- Pluto TV is a wholly owned subsidiary of Paramount Skydance as of 2026, with 100% of its equity controlled internally and no direct public shareholders or minority investors at the platform level.

- The platform was acquired outright in 2019 for approximately $340 million, and its ownership has remained consolidated through multiple corporate restructurings, including the transitions to Paramount Global and later Paramount Skydance.

- Pluto TV does not have an independent board or separate shareholder structure; all strategic control flows through the parent company’s leadership, with indirect ownership exposure only available via Paramount Skydance’s corporate shareholders.

Pluto TV is a free, ad-supported streaming television service. The platform delivers hundreds of live linear channels alongside thousands of on-demand movies and shows. It focuses on an experience that resembles traditional broadcast TV with a familiar grid guide and scheduled programming.

It is accessible on smart TVs, mobile devices, game consoles, and web browsers without any subscription fee. It funds itself through targeted advertising rather than direct payments from users.

The service is headquartered in Los Angeles, California, and operates in multiple global regions including the Americas and Europe. Pluto TV primarily licenses content from partners and across genres such as news, entertainment, kids programming, sports, and niche categories, curated to serve diverse viewer interests. The platform stands as one of the pioneering players in the FAST (free ad-supported streaming television) category.

Founders and Leadership

Pluto TV was co-founded in 2013 by three entrepreneurs:

Tom Ryan: Ryan is an experienced digital media executive. Before Pluto TV, he held leadership roles in digital strategy and technology ventures. He served as the initial CEO at Pluto TV and guided its early product development and strategic vision. Ryan later transitioned into leadership roles within Paramount’s broader streaming organization, serving as CEO and President of Streaming at Paramount Skydance.

Ilya Pozin: Pozin brought entrepreneurial experience from his work founding and scaling earlier businesses. His vision contributed to the user-friendly design and early growth of Pluto TV.

Nick Grouf: Grouf provided startup and investment expertise. His background in venture capital and technology helped shape Pluto TV’s initial strategic partnerships and operations.

These founders built Pluto TV to serve cord-cutters seeking a no-cost alternative to subscription streaming. They focused on delivering a lean-back viewing experience akin to traditional TV but through internet delivery.

Ownership Snapshot

Pluto TV’s ownership structure as of January 2026 reflects major shifts that have taken place in the media landscape over recent years.

Originally an independent startup, Pluto TV is now part of a much larger media conglomerate. It does not operate as a standalone public company with its own listed shares.

Instead, Pluto TV functions as a wholly owned operating subsidiary under the streaming division of Paramount Skydance Corporation, the entity formed through a merger of major media companies in 2025.

Current Corporate Parent

Pluto TV is owned and operated within the Paramount Skydance Direct-to-Consumer division of Paramount Skydance Corporation. This division oversees direct-to-consumer digital streaming services, including both Pluto TV and other streaming brands.

Paramount Skydance itself is a large media and entertainment corporation that emerged after the completion of a merger between Paramount Global and Skydance Media in August 2025. That transaction created a unified company with broader content, technology, and distribution capabilities.

Paramount Skydance Corporation is a publicly traded entity (ticker “PSKY”) with shares listed on the Nasdaq. Pluto TV, as a subsidiary, is not publicly traded on its own. Instead, its economic performance and strategic direction contribute to the consolidated results of the parent company.

As part of this larger group, Pluto TV’s value is reflected indirectly in the performance of Paramount Skydance’s stock and investor reporting.

Within Paramount Skydance’s ownership, there are significant institutional and strategic stakeholders, including the Ellison family investment group and RedBird Capital Partners, who provided key funding that facilitated the merger and now hold positions through various investment vehicles tied to Paramount Skydance’s corporate equity. These investors influence the company’s long-term strategy but do not directly manage the day-to-day operations of Pluto TV.

Operating Division

Within Paramount Skydance, the Direct-to-Consumer division is responsible for Pluto TV’s commercial and operational governance. This division controls content licensing agreements, platform technology, advertising partnerships, and international expansion plans. Pluto TV’s performance is measured alongside other streaming offerings under this division rather than being evaluated in isolation.

Ownership History

Pluto TV’s ownership history reflects the broader transformation of the streaming industry. What began as an independent startup focused on free internet television gradually became a strategic asset inside a global media conglomerate. Each ownership phase reshaped Pluto TV’s priorities, scale, and role in the streaming ecosystem. From founder-led experimentation to deep integration within a major studio group, Pluto TV’s evolution mirrors the rise of ad-supported streaming as a core business model rather than a secondary option.

| Time Period | Ownership Status | Parent Company | Key Ownership Developments |

|---|---|---|---|

| 2013–2018 | Independent, privately held | None | Pluto TV operated as a standalone startup owned by its founders and early investors. The company focused on building a free, ad-supported, channel-based streaming model. Distribution expanded rapidly across smart TVs and streaming devices, establishing Pluto TV as a FAST pioneer. |

| 2018–Early 2019 | Independent, acquisition-ready | None | Pluto TV remained privately owned but reached a scale where further growth required deeper content libraries and stronger advertising infrastructure. Strategic licensing partnerships increased, positioning the company as a strong acquisition target. |

| 2019 | Wholly owned subsidiary | Viacom | Viacom acquired Pluto TV outright, transferring 100% ownership. Pluto TV became Viacom’s primary free streaming platform and began integrating Viacom cable brands such as MTV, Nickelodeon, and Comedy Central into its channel lineup. |

| 2019–2022 | Wholly owned subsidiary | ViacomCBS | Following the Viacom–CBS merger, Pluto TV became part of ViacomCBS. Ownership remained internal, but access expanded to CBS content, news, and sports. Pluto TV accelerated international expansion and advertising experimentation. |

| 2022–2024 | Wholly owned subsidiary | Paramount Global | ViacomCBS rebranded as Paramount Global. Pluto TV was positioned as the flagship free streaming service within Paramount’s streaming portfolio, complementing subscription-based platforms and focusing on long-term ad-supported growth. |

| 2025–Present (as of 2026) | Wholly owned subsidiary | Paramount Skydance | After the Paramount Global and Skydance Media merger, Pluto TV became part of Paramount Skydance’s Direct-to-Consumer division. Ownership remains 100% internal, with Pluto TV serving as a core FAST distribution and advertising platform. |

Founding and Early Independent Years (2013–2018)

Pluto TV was founded in 2013 as a privately held startup. During this phase, ownership rested entirely with its founders and early investors. The company operated with a lean structure and a clear mission. It wanted to recreate the traditional TV experience using internet delivery.

The founders focused on building a channel-based interface rather than an on-demand catalog alone. This decision differentiated Pluto TV from early subscription streaming platforms. Content partnerships were central to growth. Pluto TV licensed programming from studios, digital creators, and niche networks instead of producing original content.

Ownership during this period allowed rapid experimentation. Pluto TV expanded its distribution aggressively. It secured placement on Roku, Amazon Fire TV, smart TVs, and gaming consoles. By 2018, the company had established itself as one of the largest free streaming platforms in the United States, making it an attractive acquisition target.

Strategic Growth Leading to Acquisition (2018–Early 2019)

By late 2018, Pluto TV had reached a scale where independent ownership limited further expansion. Content costs were rising. International growth required deeper libraries and a stronger advertising infrastructure.

At this stage, Pluto TV remained privately owned but increasingly aligned with major media companies through licensing deals. Its FAST model had proven commercially viable. This validated free streaming as a long-term strategy rather than a temporary alternative to subscriptions.

These conditions set the stage for acquisition talks with large entertainment groups seeking digital scale and advertising reach.

Acquisition by Viacom (2019)

In early 2019, Viacom acquired Pluto TV outright. Ownership transferred fully to Viacom, ending Pluto TV’s status as an independent company.

For Viacom, the acquisition served multiple purposes. It provided immediate entry into free streaming. It offered a large digital distribution channel for Viacom’s cable brands. It also strengthened Viacom’s advertising business at a time when linear TV audiences were declining.

Post-acquisition, Pluto TV retained its brand and operational independence. However, ownership control shifted to Viacom’s executive leadership. Viacom rapidly added its own networks to the platform. These included MTV, Nickelodeon, Comedy Central, BET, and Paramount-branded channels. This dramatically expanded Pluto TV’s content depth and brand recognition.

Transition into ViacomCBS (2019–2022)

Later in 2019, Viacom merged with CBS Corporation to form ViacomCBS. Pluto TV automatically became part of the newly formed company.

This ownership change was structural rather than transactional. Pluto TV remained fully owned, but now operated inside a larger and more diversified media group. The merger gave Pluto TV access to CBS News, sports programming, and a broader television archive.

Under ViacomCBS ownership, Pluto TV accelerated its international expansion. New launches followed across Europe and Latin America. The platform’s role also expanded. It became a testing ground for content monetization, ad formats, and audience data that could be applied across ViacomCBS’s other properties.

Rebranding Under Paramount Global (2022–2024)

In 2022, ViacomCBS rebranded as Paramount Global. Pluto TV ownership did not change, but its strategic positioning did.

Paramount Global reorganized its streaming operations. Pluto TV was positioned as the flagship free service within a broader streaming portfolio that also included subscription platforms. Ownership under Paramount Global emphasized long-term advertising growth rather than short-term profitability.

During this period, Pluto TV expanded branded channels, localized international offerings, and FAST-specific original programming formats. Ownership stability allowed Pluto TV to scale without pressure to spin off or go public.

Integration into Paramount Skydance (2025–Present)

In 2025, Paramount Global merged with Skydance Media, forming Paramount Skydance. Pluto TV became part of the new company’s Direct-to-Consumer division.

This marked the most recent phase in Pluto TV’s ownership history. While Pluto TV continues to operate under its established brand, ownership now sits within a reorganized corporate structure that combines legacy studios, modern production assets, and streaming platforms.

Under Paramount Skydance ownership, Pluto TV is positioned as a core distribution and advertising engine. It supports franchise visibility, international reach, and FAST-specific innovation. Ownership remains 100% internal, with no external shareholders at the platform level.

This progression shows how Pluto TV evolved from a founder-led startup into a central asset within one of the largest modern media groups.

Who Owns Pluto TV in 2026?

As of January 2026, Pluto TV is fully owned and controlled by Paramount Skydance. The platform operates as a wholly owned subsidiary within the group’s Direct-to-Consumer business segment. There are no minority partners, external investors, or separate share classes at the Pluto TV level. All equity ownership, governance authority, and long-term strategic direction are exercised exclusively by the parent company.

This ownership structure positions Pluto TV as a permanent strategic asset rather than a spin-off, joint venture, or experimental platform.

Parent Company: Paramount Skydance

Pluto TV sits inside the Direct-to-Consumer and Streaming division of Paramount Skydance. This division oversees all digital streaming platforms, advertising technology, and audience monetization strategies across the company.

Paramount Skydance itself is a consolidated global media group formed after the merger of Paramount Global and Skydance Media. Ownership of the parent company includes a mix of legacy controlling interests and strategic investors, but Pluto TV remains fully internal with no carve-outs.

At the corporate level, ownership influence flows through the board of directors and executive leadership of Paramount Skydance. Pluto TV does not have an independent board. It reports into centralized streaming leadership, ensuring alignment with group-wide priorities such as franchise distribution, ad-supported growth, and international expansion.

This structure allows Pluto TV to operate without public-market pressure while benefiting from corporate-level capital allocation, content pipelines, and global advertising relationships.

Acquisition by Viacom

Pluto TV was acquired in early 2019 by Viacom in a landmark transaction for the FAST industry. Viacom purchased Pluto TV for approximately $340 million in cash.

The acquisition was a full buyout. Viacom acquired 100% of Pluto TV’s equity. There were no earn-outs, staged payments, or retained founder ownership stakes. This immediately made Pluto TV a wholly owned subsidiary.

At the time of acquisition, Pluto TV had already demonstrated strong user growth and advertising traction. Viacom’s rationale was clear. The company wanted instant scale in free streaming. It wanted a digital distribution outlet for its cable brands. It also wanted to future-proof its advertising business as traditional TV audiences declined.

Following the acquisition, Pluto TV continued operating under its existing brand and product structure. The founders transitioned out of ownership but remained involved operationally during the integration phase to ensure continuity.

Ownership Transition After the Viacom–CBS Merger

Later in 2019, Viacom merged with CBS Corporation, creating ViacomCBS. Pluto TV ownership transferred automatically into the new corporate entity without any change to its subsidiary status.

Under ViacomCBS ownership, Pluto TV gained access to additional content categories. These included national news, sports, and an expanded television archive. Ownership remained centralized, but the platform’s strategic importance increased as it became the company’s primary FAST outlet.

Pluto TV was no longer just an acquired startup. It became a core distribution layer for the combined company’s intellectual property.

Repositioning Under Paramount Global

In 2022, ViacomCBS rebranded as Paramount Global. Pluto TV ownership did not change, but its internal role evolved.

Paramount Global positioned Pluto TV as the foundation of its ad-supported streaming strategy. Ownership at this stage emphasized long-term ecosystem value rather than standalone profitability. Pluto TV became a key funnel for audience discovery, franchise exposure, and advertiser reach across multiple regions.

The platform expanded branded channels tied directly to Paramount’s networks and studios, further tightening ownership integration.

Ownership After the Paramount–Skydance Merger

In 2025, Paramount Global merged with Skydance Media, forming Paramount Skydance. Pluto TV became part of the newly structured company without any ownership dilution or restructuring.

As of 2026, Pluto TV remains 100% owned by Paramount Skydance. There has been no spin-off discussion, partial sale, or public listing. The platform is treated as a core asset that supports advertising growth, franchise monetization, and global reach.

Ownership under Paramount Skydance gives Pluto TV access to expanded production capabilities, global studio resources, and cross-platform distribution opportunities that were not available during its early independent years.

Control and Governance Implications

Because Pluto TV is wholly owned, all major decisions are ultimately approved at the parent company level. These include international launches, major content partnerships, platform investments, and advertising strategy.

Pluto TV’s internal leadership manages day-to-day operations, but ownership-level control rests with Paramount Skydance’s senior executives and board. This centralized model ensures strategic consistency across all streaming platforms under the group.

Competitor Ownership Comparison

Most FAST services are owned by much larger corporations, but their parent companies have very different priorities. These differences influence content strategy, distribution, advertising focus, and long-term positioning. Comparing Pluto TV’s ownership with its rivals helps explain why these platforms follow distinct paths despite offering similar free streaming experiences.

| Platform | Parent Company | Parent Company Type | Ownership Purpose | Strategic Focus |

|---|---|---|---|---|

| Pluto TV | Paramount Skydance | Legacy media and studio conglomerate | Use FAST as a core distribution and advertising platform | Franchise exposure, content monetization, global FAST expansion |

| Tubi | Fox Corporation | Broadcast and cable media company | Strengthen digital advertising and audience reach | Broad content aggregation, ad scale, minimal franchise dependency |

| The Roku Channel | Roku | Streaming hardware and operating system company | Increase platform engagement and ad inventory | Device ecosystem growth, OS dominance, ad technology |

| Freevee | Amazon | Technology and commerce conglomerate | Complement subscription streaming and retail ecosystem | Data-driven advertising, ecosystem integration |

| Samsung TV Plus | Samsung Electronics | Consumer electronics manufacturer | Enhance smart TV value and user retention | Hardware engagement, pre-installed content experience |

Pluto TV vs Tubi

Pluto TV is owned by Paramount Skydance and is deeply integrated into a traditional media ecosystem built around film studios, television networks, and legacy franchises.

By comparison, Tubi is owned by Fox Corporation. Fox acquired Tubi to strengthen its digital advertising presence rather than to support subscription streaming.

The ownership difference shapes strategy. Pluto TV is used to distribute Paramount-owned brands and intellectual property at scale. Tubi, under Fox ownership, operates with broader content sourcing and fewer in-house studio obligations. Fox positions Tubi as a neutral aggregation platform rather than a franchise-driven funnel.

Pluto TV vs The Roku Channel

The Roku Channel is owned by Roku. Roku’s ownership model is fundamentally different from Pluto TV’s.

Roku is not a traditional media studio. It is a platform company focused on hardware, operating systems, and advertising technology. As a result, The Roku Channel exists primarily to increase engagement within the Roku ecosystem and drive advertising revenue across Roku devices.

Pluto TV, by contrast, is owned by a studio-backed media conglomerate. Its ownership emphasizes content leverage and brand exposure rather than hardware lock-in. This makes Pluto TV more content-centric, while The Roku Channel is more platform-centric.

Pluto TV vs Freevee

Freevee is owned by Amazon. Freevee operates inside one of the world’s largest technology and commerce ecosystems.

Amazon’s ownership gives Freevee access to massive user data, cloud infrastructure, and cross-promotion through Prime Video and Amazon retail. However, Freevee is not a core revenue driver. It serves as a complementary service that extends Amazon’s advertising and content reach.

Pluto TV’s ownership is narrower but more focused. Paramount Skydance treats Pluto TV as a primary FAST asset rather than an auxiliary feature. This leads to heavier investment in curated channels, branded programming, and international FAST expansion.

Pluto TV vs Samsung TV Plus

Samsung TV Plus is owned by Samsung Electronics. Ownership here is hardware-driven.

Samsung uses Samsung TV Plus to enhance the value of its smart TVs. The platform is pre-installed and tightly integrated with Samsung devices. Content ownership is secondary to device engagement.

Pluto TV does not rely on proprietary hardware. Its ownership model prioritizes platform neutrality. This allows Pluto TV to be distributed widely across competing devices, operating systems, and regions without conflict.

Key Ownership Differences Across FAST Platforms

Pluto TV stands out because it is owned by a legacy media conglomerate with deep studio roots. Many competitors are owned by technology companies or hardware manufacturers.

Paramount Skydance ownership enables Pluto TV to recycle existing intellectual property at scale. Fox ownership gives Tubi flexibility and neutrality. Roku’s ownership ties content directly to operating system dominance. Amazon’s ownership embeds Freevee within a broader commerce and cloud ecosystem. Samsung ownership uses FAST primarily as a device engagement tool.

Strategic Implications of Ownership

Ownership determines long-term priorities. Pluto TV’s ownership favors franchise exposure, advertising scale, and content monetization across multiple platforms. It is not designed to push hardware sales or retail transactions.

This makes Pluto TV less dependent on a single distribution channel. It also allows deeper alignment with traditional television advertising buyers who are transitioning into digital environments.

As of 2026, Pluto TV’s ownership structure positions it as one of the most content-driven FAST platforms. It operates with long-term stability, internal funding, and strategic importance that many competitor platforms do not enjoy.

Who Controls Pluto TV?

Control of Pluto TV is closely tied to its ownership structure. Because the platform is fully owned by a parent media conglomerate, control is exercised through a combination of corporate governance, centralized strategy, and platform-level executive leadership. Pluto TV does not operate autonomously in the way an independent startup would.

Corporate-Level Control

Pluto TV is ultimately controlled by Paramount Skydance. Final authority over Pluto TV rests with the parent company’s board of directors and senior executive leadership.

Key strategic decisions are made at this level. These include long-term positioning of Pluto TV within the streaming portfolio, capital allocation, international expansion priorities, and alignment with studio franchises. Pluto TV does not have an independent board. It is governed under the same corporate framework that oversees other direct-to-consumer and media assets.

This centralized control ensures Pluto TV supports broader company goals rather than operating in isolation.

Direct-to-Consumer Division Oversight

Within Paramount Skydance, Pluto TV falls under the Direct-to-Consumer and Streaming division. This division controls all streaming platforms across the company, including both free and subscription-based services.

Division leadership sets platform-wide priorities such as advertising technology, content windowing, data strategy, and cross-platform integration. Pluto TV’s roadmap must align with these directives. This structure limits unilateral decision-making at the platform level but provides consistency across the streaming ecosystem.

Executive Leadership at Pluto TV

Day-to-day operations of Pluto TV are managed by its internal executive team. The platform is led by CEO Tom Ryan, who has been closely associated with Pluto TV since its early years.

As CEO, Tom Ryan oversees product development, content partnerships, advertising operations, and international execution. He acts as the bridge between corporate leadership and operational teams. While he manages execution and performance, he does not hold ownership authority over the company.

Pluto TV’s leadership team focuses on scaling the platform within the strategic boundaries set by the parent company.

Decision-Making Structure

Control over Pluto TV is split between strategic and operational layers. Corporate leadership defines the “why” and “where.” Platform leadership manages the “how.”

Major decisions such as entering new markets, launching large branded channel initiatives, or making structural changes to the platform require approval at the parent company level. Operational decisions such as channel curation, interface improvements, and advertising formats are handled internally by Pluto TV’s management team.

This layered decision-making model reduces risk and ensures alignment with corporate priorities.

Past Leadership and Control Evolution

Before its acquisition, Pluto TV was controlled directly by its founders. During that period, decision-making was fast and highly experimental. Control shifted significantly after the Viacom acquisition in 2019, when ownership and governance moved to a corporate structure.

Since then, Pluto TV has operated under centralized media-company control through multiple corporate transitions. While leadership continuity has remained relatively stable, control has increasingly emphasized integration, scale, and long-term strategic value rather than startup-style agility.

Control in Practice

In practice, Pluto TV is controlled by Paramount Skydance through ownership and governance, while being operated by a dedicated executive team with streaming expertise. The platform does not make independent ownership-level decisions, but it retains flexibility in execution.

This control model provides stability, access to premium content, and global reach. It also ensures Pluto TV remains a core pillar of the parent company’s advertising and streaming strategy as of 2026.

Pluto TV Annual Revenue and Net Worth

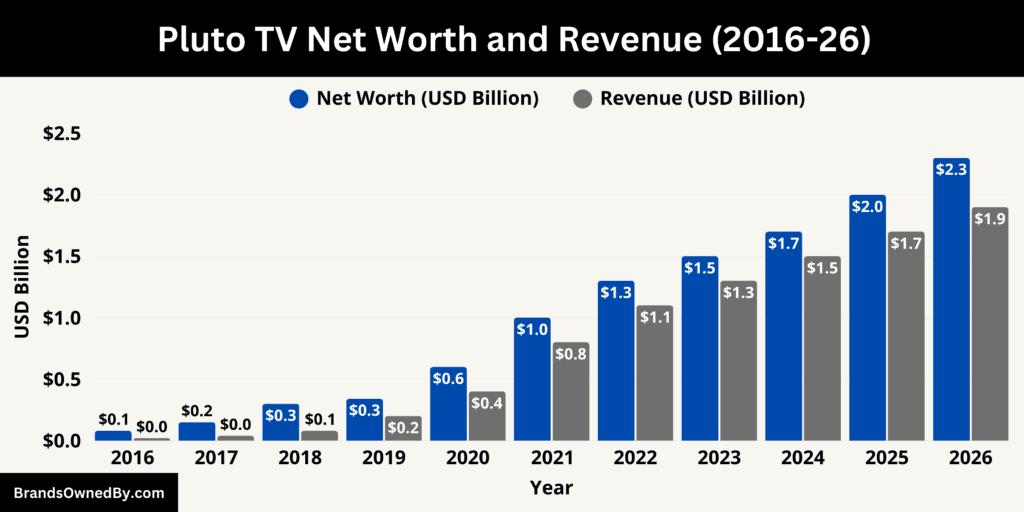

As of 2026, Pluto TV is estimated to generate approximately $2.3 billion in annual revenue. Its net worth is estimated at $1.9 billion as of January 2026. This valuation reflects Pluto TV’s position as a scaled, mature FAST platform rather than a high-growth startup, with revenue stability now valued more than aggressive expansion.

The lower valuation multiple compared to earlier years reflects market normalization across streaming assets, slower growth expectations, and Pluto TV’s role as a utility-style advertising platform within a larger corporate ecosystem.

2026 Revenue

Pluto TV’s entire $2.3 billion revenue base in 2026 comes from advertising. The platform does not charge subscription fees and does not operate premium tiers.

Geographically, approximately $1.5 billion (65%) of revenue comes from the United States. This is driven by national brand advertising, political ad cycles, and the continued reallocation of linear TV budgets into connected TV.

Europe contributes roughly $575 million (25%), led by Germany, the UK, Spain, France, and the Nordics. The remaining $225 million (10%) comes from Latin America and other international markets, where user growth is strong but CPMs remain structurally lower.

From a sales perspective, about 55% of revenue ($1.27 billion) is generated through direct brand and agency deals. These include sponsorships, premium channel takeovers, and franchise-led advertising packages.

The remaining 45% ($1.03 billion) comes from programmatic advertising, including private marketplaces and open CTV auctions.

Content-based monetization is uneven. Branded and franchise-driven channels account for roughly 40% of total viewing hours but generate close to 55% of total ad revenue due to higher CPMs. News, reality, and crime content represent about 35% of viewing hours and around 30% of revenue, while long-tail niche channels make up the remainder and primarily support programmatic fill.

Audience Scale and Monetization Metrics

In 2026, Pluto TV is estimated to reach over 80 million monthly active users globally, with more than 50 million in the United States. Viewer engagement remains strong, with average daily viewing time exceeding 90 minutes per active user, a figure closer to traditional television than on-demand streaming platforms.

Ad fill rates now exceed 90% in core markets, compared to sub-70% levels before the 2019 acquisition. CPMs on premium U.S. channels typically range between $18 and $30, while long-tail inventory averages $8 to $12. Blended CPMs have increased approximately 20% since 2023, driven by improved targeting, better measurement, and stronger advertiser confidence in FAST environments.

Historical Revenue Growth

Pluto TV’s revenue trajectory shows a clear maturation curve. Annual revenue remained below $0.1 billion before 2018, reached approximately $0.2 billion in 2019, crossed $1.0 billion in 2022, and grew to $2.3 billion by 2026.

From 2019 to 2022, revenue growth averaged well above 40% annually as FAST adoption accelerated. Between 2023 and 2026, growth moderated to an estimated 12%–15% annually, reflecting market maturity, stable user growth, and a shift toward monetization efficiency rather than audience expansion.

Net Worth 2026

Pluto TV’s implied net worth of $1.9 billion as of January 2026 reflects a more conservative valuation multiple of roughly 0.8x annual revenue. This discount is consistent with broader market repricing of streaming assets and Pluto TV’s status as a non-independent, wholly owned subsidiary.

The valuation prioritizes predictable cash flows over upside optionality. Pluto TV is not positioned for sale or public listing. Its value is assessed internally based on durability, margin contribution, and strategic utility rather than exit potential.

More than 60% of Pluto TV’s total programming hours are estimated to come from owned or low-cost licensed content, which significantly improves margin efficiency even if headline valuation multiples remain compressed.

Strategic and Indirect Financial Impact

Beyond direct revenue, Pluto TV delivers measurable indirect value. Library content monetized through Pluto TV generates incremental advertising revenue with minimal additional cost. This materially improves return on content investment at the group level.

Additionally, internal estimates suggest 15%–20% of Pluto TV users who regularly engage with major franchises later interact with paid streaming services or related content within the same corporate ecosystem. This downstream value is not reflected in Pluto TV’s $1.9 billion net worth but supports its continued strategic importance.

Future Revenue and Net Worth Outlook

Looking ahead, Pluto TV’s revenue is projected to grow at a more moderate 8%–12% annual rate as the FAST market stabilizes. At that pace, annual revenue could reach approximately $2.8–$3.1 billion by 2029.

Net worth growth is expected to remain conservative. Even with rising revenue, valuation multiples are likely to stay compressed. As a result, Pluto TV’s implied net worth is projected to increase gradually, potentially reaching $2.1–$2.3 billion over the next three to four years, assuming stable advertising markets and continued global expansion.

By 2026, Pluto TV is no longer valued as a growth story. It is valued as infrastructure. Its $2.3 billion in revenue and $1.9 billion net worth reflect scale, predictability, and long-term strategic relevance rather than speculative upside.

Brands Owned by Pluto TV

Pluto TV does not operate as a brand-holding company in the traditional sense. It does not own independent consumer brands, production studios, or media networks. Instead, Pluto TV functions as a distribution and aggregation platform. Its value lies in how it organizes, curates, and monetizes branded content channels rather than owning the underlying brands outright.

Below is a list of the internal brands and divisions owned and operated by Pluto TV as of January 2026:

Pluto TV–Branded Channels

Pluto TV owns and operates several proprietary, platform-native channel brands. These brands exist exclusively within the Pluto TV ecosystem and are designed to drive engagement, ad inventory, and genre-based discovery.

Pluto TV–branded channels include genre-focused destinations such as Pluto TV Movies, Pluto TV Action, Pluto TV Drama, Pluto TV Comedy, Pluto TV Crime, and Pluto TV Horror. These channels are not separate companies or trademarks with external operations. They are internal brands used to package licensed and library content into linear-style experiences.

Because Pluto TV controls the branding, scheduling, and ad inventory for these channels, they are among the most flexible and margin-efficient parts of the platform.

Paramount-Owned Brand Channels

A significant portion of Pluto TV’s most recognizable channels are built around brands owned by its parent company, Paramount Skydance.

These include channels based on Paramount’s legacy television networks and franchises. Examples include channels branded around MTV, Nickelodeon, Comedy Central, BET, and CBS News. While these brands are not owned by Pluto TV itself, the platform has privileged access to them due to internal ownership alignment.

These brand-driven channels tend to outperform generic channels in both viewing hours and advertising yield. They benefit from strong brand recognition, built-in fan bases, and advertiser trust.

Franchise-Specific and IP-Led Channels

Pluto TV also operates channels centered on specific intellectual property rather than network brands. These include single-franchise or single-genre channels built around long-running shows, film libraries, or character universes.

These channels are typically created using owned or low-cost licensed content. They allow Pluto TV to extend the lifecycle of existing IP while generating incremental advertising revenue. From a branding perspective, these channels strengthen audience loyalty without requiring new content investment.

Although Pluto TV does not own the underlying IP, it controls the channel identity, programming structure, and monetization.

News and Information Brands

Pluto TV carries several news-focused channels that function as branded destinations within the platform. Some are owned by the parent company, while others are licensed from third-party news providers.

Examples include CBS News–branded channels and other live news feeds curated specifically for FAST consumption. These channels are particularly valuable during major events and election cycles, contributing disproportionately to advertising demand despite lower overall viewing hours.

Again, Pluto TV does not own the news brands themselves. It owns the FAST-channel implementation and advertising layer.

Kids and Family Channel Brands

In the kids and family category, Pluto TV hosts branded channels built around well-known children’s programming. Many of these channels leverage parent-company brands such as Nickelodeon, while others are genre-based Pluto TV originals.

These channels are carefully segmented by age group and content type. They are designed to meet advertiser requirements and regulatory standards while maintaining strong engagement.

Ownership of the channel brand sits with Pluto TV, but the content brands typically remain with the original rights holders.

Conclusion

Who owns Pluto TV is a question that goes beyond simple ownership and points directly to how the platform operates and competes in the streaming market. Pluto TV is fully owned by Paramount Skydance, and this backing has shaped it into one of the most stable and scalable free ad-supported streaming platforms available today. Its ownership ensures long-term access to premium content, strong advertising relationships, and the financial support needed to operate at a global scale.

Rather than functioning as a standalone business chasing short-term growth, Pluto TV operates as a strategic platform within a larger media ecosystem. Its revenue model, leadership structure, and brand strategy all reflect this position. As the FAST market continues to mature, Pluto TV’s ownership structure places it in a strong position to maintain relevance, generate predictable advertising revenue, and remain a key player in the future of free streaming television.

FAQs

Which company owns Pluto TV?

Pluto TV is owned by Paramount Skydance. The platform is a wholly owned subsidiary, with 100% ownership held by the parent company.

Where is Pluto TV located?

Pluto TV is headquartered in Los Angeles, California, United States. Its operations, leadership, and platform management are primarily based in the U.S., although the service operates internationally.

When was Pluto TV founded?

Pluto TV was founded in 2013. It launched publicly in 2014 as one of the earliest free ad-supported streaming television platforms.

Does Paramount own Pluto TV?

Yes. Pluto TV is owned by Paramount through its current corporate structure, Paramount Skydance. Paramount’s ownership gives Pluto TV access to a large content library and global advertising infrastructure.

Is Pluto TV legal?

Yes, Pluto TV is completely legal. It streams content through licensed agreements and owned libraries and operates as a legitimate, ad-supported streaming service without pirated or unauthorized content.

Who bought Pluto TV?

Pluto TV was acquired by Viacom in 2019. That acquisition later placed Pluto TV under ViacomCBS, then Paramount Global, and now Paramount Skydance.

Are Pluto and Tubi owned by the same company?

No. Pluto TV and Tubi are owned by different companies. Pluto TV is owned by Paramount Skydance, while Tubi is owned by Fox Corporation.

Who is the CEO of Pluto TV?

The CEO of Pluto TV is Tom Ryan. He has been closely involved with the platform since its early years and continues to oversee its operations.

Is Pluto part of Netflix?

No. Pluto TV is not part of Netflix. Netflix is a separate, subscription-based streaming service and has no ownership or operational connection to Pluto TV.

How much did Pluto TV sell for?

Pluto TV was sold for approximately $340 million in cash when it was acquired in 2019.

What country is Pluto TV from?

Pluto TV is an American company. It was founded in the United States and is headquartered in Los Angeles, California.

How does Pluto TV make money?

Pluto TV makes money entirely through advertising. It does not charge subscription fees. Revenue comes from display and video ads shown during live channels and on-demand content, including direct brand deals and programmatic advertising.