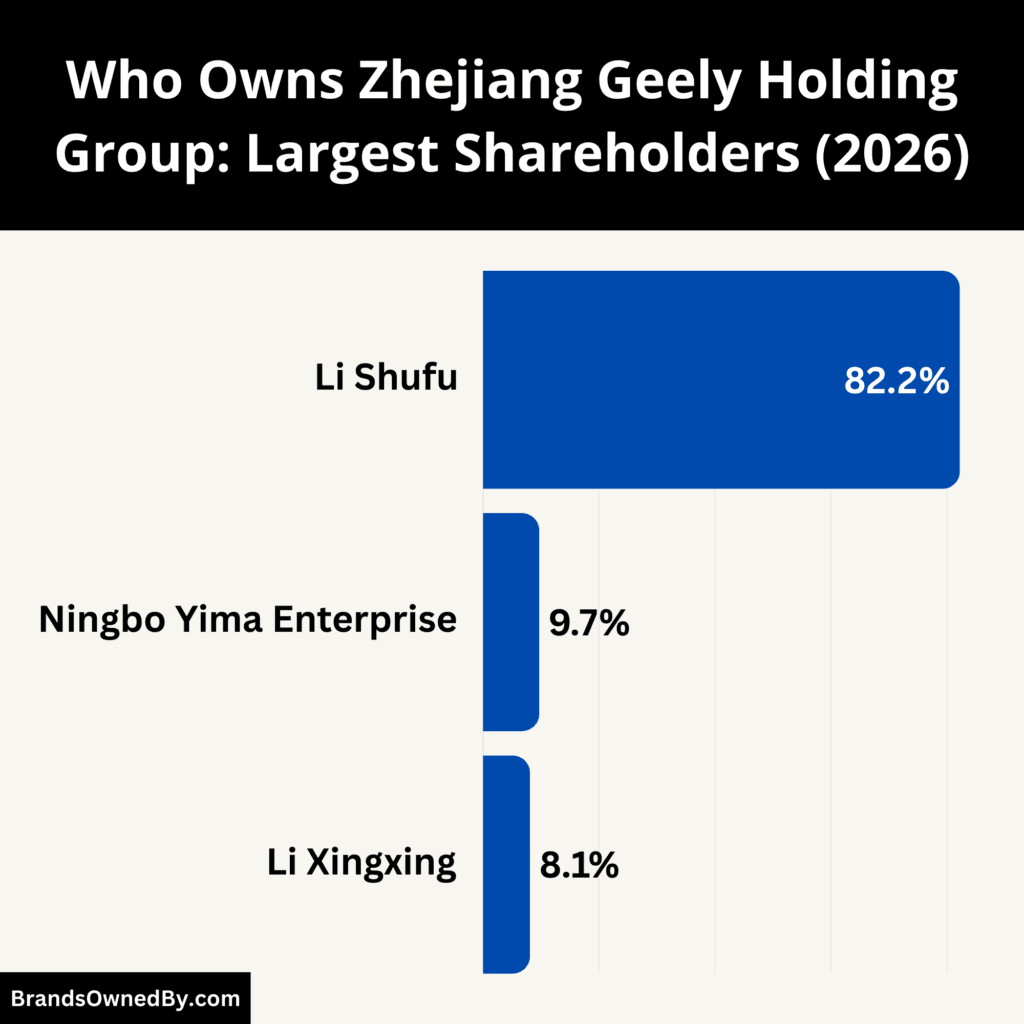

- Zhejiang Geely Holding Group is privately owned and controlled by Li Shufu, who holds approximately 82.2% of the holding company and retains ultimate voting and strategic authority.

- Ningbo Yima Enterprise Management Partnership holds about 9.7%, acting as a minority private investment shareholder with no controlling or strategic decision-making power.

- Li Xingxing, a member of the founding family, owns roughly 8.1%, representing family-level continuity in ownership while remaining non-controlling.

- Control is highly concentrated despite multiple shareholders, with Li Shufu’s majority stake ensuring that ownership, governance, and long-term strategy remain centralized and insulated from public or institutional influence.

Zhejiang Geely Holding Group (often shortened to Geely Holding or ZGH) is a private, global mobility technology group headquartered in Hangzhou, Zhejiang province, China.

The group builds passenger cars, commercial vehicles, and vehicle platforms. It also develops vehicle software, powertrains, and mobility services. Geely Holding operates R&D and design centres across Asia and Europe. It runs manufacturing sites in multiple countries and manages several independent consumer brands and engineering units.

The holding company itself is privately held and acts as a strategic investor and capital allocator for the group’s brands and businesses.

Geely has long pursued a multi-brand strategy. Brands under the group span mass market, premium, sports and commercial segments. The group organises brands to keep product development agile. Individual brands run their own design and executive teams. Group leadership coordinates long-term strategy, platform sharing, and capital allocation.

Founder

Li Shufu (also known as Eric Li) founded the company that became Geely Holding in 1986. He started as an entrepreneur in Taizhou, Zhejiang. His early business activities included refrigerator parts and other manufacturing.

Li moved the company into motorcycles and then into cars in the 1990s. He remains the driving force behind group strategy and major acquisitions. Li is widely described as the founder, chairman, and the ultimate controlling shareholder of the holding group.

Li’s leadership style blends long-term vision with bold dealmaking. He led the group’s first major international acquisition in 2010 when Geely bought Volvo Cars. That acquisition established Geely’s credentials as a global car company.

Since then, Li has overseen a steady program of brand purchases, joint ventures, and the creation of new EV-focused marques. His influence is exercised through private holding vehicles and group governance structures rather than through a widely dispersed public shareholder base.

Early Team and Evolution

The initial company was small and founder-led. Early teammates were engineers and managers drawn from local industry. As Geely moved into automobiles in 1997, the company recruited engineers, designers, and international advisers.

Over time Geely built global R&D hubs and hired international management for acquired brands while keeping ultimate decision rights at the group level. The result is a hybrid structure: local entrepreneurship at the brand level, and central strategic control at the holding level.

Ownership History

Zhejiang Geely Holding Group’s ownership history is defined by continuity. Control has remained concentrated since inception. Strategic evolution happened without surrendering authority.

Founder-Led Private Ownership In The Early Years

Zhejiang Geely Holding Group began as a privately owned enterprise. From the outset, ownership was held by its founder, Li Shufu. There were no institutional investors. There was no state participation. Control was personal and direct.

This structure gave the company freedom to experiment. It also allowed long-term planning without external pressure. Early decisions reflected entrepreneurial risk rather than policy direction or shareholder consensus.

Entry Into The Automotive Industry Without Diluting Control

When Geely entered the passenger vehicle business in 1997, ownership strategy did not change. The company did not raise capital by selling stakes in the holding group.

Growth was financed internally and through operating expansion. This was unusual in China’s auto sector, where many manufacturers relied on government backing or joint ventures. Geely’s private ownership preserved strategic independence at a critical stage.

Listing Subsidiaries While Keeping The Parent Company Private

A structural shift occurred in the early 2000s. Geely separated operating companies from the holding group.

The listing of Geely Auto in Hong Kong introduced public shareholders at the subsidiary level. It brought funding and market visibility. However, it did not alter who owned Zhejiang Geely Holding Group.

The holding company retained controlling stakes and voting power. Decision-making authority stayed centralized. This layered structure became a core feature of Geely’s ownership model.

Global Acquisitions And Layered Ownership Structures

The acquisition of Volvo Cars in 2010 marked a defining moment. Ownership was executed through Geely-controlled entities rather than a listed subsidiary.

Volvo remained operationally independent. It kept its brand identity and management structure. Yet ultimate ownership and strategic direction flowed back to the holding group.

This layered approach balanced global credibility with centralized control. It later became the template for other international brands acquired by Geely.

Expansion Through Majority And Strategic Minority Stakes

As Geely expanded, it adopted a flexible ownership strategy. Full ownership was not always required.

In some cases, Geely acquired majority stakes to guide direction while preserving brand autonomy. In others, it took influential minority positions to gain technology or market access. Regardless of structure, coordination remained with the holding group.

This flexibility reduced risk. It also made cross-border expansion easier in regulated markets.

Electric Vehicle Era And Internal Ownership Realignment

The shift toward electric vehicles introduced a new ownership phase. Geely created new EV-focused brands and technology platforms.

Some of these entities attracted external investors or were partially listed. Despite this, control mechanisms remained intact. The holding group retained board influence, voting rights, or majority ownership.

At the same time, Geely streamlined internal ownership. Overlapping brands were reorganized. Stakes were adjusted among subsidiaries. The goal was efficiency, not a change in control.

Current Ownership Structure And Continuity Of Control

Today, Zhejiang Geely Holding Group is still privately owned. There is no public shareholding at the parent level.

Ownership remains anchored with the founder and privately controlled entities. Strategic authority is centralized. Listings and partnerships operate beneath the holding structure.

This continuity explains Geely’s ability to execute long-term strategies, manage diverse global brands, and adapt repeatedly without losing control.

Who Owns Zhejiang Geely Holding Group: Major Shareholders

Zhejiang Geely Holding Group is owned and controlled by its founder, Li Shufu. He is the majority shareholder and holds decisive voting power over the privately held automotive conglomerate.

Ownership is concentrated among Li Shufu, select family interests, and a small number of private investment entities. This founder-centric ownership structure gives Li Shufu final authority over strategy, acquisitions, and long-term direction, making him the ultimate owner of Zhejiang Geely Holding Group as of 2026.

As of January 2026, the major shareholders of Zhejiang Geely Holding Group are:

- Li Shufu (Founder and Chairman): 82.2% ownership, controlling shareholder.

- Ningbo Yima Enterprise Management Partnership: 9.7% ownership, private limited partnership investor.

- Li Xingxing (Family Shareholder): 8.1% ownership, minority family stake.

Together, these shareholders create a concentrated ownership base. Li Shufu’s majority position ensures that all strategic decisions at the group level are made with unified control. Minority shareholders participate in capital but do not influence broad strategic direction.

Li Shufu: Founder and Controlling Shareholder

Li Shufu is the principal owner of Zhejiang Geely Holding Group. He founded the company in 1986 and has maintained overall control ever since. Li Shufu holds the largest portion of registered capital and voting power at the holding group level.

As of January 2026, Li Shufu directly and indirectly controls approximately 82.2% of the registered capital of Zhejiang Geely Holding Group. This makes him the majority shareholder and the final decision-maker for strategy and capital allocation within the conglomerate. His control is exercised through private holding vehicles rather than a public share class.

Li’s influence extends beyond simple ownership. As chairman, he shapes the group’s long-term direction, global acquisitions, and brand strategy. His role ensures that the holding group operates with strategic cohesion across a sprawling portfolio of automotive and mobility brands.

Ningbo Yima Enterprise Management Partnership

The second significant shareholder is Ningbo Yima Enterprise Management Partnership (Limited Partnership). This is a private investment partnership that holds roughly 9.7% of the registered capital in Zhejiang Geely Holding Group according to the latest financial disclosures. This entity is not a public institution or government body. Instead, it functions as a private investor within the group’s capital structure.

The presence of Ningbo Yima provides a minority ownership interest that participates in the group’s growth. However, its influence on strategic decisions is limited compared to the founder’s controlling position.

Li Xingxing

Another shareholder is Li Xingxing, an individual closely associated with the founding family. As of the most recent data, Li Xingxing holds approximately 8.1% of Zhejiang Geely Holding Group’s registered capital. Although a minority shareholder, this stake reflects family involvement in ownership beyond the founder himself. It also contributes to continuity in corporate governance within the family network.

Li Xingxing’s ownership illustrates how family members participate in the group’s capital while strategic control remains centralized. This type of family shareholding is common in privately controlled conglomerates.

Competitor Ownership Comparison

Zhejiang Geely Holding Group is founder-controlled and privately held, with Li Shufu as the ultimate owner and decision-maker. The competitors below represent a range of ownership models you’ll commonly see in the global auto industry: widely held public companies dominated by institutional investors, family/holding-company control, state-linked stakes, and founder/CEO concentrated ownership. Understanding these models clarifies how Geely’s governance, agility, risk tolerance, and strategic choices differ from peers.

| Company / Group | Ownership Type | Largest Owner(s) | Ownership Concentration | Control Structure | Strategic Implications |

|---|---|---|---|---|---|

| Zhejiang Geely Holding Group | Private, Founder-Owned | Li Shufu | Very High | Founder has majority ownership and full voting control | Fast decision-making. Long-term strategy prioritized. Minimal external pressure. |

| Toyota Motor Corporation | Public, Institution-Led | Toyota Industries, Japanese trust banks, institutional investors | Low | Board-driven with institutional and cross-shareholding influence | Conservative strategy. High stability. Slower strategic pivots. |

| Volkswagen Group | Public, Family + State Hybrid | Porsche–Piëch family (via Porsche SE), State of Lower Saxony | High (but split) | Voting control shared between family holding and state | Complex governance. Strategic decisions require multi-stakeholder alignment. |

| Stellantis | Public, Anchor Shareholder Model | Exor (Agnelli family), Peugeot family, Bpifrance | Medium | Anchor shareholder influences long-term direction | Balance between founder-style vision and public market discipline. |

| Ford Motor Company | Public, Family-Influenced | Ford family (via special voting shares), institutional investors | Medium | Dual-class structure preserves family influence | Long-term family vision with institutional oversight. |

| General Motors | Public, Institution-Led | Vanguard, BlackRock, State Street | Low | Institutional investor dominance | Strong capital market discipline. High transparency requirements. |

| Tesla | Public, Founder-Dominant | Elon Musk, institutional investors | Medium to High | Founder is largest individual shareholder and CEO | Bold strategy possible but constrained by public shareholders. |

| BYD | Public, Founder-Influenced | Founder-led entities, institutional investors | Medium | Management-led with strong institutional presence | Entrepreneurial leadership with capital market oversight. |

| Hyundai Motor Group | Public, Family & Cross-Holding | Chung family, Hyundai Mobis, affiliates | High | Chaebol-style cross-shareholding | Stable group control. Regulatory and governance scrutiny present. |

Toyota Motor Corporation

Toyota is one of the most widely held automakers in the world. Ownership is dispersed across institutional investors, Japanese trust banks, and long-standing cross-shareholdings with industrial partners. There is no dominant founder, family, or individual with decisive voting power.

This structure prioritizes stability and continuity. Decision-making is consensus-driven and deeply embedded in corporate governance processes. Strategic shifts tend to be incremental rather than disruptive.

In contrast, Geely’s ownership allows faster and more centralized execution. Where Toyota emphasizes risk control and gradual change, Geely can pursue bold structural moves without prolonged shareholder coordination.

Volkswagen Group

Volkswagen’s ownership is concentrated but fragmented. Control is shared between the Porsche–Piëch family, which dominates voting rights, and the State of Lower Saxony, which holds a legally protected stake. Public shareholders make up the remainder.

This creates a multi-layered power balance. Strategic decisions must account for family interests, political considerations, labor influence, and market expectations. Governance is powerful but complex.

Geely’s ownership is simpler. Authority flows from a single founder rather than competing blocs. This reduces internal friction and shortens decision cycles compared with Volkswagen’s hybrid model.

Stellantis

Stellantis sits between family influence and public accountability. Exor, the Agnelli family’s investment company, is the largest shareholder and provides long-term strategic direction. At the same time, the Peugeot family, the French state investment arm, and institutional investors hold meaningful stakes.

This anchor-shareholder model offers continuity but limits unilateral control. Major decisions require alignment among several powerful owners and compliance with public-market governance standards.

Geely differs in that it does not require such alignment at the parent level. Strategic authority is concentrated, not negotiated.

Ford Motor Company

Ford represents a legacy family-influenced public company. The Ford family retains enhanced voting rights through a dual-class share structure, despite owning a minority of economic shares. Institutional investors dominate the remainder.

This allows the family to protect long-term vision while still operating within public market constraints. Transparency, earnings expectations, and shareholder scrutiny shape major decisions.

Geely faces none of these pressures at the holding-company level. Its founder does not answer to public investors, which provides greater freedom in restructuring and capital allocation.

General Motors

General Motors is fully institutional in character. Ownership is widely distributed among asset managers and investment funds. There is no controlling shareholder and no founding family influence.

Governance is board-led and market-driven. Strategy is closely tied to shareholder returns, regulatory compliance, and quarterly performance metrics.

Compared with Geely, General Motors operates with far less strategic autonomy. Geely’s ownership allows it to absorb longer payback periods and structural experimentation without immediate market reaction.

Tesla

Tesla combines public ownership with strong founder influence. Its founder is the largest individual shareholder and holds significant informal power through leadership and reputation. Institutional investors still own a large portion of shares.

This hybrid structure enables bold leadership but imposes limits. Public disclosure rules, shareholder activism, and market volatility constrain absolute control.

Geely’s model goes further. Its founder control is embedded structurally, not reputationally. There is no public market mechanism capable of diluting authority at the parent level.

BYD

BYD operates as a publicly listed company with founder-linked ownership and substantial institutional participation. The founder remains closely tied to management, but ownership is dispersed across public shareholders.

This produces a balance between entrepreneurial leadership and capital-market discipline. Strategic decisions must satisfy both internal vision and external investor expectations.

Geely’s ownership is more concentrated. Control is not shared with public investors, making governance tighter and more centralized.

Hyundai Motor Group

Hyundai follows a chaebol structure rooted in family influence and cross-shareholdings among affiliated companies. Control is maintained through interconnected ownership rather than a single holding entity.

This enables coordinated group strategy but introduces complexity and regulatory scrutiny. Governance reforms and transparency pressures continue to shape the group.

Geely’s structure is cleaner. Control rests with one private holding company and one dominant founder, rather than a network of affiliated entities.

How Ownership Models Affect Strategy

- Speed vs. Accountability: Founder-controlled private groups (Geely) can move faster on acquisitions, restructurings, and brand experiments. Public/institutional models trade speed for investor accountability and market discipline. (See comparisons above.)

- Risk Appetite: Concentrated founders can take long-term, transformational bets (e.g., Geely buying Volvo). Institutions temper risk appetite with governance and disclosure demands.

- Political and Regulatory Considerations: State or politically significant shareholders (e.g., State of Lower Saxony at VW; Bpifrance at Stellantis) introduce policy and labor dimensions into decisions that a private founder can sidestep to a larger degree.

- Financing and Transparency: Public companies access broad capital markets but must meet investor expectations. Private parent companies rely on internal capital allocation and selective subsidiary listings to raise funds while preserving control.

Who Controls Zhejiang Geely Holding Group?

Control of Zhejiang Geely Holding Group is highly centralized and founder-driven. While the group operates dozens of brands and subsidiaries across multiple countries, strategic authority flows from the top. Governance is designed to combine tight control at the holding level with operational autonomy at the brand level.

Ultimate Control At The Holding Group Level

Zhejiang Geely Holding Group is a privately held company. There is no public board elected by external shareholders at the parent level. Control is exercised through ownership, not market mechanisms.

The holding company sets long-term strategy, approves major acquisitions, allocates capital, and determines brand positioning. Subsidiaries operate within this framework. Final authority always rests with the holding group.

This structure ensures unified direction across a complex global portfolio.

Role Of The Founder And Chairman

Li Shufu is the founder and chairman of Zhejiang Geely Holding Group. He is also the controlling shareholder.

Li Shufu exercises decisive influence over:

- Group-level strategy

- Major mergers and acquisitions

- Creation, consolidation, or restructuring of brands

- Senior leadership appointments at key subsidiaries.

His role goes beyond ceremonial chairmanship. He is actively involved in shaping the group’s long-term vision, especially in areas such as electrification, global expansion, and platform integration.

Because the group is privately owned, there are no external shareholders capable of overriding his decisions.

Decision-Making Structure Inside The Group

Zhejiang Geely Holding Group uses a layered decision-making model.

At the top, the holding group leadership defines strategy, investment priorities, and governance standards. Below that, each major business unit and brand has its own board and executive management team.

Operational decisions such as product design, marketing, and regional execution are handled at the brand level. Strategic decisions such as acquisitions, platform sharing, capital deployment, and brand realignment require approval from the holding group.

This structure balances control with flexibility.

Management Autonomy At The Brand Level

While control is centralized, Geely deliberately avoids micromanagement.

Brands such as Volvo Cars, Polestar, Lotus, and Zeekr operate with independent management teams. They have their own CEOs, boards, and engineering leadership. This autonomy protects brand identity and local market relevance.

However, autonomy does not mean independence from control. Capital allocation, ownership structure, and long-term direction remain aligned with group strategy set at the holding level.

Absence Of A Traditional Group CEO

Zhejiang Geely Holding Group does not operate with a single high-profile CEO in the Western conglomerate sense.

Instead, leadership is exercised through:

- The chairman

- Executive committees

- Brand-level CEOs.

This model reflects the group’s private ownership and founder-led governance. Authority is centralized through ownership rather than delegated to a standalone group CEO role.

Past And Present Leadership Continuity

Unlike many global automakers, Zhejiang Geely Holding Group has not seen frequent leadership turnover at the top.

Li Shufu has remained the central controlling figure since the company’s founding. This continuity has provided strategic consistency across decades of expansion, acquisitions, and industry transformation.

Brand-level leadership has evolved over time, especially after major acquisitions, but holding-level control has remained stable.

How Control Differs From Public Automakers

In publicly listed automotive groups, control is shaped by boards, institutional investors, and shareholder votes. Strategy is often constrained by quarterly performance and market expectations.

At Zhejiang Geely Holding Group, control is ownership-based. Strategic decisions are insulated from short-term market pressure. This allows long investment horizons and rapid execution.

This difference explains how Geely has been able to acquire global brands, reorganize portfolios, and invest aggressively in new technologies without dilution of authority.

Zhejiang Geely Holding Group Annual Revenue and Net Worth

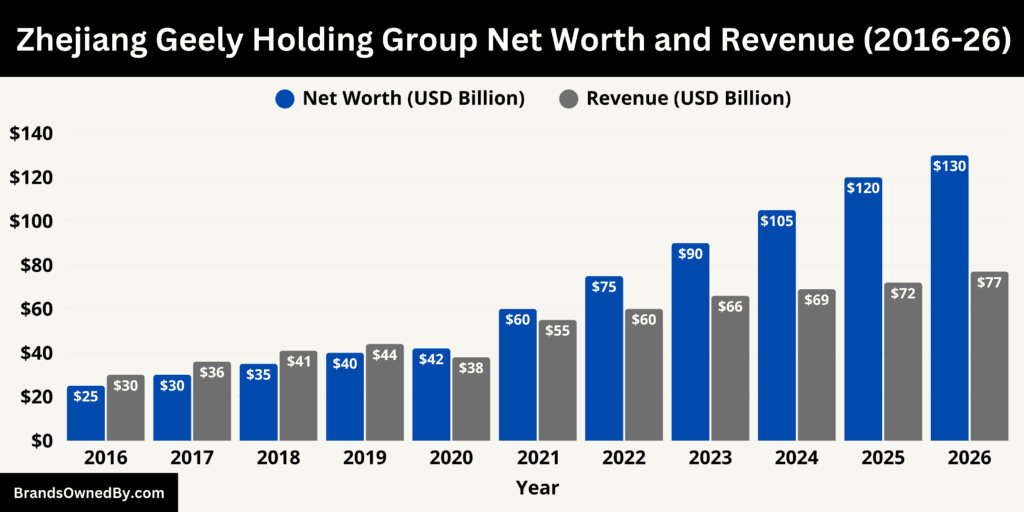

As of Januay 2026, Zhejiang Geely Holding Group reports estimated consolidated revenue of $77 billion and an estimated group net worth of $130 billion. These figures reflect the combined scale of its passenger vehicle brands, electric vehicle platforms, commercial vehicle operations, and automotive technology assets. Despite being privately held, the group’s size now rivals many publicly listed global automakers.

2026 Revenue Breakdown By Business Segment

Zhejiang Geely Holding Group’s 2026 revenue is diversified across four core segments.

Passenger vehicles remain the largest contributor. Mass-market brands led by Geely Auto account for approximately $38 billion, representing nearly half of total revenue. This segment benefits from high production volumes, strong domestic demand in China, and export growth in selected international markets.

Premium and luxury vehicles contribute an estimated $25 billion in revenue. This includes Volvo Cars, Zeekr, Polestar, and Lotus. Although unit volumes are lower than mass-market brands, higher average selling prices and technology-heavy models significantly lift revenue contribution.

Electric-vehicle-focused platforms and new-energy brands generate roughly $9 billion. This includes pure EV sales, platform-based vehicle production, and EV-specific architectures deployed across multiple brands.

Commercial vehicles and mobility services add approximately $5 billion. This segment includes electric vans, trucks, logistics vehicles, and urban mobility solutions. While smaller in scale, it is one of the fastest-growing revenue streams within the group.

Combined, these segments form the $77 billion consolidated revenue base for 2026.

Revenue Distribution By Geography

China remains the dominant revenue source, contributing an estimated $45 billion, or nearly 60% of total group revenue. Europe contributes approximately $22 billion, largely driven by Volvo Cars, Polestar, and Lotus. Other international markets, including Asia-Pacific regions outside China and limited exposure in North America, contribute the remaining $10 billion.

This geographic mix shows reduced reliance on a single market compared to earlier years, though China continues to anchor overall scale.

Net Worth

Zhejiang Geely Holding Group’s estimated $130 billion net worth, as of January 2026, is asset-driven rather than cash-driven.

Approximately $55 billion of net worth is derived from equity value in operating automotive brands, including wholly owned and majority-controlled companies. Volvo Cars represents the single largest value component within this category.

Another $35 billion is attributed to listed and partially listed subsidiaries, including market-based valuations adjusted for controlling stakes.

Technology platforms, intellectual property, and proprietary vehicle architectures account for an estimated $25 billion. This includes EV platforms, battery systems, powertrain technology, and software systems deployed across brands.

Manufacturing assets, global R&D centers, and strategic real estate holdings contribute the remaining $15 billion.

Together, these components form the group’s $130 billion estimated net worth in 2026.

Revenue And Net Worth Growth Drivers

Revenue growth between 2024 and 2026 was driven primarily by higher per-vehicle revenue rather than pure volume growth. Premium vehicles and electric models increased average selling prices. Platform sharing reduced marginal costs, improving revenue retention.

Net worth expanded faster than revenue due to asset appreciation. EV platforms, premium brands, and technology ownership increased valuation even when revenue growth moderated.

Private ownership enabled long-term investment without dilution, supporting asset value growth independent of short-term earnings cycles.

Future Revenue And Net Worth Forecast (Post-2026)

Based on current production capacity, brand mix, electrification progress, and platform integration, Zhejiang Geely Holding Group’s forward outlook can be reasonably estimated as follows:

- 2027: Estimated revenue of $82 billion, driven by higher EV penetration across Geely Auto, Zeekr, and Volvo models. Net worth estimated at $138 billion, reflecting asset appreciation in EV platforms and premium brands.

- 2028: Estimated revenue of $86 billion, supported by premium vehicle growth and improved per-unit margins. Net worth estimated at $147 billion, aided by technology platform valuation and expanded international presence.

- 2029: Estimated revenue of $90 billion, as electric and hybrid vehicles account for a larger share of total sales. Net worth estimated at $156 billion, with stronger contribution from proprietary architectures and software integration.

- 2030: Estimated revenue of $95 billion, assuming continued scaling of EV brands and stable demand in China and Europe. Net worth estimated at $165 billion, driven primarily by long-term asset value rather than short-term earnings.

Key Assumptions Behind The Forecast

- EV and electrified vehicles continue to replace internal combustion models across the portfolio

- Premium and luxury brands contribute a larger share of total revenue

- Platform sharing improves margins without proportional cost growth

- No major divestments or ownership dilution at the holding group level.

This forecast reflects controlled, asset-driven growth, consistent with Zhejiang Geely Holding Group’s founder-led and privately held structure.

Companies Owned by Zhejiang Geely Holding Group

Zhejiang Geely Holding Group directly owns, controls, and operates a broad portfolio of automotive manufacturers, electric vehicle brands, commercial vehicle units, technology companies, and engineering entities. These businesses sit under the holding group itself, not under an external parent.

Below is a list of the major companies and brands owned by Zhejiang Geely Holding Group:

| Company / Brand | Business Type | Primary Segment | Core Markets | Strategic Role Within Geely |

|---|---|---|---|---|

| Geely Auto | Automotive Manufacturer | Mass-market passenger vehicles | China, Asia, Middle East, Europe (exports) | Volume engine of the group. Platform testing ground. Core hybrid and ICE-to-EV transition brand. |

| Volvo Cars | Premium Automotive Brand | Premium and luxury passenger vehicles | Europe, North America, China | Global credibility anchor. Safety and EV technology leader. Platform and engineering contributor. |

| Polestar | EV Manufacturer | Premium electric performance vehicles | Europe, North America, China | Innovation showcase. Software-led EV development. Sustainability-focused brand. |

| Zeekr | EV Manufacturer | Premium electric vehicles | China, Europe (expanding) | High-margin EV growth engine. Advanced battery and digital architecture deployment. |

| Lotus Cars | Performance Automaker | Sports cars and electric performance vehicles | Europe, China, global luxury markets | Halo performance brand. Advanced aerodynamics and high-output EV technology. |

| Lynk & Co | Automotive Brand | Connected and subscription-based vehicles | Europe, China | Experimental ownership models. Digital retail and mobility concepts. |

| London Electric Vehicle Company | Commercial Vehicle Manufacturer | Electric taxis and light commercial vehicles | United Kingdom, Europe | Urban mobility and city-focused EV solutions. Specialized commercial segment presence. |

| Farizon Auto | Commercial Vehicle Brand | Electric trucks, vans, logistics vehicles | China, Asia | Electrified commercial transport growth. Fleet and logistics electrification strategy. |

| China Euro Vehicle Technology | Engineering & R&D Center | Vehicle platforms and safety systems | Europe, Global | Modular architecture development. Cost efficiency and platform sharing across brands. |

| Geely Design | Design Organization | Vehicle styling and UX | Global studios | Brand differentiation. Centralized design quality control. |

| Geely Powertrain | Powertrain Developer | ICE, hybrid, and electric drivetrains | Global | In-house propulsion technology. Reduces supplier dependence. |

| Geely Technology Group | Technology Division | Software, connectivity, autonomous systems | Global | Software-defined vehicle strategy. Intelligent mobility foundation. |

| Geely Battery Research | Battery R&D Unit | Battery chemistry and energy systems | Global | Battery cost control, performance optimization, supply security. |

Geely Auto

Geely Auto is the group’s primary mass-market automotive business and the foundation of its scale. It designs, manufactures, and sells a wide portfolio of sedans, SUVs, crossovers, hybrids, and battery-electric vehicles. The brand focuses heavily on the Chinese market, where it competes across multiple price segments, while steadily expanding exports into Europe, the Middle East, Eastern Europe, and Southeast Asia.

Operationally, Geely Auto acts as the group’s volume engine. High production scale allows it to amortize platform and powertrain development costs across millions of vehicles. The brand is also central to Geely’s hybrid strategy, serving customers transitioning from internal combustion engines to electrified drivetrains. Many vehicle architectures and software systems later used by other group brands are first deployed and tested within Geely Auto.

Volvo Cars

Volvo Cars represents Geely’s global premium automotive pillar. It operates as a full-scale international manufacturer with its own product planning, safety research, engineering standards, and global sales network. Volvo’s identity remains distinctly Scandinavian, with strong emphasis on safety, sustainability, and electrification.

Within the Geely ecosystem, Volvo Cars plays a critical technological and reputational role. Its safety systems, modular architectures, and electrification expertise are shared across the group. Volvo also anchors Geely’s presence in Europe and North America, providing regulatory credibility and brand trust that benefits the wider portfolio. Electrification is central to Volvo’s strategy, making it a key driver of Geely’s long-term EV transition.

Polestar

Polestar is positioned as a premium electric performance brand with a global footprint. It focuses on fully electric vehicles that combine performance, sustainability, and advanced digital interfaces. The brand emphasizes minimalist design, software-led user experience, and direct-to-consumer sales models.

Strategically, Polestar serves as Geely’s innovation-forward EV showcase. It operates at the intersection of luxury, performance, and sustainability, targeting buyers who prioritize technology and design over traditional brand heritage. Polestar also acts as a testing ground for next-generation vehicle software, over-the-air updates, and digital ownership models that may later be adopted by other Geely brands.

Zeekr

Zeekr is Geely’s premium electric brand aimed at higher-margin EV segments. It targets technology-focused consumers seeking advanced battery systems, long-range performance, fast charging, and high-end digital interiors. Zeekr vehicles are built on dedicated EV architectures designed for scalability and performance.

Within the group, Zeekr is central to Geely’s premium EV monetization strategy. It bridges the gap between mass-market EVs and ultra-luxury electric vehicles. Zeekr also plays a role in accelerating Geely’s in-house battery, software, and intelligent driving development, with many innovations later cascaded across the portfolio.

Lotus Cars

Lotus Cars functions as Geely’s performance and sports car brand. Historically known for lightweight engineering and driving dynamics, Lotus is undergoing a transformation into a modern performance and luxury EV brand. Its product range now includes electric hypercars, performance SUVs, and high-end electric sedans.

For Geely, Lotus serves as a halo brand. It reinforces engineering credibility and performance expertise at the top end of the portfolio. Lotus also allows Geely to compete in segments traditionally dominated by European luxury performance brands, while showcasing advanced materials, aerodynamics, and high-output electric powertrains.

Lynk & Co

Lynk & Co is a globally oriented brand positioned between mass-market and premium segments. It emphasizes connectivity, digital services, and alternative ownership models such as subscriptions and flexible usage. The brand combines European design language with efficient Chinese manufacturing.

Strategically, Lynk & Co targets urban, digitally native consumers who value access and technology over traditional car ownership. It allows Geely to experiment with new retail, subscription, and mobility concepts while maintaining a strong brand identity distinct from Geely Auto and Volvo.

London Electric Vehicle Company

The London Electric Vehicle Company focuses on electric taxis and light commercial vehicles. Its most recognizable product is the electric London black cab, which is widely used in urban transport systems. LEVC also develops electric vans for last-mile delivery and municipal use.

LEVC gives Geely a foothold in specialized urban mobility. It supports the group’s ambitions in electric commercial transport and city-focused vehicle solutions. The brand also strengthens Geely’s industrial presence in the United Kingdom and Europe.

Farizon Auto

Farizon Auto is Geely’s dedicated commercial vehicle division. It produces electric trucks, delivery vans, logistics vehicles, and specialized commercial platforms. The brand focuses heavily on electrification, fleet efficiency, and total cost of ownership.

Farizon plays a strategic role in diversifying Geely beyond passenger vehicles. It positions the group to benefit from electrification of logistics, urban delivery, and public-sector fleets. Commercial vehicles provide stable, long-term demand that complements cyclical passenger car markets.

China Euro Vehicle Technology (CEVT)

CEVT is Geely’s global engineering and research center. It develops modular vehicle architectures, powertrain systems, safety structures, and chassis technologies used across multiple brands. CEVT enables large-scale platform sharing while preserving brand differentiation.

This entity is central to Geely’s cost efficiency and speed to market. By developing common architectures centrally, Geely reduces duplication and accelerates product development across its portfolio.

Geely Design

Geely Design oversees global styling and user experience development. It operates multiple studios across Asia and Europe and influences the visual identity of most Geely-owned brands. The unit ensures consistent quality while allowing each brand to maintain its own design language.

Design centralization helps Geely compete visually with established global brands while maintaining efficiency. It also supports rapid iteration as consumer preferences evolve.

Geely Powertrain

Geely Powertrain develops internal combustion engines, hybrid systems, electric drivetrains, and transmission technologies. It supports both current-generation vehicles and transitional technologies needed during the shift to full electrification.

This unit reduces reliance on external suppliers and strengthens Geely’s intellectual property base. It also ensures flexibility as markets adopt electrification at different speeds.

Geely Technology Group

Geely Technology Group focuses on vehicle software, connectivity, autonomous driving systems, and digital platforms. It supports the transition toward software-defined vehicles and intelligent mobility.

This entity underpins Geely’s long-term competitiveness as vehicles become more software-centric. It also enables data-driven services and future mobility offerings.

Geely Battery Research

Geely Battery Research develops battery chemistry, energy density improvements, thermal management systems, and energy storage solutions. Battery technology is treated as a strategic asset rather than a commodity input.

In-house battery research improves cost control, supply security, and performance optimization across electric brands. It also supports long-term competitiveness as battery technology continues to evolve.

Final Words

Who owns Zhejiang Geely Holding Group is ultimately a question of control, not complexity. The group is privately owned and firmly controlled by its founder, Li Shufu. That ownership structure shapes everything the company does, from long-term investment decisions to how it manages a diverse global portfolio of brands.

Unlike many global automakers influenced by public markets or state interests, Geely operates with centralized authority and long-term focus. This has allowed it to grow across regions, technologies, and price segments while preserving brand independence and strategic coherence. Understanding who owns Zhejiang Geely Holding Group explains why the company moves decisively, invests patiently, and maintains a clear strategic direction across its global operations.

FAQs

Who is the owner of Zeekr?

Zeekr is owned and controlled by Zhejiang Geely Holding Group. The brand was created by Geely as a premium electric vehicle division, and strategic control remains with the Geely holding group.

Who owns Geely Holding Group?

Zhejiang Geely Holding Group is privately owned and controlled by its founder, Li Shufu. He holds the majority ownership stake and has final authority over strategy, investments, and governance.

Is Volvo 100% owned by Geely?

Yes. Volvo Cars is fully owned by Zhejiang Geely Holding Group. Volvo operates independently as a brand, but ultimate ownership and control rest with Geely.

Is VW owned by Geely?

No. Volkswagen Group is not owned by Geely. Volkswagen is controlled primarily by the Porsche–Piëch family through a holding company, along with state and public shareholders.

Is Geely owned by Volvo?

No. The relationship is the opposite. Volvo Cars is owned by Zhejiang Geely Holding Group. Geely is the parent owner, not a subsidiary of Volvo.

Does Geely use a Mitsubishi engine?

Historically, Geely used some Mitsubishi-sourced engines in older models. Today, Geely primarily relies on its own in-house engines and powertrain technologies, as well as shared architectures developed across its group brands.

Does Geely own Mercedes-Benz?

No. Geely does not own Mercedes-Benz. However, Geely’s founder Li Shufu holds a minority personal stake in Mercedes-Benz Group, which does not give Geely corporate control over the company.

Does Geely use a Volvo engine?

Yes. Geely uses Volvo-developed engines and powertrain technologies across several of its brands. Engine sharing and platform integration are part of Geely’s group-wide technology strategy.

What does Geely own?

Geely owns and controls a global portfolio of automotive and mobility businesses, including Geely Auto, Volvo Cars, Polestar, Zeekr, Lotus Cars, Lynk & Co, London Electric Vehicle Company, Farizon Auto, and multiple engineering and technology entities that support vehicle platforms, powertrains, and electric mobility.

Does Geely own Mercedes?

No. Geely does not own Mercedes. While there are partnerships and a minority personal investment by Li Shufu, Mercedes-Benz is not a subsidiary of Geely and operates independently under its own corporate structure.