Albertsons is one of the largest grocery chains in the United States. It has a rich history and a complex ownership structure. If you’re wondering who owns Albertsons, this article breaks down everything from its founding to its shareholders, subsidiaries, and financials.

Albertsons Company Profile

Albertsons Companies, Inc. is one of the largest food and drug retailers in the United States. Headquartered in Boise, Idaho, it operates over 2,200 stores across 34 states and the District of Columbia. The company serves millions of customers every week through a wide network of supermarket banners including Safeway, Vons, Shaw’s, Jewel-Osco, Acme, Tom Thumb, and others.

Founding and Early History

Albertsons was founded in 1939 by Joe Albertson, a former district manager for Safeway. He opened the first store in Boise, Idaho, with the philosophy: “Give the customer the merchandise they want, at a price they can afford, complete with lots of tender, loving care.” That single store was larger and more modern than most at the time and offered innovations such as a scratch bakery and an ice cream shop.

The company quickly gained popularity, expanding throughout the West and becoming a respected regional brand.

Growth and Expansion Milestones

- 1960s–1970s: Albertsons expanded across the western U.S., and by 1970, it had become a publicly traded company listed on the New York Stock Exchange. During this time, it opened stores in new markets including Texas and Louisiana.

- 1999: Albertsons made one of its most significant moves by acquiring American Stores Company for $11.7 billion. This acquisition added major grocery brands like Jewel-Osco, Shaw’s, and Acme Markets, strengthening Albertsons’ presence in the Midwest and Northeast.

- 2006: The company was broken up and sold to multiple buyers. Cerberus Capital Management acquired a portion of the stores and began rebuilding the brand.

- 2013: Albertsons, under Cerberus, acquired SuperValu’s Albertsons stores, uniting many locations under a single umbrella again.

- 2015: Albertsons merged with Safeway Inc. for about $9 billion. This brought in additional brands like Vons, Randalls, Tom Thumb, and Carrs.

- 2020: After several failed IPO attempts, Albertsons finally went public again on the New York Stock Exchange under the ticker symbol ACI.

- 2022–2025: Albertsons and Kroger announced a proposed merger to create a retail grocery powerhouse. As of 2025, the merger is still under regulatory review due to antitrust concerns.

Albertsons continues to adapt by investing in digital retail technology, loyalty programs, and home delivery services. It operates pharmacies in many of its stores and offers private label products that appeal to cost-conscious consumers.

This strong foundation, combined with strategic acquisitions and leadership, has helped Albertsons remain a key player in the competitive U.S. grocery market.

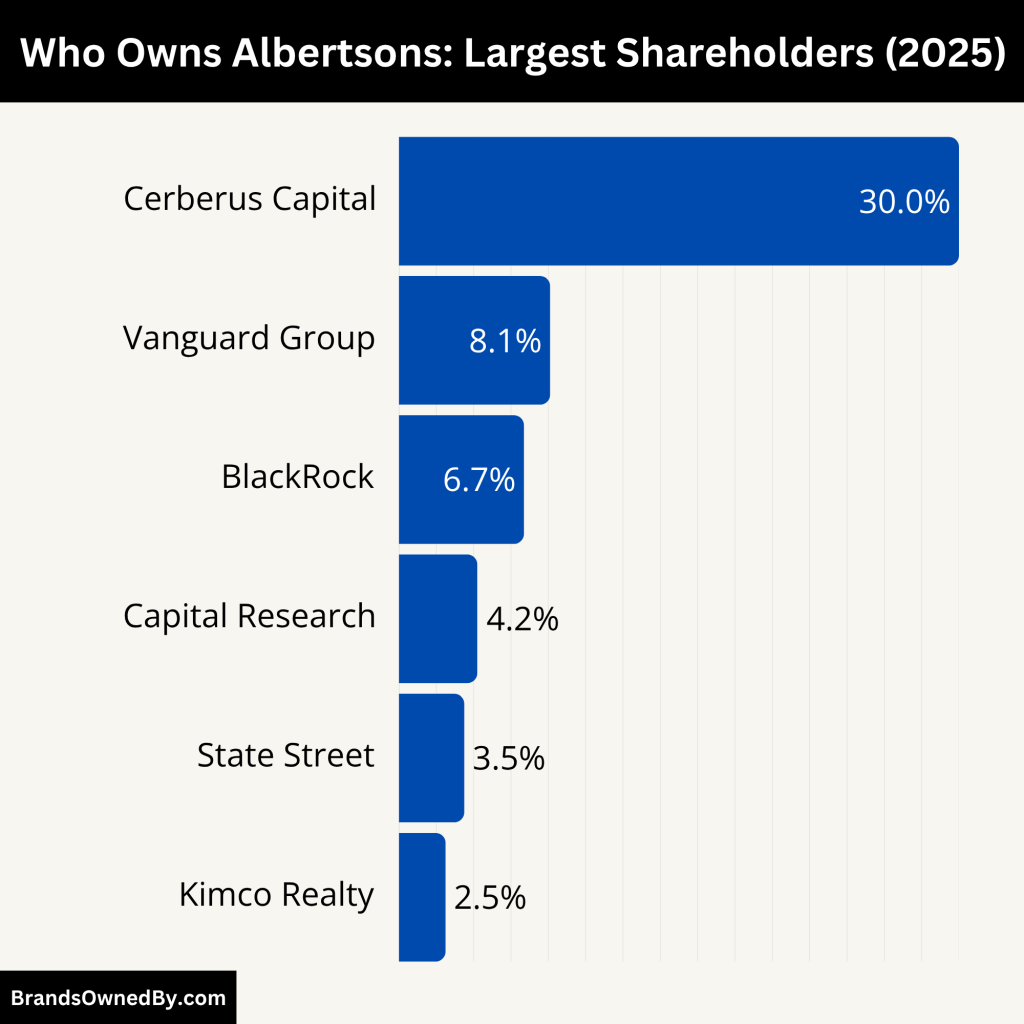

Who Owns Albertsons Markets: Top Shareholders

As of 2025, Albertsons is a publicly traded company listed on the New York Stock Exchange. While it has multiple institutional and retail shareholders, the majority stake is still held by Cerberus Capital Management, a private equity firm that played a key role in rebuilding the company.

Cerberus helped rescue Albertsons after its split from SuperValu and guided it through its merger with Safeway. Although Albertsons is now public, Cerberus continues to exercise significant influence through its holdings and board representation.

Below is a list of the largest shareholders of Albertsons as of 2025:

| Shareholder | Ownership % (2025) | Type | Control/Influence |

|---|---|---|---|

| Cerberus Capital Management | 30.0% | Private Equity | Board influence, strategic decisions |

| The Vanguard Group | 8.1% | Institutional | Passive investor, strong governance influence |

| BlackRock Inc. | 6.7% | Institutional | Corporate governance, ESG voting |

| Capital Research & Management | 4.2% | Institutional | Shareholder voting, long-term value investor |

| State Street Global Advisors | 3.5% | Institutional | Proxy voting, passive management |

| Kimco Realty | 2.5% | Strategic Investor | Real estate-focused, reduced control post-IPO |

| Executives and Insiders | 1.5% | Internal | Incentive-aligned ownership, limited voting power |

| Retail/Public Shareholders | 8.0% | Individual/Small Funds | Broad, dispersed, minor governance role |

Cerberus Capital Management

Cerberus Capital Management remains the largest single shareholder of Albertsons Companies in 2025. The private equity firm first invested in Albertsons in 2006 when it acquired a large portion of the business during its split from SuperValu. Since then, Cerberus has been instrumental in Albertsons’ rebuilding and expansion strategy.

As of 2025, Cerberus holds approximately 30% of the company’s outstanding shares. Despite Albertsons being a public company, Cerberus retains significant influence through multiple seats on the board of directors. This gives the firm considerable say in major decisions such as mergers, strategic partnerships, and executive appointments.

Cerberus also played a central role in the Safeway acquisition and supported Albertsons’ return to the public market in 2020. Although the firm has slowly reduced its holdings over time, it still maintains a controlling interest and exerts behind-the-scenes influence.

The Vanguard Group

The Vanguard Group, one of the world’s largest asset managers, is among the top institutional shareholders of Albertsons. As of early 2025, Vanguard owns roughly 8.1% of the company.

Vanguard is a passive investor, meaning it doesn’t engage in day-to-day management or strategic decisions. However, it participates actively in shareholder votes and corporate governance issues. Its large shareholding gives it a powerful voice on matters such as executive compensation, environmental policies, and board composition.

Vanguard’s presence signals strong institutional confidence in Albertsons’ long-term performance.

BlackRock Inc.

BlackRock, another leading investment management firm, owns around 6.7% of Albertsons as of 2025. Similar to Vanguard, BlackRock is a passive investor but plays a role in corporate governance through proxy voting.

BlackRock advocates for long-term value creation and sustainability. While it does not involve itself in Albertsons’ operations, it can influence decisions at shareholder meetings and annual votes.

Combined, BlackRock and Vanguard represent the voice of large institutional investors, giving them collective leverage in guiding company policies.

Kimco Realty Corporation

Kimco Realty was one of the early investors in Albertsons during its private equity phase. Though it held a larger share at the time of the company’s 2020 IPO, Kimco’s stake has since been reduced. As of 2025, it holds about 2.5% of Albertsons.

Kimco’s original interest was largely driven by the value of Albertsons’ real estate holdings. While no longer a major controlling shareholder, Kimco still maintains a financial interest and may benefit from any future asset monetization or mergers.

Capital Research & Management Company (American Funds)

Capital Research and Management, which manages the American Funds family, owns around 4.2% of Albertsons in 2025. This actively managed fund company is known for holding strategic positions in consumer-facing businesses.

Capital Research may influence shareholder outcomes through its voting power, though it does not engage directly with management on a regular basis.

State Street Global Advisors

State Street is another significant institutional shareholder, holding approximately 3.5% of the company’s shares in 2025. Like Vanguard and BlackRock, it manages index funds and ETFs.

Although State Street plays no direct operational role, it often aligns its governance stance with shareholder interests and corporate responsibility.

Company Executives and Insiders

Albertsons’ executive team and board members collectively own less than 1.5% of the company. These insider holdings include restricted stock units (RSUs), stock options, and direct share ownership by top leadership.

Current CEO Vivek Sankaran, CFO Sharon McCollam, and select board members have equity incentives tied to the company’s performance. While the percentage is relatively small, these shares align their financial interests with shareholders.

Retail Investors and Public Shareholders

Since its IPO, a growing number of retail investors have bought shares of Albertsons. These include individual investors using brokerage platforms and small investment funds. Retail ownership is estimated to account for around 8% of the total float.

While these shareholders typically lack the influence of institutional investors, they still contribute to the company’s public market valuation and voting base.

Who is the CEO of Albertsons?

Vivek Sankaran serves as the Chief Executive Officer of Albertsons Companies since April 2019. He brings extensive experience from his time at PepsiCo Foods North America, where he led major business segments and brand transformations. At Albertsons, he has prioritized digital transformation, expansion of loyalty programs, and modernization of store formats. Under his leadership, the company successfully completed its long-awaited IPO in March 2020 and navigated towards potential merger discussions with Kroger.

Leadership Style and Decision-Making

Vivek follows a collaborative leadership style. He emphasizes cross-functional teamwork among store operations, supply chain, marketing, and digital teams. He regularly meets with regional presidents and division heads to ensure aligned strategy execution. The board of directors oversees his strategic decisions, but Sankaran retains authority over day-to-day operations and long-term vision.

Strategic Initiatives Under Sankaran

- Technology and Digital Retail: Rollout of “DriveUp & Go” pickup services and expansion of online grocery delivery.

- Customer Loyalty: Revamped the “Just for U” program with personalized deals and expanded app engagement.

- Store Modernization: Refreshed several banner formats including Safeway and Jewel‑Osco with enhanced fresh-food sections and updated layouts.

Past CEOs of Albertsons

Bob Miller (2015–2018)

Prior to Vivek Sankaran, Bob Miller served as CEO after leading Safeway during the 2015 merger with Albertsons. Miller became executive chairman following the merger and guided the integration of the two large grocery chains. He played a key role in preparing the company for its IPO and led rebuilding initiatives across brands.

Don Carty (Interim, 2016)

Don Carty briefly served as the interim CEO during the transition period between the Safeway merger and permanent leadership appointments. He helped maintain operational stability during the integration process.

Larry Johnston (2011–2015)

Larry Johnston served as CEO before the merger with Safeway. He focused on operational efficiency, supply chain enhancements, and expansion of private labels. His tenure helped prime Albertsons for the subsequent multi-billion-dollar merger.

Leadership Structure and Governance

Albertsons operates under a classic corporate governance framework. The board of directors, chaired by a non-executive member, sets major corporate strategy, approves large investments, and oversees succession planning. The CEO chairs the executive leadership team, which includes the CFO, Chief Operating Officer, Chief Digital Officer, and heads of regional divisions. Major capital decisions or mergers require both the CEO’s recommendation and board approval.

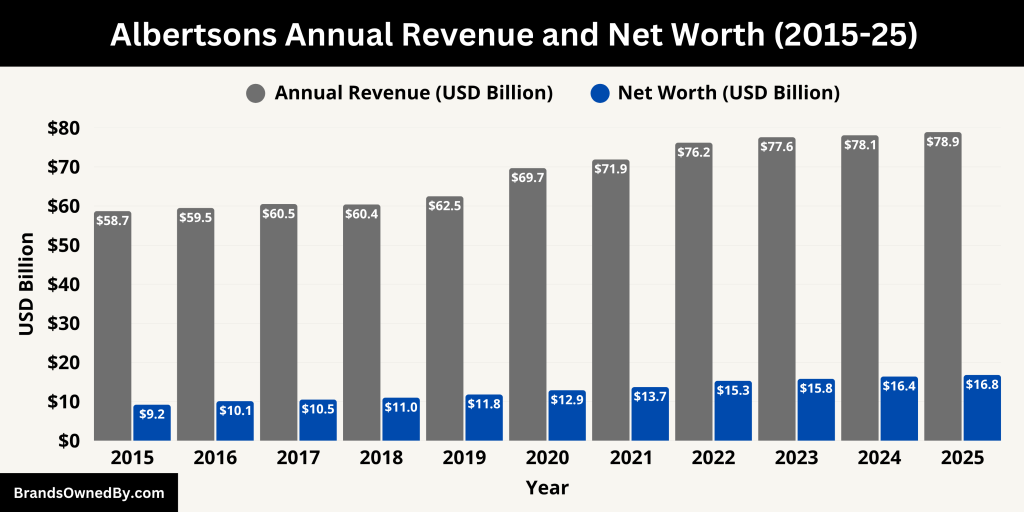

Albertsons Annual Revenue and Net Worth

For the fiscal year ending February 2025, Albertsons generated a trailing twelve‑month revenue of $80.39 billion, marking a 1.46 % increase from 2024’s $79.24 billion. This steady growth reflects consistent demand in its core grocery and pharmacy segments.

In Q1 2025 (ended February 28), Albertsons reported $18.80 billion in sales, a 2.51 % year‑over‑year rise. Notably, the pharmacy operations played a central role in boosting same-store sales during this period.

Albertsons recorded a net income of $958.6 million for the 12 months ending February 2025, down about 26 % from 2024’s $1.295 billion. This decline mainly stems from rising operational and labor costs.

The Q1 2025 net profit of $172 million represented a 31 % decrease compared to the same quarter last year. Despite strong revenues, margin pressures from inflation and strategic investments weighed on profitability.

As of early June 2025, Albertsons’ net worth stands at approximately $16.8 billion, fluctuating slightly across sources. This value reflects market expectations based on earnings, debt, and growth potential.

Including total debt of $339 million, Albertsons’ enterprise value is around $26 billion.

Financial Metrics

- EBITDA: Approximately $4.5 billion for the trailing 12 months.

- Total Debt: $14.18 billion, with moderate leverage.

- Shareholder Equity: $3.39 billion, implying a tangible book value of about $5.88 per share.

- Free Cash Flow: Roughly $749 million for the trailing 12 months.

Here’s an overview of the historical revenue and net worth of Albertsons for the last 10 years:

| Year | Annual Revenue (USD) | Estimated Net Worth (USD) |

|---|---|---|

| 2015 | $58.7 billion | $9.2 billion |

| 2016 | $59.5 billion | $10.1 billion |

| 2017 | $60.5 billion | $10.5 billion |

| 2018 | $60.4 billion | $11.0 billion |

| 2019 | $62.5 billion | $11.8 billion |

| 2020 | $69.7 billion | $12.9 billion |

| 2021 | $71.9 billion | $13.7 billion |

| 2022 | $76.2 billion | $15.3 billion |

| 2023 | $77.6 billion | $15.8 billion |

| 2024 | $78.1 billion | $16.4 billion |

| 2025 | $78.9 billion | $16.8 billion |

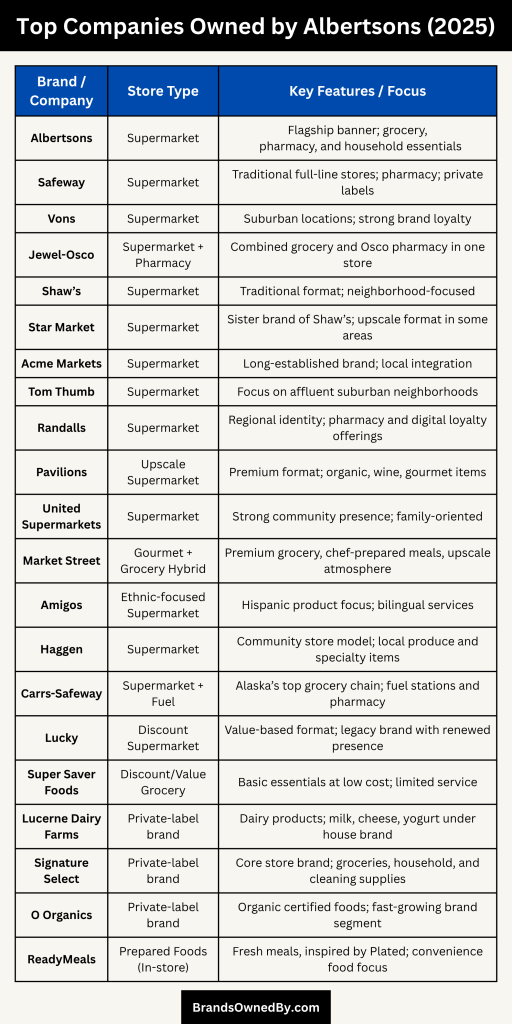

Brands and Companies Owned by Albertsons

Albertsons owns several well-known grocery store chains. Each operates under its original brand name but follows centralized management strategies.

Here’s a list of the major companies, brands, acquisitions, mergers, and entities owned and operated by Albertsons Companies Inc. as of 2025:

| Brand/Company Name | Primary Regions | Store Type | Key Features / Focus |

|---|---|---|---|

| Albertsons | Western U.S. | Supermarket | Flagship banner; grocery, pharmacy, and household essentials |

| Safeway | Western & Central U.S. | Supermarket | Traditional full-line stores; pharmacy; private labels |

| Vons | Southern California & Nevada | Supermarket | Suburban locations; strong brand loyalty |

| Jewel-Osco | Midwest (IL, IN, IA) | Supermarket + Pharmacy | Combined grocery and Osco pharmacy in one store |

| Shaw’s | New England (MA, VT, ME, NH) | Supermarket | Traditional format; neighborhood-focused |

| Star Market | Greater Boston area | Supermarket | Sister brand of Shaw’s; upscale format in some areas |

| Acme Markets | East Coast (PA, NJ, DE, MD) | Supermarket | Long-established brand; local integration |

| Tom Thumb | Dallas–Fort Worth, Texas | Supermarket | Focus on affluent suburban neighborhoods |

| Randalls | Houston & Central Texas | Supermarket | Regional identity; pharmacy and digital loyalty offerings |

| Pavilions | Southern California | Upscale Supermarket | Premium format; organic, wine, gourmet items |

| United Supermarkets | West Texas & Eastern New Mexico | Supermarket | Strong community presence; family-oriented |

| Market Street | Texas (under United division) | Gourmet + Grocery Hybrid | Premium grocery, chef-prepared meals, upscale atmosphere |

| Amigos | Texas & New Mexico | Ethnic-focused Supermarket | Hispanic product focus; bilingual services |

| Haggen | Pacific Northwest | Supermarket | Community store model; local produce and specialty items |

| Carrs-Safeway | Alaska | Supermarket + Fuel | Alaska’s top grocery chain; fuel stations and pharmacy |

| Lucky | Select markets in California | Discount Supermarket | Value-based format; legacy brand with renewed presence |

| Super Saver Foods | Select regional markets | Discount/Value Grocery | Basic essentials at low cost; limited service |

| Lucerne Dairy Farms | Nationwide | Private-label brand | Dairy products; milk, cheese, yogurt under house brand |

| Signature Select | Nationwide | Private-label brand | Core store brand; groceries, household, and cleaning supplies |

| O Organics | Nationwide | Private-label brand | Organic certified foods; fast-growing brand segment |

| ReadyMeals | Nationwide (in-store) | Prepared Foods (In-store) | Fresh meals, inspired by Plated; convenience food focus |

Safeway

Safeway is one of the largest and most recognized supermarket chains under the Albertsons umbrella. Acquired in 2015, Safeway operates across the western and central United States. It continues to run under its own name, with a strong focus on fresh produce, private-label brands, and pharmacy services. Safeway remains a key driver of revenue and regional loyalty for Albertsons.

Vons

Vons is a long-standing supermarket chain operating mainly in Southern California and Nevada. Known for its suburban neighborhood presence, Vons offers Albertsons’ full suite of loyalty programs, digital coupons, and private-label brands. It continues to be one of the most visible regional assets in the company’s portfolio.

Albertsons (Flagship Brand)

The Albertsons banner is the flagship and original grocery brand, primarily operating in the western United States. It reflects the traditional supermarket model, combining groceries, household goods, and pharmacy services. Many legacy stores have been remodeled under Sankaran’s leadership to offer a more modern and fresh-focused experience.

Jewel-Osco

Jewel-Osco is a major regional chain in the Midwest, particularly Illinois, Indiana, and Iowa. The brand combines a full-line grocery store (Jewel) and a pharmacy (Osco) in one location. Jewel-Osco has a strong market presence in Chicago and is central to Albertsons’ Midwest operations.

Shaw’s

Shaw’s is a grocery brand operating in New England, with a legacy dating back to the 1800s. Albertsons owns and operates Shaw’s stores in states like Massachusetts, Vermont, and Maine. The chain emphasizes community engagement and traditional values while adopting modern digital platforms.

Star Market

Star Market is the sister brand to Shaw’s and operates mainly in the Greater Boston area. Star Market stores often share layouts, offerings, and promotions with Shaw’s but retain unique branding and customer identity.

Acme Markets

Acme is Albertsons’ dominant East Coast brand, particularly in Pennsylvania, New Jersey, Delaware, and Maryland. Known for its deep roots and neighborhood focus, Acme has grown into a vital part of Albertsons’ East Coast footprint. It offers pharmacy services, digital shopping, and in-store pickup options.

Tom Thumb

Tom Thumb operates in the Dallas–Fort Worth metroplex in Texas. The brand emphasizes fresh offerings, personalized service, and regional engagement. Its stores often cater to affluent neighborhoods and offer expanded specialty food options.

Randalls

Randalls is the Houston-based sibling to Tom Thumb, serving much of South Texas. Though smaller in scale, it plays a key role in Albertsons’ strategy in Texas, where competition is intense from H-E-B and Kroger.

Pavilions

Pavilions is an upscale grocery brand found primarily in Southern California. It caters to more premium demographics and offers organic, natural, and gourmet food selections. Pavilions stores are known for wide wine selections, higher-end produce, and wellness product lines.

United Supermarkets

United Supermarkets operates in West Texas and eastern New Mexico. It’s a regionally beloved brand offering traditional groceries, bakery items, and community-centered service. It was acquired by Albertsons in 2014 and has remained operational under its own brand.

Market Street

Market Street is a subsidiary of United Supermarkets and functions as a hybrid between a traditional grocery store and a gourmet market. It offers organic produce, chef-prepared meals, and lifestyle-based merchandising. Market Street stores emphasize in-store dining, health-conscious options, and upscale presentation.

Amigos

Amigos caters to Hispanic communities in Texas and New Mexico. It is a culturally focused grocery chain offering authentic Latin American products, bilingual signage, and community-specific services. Amigos plays a vital role in Albertsons’ multicultural market strategy.

Haggen

Haggen was acquired by Albertsons in stages, starting in 2015 after the chain filed for bankruptcy. Though most stores were converted into other Albertsons banners, a few Haggen stores continue to operate under their original name in the Pacific Northwest. These serve as niche, community-oriented stores with a focus on local produce and specialty goods.

Carrs-Safeway

Carrs is Albertsons’ Alaskan grocery banner, operating under the co-branded name Carrs-Safeway. It offers grocery, pharmacy, and fuel services, and has a strong presence in Anchorage and surrounding regions. Carrs is the dominant supermarket name in Alaska.

Lucky (Legacy/Selected Locations)

Lucky is a legacy brand originally from Northern California, which Albertsons has reintroduced in select markets. The brand is often positioned as a value-oriented chain with a focus on affordable grocery offerings. While limited in scale, it adds variety to Albertsons’ brand mix.

Super Saver Foods

Super Saver is a discount grocery brand that operates in a few regional markets. The banner targets price-sensitive customers and focuses on essentials, limited service, and value-driven promotions.

Plated (Discontinued Brand)

Plated was a meal kit company acquired by Albertsons in 2017. Although it was integrated into in-store offerings for a short time, the brand has since been phased out. However, its influence continues through ReadyMeals, a newer prepared-meals concept within Albertsons stores.

Lucerne Dairy Farms (Private Label)

Lucerne Dairy Farms is one of Albertsons’ most successful private-label brands. It offers dairy products, including milk, cheese, yogurt, and creamers. The brand is sold across nearly all Albertsons banners.

Signature Select and O Organics (Private Labels)

Albertsons operates Signature Select, its core private-label grocery brand, offering a wide array of pantry and household essentials. It also owns O Organics, a growing line of certified organic foods, which has gained strong traction nationwide. These labels are part of Albertsons’ broader strategy to compete with Trader Joe’s, Walmart’s Great Value, and Kroger’s Simple Truth.

Final Thoughts

Understanding who owns Albertsons helps explain how it has grown and adapted over time. From a single store in Idaho to a nationwide supermarket powerhouse, Albertsons has undergone significant changes. While it is now a public company, Cerberus Capital Management still plays a central role in its operations.

Albertsons remains a key player in the grocery industry, driven by strong leadership and a diverse portfolio of regional brands.

FAQs

Who is the largest shareholder of Albertsons?

The largest shareholder of Albertsons in 2025 is Cerberus Capital Management, a private equity firm that has held a controlling stake in the company since its acquisition of Albertsons in 2006. Through various investment vehicles like Kimco Realty, Lubert-Adler, and Schottenstein Stores, Cerberus has retained substantial influence, though it has gradually reduced its ownership through public offerings.

Are Safeway and Albertsons owned by the same company?

Yes, Safeway and Albertsons are owned by the same parent company—Albertsons Companies Inc. Safeway was acquired by Albertsons in 2015 in a multi-billion-dollar deal that created one of the largest supermarket chains in the U.S.

Is Albertsons in debt?

Yes, as of 2025, Albertsons carries a moderate level of long-term debt, typical of large retail chains with extensive operations, real estate holdings, and store refurbishments. The debt level is manageable and supported by steady revenues and strong cash flow, but rising interest rates and inflationary pressures have increased debt servicing costs.

How much of Albertsons does Cerberus own?

As of 2025, Cerberus Capital Management and its affiliates still own approximately 28–30% of Albertsons’ outstanding shares. Though this is lower than their original controlling stake pre-IPO, they remain the largest and most influential shareholder group.

Who is the chairman of the Albertsons board?

As of 2025, the Chairman of the Board of Albertsons Companies is Chan Galbato, a longtime Cerberus operating executive. He represents Cerberus’ interests and plays a key governance role in shaping corporate strategy and shareholder decisions.

How many shares of Albertsons are there?

As of 2025, Albertsons Companies Inc. has approximately 576 million shares outstanding, based on its recent filings. This includes shares held by institutional investors, public shareholders, insiders, and private equity groups.

Does Kroger own Albertsons?

No, Kroger does not own Albertsons. Although Kroger announced a proposed acquisition of Albertsons in 2022, the deal faced heavy regulatory scrutiny from the Federal Trade Commission (FTC). As of 2025, the merger has been delayed and remains under review, and the companies continue to operate independently.

Who bought Albertsons grocery stores?

Albertsons grocery stores were originally bought by Cerberus Capital Management and partners in 2006 after being spun off from SuperValu and other groups. Later, Albertsons grew by acquiring Safeway in 2015 and other regional chains.

Is Safeway owned by Albertsons?

Yes, Safeway is fully owned by Albertsons Companies Inc. It has been part of the Albertsons brand portfolio since its acquisition in 2015, and it operates under its own banner across multiple U.S. states.

Does Albertsons own Aldi?

No, Albertsons does not own Aldi. Aldi is a German-based discount supermarket chain, privately owned by the Albrecht family, and operates entirely independently of Albertsons.

Who owns Albertsons supermarkets?

Albertsons supermarkets are owned by Albertsons Companies Inc., a publicly traded company on the NYSE under the ticker ACI. Its largest owners include Cerberus Capital Management, Apollo Global Management, Vanguard Group, and BlackRock, among other institutional investors.

What grocery stores are owned by Albertsons?

Albertsons owns several major grocery store brands including:

- Albertsons (flagship)

- Safeway

- Vons

- Jewel-Osco

- Shaw’s

- Star Market

- Acme Markets

- Tom Thumb

- Randalls

- Pavilions

- United Supermarkets

- Market Street

- Amigos

- Carrs-Safeway

- Haggen

- Lucky (in select markets)

Who owns Albertsons Companies?

Albertsons Companies Inc. is a public company listed on the NYSE. It is majority-owned by institutional investors, with Cerberus Capital Management holding the largest stake. Other significant shareholders include Apollo Global, Vanguard, and BlackRock.

Who bought out Safeway stores?

Albertsons Companies Inc. bought out Safeway Inc. in a major acquisition completed in 2015. This strategic merger helped Albertsons become one of the largest grocery retailers in the United States.

Is Albertsons still privately owned?

No, Albertsons is a public company. It went public in 2020 but still has significant private equity ownership.

What happened to the Kroger and Albertsons merger?

As of 2025, the merger is still under regulatory review. The companies proposed it in 2022, but no final decision has been announced.

Does Cerberus still own Albertsons?

Yes, Cerberus Capital Management remains the largest shareholder with about 30% of the company.

How many stores does Albertsons own?

Albertsons owns over 2,200 stores across the U.S. under various brand names.

Who started Albertsons?

Albertsons was founded by Joe Albertson in 1939 in Boise, Idaho.

What companies does Albertsons own?

It owns Safeway, Vons, Jewel-Osco, Shaw’s, Star Market, Acme Markets, United Supermarkets, Tom Thumb, Randalls, and Haggen.

Who is the parent company of Safeway?

Safeway is a subsidiary of Albertsons Companies, Inc.