Yum Brands is one of the biggest names in the fast-food world. Known for owning famous chains like KFC, Pizza Hut, and Taco Bell, many ask: who owns Yum Brands?

It is a publicly traded company with the largest shareholder being The Vanguard Group.

Keep reading to find out more about its ownership, leadership, financials, and more.

History of Yum! Brands

Yum! Brands was formed in 1997 as Tricon Global Restaurants. It was a spin-off from PepsiCo, which had originally owned KFC, Pizza Hut, and Taco Bell.

Origins under PepsiCo

Before Yum Brands existed, PepsiCo owned several restaurant chains. These included KFC, Pizza Hut, and Taco Bell. PepsiCo acquired Pizza Hut in 1977, followed by Taco Bell in 1978. It later added KFC to its portfolio by purchasing its parent company, Heublein, in 1986. These chains were managed together under the PepsiCo Restaurants division.

However, by the mid-1990s, PepsiCo wanted to focus on its core beverage and snack businesses. The restaurant division was profitable but required a different operational focus. As a result, PepsiCo decided to spin off its restaurant business.

Spin-Off and Creation of Tricon Global Restaurants

In 1997, PepsiCo officially spun off its restaurant division. The new independent company was named Tricon Global Restaurants, Inc. It began trading on the New York Stock Exchange with the stock ticker “YUM.” At the time, it was the world’s largest restaurant company in terms of units, overseeing over 29,000 restaurants.

Tricon focused on strengthening operations, cutting costs, and expanding globally. It operated KFC, Pizza Hut, and Taco Bell, each with a strong international presence.

Rebranding as Yum! Brands

In 2002, Tricon changed its name to Yum! Brands, Inc. The new name reflected a shift toward building a strong consumer-facing identity. The rebrand also aligned better with its focus on food and global expansion.

The company began emphasizing its mission to be the world’s best quick-service restaurant company. It ramped up international franchising and streamlined operations. Yum also invested heavily in brand positioning and customer experience.

International Growth and Entry into Emerging Markets

Throughout the 2000s and early 2010s, Yum Brands expanded rapidly, especially in emerging markets like China and India. China, in particular, became a key market. KFC was especially successful there, adapting its menu to local tastes.

By 2011, China accounted for a major share of Yum’s profits. However, managing operations in China proved complex due to regulatory and food safety challenges. This led to a major structural decision.

The Creation of Yum China

In 2016, Yum Brands spun off its China business into a separate company called Yum China Holdings, Inc. Yum China was listed on the New York Stock Exchange and now operates independently. It owns exclusive rights to KFC, Pizza Hut, and Taco Bell in China.

This spin-off allowed Yum Brands to focus on franchising and asset-light growth in other global markets, while Yum China handled local operations in one of the world’s largest consumer markets.

Recent Developments and Brand Expansion

In 2020, Yum acquired The Habit Burger Grill, a fast-casual chain specializing in chargrilled burgers. This marked a diversification beyond its traditional fast-food roots.

Yum also doubled down on digital transformation, delivery partnerships, and sustainability initiatives. Under current leadership, the company continues to innovate, focusing on digital ordering, eco-friendly packaging, and expanding its franchise network globally.

Today, Yum Brands operates over 55,000 restaurants in more than 155 countries, making it one of the largest and most recognized names in global quick-service dining.

Who Owns Yum Brands: List of Shareholders

Yum! Brands is a publicly traded company listed on the New York Stock Exchange under the ticker symbol YUM. It is not owned by a single person. Instead, its ownership is divided among institutional investors, mutual funds, and individual shareholders. The largest shareholder is Vanguard Group Inc., one of the biggest asset managers in the world.

Here’s an overview of the top shareholders of Yum! Brands:

- Total Institutional Ownership: 84.63%

- Total Insider Ownership: 8.92%

- Retail/Public Ownership: 6.44%

| Shareholder Name | Ownership % | Shares Owned | Type |

|---|---|---|---|

| Vanguard Group Inc. | 11.92% | 33,541,268 | Institutional (Passive) |

| BlackRock Inc. | 9.60% | 26,718,863 | Institutional (Passive) |

| JPMorgan Chase & Co. | 8.24% | 22,992,768 | Institutional (Active) |

| Keith A. Meister (Corvex Management) | 7.54% | 21,040,195 | Individual / Hedge Fund |

| Capital Research & Mgmt. Co. | 5.54% | 15,460,580 | Institutional (Active) |

| State Street Corporation | 4.69% | 13,081,621 | Institutional (Passive) |

| T. Rowe Price Investment Mgmt. | 3.72% | 10,374,367 | Institutional (Active) |

| Capital World Investors | 3.50% | 9,773,241 | Institutional (Active) |

| Geode Capital Management LLC | 2.72% | 7,604,632 | Institutional (Passive) |

| Sustainable Growth Advisers LP | 2.00% | 5,579,115 | Institutional (Active) |

Vanguard Group Inc.

The Vanguard Group is the largest shareholder of Yum Brands. As of early 2025, Vanguard owns approximately 11.92% of Yum’s outstanding shares, totaling 33,541,268 shares. Vanguard is known for being a long-term institutional investor with passive management strategies, typically through index funds and ETFs.

Although it does not participate in day-to-day decisions, Vanguard wields significant influence through its proxy voting rights during shareholder meetings. This gives it a voice in critical decisions such as executive compensation, board appointments, and governance policies. Its large stake makes it a central figure in Yum’s ownership structure, but it exercises no direct operational control.

BlackRock Inc.

BlackRock Inc. is the second-largest shareholder, with a stake of about 9.60%, amounting to 26,718,863 shares as of 2025. Similar to Vanguard, BlackRock’s investment is largely passive, but it holds substantial voting power that can impact Yum Brands’ governance and strategic direction.

BlackRock’s influence lies in its voting power during shareholder proposals. The company has become increasingly active in pushing ESG (Environmental, Social, and Governance) initiatives across its portfolio. While not directly involved in Yum’s management, its investment decisions and voting behavior can shape the company’s direction in areas like sustainability and corporate responsibility.

JPMorgan Chase & Co.

JPMorgan Chase & Co. holds approximately 8.24% of Yum Brands, translating to 22,992,768 shares. As an active institutional investor, JPMorgan’s significant stake indicates a strong confidence in Yum Brands’ financial performance and growth prospects.

State Street Corporation

State Street Corporation holds a 4.69% stake in Yum Brands, amounting to 13,081,621 shares. As one of the major institutional investors, State Street plays a vital role in corporate governance through its voting rights, despite its passive investment strategy.

State Street’s voting behavior also reflects a growing emphasis on ESG principles, corporate diversity, and long-term governance standards. While its role is passive, its voting shares carry influence in annual general meetings and strategic decisions.

Capital Research and Management Company

Capital Research and Management Company owns about 5.54% of Yum Brands, with 15,460,580 shares under its management. This firm is known for its active investment approach, conducting in-depth analyses to inform its holdings, which suggests a strategic interest in Yum Brands’ long-term value.

Unlike passive investors, Capital Group is known for deep fundamental analysis and active portfolio management. This gives its investment team a closer lens on Yum Brands’ performance and potential. Though less vocal publicly, its influence can be significant, particularly when aligning with other large shareholders.

T. Rowe Price Associates, Inc.

T. Rowe Price Investment Management Inc. owns approximately 3.72% of Yum Brands, equating to 10,374,367 shares. Known for its active management style, T. Rowe Price’s investment reflects a calculated confidence in Yum Brands’ operational strategies and market position.

T. Rowe Price typically supports management teams that show consistent returns and forward-thinking strategies. Their support for Yum signals institutional trust in its leadership and international growth model.

Capital World Investors

Capital World Investors holds a 3.50% stake in Yum Brands, with 9,773,241 shares. As part of the Capital Group, this entity focuses on long-term investment horizons, indicating a belief in Yum Brands’ sustained growth and profitability.

Geode Capital Management

Geode Capital Management LLC owns about 2.72% of Yum Brands, totaling 7,604,632 shares. Geode primarily manages assets for Fidelity’s index funds, making it a significant passive investor with considerable influence through its shareholding.

Though it does not actively engage in company affairs, Geode’s votes count in corporate decisions. It generally follows the same patterns as other index-based firms like Vanguard and BlackRock.

Sustainable Growth Advisers LP

Sustainable Growth Advisers LP holds a 2.00% stake in Yum Brands, amounting to 5,579,115 shares. This firm focuses on investing in companies with strong growth potential, suggesting a positive outlook on Yum Brands’ future performance.

Keith A. Meister

Keith A. Meister, a notable individual investor and founder of Corvex Management, is the largest individual shareholder, owning 7.54% of Yum Brands, which translates to 21,040,195 shares. His significant stake underscores a strong personal investment in the company’s success.

Individual and Retail Shareholders

While institutional investors dominate the shareholder landscape, individual and retail investors also own a portion of Yum Brands stock. These include private investors, employees, and company insiders. Their holdings are smaller in percentage but still important, especially in markets like the U.S. where retail investing is growing.

Retail investors may have less influence in shareholder meetings, but contribute to stock liquidity and market sentiment.

Insider Ownership

Yum Brands’ executive team and board members also hold company shares. While insider ownership is modest—typically under 1% for any one person—it signals confidence in the company’s future. Executives like CEO David Gibbs hold shares through stock options and performance-based awards. This aligns leadership interests with shareholder returns.

Who is the CEO of Yum! Brands?

As of April 2025, David Gibbs serves as the Chief Executive Officer (CEO) of Yum Brands, Inc., a position he has held since January 1, 2020. Gibbs has been instrumental in steering the company through significant transformations, including navigating the challenges posed by the COVID-19 pandemic and spearheading technological advancements within the organization.

David Gibbs’ Career at Yum Brands

David Gibbs’ association with Yum Brands spans over three decades, having joined the company in 1989. Throughout his tenure, he has held various leadership roles across Yum’s portfolio of brands, including KFC, Pizza Hut, and Taco Bell.

His positions have encompassed global strategy, finance, general management, operations, and real estate.

Notably, Gibbs served as the CEO of the global Pizza Hut Division and as President and Chief Financial Officer (CFO) of Yum Restaurants International, where he was responsible for expanding the company’s presence outside the U.S. and China.

He also played a pivotal role as Yum’s Chief Strategy Officer, during which he revamped the company’s global restaurant operations model.

Leadership Structure and Decision-Making

In his capacity as CEO, Gibbs oversees Yum Brands’ overarching strategies, organizational structure, information technology, people development, and culture, all aimed at driving global growth, sales, and profitability across all Yum franchise businesses worldwide. Functional leaders and global brand division CEOs report directly to him. Gibbs also serves on the company’s Board of Directors, contributing to high-level strategic decisions.

Succession Planning and Future Leadership

In March 2025, David Gibbs announced his intention to retire in the first quarter of 2026, after more than five years as CEO and a 36-year tenure with the company.

During his leadership, Yum Brands experienced significant growth, including the opening of 4,535 new stores in 2024 alone. The company’s board has established a succession planning committee to identify and appoint the next CEO. Gibbs will continue to lead the company during this transition period.

Recent Initiatives and Achievements

Under Gibbs’ leadership, Yum Brands has made significant strides in digital transformation and technological innovation.

In early 2025, the company entered into a partnership with Nvidia to implement AI-driven automation in its restaurants, including automated ordering at drive-thrus and call centers, as well as computer-enhanced operation plans. These initiatives aim to enhance customer experience and operational efficiency.

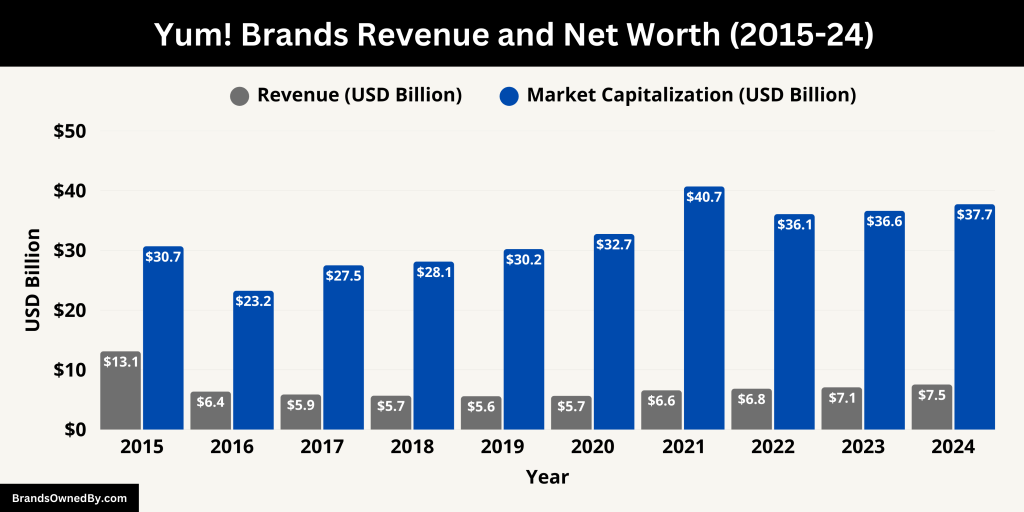

Annual Revenue and Net Worth of Yum! Brands

In 2024, Yum Brands achieved an annual revenue of $7.55 billion, marking a 6.68% year-over-year growth from $7.08 billion in 2023. This increase was driven by robust performances from key brands like Taco Bell and KFC, as well as significant advancements in digital sales.

The company’s net income for 2024 stood at $1.49 billion, a slight decrease from $1.6 billion in 2023. Despite this dip, Yum Brands’ strategic initiatives and global expansion efforts have positioned it for continued growth in the competitive restaurant industry.

As of early 2025, Yum Brands reported a market capitalization of $45.36 billion, reflecting a 20.37% increase over the past year. This growth underscores the company’s strong financial performance and investor confidence.

Here’s a breakdown of Yum! Brands revenue and net worth for the last 10 years (2015-24):

| Year | Revenue (USD Billion) | Market Capitalization (USD Billion) |

|---|---|---|

| 2024 | 7.54 | 37.73 |

| 2023 | 7.07 | 36.62 |

| 2022 | 6.84 | 36.07 |

| 2021 | 6.58 | 40.70 |

| 2020 | 5.65 | 32.74 |

| 2019 | 5.59 | 30.21 |

| 2018 | 5.68 | 28.12 |

| 2017 | 5.87 | 27.50 |

| 2016 | 6.36 | 23.24 |

| 2015 | 13.10 | 30.68 |

Companies Owned by Yum Brands

As of 2025, Yum! Brands owns and operates several prominent restaurant chains, each contributing uniquely to its global portfolio.

Here’s a list of the major brands and companies owned by Yum Brands:

| Company Name | Stake % | Description |

|---|---|---|

| KFC (Kentucky Fried Chicken) | 100% | Full ownership of the global fried chicken chain. |

| Pizza Hut | 100% | Full ownership of the global pizza chain. |

| Taco Bell | 100% | Full ownership of the Mexican-inspired fast-food chain. |

| Habit Burger & Grill | 100% | Full ownership since acquisition in 2020. |

| WingStreet | Majority | Co-branded with Pizza Hut; majority control in the wing concept. |

| Banh Shop | Minority | Minority stake in a Vietnamese sandwich chain. |

| Heartstyles | 100% | Full ownership of the leadership training platform. |

| Tictuk Technologies | 100% | Full ownership of the omnichannel ordering platform. |

| Kvantum Inc. | 100% | Full ownership of the AI-driven consumer insights firm. |

| Dragontail Systems | 100% | Full ownership of the kitchen management and delivery software. |

KFC (Kentucky Fried Chicken)

KFC is a leading global fast-food chain specializing in fried chicken. Founded by Colonel Harland Sanders in 1930, KFC has grown to over 30,000 locations in more than 150 countries as of 2024.

In 2025, KFC announced the relocation of its U.S. headquarters from Louisville, Kentucky, to Plano, Texas. This move aims to foster greater collaboration among Yum! Brands’ various segments.

Pizza Hut

Pizza Hut is a globally recognized pizza chain offering a variety of pizzas, pastas, and side dishes. Established in 1958, it has expanded to numerous countries, becoming a staple in the pizza industry.

The brand’s U.S. operations are headquartered in Plano, Texas, aligning with Yum! Brands’ strategy to centralize its operations.

Taco Bell

Taco Bell is a fast-food chain known for its Mexican-inspired menu, including tacos, burritos, and quesadillas. Founded in 1962, it has become a significant player in the quick-service restaurant sector.

The company is headquartered in Irvine, California, and continues to innovate its menu to cater to a diverse customer base.

Habit Burger & Grill

Habit Burger & Grill, formerly known as The Habit Burger Grill, is a fast-casual restaurant chain specializing in chargrilled hamburgers and sandwiches. Founded in 1969 in Santa Barbara, California, it was acquired by Yum! Brands in March 2020.

As of 2024, the chain underwent a rebranding, changing its name to Habit Burger & Grill. The company operates 372 locations across the United States and select international markets.

WingStreet

WingStreet is Yum! Brands’ specialty chicken wing concept. It launched in 2003 as a hybrid unit alongside Pizza Hut restaurants.

By 2009, WingStreet had achieved a national rollout, with over 1,000 locations opening in 2007–2008 alone. It remains co-branded at many Pizza Hut sites, offering flavored wings alongside pizza on a shared menu.

Banh Shop

Banh Shop is a fast-casual Vietnamese sandwich concept in which Yum! Brands holds a minority stake. Developed under YUM! Emerging Brands II, LLC, it debuted in 2014 alongside Super Chix and U.S. Taco Co. In 2017, the founding team acquired 80% of the subsidiary from Yum! to continue expanding the concept in select Texas markets.

Heartstyles

In March 2020, Yum! Brands acquired Heartstyles, an omnichannel leadership-training platform. Heartstyles provides digital courses and in-restaurant coaching to improve team member development and culture alignment across Yum’s global franchise network.

Tictuk Technologies

Yum! Brands added Tictuk Technologies to its tech portfolio in March 2021. Based in Israel, Tictuk offers conversational-commerce and omnichannel ordering solutions. Its platform enables customers to place orders via SMS, WhatsApp, Facebook Messenger, and other messaging apps.

Kvantum Inc.

Also in 2021, Yum! Brands acquired Kvantum Inc., an AI-driven consumer-insights and marketing-technology firm. Kvantum’s analytics platform helps Yum tailor promotions and menu innovations across its restaurant concepts by leveraging real-time customer data.

Dragontail Systems

In September 2021, Yum! Brands completed the $69.1 million acquisition of Dragontail Systems. This Australia-based company provides kitchen-order-management and delivery-integration software. Its tools streamline back-of-house operations and unify delivery-app workflows across Yum’s restaurant brands

Final Thoughts on Yum! Brands Ownership

So, who owns Yum Brands?

The answer lies in public shareholders with firms like Vanguard and BlackRock at the top.

The company’s strong leadership and diverse brand portfolio have helped it become a global force in the fast-food industry. Yum continues to grow through franchising, innovation, and expansion into new markets.

FAQs

What companies are under Yum Brands?

Yum Brands owns KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill.

Does Yum Brands own Yum China?

No. Yum China was separated in 2016. It is now a publicly traded company with its own stock.

Is Yum Brands a franchise?

Yes. Most of Yum Brands’ restaurants are run by franchisees. The company earns revenue through franchise fees and royalties.

Is Yum still owned by PepsiCo?

No, Yum! Brands is no longer owned by PepsiCo. It was spun off from PepsiCo in 1997, becoming an independent company. Yum! Brands now operates as a standalone entity.

Who owns KFC now?

KFC is owned by Yum! Brands, Inc. Yum! Brands acquired the global rights to KFC in 2002, and it remains a key part of their portfolio today.

What company owns Yum?

Yum! Brands, Inc. is an independent company, and it owns several major fast-food brands, including KFC, Pizza Hut, Taco Bell, and others. It is publicly traded on the New York Stock Exchange under the ticker YUM.

When did Yum split from Pepsi?

Yum! Brands split from PepsiCo in 1997, after PepsiCo decided to focus more on its core beverage business. The company became an independent entity, still retaining control over its restaurant brands.

Who is the largest shareholder of Yum Brands?

As of 2025, the largest shareholders of Yum! Brands are institutional investors. The largest among them include Vanguard Group Inc. with 11.92% ownership and BlackRock Inc. with 9.60% ownership.

Who owned KFC before Yum?

Before Yum! Brands, KFC was owned by Heublein Inc., which was acquired by R.J. Reynolds in 1982. KFC was later acquired by PepsiCo in 1986 before being spun off as part of Yum! Brands in 1997.

What is Yum Brands net worth?

As of 2025, Yum! Brands has a market capitalization of approximately $45.36 billion, reflecting its total market value based on its stock price and shares outstanding.

What is Yum Brands owner country?

Yum! Brands is headquartered in the United States, specifically in Plano, Texas. It operates globally, but it is a U.S.-based company.

Is Yum Brands owned by PepsiCo?

No, Yum! Brands is no longer owned by PepsiCo. It was spun off as an independent company in 1997, although PepsiCo did retain control of Taco Bell’s beverage business for a time.

Who owns Yum Brands subsidiaries?

Yum! Brands owns its subsidiaries outright. These include KFC, Pizza Hut, Taco Bell, and several smaller brands and investments in emerging markets. Yum! also holds full control of tech-related acquisitions like Tictuk Technologies and Dragontail Systems.

When was Yum Brands founded?

Yum! Brands was founded in 1997, following its spin-off from PepsiCo. However, its predecessor companies, including Taco Bell, KFC, and Pizza Hut, have been in operation since much earlier.

What are the restaurants owned by Yum Brands?

Yum! Brands owns the following major restaurants:

- KFC (Kentucky Fried Chicken)

- Pizza Hut

- Taco Bell

- The Habit Burger Grill

- WingStreet (co-branded with Pizza Hut)

- Banh Shop (minority stake)

- Heartstyles (training platform)

- Tictuk Technologies (ordering technology firm)

- Kvantum Inc. (AI-driven consumer insights firm)

- Dragontail Systems (kitchen management software)