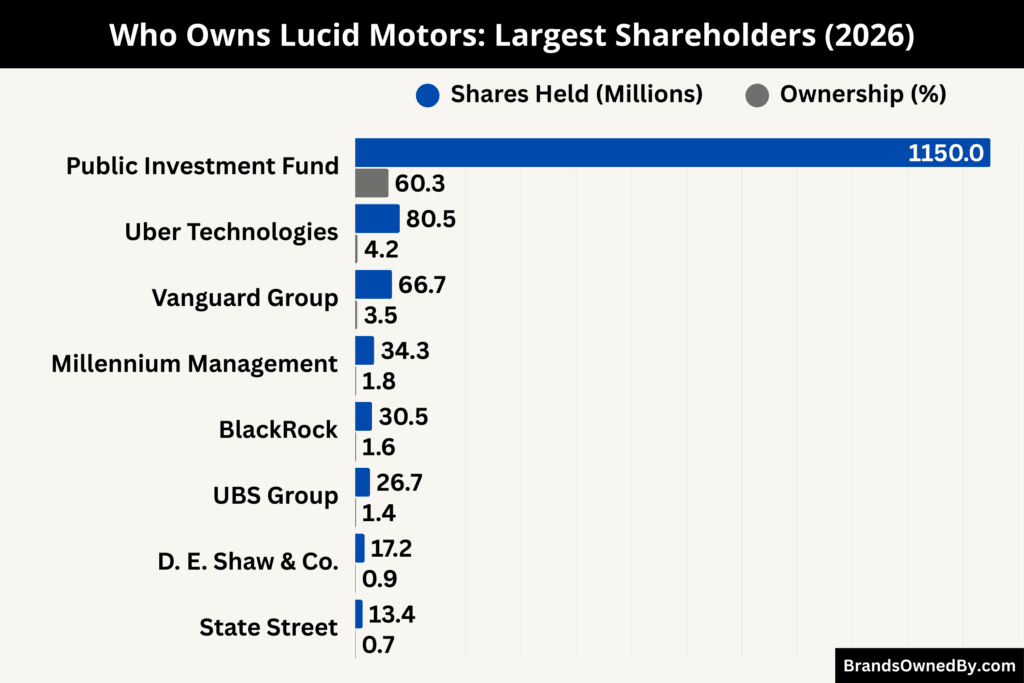

- Lucid Motors is a publicly traded company listed on the Nasdaq under the ticker LCID, but ownership is highly concentrated; the Public Investment Fund of Saudi Arabia controls 60.29% of outstanding shares as of January 2026, giving it decisive voting power and governance control.

- The Public Investment Fund owns 1.15 billion shares of Lucid Motors, making it the clear controlling shareholder and the primary source of long-term capital support, board influence, and strategic direction, including global manufacturing expansion and product roadmap decisions.

- Outside the majority owner, Lucid’s key shareholders include Uber Technologies (4.22%), Vanguard Group (3.50%), Millennium Management (1.80%), BlackRock (1.60%), UBS Group (1.40%), D. E. Shaw & Co. (0.90%), and State Street Corporation (0.70%), which together provide institutional depth and liquidity but do not influence control.

- Retail investors and company insiders collectively hold about 23% of Lucid Motors, supporting public float and trading activity, while effective decision-making authority remains concentrated with the Public Investment Fund and the board.

Lucid Motors is an American electric vehicle and technology company known for building luxury electric cars and advanced vehicle systems. The company was founded in 2007 under the name Atieva and originally focused on designing and supplying high-performance battery systems and electric powertrains for other manufacturers.

In 2016, the company rebranded as Lucid Motors and shifted its core mission to producing complete electric vehicles with a focus on efficiency, range, and luxury. Its design and engineering centers are in California, while primary manufacturing happens at facilities in Casa Grande, Arizona, and internationally in Saudi Arabia.

Lucid has also positioned itself as a technology partner, supplying electric powertrain components to other automakers and developing proprietary innovations in battery architecture, aerodynamics, and driver assistance.

It went public in 2021 via a SPAC merger and continues to expand its model lineup and global presence.

Lucid Motors Founders

Lucid Motors was founded in 2007 by Bernard Tse, Sam Weng, and Sheaupyng Lin. The company originally operated under the name Atieva and was established with a clear focus on advanced electric vehicle battery systems and powertrain technology.

From the beginning, the founders positioned the company as an engineering-driven organization rather than a traditional automaker. Their combined experience in electric mobility, technology startups, and battery innovation shaped the company’s early direction and laid the groundwork for its eventual transition into a full-scale electric vehicle manufacturer.

Bernard Tse was instrumental in the early development of the business. Before Lucid, he served as Vice President at Tesla Motors, where he gained deep expertise in electric vehicle technology. At Lucid, Tse helped shape the initial vision that combined battery systems with high-performance engineering, anchoring the company’s technical DNA.

Sam Weng co-founded the company alongside Tse. Weng brought broad business and engineering experience from earlier roles in the technology sector. His focus in the early years helped guide Lucid through pilot projects in battery development and initial market positioning.

Sheaupyng Lin also played a foundational role, contributing significant technical leadership in battery and electric powertrain innovation. Lin’s expertise supported the company’s reputation for high-efficiency systems and advanced energy solutions that would later become central to Lucid’s vehicle lineup.

Major Milestones

- 2007: The company is founded as Atieva in California with a focus on advanced electric vehicle battery systems and powertrain technology rather than manufacturing complete vehicles.

- 2009: Early research and prototype development begins for high-density battery packs and electric drive systems, establishing the company’s engineering foundation.

- 2011: Atieva starts working on electric powertrain projects for external partners, gaining experience in large-scale battery integration and performance optimization.

- 2013: Peter Rawlinson joins the company as Chief Technology Officer, marking a strategic pivot toward designing and engineering complete electric vehicles.

- 2014: Internal development begins on a proprietary vehicle architecture, including in-house battery modules, motors, and inverter systems.

- 2016: The company rebrands from Atieva to Lucid Motors and publicly announces its ambition to produce luxury electric vehicles.

- 2017: Lucid reveals early prototypes of its first electric sedan, showcasing its design language and technology direction.

- 2018: Lucid secures long-term strategic backing from Saudi Arabia’s Public Investment Fund, enabling large-scale vehicle development and factory construction.

- 2019: Peter Rawlinson is appointed Chief Executive Officer, consolidating leadership over both engineering and corporate strategy.

- 2020: Construction accelerates at Lucid’s Arizona manufacturing facility in preparation for commercial production.

- 2021: Lucid becomes a publicly traded company and begins production of its first luxury electric sedan, the Lucid Air.

- 2022: Customer deliveries scale up while Lucid expands its retail, service, and operational footprint.

- 2023: Lucid advances international manufacturing plans and strengthens its focus on vertically integrated vehicle technology.

- 2024: The company confirms production readiness for its second vehicle platform, expanding beyond sedans.

- 2025: The Lucid Gravity SUV enters production, marking Lucid’s expansion into the SUV segment.

- 2025: Lucid vehicles achieve record-setting efficiency and driving range benchmarks, reinforcing the brand’s engineering-first reputation.

- 2026: Lucid continues global expansion, technology partnerships, and development of future vehicle platforms while advancing software and autonomous capabilities.

Who Owns Lucid Motors: Major Shareholders

Lucid Motors is a publicly traded company listed on the Nasdaq stock exchange under the ticker LCID. The company went public in July 2021 through a merger with a special purpose acquisition company (SPAC), which provided a rapid route to public markets without a traditional IPO process. Since listing, Lucid’s ownership has been dominated by a large sovereign investor, with the remainder held by institutional investors, strategic corporate partners, and retail shareholders.

As of January 2026, Lucid Motors has approximately 1.9 billion shares outstanding. Despite being publicly listed, the company is not widely controlled by the public float. Ownership is highly concentrated.

The largest and controlling shareholder is the Public Investment Fund, which owns around 60% of Lucid Motors, equivalent to roughly 1.14 billion shares. This majority stake gives PIF decisive control over Lucid’s board composition, capital strategy, and long-term direction.

The remaining shares are held by a mix of strategic corporate investors, large institutional asset managers, hedge funds, insiders, and retail investors.

Below is a detailed breakdown of the primary shareholders of Lucid Motors as of January 2026:

Public Investment Fund (PIF)

The Public Investment Fund of Saudi Arabia is the controlling shareholder of Lucid Motors.

As of January 2026, PIF owns 1.15 billion shares, equal to 60.29% of the company’s outstanding equity. The stake is held primarily through its wholly owned subsidiary, Ayar Third Investment Company.

PIF’s ownership is strategic and long-term. It has repeatedly supported Lucid through direct equity purchases, private placements, and structured financing arrangements. This backing allows Lucid to pursue large-scale manufacturing, international expansion, and multi-year product development plans without excessive reliance on volatile public markets.

Uber Technologies

Uber Technologies is Lucid Motors’ most significant strategic corporate shareholder.

As of January 2026, Uber owns 80.5 million shares, representing 4.22% of Lucid Motors. This equity stake is tied to a strategic partnership focused on autonomous mobility and premium electric fleets.

Uber’s investment aligns with its long-term plans to deploy Lucid Gravity SUVs in future robotaxi and high-end ride-hailing services. While Uber does not exert governance control, its dual role as both shareholder and commercial partner makes it a strategically important stakeholder.

Vanguard Group

Vanguard Group is Lucid Motors’ largest passive institutional investor.

As of January 2026, Vanguard owns 66.7 million shares, equivalent to 3.50% of the company. These shares are held across multiple index funds, ETFs, and mutual funds managed by Vanguard.

Vanguard’s position reflects Lucid’s inclusion in major equity indices and long-term institutional portfolios. Vanguard does not participate in operational decision-making or strategy but contributes to liquidity and shareholder stability.

BlackRock Inc.

BlackRock holds a meaningful institutional position in Lucid Motors.

As of January 2026, BlackRock owns 30.5 million shares, representing 1.60% of outstanding shares. The stake is distributed across various advisory, index, and actively managed investment vehicles.

BlackRock’s ownership is passive in nature. However, as one of the world’s largest asset managers, its continued presence supports Lucid’s credibility within institutional capital markets.

Millennium Management LLC

Millennium Management is one of the largest hedge fund shareholders in Lucid Motors.

As of January 2026, Millennium owns 34.3 million shares, accounting for 1.80% of the company. This position is actively managed and reflects Millennium’s exposure to the electric vehicle and clean technology sector.

Millennium does not hold board representation or strategic influence. Its ownership is primarily financial and market-driven.

UBS Group AG

UBS Group is a notable institutional shareholder in Lucid Motors.

As of January 2026, UBS owns 26.7 million shares, equal to 1.40% of outstanding shares. These holdings are spread across wealth management products, institutional mandates, and structured investment portfolios.

UBS’s involvement provides Lucid with additional exposure to global capital markets and international investors, particularly in Europe and Asia.

D. E. Shaw & Co.

D. E. Shaw & Co. holds a quantitatively managed stake in Lucid Motors.

As of January 2026, D. E. Shaw owns 17.2 million shares, representing 0.90% of the company. The position is part of the firm’s multi-strategy and algorithmic trading portfolios.

D. E. Shaw’s ownership reflects market-based confidence in Lucid’s long-term technology and growth prospects rather than strategic involvement.

State Street Corporation

State Street Corporation is a major passive institutional holder.

As of January 2026, State Street owns 13.4 million shares, accounting for 0.70% of Lucid Motors. The stake is largely associated with index-tracking and custodial investment products.

State Street’s ownership supports market liquidity and institutional participation but does not influence corporate strategy.

Insider and Retail Shareholders

Company executives, directors, and employees collectively own 18.8 million shares, representing 0.99% of Lucid Motors. These holdings are largely tied to stock-based compensation and long-term incentive programs.

Retail investors collectively own 424.9 million shares, equivalent to 22.30% of outstanding shares. Although fragmented, retail ownership contributes significantly to daily trading volume and market price discovery.

Who Manufactures Lucid Cars?

Lucid cars are manufactured directly by Lucid Motors, not by a third-party automaker or contract manufacturer. The company follows a vertically integrated manufacturing model, meaning it designs, engineers, assembles, and quality-controls its vehicles in-house through company-owned facilities and subsidiaries.

Primary Manufacturer: Lucid Motors

Lucid Motors is responsible for the full manufacturing lifecycle of its vehicles. This includes body construction, paint, powertrain assembly, battery pack production, final vehicle assembly, and quality testing. Lucid does not outsource core manufacturing to legacy automakers.

Lucid’s manufacturing strategy is built around tight control of technology, efficiency, and quality, especially for its proprietary battery systems and electric drive units.

AMP-1: Arizona Manufacturing Facility

Lucid’s main manufacturing site is Advanced Manufacturing Plant 1 (AMP-1) located in Casa Grande, Arizona. This is where Lucid currently manufactures the Lucid Air sedan and the Lucid Gravity SUV.

AMP-1 is a company-owned and operated factory. It includes stamping, body shop, paint shop, battery module assembly, drive unit production, and final vehicle assembly. Lucid employs its own workforce and manufacturing leadership at this facility.

AMP-1 serves as the backbone of Lucid’s North American production and is designed to scale as demand grows.

AMP-2: Saudi Arabia Manufacturing Operations

Lucid also manufactures vehicles through AMP-2, its international manufacturing operation located in King Abdullah Economic City, Saudi Arabia. This facility is owned and operated by Lucid’s regional subsidiaries, not by the Saudi government or any external automaker.

AMP-2 initially focuses on semi-knocked-down (SKD) assembly and is designed to transition toward full vehicle production over time. Vehicles assembled here are primarily intended for the Middle East and international markets.

This facility supports Lucid’s global expansion strategy and reduces logistics costs for non-U.S. markets.

In-House Battery and Powertrain Manufacturing

Lucid manufactures its battery packs, electric motors, inverters, and power electronics in-house. These components are not sourced as complete systems from third parties.

Lucid’s proprietary powertrain architecture allows the company to control efficiency, performance, and packaging. This vertical integration is a key differentiator compared to automakers that rely heavily on suppliers for core EV systems.

Role of Suppliers and Partners

While Lucid manufactures vehicles itself, it does work with suppliers for raw materials, components, and subassemblies, such as cells, interior materials, semiconductors, and structural parts.

However, suppliers do not manufacture complete Lucid vehicles. Final assembly, system integration, and quality control remain entirely under Lucid’s control.

Who is the CEO of Lucid Motors?

As of 2026, Marc Winterhoff is serving as Interim Chief Executive Officer of Lucid Motors. He was appointed to this role in February 2025 after the long-time CEO stepped down and the company initiated a search for a permanent successor. Marc Winterhoff combines operational leadership with executive responsibility during this transitional period.

Marc Winterhoff – Interim CEO

Marc Winterhoff is the Interim Chief Executive Officer of Lucid Motors. Before stepping into the CEO role, he served as the company’s Chief Operating Officer. In that capacity, Winterhoff oversaw key operational functions including manufacturing scale-up, supply chain execution, and production planning.

Winterhoff’s appointment as interim CEO reflects the board’s focus on operational continuity during a time of significant expansion. Under his leadership, Lucid is navigating the commercial launch and scaling of its SUV model, the Gravity, as well as the development of future platforms and extensions of its product lineup.

Winterhoff brings decades of automotive and management experience to the role. His background includes senior roles at major firms where he led complex operational transformations and helped align manufacturing processes with strategic growth objectives.

At Lucid, his role requires balancing production efficiency with product quality and cost discipline amid competitive pressures in the EV market.

As interim CEO, Winterhoff oversees executive leadership teams across finance, engineering, manufacturing, and global markets. He reports directly to the board of directors, which continues to lead the search for a permanent chief executive.

Leadership Transition from Peter Rawlinson

Prior to Winterhoff’s interim appointment, Peter Rawlinson served as CEO and Chief Technology Officer. Rawlinson stepped down from the CEO role in February 2025 and transitioned to a strategic advisory position. His tenure was marked by Lucid’s transition from a startup focused on battery systems to an EV manufacturer with commercial vehicle deliveries.

Rawlinson’s work included leading Lucid to public markets in 2021 and overseeing the launch of its first production vehicles. Although no longer CEO, he remained involved with Lucid in an advisory capacity as the company continues searching for a permanent successor.

Leadership Structure and Responsibilities

As interim CEO, Winterhoff leads Lucid’s senior leadership team across key functions:

- Operations and Manufacturing: Ensuring production targets are met and factory efficiencies improve.

- Product and Engineering Collaboration: Working with engineering leadership on vehicle quality, performance, and technology evolution.

- Finance and Stakeholder Communication: Coordinating with the CFO and investor relations to maintain market confidence and funding.

- Strategic Execution: Driving implementation of strategic priorities set by the board, including global expansion and new model launches.

The board, influenced by Lucid’s largest shareholder, continues to conduct a global search for a permanent CEO. This search is expected to identify a leader with extensive EV industry experience to guide Lucid through its next growth phases.

Historical CEO Context

Lucid originally operated without a traditional automotive CEO during its early years, focusing primarily on engineering leadership. The appointment of Peter Rawlinson as CEO in 2019 aligned with the company’s shift toward full vehicle manufacturing. Rawlinson’s technical background and leadership helped shape Lucid’s engineering identity.

Lucid Motors Annual Revenue and Net Worth

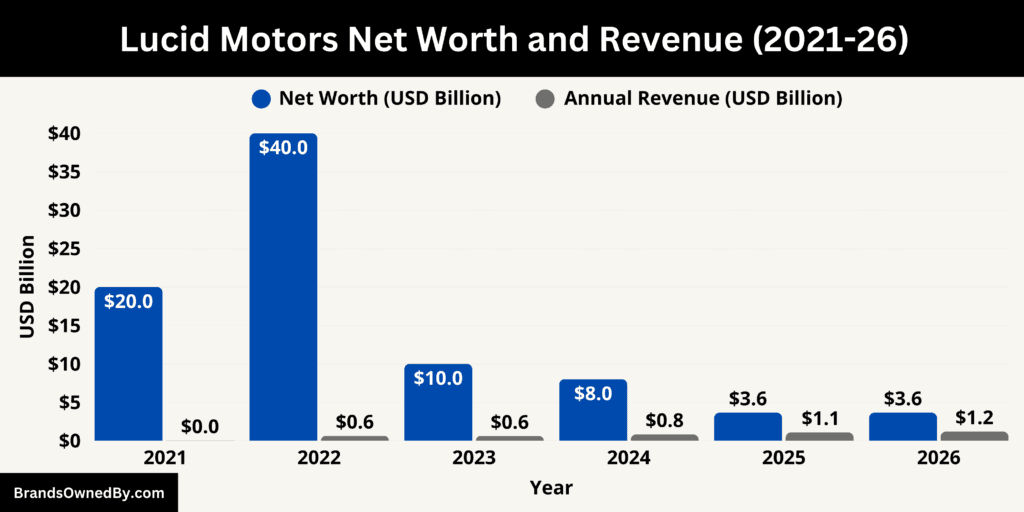

As of early 2026, Lucid Motors continues its transition from a startup to a scaling electric vehicle manufacturer. The company reported annual revenue of approximately $1.18 billion for the trailing twelve months, marking continued growth beyond the $1 billion threshold first crossed in 2025. Lucid’s net worth, reflected in its public market capitalization, stood near $3.64 billion as of January 2026, illustrating the market’s valuation of the company relative to its revenue growth, production scale, and broader EV sector dynamics.

Revenue History and Growth

Lucid Motors’ revenue history over the past decade illustrates its evolution from a research and development–focused enterprise into a producer of commercially sold luxury electric vehicles. During the pre-production years (2016 through 2020), Lucid generated negligible revenue as it prioritized engineering, powertrain development, and corporate build-out. The company’s first material revenue arrived in 2021 when the Lucid Air entered limited production and deliveries began. Lucid reported approximately $30 million in 2021, reflecting nascent sales activity.

In 2022, Lucid achieved its first full year of significant production and recognized approximately $0.61 billion in revenue, driven by broader customer deliveries of the Air sedan. Revenue growth continued into 2023, with Lucid reporting about $0.60 billion, as the company refined production processes and gradually expanded deliveries despite market headwinds. In 2024, annual revenue increased further to approximately $0.81 billion, benefiting from continued scale, expanded retail availability, and progress toward vehicle lineup diversification.

Lucid’s revenue crossed the $1 billion mark in 2025, with about $1.07 billion, reflecting the broader ramp-up of Lucid Air production and early shipments of the Gravity SUV. This sustained revenue growth carried into early 2026, yielding a trailing annual revenue figure estimated at $1.18 billion, driven by combined sales of the Air and Gravity models, increasing factory utilization, and incremental price realization in select markets.

Net Worth

Lucid Motors’ net worth is most commonly expressed through its public market capitalization, which represents the aggregate market value assigned to the company’s outstanding shares. Following its public listing in 2021 through a merger with a special purpose acquisition company, Lucid’s market valuation experienced significant volatility.

In the immediate post-SPAC period and through 2022, Lucid’s market capitalization expanded rapidly as investor enthusiasm for new electric vehicle entrants surged. At its peak, Lucid’s valuation approached levels near $40 billion, driven by growth expectations, early delivery milestones, and broader EV sector optimism.

However, as the company scaled production and moved into revenue growth phases, market sentiment shifted amid broader EV industry repricing and profitability pressures. By 2023, Lucid’s market cap had contracted to approximately $10 billion, reflecting a recalibration of investor expectations relative to production throughput and recurring operating losses.

In 2024, Lucid’s valuation declined further to about $8 billion, even as revenue climbed. In 2025, market capitalization settled near $3.64 billion, reflecting persistent operating losses, capital demands for growth, and macroeconomic impacts on technology and EV valuations.

In early 2026, Lucid’s net worth in terms of market capitalization remained near $3.64 billion, early in the fiscal year yet consistent with year-end 2025 levels. This valuation underscores the tension between scaling revenue, continued investment in future vehicle programs, and investor focus on profitability and cash flow generation. The company’s market value in 2026 reflects both its realized progress in production and deliveries and the broader capital markets’ assessment of its prospects relative to competition and long-term growth potential.

Brands Owned by Lucid Motors

Below is a list of the major brands owned by Lucid Motors as of January 2026:

| Company / Brand / Entity | Category | Ownership Status | Core Function | Key Details |

|---|---|---|---|---|

| Lucid Air | Vehicle brand | 100% owned and operated | Luxury electric sedan | Flagship product built on Lucid’s proprietary LEAP platform; fully designed, engineered, manufactured, sold, and serviced by Lucid |

| Lucid Gravity | Vehicle brand | 100% owned and operated | Electric SUV | Second production vehicle; SUV platform used for retail sales and future fleet/autonomous variants |

| LEAP (Lucid Electric Advanced Platform) | Technology platform | Fully owned IP | Vehicle architecture and powertrain | Proprietary battery systems, drive units, power electronics, software, and thermal management used across all Lucid vehicles |

| Lucid Financial Services | Business unit / brand | Owned and operated | Vehicle financing and leasing | Manages customer financing, leasing, and purchase experience through partner-backed lending structures |

| Lucid Retail Studios | Operating entity | Owned and operated | Sales and brand experience | Company-owned studios for vehicle configuration, sales, and customer engagement |

| Lucid Service Centers & Mobile Service | Operating entity | Owned and operated | Vehicle servicing | In-house service facilities and mobile repair units handling maintenance and warranty work |

| AMP-1 (Arizona Manufacturing Plant) | Manufacturing entity | Owned and operated | Vehicle manufacturing | Primary production site in Casa Grande, Arizona; produces Lucid Air and Lucid Gravity with vertical integration |

| AMP-2 (Saudi Manufacturing Plant) | Manufacturing entity | Owned and operated via subsidiary | International manufacturing | Global manufacturing site supporting regional assembly and future volume expansion |

| Lucid Group Technologies, LLC | Corporate subsidiary | 100% owned | R&D and IP management | Houses engineering assets, technology agreements, and intellectual property |

| Atieva, Inc. (and Atieva entities) | Legacy subsidiaries | 100% owned | IP and historical contracts | Original company structure retained for legacy engineering assets and global IP management |

| Lucid Motors North America | Regional subsidiary | 100% owned | North American operations | Manages sales, service, regulatory compliance, and operations in the U.S. and Canada |

| Lucid Motors Canada ULC | Regional subsidiary | 100% owned | Canadian operations | Oversees sales, servicing, and regulatory compliance in Canada |

| Lucid Netherlands B.V. | Regional subsidiary | 100% owned | European operations | Handles EU vehicle distribution, homologation, and service infrastructure |

| Lucid LLC (Riyadh) | Regional subsidiary | 100% owned | Middle East operations | Oversees Saudi manufacturing, regional sales, and operational compliance |

| Lucid Powertrain & Battery Systems | Internal product line | Fully owned | EV components | In-house battery packs, motors, inverters, and charging systems used across Lucid vehicles |

| Lucid Software & OTA Platform | Internal technology | Fully owned | Vehicle software | Controls infotainment, vehicle controls, OTA updates, and digital services |

| Autonomous & Fleet Vehicle Programs | Internal program | Fully owned | Commercial vehicle variants | Lucid-owned vehicle adaptations for fleet and autonomous use, developed with partners but owned by Lucid |

Lucid Air

Lucid Air is Lucid’s original production vehicle and the company’s flagship luxury electric sedan. It is developed, manufactured, and sold directly by Lucid through its own channels.

The Air is built on Lucid’s LEAP architecture and showcases the company’s core powertrain, battery, and software capabilities. Lucid retained full product ownership of the Air platform, controls its manufacturing process at AMP-1 (Casa Grande, Arizona), manages its distribution and after-sales service, and delivers OTA software updates and warranty coverage directly to customers.

Lucid Gravity

Lucid Gravity is Lucid’s mid- to large-segment SUV and the company’s second production vehicle. Lucid designs, engineers, and produces the Gravity at its AMP-1 facility and integrates the same in-house powertrain and battery technologies used in the Air.

The Gravity is a Lucid-owned product line (not a joint brand), and Lucid handles its sales, configuration, delivery, and service through the company’s retail studios and service centers. The Gravity platform is also the basis for certain strategic fleet and autonomous variants being developed with partners.

LEAP

LEAP is Lucid’s proprietary vehicle architecture and powertrain family. It is a company-owned technology stack that bundles battery pack design, drive units, power electronics, thermal management, and control software.

Lucid develops, manufactures, and iterates LEAP internally and deploys it across its vehicle lines (Air, Gravity, and the upcoming Midsize platform). Lucid retains ownership of LEAP intellectual property and integrates it into its manufacturing, R&D, and licensing strategies as appropriate.

Lucid Financial Services

Lucid Financial Services is Lucid’s owned financing platform and customer-facing brand for loans, leases, and purchase-finance experiences. Operated by Lucid in partnership arrangements with banks and third-party lenders, the platform is integrated into Lucid’s online configurator and sales flow.

Lucid controls the product terms and customer experience, while third-party lending partners commonly underwrite or warehouse many retail financing arrangements. The platform is run as an internal business unit under Lucid’s corporate structure.

Lucid Retail Studios and Service Network

Lucid owns and operates a geographically distributed retail studio and service network. This includes company-owned Lucid Studios for sales and configuration, company service centers for maintenance and repairs, and a mobile service fleet.

Lucid controls service standards, training, and parts distribution for these operations and supplements in-house capacity with approved third-party collision and repair partners where needed. These retail and service operations are operated as company business units and legal subsidiaries in target regions.

AMP-1

AMP-1 is Lucid’s primary manufacturing complex in Casa Grande, Arizona. Lucid owns and operates AMP-1 and its associated manufacturing entities and shops (body, paint, stamping, powertrain).

AMP-1 produces the Lucid Air and the Lucid Gravity and houses significant vertical integration assets for battery pack assembly and drive unit production. Lucid controls AMP-1 operations, capital expenditures, and staffing directly through its manufacturing subsidiaries and operating companies.

AMP-2

AMP-2 is Lucid’s manufacturing operation in King Abdullah Economic City (Saudi Arabia). Lucid established AMP-2 and operates SKD and CBU production there through its regional subsidiary entities. AMP-2 is owned and operated by Lucid Group subsidiaries and is part of Lucid’s global manufacturing footprint rather than an asset owned by Lucid’s majority shareholder or a third party.

The facility is controlled operationally by Lucid’s manufacturing organization and aligned with the company’s global production plans.

Lucid Group Technologies, LLC

Lucid Group Technologies, LLC is a Lucid legal subsidiary that houses certain R&D and technology assets, including engineering contracts and technology transfer activities.

The entity has been used in commercial arrangements and supply agreements with third parties and is part of Lucid’s consolidated subsidiary structure. Lucid owns and controls this entity for purposes of IP management, supplier agreements, and technology commercialization.

Atieva / Atieva-branded entities

Atieva, the company that preceded Lucid Motors, and related Atieva legal entities (Atieva, Inc.; Atieva Shanghai Co., Ltd.; Atieva Hong Kong, etc.) remain part of Lucid’s corporate group as legal subsidiaries.

These entities hold legacy contracts, engineering assets, and cross-jurisdictional intellectual property developed before the rebrand to Lucid. Lucid owns these Atieva entities and consolidates them within its subsidiary structure for historical contracts and IP management.

Regional Operating Subsidiaries

Lucid maintains a set of regional operating subsidiaries—Lucid USA, Lucid Motors North America (NA), Lucid Motors Canada ULC, Lucid Netherlands B.V., and Lucid LLC (Riyadh) among others—that Lucid owns outright.

These entities manage local regulatory compliance, distribution, service networks, assembly/assembly support activities (including SKD operations), and commercial agreements within their jurisdictions. They are company-owned legal entities used to execute Lucid’s global operations.

Final Thoughts

Understanding who owns Lucid Motors explains much about its strategy and survival in a competitive EV market. Majority ownership by Saudi Arabia’s Public Investment Fund gives Lucid financial stability and long-term backing.

At the same time, public shareholders and executive leadership shape day-to-day operations. Lucid remains a high-risk, high-potential automaker focused on redefining luxury electric vehicles.

FAQs

Is Lucid Motors American?

Yes. Lucid Motors is an American company. It was founded in the United States and operates as a U.S.-based electric vehicle manufacturer with American engineering, design, and manufacturing operations.

Who owns Lucid car company?

Lucid Motors is a publicly traded company, but it is majority owned by the Public Investment Fund of Saudi Arabia. As of January 2026, the Public Investment Fund owns 60.29% of Lucid Motors, giving it controlling ownership. The remaining shares are held by institutional investors, strategic partners, insiders, and public shareholders.

Who manufactures Lucid cars?

Lucid Motors manufactures its own cars. The company does not rely on third-party automakers or contract manufacturers for vehicle production. Lucid designs, engineers, assembles, and quality-tests its vehicles through company-owned facilities and subsidiaries.

Where are Lucid cars made?

Lucid cars are made in two primary locations. Most vehicles are produced in Casa Grande, Arizona, while additional manufacturing and assembly takes place in Saudi Arabia for regional and international markets.

Where is Lucid Motors based?

Lucid Motors is headquartered in Newark, California, United States. This location serves as the company’s corporate, engineering, and technology center.

Who is the biggest investor in Lucid Motors?

The Public Investment Fund of Saudi Arabia is the largest and controlling investor in Lucid Motors. With a 60.29% ownership stake, it has a decisive influence over governance, board composition, and long-term strategy.

How much has Saudi Arabia invested in Lucid?

Saudi Arabia, through the Public Investment Fund, has invested tens of billions of dollars into Lucid Motors since its initial investment in 2018. This includes equity purchases, private placements, and long-term funding commitments to support manufacturing expansion, product development, and global operations.

Does BlackRock own Lucid?

Yes, BlackRock owns shares in Lucid Motors, but it is not a controlling owner. As of January 2026, BlackRock holds 1.60% of Lucid Motors, making it a passive institutional shareholder with no operational or governance control.

When was Lucid Motors founded?

Lucid Motors was founded in 2007. The company originally operated under the name Atieva before rebranding to Lucid Motors in 2016.

What are the Lucid Motors manufacturing locations?

Lucid Motors operates manufacturing facilities in Casa Grande, Arizona (AMP-1) and King Abdullah Economic City, Saudi Arabia (AMP-2). The Arizona plant is the primary production site, while the Saudi facility supports international manufacturing and regional assembly.