Verizon Communications Inc. is one of the most recognized names in telecommunications, powering millions of connections across the U.S. and beyond. Founded in 2000, the company has evolved into a leader in wireless, broadband, and digital innovation. Exploring who owns Verizon reveals how its ownership structure and investor base have shaped its growth, stability, and influence in the global telecom industry.

Key Takeaways

- Verizon Communications Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker VZ, with no single majority owner; its ownership is spread across institutional, retail, and insider shareholders.

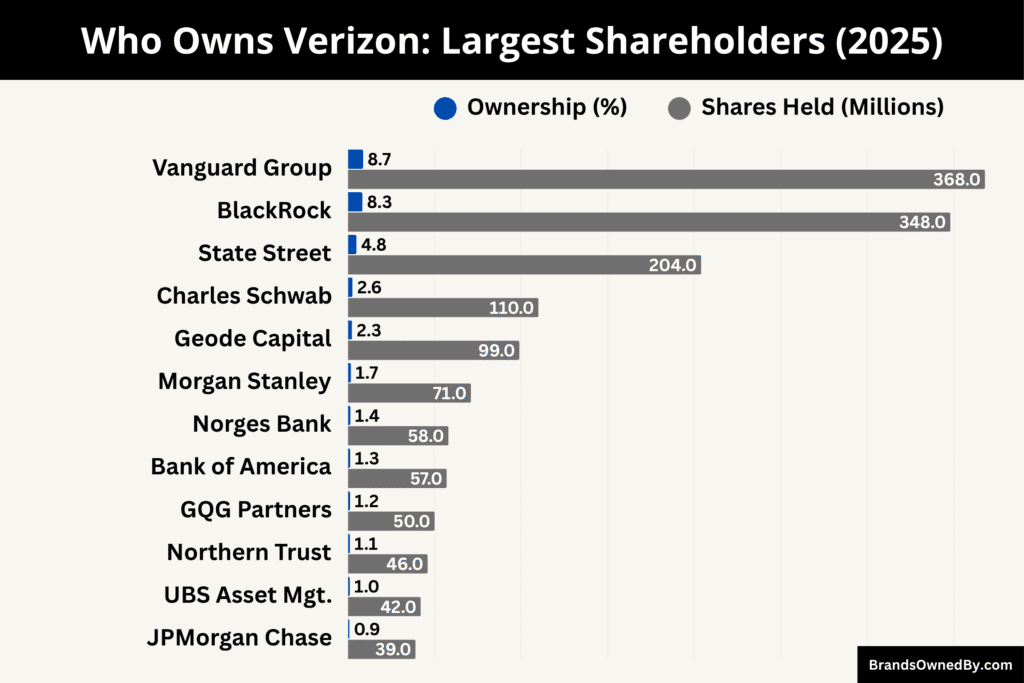

- Institutional investors collectively own about 66% of Verizon’s shares, led by The Vanguard Group (8.7%), BlackRock (8.3%), and State Street Corporation (4.8%), giving them significant influence over governance and long-term strategy.

- Retail investors hold roughly 33% of Verizon’s stock, ensuring broad market participation and liquidity, while company insiders own less than 0.3%, indicating that corporate control lies primarily with institutional investors and the board of directors.

Verizon Overview

Verizon Communications Inc. is a leading U.S. telecommunications company that offers wireless, broadband, and enterprise services. It operates a wide-reaching nationwide network and serves both consumers and businesses. The company maintains a presence in digital media, infrastructure, and communication technologies.

Its network coverage spans nearly the entire U.S. population, supporting mobile, fixed wireless, and fiber services. Verizon is headquartered in New York City. It trades publicly under the ticker VZ. It also works with many of the Fortune 500 companies to deliver connectivity and networking solutions.

Verizon’s strategy centers on expanding fiber infrastructure, growing its 5G network, and strengthening its business services arm.

In 2024 and 2025, Verizon closed significant deals to bolster its broadband and fiber assets, including the approved acquisition of Frontier Communications for the expansion of its fiber footprint.

Verizon’s wireless unit is one of the largest in the United States, covering about 99% of the U.S. population and serving over 146 million subscribers as of mid-2025.

In 2025, regulatory approval from the FCC enabled Verizon’s planned acquisition of Frontier to move forward, an important step in the company’s vision to expand its fiber network reach.

Founders and Origins

Verizon emerged from a merger between two legacy telecom firms: Bell Atlantic and GTE. The definitive merger agreement was signed in 1998. The merger was completed on June 30, 2000.

Bell Atlantic had roots as one of the regional “Baby Bell” companies following the breakup of AT&T in the 1980s, while GTE was a large independent telephone and communications company operating across many states.

At the time the merger took effect, Verizon was organized so that it would own 55 percent of the newly formed wireless venture (Verizon Wireless), with the rest held by GTE’s former wireless operations.

After subsequent restructuring and acquisitions, Verizon eventually acquired full ownership of its wireless business

In the early leadership structure, Charles R. “Chuck” Lee (formerly GTE chairman) and Ivan Seidenberg (formerly Bell Atlantic leader) served as co-CEOs at the founding.

Lee retired in 2002, and Seidenberg became the sole CEO and later chairman.

Major Milestones

- 2000: Verizon Communications Inc. was officially formed after the merger of Bell Atlantic and GTE Corporation, creating one of the largest telecom providers in the United States.

- 2001: Verizon Wireless became the largest wireless carrier in the U.S. after integrating Bell Atlantic Mobile and GTE Wireless operations.

- 2002: Co-founder Charles R. “Chuck” Lee retired, leaving Ivan Seidenberg as the sole CEO and Chairman of Verizon.

- 2004: Verizon was added to the Dow Jones Industrial Average, cementing its place among America’s most influential corporations.

- 2005: The company launched Verizon Fios, one of the first large-scale fiber-optic networks offering high-speed internet and television services.

- 2006: Verizon acquired MCI Inc., expanding its reach into enterprise communications and global networking.

- 2009: Verizon completed the Alltel acquisition, which significantly expanded its wireless coverage and rural network presence.

- 2010: Verizon launched its 4G LTE network, setting the stage for faster data speeds and next-generation mobile connectivity.

- 2013: Verizon acquired Vodafone’s 45% stake in Verizon Wireless for $130 billion, gaining full ownership of its wireless division.

- 2015: The company entered the digital media market by acquiring AOL, followed by Yahoo in 2017, forming Oath Inc. (later Verizon Media).

- 2018: Verizon became one of the first major carriers to launch 5G Home Internet, marking the start of its nationwide 5G rollout.

- 2021: Verizon sold Verizon Media (AOL and Yahoo) to Apollo Global Management, refocusing on core telecom and network services.

- 2022: The company expanded its C-Band 5G network, bringing mid-band 5G coverage to millions of additional users across the U.S.

- 2024: Verizon announced its intent to acquire Frontier Communications to strengthen its fiber infrastructure and broadband reach.

- 2025: Verizon received FCC approval to complete the Frontier acquisition, reinforcing its position as the nation’s leading fiber and 5G network provider.

Who Owns Verizon: List of Shareholders

Verizon Communications Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker symbol VZ.

As of October 2025, Verizon’s ownership is broadly divided among three groups — institutional investors, retail shareholders, and company insiders.

Institutional investors collectively hold about 66% of the company’s total outstanding shares, giving them substantial control over governance, policy decisions, and board appointments. Retail shareholders (individual investors) account for roughly 33%, while insiders, including executives and board members, own less than 0.3% of Verizon’s stock.

Below is a list of the top shareholders of Verizon as of October 2025:

The Vanguard Group, Inc.

The Vanguard Group remains Verizon’s largest institutional shareholder as of 2025, holding around 368 million shares, or approximately 8.7% of total outstanding stock. Vanguard’s ownership represents holdings through its various mutual and index funds, particularly those tracking the S&P 500 and large-cap value indexes. The firm typically adopts a long-term investment approach and supports stable corporate governance.

Vanguard rarely intervenes directly in daily management but influences strategic direction through proxy votes on board elections, sustainability goals, and executive compensation. Its large stake also signals strong confidence in Verizon’s long-term performance and steady dividend record.

BlackRock, Inc.

BlackRock holds about 348 million shares, representing nearly 8.3% of Verizon’s equity. As the world’s largest asset management firm, BlackRock invests in Verizon through a mix of ETFs, institutional portfolios, and index funds.

BlackRock’s influence comes from its active participation in shareholder voting and corporate governance discussions. The firm is known for encouraging companies to adopt sustainable business practices and maintain transparency with investors. Its position gives it major sway in Verizon’s boardroom matters and long-term planning, especially concerning ESG and digital transformation policies.

State Street Corporation

State Street Corporation owns around 204 million shares, or roughly 4.8% of Verizon’s outstanding stock. It manages Verizon shares primarily through index and exchange-traded funds. State Street’s ownership is part of its passive investment strategy, but the firm regularly votes on important corporate matters such as executive compensation, governance standards, and director appointments.

While less vocal than BlackRock or Vanguard, State Street’s consistent and stable holdings make it a key institutional backer, reinforcing investor confidence in Verizon’s long-term growth.

Charles Schwab Investment Management

Charles Schwab Investment Management holds about 110 million shares, accounting for 2.6% of Verizon’s total shares. Its ownership mainly represents clients’ investments through mutual funds and retirement accounts. Schwab’s approach is conservative and passive, with a focus on stable, dividend-yielding stocks like Verizon.

Although Schwab does not actively seek board-level influence, its sustained investment contributes to Verizon’s institutional stability. The firm’s steady ownership underscores Verizon’s appeal among long-term retail and retirement-oriented investors.

Geode Capital Management, LLC

Geode Capital Management holds roughly 99 million shares, equal to around 2.3% of Verizon’s stock. Geode serves as a sub-adviser for some of Vanguard’s funds, meaning its holdings often overlap with Vanguard’s total exposure.

Geode’s involvement adds depth to Verizon’s institutional ownership base. Like other large asset managers, it focuses on governance consistency and market stability, aligning with Verizon’s profile as a mature, dividend-driven telecom company.

Morgan Stanley

Morgan Stanley owns approximately 71 million shares, translating to about 1.7% ownership in Verizon. The investment bank holds shares through a combination of client portfolios, brokerage accounts, and institutional funds.

While not a top-three shareholder, Morgan Stanley influences market perception of Verizon through its analyst coverage, investment research, and recommendations. Its steady position indicates strong institutional confidence in Verizon’s fundamentals and long-term growth strategy.

GQG Partners LLC

GQG Partners, a fast-growing global investment firm, holds around 50 million shares, or roughly 1.2% of Verizon’s stock. The firm increased its holdings in 2025, marking a noticeable rise in institutional interest.

GQG focuses on value and quality companies with strong cash flow — qualities Verizon consistently demonstrates. Its growing stake highlights confidence in Verizon’s ability to maintain dominance in the telecom and broadband sectors.

Norges Bank

Norges Bank, which manages Norway’s sovereign wealth fund, owns about 58 million shares, equivalent to 1.4% of Verizon’s total stock. Known for its focus on ethical and sustainable investing, Norges Bank’s presence reinforces Verizon’s appeal to global institutional investors who prioritize ESG performance and governance accountability.

Though not an activist investor, Norges Bank votes regularly on governance proposals and board selections, supporting transparency and long-term growth.

Bank of America Corporation

Bank of America holds roughly 57 million shares, or 1.3% of Verizon’s stock, through its wealth management and institutional portfolios. As one of the largest financial institutions in the U.S., Bank of America’s involvement signals continued investor confidence in Verizon as a reliable blue-chip investment.

Its investment teams often engage in market analysis that indirectly shapes broader investor sentiment toward Verizon’s performance and growth trajectory.

UBS Asset Management

UBS Asset Management controls approximately 42 million shares, representing around 1% of Verizon’s stock. The firm includes Verizon in several of its global equity and income-focused funds.

UBS is known for its disciplined investment philosophy, favoring companies with consistent dividends and strong market positions. Verizon fits that profile, which explains UBS’s long-standing investment.

JPMorgan Chase & Co.

JPMorgan Chase holds about 39 million shares, or 0.9% of Verizon’s equity. As both an investor and research provider, JPMorgan plays a dual role — it contributes capital through managed funds and influences perception through market reports and analyst ratings.

Its continued ownership demonstrates faith in Verizon’s financial resilience, brand strength, and technological leadership.

Northern Trust Corporation

Northern Trust Corporation holds around 46 million shares, equal to roughly 1.1% of Verizon’s total outstanding stock. Known for managing assets for institutions and high-net-worth clients, Northern Trust includes Verizon in its long-term dividend and value strategies.

The firm’s investment supports Verizon’s image as a stable and dependable company for conservative investors seeking consistent returns.

Retail Investors and Company Insiders

Retail investors collectively hold between 30% and 35% of Verizon’s shares as of 2025. These include individual shareholders, retirement accounts, and small investment funds. Their ownership provides liquidity and market diversity, ensuring that Verizon’s stock remains actively traded.

Company insiders — executives, directors, and senior officers — own less than 0.3% of the total shares. While their financial stake is small, they remain key decision-makers in Verizon’s strategic direction. The combination of institutional control and public participation makes Verizon one of the most widely held and balanced telecom stocks in the U.S. market.

Who is the CEO of Verizon?

As of October 2025, Dan Schulman is the Chief Executive Officer (CEO) of Verizon Communications Inc., succeeding Hans Vestberg after a seven-year tenure. Schulman’s appointment marks a strategic shift for Verizon — one focused on accelerating digital transformation, enhancing customer experience, and expanding into fintech-driven telecommunications services.

A long-time member of Verizon’s board of directors since 2018, Schulman brings over three decades of leadership experience across technology, telecommunications, and finance. His appointment reflects Verizon’s continued commitment to innovation, operational efficiency, and global expansion.

Background and Career of Dan Schulman

Dan Schulman was born in Newark, New Jersey, in 1958. He earned his degree in economics from Middlebury College and an MBA from New York University’s Stern School of Business. Schulman’s career spans major global corporations, where he has earned a reputation as a visionary leader in technology, consumer experience, and digital finance.

Before joining Verizon as CEO, Schulman served as the President and CEO of PayPal Holdings Inc. from 2014 to 2024. During his decade-long tenure, he transformed PayPal into one of the world’s most trusted digital payment platforms, expanding its user base to over 400 million accounts and driving its valuation beyond $250 billion at its peak.

Before PayPal, Schulman held executive roles at:

- AT&T – where he led marketing and consumer services divisions early in his career, gaining firsthand telecom experience.

- Priceline.com – serving as President and expanding the company’s online travel and commerce footprint.

- Virgin Mobile USA – where he was Founding CEO, building one of the fastest-growing prepaid mobile brands in the U.S.

- American Express – where he served as Group President of Enterprise Growth, focusing on digital payment solutions.

Schulman’s broad experience across telecommunications, fintech, and digital commerce makes him uniquely equipped to lead Verizon through its next phase of innovation — blending network strength with digital financial integration and customer-centric services.

Leadership and Management at Verizon

Under Dan Schulman’s leadership, Verizon’s management structure has been refreshed to emphasize speed, accountability, and innovation. The company operates under four main business units:

- Verizon Consumer Group – overseeing wireless, broadband, and retail operations.

- Verizon Business Group – managing enterprise, public sector, and global network services.

- Network & Technology – handling 5G, fiber, and infrastructure development.

- Corporate and Strategy Operations – managing finance, HR, sustainability, and strategic planning.

Schulman is known for his hands-on, people-first leadership style, prioritizing employee empowerment and customer satisfaction. He has also championed diversity, equity, and inclusion (DEI) as critical drivers of innovation — a value he strongly supported during his time at PayPal and continues to emphasize at Verizon.

The Verizon board of directors, chaired by Mark Bertolini, works closely with Schulman on governance, shareholder relations, and long-term strategic vision. Former CEO Hans Vestberg remains in this role as a Special Advisor through 2026, ensuring continuity during the transition.

Dan Schulman Salary and Compensation

As Verizon’s CEO, Dan Schulman’s annual compensation package in 2025 is estimated to total around $25 million, structured to reward long-term performance and shareholder value.

His pay structure includes:

- Base Salary: Approximately $1.8 million per year.

- Performance-Based Bonus: Up to $4–5 million, depending on revenue growth, profitability, and customer satisfaction targets.

- Stock Awards: Roughly $17–18 million in restricted stock units and performance shares tied to Verizon’s market performance and long-term goals.

- Other Compensation: Around $1 million, covering retirement contributions, travel, and executive security expenses.

Schulman’s compensation aligns with Verizon’s pay-for-performance philosophy, ensuring his rewards are directly tied to operational efficiency, innovation milestones, and shareholder returns.

Dan Schulman Net Worth

As of October 2025, Dan Schulman’s estimated net worth is approximately $394 million. The majority of his wealth comes from:

- His decade-long leadership at PayPal, where he accumulated substantial equity holdings and stock gains.

- Current Verizon stock options and restricted shares, which form a significant portion of his compensation package.

- Past roles at major companies like AT&T, Virgin Mobile USA, and American Express, where he earned both executive bonuses and long-term equity incentives.

Schulman’s strong personal financial position underscores his long-standing success in executive leadership and corporate transformation. Despite his wealth, he is known for his pragmatic, socially responsible leadership style, emphasizing ethical business practices, financial inclusion, and workforce empowerment.

Strategic Vision Under Dan Schulman

Dan Schulman’s appointment signals Verizon’s ambition to evolve beyond traditional telecommunications and become a digital infrastructure and technology services powerhouse. His priorities for the coming years include:

- Expanding 5G and Fiber Infrastructure: Accelerating the rollout of advanced broadband and mobile connectivity.

- Integrating Digital Finance: Exploring financial service innovations within the Verizon ecosystem, such as mobile payments and fintech partnerships.

- Customer-Centric Growth: Streamlining customer experience across consumer and enterprise divisions.

- Sustainability and Inclusion: Building on Verizon’s goal to achieve net-zero emissions by 2035, while strengthening digital equity initiatives.

Under Schulman’s guidance, Verizon is expected to balance innovation with long-term stability — ensuring continued dominance in wireless and broadband while venturing into the future of digital communication and connected services.

Verizon Annual Revenue and Net Worth

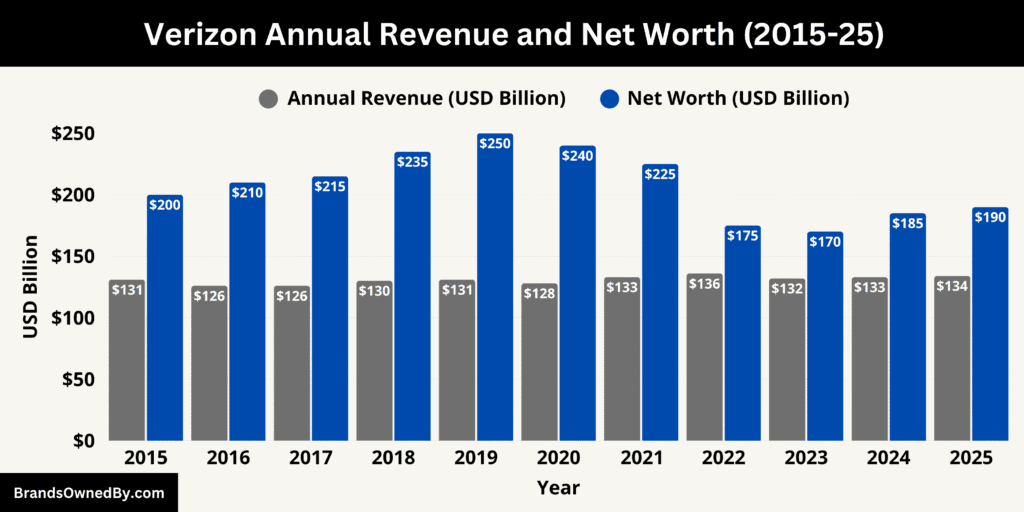

As of 2025, Verizon Communications Inc. reports an estimated annual revenue of around $134 billion and a net worth of approximately $190 billion (as of October 2025) based on its market capitalization and asset valuations. These figures reinforce Verizon’s standing as one of the largest and most financially stable telecommunications companies in the world.

Revenue Overview

Verizon’s revenue in 2025 reflects steady growth despite a competitive market and evolving industry dynamics. The company generates the majority of its income from its wireless segment, which includes mobile services, data plans, and device sales. Verizon Wireless serves more than 140 million subscribers across the United States, making it one of the largest carriers in the country.

The consumer segment continues to deliver consistent results, supported by increased 5G adoption, device upgrades, and bundled service offerings that include home internet and entertainment packages. Meanwhile, the business and enterprise division has expanded its footprint, driven by the rollout of private 5G networks, IoT solutions, and secure cloud-based communications for government and corporate clients.

Verizon’s broadband and fiber services — particularly through its Fios network — have also contributed to revenue stability. The company’s recent acquisition of Frontier Communications’ fiber assets (approved in 2025) is expected to further enhance its broadband infrastructure and future revenue potential.

Overall, Verizon’s 2025 revenue growth underscores the company’s ability to maintain profitability through diversified service offerings, operational efficiency, and ongoing network innovation.

Net Worth and Market Valuation

Verizon’s net worth as of October 2025 is estimated at about $190 billion, based on its market capitalization and overall asset strength. The company’s net worth represents a combination of equity value, physical infrastructure (including its vast fiber and wireless networks), and intangible assets such as brand equity and customer relationships.

Despite fluctuations in stock market conditions, Verizon has maintained a relatively stable market value due to consistent cash flow, strong dividend payouts, and investor confidence in its long-term business model. Its financial resilience stems from a balanced capital structure, disciplined spending, and ongoing efforts to reduce debt following major acquisitions and infrastructure investments.

In addition to its public market valuation, Verizon’s net worth is reinforced by its leadership in 5G and broadband expansion, which continue to attract long-term institutional investors. The company’s extensive network coverage, high service reliability, and growing enterprise portfolio position it as a key player in global telecommunications and digital infrastructure.

Revenue Drivers and Growth Outlook

Verizon’s growth outlook for the coming years remains positive, supported by continued investment in 5G technology, network modernization, and fiber connectivity. The company’s strategy emphasizes scaling its infrastructure to meet rising demand for high-speed internet, cloud services, and digital communication tools.

The 5G Home and Business Internet segments are among the fastest-growing areas, contributing to new recurring revenue streams. Meanwhile, enterprise clients increasingly rely on Verizon’s secure connectivity solutions, positioning the company for sustainable growth in both consumer and business markets.

By maintaining strong operational performance and adapting to emerging digital trends, Verizon continues to deliver stable revenue and robust shareholder value — a testament to its enduring financial strength and strategic foresight.

Historical Revenue and Growth

From 2015 to 2025, Verizon’s annual revenue remained consistently strong, generally ranging between $125–135 billion, reflecting steady operations and recurring service-based income. Its net worth (market capitalization) has fluctuated more significantly, influenced by market sentiment, acquisitions, and broader economic factors.

The peak valuation years around 2018–2020 coincided with the company’s early 5G rollout and expansion in digital media. While its market value moderated in subsequent years due to competition and capital expenditures, Verizon remains one of the most valuable telecommunications companies in the world, supported by reliable revenue, strong cash flow, and long-term investor confidence.

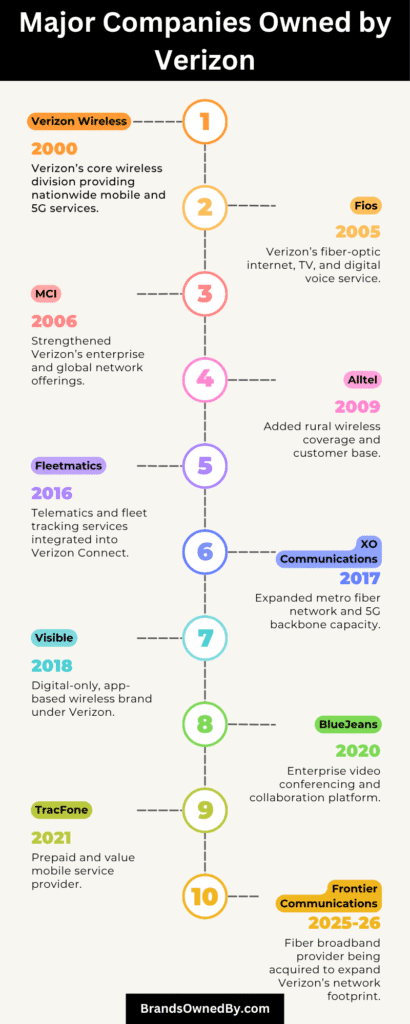

Companies Owned by Verizon

As of 2025, Verizon’s portfolio reflects a comprehensive mix of telecommunications, broadband, enterprise, IoT, and digital service brands. From its core operations under Verizon Wireless and Fios to its strategic acquisitions like TracFone, BlueJeans, and XO Communications, the company has built a powerful ecosystem of connectivity solutions.

Below is a list of the major companies owned by Verizon as of October 2025:

| Company / Brand / Acquisition | Type | Year Established / Acquired | Status (2025) | Primary Function / Business Area | Key Details & Description |

|---|---|---|---|---|---|

| Verizon Wireless | Core Division | Established 2000 | Active | Mobile & Wireless Communications | Verizon’s flagship division; serves over 140 million U.S. subscribers; provides 4G, 5G, and IoT services nationwide. |

| Verizon Business | Core Division | Established 2006 (as Verizon Enterprise) | Active | Enterprise & Government Solutions | Offers global business connectivity, cybersecurity, managed network, and cloud services to corporations and government clients. |

| Verizon Consumer Group | Core Division | Established 2019 (structural reorg) | Active | Consumer Wireless & Home Internet | Handles retail, broadband, and wireless consumer operations; oversees Fios, Verizon Home Internet, and digital channels. |

| Fios by Verizon | Brand / Product Line | Launched 2005 | Active | Fiber-Optic Broadband & TV | High-speed fiber-optic internet, TV, and home phone service; available in major U.S. metro regions. |

| TracFone Wireless, Inc. | Acquisition | Acquired 2021 | Active | Prepaid & Value Wireless Services | Prepaid wireless provider; operates brands like Straight Talk, Total by Verizon, and SafeLink Wireless; serves over 20 million users. |

| Visible by Verizon | Owned Brand | Launched 2018 | Active | Digital Wireless Brand | App-based mobile service with no contracts; offers low-cost, unlimited plans using Verizon’s 5G/4G network. |

| BlueJeans by Verizon | Acquisition | Acquired 2020 | Active | Video Conferencing & Collaboration | Provides enterprise-grade video conferencing and virtual meeting platforms integrated with Verizon’s enterprise solutions. |

| Verizon Connect | Acquisition / Division | Formed 2018 (Fleetmatics & Telogis merger) | Active | Fleet Management & Telematics | Manages vehicle tracking, logistics, and telematics; serves logistics, construction, and transportation industries. |

| Fleetmatics | Acquisition | Acquired 2016 | Integrated (Part of Verizon Connect) | Fleet Tracking & IoT | GPS fleet management software; improved logistics efficiency and analytics for businesses. |

| XO Communications | Acquisition | Acquired 2017 | Integrated | Fiber Network & Enterprise Services | Provided metro fiber and IP infrastructure; integrated to enhance Verizon’s 5G backhaul and fiber coverage. |

| MCI Inc. | Acquisition | Acquired 2006 | Integrated | Enterprise & Long-Distance Services | Strengthened Verizon’s enterprise communications and expanded global network reach. |

| Alltel Corporation | Acquisition | Acquired 2009 | Integrated | Wireless Services | Expanded Verizon’s rural and regional network coverage; merged with Verizon Wireless operations. |

| Verizon Partner Solutions (VPS) | Subsidiary / Division | Established 2000s | Active | Wholesale Network Services | Provides voice, data, and internet connectivity to other carriers and service providers. |

| Verizon Ventures | Corporate Investment Arm | Established 2012 | Active | Venture Capital & Innovation | Invests in emerging technologies like 5G, AI, IoT, cybersecurity, and sustainable infrastructure. |

| Verizon Media (Yahoo / AOL) | Acquisition | Acquired 2015–2017, Sold 2021 | Partially Integrated / Sold | Digital Media & Advertising | Owned Yahoo and AOL; sold to Apollo in 2021; Verizon retained advertising tech and data analytics infrastructure. |

| Yahoo Mobile | Brand / Service | Launched 2020 | Integrated (Rebranded / Merged) | Wireless Service | Mobile service under Verizon Media; integrated into TracFone and Visible after Yahoo sale. |

| Verizon Digital Media Services | Subsidiary / Platform | Established 2013 | Active (Under Enterprise Operations) | Cloud, CDN, and Streaming Infrastructure | Provides content delivery, cloud hosting, and edge solutions for media and entertainment clients. |

| Verizon Public Sector | Division | Formed 2020 | Active | Government & Education Services | Provides cybersecurity, broadband, and communication networks for U.S. federal, state, and local governments. |

| Verizon Global Network Operations (GNO) | Division | Established 2000s | Active | Global Network Infrastructure | Manages Verizon’s international data centers, undersea cables, and global network connectivity. |

Verizon Wireless

Verizon Wireless is the company’s flagship and most profitable division. It provides mobile voice, data, and broadband services to more than 140 million customers across the United States. Verizon Wireless operates the country’s largest and most reliable 4G LTE and 5G networks, covering nearly 99% of the U.S. population.

As of 2025, Verizon Wireless continues to be a primary driver of the company’s revenue. Its services include postpaid and prepaid mobile plans, business wireless solutions, and IoT (Internet of Things) connectivity for enterprises. The company also offers device financing, mobile hotspot services, and private 5G networks for large corporations and government agencies.

Verizon Business

Verizon Business serves corporate, enterprise, and government clients around the world. It delivers networking, cybersecurity, cloud computing, and unified communications solutions. The division operates in over 150 countries and provides connectivity services for multinational organizations.

Under Verizon Business, clients have access to secure, high-performance solutions such as private 5G, managed network services, and IoT integration. The company’s enterprise partnerships with AWS, Microsoft, and Google Cloud enable businesses to combine Verizon’s network infrastructure with cloud-based platforms.

Verizon Business also provides mission-critical communications for public safety, finance, and healthcare sectors. Its Global Enterprise unit focuses on large organizations, while its Public Sector division serves federal, state, and local government clients.

Verizon Consumer Group

Verizon Consumer Group is responsible for retail and residential services, including mobile, broadband, and home internet solutions. This division operates the Fios fiber network, Verizon Home Internet, and the company’s customer-facing stores and digital sales channels.

The Consumer Group focuses on delivering seamless connectivity through wireless and fiber services, entertainment bundles, and smart home integration. As of 2025, Verizon continues to expand its fixed wireless access (FWA) coverage, offering high-speed 5G home internet to millions of households.

Fios by Verizon

Fios (Fiber Optic Service) is Verizon’s premium fiber-optic broadband, television, and digital voice service. It was one of the first large-scale fiber-to-the-home (FTTH) networks in the United States. Fios is currently available in major metropolitan areas, including New York, Boston, Philadelphia, and Washington, D.C.

Fios provides symmetrical high-speed internet (up to 2 Gbps), HD and 4K TV services, and digital home phone options. It remains a key differentiator for Verizon in markets where high-capacity fiber infrastructure drives consumer demand for faster internet and streaming capabilities.

TracFone Wireless, Inc.

Verizon acquired TracFone Wireless in 2021, solidifying its presence in the prepaid and value mobile market. TracFone operates several prepaid wireless brands, including Straight Talk, Simple Mobile, Total by Verizon, and SafeLink Wireless.

As of 2025, TracFone serves over 20 million subscribers in the U.S. Its acquisition allowed Verizon to reach a broader demographic, including cost-conscious consumers and those using Lifeline government-subsidized plans. TracFone operates independently under Verizon’s Consumer Group but utilizes Verizon’s network for all its services.

BlueJeans by Verizon

BlueJeans is Verizon’s video conferencing and collaboration platform, acquired in 2020. It provides secure video communication tools for enterprises, education, and healthcare sectors. BlueJeans integrates features such as HD video, content sharing, virtual events, and integration with Microsoft Teams and Zoom.

While competition in the video conferencing industry remains strong, BlueJeans differentiates itself through its security, low-latency connections, and direct network optimization over Verizon’s infrastructure. It plays a key role in Verizon’s enterprise communications ecosystem.

Visible by Verizon

Visible is Verizon’s digital-only wireless brand targeting younger and tech-savvy consumers. Launched in 2018, it offers affordable, no-contract mobile plans with unlimited data, messages, and calls, entirely managed through a mobile app.

Visible operates on Verizon’s nationwide 5G and 4G LTE networks, providing the same coverage as Verizon Wireless but at a lower price point. The brand’s success lies in its fully digital experience — no physical stores, simplified billing, and transparent pricing. In 2025, Visible continues to grow as one of the most recognized budget-friendly mobile services in the U.S.

Verizon Connect

Verizon Connect specializes in fleet management, telematics, and vehicle tracking solutions. The company offers software and IoT-based systems that help businesses monitor logistics operations, vehicle usage, and driver performance.

Its offerings include real-time GPS tracking, predictive maintenance alerts, and analytics to improve fuel efficiency and operational safety. Verizon Connect serves logistics, transportation, construction, and delivery businesses worldwide.

The division leverages Verizon’s IoT network, enabling large-scale connected vehicle systems for smart city and industrial applications.

Verizon Media (Legacy Operations)

Before 2021, Verizon operated Verizon Media, which included digital brands such as Yahoo, AOL, and TechCrunch. While Verizon sold most of Verizon Media to Apollo Global Management in 2021, the company retained certain advertising technology, data management, and cloud media delivery systems that continue to support its enterprise and network services.

These retained assets are now integrated into Verizon’s internal digital and data analytics platforms, helping enhance its advertising partnerships and customer insights.

Yahoo Mobile (Legacy Integration)

While Verizon sold Yahoo to Apollo in 2021, the Yahoo Mobile service — originally part of Verizon’s mobile brand portfolio — has been integrated into Verizon’s existing prepaid and mobile network operations under TracFone and Visible. Some elements of Yahoo’s technology and email infrastructure continue to be used internally for customer engagement and data-driven marketing.

Fleetmatics (Part of Verizon Connect)

Fleetmatics, acquired in 2016, is now a fully integrated part of Verizon Connect. It specializes in GPS fleet tracking and data analytics. The platform helps companies reduce operating costs, improve delivery times, and enhance route efficiency. Fleetmatics remains one of Verizon’s most important acquisitions in the telematics and connected vehicle sector.

XO Communications

Verizon completed its acquisition of XO Communications in 2017. The deal gave Verizon access to an extensive fiber-optic and metro network infrastructure across the U.S. XO’s assets have since been fully integrated into Verizon’s fiber and enterprise networking operations, supporting both consumer broadband and corporate data services.

This acquisition expanded Verizon’s footprint in high-capacity metro fiber networks, boosting its 5G backhaul capabilities and providing a foundation for its edge computing services.

Verizon Partner Solutions

Verizon Partner Solutions (VPS) operates as the company’s wholesale division, providing network services to other carriers, ISPs, and technology companies. VPS offers voice, data, and internet access across Verizon’s global infrastructure.

Through VPS, Verizon supports partnerships and network sharing agreements with domestic and international providers, enabling connectivity for smaller telecom and enterprise clients that rely on Verizon’s backbone infrastructure.

Verizon Ventures

Verizon Ventures is the company’s venture capital arm. It invests in emerging technology startups that align with Verizon’s focus areas — including 5G applications, edge computing, cybersecurity, artificial intelligence, and digital media.

Since its establishment, Verizon Ventures has funded numerous innovative companies, supporting the development of technologies that complement Verizon’s core services. The investment division continues to explore opportunities in IoT, sustainable connectivity, and next-generation communication platforms.

Final Thoughts

Understanding who owns Verizon highlights why it remains a trusted and dominant force in communication technology. Its broad base of institutional and public shareholders ensures balanced control and long-term stability. Verizon’s ownership model reflects confidence, transparency, and the collective strength behind one of the world’s most reliable telecommunications companies.

FAQs

Who owns Verizon Wireless network?

The Verizon Wireless network is wholly owned and operated by Verizon Communications Inc. It was originally formed as a joint venture between Bell Atlantic and Vodafone in 2000, but Verizon acquired Vodafone’s 45% stake in 2014, gaining full ownership and control of the wireless network.

Who owns Verizon Communications Inc.?

Verizon Communications Inc. is a publicly traded company listed on the New York Stock Exchange under the symbol VZ. It is owned by institutional investors, retail shareholders, and company insiders. Major shareholders include The Vanguard Group (8.7%), BlackRock (8.3%), and State Street Corporation (4.8%).

Who is the majority owner of Verizon?

Verizon has no single majority owner. The company’s ownership is widely distributed among institutional investors and public shareholders. The Vanguard Group is the largest shareholder, but it does not hold a controlling stake.

Who did Verizon merge with?

Verizon was created in 2000 through a merger between Bell Atlantic and GTE Corporation. This merger formed one of the largest telecommunications companies in the world. Over the years, Verizon has also merged with or acquired companies like MCI (2006), Alltel (2009), and XO Communications (2017) to expand its operations.

What does Verizon stand for?

The name “Verizon” is derived from the Latin word “veritas” (meaning truth) and the English word “horizon.” It symbolizes reliability, trust, and forward-looking innovation — key qualities the company associates with its brand identity.

Is Verizon owned by AT&T?

No, Verizon is not owned by AT&T. The two are separate and competing telecommunications companies headquartered in the United States. Both operate independently with their own infrastructure, leadership, and shareholders.

Are AT&T and Verizon the same company?

No, AT&T and Verizon are distinct companies. They are direct competitors in the wireless, broadband, and business communications markets. While both provide similar services, Verizon operates under its own corporate structure and management, separate from AT&T.

Who owns Verizon email?

Verizon previously operated its own email service but discontinued it in 2017. Existing Verizon email accounts were migrated to AOL Mail or Yahoo Mail — both platforms that were part of Verizon’s former Verizon Media division. After Verizon sold Verizon Media to Apollo Global Management in 2021, those email services became part of Yahoo, under Apollo’s ownership, not Verizon’s.

Does Warren Buffett own Verizon?

Warren Buffett’s Berkshire Hathaway previously held a large position in Verizon shares but sold its stake in 2022. As of 2025, Berkshire Hathaway no longer owns shares of Verizon Communications Inc.

Who is bigger, AT&T or Verizon?

As of 2025, Verizon and AT&T are close in size, but Verizon leads in wireless subscribers and network coverage, while AT&T has broader media and entertainment assets. Both generate annual revenues above $130 billion, but Verizon is generally considered the stronger wireless network operator in the U.S.

Which company does Verizon own?

Verizon owns several companies and brands, including Verizon Wireless, Verizon Business, Fios by Verizon, Visible, TracFone Wireless, BlueJeans by Verizon, Verizon Connect, and Verizon Partner Solutions. It also operates Verizon Ventures, its investment arm focused on technology startups.

Who owns Verizon Media?

Verizon Media (formerly Oath Inc.) was sold in 2021 to Apollo Global Management. Verizon retained certain advertising and data analytics technologies but no longer owns the Yahoo or AOL brands. Verizon Media now operates as part of Yahoo Inc. under Apollo’s ownership.

Who is Verizon’s largest retailer?

Verizon’s largest retailer is Verizon itself, operating more than 1,500 corporate-owned stores across the United States. Additionally, it partners with authorized retailers like Victra, Cellular Sales, and TCC (The Cellular Connection), which are independent businesses operating Verizon-branded locations.

How many countries use Verizon?

Verizon provides services in over 150 countries through its Verizon Business division. While its consumer wireless operations primarily serve the U.S., Verizon’s enterprise and global network solutions support multinational corporations, government clients, and global communication infrastructure worldwide.