Lululemon has become a global leader in athletic apparel, known for its innovative products and community-driven brand. But many people still wonder, who owns Lululemon? In this article, we’ll explore the company’s background, ownership structure, leadership, revenue, and more.

Lululemon Company Profile

Lululemon Athletica Inc. is a leading athletic apparel company known for high-quality yoga and workout clothing. Originally focused on women’s activewear, it has since expanded into men’s apparel, lifestyle products, and connected fitness. Lululemon blends fashion and function, making it a top brand for fitness enthusiasts and casual wearers alike.

Headquartered in Vancouver, Canada, and incorporated in Delaware, USA, Lululemon operates globally. Its products are sold through company-operated stores, its website, mobile apps, and selected third-party wholesalers. The brand is synonymous with premium activewear and has built a loyal customer base through innovation, community engagement, and a lifestyle-driven marketing approach.

Company Details

- Name: Lululemon Athletica Inc.

- Ticker Symbol: LULU (NASDAQ)

- Industry: Apparel – Athletic & Lifestyle

- Headquarters: Vancouver, British Columbia, Canada

- Founded: 1998

- Public Since: 2007

- CEO (2025): Calvin McDonald

- Employees (2025): Over 40,000 globally

- Global Stores: 700+ across North America, Asia, Europe, Oceania

Lululemon operates both brick-and-mortar retail stores and a strong digital commerce platform. The company has also invested in supply chain optimization, product design labs, and community-based initiatives such as in-store fitness classes and ambassador programs.

Lululemon Founders

Lululemon was founded in 1998 by Chip Wilson, a Canadian entrepreneur with a background in surf, skate, and snowboard apparel. Wilson was inspired to create high-quality, technically advanced yoga apparel after attending a yoga class and realizing there was a gap in the market.

He named the company “Lululemon” partly because he believed a name with multiple L’s would be hard to pronounce for some non-English speakers, making it uniquely Western. The first Lululemon store opened in 2000 in Vancouver’s Kitsilano neighborhood, a hub for health-conscious consumers.

Although Wilson stepped down from executive roles in the 2010s, he played a critical role in shaping the brand’s early vision, values, and aesthetic.

Major Milestones

1998: Lululemon is founded in Vancouver by Chip Wilson.

2000: The first standalone retail store opens in Vancouver, offering yoga-specific athletic apparel for women.

2005: The brand begins rapid expansion into the U.S. and other global markets.

2007: Lululemon goes public and is listed on the NASDAQ under the ticker symbol LULU.

2013: Chip Wilson steps down as chairman after controversies regarding product quality and remarks about body shapes.

2014: Men’s apparel line is officially launched to diversify product offerings.

2018: Calvin McDonald is appointed CEO, bringing experience from Sephora and Sears Canada.

2020: Lululemon acquires Mirror, a connected fitness company, for $500 million, marking its move into digital wellness.

2022: The company launches its footwear line, beginning with women’s running shoes, a significant step into new product categories.

2023: Mirror is rebranded and integrated into the company’s new fitness platform, Lululemon Studio.

2024: Lululemon reaches over $10 billion in annual revenue, driven by strong growth in digital sales and international expansion.

These milestones highlight Lululemon’s transformation from a niche yoga brand into a global athletic lifestyle powerhouse. Its focus on innovation, brand experience, and community has allowed it to thrive in a competitive retail landscape.

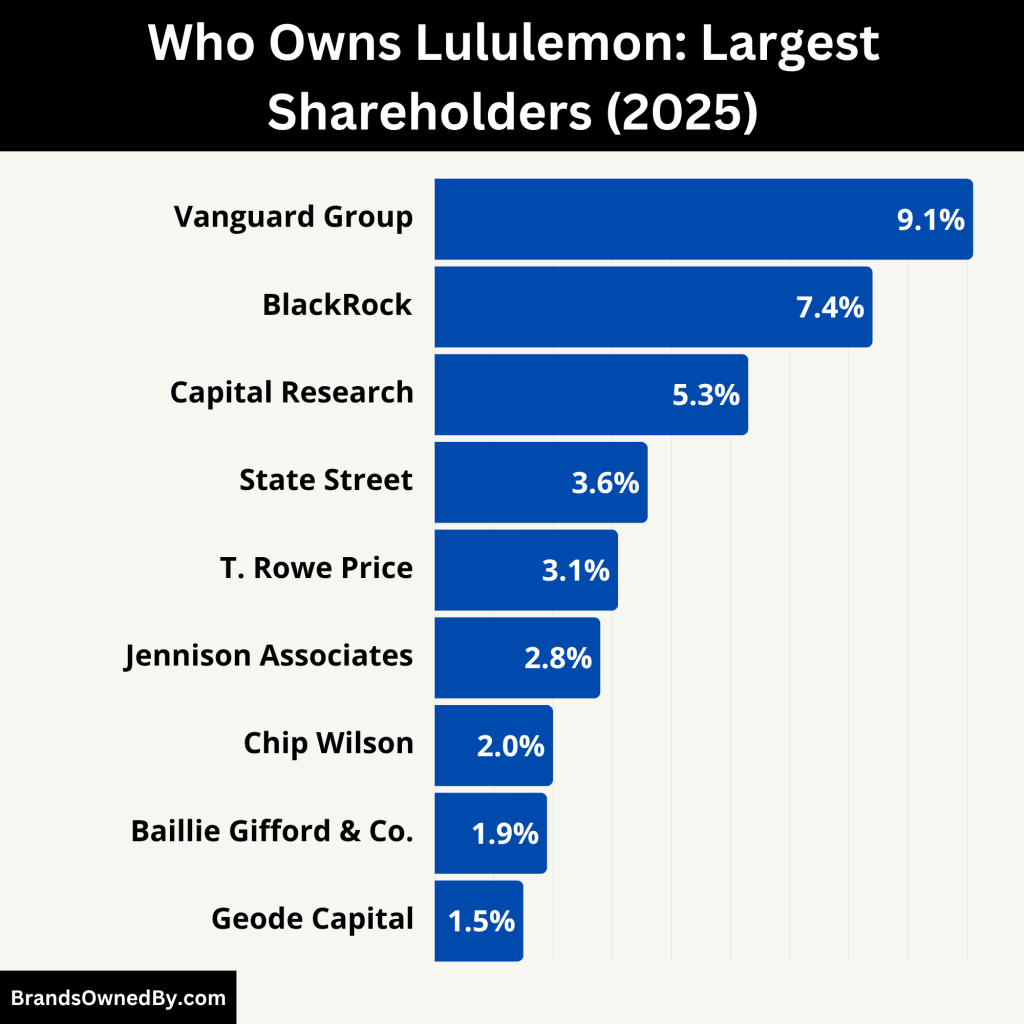

Who Owns Lululemon: Largest Shareholders

Lululemon is a publicly traded company. That means it is owned by a wide range of institutional investors, mutual funds, and individual shareholders. There is no single owner of Lululemon, but the largest shareholder typically holds a minority stake. Ownership changes frequently due to the buying and selling of shares on the stock market.

Here’s a list of the major shareholders of Lululemon as of 2025:

| Shareholder | Approx. Ownership | Type | Influence |

|---|---|---|---|

| The Vanguard Group | 9.1% | Institutional | High (passive) |

| BlackRock | 7.4% | Institutional | High (passive) |

| Capital Research & Management | 5.3% | Institutional | Moderate |

| State Street Global Advisors | 3.6% | Institutional | Moderate |

| T. Rowe Price Associates | 3.1% | Institutional | Moderate |

| Jennison Associates | 2.8% | Institutional | Moderate |

| Chip Wilson (Founder) | <2% | Individual | Symbolic |

| Baillie Gifford & Co. | 1.9% | Institutional | Low to moderate |

| Geode Capital Management | 1.5% | Institutional | Low |

| Other Investors | ~63.3% (combined) | Institutional + Retail | Distributed control |

The Vanguard Group, Inc.

As of 2025, The Vanguard Group remains Lululemon’s largest institutional shareholder, owning approximately 9.1% of the company’s outstanding shares. Vanguard is known for its long-term investment strategy, often through index funds and ETFs. While Vanguard does not influence daily operations, it holds considerable voting power in shareholder resolutions and board elections due to its large stake.

Vanguard does not seek active control of the company but has a say in governance practices, especially on matters involving board composition, executive compensation, and sustainability policies.

BlackRock, Inc.

BlackRock holds around 7.4% of Lululemon’s shares in 2025. It is the second-largest institutional investor, managing assets through mutual funds and ETFs such as iShares. Like Vanguard, BlackRock is a passive investor but has considerable influence through proxy voting.

BlackRock advocates for long-term value creation and often engages with companies on environmental, social, and governance (ESG) issues. Its ownership gives it strong visibility into Lululemon’s strategic direction, but it does not directly intervene in daily operations.

Capital Research & Management Company

Capital Research, part of Capital Group, owns about 5.3% of Lululemon. Known for its active management style, Capital Group invests in companies with long-term growth potential. Their stake in Lululemon indicates strong confidence in its financial performance and market strategy.

While not directly involved in operations, Capital Group’s analysts and portfolio managers maintain communication with Lululemon’s investor relations team and sometimes influence investor sentiment.

State Street Global Advisors

State Street owns approximately 3.6% of Lululemon in 2025. As another major index fund provider, State Street primarily holds shares on behalf of long-term investors and pension funds. It often aligns with Vanguard and BlackRock during shareholder votes and governance proposals.

State Street’s role is largely passive, but its substantial ownership contributes to the institutional stability of Lululemon’s shareholder base.

T. Rowe Price Associates

T. Rowe Price owns around 3.1% of the company as of 2025. The firm is known for its research-driven investment approach and long-term equity positions. Its holding in Lululemon reflects high confidence in the company’s growth trajectory, especially in digital and international markets.

While T. Rowe Price does not play an active role in management, its voice is considered influential among Lululemon’s investor community.

Jennison Associates

Jennison Associates holds about 2.8% of Lululemon’s stock. The firm focuses on growth-oriented portfolios and typically invests in companies with strong brand presence and innovation. Jennison’s position in Lululemon aligns with its strategy of investing in high-performance consumer companies.

Its analysts may meet with company executives during earnings calls and investor conferences, but it remains a passive investor in terms of governance.

Chip Wilson (Founder)

Chip Wilson, the founder of Lululemon, still owns less than 2% of the company’s shares in 2025. He was once the largest individual shareholder but gradually sold off his holdings over the past decade. While he no longer has a board seat or executive role, he remains a symbolic figure in the brand’s origin story.

His influence today is limited, but his past leadership and vision continue to shape Lululemon’s identity.

Baillie Gifford & Co.

Baillie Gifford holds a modest 1.9% stake in Lululemon. Known for backing innovative growth companies, Baillie Gifford’s investment reflects its interest in the company’s future potential, especially its technology-driven wellness expansion.

This firm does not actively engage in governance but supports long-term performance through research-based investment.

Geode Capital Management

Geode Capital, which manages index funds largely on behalf of Fidelity, holds about 1.5% of Lululemon. It follows a passive investment strategy and rarely engages in corporate matters. However, it contributes to overall institutional ownership stability.

Other Institutional and Retail Investors

The remaining shares of Lululemon are held by a wide range of mutual funds, pension funds, hedge funds, and retail investors. These include firms like Morgan Stanley, Northern Trust, Invesco, and retail shareholders who buy stock through brokerage platforms.

Retail investors collectively own a smaller percentage compared to institutional holders, but they still influence market movements, particularly during earnings seasons and major product announcements.

Who is the CEO of Lululemon?

Calvin McDonald has been the CEO of Lululemon since August 20, 2018. He is also a member of the company’s Board of Directors and serves as the public face of Lululemon’s growth and innovation initiatives.

Professional Background

Before joining Lululemon, McDonald held significant leadership roles:

- He served five years as President and CEO of Sephora Americas, where he drove double-digit growth and expanded digital and in-store engagement.

- He was CEO of Sears Canada from 2011 to 2013, bringing retail operations experience.

- He spent 17 years with Loblaw Companies Limited, Canada’s largest retailer, in various executive roles.

McDonald holds a Bachelor of Science from the University of Western Ontario and an MBA from the University of Toronto.

Leadership Style & Achievements

McDonald is a growth-focused executive. Under his leadership:

- He has delivered double-digit revenue growth annually.

- He has led Lululemon’s international expansion—aiming to grow international sales from ~25% to 50%.

- He launched new categories: footwear, men’s gear beyond yoga, and connected fitness via Mirror (now Lululemon Studio).

- Valued for his emphasis on sustainability, diversity, inclusion, and athlete-first product innovation.

Strategic Vision & Initiatives

At the January 2025 NRF Big Show, McDonald outlined his priorities:

- Double Lululemon’s revenue again, targeting roughly $12.5 billion by 2026 through new product categories and markets.

- Expand globally—pursuing new stores in Italy, Denmark, Turkey, Czech Republic, Belgium, plus growth in Asia.

- Cultivate a high-performance culture with care—balancing competitive ambition with employee well‑being, sustainability, and circularity initiatives.

Market Performance & Decision-Making

Under McDonald’s guidance, Lululemon:

- Tripled its stock value since 2018.

- Grew annual revenue from ~$3 billion in 2018 to nearly $10.5 billion by 2024, with FY 2025 guidance of $11.15–11.3 billion.

- Achieved strong Q1 2025 results: $2.37 billion in revenue (+7% YoY), expanded international sales (+19%) and domestic (+3%).

- Implemented share buyback programs ($430 million in Q1) to enhance shareholder value.

Despite cautious U.S. consumer trends and inventory challenges, McDonald’s leadership emphasized agility, “newness” in product lines, and premium positioning through pricing and technical innovation.

Tenure & Succession

McDonald succeeded Laurent Potdevin in 2018, following a leadership transition due to misconduct issues. His predecessors include Christine Day (2008–2013) and Potdevin (2013–2018).

He is widely expected to continue steering Lululemon through its next growth phase, building on past success while addressing market headwinds.

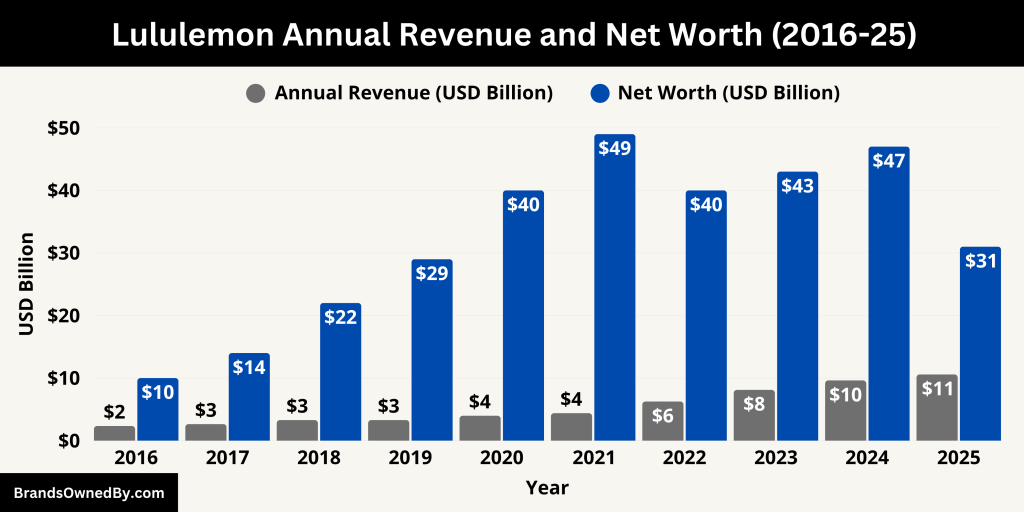

Lululemon Annual Revenue and Net Worth

Lululemon’s fiscal year ends in early February. For the year ending Feb 2, 2025, the company reported $10.59 billion in revenue—up more than 10% year-over-year.

For the trailing 12 months through March 31, 2025, total revenue reached approximately $10.75 billion, maintaining a solid growth rate of around 9.4%.

In Q1 2025 (ending May 4), Lululemon generated $2.37 billion in net revenue—a 7% increase compared to Q1 2024, or 8% on a constant-currency basis.

- Americas sales grew 3% (4% constant-currency).

- International revenue surged 19% (20% constant-currency).

The company reaffirmed its full-year 2025 revenue guidance of $11.15–11.30 billion, projecting 5–7% growth, or 7–8% excluding a calendar 53rd week in 2024.

Summary: 2025 Financial Snapshot

- Revenue: ~$10.6 billion (fiscal year), with strong growth continuing into Q1

- TTM Revenue: ~$10.75 billion

- Market Cap: ~$28–31 billion mid‑2025, down from ~$47 billion early in the year

- Profitability: High margin structure, solid profits

- Liquidity: Cash-rich with low debt.

As of mid-2025, Lululemon’s market capitalization is estimated to be between $28 billion and $31 billion. This is a decline from early 2025, when the company’s market cap stood near $47 billion. The drop reflects broader economic concerns including softer U.S. consumer demand, shifting inventory dynamics, and increased global tariffs. Despite this, the company retains a strong valuation in comparison to other apparel brands, underscoring investor confidence in Lululemon’s premium positioning and future earnings potential.

Lululemon remains highly profitable in 2025. In the first quarter alone, gross profit reached approximately $1.38 billion, with a healthy gross margin of 58.3%, which was up 60 basis points compared to the same quarter last year. Operating income came in at $438.6 million, representing an operating margin of 18.5%. Net income stood at $314.6 million, and diluted earnings per share reached $2.60. These figures reaffirm Lululemon’s ability to manage costs efficiently while maintaining its premium pricing.

In terms of liquidity, the company continues to operate with a strong balance sheet. As of the most recent quarter, Lululemon held over $1.3 billion in cash and cash equivalents, with no long-term debt. This provides financial flexibility for investments in product innovation, international growth, and shareholder returns, such as buybacks.

Here’s an overview of the revenue and net worth of the last 10 years:

| Fiscal Year | Annual Revenue (USD Billion) | Estimated Market Cap / Net Worth (USD Billion) |

|---|---|---|

| 2025 | 10.59 | 28 – 31 |

| 2024 | 9.62 | 47.2 |

| 2023 | 8.11 | 42.5 |

| 2022 | 6.26 | 40.1 |

| 2021 | 4.40 | 48.5 |

| 2020 | 3.98 | 39.7 |

| 2019 | 3.29 | 29.1 |

| 2018 | 3.29 | 21.6 |

| 2017 | 2.65 | 13.5 |

| 2016 | 2.34 | 9.7 |

Companies Owned by Lululemon

Lululemon is not just an apparel brand. It also owns and operates other ventures that align with its wellness and fitness mission.

Below is a list of the major companies and brands owned by Lululemon:

| Name | Year Launched / Acquired | Type | Status (2025) | Description |

|---|---|---|---|---|

| Lululemon Athletica | 1998 | Core Apparel Brand | Active | Flagship brand offering premium athletic wear for men and women, sold globally via stores and e-commerce. |

| Lululemon Studio | Acquired 2020 (Mirror) | Digital Fitness Platform | Active | Former smart mirror product rebranded as a subscription-based fitness content platform integrated with Lululemon. |

| Lululemon Footwear | 2022 | Footwear Division | Active | In-house athletic footwear line, includes running and training shoes for men and women. |

| lululemon Lab | Originally 2009, reimagined 2019 | Design Sub-label | Active | Limited-edition experimental clothing line focusing on elevated streetwear and technical design. |

| ivivva | 2009 | Youth Apparel Brand | Discontinued | Former athletic wear brand for young girls; shut down to refocus on core Lululemon business. |

| Lululemon China | Expanded 2020s | Regional Division | Active | Operates localized e-commerce, retail, and marketing across China; critical to global growth. |

| Lululemon Europe | Expanded 2020s | Regional Division | Active | Oversees Lululemon operations in Europe including UK, Germany, and France. |

| Lululemon Asia-Pacific | Expanded 2020s | Regional Division | Active | Covers markets such as Australia, Japan, South Korea, and Singapore. |

| Lululemon Middle East | Expanded post-2022 | Regional Division | Active | Supports growth and localized retail strategies in Gulf countries and surrounding markets. |

Lululemon Athletica

Lululemon Athletica is the core brand and the flagship business of the company. It is known for premium athletic apparel, including yoga pants, leggings, sports bras, outerwear, and accessories for women and men. The brand remains the primary revenue driver and is sold through a combination of physical retail stores, e-commerce, and wholesale partnerships in select international markets.

Lululemon has evolved from a niche yoga brand to a global athletic performance company. By 2025, the brand has significantly expanded into men’s performance wear, on-the-move casual collections, tennis, golf, and technical outerwear. The expansion into footwear and digitally connected fitness also aligns under the core Lululemon brand identity.

Lululemon Studio (formerly Mirror)

Lululemon acquired Mirror, a fitness technology company, in 2020 for $500 million. It was rebranded as Lululemon Studio in 2022. This platform originally sold a wall-mounted smart fitness mirror offering live and on-demand workout classes. However, in 2024, Lululemon pivoted the strategy.

As of 2025, Lululemon Studio has transitioned into a digital membership-based platform. It no longer sells hardware but offers content and benefits via app-based subscriptions. Lululemon Studio integrates seamlessly with the company’s core offerings, providing value-added fitness services to members. Classes include strength, yoga, pilates, HIIT, and more, with exclusive discounts for Lululemon products. This platform supports customer retention and enhances brand engagement.

Lululemon Footwear

Launched in 2022, Lululemon’s in-house footwear division has grown steadily. Initially focused on women’s running and training shoes, the brand added men’s shoes in 2023. By 2025, the company continues expanding its athletic and everyday sneaker collections. Footwear is fully integrated into the Lululemon brand but operates as a dedicated product category with its own innovation and design teams.

Footwear is positioned as an extension of Lululemon’s commitment to technical performance. Product names like “Blissfeel” and “Chargefeel” have become known in the women’s fitness shoe segment. The category remains small compared to apparel but is strategically important for long-term growth.

ivivva (discontinued but formerly operated)

ivivva was a youth-focused athletic wear brand targeting young girls, operated by Lululemon. It launched in 2009 but was gradually phased out between 2017 and 2020 due to weak performance and strategic reallocation of resources. As of 2025, ivivva no longer operates as a standalone brand or product line.

lululemon Lab

lululemon Lab is a sub-label under the Lululemon brand that focuses on experimental, fashion-forward designs. It offers limited-edition collections blending performance and style. Originally created to explore elevated urban looks, Lab products are designed in New York, Vancouver, and Tokyo.

Though not a separate company, Lab functions like an internal innovation studio, creating exclusive drops and influencing Lululemon’s main product lines. It is considered a design-forward platform for fashion-conscious consumers looking for minimalist, street-style inspired activewear.

Collaborations and Limited Edition Collections

While Lululemon doesn’t own many external companies, it regularly partners with athletes, wellness experts, and local artists to release co-branded or limited collections. These are typically time-limited and do not constitute long-term ownership stakes but contribute to product innovation and community engagement.

Notable examples have included collaborations with Barry’s Bootcamp, Peloton instructors, and ambassadors in global markets. These collaborations strengthen the Lululemon brand without forming permanent joint ventures or new business entities.

Lululemon International Divisions

As of 2025, Lululemon operates across several global regions with dedicated infrastructure. These include:

- Lululemon China

- Lululemon Europe

- Lululemon Asia-Pacific

- Lululemon Middle East

While these are not separate companies, they operate under Lululemon’s umbrella with localized leadership, supply chain, and marketing strategies. These regional entities are critical for executing Lululemon’s growth strategy in international markets, where it continues to open new stores and launch e-commerce platforms.

Strategic Partnerships (Non-Owned)

While not owned outright, Lululemon maintains a strategic partnership with Peloton, formed in 2023. It includes co-branded apparel and cross-promotion of fitness content. However, Peloton remains an independent company, and Lululemon does not own any stake in it.

Final Thoughts

Lululemon is a global leader in activewear, and it continues to grow through innovation and strong leadership. While no single person owns Lululemon, institutional investors like Vanguard and BlackRock are the largest shareholders. Calvin McDonald’s leadership has helped steer the company into new markets and categories. With consistent revenue growth and a strong brand identity, Lululemon remains a dominant force in the industry.

FAQs

Why is Lululemon so expensive?

Lululemon is considered expensive due to its focus on high-quality, technical fabrics, premium design, and brand positioning. The company invests heavily in research and innovation, offering products that are durable, comfortable, and performance-driven. It also emphasizes exclusivity, limited collections, and a strong brand community, all of which contribute to its premium pricing.

Who is Lululemon’s sister company?

Lululemon does not have a traditional “sister company” since it is an independent public company. However, it previously operated ivivva, a youth-focused activewear brand, which was considered a sister brand before being discontinued. As of 2025, all active divisions like Lululemon Studio and Lululemon Lab operate under the Lululemon umbrella rather than as separate sister companies.

Does Chip Wilson still own Lululemon?

As of 2025, Chip Wilson no longer holds a controlling stake in Lululemon. He sold most of his shares years ago but still retains a small minority interest, making him a legacy stakeholder rather than an active owner. He has no role in the company’s management or operations.

Who is Lululemon’s biggest competitor?

Lululemon’s biggest competitors include Nike, Adidas, Athleta, and Under Armour. Among them, Nike remains the most formidable rival in terms of brand scale, product range, and global presence. Athleta, owned by Gap Inc., is also a strong competitor in the women’s premium activewear segment.

Is Lululemon a Nike competitor?

Yes, Lululemon is a direct competitor to Nike, particularly in the athletic apparel and women’s performance wear categories. While Nike dominates in footwear, Lululemon has gained ground in apparel by targeting a premium, lifestyle-oriented consumer with a focus on yoga, wellness, and athleisure.

Why did they call it Lululemon?

The name “Lululemon” was chosen by founder Chip Wilson in part because he believed that having the letter “L” in the name would appeal to Japanese consumers, who may find it more exotic or difficult to pronounce. It was also selected as a made-up word that would have no existing associations, giving it a unique brand identity.

Is Lululemon a Korean brand?

No, Lululemon is not a Korean brand. It is a Canadian company, founded in Vancouver, British Columbia, in 1998. While it has a growing presence in Asia—including South Korea—it is still headquartered in North America and operates under Canadian origins.

Why did Nike sue Lululemon?

Nike sued Lululemon in early 2022, alleging that Lululemon’s Mirror fitness technology infringed on several of Nike’s patents related to digital fitness and motion tracking. The case highlighted the increasing competition between the two companies in the connected fitness space. The lawsuit was part of broader tensions as Lululemon expanded beyond apparel into tech-driven fitness.

What is Chip Wilson’s net worth?

As of June 2025, Chip Wilson’s estimated net worth is around $5.7 billion. Much of his wealth originates from his early ownership of Lululemon, although he has diversified his assets through real estate and his holding company, Low Tide Investments.

Who is the wife of the Lululemon founder?

Chip Wilson’s wife is Shannon Wilson, a designer who also played a key role in Lululemon’s early development. She helped with product creation and design direction in the brand’s formative years. The couple later launched other ventures together, including Kit and Ace.

What is the Lululemon founder scandal?

The most prominent controversy involving Chip Wilson occurred in 2013 when he made public comments blaming product issues on certain women’s body types. His remarks caused backlash and led to reputational damage for the brand. Though he later apologized, the incident contributed to his stepping down from active involvement in the company.

What is the Lululemon founder’s net worth?

Chip Wilson, the founder of Lululemon, has a net worth of approximately $5.7 billion as of 2025. His fortune is tied to his Lululemon legacy and investments in real estate and private equity through Low Tide Investments.

When was Lululemon founded?

Lululemon was founded in 1998 by Chip Wilson in Vancouver, Canada. It started as a yoga studio by day and design studio by night, later evolving into a global athletic apparel company.

Who owns Lululemon now?

As of 2025, Lululemon Athletica Inc. is a publicly traded company listed on NASDAQ under the ticker symbol LULU. It is owned by a mix of institutional investors, retail investors, and mutual funds. The largest shareholders include Vanguard Group, BlackRock, and Capital Research.

Who owned Lululemon previously?

Originally, Lululemon was privately owned by Chip Wilson, who founded the company and maintained a majority stake through its early growth. He reduced his stake significantly after the company went public in 2007 and eventually exited active leadership.

Who bought Lululemon?

No other company has bought Lululemon. It remains an independent, publicly traded firm. Although investment firms and shareholders hold large stakes, it has never been acquired or merged with a parent company.

What is Lululemon country of origin?

Lululemon originated in Canada. It was founded in Vancouver, British Columbia, and continues to be recognized as one of the most successful Canadian global brands.

Who is the current owner of Lululemon?

Lululemon is a public company, so it has no single owner. Its largest shareholders include Vanguard and BlackRock.

Is Lululemon privately owned?

No, Lululemon is publicly traded on the NASDAQ under the ticker symbol LULU.

Who founded Lululemon?

Lululemon was founded by Chip Wilson in 1998 in Vancouver, Canada.

Does Chip Wilson still own Lululemon?

Chip Wilson owns a small portion of Lululemon shares but is no longer involved in daily operations.

Who is the CEO of Lululemon in 2025?

Calvin McDonald is the CEO of Lululemon in 2025.

How much is Lululemon worth in 2025?

Lululemon’s market capitalization is over $60 billion as of 2025.