Lyft has become one of the most recognized names in the ridesharing industry. But many people still ask the question—who owns Lyft? With its presence across North America and a significant share in the rideshare market, it’s essential to understand who controls the company, its major shareholders, leadership, and overall financial footprint.

Lyft Company Profile

Lyft, Inc. is a leading North American transportation network company headquartered in San Francisco, California. It was founded in June 2012 by Logan Green and John Zimmer. Lyft began as a peer-to-peer ride-sharing service and has since grown into a diversified mobility platform. It offers rideshare services, bike and scooter rentals, ride subscriptions, business travel solutions, and limited autonomous vehicle pilot programs.

The company operates only in the United States and Canada, positioning itself as a more focused alternative to its global rival Uber. As of 2025, Lyft has millions of active users and continues to be a major force in urban mobility.

Lyft’s mission is to improve people’s lives with the world’s best transportation. Unlike Uber, Lyft exited food delivery and freight services to double down on its core business of ride-hailing.

Lyft Founders

- Logan Green: Former CEO and co-founder, Green led the company until April 2023. He remains a board member. He was inspired by carpooling systems he observed in Zimbabwe and launched Zimride before Lyft.

- John Zimmer: Former President and co-founder, Zimmer played a key role in Lyft’s early growth and brand positioning. He stepped away from day-to-day operations in 2023 but remains involved in strategic decisions.

Major Milestones

- 2007: Green and Zimmer launched Zimride, a long-distance carpooling service, which laid the foundation for Lyft.

- June 2012: Lyft officially launched as a mobile app, offering peer-to-peer short-distance rides.

- 2013–2016: Lyft expanded rapidly across major U.S. cities and introduced features like Lyft Line (shared rides) and Lyft Lux (premium rides).

- 2017: Secured major investments from Alphabet’s CapitalG and other firms, increasing its valuation to over $11 billion.

- March 2019: Lyft went public on the NASDAQ under the ticker symbol LYFT, raising over $2 billion in its IPO.

- 2020–2021: The COVID-19 pandemic caused a sharp decline in ridership. Lyft responded by cutting costs and exiting non-core business lines.

- 2021: Sold its self-driving division to Woven Planet Holdings, a subsidiary of Toyota.

- 2023: Co-founders Logan Green and John Zimmer stepped down from executive roles. David Risher, a former Amazon executive, was appointed CEO to lead Lyft into a new operational phase.

- 2024–2025: Lyft launched its new ad-based revenue model through Lyft Media, scaled up its business-to-business rideshare operations, and focused on achieving consistent profitability.

Lyft in 2025 is more streamlined and focused than ever before, aiming for efficiency, market stability, and user experience rather than aggressive global expansion.

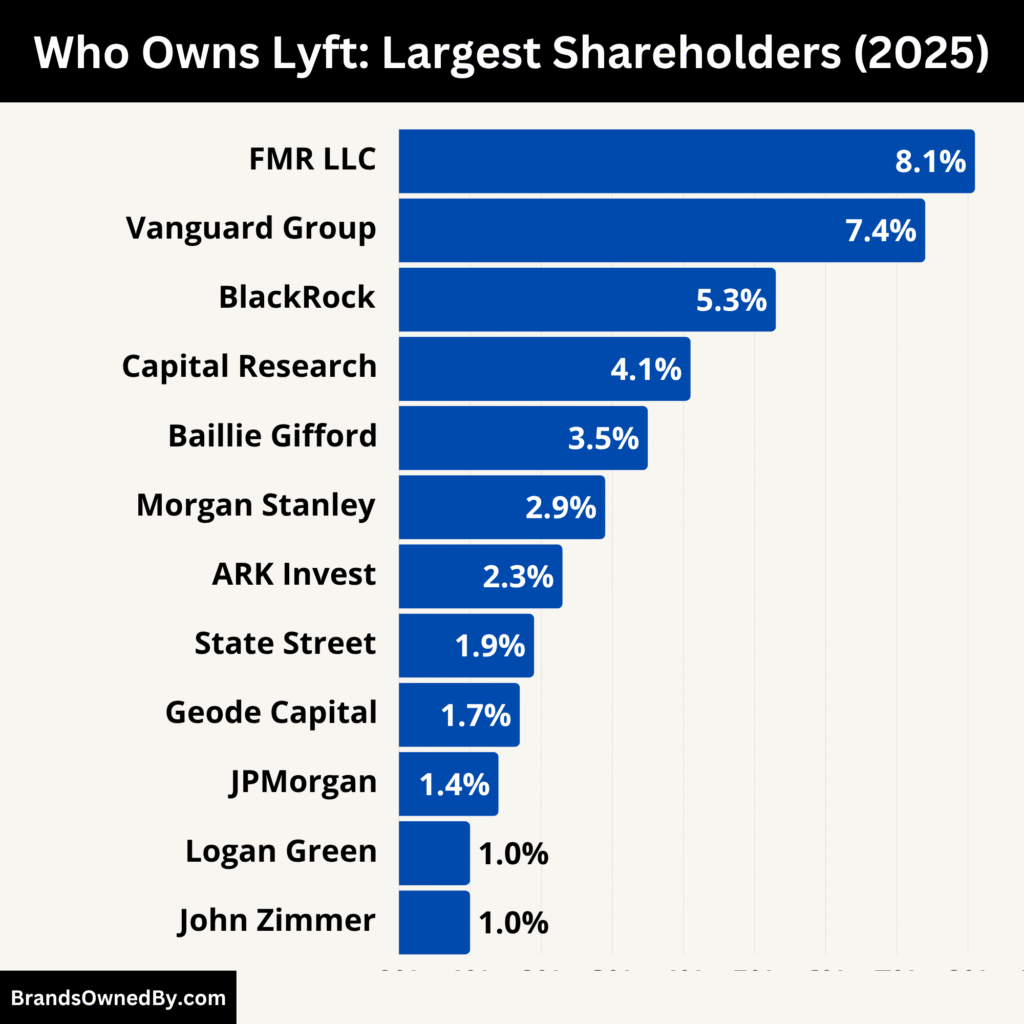

Who Owns Lyft: Top Shareholders

Lyft is a publicly traded company. That means it is owned by shareholders who purchase its stock on the open market. The ownership is distributed across institutional investors, mutual funds, individual stakeholders, and the company’s co-founders and executive leadership.

As of July 2025, no single entity holds a majority ownership in Lyft. However, institutional investors control over 70% of Lyft’s equity, giving them substantial influence in shaping the company’s policies and leadership structure. The dual-class share structure still allows co-founders Green and Zimmer to retain strategic control over major decisions despite limited economic ownership.

Below is a list of the major shareholders of Lyft as of July 2025:

| Shareholder | Ownership (%) | Type | Influence / Control |

|---|---|---|---|

| FMR LLC (Fidelity Investments) | 8.1% | Institutional | Largest shareholder, strong voting power in governance |

| Vanguard Group Inc. | 7.4% | Institutional | Passive investor with major influence via proxy voting |

| BlackRock Inc. | 5.3% | Institutional | Passive index investor, important in executive and board oversight |

| Capital Research Global Investors | 4.1% | Institutional | Actively managed position; supports growth and long-term strategy |

| Baillie Gifford & Co. | 3.5% | Institutional | Long-term growth investor, indirectly shapes company trajectory |

| Morgan Stanley | 2.9% | Institutional/Strategic | IPO underwriter, holds financial interest and advisory influence |

| ARK Invest (Cathie Wood) | 2.3% | Innovation-Focused Fund | Small stake, but high visibility in retail and tech-focused investing |

| Logan Green (Co-founder) | <1% equity, ~8% voting power | Insider/Individual | Holds Class B shares; significant control via super-voting rights |

| John Zimmer (Co-founder) | <1% equity, ~7% voting power | Insider/Individual | Also retains Class B shares, contributing to founder influence |

| State Street Global Advisors | 1.9% | Institutional | Passive investor, aligned with peer institutional strategies |

| Geode Capital Management | 1.7% | Institutional | Index fund affiliate of Fidelity; passive investor |

| JPMorgan Asset Management | 1.4% | Institutional | Financial investor with moderate voting influence |

| Retail Shareholders | 8–10% (estimated) | Individual | Dispersed ownership, growing voice via coordinated voting |

| Employees and Executives | 4–5% (estimated) | Insiders | Compensated via stock/RSUs; aligned with long-term performance |

FMR LLC (Fidelity Investments)

As of 2025, FMR LLC, widely known as Fidelity Investments, is Lyft’s largest institutional shareholder, owning approximately 8.1% of the company’s outstanding common shares. Fidelity is a long-term investor and typically takes passive stakes in technology and mobility companies. Though it doesn’t engage in daily management, its substantial stake gives it significant voting power during shareholder meetings and corporate governance decisions.

Vanguard Group Inc.

The Vanguard Group owns around 7.4% of Lyft’s stock as of mid-2025. Vanguard is known for its broad index funds, which include large-cap stocks like Lyft. While Vanguard is also a passive investor, it has an influential voice in proxy voting, executive pay policies, and sustainability practices. Its large holding makes it one of the most influential shareholders in Lyft’s long-term direction.

BlackRock Inc.

BlackRock, the world’s largest asset manager, holds nearly 5.3% of Lyft shares in 2025. Through its iShares ETFs and institutional funds, BlackRock provides Lyft with access to a broad base of investors. The firm generally supports strategic initiatives aligned with long-term value creation. Its voting power contributes to executive evaluations and board member selections.

Capital Research Global Investors

Capital Research owns around 4.1% of Lyft as of 2025. The firm is part of Capital Group, one of the oldest investment management organizations in the U.S. Capital Research tends to take more actively managed positions and engages with leadership teams about growth strategies. Its presence suggests institutional confidence in Lyft’s future.

Baillie Gifford & Co.

This Scottish investment firm is known for supporting disruptive tech firms and owns about 3.5% of Lyft stock in 2025. Baillie Gifford tends to invest in companies with long-term growth potential. While not active in daily operations, it may influence strategic decisions through private conversations with leadership and shareholder voting.

Morgan Stanley

As both an investor and an underwriter of Lyft’s IPO, Morgan Stanley remains a notable shareholder with about 2.9% ownership in 2025. It also provides ongoing advisory services. Morgan Stanley’s investment indicates institutional trust, though its stake is more financial than operational.

ARK Invest (Cathie Wood)

ARK Investment Management, led by Cathie Wood, holds a growing stake in Lyft through its ARK Innovation ETF. As of 2025, it controls about 2.3% of the company. ARK supports companies in mobility, robotics, and next-gen internet, aligning with Lyft’s transportation tech focus. Though small in percentage, ARK’s voice is prominent in retail and innovation-focused investing communities.

Co-founders Logan Green and John Zimmer

Both Logan Green and John Zimmer have reduced their equity holdings since Lyft’s IPO. However, they still retain a portion of Class B shares, which come with enhanced voting rights (20 votes per share vs. 1 for Class A). As of 2025, they jointly hold under 2% equity but retain over 15% of voting power combined due to a dual-class share structure. This allows them to influence leadership decisions, especially board appointments and corporate direction.

Other Institutional Shareholders

Other asset managers and pension funds own smaller but notable stakes, including:

- State Street Global Advisors: Holds around 1.9%.

- Geode Capital Management: Owns close to 1.7%.

- JPMorgan Asset Management: With approximately 1.4%, often aligning with other large institutional votes.

These firms are passive investors but play a role in shaping governance policies and executive compensation decisions through voting rights.

Retail Shareholders

Thousands of individual investors also hold Lyft shares through brokerage accounts and trading apps like Robinhood, Fidelity, and Schwab. Combined, retail shareholders own about 8–10% of the total equity as of 2025. Though no single retail investor holds control, their influence has grown through social media campaigns and coordinated proxy votes.

Employee Stockholders and Executives

Lyft’s current executives, engineers, and operations teams hold shares through stock options and restricted stock units (RSUs). These shares represent part of employee compensation and help align internal performance with shareholder value. Collectively, employees and insiders own an estimated 4–5% of shares.

Who is the CEO of Lyft?

As of 2025, David Risher serves as the Chief Executive Officer of Lyft. He assumed the role in April 2023, following the departure of co-founder Logan Green from the CEO position. Risher brings extensive executive experience from Amazon and Microsoft. His leadership has focused on improving Lyft’s profitability and operational efficiency. Under his direction, the company adopted a leaner operating model, prioritized core mobility services, and expanded enterprise transport offerings.

Leadership Style and Decision-Making Structure

David Risher champions a data-driven and results-oriented management approach. He has emphasized cost discipline, margin improvement, and streamlined operations. Strategic decisions are made collaboratively by the executive leadership team, consisting of heads of operations, finance, product, and marketing. The board of directors meets regularly to oversee major initiatives like partnerships, acquisitions, and long-term planning. Risher maintains close alignment with the co-founders through the dual-class share governance structure.

Past CEOs and Leadership Transition

- Logan Green served as Lyft’s CEO from its founding in June 2012 until April 2023. He played a pivotal role in Lyft’s early growth, brand identity, and service innovation. Green remains on the board of directors and retains significant voting influence through Class B shares.

- John Zimmer, while not formally CEO, held the title of President and was responsible for corporate strategy and brand experience. He stepped away from day-to-day operations in 2023 but continues to participate in strategic decision-making at the board level.

Executive Team Support

Risher works alongside a leadership team with deep expertise in transportation, technology, and mobility services. Key executives include:

- Chief Financial Officer (CFO): Oversees financial planning, investor relations, and cost controls.

- Chief Operating Officer (COO): Manages operations at scale, including driver relations and urban market logistics.

- Chief Technology Officer (CTO): Drives engineering initiatives, platform reliability, and rideshare product development.

- Head of Lyft Business: Directs enterprise and B2B growth, including healthcare transport and corporate travel programs.

Vision Under David Risher

Risher’s vision centers on profitability through focused growth. He has prioritized urban mobility, retention of high-frequency riders, and expansion of the Lyft Business platform. Lyft Media, the ad-tech arm, has become a revenue focus, helping monetize platform engagement. Risher aims to position Lyft as a lean, sustainable company rather than pursuing broad diversification.

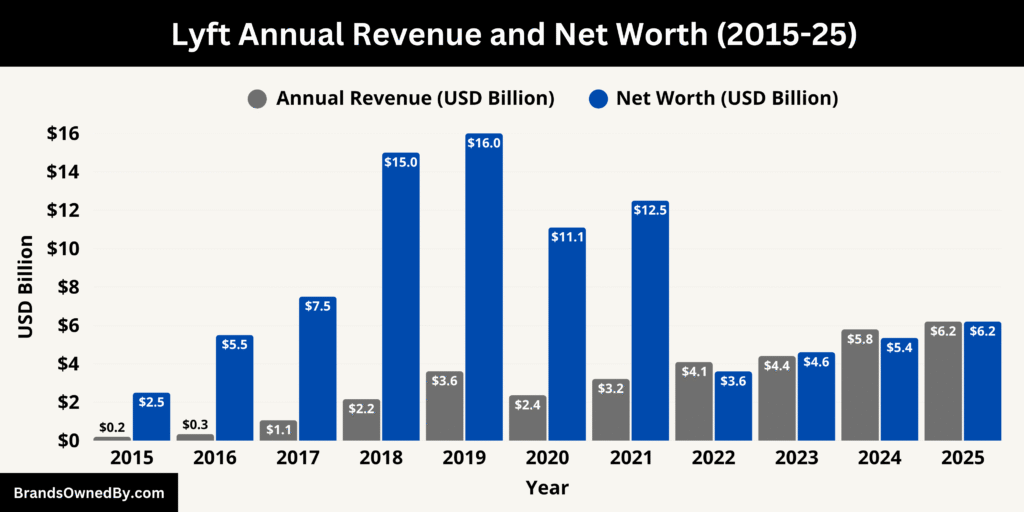

Lyft Annual Revenue and Net Worth

Lyft’s financial recovery has been one of the more notable turnaround stories in the mobility space. For the full fiscal year ending December 31, 2024, Lyft reported total revenue of approximately $5.79 billion, up significantly from $4.4 billion in 2023. This 31% annual increase was driven by a return in urban travel demand, business rides, and the full rollout of its advertising platform, Lyft Media.

By Q1 2025, Lyft’s growth had continued into the new fiscal year. The company reported $1.45 billion in revenue in the first quarter alone, marking a 14% year-over-year increase compared to Q1 2024. Analysts forecast Lyft’s total 2025 revenue could reach or exceed $6.2 billion if current trends hold across quarters. If achieved, this would mark Lyft’s highest-ever annual revenue, reinforcing investor optimism about its strategic focus on core ride-hailing operations.

Lyft’s recovery was fueled by several strategic shifts:

- Restructuring to reduce fixed operational costs by more than $330 million in 2024.

- Growth in Lyft Business, which includes rides for corporations, healthcare providers, and transit agencies.

- Expansion of subscription products like Lyft Pink, contributing to a stable, recurring revenue stream.

- Increased usage of shared rides and multi-stop trip features, improving ride efficiency and revenue per ride.

Operating Profitability and Cash Flow

In 2024, for the first time in its history, Lyft posted positive net income of around $22.8 million—a dramatic improvement from the $1.58 billion net loss recorded in 2022 and a $584 million loss in 2023. This shift was not only symbolic but also substantial, signaling Lyft’s new era of financial discipline under CEO David Risher.

Operating cash flow also turned positive. In Q1 2025 alone, Lyft generated $287 million in cash from operations, while free cash flow reached $563 million, indicating the company is now capable of funding its business without relying on external financing or dilution. These numbers are particularly important after years of persistent losses following its IPO in 2019.

Lyft has also been actively reducing unprofitable incentives and driver subsidies, instead focusing on dynamic pricing and real-time demand balancing. This approach has not only stabilized ride prices but also increased driver retention and ride availability during peak hours.

Lyft Net Worth

As of July 2025, Lyft’s market capitalization—the best measure of its net worth in public markets—stood at approximately $6.2 billion. This represents a 16% increase from its valuation in 2024, when the company’s market cap dropped to around $5.35 billion following a volatile year in tech stocks.

This upward revision in valuation is due to:

- Consistent revenue growth over multiple quarters.

- Return to profitability.

- Investor confidence in Risher’s restructuring.

- Improved guidance for 2025–2026.

However, this is still a far cry from its IPO market cap of over $20 billion in 2019. Lyft’s valuation today reflects a leaner company with more realistic growth expectations, but significantly improved fundamentals.

Institutional investors now view Lyft as a mid-cap company with high upside rather than a speculative hypergrowth stock. Its valuation is closely tied to user retention, ride volume growth, and the ability to generate consistent free cash flow over the coming years.

Here is Lyft’s historical revenue and net worth (market capitalization) over the past 10 years (2015–2025):

| Year | Annual Revenue (USD) | Net Worth / Market Cap (USD) |

|---|---|---|

| 2025 | $6.2 billion (est.) | $6.2 billion (as of July 2025) |

| 2024 | $5.79 billion | $5.35 billion |

| 2023 | $4.40 billion | $4.6 billion |

| 2022 | $4.09 billion | $3.6 billion |

| 2021 | $3.21 billion | $12.5 billion |

| 2020 | $2.36 billion | $11.1 billion |

| 2019 | $3.61 billion | $16–20 billion (IPO year peak) |

| 2018 | $2.16 billion | $15 billion (pre-IPO estimate) |

| 2017 | $1.06 billion | $7.5 billion (private valuation) |

| 2016 | $0.343 billion | $5.5 billion (private valuation) |

| 2015 | $0.200 billion | $2.5 billion (private valuation) |

Forward-Looking Financial Strategy

Lyft is now focused on long-term financial sustainability. Management has introduced a stock buyback program to return capital to shareholders, targeting $750 million in repurchases over 12–18 months. This marks a major shift from its earlier capital-raising strategies and is made possible by its newfound free cash flow.

In addition, the company is gradually diversifying revenue through Lyft Media, which leverages in-app advertising, vehicle-top displays, and driver dashboard screens. This business line is expected to contribute nearly $200 million in revenue by year-end 2025, according to internal projections.

Lyft has also reaffirmed its midterm target of reaching $25 billion in gross bookings by 2027, with operating margins steadily improving quarter by quarter. Though aggressive, this projection reflects confidence in the scalability of its platform and brand strength in U.S. urban centers.

Companies Owned by Lyft

Lyft does not operate a wide portfolio of subsidiaries like some tech giants, but it does own and operate several transportation-related businesses. Below is a list of the companies and brands owned by Lyft as of 2025:

| Entity / Brand | Type | Function / Description |

|---|---|---|

| Lyft Rideshare | Core Business | Main on-demand ride-hailing service across U.S. and Canada, including standard, XL, Lux rides. |

| Lyft Business | B2B Division | Provides transport solutions to companies, hospitals, schools, and event organizers. |

| Lyft Media | Advertising Platform | In-car tablets, rooftop ads, and in-app promotions that generate ad-based revenue. |

| Motivate / Lyft Bikes | Subsidiary Brand | Operates major bike-sharing programs like Citi Bike, Bay Wheels, and Divvy. |

| Lyft Scooters | Micromobility | Electric scooter-sharing in urban areas for short-distance, last-mile transport. |

| Lyft Rentals | Consumer Service | App-based car rentals offered in select cities for daily or hourly usage. |

| Autonomous Rides | Strategic Partnership | Self-driving ride-hailing via partners like Motional; Lyft handles customer platform side. |

| Flexdrive | Driver Leasing Ops | Weekly car rentals for Lyft drivers without personal vehicles; supports driver onboarding. |

| Lyft Pink | Subscription Program | Loyalty membership offering ride discounts, priority service, and bundled mobility benefits. |

Lyft Rideshare

Lyft Rideshare is the company’s core product and the most recognized brand under its umbrella. Launched in 2012, it offers on-demand ride-hailing services via its mobile app in over 600 cities across the United States and Canada. In 2025, it includes options like standard rides, Lyft XL (for larger groups), and Lyft Lux (premium vehicles). Shared rides, once paused during the pandemic, have been reintroduced in several cities with improved efficiency and pricing.

Lyft Rideshare accounts for over 85% of the company’s revenue and remains its primary business focus. It includes a robust driver platform, customer rewards through Lyft Pink, and AI-powered dynamic pricing.

Lyft Business

Lyft Business is a B2B-focused division offering transportation solutions to corporations, healthcare providers, universities, and government organizations. As of 2025, Lyft Business serves thousands of enterprise clients and contributes a growing share of recurring revenue.

Key offerings include:

- Scheduled and on-demand rides for employees.

- Non-emergency medical transportation for patients.

- Ride credits for universities and event organizers.

Lyft Business has become a core pillar of Lyft’s profitability strategy by offering contracted, volume-based deals that provide predictable revenue streams.

Lyft Media

Lyft Media is Lyft’s in-house advertising platform, launched to monetize the rider and driver experience. It includes:

- In-car digital tablet screens showing ads and ride information.

- Digital rooftop ads on select vehicles.

- Sponsored in-app promotions during booking and ride-tracking.

By mid-2025, Lyft Media has become one of the fastest-growing non-transport segments of the company, with projected revenues of nearly $200 million by year-end. It also provides local businesses with geotargeted advertising options, tapping into the platform’s rich data on user behavior.

Motivate (Lyft Bikes)

Lyft owns Motivate, one of the largest bike-sharing operators in North America. Acquired in 2018, Motivate powers popular programs such as:

- Citi Bike in New York City

- Bay Wheels in San Francisco

- Divvy in Chicago

Lyft continues to operate these systems under local partnerships and licensing agreements. The bikes, docks, and back-end software are maintained and supported by Lyft’s mobility operations teams. As of 2025, Lyft remains the leading operator of docked and e-bike sharing in the U.S., with expanded fleets in urban centers.

Lyft Scooters

Lyft Scooters is the electric scooter-sharing program deployed in select U.S. cities. While the scale has been reduced compared to earlier years, scooters are still operational in areas with high pedestrian activity and tourism. These vehicles can be unlocked via the Lyft app and are frequently used for short, last-mile commutes.

Lyft has refined this business line by focusing only on profitable zones, partnering with cities for designated parking areas, and integrating micromobility pricing with ride credits and subscriptions.

Lyft Rentals

Lyft Rentals is Lyft’s short-term vehicle rental service, allowing users to rent cars directly through the app. While this service has been scaled back compared to earlier expansions, it still operates in select markets where demand is strong.

In 2025, Lyft Rentals functions primarily as a complementary service for customers who need a vehicle for multiple hours or days, offering insurance, gas discounts, and contactless pickup/drop-off via rental partners and Lyft-managed lots.

Lyft Autonomous Partnerships

While Lyft sold its internal autonomous vehicle division in 2021, it still operates partnerships under its autonomous ride-hailing program. In 2025, Lyft works with companies like Motional to offer limited self-driving rides in select cities, including Las Vegas and Los Angeles.

Lyft provides the consumer-facing platform, while the autonomous technology is handled by partners. The vehicles are available under a co-branded experience within the Lyft app, but all customer service, payments, and app UX remain under Lyft’s control.

Flexdrive (Leased Fleet Operations)

Flexdrive, originally a separate startup, is now operated as a leasing solution under Lyft’s driver ecosystem. It allows approved drivers to rent vehicles on a weekly basis to drive for Lyft without owning a car. The vehicles are maintained and insured through Lyft’s partners, but managed through Lyft’s operational platform.

This service is essential in onboarding drivers who don’t have access to vehicles but still want to work flexibly. As of 2025, Flexdrive has helped boost driver supply in cities facing high demand.

Lyft Pink

Lyft Pink is not a separate company, but it functions as a distinct brand identity within the app. It is Lyft’s subscription-based loyalty program offering perks like:

- Priority pickups

- Free upgrades to Lyft Lux

- Discounted rides and bike access

- Roadside assistance

In 2025, Lyft Pink continues to expand, with premium tiers tailored to business users, frequent riders, and corporate accounts.

Final Thoughts

Lyft remains a prominent player in North America’s mobility market. While it doesn’t dominate globally like its main rival Uber, it has carved out a strong niche. The company is publicly owned, with no single controlling entity, although institutional investors like Fidelity, Vanguard, and BlackRock hold significant shares.

Under the leadership of David Risher, Lyft is navigating a path toward profitability. With a trimmed-down business model focused on rideshare and urban mobility, Lyft’s future depends on operational efficiency and competitive pricing. For anyone wondering who owns Lyft, the answer lies in the hands of the public, with major financial institutions playing key roles.

FAQs

Who is Lyft owned by?

Lyft is a publicly traded company, owned by a mix of institutional investors, retail shareholders, and company insiders. It is listed on the NASDAQ under the ticker LYFT.

Is Lyft owned by Uber?

No, Lyft is not owned by Uber. They are two separate competing companies in the ride-sharing industry. Uber is significantly larger, but both operate independently.

Who owns Lyft and Uber?

Neither company owns the other. Both Lyft and Uber are public companies with separate shareholders, leadership, and stock listings. Uber is traded as UBER, and Lyft as LYFT.

Did Uber and Lyft merge?

No, Uber and Lyft have not merged. They remain direct rivals and operate independently across the U.S. and in selected international partnerships.

Where is Lyft’s headquarters?

Lyft’s headquarters is located in San Francisco, California, in the United States.

Where is Lyft based?

Lyft is based in the United States, with its central operations and leadership rooted in San Francisco.

Are Lyft and Uber the same company?

No, they are not the same company. While they offer similar services, they have separate business models, management teams, technologies, and investor bases.

How many institutional investors own Lyft?

As of 2025, over 500 institutional investors hold stakes in Lyft, including investment firms, pension funds, and mutual fund companies. The top 10 control more than 50% of the company’s stock.

How did Lyft become a public company?

Lyft went public through an initial public offering (IPO) on March 29, 2019. It was one of the first major ride-hailing companies to list on a U.S. stock exchange.

Who is the biggest shareholder of Lyft?

As of 2025, the largest shareholder of Lyft is Rakuten Group, Inc., holding around 10.4% of the total shares. Major institutional investors like Vanguard and BlackRock also hold significant stakes.

Who acquired Lyft?

No company has acquired Lyft. It continues to operate as an independent, publicly traded entity.

Did Uber buy Lyft?

No, Uber has never bought Lyft. Both companies remain strong competitors in the North American ride-hailing market.

Which country owns Lyft?

Lyft is a U.S.-based company, and the majority of its shareholders and operations are American. However, foreign investors like Japan’s Rakuten do own shares.

Who is the biggest ride-sharing company?

Globally, Uber is the largest ride-sharing company by revenue, number of rides, and market capitalization. In the U.S., Lyft holds the second-largest market share after Uber.

What is John Zimmer’s net worth?

As of July 2025, John Zimmer, co-founder and former president of Lyft, has an estimated net worth of around $300 million. His wealth mainly comes from his equity in Lyft and related investments.

Is Lyft publicly traded?

Yes, Lyft is a publicly traded company. It was listed on the NASDAQ in March 2019 under the ticker symbol LYFT.

Who founded Lyft?

Lyft was founded by Logan Green and John Zimmer in 2012. The concept originated from their earlier startup, Zimride.

Who owns the most shares of Lyft?

Institutional investors like Fidelity (FMR LLC), Vanguard, and BlackRock own the largest shares. Among individuals, co-founders Logan Green and John Zimmer still hold a portion of the stock and retain voting power through Class B shares.

Does Amazon or Google own Lyft?

No, neither Amazon nor Google owns Lyft. However, Google’s parent company Alphabet once invested in Lyft through its venture capital arm, CapitalG.