Krispy Kreme is one of the most iconic doughnut brands in the world. With its hot, fresh glazed doughnuts, the company has built a loyal global following. But many people still wonder—who owns Krispy Kreme?

This article dives deep into the ownership structure, shareholders, leadership, financials, and the companies owned by Krispy Kreme.

History of Krispy Kreme

Krispy Kreme was founded in 1937 in Winston-Salem, North Carolina, by Vernon Rudolph. He bought a yeast-raised doughnut recipe from a New Orleans chef and began selling to local grocery stores. Soon, the irresistible aroma attracted people to his bakery, and he started selling hot doughnuts directly to customers.

By the 1950s, Krispy Kreme expanded across the Southeastern U.S. The company maintained a cult-like regional following for decades.

In 2000, it went public, but after rapid overexpansion and financial issues, its stock collapsed.

In 2016, Krispy Kreme was acquired and taken private again, starting a new chapter under different leadership.

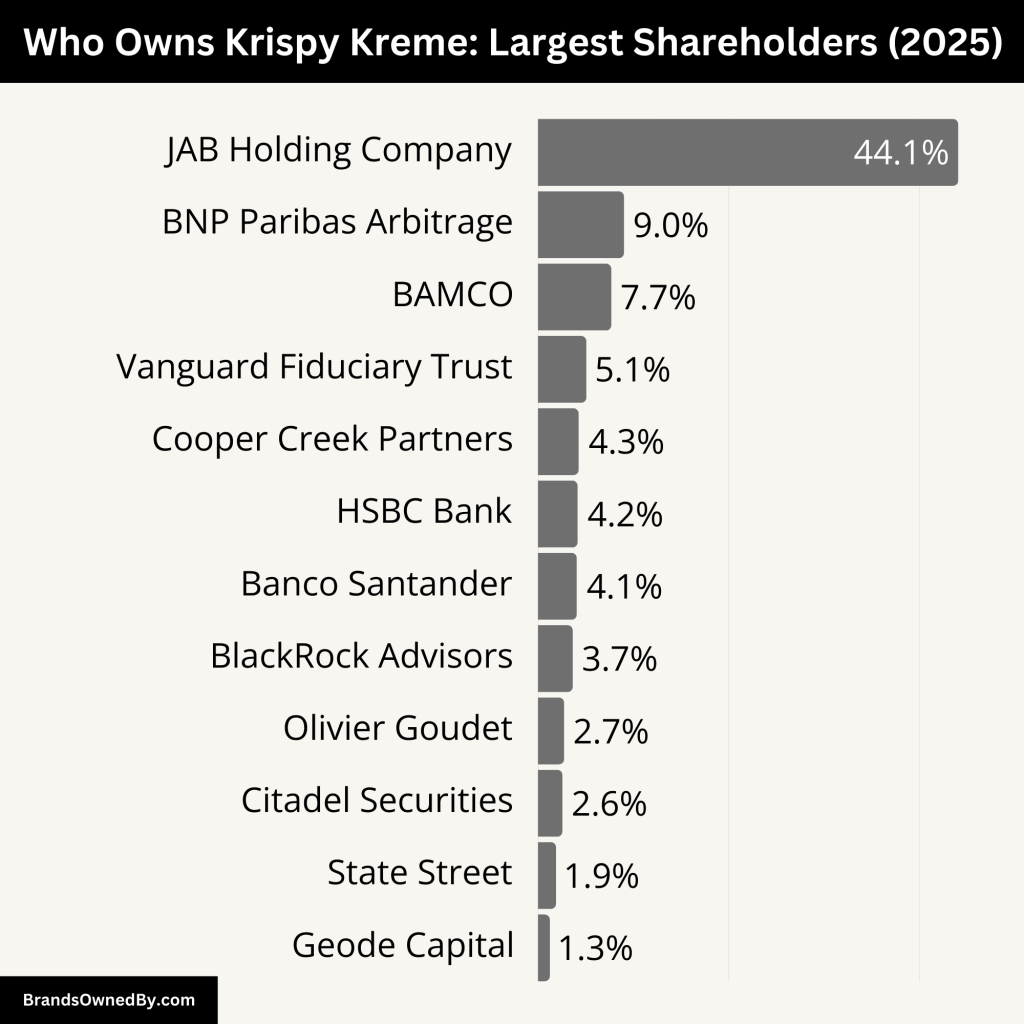

Who Owns Krispy Kreme in 2025: Top Shareholders

Krispy Kreme is owned by JAB Holding Company, a private German conglomerate. JAB is known for owning numerous food and beverage companies around the world. It acquired Krispy Kreme in 2016 through its controlled investment vehicle, JAB Beech, in a deal worth approximately $1.35 billion.

In July 2021, Krispy Kreme returned to the public markets under the ticker DNUT on the NASDAQ, but JAB remains the largest shareholder and controlling force behind the company.

Here’s a detailed overview of the major shareholders of Krispy Kreme:

| Shareholder | Ownership (%) | Type | Description / Role |

|---|---|---|---|

| Agnaten SE (JAB Holding Company) | 44.05% | Controlling Shareholder | Backed by JAB; controls strategy, governance, and long-term vision |

| BNP Paribas Arbitrage SA | 9.02% | Institutional Investor | Arbitrage-based investor; significant voting power |

| BAMCO, Inc. (Baron Capital) | 7.69% | Growth Investor | Long-term growth investor; focuses on scalable brand investments |

| Vanguard Fiduciary Trust Co. | 5.08% | Passive Institutional | Index fund manager; holds voting rights, non-active in operations |

| Cooper Creek Partners | 4.27% | Hedge Fund / Value Investor | Event-driven strategy; interested in operational and valuation upside |

| HSBC Bank Plc | 4.16% | Institutional Investor | Global bank investment; focuses on strong consumer brands |

| Banco Santander SA | 4.07% | Institutional Investor | European bank; investment via asset management arm |

| BlackRock Advisors LLC | 3.65% | Passive Institutional | Global index fund leader; influential via voting and ESG policies |

| Olivier Goudet | 2.74% | Insider / Individual | Former JAB CEO; personal stake shows long-term confidence |

| Citadel Securities GP LLC | 2.57% | Hedge Fund / Quantitative | Market maker and quantitative trader; influences liquidity and pricing |

| State Street Global Advisors | 1.90% | Passive Institutional | Index-based investor; adds to retail and institutional exposure |

| Geode Capital Management | 1.25% | Sub-advisor / Institutional | Fidelity sub-advisor; passive investor in index-aligned portfolios |

Agnaten SE (JAB Holding Company) – Approx. 44.05%

Agnaten SE is the largest shareholder of Krispy Kreme, holding around 44.05% of the company as of early 2025. It is an investment vehicle controlled by JAB Holding Company, a privately held German conglomerate backed by the billionaire Reimann family. JAB has a global portfolio of companies in consumer goods, particularly in the food, coffee, and beverage sectors. Other JAB-owned or controlled companies include Panera Bread, Pret A Manger, Keurig Dr Pepper, and Peet’s Coffee.

Agnaten SE’s significant stake gives JAB effective control over Krispy Kreme’s strategic direction, board composition, and long-term business planning. Although Krispy Kreme is a public company, JAB’s controlling interest ensures that most major decisions align with its vision for brand growth and synergy across its portfolio.

BNP Paribas Arbitrage SA – Approx. 9.02%

BNP Paribas Arbitrage SA, a subsidiary of French banking giant BNP Paribas, holds approximately 9.02% of Krispy Kreme. The firm’s interest likely stems from its arbitrage and structured investment strategies, typically involving short- to medium-term positions in companies undergoing changes in ownership, structure, or market valuation.

While BNP Paribas does not participate in day-to-day management, its position gives it significant voting rights at shareholder meetings. It may also influence the company’s capital market activity, especially if Krispy Kreme undergoes further restructuring or expansion through mergers and acquisitions.

BAMCO, Inc. – Approx. 7.69%

BAMCO, Inc., a division of Baron Capital Group, is a long-term growth-focused investment firm based in New York. Holding about 7.69% of Krispy Kreme, BAMCO’s investment reflects confidence in the doughnut brand’s ability to expand domestically and internationally.

BAMCO typically invests in companies with strong brand equity, scalable models, and visionary leadership—criteria that Krispy Kreme meets. Its involvement is passive but strategic, with a focus on long-term capital appreciation.

Vanguard Group (through Vanguard Fiduciary Trust Co.) – Approx. 5.08%

Vanguard Fiduciary Trust Co., part of the Vanguard Group, owns roughly 5.08% of Krispy Kreme. Vanguard is one of the world’s largest asset managers, known for its index funds and ETFs.

As a passive investor, Vanguard does not engage in management decisions but has voting power at the annual general meeting. Its stake is reflective of Krispy Kreme’s inclusion in various broad-market and consumer discretionary indexes.

Cooper Creek Partners Management LLC – Approx. 4.27%

Cooper Creek is an alternative asset manager that focuses on event-driven and value-oriented investing. Its 4.27% stake in Krispy Kreme suggests it sees potential for higher returns from either operational improvements or capital appreciation.

Though not a traditional long-term institutional holder, Cooper Creek may advocate for changes that enhance shareholder value, such as improved financial performance or more aggressive international expansion.

HSBC Bank Plc – Approx. 4.16%

HSBC Bank Plc, part of the global banking and financial services giant HSBC Holdings, owns around 4.16% of Krispy Kreme. HSBC’s investment is managed through its asset management and wealth advisory arms.

While the bank is not involved in the company’s operations, its stake reflects confidence in Krispy Kreme’s global consumer appeal and ability to generate stable returns. HSBC’s clients may hold Krispy Kreme shares as part of their portfolios in consumer growth sectors.

Banco Santander SA – Approx. 4.07%

Banco Santander, one of Europe’s largest banking groups, holds about 4.07% of the company. The Spanish financial institution typically invests in well-branded, stable-growth companies that can deliver predictable earnings.

Its investment likely comes via its asset management division. Santander’s presence adds to the international investor profile backing Krispy Kreme’s global ambitions.

BlackRock Advisors LLC – Approx. 3.65%

BlackRock Advisors LLC, a division of BlackRock Inc., the world’s largest asset manager, controls about 3.65% of Krispy Kreme. Like Vanguard, BlackRock’s role is passive, investing on behalf of institutional and retail investors through index funds and ETFs.

While BlackRock does not take active roles in the company’s operations, it exercises voting rights and may influence governance through shareholder advocacy on topics like sustainability and board independence.

Olivier Goudet – Approx. 2.74%

Olivier Goudet, the former CEO of JAB Holding Company, individually holds approximately 2.74% of Krispy Kreme. His personal investment aligns his financial interests with the long-term performance of the company.

As a former executive deeply involved in JAB’s food and beverage strategy, Goudet’s investment may reflect continued confidence in Krispy Kreme’s expansion trajectory and leadership.

Citadel Securities GP LLC – Approx. 2.57%

Citadel Securities GP LLC is part of the broader Citadel organization, a multinational hedge fund and market maker. Its 2.57% ownership in Krispy Kreme is part of a broader strategy to identify and profit from undervalued or volatile stocks with strong consumer brands.

Citadel is known for quantitative and algorithm-driven investing. Though it doesn’t engage directly in corporate governance, its influence on trading activity and price discovery is significant.

State Street Global Advisors – Approx. 1.90%

State Street Global Advisors is another major institutional investor, managing assets through ETFs and mutual funds. Holding just under 2%, State Street typically invests passively in consumer goods firms that demonstrate stable performance and growth opportunities.

Their presence in Krispy Kreme’s shareholder registry adds to the blue-chip investment backing the company enjoys.

Geode Capital Management – Approx. 1.25%

Geode Capital, a Boston-based investment firm and sub-advisor to Fidelity, holds about 1.25% of Krispy Kreme. It provides investment management services for index and customized strategies.

Geode’s inclusion reflects Krispy Kreme’s position in various index-based portfolios, further reinforcing the brand’s appeal among retail and institutional investors alike.

Who is the CEO of Krispy Kreme?

As of 2025, Krispy Kreme is led by CEO Josh Charlesworth, who officially assumed the role on January 1, 2024. His appointment marked a significant leadership transition following the tenure of Michael Tattersfield.

Josh Charlesworth: From CFO to CEO

Josh Charlesworth joined Krispy Kreme in 2017 as Chief Financial Officer. Over the years, he expanded his responsibilities, serving as Chief Operating Officer and later as Global President. His leadership was instrumental in implementing the company’s omni-channel strategy and asset-light distribution model, contributing to consistent double-digit organic revenue growth and global expansion.

Michael Tattersfield’s Legacy

Michael Tattersfield served as CEO from 2017 until the end of 2023. During his tenure, he transformed Krispy Kreme from a primarily U.S.-focused, multi-product company into a global, capital-efficient, omni-channel enterprise. Under his leadership, revenue grew from $550 million in 2016 to over $1.6 billion in 2023. Tattersfield remains on the company’s board, serving as a senior advisor and brand ambassador.

Leadership Structure and Governance

Krispy Kreme’s leadership team operates under the guidance of its Board of Directors, chaired by Olivier Goudet. The board includes representatives from major stakeholders, such as JAB Holding Company, ensuring that the company’s strategic direction aligns with shareholder interests. The executive team, led by CEO Josh Charlesworth, is responsible for day-to-day operations and implementing the company’s growth strategies.

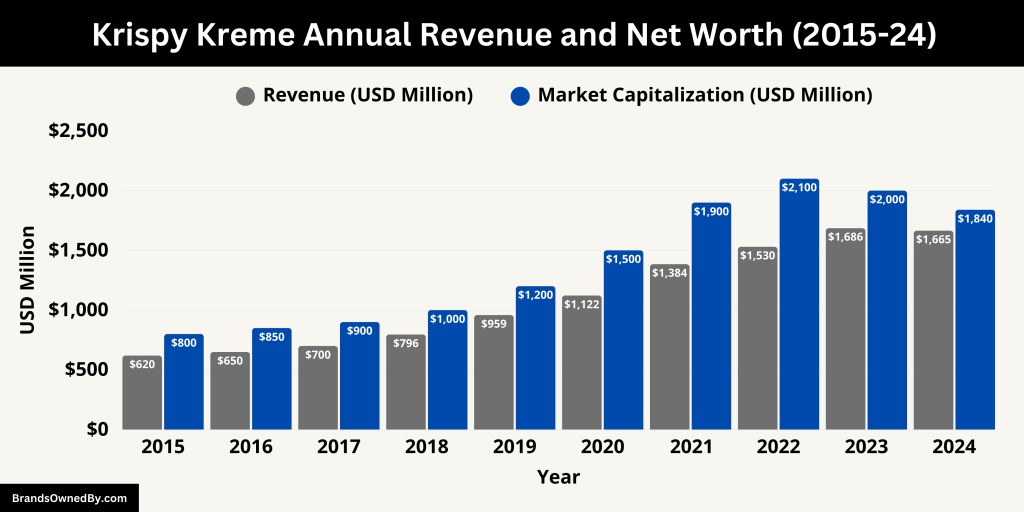

Annual Revenue and Net Worth of Krispy Kreme

In 2024, Krispy Kreme reported net revenues of $1.67 billion, a slight decline of 1.2% compared to the previous year. This decrease was primarily due to the sale of a majority ownership stake in Insomnia Cookies and the impact of a cybersecurity incident. Despite these setbacks, the company achieved a 5.0% organic revenue growth, driven by the expansion of its Delivered Fresh Daily (DFD) program and international growth.

The company reported a GAAP net income of $3.8 million for the year, a significant improvement from a net loss of $36.6 million in 2023. Adjusted EBITDA for 2024 was $193.5 million, a decline of 8.6%, primarily linked to the sale of Insomnia Cookies and the cybersecurity incident.

2025 Financial Outlook

For 2025, Krispy Kreme has issued guidance anticipating net revenues between $1.55 billion and $1.65 billion, with organic revenue growth projected at 5% to 7%. Adjusted EBITDA is expected to range from $180 million to $200 million, and adjusted EPS is projected between $0.04 and $0.08.

The company plans to continue its expansion, particularly through its partnership with McDonald’s, aiming to reach more than 1,900 locations with daily deliveries. Additionally, Krispy Kreme is focusing on international growth through a capital-light franchise model.

Market Capitalization and Net Worth

As of April 2025, Krispy Kreme’s market capitalization is approximately $2.5 billion, reflecting investor confidence in the company’s growth strategies and brand strength. The company’s net worth, considering its assets, liabilities, and market position, aligns with its market capitalization, indicating a stable financial foundation for future expansion.

The table below highlights the annual revenue and net worth of Krispy Kreme for the last 10 years:

| Fiscal Year | Revenue (USD Millions) | Market Capitalization (USD Billions) |

|---|---|---|

| 2024 | $1,665 | $1.84 |

| 2023 | $1,686 | $2.00 |

| 2022 | $1,530 | $2.10 |

| 2021 | $1,384 | $1.90 |

| 2020 | $1,122 | $1.50 |

| 2019 | $959 | $1.20 |

| 2018 | $796 | $1.00 |

| 2017 | $700 | $0.90 |

| 2016 | $650 | $0.85 |

| 2015 | $620 | $0.80 |

Companies Owned by Krispy Kreme

As of 2025, Krispy Kreme Inc. (NASDAQ: DNUT) continues to expand its global footprint through a combination of company-owned operations and strategic franchise partnerships.

Below is a detailed overview of its key brands and partnerships:

| Company/Brand | Details |

|---|---|

| Krispy Kreme Doughnuts | Flagship brand with over 2,160 stores globally and more than 14,100 points of access. Known for its “hot light” concept and fresh daily delivery model. |

| Insomnia Cookies | Acquired in 2018. Specializes in late-night cookie delivery. In 2024, Krispy Kreme sold a majority stake but retains a 34% minority interest. |

| Grocery-Packaged Doughnuts | Offers doughnuts in supermarkets and convenience stores. Includes Original Glazed®, Chocolate Iced, and Raspberry Filled doughnuts, among others. |

| Retail Distribution Partnerships | Krispy Kreme distributes fresh doughnuts through national retailers like Walmart, Target, and Kroger, expanding to 15,000 access points by 2026. |

| Craving Cheesecake Collection | Limited-time line featuring cheesecake-inspired doughnuts such as Strawberry Dream and Cookies & Kreme Cheesecake doughnuts, launched in April 2025. |

| Pop-Tarts Collaboration | Launched in January 2025, featuring doughnuts filled with Pop-Tarts bits, available at Krispy Kreme and grocery retailers like Walmart and Target. |

| Summer Beverage Offerings | Includes seasonal drinks like strawberry and blackberry lemonade chillers and S’mores lattes, launched in summer 2025 to complement doughnut sales. |

| Brazil Partnership (AmPm) | Entered Brazil in April 2025 via a partnership with AmPm convenience stores to sell fresh doughnuts daily at São Paulo locations. |

| South & West India Operations (Curefoods) | In January 2025, Curefoods acquired the rights to operate Krispy Kreme in South and West India. Plans to open 25 new stores by the end of 2025. |

| Germany Master Franchise (ISH Foods) | In 2025, Krispy Kreme partnered with ISH Foods for expansion into Germany, starting with a store in Berlin. The franchise also holds rights for Turkey. |

Krispy Kreme Doughnuts

The flagship brand, Krispy Kreme Doughnuts, operates over 2,160 stores and more than 14,100 global points of access across 39 markets. The company employs a hub-and-spoke model, delivering fresh doughnuts daily to various retail outlets, including convenience stores, grocery chains, and quick-service restaurants.

Notably, a significant partnership with McDonald’s aims to offer Krispy Kreme doughnuts at McDonald’s locations nationwide in the U.S. by the end of 2026, potentially doubling Krispy Kreme’s distribution points.

Insomnia Cookies

Insomnia Cookies, known for its late-night cookie delivery service, was acquired by Krispy Kreme in 2018. In 2024, Krispy Kreme sold a majority stake in Insomnia Cookies to investment firms Verlinvest and Mistral Equity Partners at a $350 million enterprise value.

Despite the sale, Krispy Kreme retains a minority stake, allowing it to focus more on its core doughnut operations while still benefiting from Insomnia’s growth.

International Franchise Partnerships

Krispy Kreme’s international expansion is driven by strategic franchise agreements:

- Germany: In partnership with ISH Foods, Krispy Kreme plans to open its first German store in Berlin in early 2025. ISH Foods, a subsidiary of IS Holdings, also franchises Krispy Kreme in Turkey.

- India: Curefoods acquired the south and west India operations from Landmark Group, with plans to add over 350 new access points in the next five years. Landmark Hospitality Services Ltd. has taken a stake in Curefoods India to support this expansion.

- Morocco: Krispy Kreme opened its first Moroccan shop in Rabat on August 9, 2024, in partnership with franchisee Americana. The shop features the “Hot Light Theatre Shop” concept, allowing customers to watch doughnuts being made fresh daily.

- France: Collaborating with Columbus Café & Co, Krispy Kreme has expanded to 19 shops across Paris, with plans to add another 50 points of access in 2025.

- South Korea: In partnership with Lotte, Krispy Kreme continues to grow its presence in South Korea, leveraging Lotte’s extensive retail network.

Grocery-Packaged Doughnut Line

Krispy Kreme packages fan-favorite doughnuts—Original Glazed®, Chocolate Iced with Kreme Filling, Raspberry Filled, and more—for sale in supermarkets, mass merchants, and convenience stores. The line includes snack-size bags of Dipped Chocolate Cake Doughnut Holes and Krispy Juniors (dipped cake doughnut mini-rings). These items broaden the brand’s reach beyond storefronts into grab-and-go channels.

Retail Distribution Partnerships

Leveraging its DFD network, Krispy Kreme supplies fresh 6-pack boxes and mixed dozen assortments to national retailers. In 2024, it expanded into Walmart, Target, Kroger, and Costco, and aims to reach 15,000 total points of access in the U.S. by 2026. These partnerships complement the McDonald’s rollout and deepen Krispy Kreme’s omnichannel presence.

Craving Cheesecake Collection

Launched April 22, 2025, this limited-time line blends cheesecake flavors with signature doughnut textures. Offerings include Strawberry Dream Cheesecake, Cookies & Kreme™ Cheesecake, and Caramel Delight Cheesecake doughnuts. Available by the dozen or singly in stores, for pickup, delivery, and at select grocery retailers in 6-packs.

Pop-Tarts Collaboration

Debuting January 6, 2025, Krispy Kreme teamed with Pop-Tarts to create three doughnuts featuring actual Pop-Tarts pieces. Varieties include Frosted Strawberry Doughnut with Pop-Tarts bits, Frosted Chocolatey Fudge Doughnut, and Frosted Brown Sugar Cinnamon Doughnut. Sold at Krispy Kreme shops and in grocery cases at Publix, Walmart, Albertsons, and Target.

Summer Beverage Offerings

In summer 2025, Krispy Kreme introduced five new beverage flavors—strawberry and blackberry lemonade chillers, S’mores lattes (hot, iced, and frozen), and mocha melts. These seasonal drinks complement doughnut sales and drive repeat visits during warmer months.

Brazil Partnership with AmPm

Krispy Kreme made its Brazilian debut in late April 2025 by partnering with AmPm convenience stores in São Paulo. Through this alliance, Original Glazed® doughnuts are delivered fresh daily to AmPm locations, marking the brand’s first South American market entry.

South & West India Operations (Curefoods)

In January 2025, Bengaluru-based Curefoods acquired the rights to operate Krispy Kreme in South and West India from Landmark Group. Curefoods plans to integrate doughnut and coffee operations into its 300-unit cloud kitchen network and open 25 new brick-and-mortar stores by the end of 2025. Landmark Hospitality retains a stake in Curefoods as part of the deal.

Germany Master Franchise (ISH Foods)

Krispy Kreme signed a master franchise agreement with ISH Foods to launch its first German shop in Berlin in early 2025. ISH Foods, which also holds Turkish rights, will develop multiunit outlets and points of access under Krispy Kreme’s capital-light franchise model, targeting rapid expansion across Germany.

Final Words

Krispy Kreme, a beloved doughnut chain with a long history, is now owned and controlled by JAB Holding Company.

After returning to public trading in 2021, it continues to attract institutional investors but remains under the strategic direction of JAB. With a solid leadership team and growing revenues, Krispy Kreme is expanding its footprint while holding on to the tradition that made it famous. From hot glazed doughnuts to late-night cookies, the company’s portfolio is designed for sweet success.

FAQs

Who owns Krispy Kreme right now?

Krispy Kreme is majority-owned by JAB Holding Company, which controls nearly half of the company’s shares.

Is Krispy Kreme publicly traded?

Yes, Krispy Kreme trades on the NASDAQ under the ticker DNUT. It went public again in 2021 after being private for several years.

Who bought Krispy Kreme in 2016?

JAB Holding Company bought Krispy Kreme in 2016 for about $1.35 billion, taking the company private before relisting it later.

Does Krispy Kreme own Insomnia Cookies?

Yes, Krispy Kreme owns a majority stake in Insomnia Cookies, which operates independently but under its parent company.

Who currently owns Krispy Kreme Donuts?

Krispy Kreme is publicly traded, with a large portion of its shares owned by institutional investors and major stakeholders such as JAB Holding Company, which has a significant controlling interest. As of 2025, Krispy Kreme is also majority-owned by private equity firms, including JAB Holding Company and various institutional investors.

Did Shaq buy Krispy Kreme donuts?

No, Shaquille O’Neal did not buy Krispy Kreme Donuts, but he does have a significant stake in the company. O’Neal has been a franchisee and ambassador for Krispy Kreme, owning multiple locations across the U.S. through his partnership with the company.

Who is the parent brand of Krispy Kreme?

Krispy Kreme’s parent company is JAB Holding Company, a European-based private investment firm with substantial investments in various food and beverage brands. JAB holds a controlling stake in Krispy Kreme.

Is Krispy Kreme halal?

Krispy Kreme does offer some halal-certified products in certain regions, especially in the Middle East and some parts of Asia. However, not all Krispy Kreme locations globally offer halal-certified doughnuts, so it’s important to check with local outlets for specific product information.

Which country owns Krispy Kreme?

Krispy Kreme is an American company founded in the U.S. and headquartered in Winston-Salem, North Carolina. However, it is currently owned by JAB Holding Company, which is based in Luxembourg.

Why does McDonald’s have Krispy Kreme?

McDonald’s has entered into a partnership with Krispy Kreme to offer their doughnuts in select locations across the U.S. starting in 2024. This collaboration is aimed at enhancing McDonald’s breakfast offerings and capitalizing on Krispy Kreme’s strong brand recognition and customer loyalty.

Who acquired Krispy Kreme?

In 2016, Krispy Kreme was acquired by JAB Holding Company. They purchased the company for $1.35 billion, making it part of their portfolio of food and beverage brands.

Who is the owner of the JAB Holding Company?

Johann A. Benckiser, the founder of JAB Holding Company, originally established the firm. Today, it is managed by his heirs and a leadership team focused on investment in consumer goods and food companies.

Does JAB own Krispy Kreme?

Yes, JAB Holding Company owns a controlling stake in Krispy Kreme. They purchased the doughnut brand in 2016, and the company is still part of their diverse investment portfolio as of 2025.

Who is Krispy Kreme’s owner’s daughter?

The daughter of the JAB Holding Company family is not a publicly known figure associated with Krispy Kreme. However, JAB Holding Company is a family-controlled investment firm, and its business is overseen by various family members, including the descendants of Johann A. Benckiser.

Is the original Krispy Kreme still open?

Yes, the original Krispy Kreme store is still open. It is located in Winston-Salem, North Carolina, where the company was founded in 1937. The original shop remains a popular destination for fans of the brand and tourists.

What is Krispy Kreme owner’s daughter’s net worth?

There is no publicly available information on the specific net worth of the daughter of the JAB Holding Company owner, as the family maintains a private lifestyle. However, JAB’s total assets are estimated to be in the tens of billions, making the Benckiser family one of the wealthiest in Europe.

What is the Krispy Kreme origin?

Krispy Kreme originated in the United States in 1937. The brand was founded by Vernon Rudolph in Winston-Salem, North Carolina, where the first Krispy Kreme doughnut was made. The company became known for its Original Glazed doughnut and its fresh, hot doughnuts served with the famous “Hot Now” sign.

Where was Krispy Kreme founded?

Krispy Kreme was founded in Winston-Salem, North Carolina, in 1937. The location remains the brand’s headquarters and is home to the original doughnut shop.

Where did Krispy Kreme originate?

Krispy Kreme originated in Winston-Salem, North Carolina, where Vernon Rudolph first began selling doughnuts to local grocery stores. The company grew from this small operation into the global doughnut brand it is today.

Who owns Panera Brands?

JAB Holding Company also owns Panera Bread, making it part of the same family of food and beverage brands as Krispy Kreme. JAB acquired Panera Bread in 2017, making it a subsidiary under their umbrella.

Where is Krispy Kreme’s headquarters?

The headquarters of Krispy Kreme is located in Winston-Salem, North Carolina, the same city where it was founded in 1937. The headquarters is a key part of the brand’s history and growth.