When asking who owns Rolls-Royce, it’s important to consider both the history and current structure of this iconic British brand. Rolls-Royce, known for its luxury cars and aerospace engineering, has an intriguing ownership landscape.

The company’s ownership has evolved significantly over the years, and today, it’s a publicly traded entity, with a range of shareholders influencing its direction.

History of Rolls-Royce Holdings

Rolls-Royce was founded in 1904 by Charles Rolls and Henry Royce in Manchester, England. Royce, an engineer, designed the first car that bore the Rolls-Royce name. The company quickly earned a reputation for quality and luxury, with the Rolls-Royce 10 hp being the first model to roll out in 1904.

Charles Rolls, an accomplished businessman and aviator, provided the financial support and the marketing vision for the company. In 1906, Rolls-Royce introduced the Silver Ghost, a car that would become an iconic symbol of the brand due to its reliability and luxury.

Expanding into Aviation: 1910–1930

In 1914, Rolls-Royce took a monumental step into aviation by designing its first aircraft engine, the Eagle. The engine was a major success and helped establish Rolls-Royce as a pioneer in aerospace engineering. By the 1920s, Rolls-Royce was already a leader in aircraft engines. The company’s engines powered military and commercial aircraft during World War I, and by the 1930s, Rolls-Royce was supplying engines for the Supermarine Spitfire during World War II.

Post-War Expansion and Innovation: 1940–1960

After World War II, Rolls-Royce turned its attention to civilian aviation, developing groundbreaking engines for commercial aircraft. The Avon and RB211 engines were notable achievements, and the company’s success in the aviation industry continued to grow. In 1951, Rolls-Royce introduced the Comet, the world’s first commercial jet airliner, powered by its engines. This marked the beginning of Rolls-Royce’s dominance in the jet engine market, setting a global standard for reliability and performance in aviation.

The Formation of Rolls-Royce Limited and Nationalization: 1960s

By the 1960s, Rolls-Royce was struggling financially due to the immense costs of developing its engines. In 1971, the British government took control of the company under a policy of nationalization. This move allowed Rolls-Royce to continue its aircraft engine production and development despite financial difficulties. The RB211 engine, developed during this period, became one of Rolls-Royce’s most famous contributions to aerospace technology, despite initial production delays.

The Privatization Era: 1980s

In 1987, the British government sold Rolls-Royce to private investors, marking the end of its nationalized status. The company began its journey back to profitability under private ownership, focusing on improving its jet engines and expanding its services in aerospace. The RB211 was later adapted for various aircraft, cementing Rolls-Royce’s position as a leader in the jet engine market. During the 1980s, Rolls-Royce also expanded into non-aviation markets, particularly power systems, making significant strides in energy generation and marine propulsion.

Mergers and Acquisitions: 1990s

In the 1990s, Rolls-Royce made several key acquisitions to strengthen its position in both aerospace and power systems. The company acquired Vickers plc in 1999, a move that allowed Rolls-Royce to expand into defense systems. The acquisition also included the MTU Aero Engines, allowing the company to bolster its presence in the global aerospace market and diversify its portfolio into defense and power systems.

Modern Era: 2000s–Present

In the 2000s, Rolls-Royce continued to innovate with the development of new aircraft engines such as the Trent series. These engines became the backbone of Rolls-Royce’s success in the aerospace industry. By 2006, Rolls-Royce had established itself as a major player in the global aerospace sector, supplying engines for the Airbus A350, the Boeing 787 Dreamliner, and other cutting-edge aircraft.

The company expanded further into energy and defense systems, developing power generation turbines and propulsion systems for naval and defense applications. Rolls-Royce also made significant strides in sustainability, aiming to reduce the carbon footprint of its products. The company’s future efforts included investments in electric aviation, renewable energy solutions, and advancing autonomous technologies.

Recent Developments: 2010s–2020s

In recent years, Rolls-Royce has focused on cutting-edge technology to maintain its leadership in aerospace, energy, and defense. The company is heavily invested in the future of electric aviation and sustainable energy. Rolls-Royce is working on next-generation electric propulsion systems and hybrid engines, as well as pushing the boundaries of small modular reactors (SMRs) for nuclear energy.

In 2021, Rolls-Royce announced its commitment to achieving net-zero emissions by 2050, aligning with global sustainability efforts. In the aerospace sector, the company continues to develop engines for next-gen aircraft like the UltraFan, which is designed to reduce fuel consumption by 25% compared to previous models.

The Future of Rolls-Royce

As of 2025, Rolls-Royce is poised to continue its legacy of innovation, focusing on electric and hybrid aviation, defense technology, and sustainable energy systems. The company’s research and development into autonomous technologies and environmentally friendly propulsion systems suggests that it will continue to shape the future of both the aerospace and energy industries.

Difference Between Rolls-Royce Cars and Rolls-Royce Holdings

Rolls-Royce Cars

Rolls-Royce cars refer to the luxury automobile brand that is renowned for producing high-end, handcrafted vehicles. This division is now owned by BMW Group, which acquired the rights to the Rolls-Royce name for automobiles in 1998. Rolls-Royce Motor Cars manufactures premium cars with a focus on performance, craftsmanship, and luxury. Their lineup includes models such as the Phantom, Cullinan, Wraith, and Dawn.

Key Features of Rolls-Royce Cars:

- Focus on ultra-luxury and customization

- Iconic designs with bespoke interiors

- Advanced engineering, particularly in engine performance and ride comfort

- Marketed to wealthy individuals and celebrities

- Examples of famous owners include Cristiano Ronaldo, Kim Kardashian, and Jay-Z.

Rolls-Royce cars are built in Goodwood, England, and are considered some of the most prestigious and expensive vehicles in the world.

Rolls-Royce Holdings

On the other hand, Rolls-Royce Holdings plc is a global engineering company, primarily involved in the manufacture of aircraft engines, power systems, and defense technologies. Unlike Rolls-Royce Motor Cars, Rolls-Royce Holdings focuses on the aerospace, defense, and energy sectors. The company is still headquartered in the UK, and it provides cutting-edge engines for both civil and military aviation, as well as power generation and naval propulsion.

Key Features of Rolls-Royce Holdings:

- Specializes in aircraft engines, power generation systems, and defense technology

- Operates in aerospace, defense, and energy sectors

- Major customers include commercial airlines, military organizations, and power plants worldwide

- Not involved in car manufacturing, but has a strong presence in the aerospace industry

- Not connected to the production of luxury vehicles or the consumer automotive market

Rolls-Royce Holdings’ contributions are crucial to the aviation industry, with its Trent series engines powering major airliners such as the Boeing 787 Dreamliner and Airbus A350.

Ownership and Management

The ownership of Rolls-Royce Cars and Rolls-Royce Holdings is also distinct.

- Rolls-Royce Cars is owned by BMW Group, which holds the rights to manufacture automobiles under the Rolls-Royce name.

- Rolls-Royce Holdings operates independently and remains one of the largest manufacturers of aircraft engines in the world, with a diversified portfolio spanning aerospace, marine, and power generation.

Historical Context

The distinction between Rolls-Royce cars and Rolls-Royce Holdings arose from a split in the company’s operations in the late 20th century.

In 1971, Rolls-Royce faced financial difficulties due to the costly development of its engines and was nationalized by the British government. In 1987, Rolls-Royce Motor Cars was sold to BMW, while Rolls-Royce Holdings continued as a separate entity focused on aircraft engines and industrial power systems.

In essence, Rolls-Royce Motor Cars became part of BMW, while Rolls-Royce Holdings remained a British company focused on high-tech engineering and manufacturing, mainly for aerospace and defense.

Who Owns Rolls-Royce Holdings: Major Shareholders

Rolls-Royce Holdings is a publicly traded company listed on the London Stock Exchange. The ownership is distributed among numerous institutional investors, public shareholders, and individual investors.

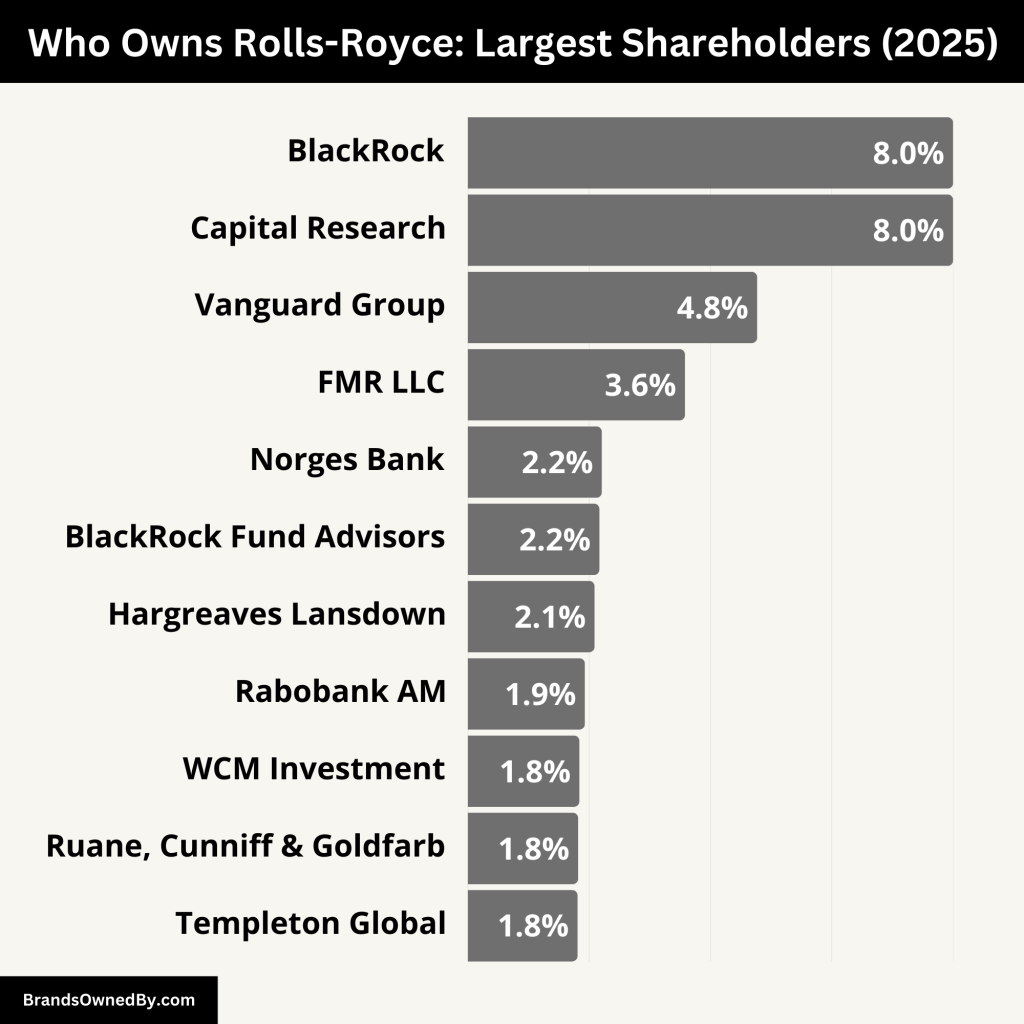

Below is a breakdown of the largest shareholders of Rolls-Royce:

| Shareholder | Ownership Percentage | Shares Owned | Role/Influence |

|---|---|---|---|

| BlackRock, Inc. | 7.62% | 637.78 million | Largest institutional investor, actively engaged in governance and strategic decisions. |

| Capital Research and Management Company | 7.54% | 631.14 million | Active investment strategy, influences shareholder value, executive compensation, and board composition. |

| The Vanguard Group, Inc. | 4.77% | 399.66 million | Long-term, low-cost investment approach; engages in governance, focusing on ESG and business strategies. |

| FMR LLC (Fidelity Investments) | 3.58% | 300.04 million | Research-driven approach, supports governance improvements, shareholder value, and sustainability. |

| Norges Bank Investment Management | 2.21% | 185.41 million | Focuses on responsible investing and ESG, engages in governance to encourage long-term value creation. |

| Hargreaves Lansdown Asset Management Ltd. | 2.09% | 174.57 million | Influences governance through retail investors, emphasizes sustainable investing and ethical practices. |

| Coöperatieve Centrale Raiffeisen‑Boerenleenbank B.A. (Rabobank AM) | 1.93% | 161 million | Supports sustainable finance, encourages environmental responsibility, and focuses on long-term growth. |

| WCM Investment Management LLC | 1.84% | 154 million | Active ownership strategy, ensures operational improvements and long-term strategic goals. |

| Templeton Global Advisors Ltd. | 1.81% | 154.78 million | Value investing approach, advocates for sound capital allocation, and long-term shareholder returns. |

| Ruane, Cunniff & Goldfarb LP | 1.82% | 154.78 million | “Buy and hold” strategy, supports long-term growth, and encourages company to focus on profitability. |

| BlackRock Fund Advisors | 2.17% | 184.26 million | Passive investment through funds, engages in governance and exercises voting rights for sustainability. |

| Other Shareholders | 68% | Various | Includes smaller institutional investors, retail investors, and company insiders, ensuring liquidity. |

BlackRock, Inc.

BlackRock is the largest institutional investor in Rolls-Royce. It holds 7.62% of the shares, equal to 637.78 million shares. BlackRock plays an active role in governance. It engages with management on strategy and votes at annual general meetings.

Capital Research and Management Company

Capital Research, part of the Capital Group, owns 7.54% of Rolls-Royce. This amounts to 631.14 million shares. It is known for its focus on shareholder value and often influences executive remuneration and board composition.

The Vanguard Group, Inc.

Vanguard holds 4.77% of the company, or 399.66 million shares. Its low‐turnover index funds make it a steady, long‑term investor. Vanguard’s stewardship teams regularly discuss environmental and social issues with Rolls Royce management.

FMR LLC (Fidelity Investments)

FMR LLC owns 3.58% of Rolls Royce, equivalent to 300.04 million shares. Known for its research‐driven approach, Fidelity often advocates for sustainable business practices in its engagements.

Norges Bank Investment Management

Norway’s sovereign wealth fund holds 2.21% of Rolls-Royce, about 185.41 million shares. Norges Bank IM is a leading voice on ESG issues and uses its voting power to promote responsible corporate behaviour.

Hargreaves Lansdown Asset Management Ltd.

Hargreaves Lansdown AM owns 2.09% of Rolls Royce, or 174.57 million shares. As a major UK retail platform, it influences governance through the voting guidelines it publishes for private investors.

Coöperatieve Centrale Raiffeisen‑Boerenleenbank B.A. (Rabobank AM)

Rabobank Asset Management holds 1.93% of the shares, around 161 million. It focuses on sustainable agriculture financing and votes its proxies with an emphasis on long‑term value.

WCM Investment Management LLC

WCM Investment Management owns 1.84% of Rolls Royce, roughly 154 million shares. Its concentrated portfolio and active‑ownership approach mean it often meets with management to discuss performance goals.

Templeton Global Advisors Ltd.

Templeton, part of Franklin Templeton Investments, holds 1.81% of the shares (154.78 million). It is a value investor that supports management on capital allocation and dividends.

Ruane, Cunniff & Goldfarb LP

Ruane, Cunniff & Goldfarb owns 1.82% of Rolls Royce, or 154.78 million shares. The firm is known for its “buy and hold” philosophy and often supports long‐term strategic plans.

BlackRock Fund Advisors

A subsidiary of BlackRock, Fund Advisors holds 2.17% (184.26 million shares). It manages index funds and ETFs, reinforcing BlackRock’s overall influence in the company.

Other Shareholders

The remaining shares are spread across smaller institutions, retail investors, and company insiders. Together, they account for a free float of approximately 68%, ensuring active trading and liquidity in Rolls-Royce’s shares.

Who Owns Rolls-Royce Cars: Major Shareholders

Rolls-Royce Motor Cars is fully owned by BMW Group, which acquired the rights to the Rolls-Royce automobile brand in 1998. While BMW Group directly controls Rolls-Royce cars, the ownership of BMW itself is split among various shareholders.

Here’s a detailed overview of the key stakeholders in BMW Group who, through their influence, indirectly own and control Rolls-Royce Motor Cars.

BMW AG (Parent Company)

BMW AG, the central operating entity of BMW Group, holds approximately 46.2% of the company’s shares. This major ownership gives BMW AG direct control over Rolls-Royce Motor Cars. It oversees manufacturing, brand positioning, and strategic decisions. BMW AG’s authority ensures that Rolls-Royce remains a key part of the group’s ultra-luxury segment. The company’s board includes senior executives and members of the Quandt family, whose long-standing involvement has shaped BMW’s leadership and direction.

The Quandt Family

The Quandt family is historically the most influential private stakeholder in BMW Group, also holding around 46.2% of shares. Their ownership is considered part of BMW AG’s total, as it is held through private family trusts and entities. Herbert Quandt, the patriarch of the family, saved BMW from collapse in the 1950s. Since then, the family has played a pivotal role in BMW’s growth and strategic direction. Their influence is deeply embedded in corporate decisions, including the stewardship of Rolls-Royce Motor Cars.

BlackRock, Inc.

BlackRock holds approximately 3.2% of BMW Group as of 2025. As the world’s largest asset manager, BlackRock’s investment signals institutional confidence in BMW’s stability and long-term growth. The firm does not manage day-to-day operations, but its stake allows participation in shareholder meetings and influence over corporate governance. BlackRock’s role in shaping BMW’s financial direction indirectly affects Rolls-Royce car production and brand positioning.

The Vanguard Group, Inc.

Vanguard Group, another leading institutional investor, owns around 2.5% of BMW Group. As a passive investor with significant assets under management, Vanguard supports BMW’s business direction by backing long-term strategies. The company’s voting rights on corporate matters give it an indirect say in how BMW runs subsidiaries like Rolls-Royce Motor Cars. Vanguard’s involvement reflects growing institutional backing for luxury and performance automotive brands.

Fidelity International

Fidelity International is estimated to own about 1.6% of BMW Group shares. Known for its strategic equity investments, Fidelity contributes to BMW’s global financial foundation. Its influence is primarily financial and governance-related, impacting corporate-level policies that also apply to Rolls-Royce operations. Through annual meetings and shareholder decisions, Fidelity plays a minor yet noticeable role in shaping Rolls-Royce’s future as a BMW brand.

Who is the CEO of Rolls-Royce Holdings?

Tufan Erginbilgic took over as CEO in July 2023. He came from a background at BP, where he led customer and products. At Rolls-Royce, he has focused on leaner operations. He aims to boost profitability. He also champions sustainability. Under his leadership, the company set targets for net-zero emissions.

Decision‑Making Structure

The Board of Directors sits at the top of Rolls-Royce’s governance framework. It comprises the Chair, the CEO, Executive Directors, and a majority of independent Non‑Executive Directors. Each director is chosen for relevant skills and experience. The Board sets the company’s strategic objectives. It oversees management performance. It also monitors risk and ensures compliance with laws and regulations.

Matters Reserved for the Board

Certain decisions cannot be made without the full Board’s approval. Key matters reserved include:

- Overall corporate governance arrangements

- Entry into or exit from major business lines and territories

- Significant capital allocations, share issues, and cash returns to shareholders

- Changes to Board composition, including appointment or removal of Chair, CEO, and Company Secretary

- Approval of material acquisitions, disposals, joint ventures, and major contracts

- Determining risk appetite and major changes to tax planning

Resolutions pass by a majority vote, with each director holding one vote.

Board Committees

The Board delegates detailed oversight to specialist committees. Each has its own terms of reference:

- Audit Committee reviews financial reporting, internal controls, and risk management processes.

- Remuneration Committee sets executive pay and incentive structures.

- Nominations and Governance Committee leads director nominations, succession planning, and reviews governance arrangements.

- Safety, Ethics & Sustainability Committee oversees health, safety, ethics, compliance, and sustainability matters.

- Risk Committee (or similar enterprise risk forum) defines risk appetite, monitors principal risks, and ensures controls are effective.

Executive Committee

The Executive Committee handles day-to-day management. It is chaired by the CEO and includes the CFO along with heads of key divisions (Aerospace, Power Systems, Corporate Affairs, etc.). This committee:

- Implements Board‑approved strategy.

- Oversees operational performance and budget adherence.

- Reviews project approvals within delegated authority levels.

- Escalates issues beyond its mandate back to the Board or relevant Board Committee.

Shareholder Approval and Engagement

Major corporate actions—such as the election of directors, adoption of the remuneration policy, and significant transactions—must be ratified by shareholders at the Annual General Meeting. Institutional investors (e.g., BlackRock, Vanguard) engage through stewardship programs. They vote on resolutions and hold the Board accountable for long‑term value creation.

Stakeholder Considerations

Rolls-Royce’s directors exercise independent judgment. They consider the interests of employees, customers, suppliers, communities, and the environment. These considerations feed into strategic choices and risk assessments. Specialized roles, like the Head of Ethics and Compliance, report both to the General Counsel and directly to the Safety, Ethics & Sustainability Committee, ensuring that ethics and stakeholder interests are embedded in decision making.

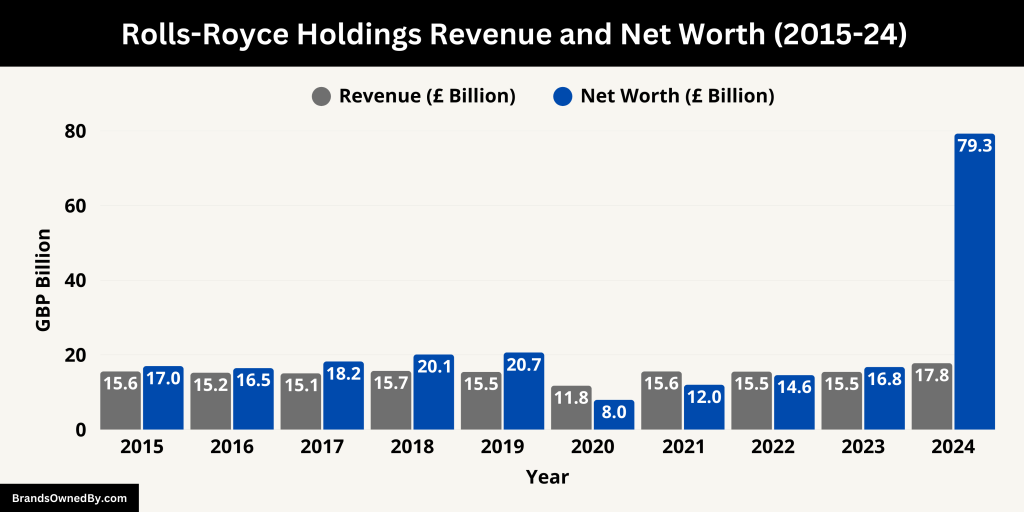

Annual Revenue and Net Worth of Rolls-Royce Holdings

In 2024, Rolls-Royce reported a revenue of £17.8 billion, marking a 15% increase from the previous year. This growth was driven by strong performances across all core divisions, particularly in civil aerospace, defense, and power systems.

The company also benefited from a rebound in global air travel and increased defense spending. Notably, Rolls-Royce’s market share for widebody commercial aircraft engines rose to 36% by the end of 2024, up from 32% in 2022.

As of April 2025, Rolls-Royce’s net worth stands at approximately $79.27 billion, reflecting an 81.5% increase over the past year. This substantial growth in market value underscores investor confidence in the company’s strategic direction and financial performance.

Looking ahead, Rolls-Royce has provided guidance for 2025, projecting an underlying operating profit and free cash flow in the range of £2.7 billion to £2.9 billion. These projections align with the company’s upgraded mid-term targets, which aim for £3.6 billion to £3.9 billion in operating profit and £4.2 billion to £4.5 billion in free cash flow by 2028.

Here’s a breakdown of the historical revenue and net worth of Rolls-Royce:

| Year | Revenue (£ Billion) | Net Worth/Market Capitalization (£ Billion) |

|---|---|---|

| 2015 | 15.57 | 16.88 |

| 2016 | 15.22 | 16.45 |

| 2017 | 15.06 | 18.23 |

| 2018 | 15.72 | 20.12 |

| 2019 | 15.45 | 20.66 |

| 2020 | 11.76 | 7.95 |

| 2021 | 15.57 | 11.99 |

| 2022 | 15.53 | 14.58 |

| 2023 | 15.46 | 16.76 |

| 2024 | 17.8 | 79.27 |

Brands and Companies Owned by Rolls-Royce Holdings

Rolls-Royce Holdings operates in multiple sectors, primarily focusing on aerospace, power systems, and defense. It owns a diverse portfolio of brands and subsidiaries that contribute to its global market presence.

Here’s an overview of the major companies and brands owned by Rolls-Royce Holdings:

| Company/Brand | Description | Key Products | Role/Significance |

|---|---|---|---|

| Rolls-Royce Aerospace | Leading manufacturer of aircraft engines and propulsion systems. | Commercial and military aircraft engines. | Core division driving Rolls-Royce’s leadership in aviation propulsion technology. |

| Rolls-Royce Power Systems | Designs engines and power systems for industrial and marine applications. | MTU Engine Series, gas turbines, diesel engines. | Vital for diversification into non-aviation industries like marine and power generation. |

| Rolls-Royce Defense | Specializes in advanced propulsion systems for military and defense applications. | Aircraft engines, naval propulsion, land vehicle engines. | Supports defense sectors globally, providing critical military hardware. |

| Rolls-Royce Energy | Provides gas turbines and power generation solutions. | Gas turbines, energy storage systems, diesel generators. | Contributes to the global energy sector, with a focus on sustainable and efficient solutions. |

| ITP Aero | Aerospace company specializing in gas turbine components. | Gas turbine components, turbo machinery systems. | Enhances Rolls-Royce’s manufacturing capabilities in the aerospace market. |

| Rolls-Royce Civil Nuclear | Develops nuclear power systems, including small modular reactors. | Nuclear reactors, small modular reactors (SMRs). | Positions Rolls-Royce as a leader in clean energy and nuclear propulsion technology. |

| Rolls-Royce Electrical | Focuses on electric propulsion systems for aviation. | Electric propulsion systems, hybrid aircraft engines. | Aims to transform the aviation sector through sustainable, electric-powered flight solutions. |

| Rolls-Royce Holdings | Parent company managing the strategic direction of the group. | Corporate governance, strategic oversight. | Oversees overall corporate strategy, investments, and ensures alignment of subsidiaries. |

| Rolls-Royce & Daimler AG JV | Joint venture for luxury vehicle engine development. | Luxury vehicle engines. | Leverages expertise to develop high-performance engines for luxury automobiles. |

| Rolls-Royce & Lufthansa Technik JV | Partnership for aircraft engine maintenance and repair services. | Engine maintenance, overhaul services. | Ensures operational continuity in aviation by providing critical engine support services. |

Rolls-Royce Aerospace

Rolls-Royce Aerospace is one of the world’s leading manufacturers of aircraft engines and propulsion systems. It designs, develops, and manufactures engines for both commercial and military aircraft. The company is renowned for its cutting-edge technology in the aerospace sector, with a significant focus on sustainability and reducing emissions in aviation. Rolls-Royce Aerospace serves clients across the globe, including major airlines, governments, and defense agencies.

Key Products:

- Commercial Aircraft Engines (such as the Trent and UltraFan series).

- Military Aircraft Engines (used by the UK Ministry of Defence and international defense contractors).

- Engine Maintenance and Services (through Rolls-Royce’s TotalCare program).

The company has continued to innovate, aiming to create the world’s most efficient and sustainable aircraft engines.

Rolls-Royce Power Systems

Rolls-Royce Power Systems designs, manufactures, and supplies engines and power generation systems for a wide range of industrial applications. The Power Systems division is vital for Rolls-Royce’s reach in sectors beyond aerospace, including marine and land-based industries. This division provides engines for high-power applications, such as ships, power plants, and industrial machinery.

Key Products:

- MTU Engine Series (for marine, rail, and power generation applications).

- Gas Turbines for power generation.

- Industrial Diesel Engines.

Rolls-Royce Power Systems focuses heavily on reducing the environmental impact of its products, aligning with global sustainability goals, and offering efficient power solutions to various industries.

Rolls-Royce Defense

Rolls-Royce Defense specializes in designing and producing advanced propulsion systems for military and defense applications. Its products are integral to many modern military aircraft, ships, and land vehicles. Rolls-Royce has longstanding contracts with numerous armed forces, providing propulsion technology for fighter jets, submarines, and military transport planes. The company’s defense division is crucial for both national defense and international military collaborations.

Key Products:

- Naval Nuclear Propulsion Systems (for submarines).

- Aircraft Engines (for various fighter jets and transport aircraft).

- Land Vehicle Propulsion Systems (for military ground vehicles).

Rolls-Royce Defense’s reputation for high performance and reliability makes it a trusted partner for governments and defense contractors.

Rolls-Royce Energy

Rolls-Royce Energy focuses on providing advanced power solutions for the energy sector, including renewable energy, oil, and gas industries. The company produces gas turbines and other technologies designed to generate power efficiently, minimizing emissions and improving operational efficiency. Rolls-Royce Energy’s turbines are widely used in both land-based and offshore applications, providing power to a variety of sectors.

Key Products:

- Gas Turbines for power generation.

- Diesel Generators for remote power applications.

- Compressed Air Energy Storage Systems.

This division plays a key role in meeting global energy demands, particularly as the world transitions toward cleaner and more sustainable energy sources.

ITP Aero

Rolls-Royce owns ITP Aero, a leading company in the aerospace sector specializing in the design, development, and manufacture of components for gas turbines. ITP Aero is a key player in the aviation industry, providing highly specialized parts and assemblies for both commercial and military aircraft. It has a strong presence in the Spanish aerospace market and collaborates with major aerospace manufacturers.

Key Products:

- Gas Turbine Components.

- Turbo Machinery Systems.

- Engine Accessories and Controls.

ITP Aero helps Rolls-Royce expand its capabilities in the global aerospace market, especially in the development of next-generation engines and components.

Rolls-Royce Civil Nuclear

Rolls-Royce Civil Nuclear provides technology and services for the nuclear power industry. The company designs, manufactures, and supports nuclear power systems for both civil and military applications.

Rolls-Royce Civil Nuclear’s products are used in various countries to generate electricity through nuclear power plants. The company is also involved in the development of small modular reactors (SMRs), an innovative solution for reducing the size and cost of nuclear power stations.

Key Products:

- Nuclear Reactor Systems.

- Small Modular Reactors (SMRs).

- Reactor Control Systems and Equipment.

The company plays a pivotal role in the energy sector, especially in providing reliable and low-carbon solutions to meet the world’s growing energy needs.

Rolls-Royce Electrical

Rolls-Royce Electrical focuses on the development of electric propulsion systems and energy storage solutions. It is a key part of the company’s strategy to reduce emissions and meet sustainability targets. This division is particularly focused on the growing electric aircraft market, providing innovative solutions to power air travel with minimal environmental impact.

Key Products:

- Electric Propulsion Systems for aircraft.

- Hybrid and Full-Electric Aircraft Solutions.

- Energy Storage Systems for aviation.

The division is expected to play a vital role in the future of sustainable aviation, working toward commercial electric aircraft that could revolutionize the airline industry.

Rolls-Royce Holdings

Rolls-Royce Holdings is the parent company of the Rolls-Royce group. It manages the overall strategic direction and investment priorities of the company’s various divisions.

While the operational focus is on aerospace, power systems, and defense, Rolls-Royce Holdings ensures the financial and strategic coordination of its subsidiaries and their alignment with the company’s overall goals. It also handles mergers, acquisitions, and partnerships that enhance the company’s market position.

Key Subsidiaries and Joint Ventures

In addition to the brands listed above, Rolls-Royce also has several joint ventures and partnerships with other industry leaders. These collaborations enable Rolls-Royce to expand its technological capabilities and market reach:

- Rolls-Royce and Daimler AG Joint Venture: Rolls-Royce holds a stake in the joint venture that focuses on engine development for high-end luxury cars.

- Rolls-Royce and Lufthansa Technik Partnership: This partnership is aimed at providing aircraft engine services, maintenance, and repair solutions across the global aviation market.

Conclusion

Rolls-Royce is a globally recognized brand with a diverse ownership structure. The company is primarily owned by institutional investors, with significant influence from major asset management firms and pension funds.

The leadership of Rolls-Royce, under CEO Tufan Erginbilgic, is focused on steering the company through a rapidly changing technological landscape. With a strong financial performance and a range of companies under its ownership, Rolls-Royce continues to thrive in both the automotive and aerospace industries.

FAQs

Is Rolls-Royce privately owned?

No, Rolls-Royce is a publicly traded company listed on the London Stock Exchange. It has a diverse range of institutional and public shareholders.

Who owns Rolls-Royce today?

As of 2025, Rolls-Royce Holdings plc is primarily owned by institutional investors. Major shareholders include Capital Research and Management Company (8.14%), BlackRock, Inc. (7.50%), and The Vanguard Group, Inc. (4.73%). Additionally, Rolls-Royce Group plc holds a portion of shares through its Employee Share Ownership Plan (ESOP).

What is Rolls-Royce’s founding date?

Rolls-Royce was founded in 1904 by Charles Rolls and Henry Royce in Manchester, England. The company started as a car manufacturer and later expanded into aerospace and defense.

Who owns the Rolls-Royce brand?

The Rolls-Royce brand is owned by BMW Group. However, Rolls-Royce Motor Cars, the luxury car division, is distinct from Rolls-Royce Holdings, which specializes in aircraft engines and power systems.

Which company makes Rolls-Royce?

Rolls-Royce Motor Cars, the luxury vehicle division, is owned by BMW Group. Rolls-Royce Holdings plc, a separate entity, manufactures aircraft engines and power systems.

Who are the celebrities who own Rolls-Royce?

Several celebrities are known to own Rolls-Royce cars. Some notable ones include:

- Jay-Z – American rapper and entrepreneur.

- Cristiano Ronaldo – Portuguese footballer.

- Kim Kardashian – Reality TV star and entrepreneur.

- Kylie Jenner – Entrepreneur and media personality.

- David Beckham – English footballer and media personality.

Who makes Rolls-Royce cars?

Rolls-Royce cars are made by BMW Group. BMW acquired the rights to the Rolls-Royce brand for automobile manufacturing in 1998, while the rights to the aerospace division remained with Rolls-Royce Holdings.

Who owns BMW and Rolls-Royce?

BMW owns the Rolls-Royce brand for automobiles, while Rolls-Royce Holdings plc owns the Rolls-Royce brand for aircraft engines and power systems. BMW Group and Rolls-Royce Holdings are separate entities, with no single company owning both.

Who is the real owner of Rolls-Royce?

The real ownership of Rolls-Royce is divided among institutional investors, with the largest shareholders being investment firms like Capital Research and Management Company and BlackRock. The Rolls-Royce brand for automobiles is owned by BMW Group, while Rolls-Royce Holdings focuses on aerospace, defense, and power systems.

Is Rolls-Royce still a British company?

Yes, Rolls-Royce Holdings plc is still a British company, headquartered in London, UK. While the automobile division is now owned by BMW, Rolls-Royce Holdings continues to operate as a British leader in aerospace, defense, and power systems.

Who owns Rolls-Royce engines?

Rolls-Royce Holdings plc owns and manufactures Rolls-Royce engines. The company is one of the leading manufacturers of aircraft engines, providing power solutions for commercial, military, and industrial applications worldwide.