company listed on the New York Stock Exchange (NYSE) under the ticker symbol TJX. Its ownership is widely distributed among institutional investors, mutual funds, and retail investors, with no single entity holding an absolute controlling stake.

Here’s a list of the major shareholders of TJX:

| Shareholder | Type | Ownership (%) | Estimated Shares Held | Role / Influence |

|---|---|---|---|---|

| The Vanguard Group, Inc. | Institutional | 8.9% | 100M+ | Largest shareholder; passive investor with strong voting power |

| BlackRock, Inc. | Institutional | 7.5% | 85M+ | Major passive investor; supports long-term governance policies |

| State Street Corporation | Institutional | 4.5% | 50M+ | Index fund investor; votes on key governance matters |

| Fidelity (FMR LLC) | Mutual Fund Manager | 3.2% | ~36M | Active investor; holds through actively managed funds |

| Capital Group Companies | Institutional | 2.6% | ~29M | Long-term value investor; American Funds family |

| T. Rowe Price Associates | Mutual Fund Manager | 2.0% | ~22M | Active manager; focused on earnings stability |

| Geode Capital Management | Institutional | 1.7% | ~19M | Index-based asset manager; manages for Vanguard funds |

| Northern Trust Corporation | Institutional | 1.0% | ~11M | Manages for institutions and trusts; systematic investing approach |

| JPMorgan Chase & Co. | Institutional | 0.9% | ~10M | Broad financial exposure through various funds |

| Invesco Ltd. | Mutual Fund Manager | 0.8% | ~9M | ETF-based investment; holds through QQQ Trust and others |

| Ernie Herrman (CEO) | Insider | <0.1% | ~700,000 | President & CEO; compensated via performance-based equity |

| Carol Meyrowitz (Chairman) | Insider | <0.2% | ~1,000,000+ | Executive Chair; long-time leader; influential in HomeGoods’ success |

| Scott Goldenberg (CFO) | Insider | <0.05% | ~400,000 | Chief Financial Officer; holds vested shares and options |

| Rosemary Power (Group Pres.) | Insider | <0.02% | ~150,000 | EVP; oversees multiple brands including HomeGoods |

| Other Insiders & Directors | Insiders | <1% (collectively) | ~1M+ (combined) | Board members and executives; hold RSUs and performance shares |

The Vanguard Group, Inc.

Vanguard is the largest single shareholder in TJX Companies. It holds approximately 8.9% of the company, which equals over 100 million shares. Vanguard’s holdings come through various mutual funds and ETFs, such as the Vanguard Total Stock Market Index Fund and the Vanguard 500 Index Fund.

Vanguard is a passive investor and doesn’t manage TJX directly. However, its voting rights at shareholder meetings give it influence over key decisions like board elections and executive compensation.

BlackRock, Inc.

BlackRock is the second-largest shareholder, owning around 7.5% of TJX Companies, or nearly 85 million shares. Through its funds like the iShares Core S&P 500 ETF and BlackRock Equity Index Fund, it maintains a strong presence in TJX stock.

BlackRock often uses its size to advocate for responsible business practices and governance reforms. It is not involved in daily operations but can influence long-term strategic decisions.

State Street Corporation

State Street owns about 4.5% of TJX shares, roughly 50 million shares. Its ownership comes primarily from index funds like the SPDR S&P 500 ETF.

It has voting power at annual meetings but does not engage in active company management. Its investment approach is typically long-term and focused on stable returns.

Fidelity Investments (FMR LLC)

Fidelity, through its actively managed funds, owns around 3.2% of TJX. It may adjust its holdings more frequently than index funds. Fidelity’s investment highlights a belief in TJX’s continued growth, especially in divisions like HomeGoods.

Fidelity’s research-driven investment style suggests confidence in the company’s financial health and off-price model.

Capital Group Companies

Capital Group owns approximately 2.6% of TJX shares. It invests through its widely held American Funds. The firm’s portfolio managers focus on long-term value and earnings consistency.

Capital Group tends to support companies with durable brands and strong financials, aligning well with the success of HomeGoods and its sister brands.

T. Rowe Price Associates

T. Rowe Price holds about 2.0% of the company. It invests in TJX across several actively managed mutual funds. The firm looks for long-term capital appreciation and tends to invest in companies with reliable performance.

T. Rowe Price is not involved in operations but may vote on major shareholder proposals.

Geode Capital Management

Geode Capital owns about 1.7% of TJX Companies. As a sub-advisor to Vanguard, Geode primarily manages index-based portfolios. It doesn’t engage in direct corporate governance but adds to Vanguard’s overall voting influence.

Northern Trust Corporation

Northern Trust holds around 1.0% of TJX stock. It manages portfolios for institutions and wealthy individuals, often using systematic investment strategies.

Though a smaller holder, its votes still contribute to decisions on director elections and shareholder resolutions.

JPMorgan Chase & Co.

JPMorgan owns approximately 0.9% of TJX. Its ownership is held across different asset management vehicles, including pension funds, ETFs, and private accounts.

JPMorgan provides analysis and trading liquidity and occasionally issues research reports on TJX’s stock performance.

Invesco Ltd.

Invesco holds about 0.8% of TJX shares. This includes exposure through funds like the Invesco QQQ Trust. While smaller than others, Invesco is still an institutional player with voting rights.

Insiders and company executives

In addition to institutional investors, several insiders at TJX Companies also hold shares. Insider ownership is relatively small compared to institutional holdings but reflects internal confidence in the company.

1. Ernie Herrman – CEO and President

Herrman owns around 700,000+ shares, either directly or through options. His stake aligns him with shareholders’ interests, especially in driving long-term value.

2. Carol Meyrowitz – Executive Chairman

Meyrowitz, a long-time leader at TJX, holds over 1 million shares, including vested and unvested equity. She played a pivotal role in TJX’s expansion, including the growth of HomeGoods.

3. Scott Goldenberg – CFO

Goldenberg owns roughly 400,000 shares. As CFO, his compensation is partly tied to company performance, reinforcing financial discipline.

4. Rosemary Power – EVP, Group President

Power holds a smaller stake, estimated at 150,000 shares, including restricted stock units and options. She oversees multiple divisions, including HomeGoods.

5. Board Members and Other Executives

Other directors and senior officers collectively own a small percentage, typically under 1% in total. Their stakes may include common stock, RSUs (Restricted Stock Units), and long-term incentive plans.

Who Controls TJX?

While institutional investors own a large portion of TJX Companies, the control of the business lies firmly in the hands of its executive leadership team and board of directors. These individuals make day-to-day decisions, oversee long-term planning, and guide the strategic direction of the company, including growth initiatives for HomeGoods and other retail banners.

Executive Leadership and Corporate Control

The senior executive team at TJX Companies holds the most influence over company operations. These leaders are responsible for everything from financial strategy to merchandising and brand management. They are supported by regional leaders and divisional presidents across various retail segments.

Although insiders like the CEO and Chairman own only a small percentage of the company, their authority comes from their positions rather than share count. Their decisions directly impact store operations, product sourcing, expansion, and shareholder value.

TJX has adopted a centralized leadership model, with corporate-level oversight over its individual store chains, such as HomeGoods, Marshalls, and T.J. Maxx. This centralized approach enables tight cost control and rapid scaling.

Role of the Board of Directors

TJX’s board of directors provides governance and oversight. They are responsible for approving major decisions such as executive appointments, compensation policies, stock repurchase programs, and expansion strategies.

The board includes seasoned professionals from finance, retail, and operations backgrounds. They meet regularly to evaluate company performance and guide the CEO and executive team. Board members are elected by shareholders but operate independently of daily operations.

CEO of TJX Companies: Ernie Herrman

Ernie Herrman is the President and Chief Executive Officer of TJX Companies and has held this position since 2016. He has been with the company for over 30 years, working his way up through various merchandising and executive roles.

Herrman is known for his deep understanding of off-price retail and his hands-on leadership style. Under his leadership, TJX has expanded internationally and strengthened brands like HomeGoods, which has seen consistent growth in the U.S. home furnishing market.

He is credited with maintaining TJX’s lean operating model, fostering a flexible supply chain, and focusing on customer loyalty. His ability to adapt to shifting retail trends, especially during economic cycles, has helped the company remain profitable even when competitors struggle.

While Herrman holds less than 0.1% of the company’s shares, his influence is significant due to his role as the top executive. He also works closely with the Chairman of the Board and other top leaders to develop strategic priorities.

Chairman of the Board: Carol Meyrowitz

Carol Meyrowitz serves as the Executive Chairman of TJX Companies and was the former CEO. Her legacy at TJX includes accelerating the growth of HomeGoods and expanding the company’s global footprint. As Chairman, she continues to advise and influence executive decisions at the highest level.

She remains deeply involved in high-level strategy, succession planning, and long-term vision, especially in areas related to merchandising and brand positioning.

Other Key Executives in Control

- Scott Goldenberg, Chief Financial Officer, manages capital allocation, cost controls, and financial forecasting.

- Rosemary Power, Group President, oversees several business units, including HomeGoods, and plays a direct role in brand-specific strategies.

- Doug Mizzi, Chief Operating Officer, handles logistics, IT, and operations, which are critical for inventory-heavy businesses like HomeGoods.

Together, this team forms the core leadership of TJX Companies, ensuring that its business units remain profitable, competitive, and aligned with shareholder interests.

Annual Revenue and Net Worth

TJX Companies is a financial powerhouse in the retail sector, consistently generating strong revenues and profitability.

- Annual Revenue: TJX generated approximately $50 billion in annual revenue in 2024 making it one of the most profitable retailers.

- Net Worth: The company’s market capitalization is estimated to be around $100 billion as of February 2025 reflecting investor confidence and strong financial performance.

Historical Revenue Growth and Year-over-Year Performance

TJX’s revenue has shown consistent growth over the years:

- 2023: $50.3 billion (strong post-pandemic recovery, fueled by consumer demand for off-price retail)

- 2022: $48.5 billion (steady growth despite inflationary pressures)

- 2021: $42.4 billion (recovery phase after COVID-19 disruptions)

- 2020: $32.1 billion (pandemic-related closures affected sales)

- 2019: $41.7 billion (pre-pandemic high, reflecting strong market position)

Factors Influencing Financial Performance

- Off-Price Model Strength: TJX thrives in economic downturns as consumers seek value-driven shopping options.

- Global Expansion: Increasing presence in Europe and Canada contributes to revenue diversification.

- E-Commerce Growth: While TJX is primarily a brick-and-mortar retailer, its online sales have grown steadily.

- Supply Chain Management: Strong vendor relationships enable TJX to offer branded products at discounted prices.

Market Share and Competitors

TJX is the dominant player in the off-price retail segment, holding a significant market share compared to traditional retailers and other discount chains.

TJX Companies holds an estimated 45% market share in the off-price retail sector, making it the undisputed leader. However, competition remains fierce from similar discount retailers and department stores.

Here’s a list of the major TJX competitors with their market share:

Ross Stores

Ross Stores is one of TJX’s main competitors, holding approximately 22% of the off-price retail market. With an annual revenue of around $20 billion, it operates brands such as Ross Dress for Less and dd’s Discounts. The company focuses on deep discounts and maintains lower overhead costs, allowing it to offer competitive pricing to budget-conscious shoppers.

Burlington Stores

Burlington Stores commands around 14% of the off-price retail market, generating approximately $9 billion in annual revenue. Its primary brand, Burlington Coat Factory, is known for its strong seasonal inventory and competitive pricing strategies that attract bargain hunters.

Nordstrom Rack

Nordstrom Rack, the off-price division of Nordstrom, holds roughly 10% of the market and generates around $6 billion in annual revenue. The retailer differentiates itself by offering designer brands at discounted rates, making it a popular choice among upscale shoppers looking for premium products at lower prices.

Macy’s Backstage

Macy’s Backstage, the discount division of Macy’s, has a market share of around 5%. While its revenue is included in Macy’s total annual earnings of $25 billion, Backstage benefits from leveraging Macy’s department store infrastructure to provide in-store discounts and attract cost-conscious consumers.

Brands Owned by TJX

Here’s an overview of the major brands and companies owned by TJX:

T.J. Maxx

Market Share: Estimated at 20% within the off-price apparel sector.

One of the largest off-price retailers in the U.S., T.J. Maxx offers a wide variety of brand-name and designer apparel, home goods, accessories, and footwear at significantly discounted prices. The store is known for its “treasure hunt” shopping experience, where customers can find new products every visit.

Marshalls

Market Share: Approximately 18% in off-price retail.

A sister store to T.J. Maxx, Marshalls provides similar off-price fashion and home goods. However, it differentiates itself with a broader selection of footwear and unique in-store-only product lines. With over 1,100 stores in the U.S. and Canada, it holds a strong market presence.

HomeGoods

Market Share: Estimated at 25% in the home décor discount retail segment.

Specializing in home décor, furniture, bedding, and kitchenware, HomeGoods has become a go-to destination for stylish yet affordable home essentials. It capitalizes on customer demand for unique, high-quality home furnishings at lower prices than traditional department stores.

Sierra

Market Share: Roughly 5% in the outdoor and sportswear retail sector.

Formerly known as Sierra Trading Post, Sierra is TJX’s discount outdoor and activewear retailer, offering gear for hiking, camping, and athletic activities at reduced prices. It competes with REI and Bass Pro Shops by providing quality outdoor brands at budget-friendly rates.

Homesense

Market Share: Estimated at 10% in the furniture and home accessories discount retail market.

A premium home goods and furniture retailer, Homesense is an expanded version of HomeGoods with more extensive furniture, lighting, and seasonal product collections. Originally launched in Canada and later expanded to the U.S., it provides designer home products at a fraction of department store prices.

Final Thoughts on Who Owns TJX Companies

TJX Companies has established itself as the dominant force in off-price retail, driven by strong financial performance, a wide market reach, and a diverse brand portfolio. With continuous expansion and adaptation to market trends, TJX remains a leader in the retail sector.

FAQs

Who is the largest shareholder of TJX Companies?

The largest shareholder of TJX Companies is The Vanguard Group, holding approximately 9% of the company’s shares.

How much revenue does TJX generate annually?

TJX generates around $50 billion in annual revenue, making it one of the most profitable off-price retailers.

What brands does TJX own?

TJX owns T.J. Maxx, Marshalls, HomeGoods, Sierra, and Homesense, among other smaller brands.

Where is TJX headquartered?

TJX Companies is headquartered in Framingham, Massachusetts, USA.

How does TJX compete with other retailers?

TJX competes by offering brand-name and designer products at lower prices through its off-price retail model.