Puma is one of the world’s most recognizable sportswear brands. Known for its innovative designs and athletic appeal, many people often ask: who owns Puma today?

Let’s take a detailed look at the company’s ownership, leadership, financials, and more.

Puma Company Profile

Puma SE is a leading global sportswear company headquartered in Herzogenaurach, Bavaria, Germany. As of 2025, it ranks as the third-largest sportswear manufacturer in the world, trailing only Nike and Adidas. Puma designs, develops, sells, and markets footwear, apparel, and accessories. Its brand is associated with performance-driven innovation and fashion-forward collaborations.

Founders and Origin

Puma was founded in 1948 by Rudolf Dassler, following a bitter split with his brother Adolf Dassler. The two had previously worked together under the Gebrüder Dassler Schuhfabrik (Dassler Brothers Shoe Factory). After their fallout during World War II, the brothers went their separate ways—Rudolf created Puma, while Adolf started Adidas.

Rudolf originally named the company RUDA (from RUdolf DAssler), but later changed it to PUMA, which conveyed strength and agility.

Major Milestones

1948 – Puma is officially established in Herzogenaurach. The first football boot, the Atom, is released shortly after.

1952 – Puma launches the Super Atom, the world’s first football boot with screw-in studs, developed in collaboration with football experts.

1968 – Puma debuts the iconic Formstrip on shoes, still used today as a signature design element. The brand gains global attention when Tommie Smith wins Olympic gold wearing Puma spikes and raises his fist in protest on the podium.

1986 – Puma becomes a publicly traded company listed on the Frankfurt Stock Exchange.

1998–2005 – Under CEO Jochen Zeitz, Puma transforms from a performance brand to a “sport-lifestyle” brand, marking the start of fashion-focused collections.

2007 – French luxury group Kering (then PPR) acquires a majority stake in Puma, enhancing its global resources and positioning.

2010 – Puma acquires Cobra Golf, expanding into the golf segment.

2014–2017 – Puma partners with celebrities and designers including Rihanna, who becomes Creative Director for women’s collections. These collaborations expand the brand’s appeal in fashion and music.

2018 – Kering spins off Puma, reducing its stake and allowing Puma to operate more independently. Puma also becomes a member of Germany’s MDAX stock index.

2020–2022 – Puma signs major sports sponsorships, including with Neymar Jr., LaMelo Ball, and multiple national football teams. It also invests heavily in sustainability.

2023–2025 – Puma continues expanding in Asia and the U.S., boosts digital sales, and enhances supply chain resilience. Arne Freundt, the current CEO, leads the company’s growth strategy with a focus on innovation, youth markets, and lifestyle branding.

As of mid-2025, Puma operates in over 120 countries with around 19,000 employees worldwide. Its balance between sports performance and cultural relevance keeps it at the forefront of the global sportswear industry.

Who Owns Puma: Major Shareholders

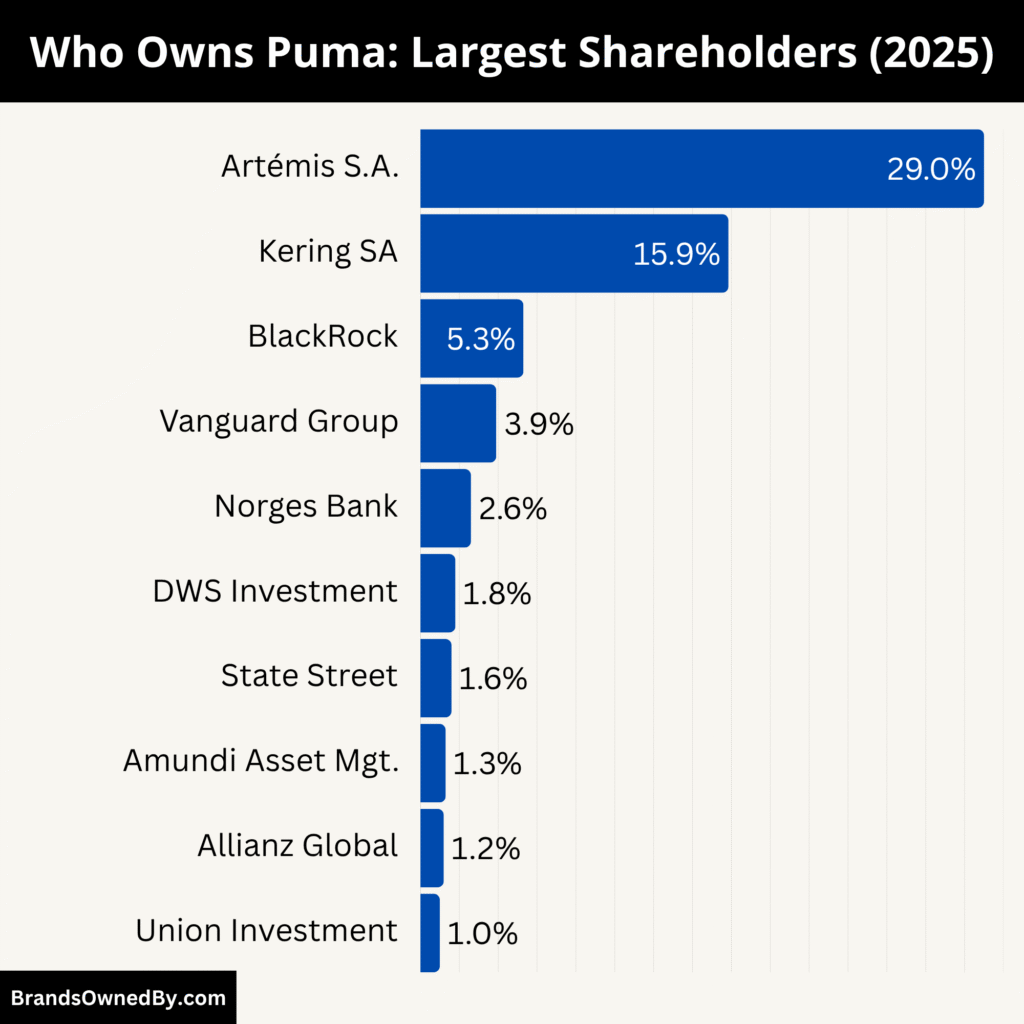

As of 2025, Puma SE is a publicly traded company listed on the Frankfurt Stock Exchange. It operates independently and is not owned by any single individual or company. The largest shareholder is Groupe Artemis S.A., the French holding company of billionaire François-Henri Pinault, which holds around 29% of Puma’s shares.

Groupe Artemis became the dominant stakeholder after Kering S.A. (also controlled by the Pinault family) spun off most of its stake in Puma in 2018, fully exiting the company by 2021.

The remaining ownership of Puma SE is distributed among institutional investors, retail shareholders, and index funds. Major institutional holders include BlackRock, The Vanguard Group, and Allianz Global Investors, each holding between 3% to 5% of shares.

Despite having a major shareholder in Artemis, Puma maintains a decentralized ownership structure, allowing it to operate with autonomy under its executive board and supervisory board.

Here’s a list of the largest shareholders of Puma as of 2025:

| Shareholder | Ownership % (2025) | Role | Influence/Control |

|---|---|---|---|

| Artémis S.A. | 29.0% | Largest individual shareholder | Strategic influence via voting & board |

| Kering SA | 15.85% | Former majority owner | Moderate strategic involvement |

| BlackRock Inc. | 5.3% | Passive institutional investor | Strong in governance & ESG voting |

| The Vanguard Group | 3.9% | Passive long-term investor | Supports transparency & long-term value |

| Norges Bank Investment Management | 2.6% | Sovereign wealth fund | Advocates ethical and ESG policies |

| DWS Investment GmbH | 1.8% | German institutional investor | Focus on governance and returns |

| State Street Global Advisors | 1.6% | ETF and index investor | Governance-focused, supports board quality |

| Amundi Asset Management | 1.3% | European institutional investor | Pushes for sustainability and ethics |

| Allianz Global Investors | 1.2% | ESG-focused asset manager | Active in corporate engagement |

| Union Investment | 1.0% | Retail-focused German investor | Governance, shareholder rights, stability |

| Free Float/Public Investors | ~36.45% | Broad institutional & retail base | Dispersed control with voting power |

Artémis S.A. – 29.0%

Artémis S.A., the investment holding company of the Pinault family, is Puma’s largest shareholder. As of 2025, it holds 29.0% of Puma SE. François-Henri Pinault oversees the firm, which manages the family’s investments across luxury, fashion, art, and sports.

Though Artémis does not manage Puma directly, its large ownership gives it strong voting rights and board-level influence. The company often supports long-term strategic planning and values-driven decisions, making it a stabilizing force in Puma’s shareholder structure.

Kering SA – 15.85%

Kering SA, which formerly controlled Puma, still owns 15.85% of the company as of 2025. Although Kering spun off Puma in 2018 to focus on its core luxury brands, its continued stake reflects a long-term interest in Puma’s success.

Kering participates in strategic matters and annual meetings. Its close ties with Artémis also help maintain alignment in governance and shareholder direction.

BlackRock Inc. – 5.3%

BlackRock is the largest global asset management company, and it holds 5.3% of Puma SE in 2025. As a passive institutional investor, BlackRock doesn’t interfere with operations but votes on key governance issues.

BlackRock supports shareholder value protection and ESG (Environmental, Social, and Governance) integration. Its ownership contributes to oversight on risk, sustainability, and executive compensation policies.

The Vanguard Group – 3.9%

The Vanguard Group holds approximately 3.9% of Puma. It is one of the largest providers of mutual funds and ETFs globally.

Vanguard is known for its index investment strategy, and while it does not play an active management role, it uses its voting power in favor of transparency, long-term performance, and accountability.

Norges Bank Investment Management – 2.6%

NBIM, managing Norway’s sovereign wealth fund, owns around 2.6% of Puma. It is a prominent investor in European markets and focuses heavily on sustainable and ethical business practices.

NBIM encourages climate-conscious investing and actively evaluates companies’ environmental and social policies. Its investment adds to Puma’s credibility with international institutions and ESG-conscious markets.

DWS Investment GmbH – 1.8%

DWS, a major German asset management firm, holds 1.8% of Puma as of 2025. It supports German-listed companies and advocates sound corporate governance and long-term financial performance.

DWS generally aligns with other institutional investors in voting behavior, especially regarding board appointments, dividend policies, and risk disclosures.

State Street Global Advisors – 1.6%

State Street, another global leader in asset management, owns 1.6% of Puma. Known for managing ETF-based strategies, State Street typically does not interfere with operations but has a strong voting policy framework.

It often supports proposals that promote diversity, transparency, and board independence. Its involvement reflects growing U.S. institutional interest in European consumer brands like Puma.

Amundi Asset Management – 1.3%

Amundi, Europe’s largest asset manager, holds about 1.3% of Puma SE in 2025. As a French firm, Amundi’s investment reinforces Puma’s ties to the European institutional community.

Amundi prioritizes responsible investing, pushing for better disclosures on supply chain ethics, carbon reduction, and corporate governance. It supports resolutions that align with social and environmental responsibility.

Allianz Global Investors – 1.2%

AllianzGI, a key division of Allianz Group, owns roughly 1.2% of Puma. It focuses on active fund management and ESG investing. The firm often collaborates with other German and European investors to ensure better long-term performance from companies like Puma.

AllianzGI’s influence may be modest, but its reputation and advocacy for sustainable finance make it an important part of Puma’s investor landscape.

Union Investment – 1.0%

Union Investment, a German asset manager and part of DZ Bank Group, holds 1.0% of Puma SE. The firm often represents German retail investors and cooperative banks, emphasizing stability and shareholder engagement.

Union Investment frequently engages with corporate management on issues like climate strategy, digitalization, and shareholder rights.

Free Float and Public Shareholders – ~36.45%

A wide range of individual retail investors, pension funds, ETFs, and other financial institutions hold the remaining 36.45% of Puma SE shares. These shares are traded publicly on the Frankfurt Stock Exchange under the symbol PUM.DE.

Who is the CEO of Puma?

Arthur Hoeld formally became the CEO and Chairman of the Management Board of Puma SE on July 1, 2025, following a mutual decision by his predecessor Arne Freundt and the Supervisory Board. His appointment reflects a strategic shift amid challenging market conditions and underperformance under the prior leadership.

Here’s a breakdown of Puma’s CEOs over the course of more than 3 decades:

| CEO | Term | Key Notes |

|---|---|---|

| Jochen Zeitz | 1993 – 2011 | Transformed Puma into sport‑lifestyle brand |

| Franz Koch | 2011 – 2013 | Oversaw conversion to Puma SE legal form and early growth |

| Bjørn Gulden | 2013 – Nov 2022 | Continued brand revival and partnerships |

| Arne Freundt | Nov 2022 – Apr 11, 2025 | Led digital and retail expansion; exited over strategic differences |

| Interim Board (Valdes, Neubrand, Bäumer) | Apr 12 – Jun 30, 2025 | Bridged management until new CEO arrival |

| Arthur Hoeld | From July 1, 2025 | Former Adidas sales chief; tasked with revitalizing Puma’s brand |

Professional Background and Adidas Legacy

Hoeld brings over 26 years of experience at Adidas, where he most recently served as an Executive Board member responsible for global sales. He initially joined Adidas in 1998 in brand advertising roles across Europe. Over time, he advanced through senior leadership positions, including VP of Brand Marketing for the Europe/Middle East/Africa region and General Manager of Adidas Originals. Under his leadership, the Originals segment grew into a €7 billion /year business. His multi-faceted roles covered marketing, regional strategy, and retail execution across several core markets.

Vision and Strategic Focus

Upon assuming leadership, Hoeld emphasized sports authenticity and an exciting brand proposition as Puma’s core focus areas. He pledged to bring clarity to Puma’s identity by aligning product development, brand storytelling, and athlete engagement. He refers to 2025 as a “reset year”, aiming to present a comprehensive turnaround strategy by October 2025 and targeting an operating margin of 8.5% by 2027.

Challenges in the Early Tenure

Hoeld’s early months were marked by serious financial headwinds. Puma issued its third profit warning of the year as sales declined in North America, Europe, and China. In Q2, revenues fell 2% to €1.9 billion, accompanied by a net loss of €246.6 million largely tied to restructuring costs and U.S. import tariffs. The introduction of 145% duties on key sourcing countries pressured margins, prompting Puma’s leadership to plan price adjustments and cost reductions. Hoeld described the situation as needing a “course‑correction” and signaled urgent action to restore momentum.

Interim Leadership and Governance Support

Between Arne Freundt’s departure (April 11, 2025) and Hoeld’s official start, Puma was led by an interim Executive Board team: Maria Valdes (Chief Product Officer), Markus Neubrand (Chief Financial Officer), and Matthias Bäumer (Chief Commercial Officer). The Supervisory Board, chaired by Héloïse Temple‑Boyer, endorsed the team to oversee operations until Hoeld assumed office. This ensured governance continuity and stability during the transition phase.

Role within Puma’s Decision‑Making Structure

As CEO and Chairman of the Management Board, Arthur Hoeld leads Puma’s executive team, sets strategic direction, and is accountable to the Supervisory Board. He works closely with CFO Markus Neubrand, CPO Maria Valdes, and CCO Matthias Bäumer. The Supervisory Board retains oversight and must authorize major strategic or financial decisions. Hoeld’s leadership is thus both operational and collaborative, balancing corporate governance with brand execution.

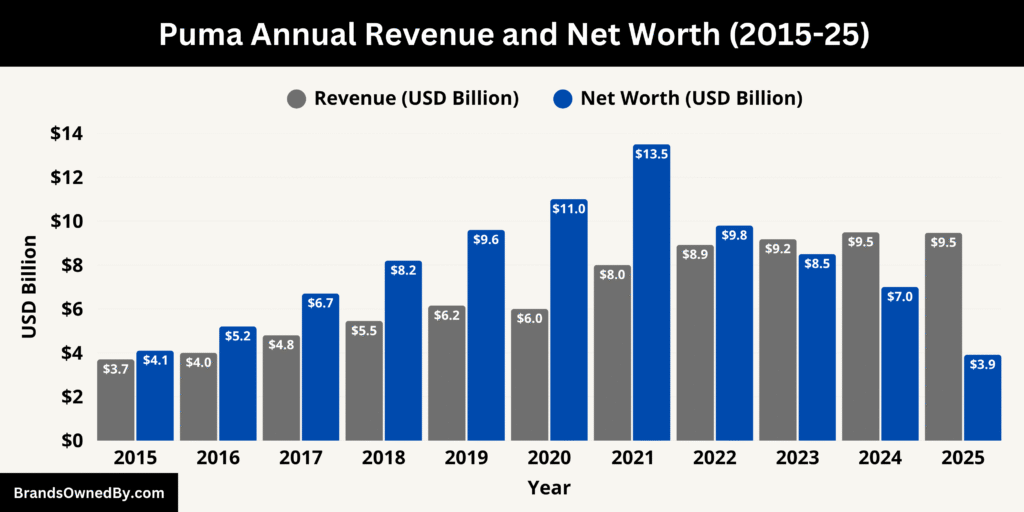

Puma Annual Revenue and Net Worth

Puma’s 2025 revenue stands at $9.47 billion (€8.79 billion), with a slight decline from the previous year. Its net worth has fallen to around $3.9 billion (about €3.4 billion), reflecting investor concern.

2025 Revenue Performance

For the trailing twelve months (TTM) up to mid‑2025, Puma generated a revenue of approximately $9.47 billion. This figure represents a slight decline of about 0.24% from 2024, when revenue stood at $9.49 billion. In euro terms, Puma’s TTM revenue was about €8.79 billion, down marginally from €8.81 billion in 2024.

The decline reflects soft sales in key regions such as North America, Europe, and Greater China, as intensified competition, currency headwinds, and U.S. tariffs weighed on topline growth.

Revenue growth over recent years had been solid, rising from €6.80 billion in 2021 to €8.81 billion in 2024—a compound increase of over 30% in that period. However, growth stabilised in 2025, with sales flattening and a modest decline as headwinds intensified.

Financial Outlook and Profitability

Puma revised its guidance for full-year 2025 following a weaker-than-expected second-quarter performance. The company now anticipates a full-year adjusted EBIT loss, citing high import tariffs, one-off restructuring charges, and softer-than-expected revenue as driving factors.

Previously, management had projected an adjusted EBIT in the range of €520–€600 million, but now expects an operating loss for 2025. Puma has also reduced its planned capital expenditure for 2025 to around €250 million, down from €300 million initially envisaged to conserve financial flexibility amid market pressures.

Net Worth

By July 2025, Puma’s net worth had sharply declined, hitting approximately $3.91 billion, which is about €3.40 billion, reflecting a drop of over 44% compared with the prior year’s valuation of around $7 billion.

This dramatic decrease occurred alongside broader investor concern over profit warnings and eroding margins.

Enterprise value (which includes debt and other obligations) stood at roughly $6–6.5 billion, suggesting that Puma retains significant liabilities and capital structure commitments despite its reduced equity value.

Here is Puma’s historical revenue and estimated net worth (market capitalization) over the last 10 years (2015–2025):

| Year | Revenue (USD Billion) | Net Worth / Market Cap (USD Billion) |

|---|---|---|

| 2025 | 9.47 (TTM est.) | 3.91 |

| 2024 | 9.49 | 7.00 |

| 2023 | 9.18 | 8.50 |

| 2022 | 8.92 | 9.80 |

| 2021 | 8.00 | 13.50 |

| 2020 | 6.00 | 11.00 |

| 2019 | 6.15 | 9.60 |

| 2018 | 5.45 | 8.20 |

| 2017 | 4.80 | 6.70 |

| 2016 | 4.00 | 5.20 |

| 2015 | 3.70 | 4.10 |

Interpretation and Strategic Context

Puma’s financial profile in 2025 reflects a transition period. Revenue remains robust at nearly $9.5 billion annually, but profit margins have been pressured by unexpected costs and a weak macroeconomic environment. The sharp fall in market cap shows that investors have downgraded their growth expectations, and Puma’s valuation now places it among smaller global sportswear names.

However, the company continues to invest in infrastructure and brand positioning, albeit at a reduced scale. Puma’s leaders describe 2025 as a reset year, with cost programmes underway, strategic realignment led by the new CEO, and a renewed focus on landing profitability despite sales challenges

Brands Owned by Puma

Here’s a list of the major brands and companies owned by Puma as of 2025:

| Company/Brand Name | Type | Description | Operational Focus |

|---|---|---|---|

| Puma SE | Core Brand & Parent Company | Global sportswear and lifestyle brand specializing in footwear, apparel, and accessories | Global design, marketing, manufacturing, and distribution |

| Cobra Golf | Subsidiary Brand | Golf equipment brand (clubs, bags, apparel, footwear) | Golf performance segment under Cobra Puma Golf |

| stichd BV | Subsidiary Company | Manufacturer of premium socks and bodywear | Production of socks and underwear for Puma and partners |

| Puma Europe GmbH | Regional Subsidiary | Handles European retail, e-commerce, and wholesale | Puma operations in Europe |

| Puma International Trading GmbH | Subsidiary | Manages global sourcing, production, and logistics | Global supply chain and sourcing hub |

| Puma México Sport SA de CV | Regional Subsidiary | Puma’s retail and wholesale presence in Mexico | Market development and regional sales |

| Puma Sports LA SA | Regional Subsidiary | Puma’s operations across Latin America | Marketing, retail, and brand development |

| Puma Sports SEA Trading Pte Ltd | Regional Subsidiary | Oversees Puma’s Southeast Asian markets | Sales and distribution in Southeast Asia |

| Puma Nordic AB | Regional Subsidiary | Nordic region operations and customer service | Sales and support for Northern Europe |

| Genesis Group International Ltd. | Subsidiary Company | UK-based manufacturer and distributor of sportswear | Wholesale and manufacturing support in UK |

| Puma International Sports Marketing BV | Subsidiary Company | Coordinates global sponsorships, athlete endorsements, and events | Global marketing and brand visibility |

Puma SE (Core Brand)

Puma SE is the flagship brand and operating company. It encompasses the design, development, marketing, and retail of footwear, apparel, and accessories under the Puma name. This includes performance lines in football, running, motorsports, golf, and lifestyle collections in Sportstyle Prime. Puma SE controls all global strategy, product innovation, brand collaborations, and distribution via subsidiaries worldwide.

Cobra Golf

Cobra Golf was acquired by Puma in 2010 and is fully integrated into the Puma SE group. Operated from Canada, Cobra designs and manufactures golf equipment including clubs, bags, shoes, and accessories. Cobra falls under Cobra Puma Golf, a brand division within Puma SE. The acquisition enabled Puma to enter the golf market with premium gear and athlete endorsements from players like Rickie Fowler and Lexi Thompson.

stichd BV

stichd BV is a Dutch sock manufacturer acquired and now wholly owned by Puma SE. Operating out of ‘s‑Hertogenbosch, stichd produces performance and lifestyle socks. Its integration within Puma ensures quality control and supply chain efficiency across Puma’s global footwear and apparel lines. stichd handles innovation in materials and sustainable textiles under Puma’s strategic oversight.

Puma Subsidiaries by Region

Puma SE directly controls over 100 subsidiaries across the globe, each responsible for local distribution, marketing, product development, sourcing, or administrative support. Key subsidiaries include:

PUMA Europe GmbH in Germany, managing design, European retail operations, e‑commerce, and wholesale.

PUMA International Trading GmbH, handling global sourcing, logistics, and supply partnerships.

PUMA México Sport SA de CV, Puma Sports LA SA, Puma Sports SEA Trading Pte Ltd, and PUMA Nordic AB, among others, which conduct regional retail, marketing, and brand operations tuned to local markets.

Genesis Group International Ltd.

Genesis Group International Ltd., headquartered in Manchester, UK, manufactures and wholesales sporting apparel and training gear. This entity operates under Puma SE’s direct control, supplying regional retailers and supporting product diversification beyond footwear.

Puma International Sports Marketing BV

This subsidiary handles Puma’s global athlete sponsorships, marketing campaigns, licensing partnerships, and event activations. It coordinates high-profile agreements with brand ambassadors, athletes, sports leagues, and fashion collaborators to amplify Puma’s global brand presence.

Puma Share Buyback Program (2024–2025)

While not a separate company, Puma SE enacted a significant share buyback program beginning in March 2024. By March 31, 2025, it repurchased approximately 2.82 million shares, representing about 1.88% of the company’s nominal capital. These shares were cancelled, improving earnings per share and concentrating ownership within the company.

Minor Brand Activities and Licensing

Beyond its main brands (Puma and Cobra Golf) and subsidiaries, Puma SE owns various licensing rights and small in-house initiatives. These include limited capsule collections and co‑branded projects tied to motorsports, collaborations with artists, and fashion lines. These are managed internally rather than by parent companies, emphasizing Puma SE’s direct control over brand direction and product quality.

Final Thoughts

Understanding who owns Puma reveals a complex but well-structured company with partial ties to the luxury world through Kering and Artémis. With a strong leadership team, solid financials, and a global presence, Puma continues to thrive in the competitive world of sportswear.

Its single-brand focus, strategic partnerships, and innovation make it stand out as more than just a shoe or clothing company—it’s a lifestyle brand with a powerful legacy and forward-looking vision.

FAQs

Is Puma a publicly traded company?

Yes, Puma is a publicly traded company. It is listed on the Frankfurt Stock Exchange under the ticker symbol PUM. It is also part of the MDAX index, which includes mid-sized German companies.

Who currently owns Puma?

Puma is majority-owned by Artemis S.A., the holding company of the Pinault family. The remaining shares are held by institutional investors, retail shareholders, and company buybacks.

Is Puma owned by Kering?

No, Kering no longer owns Puma. Kering began divesting from Puma in 2018 and completed its exit in 2021. Puma is now independently run under the majority ownership of Artemis, which is also owned by the Pinault family—the same group behind Kering.

Who made Puma shoes?

Puma shoes are designed by in-house teams at Puma SE and manufactured through a global network of factories, mainly in Asia. The original Puma shoes were made by Rudolf Dassler, the founder of the company.

Who founded Puma?

Puma was founded by Rudolf Dassler in 1948 in Herzogenaurach, Germany, following a split with his brother Adolf (Adi) Dassler, who went on to create Adidas.

Is Puma a German company?

Yes, Puma is a German company. It is headquartered in Herzogenaurach, Bavaria, and was established in Germany, where it continues to operate its global headquarters.

Who owns Puma clothing?

Puma clothing is owned and produced by Puma SE, which holds full rights over its apparel, footwear, and accessories. These products are designed, marketed, and sold by Puma’s global subsidiaries.

Is Puma owned by Adidas?

No, Puma and Adidas are completely separate companies. While both were founded by the Dassler brothers, they have been competitors for over seven decades.

Are Adidas and Puma brothers?

Yes, the founders of Adidas and Puma were brothers. Adolf “Adi” Dassler founded Adidas, and Rudolf Dassler founded Puma. They split after a family feud in the 1940s.

Why did Adidas and Puma split?

Adidas and Puma split due to a personal and professional falling out between the Dassler brothers during World War II. The conflict led them to go their separate ways in 1948, resulting in the creation of two rival companies in the same German town.

Is Puma owned by Virat Kohli?

No, Virat Kohli does not own Puma. However, he is a brand ambassador and has a long-term partnership with Puma for his One8 brand collaboration, which includes exclusive footwear and apparel lines.

Did Puma buy Reebok?

No, Puma did not buy Reebok. Reebok was previously owned by Adidas and was later sold to Authentic Brands Group. Puma has no ownership stake in Reebok.

What’s Puma company origin?

Puma originated in Germany in 1948. It was founded by Rudolf Dassler after splitting from his brother. The brand started with athletic shoes and expanded into apparel and accessories over the decades.

What’s Puma shareholders list?

As of July 2025, Puma’s major shareholders include:

- Artemis S.A. – ~29%

- BlackRock – ~5%

- Norges Bank – ~3%

- DWS Investment – ~2.8%

- The Vanguard Group – ~2.5%

- Company Treasury Shares – ~1.88%

The rest are held by institutional and retail investors across the public market.

Which is bigger Adidas or Puma?

Adidas is larger than Puma in terms of revenue, global market share, and valuation. Adidas consistently ranks among the top two global sportswear brands alongside Nike, while Puma is usually ranked third or fourth.

What rank is Puma in the world?

As of 2025, Puma is ranked as the 3rd largest sportswear brand in the world by global revenue, following Nike and Adidas. It holds a strong market position in performance and lifestyle segments.

Who is the current brand ambassador of Puma?

Puma has multiple global ambassadors in 2025. Notable ones include:

- Virat Kohli (India)

- Neymar Jr. (Football)

- Cara Delevingne (Fashion)

- Usain Bolt (Legacy ambassador)

- LaMelo Ball (Basketball)

These personalities represent Puma across sports, fashion, and pop culture markets globally.

Where is Puma headquartered?

Puma’s global headquarters is located in Herzogenaurach, Bavaria, Germany, the same town where Adidas is based.

What does Puma manufacture?

Puma manufactures footwear, apparel, and accessories for sports and casual wear. It serves athletes in categories like running, football, basketball, golf, and motorsport.