Jeep is a globally recognized brand, famous for its rugged SUVs and off-road vehicles. Many people often wonder, “Who owns Jeep?”

The answer traces back to the complex ownership structure and major stakeholders involved in its operations.

In this article, we dive into the ownership history of Jeep, its major shareholders, and the companies it owns.

History of Jeep

Jeep’s history dates back to World War II. Initially, it was developed by the American automobile manufacturer Willys-Overland to meet military demands for a light reconnaissance vehicle.

After its successful use during the war, Jeep became a symbol of rugged outdoor exploration. Over the decades, the brand evolved, with various changes in ownership and control. In 1987, Chrysler Corporation acquired Jeep from American Motors Corporation.

After Chrysler merged with Daimler-Benz in 1998, Jeep became part of DaimlerChrysler.

In 2007, the Chrysler Group filed for bankruptcy and was later acquired by the Italian automotive giant Fiat, which later formed Fiat Chrysler Automobiles (FCA).

In 2021, FCA merged with PSA Group to create Stellantis, which now owns Jeep.

Who Owns Jeep?

Jeep is owned by Stellantis, a global automotive manufacturer. Stellantis was formed from the merger of Fiat Chrysler Automobiles (FCA) and the French PSA Group. Stellantis holds a significant share of the global automotive market, and Jeep is one of its most iconic brands.

Stellantis, through its wide portfolio of car brands, operates across multiple markets globally. The company’s ownership structure is a bit complicated as it involves various institutional and individual stakeholders.

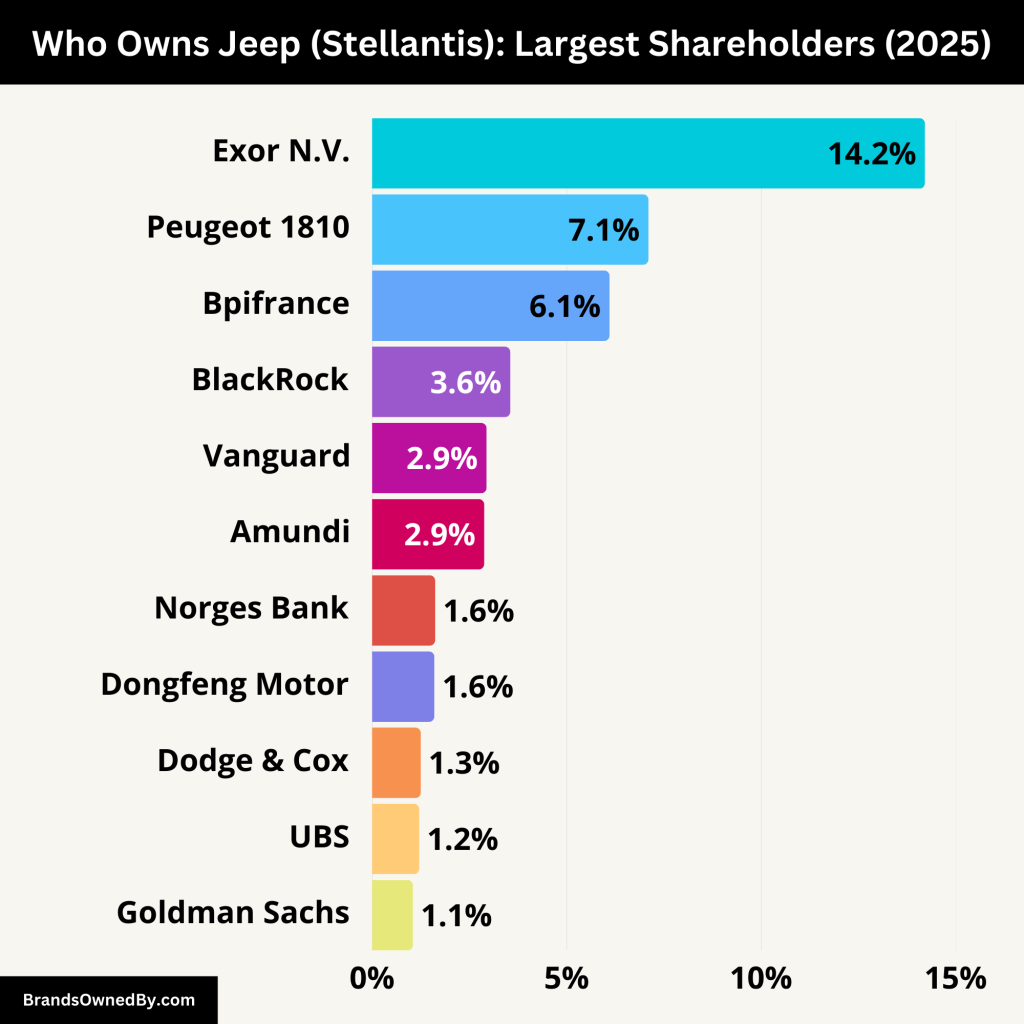

Here’s an overview of the major shareholders of Stellantis (the parent company of Jeep):

| Shareholder | Ownership % | Headquarters | Role & Influence |

|---|---|---|---|

| Exor N.V. (Agnelli family) | 14.2% | Netherlands / Italy | Largest shareholder. Exercises strong strategic and governance influence via board control. |

| Peugeot 1810 (Peugeot family) | 7.1% | France | Legacy shareholder from PSA. Involved in governance through board participation. |

| Bpifrance Participations (France) | 6.1% | France | French state investment bank. Ensures national interest in Stellantis operations. |

| Dongfeng Motor Corporation | 1.6% | China | Legacy investor from PSA. Now holds a reduced but strategic stake. |

| BlackRock, Inc. | 3.55% | United States | Global asset manager. Influences governance through ESG initiatives and voting. |

| The Vanguard Group, Inc. | 2.94% | United States | Major passive investor. Engages on governance, long-term risk, and performance. |

| Amundi Asset Management | 2.88% | France | Leading European investor. Supports sustainable development and board accountability. |

| Norges Bank Investment Management | 1.62% | Norway | Sovereign wealth fund. Promotes ethical investing and transparency. |

| Dodge & Cox | 1.25% | United States | Value-focused investor. Backs long-term profitability and growth. |

| UBS Asset Management | 1.21% | Switzerland | Invests in Stellantis for growth and innovation in EV and tech transformation. |

| Goldman Sachs Group | 1.05% | United States | Institutional investor. Sees Stellantis as a high-potential mobility firm. |

| Public Float (Retail & Other Funds) | 71.1% (approx.) | Global | Widely held by retail investors and small institutions. Contributes to market liquidity. |

Exor N.V. (Giovanni Agnelli B.V.) – 14.2%

Exor N.V., the holding company of the Agnelli family, is the largest shareholder of Stellantis, holding 14.2% of the company’s equity. This stake grants Exor significant influence over corporate decisions, including board appointments and strategic direction.

Peugeot 1810 – 7.1%

Peugeot 1810, primarily owned by Peugeot Invest (76.5%) and Établissements Peugeot Frères (23.5%), holds a 7.1% stake in Stellantis. This shareholding reflects the Peugeot family’s continued involvement and influence in the company’s governance.

Bpifrance Participations SA – 6.1%

Bpifrance, the French public investment bank, owns 6.1% of Stellantis. This investment underscores the French government’s interest in maintaining a stake in the automotive sector.

Dongfeng Motor Corporation – 1.6%

Dongfeng Motor Corporation, a Chinese state-owned automaker, holds a 1.6% stake in Stellantis. This investment stems from Dongfeng’s previous involvement with PSA Group prior to the merger forming Stellantis.

BlackRock – 3.55%

BlackRock is the largest asset management firm in the world, and it holds approximately 3.55% of Stellantis’ shares. As a passive investor through index funds and ETFs, BlackRock plays a vital role in Stellantis’ shareholder structure. While it does not engage in daily operations, it wields significant influence through proxy voting and shareholder resolutions.

BlackRock often focuses on long-term value creation and encourages companies to adopt strong governance, environmental responsibility, and strategic discipline. Its consistent engagement with management and detailed assessments of board performance help shape Stellantis’ corporate governance framework.

The Vanguard Group, Inc. – 2.94%

Vanguard is the second-largest institutional shareholder in Stellantis, with around 2.94% of total shares. Like BlackRock, Vanguard is known for passive investing, primarily through index and mutual funds. Its large holding gives it leverage in influencing the direction of Stellantis’ policies, particularly in areas like transparency, executive pay, and sustainability.

Vanguard uses its voting rights to push for long-term strategies and risk management. It regularly publishes stewardship reports highlighting its engagement with portfolio companies, including those in the automotive industry like Stellantis.

Amundi Asset Management – 2.88%

Amundi, Europe’s largest asset manager, holds approximately 2.88% of Stellantis. Based in France, Amundi’s stake in Stellantis reflects both geographic proximity and interest in maintaining a strong position in one of Europe’s most prominent industrial sectors.

Amundi is known for its responsible investment approach. It actively supports companies in transitioning to low-carbon business models, which aligns with Stellantis’ push toward electric mobility. Amundi’s position also reinforces Stellantis’ institutional support base within the European Union.

Norges Bank Investment Management (NBIM) – 1.62%

Norges Bank, the Norwegian sovereign wealth fund, owns around 1.62% of Stellantis. NBIM manages Norway’s oil wealth and is one of the most respected long-term investors globally. Its investment in Stellantis is part of its broader global diversification across sectors and markets.

NBIM focuses heavily on ESG (environmental, social, and governance) principles and corporate ethics. It encourages clear sustainability reporting, carbon reduction targets, and board accountability, pushing Stellantis to improve its environmental initiatives and corporate transparency.

Dodge & Cox – 1.25%

Dodge & Cox, a San Francisco-based investment firm, holds a 1.25% stake in Stellantis. Known for its value investing approach, Dodge & Cox looks for undervalued companies with strong fundamentals. Its investment in Stellantis is driven by the belief in the company’s long-term growth, particularly in emerging markets and electric vehicles.

Though less publicly vocal than BlackRock or Vanguard, Dodge & Cox’s influence is notable due to its concentrated portfolio and active engagement with management teams across its holdings.

UBS Asset Management – 1.21%

UBS Asset Management, part of Swiss financial giant UBS Group, holds about 1.21% of Stellantis. UBS invests on behalf of institutional and high-net-worth clients globally. Its stake in Stellantis reflects confidence in the company’s global integration, post-merger synergy realization, and innovation in EVs and hybrid technologies.

UBS supports Stellantis’ transformation into a mobility-focused technology firm and is engaged in evaluating risks related to electrification, digitalization, and global expansion.

Goldman Sachs Group – 1.05%

Goldman Sachs holds roughly 1.05% of Stellantis through its asset management and investment arms. Known for strategic and opportunistic investments, Goldman’s position indicates its belief in Stellantis’ profitability and potential return on equity.

Goldman Sachs also provides advisory and financial services to major automotive players and has insight into mobility and automation trends, which makes its investment in Stellantis both strategic and financially driven.

Public Float – 71.1%

The remaining 71.1% of Stellantis shares are publicly traded and held by a broad base of retail and institutional investors. This wide distribution ensures liquidity and reflects the company’s global investor appeal.

Who Controls Jeep?

Jeep is controlled by Stellantis N.V., a multinational automotive group formed by the 2021 merger of Fiat Chrysler Automobiles (FCA) and Peugeot S.A. (Groupe PSA). Control of Stellantis is shared among key shareholders, executive leadership, and a diverse board of directors. Though no single entity holds a majority stake, influence is balanced through ownership, board seats, and voting rights.

Exor N.V. – Strategic Influence

Exor, controlled by the Agnelli family, is the largest single shareholder of Stellantis with 14.2% ownership. This grants Exor significant influence over corporate strategy and board decisions. John Elkann, chairman of Exor, also serves as the Chairman of Stellantis, giving the family direct oversight over Jeep’s parent company.

Peugeot 1810 – Founding Family Power

The Peugeot family, through Peugeot 1810, retains 7.1% of Stellantis. The family holds board representation and plays an important role in decisions tied to Stellantis’ European operations. Their historical involvement ensures continuity in leadership and influence post-merger.

French Government – Political and Industrial Leverage

Bpifrance Participations, the French state investment bank, owns 6.1% of Stellantis. As a public shareholder, the French government has a vested interest in preserving jobs and industrial capacity in France. Its influence is mainly exercised through board appointments and policy alignment with EU industrial goals.

Dongfeng Motor Corporation – Limited but Strategic

Dongfeng holds a smaller 1.6% stake post-merger. Although its voting power has been reduced, Dongfeng still holds symbolic influence, especially in relation to Stellantis’ China strategy. It previously held board seats but now maintains only minority influence.

Institutional Shareholders – Governance Through Voting

Institutional investors like BlackRock, Vanguard, Amundi, and Norges Bank collectively hold significant influence through proxy voting. While they are passive investors, they regularly shape executive compensation, ESG policies, and board performance through shareholder resolutions and votes.

CEO of Stellantis: Carlos Tavares

The executive leadership of Stellantis is led by Carlos Tavares, who has served as Chief Executive Officer since the company was formed in January 2021.

- Background: Tavares is a seasoned automotive executive. He previously served as CEO of Groupe PSA (Peugeot-Citroën) and as COO of Renault.

- Leadership Style: Known for his cost discipline and turnaround expertise, Tavares successfully revitalized PSA before overseeing the FCA merger. He emphasizes profitability, electrification, and operational efficiency.

- Vision: Under Tavares, Stellantis is focusing on becoming a leading force in electrified vehicles, with major investment in battery tech, software platforms, and global production alignment.

- Impact on Jeep: Jeep is one of the core global brands in Stellantis’ portfolio. Tavares has prioritized expanding Jeep’s global footprint while launching new hybrid and electric models like the Jeep Avenger and Wagoneer S.

Board of Directors – Oversight and Strategic Direction

Stellantis has a balanced board structure with representatives from both legacy firms (FCA and PSA), independent directors, and representatives of major shareholders. The board oversees long-term strategy, executive performance, and major investment decisions, including Jeep’s global product roadmap.

The board includes:

- John Elkann (Chairman) – Represents Exor and the Agnelli family.

- Robert Peugeot (Vice Chairman) – Represents the Peugeot family.

- Henri de Castries, Andrea Agnelli, Fiona Clare Cicconi, and other independent directors with backgrounds in finance, industry, and technology.

These members help shape the group’s direction across key areas such as sustainability, mobility innovation, and shareholder returns.

Annual Revenue and Net Worth of Jeep

While Stellantis as a whole generates substantial revenues from various brands, Jeep is one of the highest contributors. In 2023, Stellantis reported revenues exceeding $190 billion, with Jeep contributing significantly to this figure. The brand’s global sales continue to grow, particularly in markets like North America and Europe.

Jeep’s net worth can be considered a part of Stellantis’ overall valuation. As of April 2025, Stellantis is valued at over $50 billion, and Jeep, being one of the key brands, contributes heavily to this value. The brand’s premium status, alongside its loyal customer base, ensures a strong financial outlook.

2024 Financial Performance

- Net Revenue: €156.9 billion, a 17% decrease from €189.5 billion in 2023.

- Net Profit: €5.5 billion, down 70% from €18.6 billion in 2023.

- Adjusted Operating Income (AOI): €8.6 billion, a 64% decline, with an AOI margin of 5.5%.

- Industrial Free Cash Flow: Negative €6 billion, attributed to reduced income and increased working capital needs due to production adjustments.

- Inventory Reduction: Total inventories decreased by 18% year-over-year, including a 20% reduction in U.S. dealer stock to 304,000 units.

- Dividend: A proposed dividend of €0.68 per share for 2024, representing a 5% yield, pending shareholder approval.

These figures reflect the company’s efforts to manage inventory levels and adjust to temporary gaps in product offerings, which impacted shipment volumes and overall financial performance.

2025 Outlook

Stellantis projects a positive trajectory for 2025, with expectations of:

- Net Revenue Growth: Positive growth anticipated.

- Adjusted Operating Income Margin: Mid-single digits.

- Industrial Free Cash Flow: Return to positive figures.

These projections are based on the early stages of commercial recovery and the company’s strategic initiatives, including the rollout of new multi-energy platforms and products.

Here’s a breakdown of Stellantis revenue for the last 10 years:

| Year | Revenue (USD) | Net Income (USD) | Net Assets (USD) |

|---|---|---|---|

| 2024 | $169.76B | $5.92B | $85.45B |

| 2023 | $205.14B | $20.13B | $90.78B |

| 2022 | $189.22B | $17.70B | $77.64B |

| 2021 | $176.78B | $16.80B | $63.76B |

| 2020 | $99.01B | $0.033B | $29.36B |

| 2019 | $121.17B | $7.42B | $32.12B |

| 2018 | $130.40B | $4.26B | $28.48B |

| 2017 | $125.39B | $3.95B | $25.18B |

| 2016 | $122.85B | $1.99B | $20.35B |

| 2015 | $122.81B | $0.371B | $18.55B |

Brands Owned by Jeep

Jeep itself is not a parent company—it is a brand owned by Stellantis and does not own separate automotive brands under its own corporate structure. However, Jeep has developed a range of sub-brands and special vehicle lines that are marketed distinctly under the Jeep name. These can be considered “brands within a brand”, each targeting different segments and markets.

Below are the key product lines and sub-brands Jeep operates:

Jeep Grand Wagoneer

The Grand Wagoneer is Jeep’s premium full-size SUV line. It re-entered the market in 2021 as a luxury competitor to vehicles like the Cadillac Escalade and Lincoln Navigator. It offers high-end interiors, advanced tech, and three-row seating. Though it carries the Jeep name, the Grand Wagoneer is marketed almost as a standalone luxury sub-brand.

Jeep Wagoneer

Positioned just below the Grand Wagoneer, the Wagoneer targets full-size SUV buyers who want upscale features without the ultra-luxury price. It competes with models like the Chevrolet Tahoe and Ford Expedition. Jeep treats the Wagoneer nameplate as part of a new family of large, tech-forward SUVs.

Jeep Trailhawk

Trailhawk is not a standalone brand but a specialized off-road trim level offered on several Jeep models, including the Cherokee, Compass, and Grand Cherokee. Vehicles labeled as Trailhawk are factory-equipped with enhanced 4×4 systems, increased ground clearance, skid plates, and off-road tires. Jeep uses Trailhawk branding to emphasize its off-road leadership.

Jeep Rubicon

The Rubicon name, primarily associated with the Wrangler, represents Jeep’s most capable off-road configuration. Wrangler Rubicon models include locking differentials, disconnecting sway bars, and heavy-duty axles. Rubicon is also used on the Gladiator and other special editions. Though not its own brand, the Rubicon line is strongly branded within the Jeep identity.

Jeep 4xe (Electrified Line)

Jeep 4xe is Jeep’s electrified sub-brand. It represents the brand’s plug-in hybrid and electric vehicle line. Models like the Wrangler 4xe and Grand Cherokee 4xe offer electric range while retaining off-road capability. Jeep is expanding the 4xe lineup as part of Stellantis’ larger EV goals. The “4xe” label will eventually extend to fully electric Jeeps like the Recon and Wagoneer S.

Jeep Recon (Upcoming Electric Model)

The Jeep Recon is an all-electric SUV inspired by the Wrangler, expected to launch in 2025. It is built for off-road use and will include removable doors, advanced software, and a new EV platform. Though still part of Jeep, the Recon will be marketed distinctly as a futuristic off-roader.

Jeep Avenger

The Jeep Avenger is the first fully electric Jeep, launched in Europe in 2023. Built on a compact electric platform, the Avenger targets urban SUV buyers and small crossover segments. It’s not available in the U.S. yet, but it marks Jeep’s entry into the global EV market.

Jeep Overland

Overland is another luxury-focused trim level used across Jeep models like the Grand Cherokee and Gladiator. It features premium materials, upgraded tech, and a more refined ride. Though not marketed as a separate brand, Overland editions offer a distinct identity within the Jeep portfolio.

Final Thoughts on Jeep Ownership

Jeep, one of the most iconic automobile brands, is owned by Stellantis, a global automotive company formed through the merger of Fiat Chrysler Automobiles and PSA Group.

Stellantis oversees Jeep’s operations, ensuring the brand maintains its legacy of off-road excellence while innovating in a rapidly changing automotive market. With a diverse portfolio of brands under its wing, Stellantis continues to solidify its position as a key player in the global auto industry.

FAQs

When was Jeep founded?

Jeep was founded in 1941 by the U.S. military and later transitioned into a civilian vehicle brand. It has since become one of the most iconic 4×4 vehicle manufacturers in the world.

Who owns Jeep now?

Jeep is owned by Stellantis, a multinational automotive company formed through the merger of Fiat Chrysler Automobiles and PSA Group in 2021.

What companies does Stellantis own?

Stellantis owns several brands, including Jeep, Chrysler, Dodge, Fiat, Peugeot, and Ram, among others.

Who is the largest shareholder of Stellantis?

Exor N.V., the holding company controlled by the Agnelli family, is the largest shareholder of Stellantis, owning around 14.4% of the shares.

What is the net worth of Jeep?

While specific figures for Jeep’s net worth are not available, it contributes significantly to Stellantis’ valuation of over $50 billion.

Who controls Stellantis and Jeep?

Stellantis is controlled by its executive leadership team, with major influence from its largest shareholder, Exor N.V. Decisions are also guided by Stellantis’ Board of Directors.

Is Jeep an American or European company?

Jeep is an American brand originally founded in 1941 by the U.S. military, now owned by Stellantis, a multinational corporation based in the Netherlands.

Where is Jeep made?

Jeep vehicles are manufactured in several locations worldwide, including the United States (Ohio, Michigan), Italy, and other countries. Manufacturing depends on the model and market.

Is Jeep owned by Chrysler?

Jeep was once part of Chrysler before the 2009 merger with Fiat. Now, it is owned by Stellantis, the company formed after the merger of Fiat Chrysler Automobiles (FCA) and Peugeot S.A. (PSA).