When it comes to luxury hotels, Hilton is a name that stands out. So, who owns Hilton Hotel? Understanding the ownership structure of this iconic brand gives insight into its powerful position in the global hospitality industry.

History of Hilton Hotel

Hilton Hotels was founded by Conrad Hilton in 1919 when he purchased his first hotel, the Mobley Hotel in Cisco, Texas. Conrad’s vision was to build a chain of hotels that would cater to affluent travelers, offering exceptional service and luxurious accommodations. This dream began to take shape with the opening of the first Hilton-branded hotel in 1925, in Dallas, Texas.

The Birth of the Hilton Brand

In 1925, Conrad Hilton opened the first Hilton-branded hotel in Dallas, Texas. The Hilton name quickly became synonymous with quality service, luxurious amenities, and innovative design. Hilton’s commitment to excellence helped the company stand out in a competitive market, rapidly attracting customers who were willing to pay a premium for a superior hotel experience.

Expanding Nationwide and Internationally

By the early 1940s, Hilton had begun expanding its reach. In 1943, Hilton became the first hotel chain to establish a global presence, opening properties in Canada, followed by expansions into Europe and the Pacific. The 1950s saw Hilton grow its portfolio to over 100 hotels across the United States, solidifying its reputation as a major player in the global hospitality industry.

Innovations in the Hospitality Industry

Hilton continued to set industry standards with pioneering innovations. In 1959, Hilton opened the first-ever airport hotel, the San Francisco International Airport Hilton. This move revolutionized the way travelers accessed hotel services, providing convenient accommodations near airports. Hilton also introduced its first high-rise hotel in 1965, further expanding its footprint and offerings.

The Hilton Honors Program

In 1987, Hilton launched Hilton Honors, one of the earliest hotel loyalty programs, which allowed guests to accumulate points for free stays, upgrades, and exclusive benefits. The program quickly became a favorite among frequent travelers and contributed to Hilton’s long-standing popularity.

The Shift to Public Ownership

In 1964, Conrad Hilton sold the majority of the Hilton Hotels Corporation to a public company, marking the beginning of Hilton’s transformation into a publicly owned entity. The Hilton family retained some control, but the company’s direction was increasingly shaped by the market and public shareholders. Over the next several decades, Hilton would continue to expand its brand and reach new customers.

Private Equity Ownership and Global Growth

In 2007, Blackstone Group purchased Hilton for $26 billion, taking the company private. Under Blackstone’s ownership, Hilton went through a period of significant expansion, acquiring new brands and increasing its presence in key international markets. Hilton grew its portfolio to include over 18 brands, catering to a wide variety of travelers, from luxury to budget-conscious guests.

Hilton Goes Public Again

In 2013, Hilton made its return to the public market through an initial public offering (IPO). The IPO allowed Hilton to raise capital to continue its expansion efforts, both in terms of the number of hotels it operated and the number of countries it served. Today, Hilton is one of the most recognized names in the global hotel industry, with more than 6,000 hotels across 100+ countries worldwide.

Hilton’s Global Presence and Continued Expansion

As of the 2020s, Hilton continues to thrive as a leader in the hospitality industry. It boasts an expansive global portfolio, operating in key markets across Asia, Europe, North America, and the Middle East. The company continues to grow its offerings, introducing new brands and enhancing its customer experience with innovative technology, such as digital check-ins and a mobile-based loyalty program. Hilton remains a dominant force in the hotel industry, building on its rich history and commitment to exceptional service.

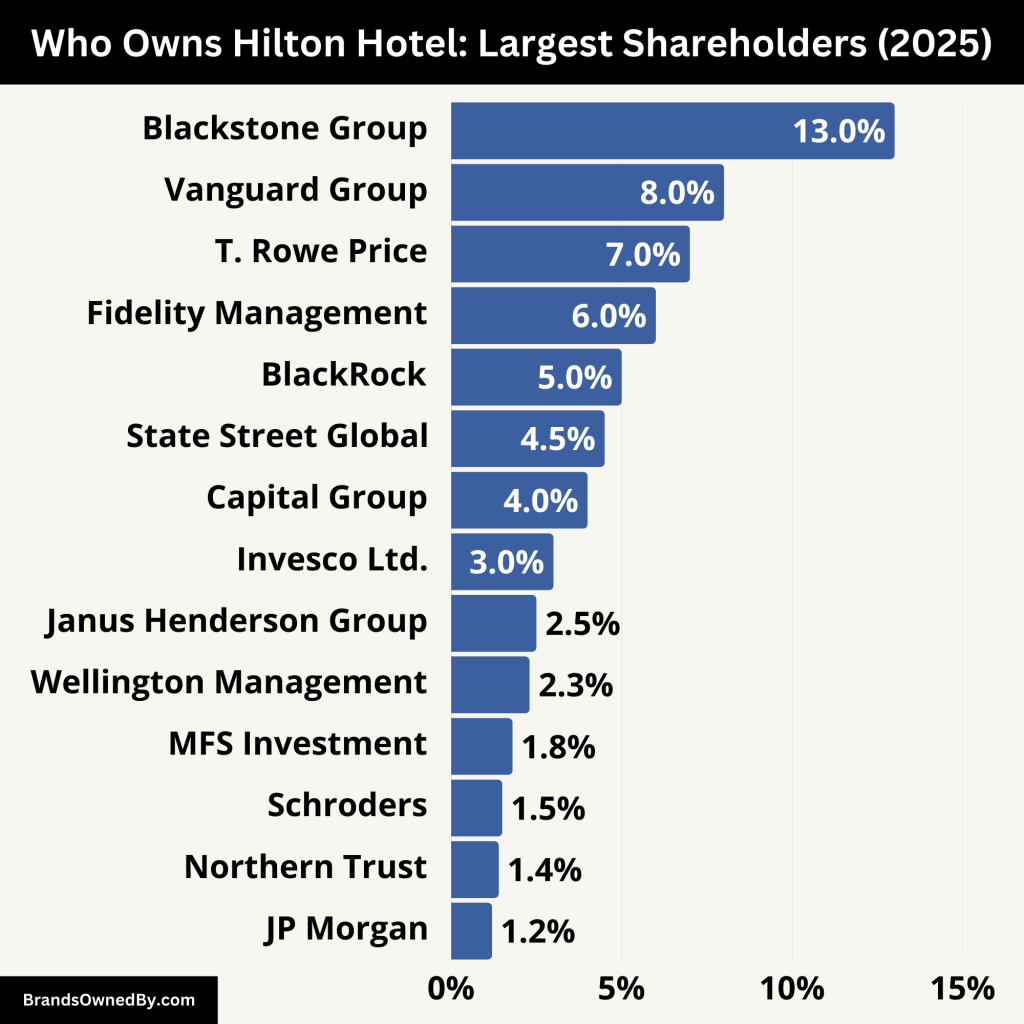

Who Owns Hilton Hotel: Largest Shareholders

Hilton Hotel’s ownership is primarily controlled by large institutional investors, with a significant share held by private equity firms. Hilton Worldwide Holdings Inc. is the parent company, and it is publicly traded on the New York Stock Exchange under the ticker symbol “HLT.”

As of the most recent reports, the largest shareholder of Hilton is the investment firm Blackstone Group, which initially took the company private in 2007. Blackstone’s stake in Hilton has been crucial to its strategy of expansion and brand development over the years. The private equity firm first acquired Hilton for $26 billion but later took the company public again in 2013. They remain a major shareholder, significantly influencing Hilton’s direction.

Here are the main shareholders of Hilton and their stakes:

| Shareholder | Ownership Percentage | Description |

|---|

| Blackstone Group | ~13% | A global investment firm specializing in private equity, real estate, and hedge funds. Blackstone played a significant role in Hilton’s growth, first taking it private and later public. |

| Vanguard Group | ~8% | One of the world’s largest institutional investors, managing equity and fixed-income portfolios. Vanguard’s influence is based on passive investment through ETFs and mutual funds. |

| T. Rowe Price Associates | ~7% | A global asset management firm with a focus on long-term investment strategies. T. Rowe Price is actively involved in corporate governance and investment decisions. |

| Fidelity Management & Research | ~6% | A large asset management firm specializing in mutual funds and investment products. Fidelity’s focus is on long-term growth and governance issues. |

| BlackRock | ~5% | The world’s largest asset manager. BlackRock’s stake in Hilton gives it substantial influence over corporate decisions and governance, focusing on financial performance and growth. |

| State Street Global Advisors | ~4.5% | A major institutional investor with a focus on passive investment strategies like ETFs. SSGA has a significant influence over Hilton’s governance and financial policies. |

| Capital Group Companies | ~4% | A global investment management firm with a focus on active management and long-term growth. Capital Group plays a significant role in Hilton’s corporate strategy. |

| Invesco Ltd. | ~3% | A global investment management firm known for active management. Invesco’s stake in Hilton influences corporate governance and strategic decisions. |

| Janus Henderson Group | ~2.5% | A global asset management firm focusing on active management of equity and fixed-income investments. Janus Henderson engages in shareholder activism and corporate governance. |

| Wellington Management | ~2.3% | A leading independent investment firm with a focus on active management and long-term growth. Wellington influences Hilton’s strategy, especially related to capital investment. |

| MFS Investment Management | ~1.8% | A global asset management firm specializing in actively managed equity and fixed-income portfolios. MFS focuses on long-term shareholder value and governance. |

| Schroders | ~1.5% | A global asset management firm that emphasizes sustainable growth and active engagement in corporate governance. Schroders has a voice in Hilton’s strategic direction. |

| Northern Trust | ~1.4% | A global financial services firm specializing in asset management and private banking. Northern Trust’s influence is felt in governance and shareholder matters. |

| Barclays Global Investors | – | Previously held a significant portion of Hilton’s shares before being acquired by BlackRock. Their legacy still influences Hilton’s strategic decisions. |

| JP Morgan Asset Management | ~1.2% | A division of JPMorgan Chase that provides financial services and asset management. JP Morgan influences Hilton’s financial strategy and governance. |

| Other Institutional Investors | ~<1% | Includes companies like State Farm, Allianz Global Investors, and Morgan Stanley Investment Management, all of which hold smaller stakes but still play a role in Hilton’s decisions. |

Blackstone Group

Blackstone Group is the largest and most influential shareholder of Hilton, holding approximately 13% of the company’s shares. Blackstone is a global investment firm that specializes in private equity, real estate, and hedge fund management.

They played a crucial role in Hilton’s growth, first taking the company private in 2007 for $26 billion, before taking it public again in 2013. Blackstone’s stake in Hilton gives it significant influence over Hilton’s business strategy and operational decisions, making them one of the most powerful players in the company’s direction.

The firm’s role extends beyond mere investment; it actively participates in strategic planning, acquisitions, and other critical business decisions.

The Vanguard Group

Vanguard Group holds about 8% of Hilton’s shares. Vanguard is one of the largest institutional investors globally, with a reputation for managing large equity and fixed-income portfolios.

As an index fund manager, Vanguard’s involvement in Hilton is mostly through its exchange-traded funds (ETFs) and mutual funds, which are widely held by individuals and institutional investors alike.

While Vanguard is not involved in Hilton’s daily operations, its significant stake in the company provides it with a notable influence in Hilton’s governance, particularly in shareholder meetings where voting power is distributed according to share ownership.

T. Rowe Price Associates

T. Rowe Price Associates owns around 7% of Hilton’s shares. This American global asset management firm is known for its strong focus on long-term investment strategies and managing large portfolios for institutional clients and individual investors.

T. Rowe Price’s investment in Hilton reflects its strategy of holding large positions in well-established companies within the hospitality and consumer services sectors.

Their influence on Hilton is primarily exerted through voting on corporate governance matters, as well as their participation in decision-making processes related to mergers, acquisitions, or other structural changes.

Fidelity Management & Research

Fidelity Management & Research holds approximately 6% of Hilton’s shares. Fidelity is one of the largest asset management firms in the world, known for its diverse portfolio of mutual funds and investments across multiple sectors.

Their stake in Hilton gives them a considerable say in the company’s strategic direction, especially concerning long-term financial performance and growth initiatives.

Fidelity’s approach typically includes a combination of active shareholder engagement and long-term investments, which gives them significant control in shareholder meetings and other corporate matters.

BlackRock

BlackRock, another major institutional investor, holds about 5% of Hilton’s shares. As the world’s largest asset manager, BlackRock oversees trillions of dollars in assets across various investment classes.

BlackRock’s interest in Hilton is largely driven by its involvement in global equity markets and the hospitality sector. Given BlackRock’s sheer size and influence in the financial world, its involvement in Hilton’s corporate decisions is substantial, particularly when it comes to matters of governance, shareholder rights, and financial performance.

State Street Global Advisors

State Street Global Advisors (SSGA) owns approximately 4.5% of Hilton’s shares. SSGA is another major player in the institutional investment space, with a focus on passive investment strategies, including index funds and ETFs.

As one of the largest asset management firms globally, SSGA has significant influence over the companies in which it invests, including Hilton.

The firm’s voting power during shareholder meetings allows it to have an impact on key decisions related to Hilton’s corporate strategy, executive compensation, and overall governance.

Capital Group Companies

Capital Group Companies holds about 4% of Hilton’s shares. Capital Group is a leading investment management organization with a long history of investing in large, global companies.

Known for its portfolio of actively managed funds, Capital Group’s stake in Hilton allows it to exert significant influence on major corporate decisions.

The company’s involvement often focuses on improving long-term shareholder value, as well as seeking to influence Hilton’s strategies regarding capital expenditures, acquisitions, and business operations.

Invesco Ltd.

Invesco Ltd. holds around 3% of Hilton’s shares. As a global investment management firm, Invesco offers a range of investment products, including mutual funds, ETFs, and institutional asset management. Invesco is known for its active management style, and its involvement in Hilton reflects its focus on growth and income strategies for clients.

While Invesco’s stake is smaller compared to the likes of Blackstone or Vanguard, the firm’s portfolio managers still play a role in influencing Hilton’s corporate governance and long-term financial planning. Invesco typically engages in shareholder meetings and may also have an active presence in discussions related to Hilton’s future acquisitions, capital investments, and strategic direction.

Janus Henderson Group

Janus Henderson Group owns approximately 2.5% of Hilton’s shares. This global asset manager has a strong track record of active management across a variety of asset classes, including equities, fixed income, and multi-asset strategies. Janus Henderson is known for its in-depth analysis of market trends and its focus on value creation for shareholders.

Their stake in Hilton gives them a say in the company’s decisions, especially around strategic investments, acquisitions, and executive compensation. Janus Henderson is also known for its shareholder activism, meaning they may push for changes that align with improving long-term shareholder value, such as new management practices or operational efficiencies.

Wellington Management

Wellington Management holds about 2.3% of Hilton’s shares. Wellington is one of the largest independent investment management firms in the world, with a focus on active management and long-term growth.

The firm’s investments span across a range of industries, and its portfolio managers often engage with the companies they invest in to influence governance practices, sustainability, and corporate strategy. Wellington’s stake in Hilton allows it to have a notable presence in shareholder meetings and decisions related to strategic initiatives, such as Hilton’s expansion into emerging markets and its approach to brand development.

Wellington’s investments are typically guided by a belief in strong management and corporate governance practices.

MFS Investment Management

MFS Investment Management owns approximately 1.8% of Hilton’s shares. MFS is a global asset management firm specializing in actively managed equity and fixed-income investments.

The firm focuses on building long-term portfolios for institutional clients, and its involvement in Hilton provides it with the opportunity to influence key strategic decisions, particularly those regarding Hilton’s financial performance, expansion strategies, and capital structure.

MFS is known for its research-driven investment process, and the firm typically emphasizes value creation and shareholder returns, making it an important voice among Hilton’s institutional investors.

Schroders

Schroders, a leading global asset management firm, owns around 1.5% of Hilton’s shares. Schroders has a long history of investing in large-cap companies, focusing on sustainable growth and risk management.

The firm operates across various asset classes, including equities, fixed income, and private equity. With its significant stake in Hilton, Schroders helps influence the company’s broader strategy and its position in the global hospitality market.

Schroders is known for its engagement with companies on issues related to governance, environmental sustainability, and financial performance, ensuring Hilton’s operations align with long-term value creation.

Northern Trust

Northern Trust holds roughly 1.4% of Hilton’s shares. As a global financial services firm, Northern Trust specializes in asset management, investment servicing, and private banking.

Their stake in Hilton is part of their broader strategy of managing funds for institutional clients, including pensions and endowments. Northern Trust’s influence on Hilton is typically exercised through voting on key shareholder resolutions and engagement with the company on governance matters.

Their participation in Hilton’s shareholder meetings helps ensure that the company’s strategic direction aligns with the best interests of their clients.

JP Morgan Asset Management

JP Morgan Asset Management holds approximately 1.2% of Hilton’s shares. A division of JPMorgan Chase, this investment management firm is one of the world’s leading providers of financial services, including equity management, fixed-income investments, and alternative asset management.

JP Morgan’s stake in Hilton aligns with its broader investment strategy, which includes a focus on long-term growth and financial stability. As a shareholder, JP Morgan’s influence is reflected in its involvement in Hilton’s corporate governance, voting on key resolutions, and engagement on financial matters.

Other Institutional Investors

Other smaller institutional investors include State Farm, Allianz Global Investors, and Morgan Stanley Investment Management, each owning minor portions of Hilton’s shares. Though their stakes are smaller, these investors still play a role in Hilton’s corporate decision-making, especially in matters relating to Hilton’s long-term growth strategy, acquisitions, and expansion into new markets.

These investors often engage with Hilton through shareholder meetings and can influence decisions on executive compensation, dividends, and overall company strategy. While their impact is more limited compared to the larger institutional investors like Blackstone or Vanguard, their participation is still important in maintaining the balance of power among shareholders.

Public Shareholders

As Hilton is publicly traded on the New York Stock Exchange under the ticker symbol “HLT,” a large portion of its shares is held by individual public shareholders. These can range from small retail investors who buy shares in Hilton through brokers or direct stock purchase programs to large hedge funds and other public investment firms.

Although individual shareholders typically have less influence than institutional investors, they still play a role in shaping the company’s future, particularly through voting in annual meetings and other shareholder events.

Insider Ownership

Alongside institutional investors, Hilton’s executive team and key insiders also hold shares in the company. This includes the CEO Christopher Nassetta, who owns a considerable amount of Hilton stock.

Insider ownership helps align the interests of the company’s leadership with those of its shareholders, ensuring that decisions made at the top level are in the best interests of all parties. Executive stock ownership is a common practice in many publicly traded companies as it helps drive leadership accountability and long-term performance.

Who Controls Hilton Hotel?

While Hilton is publicly traded, its control still remains largely in the hands of institutional investors. The CEO of Hilton, Christopher Nassetta, has been a key figure in the company since 2007. His leadership has helped guide Hilton through times of expansion, diversification, and recovery post the 2008 financial crisis. The board of directors also plays a crucial role in decision-making, with key executives and major shareholders influencing the company’s direction.

Executive Leadership

The leadership team at Hilton Hotels plays a pivotal role in shaping the company’s direction and decision-making. The control over day-to-day operations, strategic initiatives, and long-term goals largely lies with Hilton’s executive leadership, particularly the CEO and senior management team.

Christopher J. Nassetta – CEO

Christopher J. Nassetta has served as the President and CEO of Hilton since 2007. Under his leadership, Hilton has experienced significant growth and transformation. Nassetta joined Hilton when it was still privately owned by Blackstone and has been instrumental in guiding the company through its re-emergence as a publicly traded entity in 2013. He has helped lead Hilton’s expansion into emerging markets and has been a strong advocate for innovation within the hospitality industry.

Nassetta is known for his strategic vision and ability to build a customer-centric culture at Hilton. His leadership has not only transformed Hilton into a global leader in the hospitality sector but also played a key role in expanding Hilton’s portfolio of brands to meet the needs of various market segments, from luxury to mid-range hotels.

As CEO, Nassetta’s responsibilities include overseeing the company’s operations, making high-level corporate decisions, formulating strategies for growth, and ensuring profitability. His leadership style is characterized by a focus on operational efficiency, sustainability, and brand expansion.

Hilton’s Board of Directors

While the CEO plays a central role in the day-to-day control of Hilton, much of the ultimate decision-making power lies with Hilton’s Board of Directors. The Board consists of a group of elected individuals who represent the interests of Hilton’s shareholders. The Board is responsible for making major decisions, such as appointing the CEO, approving corporate strategies, managing shareholder relations, and overseeing the company’s financial performance.

The Board of Directors includes a mix of experienced executives, industry veterans, and independent members who bring a range of skills to the company. These individuals provide oversight and ensure that the company operates in line with the interests of its shareholders.

Some key members of Hilton’s Board include:

- Christopher Nassetta – CEO and member of the Board, with a focus on executive leadership and strategic direction.

- James B. Hance Jr. – Chairman of the Board, with significant experience in financial and corporate governance.

- Patricia H. Miller – Independent Director, contributing expertise in marketing, technology, and global expansion.

Influence of Major Institutional Shareholders

In addition to the company’s executive leadership and Board of Directors, Hilton’s largest institutional shareholders also hold substantial influence over key decisions, particularly in matters of governance, mergers, acquisitions, and overall corporate strategy.

Investors like Blackstone, Vanguard, and T. Rowe Price actively participate in shareholder meetings and may engage with Hilton’s management to steer the company in certain directions, especially in relation to long-term strategic goals, investment decisions, and executive compensation.

While they do not directly control the day-to-day operations of Hilton, their voting power and financial stake give them significant influence on major decisions.

The Role of the CEO in Decision-Making

As CEO, Christopher Nassetta is ultimately responsible for implementing the vision set by the Board of Directors, along with leading the company’s operations globally. He works closely with Hilton’s senior leadership team to drive operational excellence and expand Hilton’s global footprint. Nassetta plays a key role in Hilton’s strategic initiatives, including:

- Expansion into new markets: Under his leadership, Hilton has made significant moves into emerging markets, including Asia and Africa.

- Brand portfolio development: Nassetta has overseen the addition of numerous brands to Hilton’s portfolio, ranging from luxury brands like Waldorf Astoria to more budget-conscious options like Hampton by Hilton.

- Sustainability initiatives: Nassetta has also championed Hilton’s sustainability efforts, focusing on reducing its environmental impact and improving social responsibility within the communities it serves.

Operational Leadership and Senior Management

Beyond the CEO, Hilton’s senior management team holds significant power in managing the company’s day-to-day operations. This includes a team of executives who lead various departments, such as finance, marketing, human resources, operations, and technology. These senior leaders work closely with the Board and CEO to ensure that Hilton’s strategic goals are executed effectively.

Some key executives who help run Hilton include:

- Kevin Jacobs, Executive Vice President and Chief Financial Officer: Responsible for managing Hilton’s financial operations and ensuring the company’s profitability.

- Matt Wehling, Executive Vice President and Chief Commercial Officer: Oversees the company’s marketing, sales, and revenue management strategies.

- Laura Fuentes, Executive Vice President and Chief Human Resources Officer: Leads Hilton’s human resources strategy, focusing on talent acquisition, employee development, and organizational culture.

Influence of Blackstone Group

Although Hilton is publicly traded, Blackstone Group, as one of its largest institutional investors, continues to play a significant role in controlling the company’s strategic direction. As the investment firm that originally took Hilton private in 2007, Blackstone’s control over Hilton’s ownership provided the firm with considerable sway in Hilton’s governance and operational decisions.

While Blackstone no longer directly manages Hilton, its substantial ownership stake ensures that the firm has a significant say in key decisions, including executive compensation, brand expansion, and major capital investments.

Annual Revenue and Net Worth of Hilton Hotel

In 2024, Hilton reported annual revenues of approximately $11.17 billion with a net worth estimated at around $62.29 billion as of April 2025.

Despite the challenges posed by the global pandemic, Hilton has continued to grow due to its broad portfolio of brands and a strong presence in both luxury and mid-market segments. Its innovative approach to hospitality, including the digitalization of check-ins and loyalty programs, has helped it maintain financial stability.

Here’s the revenue and net worth of Hilton for the past 10 years:

| Year | Revenue (USD) | Net Worth (USD) |

|---|---|---|

| 2024 | $11.17B | $62.29B |

| 2023 | $10.24B | $57.75B |

| 2022 | $8.77B | $45.00B |

| 2021 | $5.79B | $35.00B |

| 2020 | $4.31B | $25.00B |

| 2019 | $9.45B | $30.00B |

| 2018 | $8.91B | $28.00B |

| 2017 | $8.13B | $26.00B |

| 2016 | $6.58B | $24.00B |

| 2015 | $7.13B | $22.00B |

Brands and Companies Owned by Hilton

Hilton Hotels & Resorts is the flagship brand of Hilton Worldwide Holdings Inc., a global hospitality company that owns, manages, and franchises a diverse portfolio of hotel and resort brands. Hilton’s strength lies in its multi-brand strategy, catering to a wide range of travelers across different budget segments—from luxury to economy.

Below is a detailed breakdown of the major companies and hotel brands owned by Hilton Worldwide:

| Brand / Company | Description |

|---|---|

| Waldorf Astoria Hotels & Resorts | Ultra-luxury brand with iconic properties in major global cities. |

| Conrad Hotels & Resorts | Modern luxury brand named after Hilton’s founder. |

| LXR Hotels & Resorts | Luxury collection of independent boutique hotels. |

| Hilton Hotels & Resorts | Flagship upper-upscale brand with global reach. |

| DoubleTree by Hilton | Upscale full-service hotels known for warm hospitality. |

| Embassy Suites by Hilton | All-suite hotels catering to families and business travelers. |

| Curio Collection by Hilton | Upscale independent hotels with unique local characteristics. |

| Tapestry Collection by Hilton | Boutique-style hotels in the upper-midscale category. |

| Canopy by Hilton | Lifestyle brand focused on modern, wellness-driven travel. |

| Signia by Hilton | Premium brand designed for meetings and events. |

| Tempo by Hilton | Lifestyle brand focused on wellness and efficiency for ambitious travelers. |

| Motto by Hilton | Micro-hotel brand with compact, efficient rooms for urban explorers. |

| Hilton Garden Inn | Mid-priced full-service hotels ideal for business and leisure travelers. |

| Hampton by Hilton | Midscale brand with widespread popularity for reliability and value. |

| Tru by Hilton | Economy brand focused on younger, price-conscious travelers. |

| Homewood Suites by Hilton | Extended-stay brand offering apartment-style accommodations. |

| Home2 Suites by Hilton | Budget-friendly extended-stay hotels with eco-conscious designs. |

| Hilton Grand Vacations* | Publicly traded timeshare company (spun off in 2017), maintains brand alignment. |

Waldorf Astoria Hotels & Resorts

Waldorf Astoria represents Hilton’s pinnacle of luxury. Known for exceptional service, iconic architecture, and elite clientele, this brand delivers a high-end, personalized hospitality experience. Its hotels are located in major cities and exclusive resort destinations. Famous properties include the Waldorf Astoria New York, Beverly Hills, and the Maldives Ithaafushi.

Waldorf Astoria competes with brands like Ritz-Carlton and Four Seasons. The brand plays a key role in Hilton’s strategy to capture the ultra-luxury traveler.

Conrad Hotels & Resorts

Conrad Hotels is another luxury offering under Hilton, but with a modern, stylish twist. Named after founder Conrad Hilton, the brand is designed for sophisticated travelers seeking innovation, elegance, and a global perspective. Locations include cities like Tokyo, Seoul, London, and Dubai.

Conrad Hotels are slightly more contemporary than Waldorf Astoria, targeting younger affluent travelers with a taste for design and technology-driven experiences.

LXR Hotels & Resorts

LXR is Hilton’s collection of independent luxury properties. Each LXR hotel is unique, offering culturally immersive and curated experiences. These properties maintain their individuality while benefiting from Hilton’s loyalty program and global reach.

LXR appeals to luxury travelers who prefer boutique-style stays with personalized touches rather than standardized experiences.

Hilton Hotels & Resorts

The Hilton brand is the company’s flagship. It sits in the upper-upscale segment, with full-service hotels in city centers, airports, and resort areas. This brand has widespread recognition and a global presence.

With more than 600 properties across six continents, Hilton Hotels & Resorts targets both business and leisure travelers and is central to the company’s identity and expansion strategy.

DoubleTree by Hilton

DoubleTree is known for providing upscale accommodations with a warm, welcoming atmosphere—symbolized by its signature chocolate chip cookie at check-in. The brand is positioned just below the Hilton brand in terms of price and service.

DoubleTree has strong appeal among mid- to upper-income travelers and offers a comfortable yet affordable full-service experience.

Embassy Suites by Hilton

Embassy Suites specializes in all-suite accommodations, offering extra space for families and business travelers. The brand is known for its free cooked-to-order breakfast and evening receptions, making it popular for extended stays and group travel.

Most Embassy Suites properties are located in the U.S., though the brand has been expanding internationally.

Curio Collection by Hilton

Curio Collection is a group of hand-picked, upscale hotels that retain their individual branding while operating under Hilton’s umbrella. These properties often reflect local charm and historic character.

They appeal to travelers looking for unique, independent hotel experiences without sacrificing the perks of Hilton Honors membership and consistent service standards.

Tapestry Collection by Hilton

Tapestry Collection is similar to Curio, but aimed at the upper-midscale segment. These boutique-style hotels maintain local character and independence, while still being part of Hilton’s network.

The brand attracts guests seeking stylish, distinctive accommodations at a more affordable price point.

Canopy by Hilton

Canopy is Hilton’s lifestyle brand targeting modern, urban travelers. Designed with local flair and a focus on wellness, Canopy properties offer a boutique feel in walkable neighborhoods. Amenities include locally sourced breakfast, craft cocktails, and vibrant design.

This brand directly competes with Marriott’s Moxy and Hyatt Centric.

Signia by Hilton

Signia is Hilton’s meetings- and events-focused brand in the premium category. It is designed for business travelers and conferences, featuring large event spaces, high-end dining, and cutting-edge technology.

This brand is relatively new and helps Hilton target the lucrative business and convention hotel segment.

Tempo by Hilton

Tempo is Hilton’s newer lifestyle brand aimed at ambitious, high-energy guests. It offers elevated yet affordable accommodations with wellness-focused amenities, social spaces, and efficient service.

Tempo is positioned between Hilton Garden Inn and Canopy, targeting younger professionals and urban travelers.

Motto by Hilton

Motto is a micro-hotel brand designed for urban explorers and budget-conscious millennials. The rooms are compact but smartly designed, often with features like flexible furniture, smart tech, and communal spaces.

The concept is similar to brands like Yotel or CitizenM and is perfect for travelers who value location and affordability over space.

Hilton Garden Inn

Hilton Garden Inn is a mid-priced brand offering modern accommodations, on-site dining, and business-friendly amenities. It’s designed for short stays and provides dependable service at a reasonable price.

It’s one of Hilton’s most prolific brands globally and is especially popular in secondary cities and airport locations.

Hampton by Hilton

Hampton is a midscale brand known for its clean, simple rooms, complimentary hot breakfast, and reliable service. It’s one of Hilton’s largest brands by number of properties, especially in North America and Europe.

Hampton is crucial to Hilton’s growth strategy in suburban and tertiary markets.

Tru by Hilton

Tru is a relatively new, economy-focused brand targeting younger travelers who want affordable prices without sacrificing modern design and essential amenities. It offers smaller rooms, vibrant common areas, and limited-service options.

Tru helps Hilton compete with brands like Holiday Inn Express and La Quinta.

Homewood Suites by Hilton

Homewood Suites caters to extended-stay travelers and families needing extra space. Rooms feature full kitchens, separate living areas, and free hot breakfast.

It competes with Marriott’s Residence Inn and is popular among long-term guests, including relocation and project-based travelers.

Home2 Suites by Hilton

Home2 Suites is a more affordable, extended-stay brand designed for budget-conscious guests needing a home-like experience. Suites include kitchenettes and modular furniture, and properties focus on eco-friendly practices.

It’s growing quickly in suburban and highway-adjacent locations.

Final Words on Hilton Hotel Ownership

Hilton Hotel is owned by a mix of institutional investors, with Blackstone Group being the largest shareholder. Despite its public listing, the company’s control remains largely with its significant shareholders and executive leadership. Hilton’s financial success and diverse portfolio of brands have helped it maintain a leading position in the global hospitality market.

FAQs

Who founded Hilton Hotels?

Hilton Hotels was founded by Conrad Hilton in 1919. He established the company in Texas with the goal of creating a hotel that provided quality service.

How many brands does Hilton own?

Hilton owns over 18 brands, including Waldorf Astoria, Conrad, Hampton by Hilton, and Embassy Suites, covering a range of accommodations from luxury to budget-friendly.

Does Blackstone still own Hilton?

Yes, Blackstone is still a major shareholder in Hilton, holding approximately 13% of the company’s shares and continuing to play a key role in its development.

What is Hilton’s annual revenue?

Hilton reported annual revenues of approximately $11.2 billion in 2024 reflecting its strong position in the hospitality industry.

What company owns Hilton Hotels?

Hilton Hotels is owned by Hilton Worldwide Holdings Inc., a publicly traded company listed on the New York Stock Exchange under the ticker symbol HLT.

Is Hilton privately owned?

No, Hilton is a public company. Its shares are owned by institutional investors, individual shareholders, and mutual funds.

Who is the largest shareholder of Hilton?

BlackRock Inc. is the largest shareholder of Hilton, owning around 9.6% of the company’s shares.

Who is the CEO of Hilton Hotels?

The current CEO is Christopher J. Nassetta, who has led the company since 2007.

Does Hilton own all its hotels?

No, Hilton uses a “asset-light” model. It owns some properties, but most are either franchised or managed under the Hilton brand.

How many Hilton Hotels are there worldwide?

As of 2025, Hilton operates over 7,500 hotels across 126 countries and territories.

What is the difference between Hilton and Hilton Worldwide?

Hilton is the name of the flagship hotel brand. Hilton Worldwide is the parent company that owns all of Hilton’s hotel brands.

Is Hilton part of Marriott?

No, Hilton and Marriott are separate hotel companies. They are competitors in the global hospitality industry.

Does Hilton own Waldorf Astoria?

Yes, Waldorf Astoria is a luxury hotel brand fully owned by Hilton Worldwide Holdings Inc.

Where is Hilton headquartered?

Hilton’s global headquarters is located in McLean, Virginia, USA.