The question of who owns Liverpool reveals how one of the world’s most famous football clubs is managed, funded, and controlled. Liverpool F.C., known for its passionate fanbase and historic success, is now under American ownership. This article explains who owns Liverpool as of 2025, its ownership history, leadership, and financial strength.

Key Takeaways

- Liverpool FC is fully owned by Fenway Sports Group (FSG), an American sports investment company that also owns the Boston Red Sox and Pittsburgh Penguins.

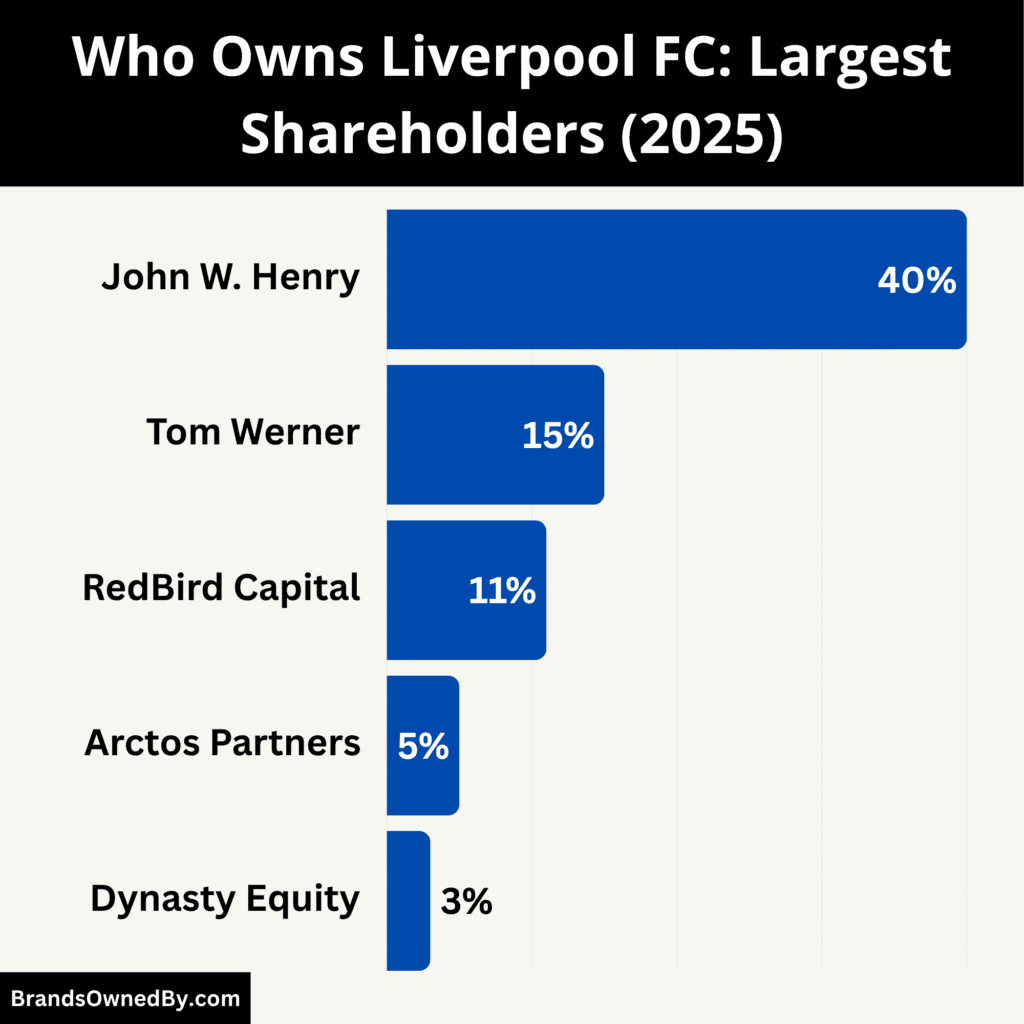

- John W. Henry serves as the Principal Owner and holds the largest individual stake (around 40–42%), while Tom Werner (15–17%) acts as Chairman, overseeing governance and strategic leadership.

- RedBird Capital Partners owns an 11% minority stake in FSG, joined by Arctos Partners (around 5–6%) and Dynasty Equity (approximately 3%) as additional minority investors providing financial support but no operational control.

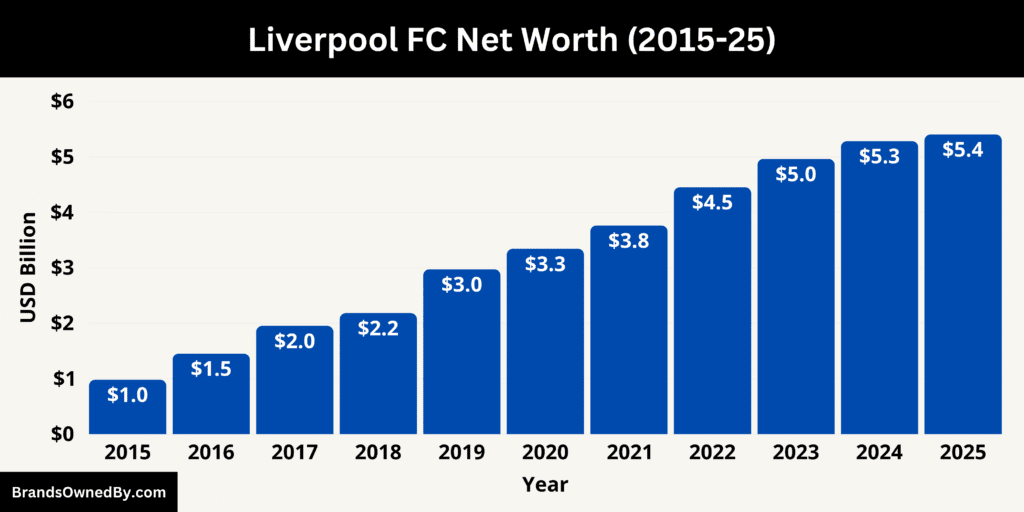

- The club’s ownership model emphasizes sustainability, data-driven management, and long-term growth, making Liverpool one of the world’s most valuable football franchises with a net worth of $5.4 billion as of November 2025.

Liverpool FC Overview

Liverpool Football Club is one of the most storied and successful football clubs in the world. Founded in 1892 and based in Liverpool, England, the club competes in the English Premier League and plays its home matches at Anfield. Over more than a century, Liverpool has built a powerful global identity rooted in passion, resilience, and unity — symbolized by its anthem, “You’ll Never Walk Alone.”

As of November 2025, Liverpool F.C. is valued at approximately $5.4 billion, making it one of the four most valuable football clubs in the world. The club is owned by Fenway Sports Group (FSG), an American sports holding company, and continues to thrive both commercially and competitively. Liverpool’s worldwide fan base, strategic sponsorships, and on-field achievements have turned it into a global sports brand with immense cultural significance.

Founder and Origin

Liverpool F.C. was founded by John Houlding, a local brewer, businessman, and politician who played a crucial role in the early development of football in the city. Originally, Houlding owned Anfield Stadium, which was rented by Everton F.C. for their matches. However, disputes over rent and ownership led Everton to leave Anfield in 1892 to move to Goodison Park.

Rather than letting the ground go unused, Houlding decided to form a new club — Liverpool Football Club and Athletic Grounds Ltd — officially registered on June 3, 1892. The club joined the Lancashire League and won the championship in its first season, quickly earning promotion to the Football League in 1893.

Under Houlding’s leadership, Liverpool was built on principles of ambition, community, and innovation. From the start, the club developed a reputation for professionalism and sporting excellence. The foundations laid in those early years paved the way for the dominance that would come in later decades.

Major Milestones

- 1892 – John Houlding founds Liverpool F.C. following a dispute with Everton over the Anfield ground.

- 1893 – The club joins the Football League Second Division and earns promotion to the First Division in its debut season.

- 1901 – Liverpool wins its first English league title, marking the beginning of national success.

- 1959 – Bill Shankly becomes manager and transforms Liverpool into a modern football club. He rebuilds the squad, restructures training, and unites the club’s culture.

- 1964 – Liverpool wins the First Division under Shankly and introduces the now-iconic all-red kit for the first time.

- 1977 – The club wins its first European Cup (now UEFA Champions League) under Bob Paisley, announcing itself as a European giant.

- 1984 – Liverpool secures a remarkable treble — the League Title, League Cup, and European Cup — becoming the most dominant club in England.

- 1989 – The Hillsborough Disaster claims 97 lives during an FA Cup semi-final. The tragedy leads to significant changes in stadium safety and leaves an enduring impact on the club’s community.

- 2005 – The “Miracle of Istanbul”: Liverpool wins the Champions League after coming back from 3–0 down against AC Milan. It becomes one of the greatest comebacks in football history.

- 2010 – Fenway Sports Group acquires Liverpool F.C. for £300 million, stabilizing the club’s finances and modernizing its structure.

- 2019 – Under Jürgen Klopp, Liverpool wins its sixth Champions League title, defeating Tottenham Hotspur in the final.

- 2020 – Liverpool wins the Premier League, ending a 30-year wait for a top-flight English title.

- 2023 – Completion of the Anfield Road Stand Expansion, increasing stadium capacity to over 61,000 and strengthening matchday revenue.

- 2025 – Liverpool’s valuation reaches $5.4 billion, reflecting its global brand power, consistent sporting success, and commercial growth.

Who Owns Liverpool FC: Major Shareholders

As of 2025, Liverpool F.C. remains under the full ownership of Fenway Sports Group (FSG), led by John W. Henry and Tom Werner. Together, they control roughly 60% of the group’s equity, ensuring consolidated leadership and stability. Minority investors such as RedBird Capital Partners, Arctos Partners, and Dynasty Equity provide capital support but have limited decision-making power.

The group’s ownership model emphasizes long-term growth, sustainable investment, and data-driven management. Since acquiring the club in October 2010 for around £300 million, FSG has transformed Liverpool into a global football superpower, both financially and competitively. Under its stewardship, Liverpool has modernized its stadium, rebuilt its squad, and expanded its commercial footprint worldwide.

FSG’s structure includes several key figures who collectively influence Liverpool’s strategic direction, each playing distinct roles in ownership, governance, and control.

| Shareholder / Entity | Approx. Ownership % | Type of Investor | Role in FSG / Liverpool F.C. | Influence Level |

|---|---|---|---|---|

| John W. Henry | 40–42% | Individual (Founder & Principal Owner) | Principal Owner and controlling shareholder of FSG. Oversees financial and strategic direction of Liverpool F.C. | Very High (Controlling) |

| Tom Werner | 15–17% | Individual (Chairman) | Chairman of FSG and Liverpool F.C.; manages governance, strategy, and board operations. | High |

| RedBird Capital Partners | 11% | Institutional (Private Investment Firm) | Strategic minority shareholder; financial and advisory partner within FSG. | Moderate (Advisory Influence) |

| Arctos Partners | 5–6% | Institutional (Private Equity) | Minority investor providing liquidity and sports investment expertise. | Low |

| Dynasty Equity | 2–3% | Institutional (Investment Firm) | Passive minority investor; supports balance sheet and infrastructure funding. | Low |

| Other Private & Individual Investors | 2–3% | Private Individuals / Celebrity Investors | Small passive shareholders within FSG’s diversified ownership base. | Minimal |

Principal Owner: John W. Henry (40%)

John W. Henry is the founder, principal owner, and controlling shareholder of Fenway Sports Group. He holds an estimated 40% stake in FSG, giving him ultimate control over the group and, by extension, Liverpool F.C.

Henry co-founded FSG (originally New England Sports Ventures) and remains its driving force. His leadership sets the group’s vision and ensures financial stability without excessive debt. All major strategic decisions — from player investments to stadium development — require his approval.

Under Henry’s leadership, Liverpool has achieved:

- Premier League title (2020) and Champions League title (2019).

- Expansion of Anfield to over 61,000 seats.

- Global commercial growth through partnerships with Nike, Standard Chartered, and AXA.

- Strong financial performance with minimal reliance on loans.

As of 2025, John W. Henry’s personal net worth is around $5.7 billion, and he remains the final authority on all FSG-related decisions. His approach prioritizes long-term value creation over short-term spending, which has helped maintain Liverpool’s competitive and financial balance.

Tom Werner (15%)

Tom Werner is the Chairman of both Fenway Sports Group and Liverpool F.C., and holds roughly 15% ownership in FSG. He is second only to John W. Henry in both equity and influence within the group.

Werner is a veteran media executive and former television producer known for his role in hit U.S. shows like The Cosby Show and That ’70s Show. His leadership role at Liverpool involves governance oversight, executive appointments, and representing the club at Premier League and UEFA levels.

Werner’s main responsibilities include:

- Chairing Liverpool’s board of directors and overseeing key management decisions.

- Approving major club initiatives such as sponsorships, infrastructure projects, and commercial ventures.

- Ensuring financial compliance and long-term business sustainability.

His leadership, alongside Henry, ensures that Liverpool remains stable and strategically consistent. Werner’s focus on brand development and media relations has also been instrumental in Liverpool’s global appeal.

RedBird Capital Partners (11%)

RedBird Capital Partners, a U.S.-based private investment firm, owns an 11% minority stake in Fenway Sports Group as of 2025. The firm invested $750 million in FSG in March 2021, marking one of the largest private equity investments in modern sports.

Although RedBird does not directly manage Liverpool, its investment provides significant financial support and strategic expertise. RedBird focuses on sports, media, and entertainment investments and plays a role in helping FSG expand its digital, data, and global marketing platforms.

The firm’s founder, Gerry Cardinale, collaborates with FSG’s leadership team on strategic growth initiatives. RedBird’s investment has allowed FSG to fund projects such as Anfield expansion, global partnerships, and data analytics programs without adding debt.

While RedBird has no operational control over Liverpool, it holds a long-term strategic position that aligns with FSG’s sustainable ownership philosophy.

Institutional and Private Investors (Approx. 10–12% Combined)

Apart from Henry, Werner, and RedBird, a group of institutional and private investors collectively hold between 10% and 12% of Fenway Sports Group’s shares. These shareholders act primarily as passive investors but play a role in providing liquidity and capital flexibility for FSG’s portfolio.

Notable among these are:

- Arctos Partners – A U.S. private equity firm specializing in sports investments. Arctos acquired a small stake (estimated 5%) in FSG to support its expansion and financing strategy.

- Dynasty Equity – A New York-based investment firm that acquired a minority stake (approximately 3%) in FSG in 2023. The investment was used to strengthen Liverpool’s balance sheet and support infrastructure and operational growth.

- Individual investors – A few private investors, including former athletes, business leaders, and U.S. celebrities, hold small equity interests. Their shares are symbolic of FSG’s diversified ownership structure but carry no management influence.

These investors hold minority positions and have no voting control over club-level operations. Governance and strategic decisions remain centralized under John W. Henry and the FSG board.

Control and Governance Structure

Liverpool’s ownership and operational structure are designed for corporate stability and accountability. Control flows from FSG’s Boston headquarters through the Liverpool F.C. Board of Directors, ensuring strategic alignment between both entities.

- Fenway Sports Group (FSG Board): Oversees all ownership-level decisions, including long-term strategy, major spending, and capital allocation.

- Principal Owner (John W. Henry): Retains final authority on all significant business and sporting matters.

- Chairman (Tom Werner): Supervises daily governance and represents the ownership in official functions.

- Minority Shareholders (RedBird, Arctos, Dynasty): Provide financial and strategic input without operational control.

- Liverpool Management Team: Led by CEO Billy Hogan, this group manages club operations, finances, and commercial performance, reporting directly to FSG.

This system ensures professional management, fiscal discipline, and long-term growth without compromising sporting ambition.

Liverpool FC Ownership History

Liverpool Football Club’s ownership journey reflects more than a century of evolution — from a locally owned working-class club to a globally recognized sports institution under American ownership.

Since its founding in 1892, the club has transitioned through several ownership eras, each defining its financial health, management style, and competitive trajectory. From John Houlding’s entrepreneurial beginnings to Fenway Sports Group’s data-driven stewardship, Liverpool’s ownership history tells the story of adaptation, ambition, and resilience.

| Era | Years | Primary Owner(s) | Ownership Type | Key Developments |

|---|---|---|---|---|

| Founding Era | 1892–1904 | John Houlding | Private (Local Businessman) | Founded the club, secured Anfield, established financial base. |

| Local Ownership Era | 1904–1991 | Moores Family | Family Ownership | Funded long-term growth; oversaw Shankly, Paisley, and the golden era. |

| Hicks & Gillett Era | 2007–2010 | George Gillett Jr., Tom Hicks | Foreign (Leveraged Buyout) | Financial instability, internal disputes, and eventual court-ordered sale. |

| FSG Era | 2010–Present | John W. Henry, Tom Werner, RedBird Capital (Minority) | Corporate (Consortium Ownership) | Stabilized finances, expanded Anfield, won major trophies, globalized the brand. |

The Founding Era (1892–1904): John Houlding and the Birth of Liverpool

Liverpool F.C. was founded in 1892 by John Houlding, a local brewer, businessman, and politician. Houlding was originally the owner of Anfield, which was leased to Everton F.C. When disputes over rent and ownership escalated, Everton left Anfield to build Goodison Park. Rather than let his stadium sit empty, Houlding formed a new club — Liverpool Football Club and Athletic Grounds Ltd — officially registered on June 3, 1892.

Under Houlding, Liverpool joined the Lancashire League and quickly found success, winning the league in its first season and earning entry into the Football League in 1893. However, internal disagreements between Houlding and other board members over the club’s management led to his gradual departure in 1904. By then, the club was firmly established in English football and financially stable.

Houlding’s role as founder remains pivotal — he laid the foundation for the club’s future growth, secured its home at Anfield, and embedded a business-minded approach that would shape Liverpool’s DNA for decades to come.

The Local Ownership Era (1904–1991): The Moores Family Legacy

Following Houlding’s exit, Liverpool transitioned to a series of local owners and businessmen who maintained private ownership structures. The most significant and enduring influence came from the Moores family, one of Liverpool’s most prominent business dynasties.

In 1959, Sir John Moores, founder of Littlewoods Pools and a lifelong football supporter, acquired a controlling interest in the club. Under his influence, Liverpool became one of the most successful football teams in the world. Moores helped professionalize the club’s management structure and provided the financial backing that supported managers like Bill Shankly, Bob Paisley, and Joe Fagan.

After Sir John’s passing, his nephew David Moores inherited the family’s controlling stake and became Liverpool’s chairman in 1991, holding approximately 51% of the club’s shares. David Moores oversaw the transition into the modern Premier League era and maintained a commitment to local identity and stability.

However, by the mid-2000s, rising costs, the need for stadium expansion, and growing competition from foreign-owned clubs made it clear that Liverpool required new investment to remain competitive.

The American Takeover (2007–2010): Hicks and Gillett Era

In 2007, Liverpool entered a new phase when American businessmen George Gillett Jr. and Tom Hicks purchased the club from David Moores for approximately £218 million. Their arrival promised modern infrastructure, a new stadium, and global commercial growth — but their partnership quickly descended into financial and internal turmoil.

The pair financed much of the acquisition through loans from the Royal Bank of Scotland (RBS), burdening the club with significant debt. Disagreements over management decisions, particularly regarding player transfers and stadium development, fractured their relationship. Liverpool’s performance suffered, and so did its finances.

By 2010, the club’s debts had reached an unsustainable level, prompting a legal battle between the owners and Liverpool’s board. The High Court ultimately ruled in favor of the board, allowing a sale to new owners.

The Hicks and Gillett era is remembered as one of the most turbulent in the club’s history — a warning of the dangers of leveraged buyouts in football ownership.

The Fenway Sports Group Era (2010–Present): A Modern Football Enterprise

In October 2010, Fenway Sports Group (FSG) — then known as New England Sports Ventures — purchased Liverpool F.C. for around £300 million, bringing the club out of financial crisis. Led by John W. Henry and Tom Werner, FSG introduced a disciplined, long-term ownership model based on sustainability, analytics, and smart investment.

Under FSG’s ownership, Liverpool experienced a resurgence both on and off the pitch:

- Financial Transformation: The club eliminated heavy debt, established strict wage structures, and achieved consistent profitability.

- Infrastructure Investment: Major redevelopment of Anfield, including the Main Stand (2016) and Anfield Road Stand (2023) expansions.

- Sporting Success: Appointment of Jürgen Klopp in 2015 led to an era of glory, winning the UEFA Champions League (2019), Premier League (2020), and FIFA Club World Cup (2019).

- Global Growth: Liverpool expanded its commercial presence with high-value sponsorships and international fan engagement programs.

FSG’s business-first approach modernized Liverpool into a global sports powerhouse. In 2025, the club’s valuation reached $5.4 billion, ranking it among the world’s top four football clubs.

John W. Henry Net Worth

As of November 2025, John W. Henry’s net worth is estimated at $5.7 billion, reflecting his extensive portfolio across sports, media, finance, and real estate. His disciplined investment strategy and commitment to sustainability have made him a model of responsible and effective sports ownership.

John W. Henry’s net worth of $5.7 billion places him among the wealthiest football club owners in the world. This figure represents the total estimated value of his holdings in sports franchises, media companies, private investments, and real estate.

Much of Henry’s wealth is tied to Fenway Sports Group, which owns several iconic sports brands, including:

- Liverpool F.C. (Premier League)

- Boston Red Sox (Major League Baseball)

- Pittsburgh Penguins (National Hockey League)

- RFK Racing (NASCAR).

Through FSG, Henry’s portfolio spans multiple continents and industries, making him one of the most diversified owners in professional sports.

Sources of Wealth

Below is a list of the major sources of income of John W. Henry and how he makes his money:

Commodity Trading and Financial Ventures

John W. Henry built the foundation of his fortune in the 1970s and 1980s through commodity futures trading. He founded John W. Henry & Company, Inc. in 1981, which became a highly successful investment management firm.

His proprietary trading strategies — based on quantitative analysis and market patterns — made him one of the most respected traders in the U.S. financial sector. By the late 1980s, Henry had earned enough wealth to begin investing in sports franchises and other large-scale ventures.

Sports Ownership through Fenway Sports Group

Henry’s most valuable assets today are held through Fenway Sports Group, which he co-founded in 2001 (originally as New England Sports Ventures). FSG’s rise to global prominence is central to his current net worth.

Key sports assets owned under FSG include:

- Liverpool F.C. – Purchased in October 2010 for around £300 million, now valued at $5.4 billion (2025).

- Boston Red Sox – Acquired in 2002 for $380 million, now worth over $4.5 billion.

- Pittsburgh Penguins – Purchased in 2021 for roughly $900 million.

- RFK Racing (NASCAR) – Part of Henry’s broader motorsport interests.

Henry’s ability to increase the valuation of his sports properties is a major contributor to his overall net worth growth over the past two decades.

Media and Publishing Investments

Henry also owns The Boston Globe, one of the oldest and most respected newspapers in the United States. He acquired the publication in 2013 from The New York Times Company for $70 million.

The Globe has since expanded into digital journalism and remains a valuable long-term media asset. Henry’s media interests align with his belief in maintaining influence across information, sports, and culture.

Real Estate Holdings

In addition to his business and sports ventures, Henry owns multiple high-value real estate properties, including:

- A luxury residence in Boca Raton, Florida, where he primarily resides.

- Estates in Boston and Massachusetts, near FSG’s corporate headquarters.

- A portfolio of investment properties linked to his business interests.

While real estate is not the largest component of his net worth, it contributes to the stability and diversity of his asset base.

Net Worth Growth and Valuation Factors

Strategic Investment Philosophy

John W. Henry’s financial philosophy is rooted in data-driven decision-making, long-term growth, and risk management — the same principles he applied as a commodities trader. Rather than relying on heavy debt or speculative acquisitions, Henry prefers measured investments that generate sustained returns over time.

His management style at FSG — emphasizing analytical recruitment, sustainable spending, and reinvestment — mirrors his approach to personal wealth creation. This long-term vision has been central to Liverpool’s resurgence and financial health under his leadership.

Sports Franchise Appreciation

A major driver of Henry’s $5.7 billion valuation is the appreciation of his sports franchises.

- The Boston Red Sox have more than quadrupled in value since his acquisition.

- Liverpool F.C. has grown from a $475 million valuation in 2010 to $5.4 billion in 2025, representing one of the most successful ownership transformations in sports history.

- FSG’s diversified portfolio across multiple leagues and continents has provided consistent revenue streams from broadcasting, merchandising, and sponsorships.

The global explosion in sports media rights — especially in football and baseball — has significantly boosted the value of Henry’s holdings.

Diversification and Liquidity

While much of Henry’s wealth is held in private assets, his diverse portfolio across sports, media, and finance ensures liquidity and stability. FSG’s partial sale of equity stakes to investors like RedBird Capital Partners (11%), Arctos Partners (6%), and Dynasty Equity (3%) has injected capital into the business while allowing Henry to retain control and increase asset value.

Relationship Between Net Worth and Liverpool F.C.

John W. Henry’s wealth directly supports Liverpool’s long-term strategy and stability. His financial strength allows FSG to:

- Invest heavily in infrastructure projects, such as the Anfield Road Stand expansion (2023).

- Maintain squad competitiveness without relying on external loans or debt.

- Secure high-value commercial partnerships with global brands like Nike and Standard Chartered.

- Ensure compliance with UEFA Financial Fair Play and Premier League sustainability rules through sound financial governance.

Liverpool’s current success — both on the pitch and in the boardroom — is inseparable from Henry’s wealth management discipline and FSG’s financial stewardship.

Philanthropy and Personal Interests

Outside of sports and business, Henry is known for his low-profile philanthropic efforts. He supports various causes related to education, journalism, and healthcare, primarily in Massachusetts and Florida. He also donates through private family foundations associated with his wife, Linda Pizzuti Henry, who serves as CEO of Boston Globe Media Partners and plays an active role in FSG’s community initiatives.

Henry’s interests extend to technology, data analytics, and environmental causes, aligning with his belief in innovation and long-term sustainability.

Liverpool FC Net Worth

As of November 2025, Liverpool Football Club has an estimated net worth of $5.4 billion, making it one of the most valuable football clubs in the world. This valuation reflects not only the club’s success on the pitch but also its dominance as a global commercial brand.

Over the past decade, Liverpool’s worth has surged under the ownership of Fenway Sports Group (FSG), supported by a combination of strong revenues, global fan engagement, strategic investments, and sustainable financial management. The club’s brand power, worldwide following, and expanded infrastructure continue to drive its financial growth and global influence.

Valuation Overview

Liverpool F.C. ranks fourth globally in Forbes’ list of the most valuable football clubs in 2025, sitting behind giants like Real Madrid, Manchester United, and Barcelona.

The club’s $5.4 billion valuation is determined through multiple financial factors — including matchday earnings, broadcasting rights, commercial partnerships, and brand equity. This figure also considers tangible assets such as Anfield Stadium and the club’s training complex at Kirkby, as well as intangible assets like brand reputation, fanbase loyalty, and social media reach.

Liverpool’s valuation represents a dramatic rise from its estimated $475 million value in 2010, when FSG first acquired the club. The increase highlights how a blend of modern management, global marketing, and consistent sporting success can transform a traditional football club into a global business empire.

Key Value Drivers

Commercial and Sponsorship Revenue

Commercial partnerships are Liverpool’s largest source of income. The club’s deals with Nike, Standard Chartered, and AXA contribute hundreds of millions annually to its revenue stream.

Nike’s global distribution network has expanded Liverpool’s merchandise sales to new markets, particularly in Asia and North America. The club’s retail division, digital platforms, and licensing deals generate continuous income, while its museum, tours, and events at Anfield add further commercial value.

Liverpool’s global fanbase — estimated at over 150 million followers worldwide — ensures strong brand visibility, making it one of the most marketable clubs in sports.

Broadcasting and Media Rights

Broadcasting remains the backbone of Liverpool’s financial success. As a top performer in both the Premier League and the UEFA Champions League, the club benefits from lucrative TV contracts and performance-based revenue distribution.

The Premier League’s international broadcasting deals, worth over $10 billion across multiple cycles, directly boost Liverpool’s earnings. Regular Champions League participation also brings in significant prize money and visibility. In 2024–25 alone, the club earned over $120 million from European competition revenues.

Matchday and Stadium Revenue

Liverpool’s Anfield Stadium, one of football’s most iconic venues, has undergone major redevelopment under FSG ownership.

The Anfield Road Stand expansion, completed in 2023, raised the stadium’s total capacity to 61,000 seats, increasing annual matchday income by an estimated $25–30 million.

Beyond matchdays, Anfield hosts concerts, tours, and corporate events — all adding to the club’s diversified income. The blend of sporting and entertainment use strengthens its financial position and keeps stadium utilization high year-round.

Infrastructure and Tangible Assets

The club’s infrastructure adds significant tangible value to its overall net worth. In addition to Anfield, the AXA Training Centre in Kirkby serves as one of the most advanced football facilities in Europe, enhancing both sporting performance and brand prestige.

Liverpool also owns global academy partnerships and development centers, which strengthen its long-term value by nurturing future talent and expanding its global footprint.

Recent Growth Trends

Liverpool’s valuation has grown consistently over the last decade, particularly since the appointment of Jürgen Klopp in 2015. Under Klopp, Liverpool achieved sporting and financial milestones that reignited its global appeal.

Between 2018 and 2022, the club won the UEFA Champions League, Premier League, FIFA Club World Cup, and FA Cup, leading to a surge in merchandise sales, sponsorship renewals, and digital engagement.

Even during global economic disruptions, Liverpool demonstrated financial resilience — maintaining profitability and expanding infrastructure without heavy debt reliance.

FSG’s data-driven management model and emphasis on long-term value creation have made Liverpool one of the few top clubs operating with sustainable profitability.

Market Position and Comparisons

At $5.4 billion, Liverpool stands shoulder-to-shoulder with the world’s largest sports franchises. Its valuation rivals that of major American teams such as the New York Yankees, Dallas Cowboys, and Los Angeles Lakers.

In Europe, Liverpool consistently ranks among the top four football clubs by value, closely competing with Manchester United, Real Madrid, and Barcelona. What sets Liverpool apart is its balance of financial prudence and competitive success — a rare combination in modern football.

Risks and Financial Challenges

Despite its robust valuation, Liverpool faces several risks that could affect its financial outlook in the coming years.

- Performance Dependence: Prolonged underperformance in the Premier League or missing out on Champions League qualification could reduce broadcasting and sponsorship income.

- Market Inflation: Transfer fee inflation and wage growth across European football put pressure on profit margins.

- Economic Conditions: Global recessions, currency fluctuations, or changes in media rights structures could affect club revenues.

- Ownership Transitions: While FSG maintains stable control, future ownership changes or strategic misalignment could impact valuation trajectory.

Nonetheless, the club’s diversified income and brand strength make it better positioned to withstand these challenges compared to many of its rivals.

Future Outlook

Liverpool’s financial future remains strong. The club’s ongoing commercial expansion, investment in digital platforms, and global fan engagement strategy are expected to continue driving growth.

Emerging opportunities in women’s football, eSports, and international academies may add new revenue streams by 2030. Furthermore, continued success under a stable management structure ensures Liverpool remains one of the most attractive global sports investments.

Liverpool FC Leadership

As of 2025, Liverpool Football Club operates under one of the most efficient and modern leadership systems in global football. The club’s governance, shaped by Fenway Sports Group (FSG), balances commercial success with on-field achievement.

The leadership framework is divided into three main tiers:

- Ownership and Board-Level Leadership

- Executive Management

- Sporting Leadership.

Each tier works in harmony to ensure Liverpool’s financial stability, global influence, and footballing excellence.

Ownership and Board-Level Leadership

John W. Henry – Principal Owner

John W. Henry is the Principal Owner of Fenway Sports Group (FSG) and the ultimate authority at Liverpool F.C. He oversees the club’s strategic direction, long-term investments, and overall business vision.

Henry’s approach centers on sustainability, data-driven decision-making, and long-term value creation. Since FSG’s takeover in 2010, he has led Liverpool’s transformation from financial uncertainty to global dominance, building a multi-billion-dollar franchise now valued at $5.4 billion (2025).

His leadership style prioritizes stability and intelligent spending, ensuring the club remains self-sufficient while competing at the highest level of European football.

Tom Werner – Chairman

Tom Werner serves as the Chairman of both Liverpool F.C. and Fenway Sports Group. He plays a crucial role in bridging the ownership’s strategic vision with the club’s operational leadership.

Werner oversees governance, approves key executive and managerial appointments, and represents Liverpool in official Premier League and UEFA matters. His influence extends beyond boardroom oversight, as he ensures that the club’s culture and operations remain aligned with FSG’s global standards.

Michael Gordon – FSG President

Michael Gordon, the President of Fenway Sports Group, acts as the operational link between FSG’s U.S. headquarters and Liverpool’s board in England.

He has been a central figure in key financial and sporting decisions, including transfer policies, infrastructure investments, and revenue management. Gordon’s financial discipline and involvement in Liverpool’s day-to-day governance have earned him a reputation as one of the most trusted figures within the ownership structure.

Together, Henry, Werner, and Gordon maintain a steady leadership foundation that ensures Liverpool’s commercial growth and footballing competitiveness remain balanced and sustainable.

Executive Management

Billy Hogan – Chief Executive Officer (CEO)

Billy Hogan has served as Liverpool’s Chief Executive Officer since 2020. He is responsible for the club’s global operations, revenue generation, sponsorships, and commercial development.

Hogan’s tenure has been marked by strong financial performance and international brand expansion. He spearheaded high-value partnerships with Nike, Standard Chartered, and AXA, making Liverpool one of the top revenue-generating clubs in football.

Under his leadership, Liverpool has strengthened its global fanbase, modernized its marketing strategy, and achieved consistent profitability while maintaining a community-focused identity.

Michael Edwards – CEO of Football (FSG)

In 2024, Michael Edwards returned to Fenway Sports Group as the CEO of Football, overseeing football operations across all FSG-owned clubs, including Liverpool.

Edwards previously served as Liverpool’s Sporting Director (2016–2022) and played a key role in assembling the squad that won the Champions League (2019) and Premier League (2020).

In his current position, Edwards ensures data analytics, scouting, and player recruitment strategies remain innovative and unified across FSG’s football portfolio. His return has reinforced Liverpool’s focus on analytical excellence and strategic talent development.

Financial and Legal Leadership

Liverpool’s financial operations are overseen by a Chief Financial Officer (CFO) who ensures compliance with Premier League and UEFA financial regulations. The CFO manages budgeting, capital allocation, and cost control, maintaining the club’s reputation for fiscal discipline.

The Chief Legal and External Affairs Officer handles regulatory affairs, international partnerships, and external communications, ensuring Liverpool’s business operations align with legal frameworks across multiple jurisdictions.

Sporting Leadership

Richard Hughes – Sporting Director

Appointed in 2024, Richard Hughes serves as Liverpool’s Sporting Director. He leads all aspects of football operations, including player recruitment, contract negotiations, and long-term squad planning.

Hughes works closely with Michael Edwards to align transfer strategies with FSG’s sustainable model. His focus lies in integrating data analytics, scouting, and youth development into the club’s decision-making process.

Under Hughes, Liverpool continues to target high-potential players who fit the club’s tactical philosophy and financial structure, ensuring long-term competitiveness.

Head Coach and First-Team Leadership

The Head Coach is responsible for first-team management, tactical systems, and player development. Supported by a specialized technical team, the coach collaborates with the sporting department on transfer planning, match preparation, and performance optimization.

Liverpool’s football operations emphasize collaboration between coaching and recruitment, ensuring every signing aligns with the club’s on-field identity.

Academy and Youth Development

Liverpool’s Academy and Youth Department, based at the AXA Training Centre in Kirkby, continues to be one of the best in Europe. The academy develops homegrown talent for both the first team and global transfer markets.

The integration between the academy and senior team has produced standout players such as Trent Alexander-Arnold and Curtis Jones, proving the club’s long-term commitment to nurturing young talent.

Governance and Decision-Making

Liverpool’s governance model is designed for efficiency and accountability. Decision-making flows clearly across three levels:

- Ownership and Board: Define long-term strategy, global partnerships, and financial priorities.

- Executive Management: Implements operational and commercial strategies aligned with board objectives.

- Sporting Leadership: Executes football-specific decisions within the club’s financial and tactical framework.

This hierarchy ensures that Liverpool maintains operational clarity while empowering football specialists to make performance-driven decisions.

Final Words

When it comes to understanding who owns Liverpool, the story goes far beyond financial figures and shareholder names. The club’s journey under Fenway Sports Group, guided by John W. Henry and Tom Werner, has redefined what modern football ownership can achieve. Through strategic investment, smart leadership, and a commitment to heritage, Liverpool has grown into a $5.4 billion global institution without losing its soul. The balance between passion and professionalism has turned Liverpool into a model of stability and success — a club built not just to win today, but to thrive for generations to come.

FAQs

Who owns the majority of Liverpool?

The majority of Liverpool F.C. is owned by Fenway Sports Group (FSG), an American sports investment company. Within FSG, John W. Henry holds the largest individual share, making him the principal and majority owner of the club.

Who owns Fenway Sports Group?

Fenway Sports Group is co-founded and primarily owned by John W. Henry and Tom Werner. Henry serves as the principal owner, while Werner is the group’s chairman. The company also includes minority shareholders such as RedBird Capital Partners, Arctos Partners, and Dynasty Equity, along with a few individual investors.

Does LeBron James own Liverpool?

LeBron James does not directly own Liverpool F.C. However, he is a minor investor in Fenway Sports Group, the parent company that owns Liverpool. His involvement gives him an indirect ownership stake in the club.

Who are the owners of Liverpool Football Club?

Liverpool F.C. is owned by Fenway Sports Group (FSG). The key figures are John W. Henry (principal owner), Tom Werner (chairman), and Michael Gordon (FSG president). Minority shareholders include RedBird Capital Partners, Arctos Partners, and Dynasty Equity.

How much does LeBron James own of Liverpool?

LeBron James initially acquired a 2% direct stake in Liverpool in 2011. In 2021, his ownership was converted into an equity stake in Fenway Sports Group, now estimated to be worth around 1% of FSG. This means he no longer owns a direct portion of the club but still indirectly benefits from Liverpool’s valuation growth.

Is it true that Elon Musk is buying Liverpool?

No, Elon Musk is not buying Liverpool. Although rumors occasionally circulate on social media, there is no factual basis or official confirmation of any sale or negotiations involving Musk. Fenway Sports Group remains the full owner of Liverpool F.C. as of 2025.