- Morgan Stanley is a publicly traded company with no single controlling owner. Ownership is widely distributed among institutional investors, funds, and public shareholders, making it a professionally managed global financial institution.

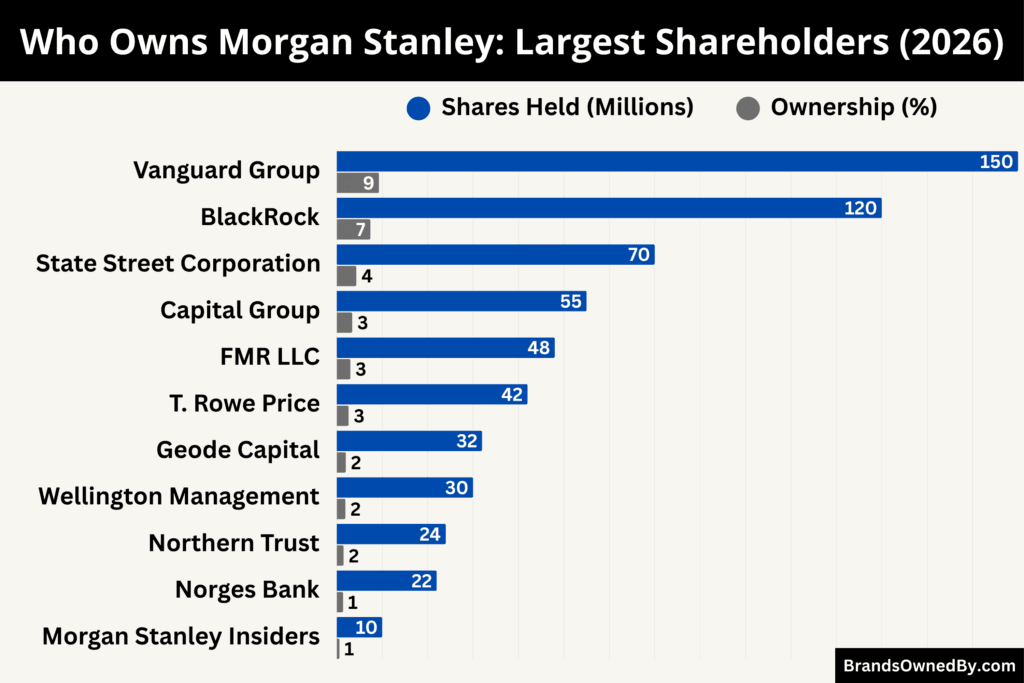

- The largest shareholders are Vanguard (9.3%), BlackRock (7.4%), and State Street (4.3%), which together hold a significant portion of shares through index funds and ETFs. These firms invest on behalf of millions of investors and influence governance through voting rather than operational control.

- Institutional investors dominate Morgan Stanley’s ownership, while insider ownership remains small. Executives and directors hold a minor stake mainly through stock-based compensation, aligning management with shareholder interests without controlling the company.

- Control of Morgan Stanley comes from executive leadership and the board of directors, not shareholders. The CEO and management run daily operations, while major institutional investors influence long-term governance, strategy oversight, and corporate accountability.

Morgan Stanley is a global financial services firm headquartered in New York, United States. It operates across investment banking, wealth management, institutional securities, and asset management. The company serves corporations, governments, institutions, and individual investors worldwide. Its operations span North America, Europe, Asia Pacific, and emerging markets.

Morgan Stanley focuses heavily on advisory, capital markets, trading, and wealth solutions. Over time, it shifted from a pure investment bank into a diversified financial powerhouse. Wealth management is now one of its core pillars. The firm also plays a major role in global capital formation, mergers and acquisitions advisory, and institutional trading services.

The company is known for its strong corporate culture, risk management discipline, and global client network. It is considered one of the most influential investment banks in the world and a key player in international financial markets.

Morgan Stanley Founders

Morgan Stanley was founded in 1935 by Henry Sturgis Morgan and Harold Stanley. Both founders were former partners at J.P. Morgan & Co. They created Morgan Stanley after the Glass-Steagall Act forced the separation of commercial and investment banking in the United States.

Henry Sturgis Morgan was the grandson of legendary banker J.P. Morgan. He brought deep financial expertise and strong industry relationships to the new firm. Henry focused on building long-term institutional trust and expanding corporate finance operations. His leadership helped Morgan Stanley quickly establish credibility on Wall Street.

Harold Stanley was a highly respected investment banker known for his strategic thinking and market knowledge. He played a key role in structuring the firm’s early deals and expanding its underwriting business. Harold helped shape Morgan Stanley into a leading securities and advisory firm during its early years.

Together, the founders built a strong institutional foundation. Their vision centered on disciplined finance, strong client relationships, and global expansion. These principles continue to influence Morgan Stanley today.

Ownership History

Morgan Stanley’s ownership history reflects its transformation from a private partnership into a publicly traded global financial institution.

Founded in 1935, the firm was originally owned by a small group of partners. In 1986, Morgan Stanley went public, allowing institutional and individual investors to own shares.

Over time, ownership became widely distributed, with major asset managers like Vanguard, BlackRock, and State Street emerging as the largest shareholders.

Today, Morgan Stanley operates under a diversified public ownership model with no single controlling owner.

Early Partnership Structure (1935–1986)

Morgan Stanley began as a private partnership in 1935. The firm was owned and controlled by its founding partners, led by Henry Sturgis Morgan and Harold Stanley. Ownership was limited to a small group of senior bankers. Partners contributed capital and shared profits. This structure allowed tight control and long-term decision making.

During this era, the firm built its reputation in underwriting and corporate finance. Ownership remained concentrated within leadership. New partners were added over time, but the company stayed privately held for five decades.

Transition to Public Ownership (1986)

In 1986, Morgan Stanley went public. This was a major shift in its ownership model. The company listed its shares on the New York Stock Exchange. Institutional investors, mutual funds, and individual investors could now buy ownership stakes.

The public listing expanded the firm’s capital base. It also reduced the dominance of internal partners. Ownership became widely distributed across shareholders. This marked the beginning of modern corporate governance at Morgan Stanley.

Merger Era and Ownership Expansion (1997–2007)

In 1997, Morgan Stanley merged with Dean Witter Discover & Co. This deal reshaped the company’s ownership. Shareholders from both firms became part of the new entity. Retail brokerage investors joined institutional shareholders, widening the ownership base.

During the early 2000s, Morgan Stanley strengthened its global investment banking and securities businesses. Institutional ownership grew significantly. Large asset managers began accumulating shares as the company expanded internationally.

By this time, ownership was already diversified. No single shareholder had controlling power. The firm operated under a typical public company structure.

Financial Crisis and Strategic Ownership Shift (2008–2010)

The 2008 global financial crisis changed the company’s structure. Morgan Stanley converted into a bank holding company. This move increased regulatory oversight and improved financial stability. It also attracted long-term institutional investors seeking stability in large financial institutions.

During this period, global banks and sovereign wealth funds showed interest in U.S. financial firms. Institutional ownership increased further. The company also began shifting toward wealth management to stabilize earnings and reduce reliance on trading.

Ownership remained public and dispersed. However, institutional investors became more influential in shareholder voting and governance.

Rise of Institutional Dominance (2010–2020)

After the crisis, major asset managers steadily increased their stakes. Firms like Vanguard, BlackRock, and State Street became the largest shareholders. Their ownership came through index funds, ETFs, and long-term investment portfolios.

This period also saw the expansion of Morgan Stanley Wealth Management. The company acquired the remaining stake in Smith Barney. This strengthened its retail and advisory presence. As the firm stabilized, institutional ownership continued to grow.

By the late 2010s, institutional investors held the majority of Morgan Stanley shares. Insider ownership was relatively small. The company operated under a highly diversified shareholder base.

Modern Ownership Structure (2020–2026)

Morgan Stanley’s recent acquisitions, including E*TRADE and Eaton Vance, did not change its public ownership model. Shares continued trading on the open market. Institutional investors remained dominant.

As of 2026, the largest shareholders are global asset management firms. Vanguard is the biggest shareholder, followed by BlackRock and State Street. These firms invest on behalf of millions of individuals and institutions worldwide.

Ownership is widely distributed. No single investor controls Morgan Stanley. The company operates under a professional management structure governed by its board and shareholders. This diversified ownership model reflects the structure of most major global financial institutions today.

Who Owns Morgan Stanley: Top Shareholders

Morgan Stanley is a publicly traded company. Its ownership is spread across institutional investors, mutual funds, pension funds, and individual shareholders. No single person or entity owns the company outright. The largest ownership stakes are held by global asset management firms that invest on behalf of millions of clients.

Institutional investors dominate Morgan Stanley’s shareholder base. They influence corporate governance through voting power but do not run daily operations. Insider ownership by executives and directors exists but represents a small portion of total shares. This widely distributed ownership model is common among major global banks.

Below are the largest shareholders of Morgan Stanley as of February 2026 and their roles in the company’s ownership structure:

Vanguard Group

Vanguard Group is the largest shareholder of Morgan Stanley. It holds about 150 million shares, representing roughly 9.3% ownership. Vanguard’s stake comes primarily from its major index funds and exchange-traded funds, including the Vanguard Total Stock Market Index Fund and Vanguard 500 Index Fund. These funds track broad market indices, meaning Vanguard’s ownership grows or shrinks based on index weighting rather than active stock picking.

Vanguard follows a passive investment strategy. It does not attempt to control Morgan Stanley or interfere with management decisions. However, because of its large stake, Vanguard has significant influence in shareholder voting, especially on issues such as board elections, executive compensation, corporate governance, and environmental or social policies. Vanguard’s long-term investment philosophy provides stability to Morgan Stanley’s shareholder base and signals strong institutional confidence in the company’s future.

BlackRock

BlackRock is the second largest shareholder, holding approximately 120 million shares, equal to about 7.4% ownership. Much of this stake is held through BlackRock’s iShares ETFs, institutional funds, and global investment portfolios. As the world’s largest asset manager, BlackRock invests in nearly every major publicly traded company, including leading banks and financial institutions.

BlackRock’s investment in Morgan Stanley is largely passive but strategically significant. The firm emphasizes risk management, governance quality, and long-term shareholder value. Through proxy voting, BlackRock can influence board composition, corporate transparency, and executive pay policies. While BlackRock does not manage Morgan Stanley’s operations, its size and reputation make it one of the most influential institutional shareholders in the company.

State Street Corporation

State Street Corporation holds about 70 million shares, representing around 4.3% ownership. Most of these shares are managed through State Street Global Advisors, one of the world’s largest institutional asset managers. State Street’s holdings are largely tied to index-tracking funds and long-term institutional investment strategies.

State Street plays an important role in corporate governance. It actively votes on shareholder resolutions related to board structure, diversity, governance transparency, and long-term risk management. Although State Street does not control Morgan Stanley, its consistent long-term investment approach provides ownership stability and reinforces institutional confidence in the firm’s strategic direction.

Capital Research and Management Company (Capital Group)

Capital Research and Management Company, part of Capital Group, owns about 55 million shares, representing roughly 3.4% ownership. Unlike Vanguard or BlackRock, Capital Group is an active investment manager. It carefully selects investments based on long-term growth potential, financial strength, and strategic positioning.

Capital Group’s investment in Morgan Stanley reflects strong confidence in the company’s wealth management and investment banking strategy. The firm typically holds shares for long periods and engages with management on strategic direction, risk management, and capital allocation. While influential, Capital Group does not seek control but contributes to long-term institutional ownership stability.

Fidelity Management & Research (FMR LLC)

Fidelity holds approximately 48 million shares, equal to about 3.0% ownership. Fidelity manages a wide range of mutual funds, retirement portfolios, and institutional investment accounts. Its investment in Morgan Stanley is based on long-term financial performance and business diversification.

Fidelity often evaluates companies based on profitability, stability, management quality, and long-term growth prospects. Its ownership in Morgan Stanley supports the firm’s position as a stable global financial institution. Fidelity participates in shareholder voting and governance matters but does not attempt to influence daily operations.

T. Rowe Price Associates

T. Rowe Price owns around 42 million shares, representing about 2.6% ownership. The firm is known for actively managed investment funds and long-term institutional portfolios. Its investment strategy focuses on sustainable growth, strong management, and competitive positioning.

T. Rowe Price’s stake reflects confidence in Morgan Stanley’s transformation into a diversified financial services company with a strong wealth management platform. The firm plays a role in governance through proxy voting and shareholder engagement, but it does not exercise operational control.

Geode Capital Management

Geode Capital Management holds approximately 32 million shares, equal to about 2.0% ownership. Geode manages index-based and quantitative portfolios, often supporting large institutional investors and index funds. Its investment approach is largely passive and aligned with long-term market exposure strategies.

Geode does not actively influence Morgan Stanley’s strategic decisions. However, its consistent institutional investment contributes to the stability of the company’s shareholder base. The firm participates in governance voting and represents large pools of institutional capital.

Wellington Management Group

Wellington Management owns about 30 million shares, representing roughly 1.9% ownership. The firm manages assets for pension funds, sovereign wealth funds, and global institutional investors. Wellington is known for long-term, research-driven investment strategies.

Its stake in Morgan Stanley reflects institutional confidence in the company’s global financial services platform and wealth management leadership. Wellington participates in shareholder governance and long-term strategic evaluation but does not attempt to control management.

Northern Trust Corporation

Northern Trust holds approximately 24 million shares, equal to about 1.5% ownership. The company invests primarily through institutional portfolios and custodial investment services for pension funds and high-net-worth clients.

Northern Trust’s ownership is governance-focused and long-term. It participates in shareholder voting and corporate oversight but does not influence operational decision-making. Its presence adds to the diversified institutional shareholder base.

Norges Bank Investment Management (Norway Sovereign Wealth Fund)

Norges Bank owns about 22 million shares, representing roughly 1.4% ownership. This stake is part of Norway’s sovereign wealth fund, one of the largest government investment funds globally. The fund invests in major global companies to ensure long-term national financial stability.

Norges Bank emphasizes transparency, governance quality, and sustainable business practices. Its investment in Morgan Stanley reflects confidence in the company’s global influence and long-term financial stability. The fund does not seek control but plays an important role in governance and shareholder oversight.

Morgan Stanley Insiders (Executives and Directors)

Morgan Stanley executives and board members collectively hold about 10 million shares, representing roughly 0.6% ownership. Insider ownership includes shares held by the CEO, senior leadership, and directors. Much of this ownership comes through stock-based compensation tied to company performance.

Insider ownership aligns management interests with shareholders. Executives benefit directly from long-term company performance and shareholder value creation. However, insider holdings are relatively small and do not provide controlling power. Strategic decisions are made through management authority rather than ownership concentration.

Other Institutional and Public Shareholders

Beyond the major shareholders listed above, thousands of institutions and millions of individual investors own Morgan Stanley shares. These include pension funds, insurance companies, hedge funds, sovereign funds, and retail investors worldwide. Public shareholders participate through stock markets, retirement accounts, and investment funds.

This broad ownership distribution prevents concentration of power and ensures regulatory transparency. Corporate governance is maintained through shareholder voting, board oversight, and financial regulation. Morgan Stanley’s diversified ownership structure supports long-term stability, institutional confidence, and global investor participation.

Competitor Ownership Comparison

Major global banks share a similar ownership structure built on public shareholding and institutional dominance. Large asset managers, index funds, and pension institutions collectively hold the majority of shares across leading U.S. banks. While no single investor controls these firms, differences exist in insider ownership, retail participation, and strategic shareholders.

Comparing ownership across major competitors helps explain how influence, governance, and shareholder concentration vary within the global banking industry.

| Bank | Largest Shareholders | Insider Ownership Level | Retail Investor Presence | Strategic / Anchor Investor | Ownership Concentration | Key Ownership Insight |

|---|---|---|---|---|---|---|

| Morgan Stanley | Vanguard, BlackRock, State Street | Low | Moderate | None | Highly Institutional | Strong institutional dominance driven by wealth and investment management focus. |

| JPMorgan Chase | Vanguard, BlackRock, State Street | Low | Very High | None | Broadly Distributed | Large retail ownership due to massive consumer banking operations. |

| Goldman Sachs | Vanguard, BlackRock, State Street | Moderate | Moderate | None | Institutional with Insider Influence | Slightly higher insider ownership from historical partnership culture. |

| Bank of America | Vanguard, BlackRock, Berkshire Hathaway | Low | Very High | Berkshire Hathaway | More Concentrated than Peers | Presence of a major strategic investor increases ownership influence concentration. |

Morgan Stanley vs JPMorgan Chase Ownership

JPMorgan Chase has one of the most diversified shareholder bases among global banks. Like Morgan Stanley, its largest shareholders include Vanguard, BlackRock, and State Street. Institutional investors hold the majority of JPMorgan shares, making ownership widely distributed.

However, JPMorgan Chase has a slightly larger retail investor base due to its massive consumer banking presence. Millions of individual shareholders own JPMorgan stock directly or through retirement accounts. Insider ownership at JPMorgan is also relatively small, similar to Morgan Stanley. No single shareholder controls the bank, and governance is driven by institutional voting and board leadership.

Compared to JPMorgan, Morgan Stanley has a stronger concentration of institutional ownership because of its wealth management and investment-focused business model rather than retail banking.

Morgan Stanley vs Goldman Sachs Ownership

Goldman Sachs has an ownership structure very similar to Morgan Stanley. Institutional investors dominate both companies. Vanguard and BlackRock are the two largest shareholders in both firms. However, Goldman Sachs typically has slightly higher insider ownership compared to Morgan Stanley.

Goldman Sachs historically maintained a strong partner culture, and many senior executives held meaningful equity stakes. This gave management more ownership alignment compared to Morgan Stanley, where insider ownership is lower. Despite this difference, Goldman Sachs is still widely owned by public investors and institutions, with no controlling shareholder.

Both firms rely heavily on institutional investors for long-term capital stability and governance influence.

Morgan Stanley vs Bank of America Ownership

Bank of America has a broader and more diversified shareholder base than Morgan Stanley. It has a large mix of institutional, retail, and strategic investors. One key difference is the presence of Berkshire Hathaway, which has historically been one of Bank of America’s largest shareholders. This creates a more concentrated ownership influence compared to Morgan Stanley, which does not have a single dominant strategic investor.

Like Morgan Stanley, Bank of America’s top shareholders include Vanguard, BlackRock, and State Street. Institutional ownership still dominates, but retail participation is higher because of Bank of America’s massive consumer banking footprint.

Morgan Stanley’s ownership is more institution-heavy and less retail-driven compared to Bank of America.

Institutional Dominance Across Major Investment Banks

Across Morgan Stanley, JPMorgan Chase, Goldman Sachs, and Bank of America, one clear pattern exists. Institutional investors dominate ownership. Asset management giants like Vanguard, BlackRock, and State Street are consistently the largest shareholders across all major U.S. banks.

These institutions invest through index funds, ETFs, pension portfolios, and mutual funds. Their investment style is long-term and governance-focused. They influence corporate policy through proxy voting but do not control daily operations.

This shared institutional ownership structure reflects the modern financial system, where large asset managers collectively hold significant stakes in most major corporations.

Key Differences in Ownership Influence

While the ownership model is similar across competitors, some differences exist. Morgan Stanley has a stronger concentration in wealth management, leading to a more institution-heavy shareholder base. JPMorgan and Bank of America have broader retail ownership due to consumer banking operations. Goldman Sachs has historically had slightly higher insider ownership due to its partnership legacy.

Despite these differences, none of these banks are owned by a single individual or controlling entity. All operate under dispersed public ownership, institutional governance, and professional management structures.

Who Controls Morgan Stanley?

Control of Morgan Stanley does not depend on ownership alone. The company is run through a structured corporate governance system. Executive leadership manages daily operations. The board of directors oversees long-term strategy and accountability. Shareholders influence governance through voting, but they do not run the company.

Below is a detailed breakdown of who actually controls Morgan Stanley and how decision-making works.

Current CEO and Executive Leadership

Morgan Stanley is currently led by Ted Pick, who became Chief Executive Officer in January 2024. He succeeded James Gorman after a long leadership transition plan. Ted Pick had previously led Morgan Stanley’s Institutional Securities division and played a major role in expanding the firm’s global trading and investment banking operations.

As CEO, Ted Pick is responsible for overall strategy, business performance, risk management, and long-term growth. He leads the executive committee, which includes heads of wealth management, investment management, finance, risk, and global operations. This leadership team makes major operational and strategic decisions for the company.

The CEO does not control Morgan Stanley through ownership. Control comes from executive authority, board approval, and governance structure.

Role of the Board of Directors

The board of directors plays a central role in controlling Morgan Stanley. The board represents shareholders and ensures that management acts in the best interest of investors and the company. It approves major strategic decisions, monitors risk, evaluates executive performance, and oversees corporate governance.

The board appoints the CEO and can replace leadership if performance declines. It also approves major acquisitions, capital allocation, and long-term strategic direction. Independent directors make up most of the board, ensuring balanced oversight rather than management dominance.

While shareholders elect the board, the board itself exercises real control over top-level corporate decisions.

Executive Committee and Decision Structure

Morgan Stanley operates through a structured executive committee system. The committee includes senior leaders responsible for major divisions such as Institutional Securities, Wealth Management, Investment Management, Risk, Technology, and Finance.

This group collectively shapes corporate strategy, operational priorities, and business expansion. Major decisions such as acquisitions, market strategy, technology investment, and regulatory compliance are reviewed at this level before board approval.

The decision structure ensures that no single executive controls the company alone. Leadership operates through collaboration, governance rules, and regulatory oversight.

Influence of Major Shareholders

Large institutional shareholders such as Vanguard, BlackRock, and State Street influence Morgan Stanley through voting power rather than direct control. They vote on board elections, executive compensation, governance policies, and shareholder proposals.

However, these investors do not manage daily operations. Their role is supervisory and governance-focused. They ensure accountability, transparency, and long-term shareholder value. Control of the company remains with executive leadership and the board.

This separation between ownership and operational control is common in large publicly traded financial institutions.

Past CEOs and Leadership Evolution

Morgan Stanley’s control structure has evolved under different CEOs. Each leader shaped the company’s strategy and governance style.

John Mack served as CEO during the global financial crisis. He stabilized the firm during one of the most challenging periods in financial history and oversaw its transition into a bank holding company.

James Gorman led Morgan Stanley from 2010 to 2023. He transformed the company from a trading-focused investment bank into a diversified financial services firm centered on wealth management. Under his leadership, Morgan Stanley acquired Smith Barney, E*TRADE, and Eaton Vance, strengthening long-term stability and recurring revenue.

Ted Pick represents the current leadership era. His focus is on global expansion, technology, institutional strength, and wealth management growth. The leadership transition reflects Morgan Stanley’s long-term governance planning and executive continuity.

How Control Actually Works in Practice

In practice, Morgan Stanley is controlled through a layered governance model. The CEO and executive leadership run daily operations and implement strategy. The board of directors oversees management and approves major decisions. Shareholders influence governance through voting but do not manage the company directly.

This structure ensures accountability, regulatory compliance, and strategic stability. It prevents concentration of power while maintaining strong leadership direction. Morgan Stanley operates under professional management control rather than ownership dominance, which is typical for large global financial institutions.

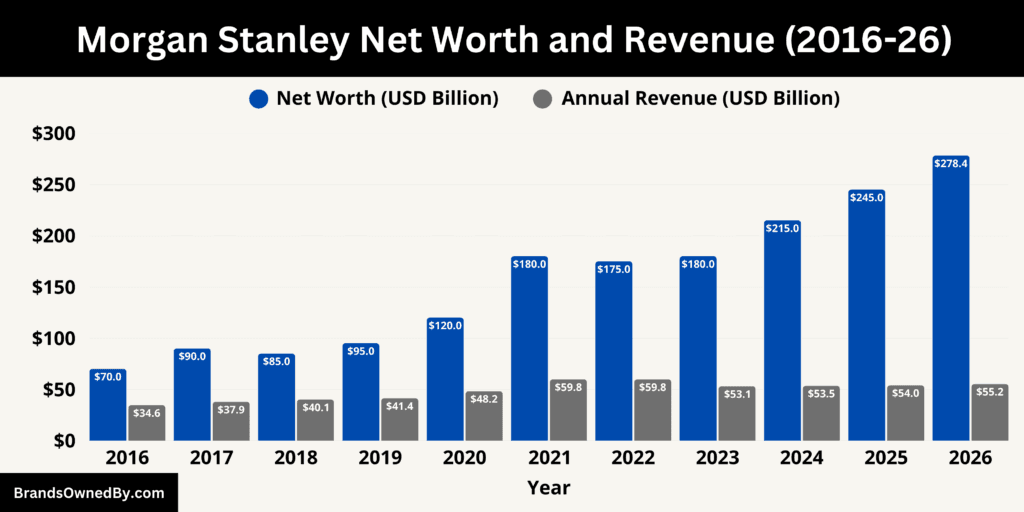

Morgan Stanley Annual Revenue and Net Worth

As of February 2026, Morgan Stanley generates approximately $55.2 billion in annual revenue and has a market capitalization of about $278.35 billion. The firm’s financial strength comes from a diversified structure built around wealth management, institutional securities, and investment management. A large share of revenue now comes from recurring, fee-based sources, which has improved earnings stability and increased long-term valuation.

Morgan Stanley Revenue in 2026

Morgan Stanley reported total revenue of about $55.2 billion in 2026. The Institutional Securities segment generated approximately $27.1 billion. Within this, equity and fixed income trading contributed around $16.4 billion combined. Investment banking, including mergers and acquisitions advisory, equity underwriting, and debt underwriting, produced roughly $7.8 billion. The remaining portion came from prime brokerage, financing, and other institutional services.

Wealth Management produced about $23.9 billion in revenue. Fee-based asset management and advisory fees accounted for nearly $14.6 billion. Net interest income from client balances and lending generated around $7.1 billion. Transaction-based and brokerage activity contributed roughly $2.2 billion. Morgan Stanley manages over $5.8 trillion in client assets within this division, making it the company’s most stable revenue source.

Investment Management generated approximately $4.2 billion. Long-term asset management and investment advisory services contributed about $2.9 billion. Performance and incentive fees from private equity, private credit, and alternative investments added roughly $0.9 billion. Distribution and other revenue streams accounted for about $0.4 billion. The division manages more than $1.6 trillion in assets globally.

Overall, about 68% of Morgan Stanley’s revenue in 2026 comes from stable, fee-based, or recurring sources. This represents a major structural shift compared to earlier decades when trading revenue dominated.

Morgan Stanley Net Worth in 2026

Morgan Stanley’s market capitalization stands at approximately $278.35 billion as of February 2026. The company has about 1.63 billion outstanding shares, and its valuation reflects strong investor confidence in earnings quality and long-term growth. The firm’s price-to-earnings ratio remains strong relative to historical averages, supported by stable fee-driven income.

The company holds over $1.2 trillion in total assets on its balance sheet and maintains strong capital ratios under global banking regulations. Morgan Stanley’s return on equity remains in the mid-to-high teens, reflecting efficient capital use and stable profitability. The valuation increase over recent years has been driven by the expansion of wealth and asset management, which now contribute a majority of pre-tax earnings.

Morgan Stanley’s market value has grown significantly from roughly $120 billion in 2020 to over $278 billion in 2026. This growth reflects higher recurring income, higher valuation multiples, and increased institutional investor confidence.

Revenue Structure and Growth Drivers

Morgan Stanley’s revenue growth is driven by structural business shifts rather than short-term market cycles. Wealth Management continues to expand through growth in fee-based client assets, which increased by hundreds of billions over recent years. Net new assets and strong advisory demand remain key drivers.

Institutional Securities benefits from global M&A advisory, capital markets issuance, and trading performance. Equity trading remains the largest single revenue contributor within the segment. The firm consistently ranks among the top global investment banks in M&A advisory and equity underwriting.

Investment Management continues expanding through private markets, ESG-focused funds, and long-term institutional mandates. Alternative investments, including private equity and private credit, generate higher-margin performance fees that support long-term profitability growth.

Net Worth Expansion Factors

Morgan Stanley’s rising valuation is linked to improved earnings quality. Wealth Management now contributes a larger share of profits, reducing volatility compared to trading-driven models. Strong capital returns through dividends and share buybacks have also supported market value growth.

The firm’s global scale, strong balance sheet, and diversified revenue streams reduce risk perception among investors. Institutional ownership and consistent profitability have helped Morgan Stanley maintain premium valuation levels compared to earlier periods.

Revenue Forecast

Morgan Stanley’s future revenue outlook is shaped by structural growth in wealth management, expansion of private markets, increasing fee-based income, and steady institutional advisory demand. The company is no longer heavily dependent on volatile trading cycles. Instead, predictable, recurring revenue streams now drive long-term financial growth. Continued global expansion, rising high-net-worth client assets, and growth in alternative investments are expected to support steady revenue increases through 2030.

Projected Revenue Growth:

- 2027: Revenue expected to reach about $57.5 billion. Growth will primarily come from higher fee-based client assets in Wealth Management and steady institutional trading activity. Net new assets and advisory demand are projected to remain strong.

- 2028: Revenue projected at around $59.3 billion. Expansion in private markets, private credit, and global capital markets activity is expected to strengthen Institutional Securities and Investment Management income streams.

- 2029: Revenue forecast near $61.2 billion. Continued growth in asset management, higher performance fees from alternative investments, and expansion in international wealth platforms are expected to drive earnings.

- 2030: Revenue projected to reach approximately $64.1 billion. Long-term growth will likely be supported by digital wealth platforms, global advisory leadership, rising institutional assets under management, and stable recurring fee-based revenue.

Overall, Morgan Stanley’s long-term financial trajectory is expected to remain stable and upward trending. The company’s diversified revenue base, strong wealth management franchise, and expansion in high-margin investment businesses position it for consistent growth rather than cyclical volatility.

Companies Owned by Morgan Stanley

Morgan Stanley owns and operates a portfolio of real companies, subsidiaries, investment firms, and operating businesses across brokerage, asset management, banking, and alternative investments. Most of these came through major acquisitions and now function as standalone regulated entities under the Morgan Stanley group.

Below are the major companies, brands, acquisitions, and operating businesses owned by Morgan Stanley as of February 2026:

| Company / Brand | Type | Core Business | Year Acquired / Formed | Key Role in Morgan Stanley |

|---|---|---|---|---|

| E*TRADE Financial Corporation | Brokerage & Digital Investing | Online trading, retirement accounts, digital wealth | 2020 | Expanded Morgan Stanley into retail investing and digital brokerage. Added large client base and deposits. |

| E*TRADE Bank | Banking Subsidiary | Savings, deposits, lending, cash management | 2020 | Provides funding base and interest income linked to brokerage ecosystem. |

| E*TRADE Securities LLC | Brokerage Execution Entity | Trade execution, clearing, brokerage operations | 2020 | Enables large-scale retail trading infrastructure. |

| Eaton Vance Corp. | Asset Management | Active funds, institutional investing, portfolio management | 2021 | Strengthened global asset management and fee-based revenue. |

| Parametric Portfolio Associates | Investment Management | Direct indexing, tax-managed portfolios, customized investing | 2021 | Drives personalized portfolio and tax-efficient investment strategies. |

| Calvert Research and Management | ESG Investment Firm | Sustainable and responsible investing | 2021 | Expands ESG and sustainability investment capabilities. |

| Solium Capital (Shareworks) | Financial Technology / Workplace Wealth | Equity compensation and stock plan management | 2019 | Manages corporate stock plans and strengthens workplace wealth platform. |

| Smith Barney (Integrated into Wealth Management) | Wealth Advisory | Financial advisory, portfolio management | Full ownership 2013 | Formed one of the world’s largest wealth management businesses. |

| Morgan Stanley Bank N.A. | Banking Subsidiary | Lending, treasury, securities-backed loans | Internal | Core funding and lending entity supporting wealth and institutional clients. |

| Morgan Stanley Private Bank | Private Banking | Mortgages, customized lending, deposits | Internal | Serves high-net-worth clients with integrated banking and wealth services. |

| Morgan Stanley Capital Partners | Private Equity | Direct investments in private companies | Internal | Core private equity investment platform. |

| Morgan Stanley Infrastructure Partners | Infrastructure Investment | Energy, utilities, transportation, digital infrastructure | Internal | Provides long-term infrastructure investment exposure. |

| Morgan Stanley Real Estate Investing (MSREI) | Real Estate Investment | Commercial property and global real estate funds | Internal | Major global real estate investment platform. |

| Mesa West Capital | Real Estate Credit | Commercial real estate lending and structured finance | Acquired / Integrated | Expands private credit and real estate debt capabilities. |

| 1st Global | Wealth & Advisory Platform | Investment advisory integrated with tax planning | Acquired | Expands advisory services for accounting and financial professionals. |

| Blooom | Digital Retirement Advisory | Automated 401(k) and retirement account management | Acquired | Expands digital wealth and retirement advisory capabilities. |

| Graystone Wealth Management Services | Institutional Advisory | Investment consulting for pensions, endowments, institutions | Internal | Provides institutional portfolio strategy and advisory services. |

| Van Kampen Investments (Legacy Integration) | Asset Management | Mutual funds and investment products | Legacy | Helped build long-term asset management infrastructure. |

| FrontPoint Partners (Legacy Platform) | Hedge Fund / Alternatives | Alternative investment strategies | Legacy | Contributed to development of private markets and hedge fund platform. |

E*TRADE Financial Corporation

E*TRADE is one of Morgan Stanley’s most significant operating subsidiaries. Acquired in 2020 for about $13 billion, E*TRADE operates as a standalone brokerage and digital investing company under Morgan Stanley. It serves millions of retail investors and manages hundreds of billions in client assets.

The business includes online stock and options trading, retirement accounts, robo-advisory services, and margin lending. E*TRADE also brought a large deposit base and digital banking infrastructure to Morgan Stanley, strengthening its consumer financial services presence.

E*TRADE Bank

E*TRADE Bank is a federally regulated banking subsidiary operating under the E*TRADE brand. It provides savings accounts, checking services, and lending products linked to brokerage accounts. The bank holds tens of billions in deposits and plays a key role in Morgan Stanley’s balance sheet funding and net interest income generation. It supports margin lending, securities-backed lending, and retail banking services tied to investment accounts.

E*TRADE Securities LLC

E*TRADE Securities is the brokerage execution entity within ETRADE Financial. It handles trade execution, market access, clearing, and brokerage operations for millions of individual investors. This entity enables Morgan Stanley to serve self-directed investors globally and significantly expands its retail trading footprint.

Eaton Vance Corp.

Eaton Vance is a major asset management company acquired by Morgan Stanley in 2021 in a transaction valued at about $7 billion. It operates as a core subsidiary under Morgan Stanley Investment Management. Eaton Vance manages hundreds of billions in assets across active funds, customized investment portfolios, and institutional mandates. The acquisition strengthened Morgan Stanley’s position in global asset management and long-term fee-based investment services.

Parametric Portfolio Associates LLC

Parametric is a specialized investment management firm acquired by Eaton Vance. It focuses on customized portfolio construction, tax-managed investing, and direct indexing strategies. Parametric manages hundreds of billions in institutional and high-net-worth client assets.

Its technology-driven tax optimization and personalized investment strategies are increasingly important in Morgan Stanley’s wealth and asset management expansion.

Calvert Research and Management

Calvert is a global responsible investing firm operating under Eaton Vance. It specializes in ESG and sustainability-focused investment strategies. Calvert manages billions in ESG-driven assets and provides research-based sustainable investing solutions to institutional and retail investors. The firm plays a growing role as ESG investing demand expands globally.

Solium Capital

Morgan Stanley acquired Solium Capital in 2019 for about $900 million. The company operates the Shareworks platform, which provides equity compensation and stock plan management software for corporations worldwide. Shareworks serves thousands of companies and millions of employees, managing stock options, restricted shares, and equity compensation programs. This acquisition strengthened Morgan Stanley’s corporate services and workplace wealth platform.

Smith Barney

Morgan Stanley took full ownership of Smith Barney from Citigroup in 2013 after initially forming a joint venture in 2009. The business now operates fully under Morgan Stanley Wealth Management. It brought one of the largest financial advisor networks in the world and trillions in client assets. This acquisition transformed Morgan Stanley into a global leader in wealth management.

Morgan Stanley Bank N.A.

Morgan Stanley Bank N.A. is a national banking subsidiary providing lending, treasury, and financing solutions to wealth and institutional clients. The bank supports securities-backed lending, commercial loans, and liquidity services. It plays a central role in the firm’s funding structure and generates significant net interest income.

Morgan Stanley Private Bank

Morgan Stanley Private Bank provides lending and deposit services to high-net-worth and ultra-high-net-worth clients. It offers customized lending solutions, mortgages, and structured credit products tied to wealth portfolios. The private bank strengthens Morgan Stanley’s integrated wealth and banking ecosystem.

Morgan Stanley Capital Partners

Morgan Stanley Capital Partners is the firm’s private equity investment business. It invests directly in private companies across industries such as healthcare, technology, and industrials. The platform manages billions in private equity capital and focuses on long-term value creation through strategic investments.

Morgan Stanley Infrastructure Partners

Morgan Stanley Infrastructure Partners invests in large-scale infrastructure assets including energy systems, transportation, utilities, and digital infrastructure. The platform manages billions in infrastructure capital and focuses on long-term cash-flow generating assets for institutional investors.

Morgan Stanley Real Estate Investing (MSREI)

Morgan Stanley Real Estate Investing manages global real estate funds and direct property investments. It operates across North America, Europe, and Asia and manages tens of billions in real estate assets. The platform invests in commercial property, logistics, housing, and infrastructure-linked real estate.

Mesa West Capital

Mesa West Capital is a real estate credit and lending business operating under Morgan Stanley Investment Management. It focuses on commercial real estate loans, structured credit, and property-backed financing. The firm manages billions in real estate debt investments and supports Morgan Stanley’s alternative investment expansion.

1st Global

Morgan Stanley acquired 1st Global, a tax-focused wealth management and advisory platform, to expand its reach among accounting and advisory professionals. The platform provides investment and advisory services integrated with tax planning and financial consulting.

Van Kampen Investments (Legacy Integration)

Van Kampen was a mutual fund and asset management business previously acquired by Morgan Stanley and later integrated into its investment management platform. While parts were sold or merged, the acquisition helped build Morgan Stanley’s long-term asset management capabilities and fund infrastructure.

FrontPoint Partners (Legacy Hedge Fund Platform)

FrontPoint Partners was a hedge fund platform once owned by Morgan Stanley. Although later spun off, it contributed to the firm’s expansion into alternative investments and hedge fund strategies, influencing Morgan Stanley’s current private markets and alternatives business.

Blooom

Blooom is a digital investment advisory and retirement planning platform focused on workplace retirement accounts such as 401(k) plans. Morgan Stanley acquired Blooom to expand its presence in digital retirement advisory and automated portfolio management.

The platform uses algorithm-driven portfolio optimization, account monitoring, and retirement planning tools. Blooom strengthens Morgan Stanley’s digital wealth ecosystem and allows the firm to reach mass-market retirement investors beyond traditional advisory channels.

Graystone Wealth Management Services

Graystone Wealth Management Services operates as Morgan Stanley’s institutional consulting and advisory platform for large organizations, pension funds, endowments, foundations, and corporate clients. The business provides investment consulting, asset allocation strategy, risk management, and portfolio advisory services. Graystone manages billions in institutional assets and plays a major role in Morgan Stanley’s institutional wealth and advisory ecosystem.

EquityZen

EquityZen is a private market investment platform acquired by Morgan Stanley in 2026 to expand its presence in late-stage private investing. The platform allows accredited and institutional investors to buy and sell shares of private companies before they go public. This gives investors access to pre-IPO opportunities that were traditionally limited to venture capital and private equity firms.

EquityZen plays a strategic role in Morgan Stanley’s expansion into private markets and alternative investments. The platform connects employees, early investors, and shareholders of private companies with buyers seeking exposure to high-growth private firms.

With this acquisition, Morgan Stanley strengthened its ability to offer clients access to private equity-style investments, expand fee-based revenue, and compete in the rapidly growing private capital market.

Final Words

Morgan Stanley is not owned by a single person or family. It is a publicly traded company owned by institutional and individual investors. Vanguard, BlackRock, and State Street are the largest shareholders. The company is controlled by its CEO and board rather than its shareholders. With strong global operations, diversified revenue streams, and major acquisitions like E*TRADE and Eaton Vance, Morgan Stanley remains one of the most powerful financial institutions in the world.

FAQs

Who is the major shareholder of Morgan Stanley?

The largest shareholder of Morgan Stanley is Vanguard Group, which holds the biggest ownership stake through its index funds and ETFs. Other major shareholders include BlackRock and State Street, but no single investor controls the company.

Is Morgan Stanley owned by BlackRock?

No. BlackRock is one of the largest institutional shareholders, but it does not own or control Morgan Stanley. The company is publicly traded and owned by a wide range of institutional and public investors.

Is Morgan Stanley connected to J.P. Morgan?

Morgan Stanley was originally created in 1935 by former partners of J.P. Morgan & Co after U.S. banking laws separated commercial and investment banking. While they share historical roots and the Morgan name, Morgan Stanley and JPMorgan Chase are separate and independent companies today.

What does Morgan Stanley do?

Morgan Stanley is a global financial services company. It provides investment banking, wealth management, asset management, trading, advisory, and financial planning services to corporations, governments, institutions, and individuals worldwide.

Is Morgan Stanley a Bank?

Yes. Morgan Stanley operates as a bank holding company and owns regulated banking subsidiaries such as Morgan Stanley Bank N.A. and Morgan Stanley Private Bank. However, its core business is broader than traditional banking and includes investment and wealth management.

What is Morgan Stanley known for?

Morgan Stanley is best known for investment banking, wealth management, and global capital markets. It is one of the world’s leading firms in mergers and acquisitions advisory, equity underwriting, institutional trading, and financial advisory for high-net-worth clients.

Is Morgan Stanley owned by Chase?

No. Morgan Stanley and JPMorgan Chase are separate companies. Neither owns the other. Both are independent global financial institutions with different ownership structures.

How big is Morgan Stanley?

Morgan Stanley is one of the largest financial institutions in the world. As of 2026, it has a market value of about $278.35 billion, manages trillions in client assets, operates in over 40 countries, and serves millions of individual and institutional clients globally.

Who bought Morgan Stanley?

Morgan Stanley has not been bought by any company. It remains an independent publicly traded firm owned by institutional and public shareholders. Over time, it has acquired other companies rather than being acquired itself.

When was Morgan Stanley founded?

Morgan Stanley was founded in 1935 in the United States following the separation of commercial and investment banking under the Glass-Steagall Act.

Who are the founders of Morgan Stanley?

Morgan Stanley was founded by Henry Sturgis Morgan and Harold Stanley, both former partners at J.P. Morgan & Co. They established the firm as an independent investment bank.

What bank is affiliated with Morgan Stanley?

Morgan Stanley operates its own banking subsidiaries, including Morgan Stanley Bank N.A. and Morgan Stanley Private Bank. It is not owned by another bank but functions as a bank holding company with integrated financial services.

Are Goldman Sachs and Morgan Stanley the same?

No. Goldman Sachs and Morgan Stanley are separate companies. Both are major global investment banks, but they operate independently with different management, ownership, and business structures.

Who is the CEO of Morgan Stanley?

As of 2026, the CEO of Morgan Stanley is Ted Pick, who took over leadership in January 2024 following James Gorman.