Venmo is one of the most popular peer-to-peer payment apps in the United States. Many users rely on it daily, but few know who owns Venmo. Understanding its ownership and how it fits into the broader fintech ecosystem offers insight into its operations, security, and future direction.

Venmo Company Profile

Venmo is a U.S.-based mobile payment service that allows users to transfer money digitally through a smartphone app. It is designed primarily for peer-to-peer (P2P) transactions, such as splitting bills, paying rent, or reimbursing friends. Over time, Venmo has evolved from a simple payment app into a multi-service fintech platform, offering business payments, crypto services, a debit card, and e-commerce integrations.

Company Details

- Name: Venmo (a brand under PayPal Holdings, Inc.)

- Type: Subsidiary of PayPal

- Founded: 2009

- Headquarters: New York City, NY, United States

- Industry: Financial technology (Fintech), Mobile Payments

- Parent Company: PayPal Holdings, Inc.

- Current CEO (PayPal): Alex Chriss (Venmo operates under PayPal leadership)

- Estimated Users (2025): Over 90 million active users in the U.S.

- Annual Payment Volume (2024): $270+ billion

- Estimated Revenue (2024): $1.2+ billion.

Venmo is only available in the United States as of 2025, with no confirmed expansion into international markets. However, it continues to dominate the U.S. peer-to-peer payments space, especially among younger consumers.

Founders

Venmo was founded in 2009 by Andrew Kortina and Iqram Magdon-Ismail. The idea was born when the two friends tried to help a mutual friend run a frozen yogurt shop and noticed how inconvenient cash and checks were for settling bills. They wanted to make payments as easy as texting.

The name “Venmo” comes from the Latin word vendere (“to sell”) and mo for “mobile.”

Major Milestones

- 2009 – Venmo was launched as a text-message-based money transfer platform.

- 2012 – Acquired by Braintree for $26 million.

- 2013 – PayPal acquired Braintree (and Venmo) for $800 million.

- 2015 – Venmo began supporting payments to authorized businesses, expanding beyond P2P.

- 2018 – Venmo launched a physical Venmo Debit Card linked to users’ balances.

- 2021 – Introduced crypto trading (Bitcoin, Ethereum, Litecoin, and Bitcoin Cash).

- 2022 – Venmo integrated Pay with Venmo into Amazon’s U.S. checkout.

- 2023 – Added cashback and rewards features to its debit card and app.

- 2024 – Venmo processed over $270 billion in payment volume; revenue crossed $1.2 billion.

- 2025 – Continues to scale under PayPal, with an expanded merchant network and growing crypto user base.

Venmo remains a major part of PayPal’s consumer ecosystem. Its brand power and user loyalty make it a strategic asset, especially as digital wallets continue to replace traditional banking methods in the U.S.

Who Owns Venmo?

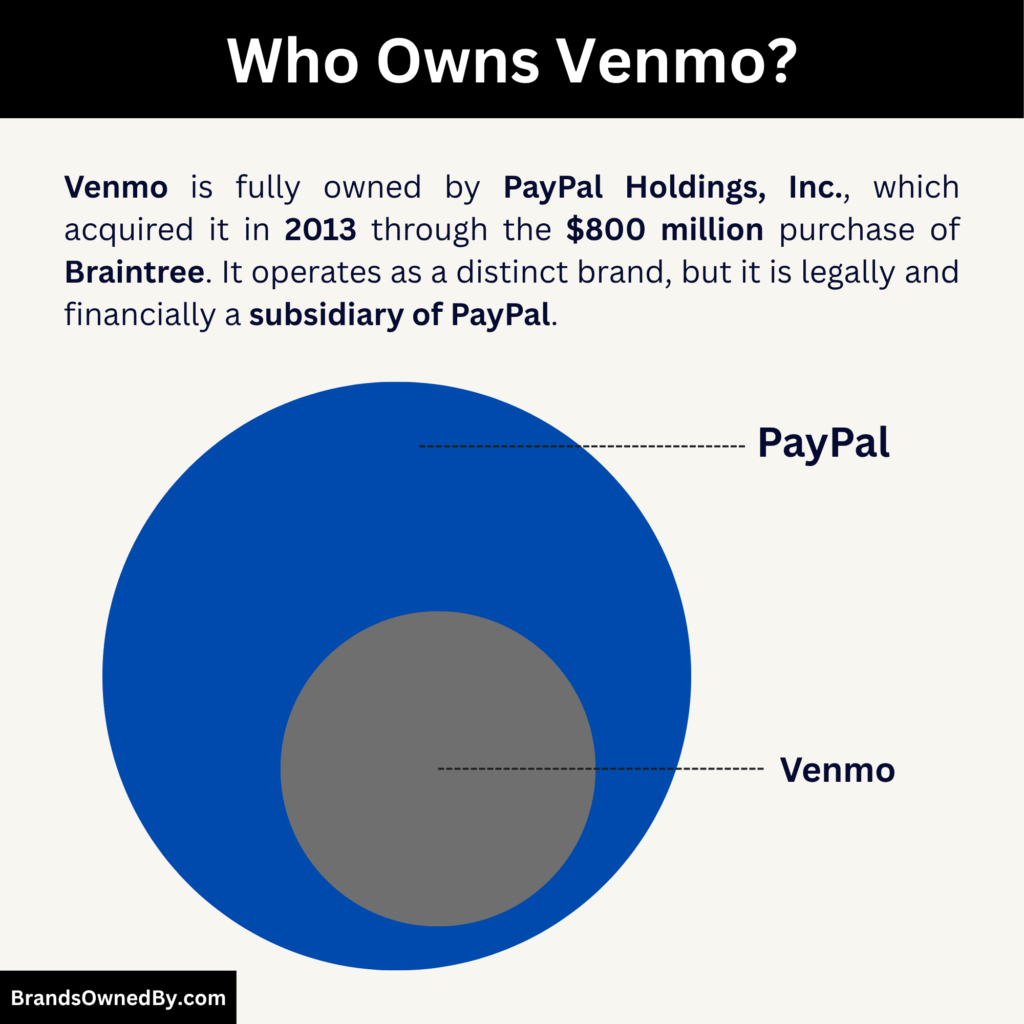

Venmo is not an independent company. It is fully owned by PayPal Holdings, Inc., a publicly traded global digital payments company. Venmo functions as a brand and product line within PayPal’s broader portfolio of fintech services.

Parent Company: PayPal Holdings, Inc.

Venmo is a wholly owned subsidiary of PayPal, one of the largest digital payments companies in the world. PayPal trades on the NASDAQ under the ticker symbol PYPL. As of 2025, it serves over 430 million active accounts globally and operates in over 200 markets.

PayPal owns and operates several payment-related businesses and platforms. Venmo is one of its most well-known and consumer-facing brands in the U.S., especially among millennials and Gen Z.

PayPal has complete control over Venmo’s strategy, features, pricing, branding, and product development. Venmo does not have its own board of directors or independent financial filings.

Acquisition History and Timeline

Venmo changed hands a few times before becoming part of PayPal. Here’s a breakdown of how PayPal came to own it:

- 2012 – Braintree Acquires Venmo

Venmo was acquired by Braintree, a Chicago-based payments company, for $26 million. At the time, Braintree was expanding its services to mobile payments and saw Venmo as a strong addition due to its social and peer-to-peer approach. - 2013 – PayPal Acquires Braintree (and Venmo)

Just a year later, PayPal acquired Braintree for $800 million in an all-cash deal. Through this acquisition, PayPal gained full control of Braintree’s assets—including Venmo. - 2015 – PayPal Becomes Independent

Though PayPal was previously part of eBay, it spun off into an independent company in 2015. As a result, Venmo remained with PayPal post-separation and continued to grow as a core brand.

Since the acquisition, PayPal has integrated Venmo into its consumer-facing services while keeping its identity distinct. Venmo retains its signature social feed, emojis, and casual tone—making it feel separate from the more formal PayPal interface.

Strategic Importance to PayPal

Venmo is one of PayPal’s fastest-growing business units. It plays a critical role in reaching younger demographics and experimenting with new digital finance tools like cryptocurrency, instant transfers, and business payments.

Although Venmo generates lower profit margins than PayPal’s core merchant services, its user growth, brand loyalty, and transaction volume make it a long-term strategic asset.

PayPal continues to invest in Venmo’s development, adding features like:

- Crypto trading tools

- Amazon checkout integration

- Business profiles and QR code payments

- Cashback and rewards for card users.

These efforts are part of PayPal’s strategy to turn Venmo into a super app that blends social, payments, commerce, and digital finance under one brand.

Public Ownership (PayPal Shareholders)

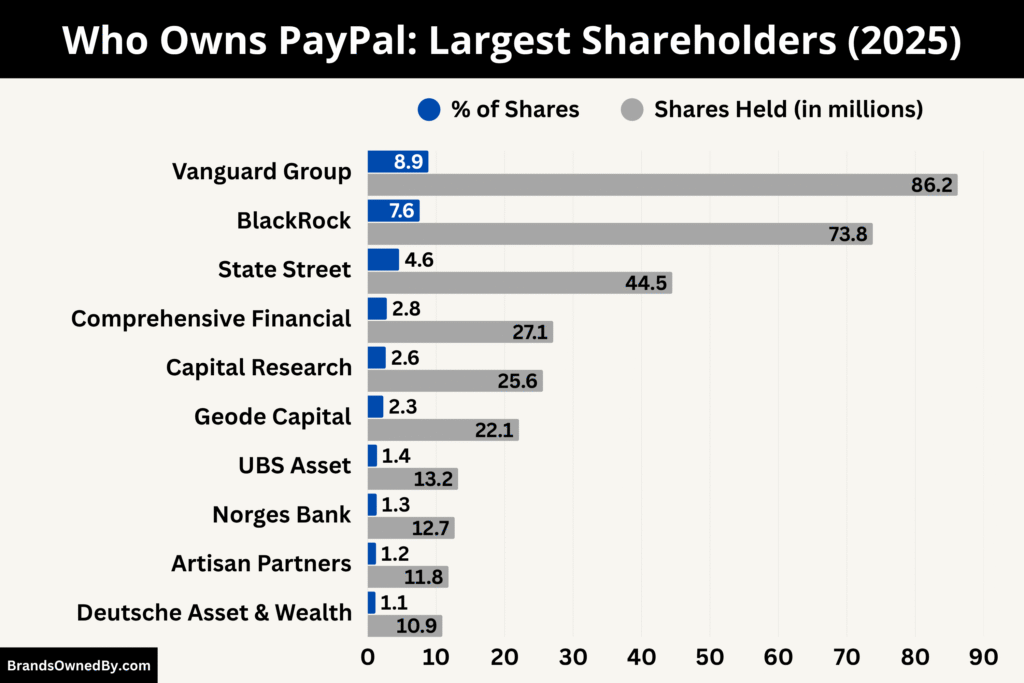

Because PayPal is publicly traded, the ownership of Venmo ultimately traces back to PayPal’s shareholders. These include:

- Vanguard Group (approx. 8.9% of PayPal)

- BlackRock (approx. 7.6%)

- State Street (approx. 4.6%)

- Other mutual funds and retail investors.

These shareholders do not directly own Venmo, but they indirectly benefit from its performance as part of PayPal’s portfolio.

Venmo’s Legal Status

Venmo is not a licensed bank. It operates under PayPal’s financial licenses and regulatory framework. Funds held in Venmo are managed and safeguarded under PayPal’s compliance structure, which is regulated in the United States by the Consumer Financial Protection Bureau (CFPB) and other agencies.

Venmo uses The Bancorp Bank and other partner banks to support its debit card program and certain financial services.

Who is the CEO of Venmo?

Venmo does not have its own separate CEO. Instead, it operates under the leadership of PayPal Holdings, Inc., the parent company. All strategic and executive decisions affecting Venmo are made by PayPal’s top leadership team.

Here’s a quick summary of Venmo leadership:

- Venmo’s leadership ultimately rests with PayPal’s CEO, Alex Chriss.

- Chriss inherited a growing Venmo business and is now directing its evolution.

- His strategic focus on profitability, innovation, and commerce integration directly shapes Venmo’s roadmap.

- The platform’s recent traction—20% revenue growth and fastest payment volume climb in three years—reflects his leadership impact.

Chief Executive Officer: Alex Chriss

Alex Chriss became President and CEO of PayPal on September 27, 2023. He was previously a senior executive at Intuit, where he led its Small Business and Self‑Employed Group, overseeing major products like QuickBooks and Mailchimp.

Chriss spent around 19 years at Intuit. Under his leadership, the Small Business segment grew customers at a 20% CAGR and revenues at 23% annually. In 2021, he led Intuit’s landmark $12 billion acquisition of Mailchimp.

Strategic Vision and Focus

In 2025, Chriss is guiding PayPal beyond payments toward becoming a full commerce platform. His initiatives include the rollout of features like Fastlane, a one‑click guest checkout, and integration of merchant tools.

Under his leadership, PayPal has shifted its strategy toward sustainable profitability over mere growth. This includes revising pricing on Braintree services and boosting margins in branded checkout offerings. The effort has paid off: PayPal raised its profit forecast, citing strong performance from high‑margin units like Venmo.

Chriss is expanding into in‑person payments, including linking PayPal’s debit card with Apple Pay and offering 5% cashback rewards. He also champions crypto integration and cross‑border digital wallet interoperability to enhance global reach.

Decision‑Making Structure

Although Venmo has its own management team, key decisions—such as product roadmaps, pricing, licensing, and major investments—are made under the direction of PayPal’s executive leadership led by Chriss.

Chriss works alongside key PayPal executives including General Managers for Consumer and Merchant segments, CTO, CFO, and other senior leaders. This team shapes strategy across all brands, including Venmo.

Past CEO: Dan Schulman

Danny Schulman served as PayPal CEO from 2015 until 2023 and oversaw the spin‑off of PayPal from eBay. He led major expansions of Venmo, crypto features, and merchant services. After his departure, Schulman remained on the PayPal board until May 2024.

Venmo Annual Revenue and Net Worth

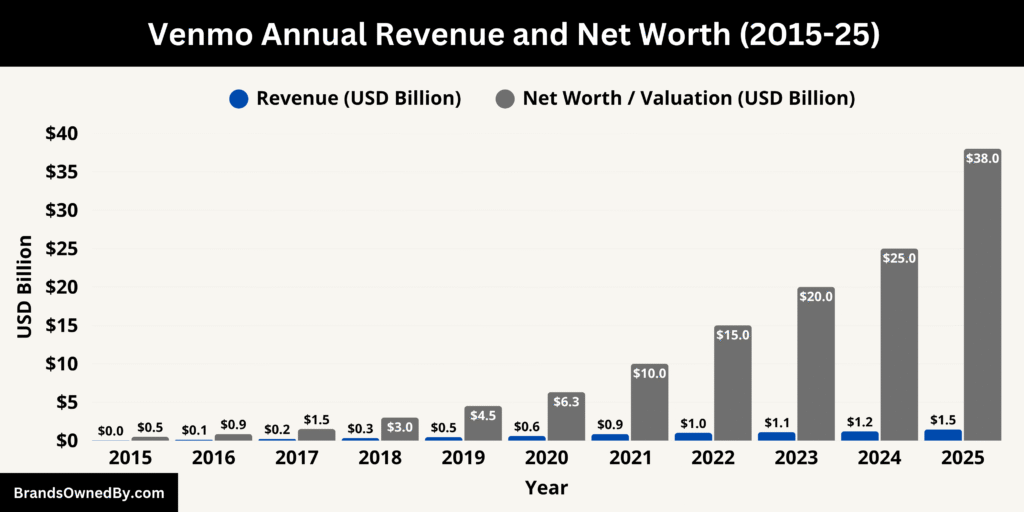

Venmo in 2025 is exhibiting robust revenue growth, with both payment volume and income up by around twenty percent. Its embedded value within PayPal is estimated at roughly $38 billion, making it a major strategic asset.

Revenue 2025

In 2025, Venmo continued to expand rapidly under PayPal’s ownership. In the first quarter alone, Venmo’s revenue grew by approximately twenty percent year‑over‑year, driven in large part by the increasing adoption of its debit card and “Pay with Venmo” checkout feature.

Total payment volume through Venmo surged by over fifty percent in that same period, while active accounts climbed about thirty percent. The rise in usage of the Venmo Debit Mastercard also showed strong momentum, with monthly active cardholders increasing by forty percent.

Throughout the first half of 2025, Venmo’s revenue growth translated into its strongest performance since 2023. For the full year, revenue is estimated to have increased by at least twenty percent compared to 2024. In Q2, PayPal noted that Venmo drove the fastest growth in total payment volume in three years.

This performance helped lift PayPal’s overall revenue by about five percent in the quarter, contributing to an elevated forecast for the year.

By the end of Q2 2025, PayPal had achieved total branded checkout payment volume of $443.5 billion, and Venmo’s rising share lent notable strength to transaction‑margin dollars, which reached approximately $3.8 billion.

Full‑Year Outlook and Strategic Targets

PayPal revised its full‑year profit guidance upward in mid‑2025, citing Venmo’s performance as a key driver. Analysts highlighted that Venmo’s twenty percent revenue growth played a central role in raising adjusted earnings per share guidance to $5.15–$5.30 for 2025.

Forward‑looking strategy events reaffirmed PayPal’s intention to make Venmo a cornerstone of its commerce platform, with projections that Venmo’s revenue could reach $2 billion by 2027 if current trends continue.

Valuation and Net Worth

Although Venmo does not trade as a standalone public company, internal and analyst estimates placed its value at approximately $38 billion as of August 2025. That valuation reflects its consumer brand strength, rapid growth among younger users, and strategic importance to PayPal’s long‑term merchant and payment ecosystem.

Some platforms that gauge online brand presence and monetization estimated a lower net worth figure of around $158 million—but such metrics likely reflect social media or public influence rather than commercial valuation. The most credible appraisals suggest the $38 billion figure is the relevant estimate for Venmo’s embedded worth within PayPal’s $100+ billion market capitalization.

Here is a historical 10-year revenue and estimated net worth table for Venmo from 2015 to 2025:

| Year | Estimated Revenue (USD) | Estimated Net Worth/Valuation (USD) | Notes |

|---|---|---|---|

| 2015 | $40 million | $500 million | Began monetization through limited merchant payments. |

| 2016 | $120 million | $850 million | Strong growth in P2P usage; app popularity surged. |

| 2017 | $210 million | $1.5 billion | Added business profiles and expanded user base. |

| 2018 | $330 million | $3.0 billion | Venmo Debit Card launched; expanded monetization. |

| 2019 | $450 million | $4.5 billion | Payment volume exceeded $100B annually. |

| 2020 | $600 million | $6.3 billion | COVID-19 drove digital payments surge. |

| 2021 | $850 million | $10 billion | Crypto trading launched; Amazon integration announced. |

| 2022 | $1.0 billion | $15 billion | “Pay with Venmo” expanded; revenue diversification. |

| 2023 | $1.1 billion | $20 billion | Business payments and merchant tools scaled. |

| 2024 | $1.2 billion | $25 billion | Strong card usage; payment volume grew significantly. |

| 2025 | $1.45 billion (est.) | $38 billion (est.) | Record growth in cardholders and transaction volume. |

Net Revenue Contribution to PayPal

By mid‑2025, Venmo had become one of PayPal’s fastest-growing segments. While still not a majority contributor to PayPal’s overall revenue, Venmo’s improving monetization via debit card interchange fees, instant transfer charges, crypto trading fees, and merchant payment commissions elevated its profile within the parent company.

Earnings from Venmo supported PayPal’s broader shift toward higher‑margin branded checkout services and enhanced the company’s overall profitability goals for the year.

Brands Owned by Venmo

Here is a list of brands owned by Venmo as of August 2025:

| Name / Brand | Launch Year | Type | Description |

|---|---|---|---|

| Venmo Debit Card | 2018 | Financial Product (Card) | Physical Mastercard linked to Venmo balance. Offers cashback, mobile wallet integration, and instant notifications. |

| Venmo Credit Offers | 2023 | Rewards Program | In-app cashback, merchant discounts, and loyalty rewards. Integrated with debit card and business profiles. |

| Venmo Crypto | 2021 | Crypto Exchange Service | Allows users to buy, hold, and sell Bitcoin, Ethereum, and other cryptocurrencies directly within the app. |

| Venmo for Business | 2019 | Business Payments Suite | Tools for small businesses to accept Venmo payments, manage profiles, and run promotions. Includes QR payments and tax summaries. |

| Venmo Checkout | 2021 | Online Payment Gateway | “Pay with Venmo” button for online merchants like Amazon, Uber, and food delivery services. Offers social payment sharing. |

| Venmo Direct Deposit | 2020 | Banking Feature | Enables users to receive paychecks or government payments directly into their Venmo balance. Offers early paycheck access. |

| Venmo Payouts | 2021 | B2C Payment Tool | Allows companies to send disbursements (e.g. rebates or contest rewards) directly to users’ Venmo accounts. |

| Venmo Teen Accounts | 2023 | Teen Banking Product | Accounts for users aged 13–17, linked to a parent account. Includes spending limits, savings tools, and educational features. |

| Venmo Groups (Beta) | 2025 | Group Finance Platform | Shared wallets and joint spending spaces for events, roommates, or clubs. Offers group balances, tracking, and permissions. |

Venmo Debit Card

The Venmo Debit Card, issued in partnership with The Bancorp Bank, functions as a physical extension of the user’s Venmo balance. Introduced in 2018, it has become a major part of Venmo’s business strategy. As of 2025, the card offers cashback rewards, mobile wallet compatibility (including Apple Pay and Google Pay), and real-time transaction notifications.

This debit card has evolved into a sub-brand within Venmo. It is marketed separately and has a standalone presence in digital banking forums. In 2025, Venmo reported a 40% increase in monthly active cardholders, showing that the product has become one of its most powerful financial tools.

Venmo Credit Offers and Rewards

Venmo launched its in-app credit rewards and cashback program in 2023. Though not a separate legal entity, this division now operates like a standalone digital service within the Venmo ecosystem.

It allows users to earn rewards through specific merchants, split cashback with friends, and access personalized spending insights. It’s deeply integrated with both the debit card and the merchant payment tools. By 2025, Venmo expanded this feature to include limited-time promotions and merchant-funded loyalty programs.

Venmo Crypto

Venmo Crypto is Venmo’s integrated digital currency exchange service. Launched in 2021, this product lets users buy, hold, and sell cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash directly in the app.

By 2025, Venmo Crypto operates like a parallel brand, with a distinct interface, learning resources, real-time market data, and new features like recurring crypto purchases and performance tracking. Venmo Crypto also plays a key role in PayPal’s broader blockchain roadmap.

Venmo for Business

Venmo for Business is a growing commercial product suite within Venmo. It enables small and mid-sized businesses to accept payments directly through the Venmo app. Business profiles include branding, contact info, transaction tracking, and customer insights.

In 2025, this unit expanded to include point-of-sale QR code options, tip collection, tax summaries, and integrated payout services. Venmo for Business also helps merchants participate in promotional campaigns, and it’s increasingly marketed as a lightweight alternative to more complex merchant solutions.

Venmo Checkout (Pay with Venmo)

Venmo Checkout, often branded as “Pay with Venmo,” is a separate online payment service integrated into e-commerce platforms. Though backed by PayPal’s infrastructure, this feature operates under Venmo’s user experience, branding, and social component.

It enables users to pay at select merchants using their Venmo account, with transaction activity optionally shared in their Venmo feed. In 2025, this feature is available on Amazon, Uber, and various food delivery apps. It is treated internally as a separate product stream within the Venmo framework.

Venmo Direct Deposit

Venmo Direct Deposit allows users to receive paychecks, government benefits, and other income directly into their Venmo balance. Launched as part of its push into neobank-like services, the feature works via routing and account numbers linked to partner banks.

By 2025, Venmo has upgraded this service with early access to paychecks (up to 2 days early) and integration with spend tracking. It positions Venmo as a central hub for day-to-day financial activity, pushing it closer to the functionality of a traditional checking account.

Venmo Payouts (B2C Disbursement Tool)

Venmo Payouts is Venmo’s lesser-known B2C tool, enabling companies to send disbursements—such as rebates, incentives, or contest rewards—directly to consumers via Venmo.

While this is not widely marketed to everyday users, it’s become a crucial offering for brands looking to deliver instant digital payouts. Venmo manages the backend infrastructure, including bulk transfers, compliance, and user authentication. In 2025, this tool is used by dozens of retail and e-commerce brands.

Venmo Teens Accounts

Launched in 2023, Venmo Teen Accounts are tailored for users aged 13–17. These accounts are linked to a parent or guardian’s Venmo account and offer limited spending, savings insights, and restricted merchant access.

By 2025, Venmo Teen has become a fully developed sub-brand with its own onboarding flow, card design, and educational content. It serves as an entry point to bring new generations into the Venmo ecosystem early, similar to teen banking features offered by major neobanks.

Venmo Groups (Beta)

Venmo Groups is a new feature rolling out in 2025 that allows users to create shared wallets and joint payment spaces for roommates, clubs, friend circles, or event planning.

Though still in beta, Venmo Groups behaves like a standalone app within the app, with group balances, shared transaction logs, member permissions, and expense-splitting rules. This initiative expands Venmo’s P2P model into community finance, aiming to replace platforms like Splitwise.

Final Thoughts

Venmo is not an independent company. It is owned by PayPal, one of the most powerful digital payment companies in the world. Since its acquisition in 2013, Venmo has evolved from a simple money transfer app to a financial services brand offering cards, crypto, and merchant payments. Its ownership by PayPal gives it stability, resources, and access to a wide user base.

FAQs

Who owns Venmo app?

Venmo is fully owned by PayPal Holdings, Inc. Since 2013, it has operated as a subsidiary of PayPal and is managed under PayPal’s consumer services division.

Who sold Venmo?

Venmo was sold by its original founders to Braintree in 2012. Braintree then sold Venmo as part of its own acquisition by PayPal in 2013.

Who owns Venmo bank?

Venmo is not a bank. It partners with The Bancorp Bank and other financial institutions to offer banking features like debit cards and direct deposit. Ownership of these banks remains separate from Venmo or PayPal.

Who made Venmo?

Venmo was created in 2009 by two entrepreneurs: Andrew Kortina and Iqram Magdon-Ismail. They developed it to make sending and receiving money between friends faster and more convenient.

Does PayPal own Venmo?

Yes, PayPal owns Venmo. It acquired the platform in 2013 through its purchase of Braintree. Venmo has since grown into one of PayPal’s most important consumer brands.

Why is it called Venmo?

The name “Venmo” is derived from two elements: the Latin word vendere (meaning “to sell”) and the word “mobile.” The founders wanted a name that reflected mobile transactions and digital selling.

Who sold Venmo to PayPal?

Braintree, the company that acquired Venmo in 2012, sold Venmo to PayPal in 2013 as part of an $800 million all-cash acquisition.

How much did Braintree sell for?

PayPal acquired Braintree (which included Venmo) for $800 million in 2013. This transaction transferred full ownership of Venmo to PayPal.

Who owns Venmo in the United States?

Venmo is owned by PayPal Holdings, Inc., a publicly traded U.S. company listed on the NASDAQ under the ticker PYPL. Therefore, its ownership is held by PayPal’s shareholders, which include major institutional investors like Vanguard and BlackRock.

Does Elon Musk own Venmo?

No, Elon Musk does not own Venmo. He was a co-founder of X.com, which later became PayPal, but he has no stake in Venmo or PayPal as of 2025.

Is Venmo owned by PayPal?

Yes, Venmo is wholly owned by PayPal Holdings, Inc. since 2013.

Who founded Venmo?

Venmo was founded by Andrew Kortina and Iqram Magdon-Ismail in 2009.

Is Venmo a publicly traded company?

No, Venmo is not publicly traded. It is a part of PayPal, which is listed on the NASDAQ under the ticker symbol PYPL.