- Progressive Insurance is a publicly traded company with no single controlling owner. Ownership is widely distributed, with major institutional investors holding the largest stakes.

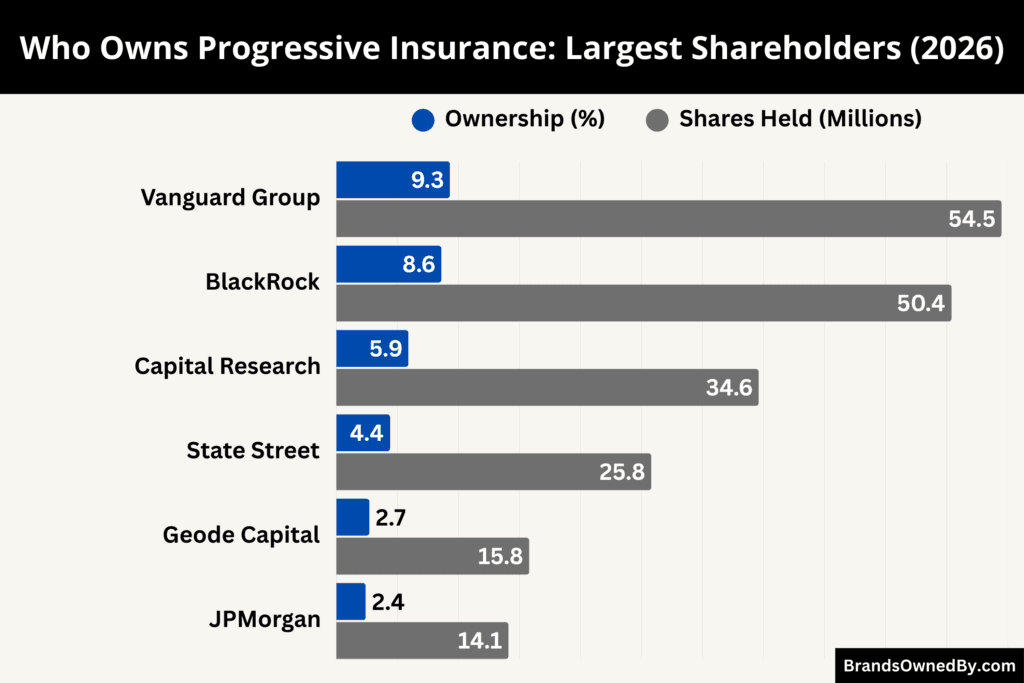

- The largest shareholders are The Vanguard Group (9.3%), BlackRock (8.6%), Capital Research and Management (5.9%), and State Street (4.4%). Together, institutional investors own the majority of Progressive Insurance and influence corporate governance through shareholder voting.

- Insider ownership, including executives and directors, represents a small percentage, while retail investors hold a meaningful minority. These groups own shares but do not control daily business operations.

- Control of Progressive Insurance rests with executive leadership led by the CEO and supervised by the board of directors. Shareholders influence governance through voting, but management runs the company, ensuring a clear separation between ownership and operational control.

Progressive Insurance operates under The Progressive Corporation and is one of the most recognized insurance providers in the United States. It focuses on auto insurance but also offers home, renters, motorcycle, boat, and commercial vehicle coverage. It is known for innovation, data-driven underwriting, and direct-to-consumer distribution. Progressive built its reputation on competitive pricing, advanced analytics, and customer convenience.

The Progressive Corporation is headquartered in Mayfield Village, Ohio. The company operates as a major multi-line insurance group serving millions of policyholders across the United States. Its primary business is personal and commercial auto insurance.

Progressive is widely recognized for modernizing insurance distribution. The company built a strong direct-to-consumer model that allows customers to purchase and manage policies online or by phone. This reduced dependence on traditional agents and improved customer accessibility.

It also pioneered usage-based insurance through telematics technology. This system evaluates real driving behavior to determine pricing, improving underwriting accuracy, and personalization.

Technology plays a central role in Progressive’s operations. The company uses predictive modeling, automation, and large-scale data analytics to assess risk and price policies. Its digital platforms allow customers to compare quotes, manage coverage, and file claims efficiently. Progressive also operates a widely used insurance comparison ecosystem, strengthening its technology-driven identity.

Brand positioning and customer focus remain core strengths. The company is widely recognized for its marketing presence and service-oriented approach. Its strategy emphasizes innovation, digital expansion, and continuous improvement in underwriting precision and claims efficiency.

Progressive Insurance Founders

Before Progressive became one of the largest insurers in the United States, it began as a small startup created to solve a major gap in the insurance market. In the 1930s, many drivers found it difficult to obtain auto insurance, especially those considered high-risk.

Two entrepreneurs, Joseph Lewis and Jack Green, saw this opportunity and founded Progressive Insurance in 1937. Their goal was to build a company that made auto insurance more accessible while maintaining disciplined risk management. They focused on practical innovation and customer-friendly policies from the very beginning.

Joseph Lewis

Joseph Lewis was the driving force behind Progressive’s founding vision. In 1937, he co-established the company with the aim of providing affordable and accessible auto insurance to drivers who were often rejected by traditional insurers. Lewis believed that insurance should be flexible, fair, and customer-focused.

During the company’s early years, Lewis helped introduce installment-based premium payments. This allowed customers to pay insurance costs over time instead of a large upfront payment. At that time, this approach was highly innovative and attracted a broader customer base. Lewis also emphasized careful risk selection and efficient claims handling. His leadership shaped Progressive’s early underwriting discipline and customer-first philosophy. He played a key role in guiding the company through its formative years and establishing a foundation for long-term growth.

Jack Green

Jack Green co-founded Progressive Insurance alongside Joseph Lewis in 1937. He played a critical role in building the company’s early financial and operational structure. Green focused on creating a stable and sustainable insurance business during a period when the industry was conservative and highly competitive.

Green helped organize Progressive’s early underwriting framework and operational systems. He worked closely with Lewis to position the company as an insurer willing to serve drivers overlooked by traditional companies. His emphasis on structured growth, operational discipline, and financial control ensured the company could scale without compromising stability. Green’s contributions were essential in helping Progressive survive its early challenges and evolve into a strong and sustainable insurance organization.

Ownership History

Progressive Insurance has evolved from a closely held private company into one of the most widely held publicly traded insurers in the United States. Its ownership structure changed significantly over time. The shift reflects its growth, public listing, institutional participation, and leadership transitions.

Below is the breakdown of Progressive’s ownership evolution:

Early Private Ownership (1937–1960s)

When Progressive Insurance was founded in 1937, it operated as a privately owned company. Ownership was concentrated among the founders, Joseph Lewis and Jack Green, along with a small group of early investors. The company functioned as a closely controlled enterprise during its early decades.

During this period, ownership and management were tightly aligned. Strategic decisions were made directly by the founders. There was no outside shareholder pressure. Capital was generated internally and through limited private investment. This structure allowed Progressive to experiment with installment-based premium payments and non-traditional underwriting approaches without external constraints.

Leadership Influence and Concentrated Control (1960s–1990s)

As Progressive expanded, ownership became more structured but remained relatively concentrated. A major turning point came under Peter B. Lewis, the son of co-founder Joseph Lewis. He became CEO in 1965 and later Chairman.

Under Peter Lewis, Progressive experienced substantial growth and modernization. Although the company was publicly traded by this time, Lewis maintained significant ownership influence. His personal stake, combined with leadership authority, gave him strong control over strategic direction. This era was marked by innovation in auto insurance pricing, early adoption of data analytics, and expansion into new markets.

During these decades, institutional investors gradually increased their stakes. However, leadership influence remained strong due to concentrated insider holdings and board alignment.

Public Market Expansion and Institutional Dominance (1990s–2010s)

As Progressive grew into a national insurance leader, ownership became increasingly diversified. Large institutional investors began acquiring significant shares through mutual funds, index funds, and pension portfolios. This shift reflected Progressive’s inclusion in major stock indices and its growing market capitalization.

Institutional ownership became the dominant force in the shareholder base. Asset management firms such as Vanguard, BlackRock, and State Street accumulated large stakes through passive and actively managed funds. Retail investors also held shares, but their collective ownership was smaller compared to institutional holdings.

This phase marked a transition from founder-influenced control to institutional shareholder oversight. Governance became more standardized, with stronger board structures and regulatory compliance aligned with large public corporations.

Post-Founder Era and Distributed Ownership (2010s–Present)

After Peter B. Lewis stepped down and later passed away in 2013, insider ownership influence decreased. The company entered a fully distributed ownership phase. No single individual or family retained controlling power.

Today, Progressive Insurance operates as a widely held public corporation. Institutional investors collectively hold the majority of shares. These institutions vote on major corporate matters, including board appointments and executive compensation. However, day-to-day management remains with executive leadership.

Insider ownership still exists through executive and director shareholdings. These stakes are comparatively small but serve to align management incentives with shareholder interests. The ownership structure now reflects a modern public company model, where control is exercised through board governance rather than concentrated founder power.

Current Ownership Structure Dynamics

As of 2026, Progressive’s ownership is characterized by strong institutional participation, diversified retail ownership, and structured corporate governance. There is no controlling shareholder. Decision-making authority is exercised through a board of directors elected by shareholders.

This ownership history demonstrates Progressive’s transformation from a founder-led private insurer into a widely held public corporation. Each phase shaped its governance structure and strategic flexibility. The company’s current ownership model supports stability, transparency, and long-term investor confidence.

Who Owns Progressive Insurance: Largest Shareholders

Progressive Insurance operates as The Progressive Corporation, a public company listed on the New York Stock Exchange under the ticker PGR. Its ownership has shifted from founder-driven control to broad institutional and retail shareholder participation.

In its early years, ownership was concentrated among the founders and a small private group. After going public, institutional investors began acquiring stakes through mutual funds, index funds, and pension portfolios.

As of Feb 2026, no single entity controls Progressive; instead, its shares are widely distributed across major asset managers, investment firms, and individual investors.

Below is an overview of the major shareholders as of early 2026:

The Vanguard Group, Inc.

The Vanguard Group is currently the largest institutional shareholder of Progressive Insurance. Vanguard holds approximately 9.3% of the company’s outstanding shares through its suite of index funds and mutual funds.

This ownership stake represents the largest concentrated institutional block among all investors. Vanguard’s holdings include assets allocated through major funds such as the Vanguard Total Stock Market Index Fund and other diversified portfolios. Vanguard’s position reflects its role as a long-term institutional investor in large public companies.

Vanguard increases its stake gradually as part of passive and active investment strategies. Its holdings give it influence in corporate governance matters such as board elections and shareholder votes, though Vanguard does not control day-to-day operations. Vanguard’s share position also reflects broader institutional confidence in Progressive’s business model and market positioning.

BlackRock, Inc.

BlackRock is the second-largest shareholder in Progressive Insurance, owning a significant percentage of shares across its investment trusts and advisory portfolios. While estimates vary slightly in filings, BlackRock’s holdings typically fall in the 8.6% range of outstanding shares.

As one of the world’s largest asset managers, BlackRock holds Progressive shares through multiple funds and institutional accounts.

BlackRock’s stake is spread across its institutional trust and index funds. Like Vanguard, BlackRock participates in governance activities but does not assume control of company operations. Its investment underscores Progressive’s attraction to large global investment managers focused on stable, established companies with strong market positions.

Capital Research and Management Company

Capital Research and Management Company is another major shareholder in The Progressive Corporation. It owns around 5.9% of shares. This firm manages capital for multiple mutual funds and institutional accounts.

Capital Research emphasizes long-term positions in companies with strong fundamentals. Its stake in Progressive aligns with its focus on financial and insurance sector investments. While not as large as Vanguard or BlackRock, Capital Research remains one of the top institutional holders and regularly engages in proxy voting and shareholder governance.

State Street Global Advisors, Inc.

State Street is a leading institutional investor and holds a notable stake in Progressive Insurance, typically around 4.4% of outstanding shares. Its holdings are largely managed through State Street’s suite of ETFs and institutional investment vehicles.

State Street’s ownership reflects its strategy of holding diversified positions in large public corporations. Similar to other institutional investors, its role is primarily governance participation at annual meetings and proxy votes. State Street’s position helps reinforce a stable institutional shareholder base for Progressive.

Geode Capital Management, LLC

Geode Capital Management holds a smaller but still relevant stake in Progressive Insurance, generally reported at 2.7% of shares. Geode’s holdings are typically accessed through index-linked strategies and quantitative portfolios.

While smaller than the very largest shareholders, Geode represents an example of diversified institutional ownership supporting Progressive’s public float. Its participation underscores the broad interest in Progressive across different investment strategies and fund types.

Other Institutional Investors

Beyond the top shareholders listed above, Progressive’s ownership includes additional institutional participants such as JPMorgan Investment Management and other diversified asset managers. These firms often hold between 2% and 3% of shares individually.

Collectively, institutional investors hold the vast majority of Progressive’s shares, often estimated at more than 80% of the total public float. Insiders and retail investors make up a smaller portion of the ownership mix.

Insider and Retail Shareholders

Insiders, including executives and board members, hold a small proportion of shares. These stakes help align leadership incentives with shareholder interests, but are not large enough to control company direction on their own. Retail investors — individual shareholders — also own a fraction of the company’s stock. Together, retail and insider holdings typically account for a modest portion of total ownership.

Insider ownership is significantly lower than institutional ownership, reflecting Progressive’s status as a widely held public company.

Competitor Ownership Comparison

Ownership structure plays a major role in how insurance companies operate, make decisions, and grow. Progressive Insurance follows a publicly traded model with widely distributed shareholders. Many of its key competitors use different ownership frameworks, including mutual ownership and conglomerate ownership.

Below is a detailed comparison explaining how Progressive’s ownership differs from that of its major competitors:

| Company | Ownership Model | Publicly Traded | Largest / Controlling Owner | Who Ultimately Controls the Company | Strategic Implications |

|---|---|---|---|---|---|

| Progressive Insurance | Publicly Traded Corporation | Yes (NYSE: PGR) | No single controlling shareholder. Largest institutional holder: Vanguard | Board of Directors and Executive Leadership | Must balance shareholder returns with long-term growth. Access to capital markets. Strong institutional governance influence. |

| GEICO | Wholly Owned Subsidiary | No | Berkshire Hathaway | Berkshire Hathaway leadership | Full backing from parent company. Long-term strategic flexibility without public market pressure. |

| State Farm | Mutual Company | No | Policyholders (members) | Internal executive leadership accountable to policyholders | Focus on policyholder value rather than shareholder returns. Profits reinvested or returned via dividends. |

| Allstate | Publicly Traded Corporation | Yes (NYSE: ALL) | No single controlling shareholder. Major institutional investors | Board of Directors and Executive Leadership | Similar to Progressive. Must meet shareholder expectations. Institutional ownership drives governance oversight. |

Progressive Insurance Ownership Model

Progressive Insurance operates as a publicly traded corporation under The Progressive Corporation. Its shares are listed on the New York Stock Exchange. Ownership is widely distributed among institutional investors, retail shareholders, and insiders. No single shareholder controls the company.

Institutional investors such as Vanguard, BlackRock, and State Street collectively hold the largest portion of shares. These investors influence corporate governance through voting rights, but they do not manage day-to-day operations.

Strategic control remains with the executive leadership and board of directors. This ownership model allows Progressive to access public capital markets while maintaining operational independence.

GEICO Ownership Structure

GEICO operates under a completely different ownership model. It is a wholly owned subsidiary of Berkshire Hathaway. This means GEICO is not publicly traded and does not have public shareholders.

Because Berkshire Hathaway owns GEICO entirely, strategic decisions ultimately align with Berkshire’s corporate leadership. GEICO benefits from strong financial backing and long-term capital support from its parent company.

Unlike Progressive, GEICO does not face public market pressure from institutional investors or quarterly shareholder expectations. This structure allows GEICO to focus on long-term market share growth rather than short-term stock performance.

State Farm Ownership Structure

State Farm uses a mutual ownership model, which is fundamentally different from both Progressive and GEICO. State Farm is owned by its policyholders rather than shareholders. Customers who purchase insurance policies effectively become members of the company.

In this structure, profits are often reinvested into the business or returned to policyholders through dividends or reduced premiums. State Farm does not issue public stock and is not controlled by institutional investors. Decision-making is guided by internal leadership with a focus on long-term stability and customer value rather than shareholder returns. Compared to Progressive, this model prioritizes policyholder interests over investor-driven growth.

Allstate Ownership Structure

Allstate follows a publicly traded ownership model similar to Progressive. Its shares are listed on the New York Stock Exchange and ownership is widely distributed among institutional investors, insiders, and retail shareholders.

Large asset managers hold significant portions of Allstate’s stock, just as they do with Progressive. However, unlike GEICO and State Farm, Allstate and Progressive operate independently without a parent conglomerate or mutual structure. Both companies must balance shareholder expectations, financial performance, and long-term strategic investment.

Key Differences in Ownership Models

Progressive’s ownership structure is characterized by distributed institutional ownership with no controlling shareholder. This provides flexibility, transparency, and access to capital markets. GEICO operates under a single-parent ownership structure, giving Berkshire Hathaway full strategic control. State Farm uses a mutual model where policyholders are the owners, eliminating shareholder pressure. Allstate, like Progressive, operates as a publicly traded corporation with broad institutional ownership.

These ownership differences influence corporate strategy, risk tolerance, and decision-making. Publicly traded companies like Progressive focus on shareholder value and market performance. Mutual companies emphasize policyholder stability. Subsidiaries like GEICO benefit from parent-company backing. Understanding these differences provides deeper insight into how Progressive positions itself within the competitive insurance landscape.

Who Controls Progressive Insurance?

Control of Progressive Insurance is exercised through a defined corporate governance framework rather than by a single owner. The company operates under The Progressive Corporation, where operational authority lies with executive leadership, strategic supervision rests with the board of directors, and governance influence comes from large institutional shareholders.

Tricia Griffith’s Operational Control as CEO

Tricia Griffith holds the highest executive authority and is the central decision-maker in Progressive’s daily and strategic operations. She has been with Progressive since the late 1980s and moved through core operational divisions before becoming CEO in 2016. This internal rise gives her deep control over underwriting culture, pricing philosophy, and operational execution.

Her control is most visible in pricing and underwriting strategy. Progressive adjusts insurance pricing frequently using actuarial and telematics data. These pricing actions directly affect profitability and market share. Under Griffith, the company aggressively refined rate segmentation, expanded usage-based insurance, and pushed automated underwriting systems. These moves were not symbolic. They materially changed how Progressive prices risk and manages policy growth.

She also directly oversees capital deployment decisions such as dividend policies, share repurchases, and technology investment. Progressive’s heavy spending on automation, AI-assisted claims handling, and digital policy servicing reflects executive-level control rather than shareholder intervention.

Executive Power Through Operating Segments

Control at Progressive is operationally distributed across specialized business segments, each led by senior executives who report directly to the CEO. These segments include:

Personal Lines Insurance, which represents the largest portion of Progressive’s business and drives policy volume growth. Decisions here determine pricing competitiveness and customer retention.

Commercial Lines Insurance, one of Progressive’s fastest-growing divisions, focuses on business vehicles, trucking fleets, and commercial risk underwriting. Leadership in this segment controls expansion strategy and underwriting discipline in high-risk categories.

Claims and Loss Management, a critical control center for profitability. Claims leadership determines settlement speed, automation adoption, and fraud detection efficiency. Claims cost management directly impacts the company’s combined ratio and margins.

Technology and Data Infrastructure, where control is exercised over telematics systems, predictive risk modeling, and automated underwriting. Progressive’s competitive advantage largely comes from this division, making it a strategic control pillar rather than a support function.

This structure means control is not symbolic. It is embedded in operational systems that determine pricing, growth, risk exposure, and profitability.

Board of Directors as Strategic Authority

The board of directors holds the highest supervisory authority but does not manage daily operations. Its control is exercised through strategic approval and executive accountability rather than operational execution.

The board has the power to appoint or remove the CEO. This alone places ultimate control above executive leadership. It also approves long-term strategy, capital allocation frameworks, and risk exposure limits. Progressive’s risk tolerance, catastrophe exposure strategy, and investment portfolio structure all require board-level approval.

Board committees further deepen governance control. The Audit Committee oversees financial reporting and reserve adequacy. The Risk Committee monitors underwriting exposure and regulatory compliance. The Compensation Committee structures executive incentives tied to profitability and growth metrics. These mechanisms ensure executive decisions remain aligned with shareholder value.

Institutional Shareholder Governance Power

Large institutional investors such as Vanguard, BlackRock, and State Street do not run Progressive, but they exert real governance influence. Their control is exercised through proxy voting rather than management involvement.

They vote on board composition, executive compensation, governance reforms, and major structural decisions. Because these investors hold large share blocks, their voting alignment can shape corporate direction. For example, institutional pressure can influence capital allocation discipline, risk appetite, and governance transparency.

However, they do not interfere in underwriting, pricing, or operational strategy. Progressive remains management-driven rather than shareholder-managed.

Pricing and Underwriting as the Real Center of Control

In insurance companies, real control lies in pricing authority and underwriting discipline. At Progressive, this authority sits firmly within executive leadership. Decisions about rate increases, segmentation, and risk acceptance directly determine profitability and growth.

Progressive is known for rapidly adjusting pricing using real-time data. This level of control allows the company to manage loss ratios more precisely than many competitors. It also enables faster response to inflation, accident trends, and repair cost changes. This operational pricing power represents the most concrete form of corporate control inside Progressive.

Regulatory Oversight as External Control

Progressive operates in a highly regulated industry. State insurance regulators approve pricing changes, monitor capital adequacy, and enforce consumer protection rules. This creates an external layer of control.

Regulators can restrict rate increases, impose solvency requirements, and review claims practices. While they do not manage strategy, they define operational boundaries. This means Progressive’s control is strong but not absolute.

Progressive Insurance Annual Revenue and Net Worth

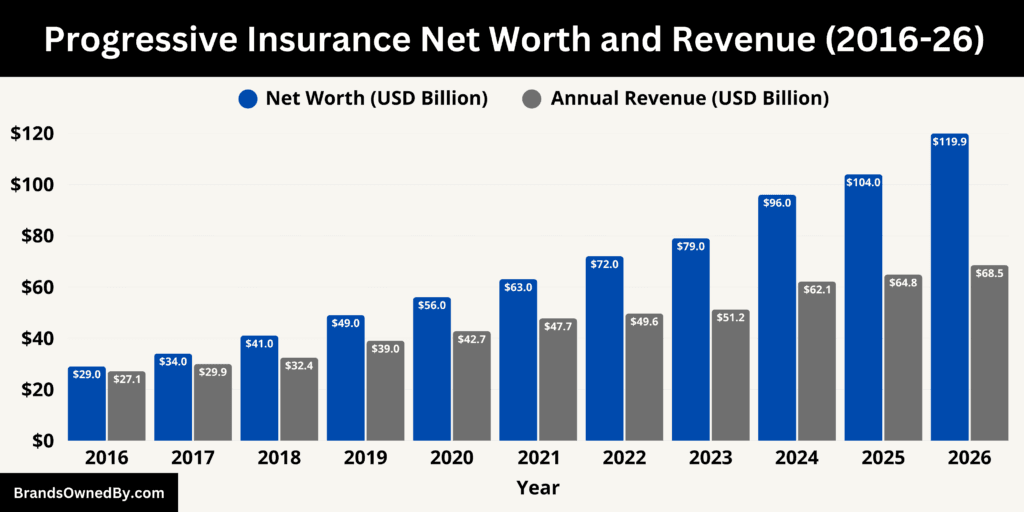

As of February 2026, Progressive Insurance reports estimated annual revenue of about $68.5 billion and a market capitalization of $119.94 billion. Revenue growth is driven primarily by earned premiums, supported by strong policy growth, disciplined pricing, and improved underwriting margins. The valuation reflects sustained profitability, strong combined ratio performance, and investor confidence in Progressive’s pricing precision and technology-driven insurance model.

2026 Revenue Composition and Segment Bifurcation

The total estimated revenue of $68.5 billion in 2026 is dominated by earned insurance premiums, which contribute roughly 92% of total revenue. Investment income and other operating income make up the remaining 8%.

Personal Lines generates approximately $51.4 billion, representing about 75% of total revenue. Personal auto insurance remains the largest contributor within this segment, accounting for nearly 88% of Personal Lines premiums. Policy count growth, higher average premium per policy, and rate adjustments contributed to revenue expansion. Premium per policy increased due to inflation in vehicle repair costs, parts pricing, and medical claims severity.

Commercial Lines contribute around $13.7 billion, or roughly 20% of total revenue. Commercial auto remains the core driver within this segment, supported by strong growth in small business vehicles, contractor fleets, and long-haul trucking insurance. Progressive’s data-driven risk segmentation and telematics-based underwriting continue to support profitability in this higher-risk segment.

Property and other insurance products generate about $2.1 billion, representing approximately 3% of total revenue. This includes homeowners and renters coverage, primarily sold through bundling strategies with auto policies.

Investment income contributes roughly $5.3 billion, or 8% of total revenue. Progressive maintains a large fixed-income investment portfolio backing insurance reserves. Higher interest yields over recent years increased investment returns, strengthening total revenue.

2026 Net Worth and Valuation Drivers

As of February 2026, Progressive’s market capitalization stands at $119.94 billion. This valuation is supported by strong underwriting profitability and stable earnings growth. Share price performance reflects investor confidence in Progressive’s pricing discipline and ability to manage loss ratios.

Progressive maintains a strong balance sheet with significant invested assets supporting policyholder reserves. Equity growth has been driven by retained earnings and consistent profitability. The company’s valuation metrics remain competitive within the insurance sector, supported by stable earnings and strong return on equity.

Technology-driven underwriting and telematics-based pricing contribute significantly to valuation strength. Investors reward Progressive for maintaining pricing precision, efficient claims handling, and consistent combined ratio performance relative to competitors.

Revenue Growth Trend and Financial Expansion

Progressive’s revenue has expanded significantly over the past decade. Revenue increased from approximately $27.1 billion in 2016 to $68.5 billion in 2026, representing more than 150% growth over ten years. Growth has been driven by policy expansion, improved pricing models, and digital distribution scale.

Personal auto policies remain the primary growth engine, supported by strong customer retention and rate optimization. Commercial auto expansion contributed meaningfully to revenue growth, particularly in fleet and logistics insurance markets.

Market capitalization increased from roughly $29 billion in 2016 to $119.94 billion in 2026, reflecting sustained earnings growth and improved market confidence.

Profitability and Margin Structure

Progressive’s revenue performance is closely tied to underwriting profitability. The company targets a competitive combined ratio, typically near or below 96%. Pricing discipline, actuarial modeling, and telematics data allow Progressive to respond quickly to claim severity changes.

Claims automation, fraud detection systems, and digital servicing reduce operating costs. Loss ratio management and expense efficiency contribute directly to margin strength. Investment income adds earnings stability, particularly during favorable interest rate environments.

Return on equity remains strong due to consistent underwriting profits and disciplined capital management. These factors support both revenue growth and rising market valuation.

Revenue Forecast

Based on current policy growth, pricing discipline, and segment expansion, Progressive’s revenue outlook remains positive. Projected revenue estimates are as follows:

- 2027: Expected revenue around $71 billion, driven by continued personal auto policy growth and rate normalization.

- 2028: Projected revenue near $74 billion, supported by expansion in commercial auto and higher telematics adoption.

- 2029: Forecast revenue approximately $77 billion, driven by digital customer acquisition and underwriting efficiency improvements.

- 2030: Expected revenue reaching about $80 billion, supported by stable combined ratio performance, technology-driven pricing, and continued policy volume growth.

Future revenue growth will depend on pricing conditions, claims severity trends, regulatory approvals for rate adjustments, and broader economic conditions. Continued investment in telematics, automation, and underwriting analytics is expected to support sustained financial expansion through 2030.

Companies Owned by Progressive Insurance

Progressive Insurance operates through a network of licensed insurance subsidiaries and specialized underwriting entities rather than consumer-facing sub-brands in the traditional sense. These subsidiaries are structured to meet regulatory requirements across U.S. states and to segment underwriting risk by product line.

Below are the key companies and operating entities owned and controlled directly by The Progressive Corporation as of 2026:

| Entity | Primary function / Lines underwritten | Details |

|---|---|---|

| Progressive Casualty Insurance Company | Personal auto, liability | Core personal auto underwriting vehicle for a large portion of Progressive’s personal-lines premium volume; multi-state licensed. |

| Progressive Direct Insurance Company | Direct-to-consumer personal and small commercial lines | Underwrites policies sold via Progressive.com and call centers; supports digital distribution and telematics integration. |

| Progressive Specialty Insurance Company | Motorcycles, RVs, boats, specialty autos | Handles specialty vehicle products and niche personal-lines risks. |

| Progressive Commercial Casualty Company | Commercial auto, fleet, trucking | Primary commercial-auto/fleet underwriting entity focused on business vehicles and commercial liability. |

| United Financial Casualty Company | Commercial auto and specialty commercial lines | Secondary commercial underwriting vehicle used to segment commercial risk and meet state licensing needs. |

| Progressive Northern Insurance Company | Personal auto and regional underwriting | Regional personal-lines carrier used to manage state-specific filings and capital allocation. |

| Progressive Northwestern Insurance Company | Personal auto and related lines | Regional subsidiary supporting underwriting and regulatory compliance in specific jurisdictions. |

| Progressive Preferred Insurance Company | Personal auto (preferred-risk) | Underwrites preferred personal auto risks; used for product segmentation. |

| Progressive Classic Insurance Company | Personal auto (classic/collector autos) | Underwrites specialty classic/collector vehicle risks and vintage vehicle programs. |

| Progressive American Insurance Company | Personal and some commercial lines | State-licensed underwriting company serving specific state regulatory requirements. |

| Progressive Bayside Insurance Company | Personal lines / property-related underwriting | State-specific underwriting entity supporting homeowner/renters and bundled products. |

| Progressive Gulf Insurance Company | Personal and specialty auto lines (regional) | Regional subsidiary for state licensing and product distribution in select states. |

| Progressive Mountain Insurance Company | Personal lines (regional) | State-licensed entity for geographic underwriting segmentation. |

| Progressive Southeastern Insurance Company | Personal and commercial lines (regional) | Supports Progressive’s presence and regulatory filings in southeastern states. |

| Progressive Michigan Insurance Company | Personal auto and regional lines (Michigan-focused) | Licensed for Michigan market specifics; used to manage state regulatory nuances. |

| Progressive Security Insurance Company | Personal auto and related coverages | Underwriting entity used in select jurisdictions. |

| Drive Insurance Holdings, Inc. | Holding company for Drive insurance businesses | Parent for Drive-brand regional carriers (used for non-standard and specialty products). |

| Drive New Jersey Insurance Company (Drive Ins. Co.) | Personal auto (non-standard) | Regional nonstandard personal auto carrier within the Drive structure. |

| Progressive Express Insurance Company | Personal/commercial auto | Licensed carrier supporting multi-jurisdictional operations and specialty programs. |

| Progressive Marathon Insurance Company | Personal auto and property | Underwriting entity used for geographic/product segmentation. |

| Progressive Max Insurance Company | Personal auto (product segmentation) | Supports targeted product lines and state filings. |

| Progressive Advanced Insurance Company | Regional/state-specific personal auto | Used for regulatory compliance and capital allocation in defined jurisdictions. |

| Progressive Universal Insurance Company | Personal and limited commercial lines | One of the group’s licensed carriers for multi-product distribution. |

| Progressive Premier Insurance Company of Illinois | Personal lines (Illinois-focused) | State-specific underwriting vehicle for Illinois market requirements. |

| Progressive Paloverde Insurance Company | Regional underwriting | State-licensed carrier used to support local filings and business. |

| Progressive Select Insurance Company | Product-segmentation carrier | Supports selective product lines and underwriting segmentation. |

| Progressive Garden State Insurance Company | Regional underwriting (New Jersey-focus) | State-specific carrier used for New Jersey filings and policies. |

| Progressive Property Insurance Company | Homeowners and property insurance | Underwrites property policies, supports bundling with auto. |

| Progressive Choice Insurance Company | Product and agency-channel underwriting | Supports both agent and direct channels for select products. |

| Progressive Freedom Insurance Company | Personal auto and consumer-facing products | Licensed entity supporting consumer offerings. |

| Progressive County Mutual Insurance Company | County/mutual-style operations and underwriting | Entity used for certain county or state structured offerings. |

| Progressive Paloverde Insurance Company | Regional personal-lines carrier | Repeated entry in regulatory lists; used for state-specific filings. |

| Artisan and Truckers Casualty Company | Commercial trucking and specialty liability | Specialized carrier for trucking and transportation industry exposures. |

| National Continental Insurance Company | Specialized commercial underwriting | Part of the group’s commercial underwriting network (state-licensed). |

| Protective Insurance / Progressive Fleet & Specialty Programs | Large-fleet and specialty commercial lines (rebranded) | Protective Insurance rebranded into Progressive Fleet & Specialty Programs to fold legacy large-fleet business into Progressive’s commercial offerings (rebranding announced 2024). |

| ASI Home / ASI Assurance Corp. (American Strategic Insurance affiliates) | Homeowners and property insurance | Regional property/home underwriting entities affiliated under Progressive’s group of carriers for property products. |

| Drive Insurance Company (Drive brand) | Nonstandard personal auto | Nonstandard personal-auto underwriting brand and carrier network used to serve higher-risk drivers. |

| PC Investment Company / Progressive Capital Management Corp. | Investment management and treasury functions | Non-insurance subsidiaries that manage invested assets backing reserves and provide internal investment functions. |

| Progressive Capital Management Corp. | Investment management | Manages fixed-income portfolio and investment operations for policyholder reserves. |

| Progressive Adjusting Company, Inc. | Claims adjusting and services | Provides claims adjusting services and centralized claims operations support. |

| B&L Brokerage Services, Inc. | Agency and brokerage support services | Support services for agency network and wholesale placements. |

| Transport Specialty Insurance Agency, Inc. | Wholesale/agency distribution for transport risks | Acts as agency/wholesale channel for transport and specialty risks. |

| Progressive Commercial Holdings, Inc. | Holding entity for commercial operations | Corporate holding structure for commercial division subsidiaries. |

| Progressive Fleet & Specialty Programs (brand) | Large-fleet commercial products and programs | Brand for large-fleet accounts and specialty commercial programs after integration of Protective Insurance business. |

| Name-Your-Price Tool (proprietary platform, internal unit) | Pricing/quote comparison platform | Proprietary platform enabling customer price-driven product selection and competitor quote comparisons; core to digital acquisition strategy. |

| Snapshot (Usage-Based Insurance program) | Telematics data collection and UBI pricing | Merchant division and program capturing driving behavior used for personalized pricing; central to telematics and risk segmentation. |

| Progressive Property / Home Affiliates (group) | Homeowners/renters underwriting across several carriers | Collection of property-licensed carriers enabling bundled products and state-level compliance. |

| Progressive Risk & Reinsurance Units (internal entities) | Reinsurance management and risk transfer operations | Internal units that structure reinsurance treaties, manage retention, and purchase (or cede) reinsurance protection. |

| Progressive Claims Tech & Automation Units (internal) | Claims automation and fraud detection operations | Internal operational entities responsible for AI/automation functions in claims and servicing. |

Progressive Casualty Insurance Company

Progressive Casualty Insurance Company is one of the primary underwriting entities within the Progressive group. It focuses primarily on personal auto insurance and liability coverage. This subsidiary plays a central role in issuing and servicing personal vehicle policies nationwide.

It supports Progressive’s largest revenue segment, Personal Lines auto insurance. The company is structured to comply with multi-state regulatory requirements and maintain capital adequacy for policyholder claims. Much of Progressive’s earned premium volume flows through this entity.

Progressive Direct Insurance Company

Progressive Direct Insurance Company is responsible for the company’s direct-to-consumer distribution channel. It underwrites policies sold directly through Progressive’s website and call centers rather than through independent agents.

This entity supports Progressive’s digital-first strategy. Direct sales reduce commission expenses and improve customer data integration. It also enables more accurate telematics-based pricing through direct customer engagement. A significant portion of Progressive’s new policy growth flows through this subsidiary.

Progressive Specialty Insurance Company

Progressive Specialty Insurance Company handles non-standard and specialty vehicle insurance products. This includes coverage for motorcycles, recreational vehicles (RVs), boats, and specialty autos.

This subsidiary allows Progressive to diversify beyond traditional auto insurance. Specialty vehicles often carry different risk profiles and pricing structures. Progressive has historically been a market leader in motorcycle and RV insurance, making this entity strategically important for niche market dominance.

Progressive Commercial Casualty Company

Progressive Commercial Casualty Company focuses on commercial auto insurance. This includes coverage for small businesses, contractors, delivery fleets, trucking operations, and rideshare vehicles.

Commercial auto represents one of Progressive’s fastest-growing segments. This entity manages underwriting for higher-risk and fleet-based policies. It uses telematics and risk modeling tailored to business vehicle operations. Revenue from commercial lines contributes approximately 20% of total company premiums as of 2026.

United Financial Casualty Company

United Financial Casualty Company is another major underwriting subsidiary specializing in commercial vehicle insurance. It operates alongside Progressive Commercial Casualty Company to manage business risk exposure.

This entity helps distribute commercial risk across multiple licensed insurers within the Progressive group. It supports regulatory compliance and capital management by diversifying underwriting exposure across separate legal entities.

Progressive Advanced Insurance Company

Progressive Advanced Insurance Company serves as a regional underwriting subsidiary. It supports state-specific regulatory requirements and allows Progressive to maintain localized capital structures.

Insurance companies often operate through multiple state-licensed entities to comply with state insurance regulations. This structure enhances financial stability and risk segmentation across geographic markets.

Progressive Northern Insurance Company

Progressive Northern Insurance Company primarily focuses on underwriting auto insurance policies in specific U.S. regions. It operates as part of Progressive’s broader Personal Lines structure.

This entity supports underwriting discipline and regional diversification. By separating exposure geographically, Progressive strengthens capital efficiency and regulatory compliance.

Progressive Home Insurance

Progressive Home operates as part of Progressive’s property insurance strategy. While some homeowners policies are underwritten directly by Progressive subsidiaries, others are facilitated through strategic underwriting partnerships.

This entity supports bundled insurance products. Auto and home bundling improves customer retention and increases policy lifetime value. Property insurance remains a smaller but strategically important segment within the Progressive portfolio.

ARX Holding Corp.

ARX Holding Corp. was acquired to strengthen Progressive’s homeowners insurance presence. It operates property insurance brands that complement Progressive’s auto offerings.

The acquisition allowed Progressive to expand into homeowners’ insurance with an established underwriting infrastructure. This supports cross-selling opportunities and risk diversification beyond auto coverage.

Name Your Price Tool

While not a separate insurer, Progressive’s proprietary pricing and comparison platform operates as a structured internal entity. This platform allows customers to compare Progressive rates with competitors and select coverage based on budget preferences.

The tool enhances customer acquisition efficiency and pricing transparency. It also supports conversion rates within the direct channel. This proprietary system differentiates Progressive from many traditional insurers.

Snapshot Telematics Program

Snapshot operates as Progressive’s telematics-based insurance program. While not a legally separate company, it functions as a structured operational division responsible for usage-based pricing.

Snapshot collects driving behavior data, including braking patterns, mileage, and time-of-day driving habits. This data feeds into underwriting algorithms. Telematics adoption improves pricing precision and loss ratio management. Snapshot plays a central role in Progressive’s competitive advantage.

Investment and Holding Structure

The Progressive Corporation also operates through internal investment management entities responsible for managing the company’s multibillion-dollar fixed-income investment portfolio. These assets support policyholder reserves and capital requirements.

Investment entities manage bonds, structured securities, and cash equivalents. Investment income represents approximately 8% of total revenue. These entities ensure capital stability and liquidity to meet claims obligations.

Final Words

Progressive Insurance operates as a widely held public company where ownership is distributed among institutional investors, insiders, and retail shareholders. While many ask who owns Progressive Insurance, the reality is that no single person or entity controls it. Strategic direction comes from professional management, with governance oversight from the board and shareholders.

The company’s strength lies in disciplined underwriting, data-driven pricing, and a scalable digital insurance model. Its structured network of subsidiaries, strong market positioning, and consistent execution continue to reinforce its role as a leading force in the insurance industry.

FAQs

Does George Soros own Progressive Insurance?

George Soros does not own Progressive Insurance. While investment funds associated with Soros may occasionally hold small, indirect positions through diversified portfolios, he is not a major shareholder and does not have any controlling stake in the company.

Who is the largest shareholder of Progressive Insurance?

The largest shareholder of Progressive Insurance is The Vanguard Group, which owns approximately 9.3% of the company’s outstanding shares as of February 2026. This stake is held through Vanguard’s index funds and institutional portfolios, making it the single biggest shareholder, though it does not control company operations.

Who owns Progressive Insurance?

Progressive Insurance is owned by a broad base of shareholders, with institutional investors holding the majority stake. As of February 2026, the largest owners include The Vanguard Group (9.3%), BlackRock (8.6%), Capital Research and Management (5.9%), and State Street Global Advisors (4.4%). Together, these major institutions hold a significant portion of the company, while insiders and retail investors own smaller shares. No single shareholder has controlling ownership.

Who started Progressive Insurance?

Progressive Insurance was founded in 1937 by Joseph Lewis and Jack Green. They established the company to make auto insurance more accessible, especially for drivers who had difficulty obtaining coverage at the time.

Are GEICO and Progressive the same thing?

No, GEICO and Progressive are separate companies. Progressive Insurance is an independent publicly traded corporation, while GEICO is a wholly owned subsidiary of Berkshire Hathaway. They operate independently and compete in the auto insurance market.

Does BlackRock own Progressive?

BlackRock is one of the largest shareholders of Progressive Insurance, but it does not own or control the company. It holds a significant institutional stake through its funds and investment portfolios.