Who owns Electrolux is a common question, especially since the brand is known worldwide for its appliances. Founded in Sweden, Electrolux has grown into a global leader with products in millions of homes. Its ownership structure, key shareholders, and control make it one of the most influential companies in the appliance industry.

Electrolux Company Profile

Electrolux AB is a Swedish multinational that designs, manufactures, and sells home and professional appliances. Its product range includes refrigerators, ovens, washing machines, vacuum cleaners, and professional foodservice and laundry equipment.

The company is headquartered in Stockholm, Sweden. It operates globally, serving dozens of markets.

In 2025, Electrolux is working through cost-saving programs and trying to respond to shifting consumer demand in regions like North America, Europe, Latin America, and Asia.

Founders of Electrolux

Electrolux was founded in 1919 by Axel Lennart Wenner-Gren, a Swedish entrepreneur and visionary. He was born on 5 June 1881 in Uddevalla, Sweden. His family had modest wealth from agricultural and wood export businesses. Wenner-Gren studied business in Germany and worked in trade and sales.

Early in his career, he saw the potential in adapting industrial vacuum cleaner designs for household use. He invested in patents and worked with Lux AB, positioning himself to lead what became Electrolux.

He acquired the rights to distribute or use certain vacuum cleaner technologies in Europe. Later, as Electrolux grew, he negotiated to receive company stock in exchange for patents and inventions rather than only cash.

By the early 1930s, his ownership was dominant enough that Electrolux was identified closely with him. Wenner-Gren also diversified into other industries such as banking, media, and manufacturing.

He died on 24 November 1961 in Stockholm. His legacy includes not just Electrolux but philanthropic institutions like the Wenner-Gren Foundations.

Major Milestones

- 1919 – Electrolux is founded through the merger of Lux AB and Svenska Elektron AB, guided by Axel Wenner-Gren.

- 1920s – Launch of the first home vacuum cleaner models. Wenner-Gren secures patents and builds export operations.

- 1930s – Expansion of vacuum cleaners and absorption refrigerators. Electrolux becomes a household name across Europe.

- 1940s – Growth during the wartime and post-war years. Acquisitions broaden the company’s presence in refrigeration and laundry.

- 1950s–1960s – Expansion into dishwashers, built-in refrigerators, and combined fridge-freezers. Early steps in design-driven innovation.

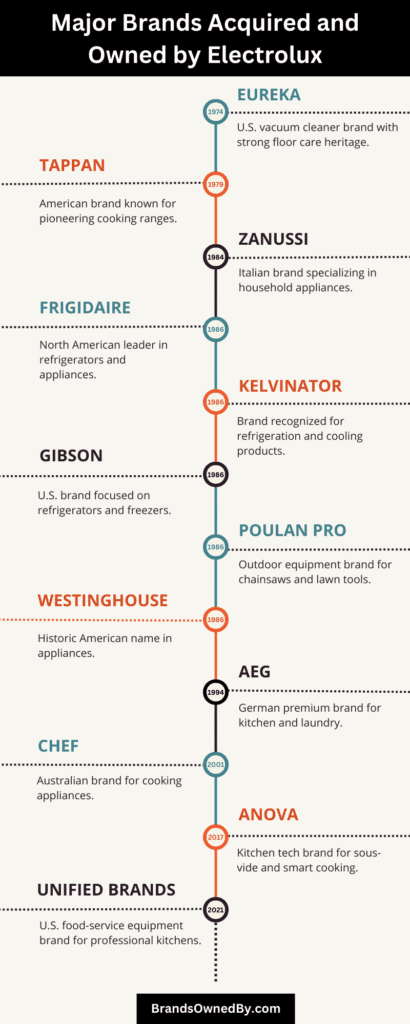

- 1977 – Acquisition of Husqvarna, diversifying into new product categories including outdoor equipment.

- 1984 – Acquisition of Zanussi in Italy, strengthening Electrolux’s foothold in Southern Europe.

- 1992–1994 – Acquisition of AEG Hausgeräte in Germany, expanding premium appliance offerings.

- Mid-1990s – Restructuring to reduce fragmented operations. Divestiture of non-core businesses like sewing machines.

- 1996–1997 – Major workforce and plant reductions as part of global efficiency programs.

- 2000s – International expansion accelerates in Asia and Latin America. Growth in professional appliances.

- 2015 – Acquisition of Shanghai Veetsan Commercial Machinery, a leading Chinese dishwasher manufacturer.

- 2017 – Acquisition of Grindmaster-Cecilware in the U.S., expanding into beverage equipment.

- 2020 – Electrolux Professional is spun off as an independent, publicly listed company.

- 2024 – Electrolux announces Yannick Fierling as the next CEO, set to succeed Jonas Samuelson.

- 2025 – Yannick Fierling officially takes office as CEO. Electrolux reports strong organic sales growth and improved margins in Q1 2025.

Who Owns Electrolux: Major Shareholders

Electrolux AB is a publicly traded company listed on Nasdaq Stockholm. No single shareholder holds a majority of all shares, but some have sizable stakes that give them influence — especially with regard to voting rights.

The shareholding is split between institutional investors, the general public (individual investors), and a few large strategic owners. The ownership also includes differences between share classes (A-shares vs B-shares), which affect voting power.

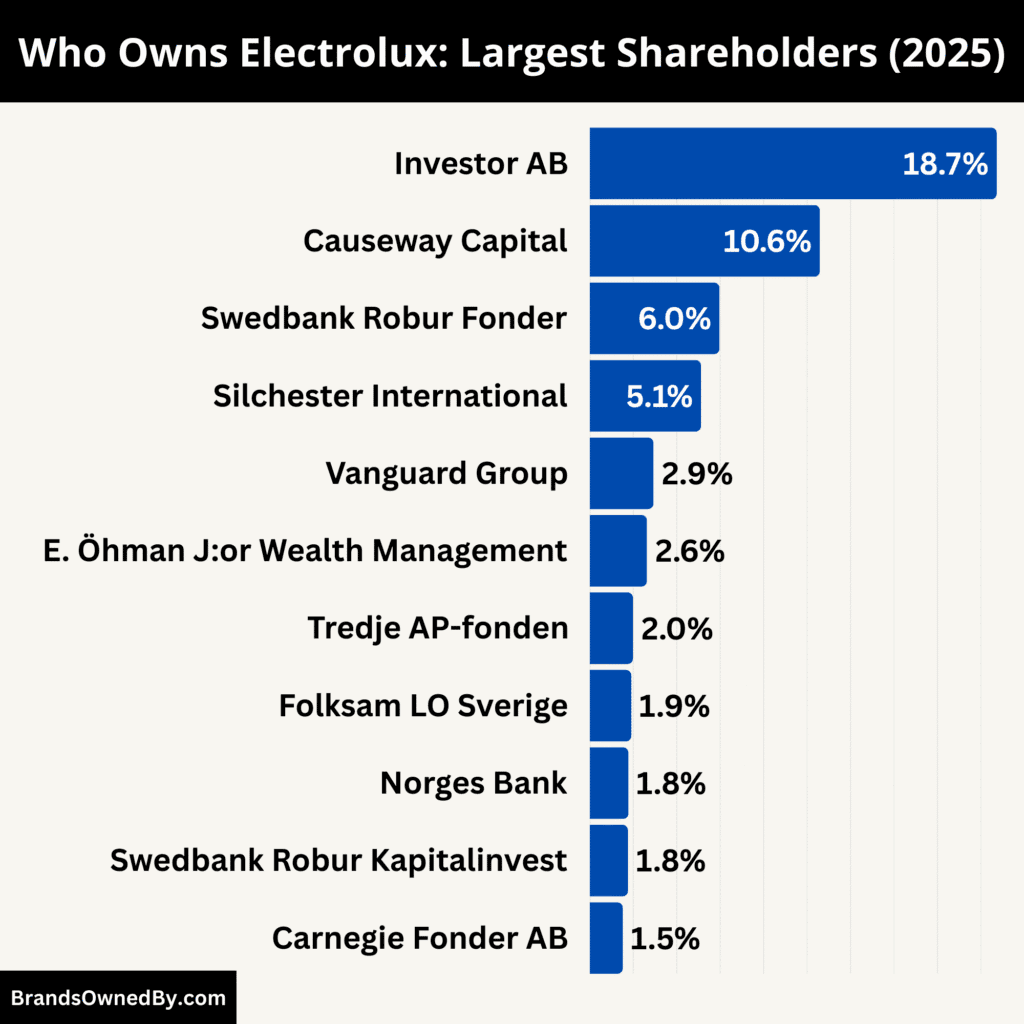

Below is an overview of the top shareholders of Electrolux as of September 2025:

| Shareholder | Ownership % | Type | Role & Influence |

|---|---|---|---|

| Investor AB (publ) | 18.73% | Swedish Investment Company | Largest shareholder, long-term stability focus, strong governance role, board representation |

| Causeway Capital Management LLC | 10.59% | US Investment Firm | Value investor, influences efficiency, costs, and governance decisions |

| Swedbank Robur Fonder AB | 5.97% | Swedish Asset Manager | Domestic institutional investor, emphasizes ESG and sustainability in governance |

| Silchester International Investors LLP | 5.12% | UK Investment Firm | Long-term value investor, quiet but effective governance influence |

| The Vanguard Group, Inc. | 2.93% | US Asset Manager | Passive investor, large global influence, focuses on ESG and reporting standards |

| E. Öhman J:or Wealth Management | 2.63% | Swedish Wealth Manager | Focuses on stability, predictable returns, and governance monitoring |

| Folksam LO Sverige | 1.91% | Swedish Pension & Insurance Fund | Long-term stability, social responsibility, labor and sustainability focus |

| Tredje AP-fonden (AP3) | 1.99% | Swedish National Pension Fund | Focuses on sustainable long-term returns, engages in ESG and accountability |

| Norges Bank Investment Management (NBIM) | 1.78% | Norwegian Sovereign Wealth Fund | Global reputation, strong ESG focus, careful governance voting |

| Swedbank Robur Kapitalinvest | 1.76% | Swedish Asset Manager (subsidiary) | Shares ESG priorities with Swedbank Robur, different product horizons |

| Carnegie Fonder AB | 1.52% | Swedish Asset Manager | Pushes for governance, dividends, efficient operations |

Investor AB — ~18.73%

Investor AB is Electrolux’s largest shareholder by far. The firm is part of the Wallenberg family’s industrial and financial investment network. Holding around 18.73% of the shares gives it strong capital backing. Because of its size and its long-term orientation, Investor AB has an outsized influence over Electrolux’s leadership decisions, board nominations, strategic planning, and capital allocation.

It typically pursues stability and enduring profitability rather than short-term trading gains. Investor AB’s representatives often serve on nomination and governance committees. Their presence helps ensure that Electrolux adheres to long-term strategies like sustainability, product innovation, and maintaining a premium brand reputation.

Causeway Capital Management LLC — ~10.59%

Causeway is a U.S. investment firm specializing in value investing. With about 10.59% ownership, it is the second largest shareholder. This size gives the firm power to influence major decisions, especially if teaming up with other institutional holders. Causeway often pushes for efficient cost structures, better margins, and disciplined capital expenditure.

Its significant stake also means it can affect outcomes at annual general meetings (AGMs) and has a voice in governance debates (e.g., sustainability, dividend policy).

Swedbank Robur Fonder AB — ~5.97%

Swedbank Robur is a prominent Swedish asset manager with comprehensive exposure across equity, bond, and mixed portfolios. With just under 6% ownership, it is a major domestic institutional investor. Swedbank Robur tends to emphasize ESG (environmental, social, governance) factors, urging companies to improve sustainability, transparency, and social responsibility.

In Electrolux’s case, it likely participates in AGMs with these priorities, influencing board oversight and disclosure practices. Being local, it also has good access to the Swedish regulatory and corporate governance environment, which helps amplify its voice.

Silchester International Investors LLP — ~5.12%

Silchester is a U.K.-based investment firm known for long-term, value orientation. With about 5.12% of shares, it is one of the larger foreign institutional holders. Silchester tends not to seek headline activism, but its voting power and steady commitment mean it can push for efficiency, financial discipline, and returns. It often works behind the scenes, engaging with management quietly but effectively.

With its consistent holding over time, it helps provide governance stability and can form alliances with other long-term holders on issues like executive compensation, investment in R&D, and risk management.

The Vanguard Group, Inc. — ~2.93%

Vanguard is a global asset manager, largely involved through passive funds and ETFs. With about 2.93%, its stake is meaningful though smaller than the top few. Vanguard tends to be less aggressive but sets expectations through its stewardship policies.

For example, it may vote in favor of enhanced reporting, sustainability credentials, board independence, and sometimes activist proposals if they align with long-term shareholder value. Because Vanguard holds many companies globally, its governance choices are often compared and amplified, which gives even a 2.93% holder some soft power.

E. Öhman J:or Wealth Management — ~2.63%

E. Öhman J:or is a Swedish wealth manager. Owning approximately 2.63%, it is smaller than the largest institutions but still large enough to matter, especially in combined institutional blocks.

Wealth management firms like this usually focus on stable growth and dividend returns. They tend to favor predictable performance, moderate risk, and good shareholder communication. In Electrolux’s case, E. Öhman J:or likely monitors product innovation, supply chain risks, and market expansion, providing feedback in governance forums.

Folksam LO Sverige — ~1.91%

Folksam LO Sverige is an insurance and pension institution in Sweden. With about 1.91%, its stake positions it to influence governance, particularly in areas of social responsibility, labor relations, and sustainable investing.

As a pension and insurance firm, it has responsibilities to its policyholders and pensioners, so it tends to favor long-term stability, risk management, and corporate responsibility. It may also collaborate with other domestic funds in Sweden to push for policy coherence.

Tredje AP-fonden (Third Swedish National Pension Fund) — ~1.99%

Tredje AP-fonden is one of Sweden’s national pension funds. Holding nearly 2%, it is a long-term institutional investor. Its mandate generally includes securing returns for pensioners in a sustainable manner.

Thus, it tends to vote in favor of ESG initiatives, transparency, and ensuring management is accountable. It often serves as a bridge between government policy expectations and corporate behavior in companies like Electrolux operating in many countries.

Norges Bank Investment Management (NBIM) — ~1.78%

NBIM manages Norway’s sovereign wealth fund, which is one of the largest in the world. Though its ~1.78% stake in Electrolux is modest compared to others, it carries influence because of NBIM’s strong engagement, reputation, and focus on governance. NBIM usually votes its holdings carefully, often against practices it perceives as risky (environmental, labor, or governance weak spots).

It may also publish expectations or engage in dialogue with Electrolux, especially on sustainability and global climate concerns.

Swedbank Robur Kapitalinvest — ~1.76%

Swedbank Robur Kapitalinvest is a subsidiary/arm of Swedbank Robur focused on more specific investment products. With around 1.76%, it is smaller but still a relevant and active institutional investor.

It shares many priorities with Swedbank Robur (e.g., ESG, responsible investing), but may have slightly different investment horizons or risk tolerances depending on product mix. Its influence is real, especially in Swedish institutional settings where multiple Robur arms coordinate.

Carnegie Fonder AB — ~1.52%

Carnegie Fonder is another Swedish asset manager. With about 1.52%, it is smaller but still among the top shareholders. Carnegie tends to be active in Sweden’s financial markets, often pushing for good governance practices, dividend policy, and efficient operations.

Though its lone stake is not large enough to dominate, in combination with like-minded institutional investors, it can affect governance and reporting decisions.

Who is the CEO of Electrolux?

Yannick Fierling is the President and Chief Executive Officer of Electrolux. He officially assumed the CEO role on January 1, 2025. Before that, he joined Electrolux in October 2024 to begin a handover period.

Fierling has over 20 years of experience in the household appliance industry. Most recently, he served as CEO, Europe, for Haier Corporation. Before Haier, from 2000 to 2015, he held senior leadership roles at Whirlpool Corporation both in Europe and globally.

He is French, holds two master’s degrees in Mechanical Engineering (one from France and another from the United States), and lives in Stockholm as part of his CEO role.

Transition from the Previous CEO

Jonas Samuelson was the CEO before Fierling. He served in that position for approximately eight years. His tenure included leading Electrolux through challenging markets, supply chain constraints, and rising input costs.

Samuelson stepped down on January 1, 2025, and also left the board. The board announced his departure in April 2024, giving months for transition.

Decision-Making Structure Under the CEO

Under Fierling, Electrolux’s governance continues to involve a Board of Directors, which makes strategic decisions and appoints senior management. The CEO is accountable to the board and works alongside the executive leadership team. Fierling was proposed and elected as a member of the Board at the Annual General Meeting in 2025.

He has indicated focus areas including cost reductions, production efficiencies, and leveraging innovation. He also seeks to balance Electrolux’s heritage of product quality with agility and speed, traits he observed particularly in Asian appliance markets.

Previous Leaders and Their Impact

- Jonas Samuelson (2016-2024): He led Electrolux through periods of market pressure, inflation, and shifting consumer demand. Under his leadership, Electrolux worked on restructuring and tried to improve margins.

- Keith McLoughlin (2011-2016): Focused on expanding Electrolux’s presence in North America and improving operations during his tenure.

- Hans Stråberg (2002-2011): Oversaw global expansion, innovation, and some of the company’s design and operational modernization. He was relatively young when he became CEO and contributed to Electrolux entering new product categories.

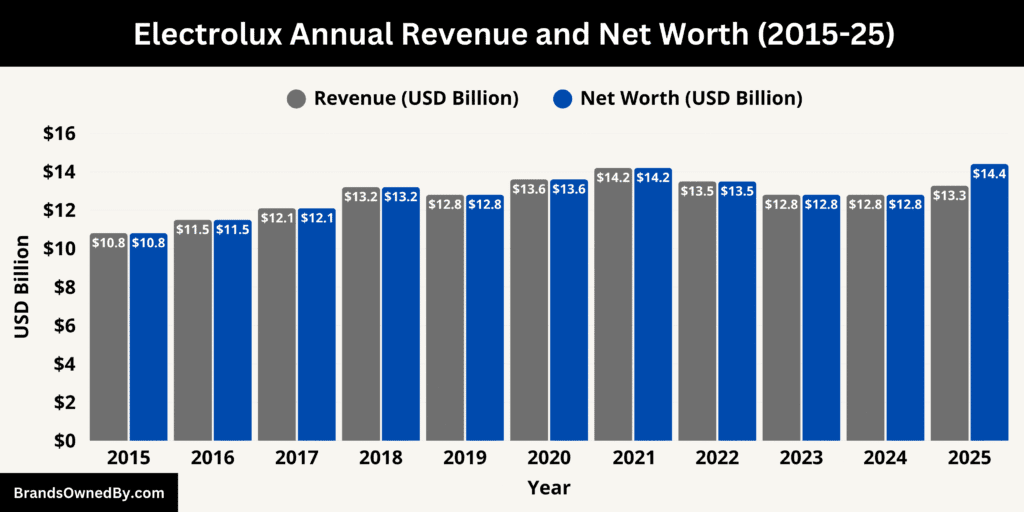

Electrolux Annual Revenue and Net Worth

In 2025, Electrolux reported trailing twelve-month (TTM) revenue of about 13.27 billion. Its market capitalization, often referred to as its net worth, is approximately 14.4 billion as of September 2025. These figures highlight a company that continues to generate significant sales while retaining a strong overall valuation.

Revenue Trends

Electrolux’s revenue in 2025 stands at 13.27 billion up from about 12.83 billion in 2024.

The increase may appear modest, but it reflects an important turnaround after a period of slower growth in 2023. This recovery has been driven by steady consumer demand, efficiency improvements in production, and a stronger performance in premium product categories.

In Swedish kronor, revenue for the quarter ending June 2025 was SEK 31.28 billion, contributing to a TTM total of around SEK 135.11 billion. The improvement in SEK figures also points to underlying stability in Electrolux’s home market.

Net Worth / Market Capitalization

Electrolux’s net worth in September 2025 is valued at 14.4 billion. This represents a much stronger figure compared to earlier valuations in 2024, when the company was valued significantly lower.

The rebound signals renewed investor confidence in Electrolux’s strategic direction, leadership transition, and ability to adapt to competitive market dynamics. The valuation is also more in line with the company’s global brand recognition and its position as one of the leading home appliance manufacturers worldwide.

Comparison & Implications

The combination of growing revenue and a solid market capitalization underscores a healthier outlook for Electrolux. While the revenue growth is steady rather than explosive, the sharp improvement in valuation suggests that investors are increasingly optimistic about profitability, restructuring efforts, and the leadership of the new CEO, Yannick Fierling.

If Electrolux maintains this trajectory, the gap between its revenues and its market value may continue to narrow, strengthening its role as a resilient global appliance company.

Companies Owned by Electrolux

Electrolux owns a wide portfolio of brands and companies that cater to different markets and consumer needs. As of 2025, its lineup ranges from global flagship names to regional heritage labels, covering everything from premium kitchen appliances to cost-friendly home solutions. This diverse brand architecture allows Electrolux to reach customers worldwide while maintaining strong local connections.

Below is a list of the major brands and companies owned by Electrolux as of 2025:

| Brand/Entity | Region/Origin | Category/Focus | Positioning & Market Role |

|---|---|---|---|

| Electrolux | Global (Sweden origin) | Full home appliances | Core corporate and consumer brand, mainstream to premium. |

| AEG | Europe (Germany origin) | Premium kitchen & laundry appliances | Innovation-led, professional-grade design, higher-end positioning. |

| Frigidaire | North America (USA origin) | Major appliances | Mass-market to mid-premium, strong retail presence. |

| Zanussi | Italy/Europe | Kitchen & compact appliances | Mid-market, practical design, regional heritage appeal. |

| Electrolux ICON | North America | Premium appliances | Upscale kitchen suites, premium laundry products. |

| Anova | USA | Smart cooking devices | Precision cooking, connectivity, innovation-driven. |

| Fensa | Chile/Latin America | Refrigerators & white goods | Regional appliances tailored to Latin American needs. |

| Gafa | Argentina/Latin America | Appliances (refrigerators, ranges, laundry) | Local mass-market focus with heritage branding. |

| Mademsa | Chile | Household appliances | Regional, cost-effective appliances for local consumers. |

| Somela | Chile/Latin America | Entry-to-mid market appliances | Practical, accessible appliances for budget-conscious buyers. |

| Volta | Europe (Scandinavia origin) | Vacuums & small appliances | Affordable, reliable household equipment. |

| Zanker | Central Europe | Kitchen appliances | Regional heritage brand with steady distribution. |

| Arthur Martin | France | Laundry appliances | Traditional French brand, trusted among older consumers. |

| Faure | France | Home appliances | French market focus, energy-compliant and practical. |

| Rex-Electrolux | Italy | Kitchen appliances | Combines Italian design with Electrolux engineering. |

| Voss | Denmark/Nordics | Premium cooking appliances | Regional luxury label for high-margin markets. |

| Progress | Europe | Vacuum & small appliances | Reliable, cost-conscious appliances. |

| Tornado | Europe | Vacuum cleaners | Floor-care appliances with regional targeting. |

| Beam | North America & Global niche | Central vacuum systems | Specialty brand for built-in home systems. |

| Juno | Europe | Premium kitchen appliances | Designer kitchens, upscale boutique appliances. |

| Molteni | France/Europe | Professional & high-end cooking | Specialized stoves and professional kitchen equipment. |

| Kelvinator (select regions) | Legacy brand | Refrigeration appliances | Divested/licensed in 2025 in some regions, still retained elsewhere. |

| Regional & Legacy Labels | Europe & Latin America | Mixed household appliances | Maintained for local brand equity and heritage value. |

Electrolux (corporate brand)

Electrolux is the company’s global flagship consumer brand. It covers a wide range of home appliances. Products include refrigerators, ovens, cooktops, dishwashers, washers and dryers, small appliances, and vacuums.

The Electrolux brand targets mainstream and premium segments depending on the market and model. It carries the group’s core design language and technology roadmap. Product development under this brand emphasizes energy efficiency, ease of use, and Scandinavian design cues.

Marketing and after-sales for Electrolux-branded products are coordinated regionally to match local consumer preferences.

AEG

AEG is Electrolux’s premium European brand. It focuses on higher-end kitchen and laundry appliances. The brand is positioned on innovation, design, and professional-grade performance. AEG models often showcase advanced features, pro-style finishes, and energy-efficiency credentials.

The brand appeals to customers who want engineering depth and a refined aesthetic. Electrolux uses AEG to capture a margin premium in Europe and in markets where consumers trade up for perceived quality and technical leadership.

Frigidaire

Frigidaire is Electrolux’s primary North American major-appliance brand. It includes refrigerators, ranges, dishwashers and laundry products. Historically known for mass-market refrigerators, Frigidaire today spans entry to mid-premium tiers.

Electrolux positions Frigidaire on value, reliability, and broad distribution through big-box retailers and national dealer networks. Product strategies for Frigidaire emphasize cost-efficient manufacturing, strong service networks, and a rapid product refresh cadence to keep shelf presence high.

Zanussi

Zanussi is an Italian brand owned by Electrolux and used widely across Southern and Central Europe. It is best known for kitchen appliances and compact household products. Zanussi’s strength is in practical design and competitive pricing, with a strong foothold in markets that favour compact, built-in kitchen solutions.

Electrolux uses Zanussi to cover mid-market buyers in regions where the Zanussi name retains local heritage appeal.

Electrolux ICON

Electrolux ICON is a premium consumer sub-brand used primarily in North America. It targets buyers looking for upscale kitchen suites and premium laundry equipment. ICON products are positioned with higher specifications and more refined finishes. Electrolux uses the ICON label to compete with other premium appliance suites and to offer trade partners an aspirational model range that sits above mainstream Frigidaire offerings.

Anova

Anova, acquired as a technology brand, is focused on smart kitchen appliances and accessories, best known for precision cooking devices. Under Electrolux ownership, it has continued as a niche, innovation-led brand. Anova products are used to reach consumer segments attracted to connected, chef-style cooking tools.

The brand also serves as a testbed for software, connectivity and new user-experience features that can later influence larger lines.

Fensa

Fensa is a Chilean and Latin American appliance brand that became part of Electrolux’s regional portfolio. It sells refrigerators, freezers and other white goods tailored to Latin American price points and distribution channels.

Electrolux maintains local manufacturing partnerships and product specifications for Fensa to meet regional power, size and pricing needs. Fensa helps Electrolux capture mass-market share in markets where local brand familiarity matters.

Gafa

Gafa is an Argentine appliance brand within Electrolux’s Latin American footprint. It is positioned for local consumers and offers products such as refrigerators, ranges and laundry machines.

Gafa’s product range and features reflect the competitive needs of Argentina and neighboring markets. Electrolux supports the brand with regional supply chains and localized after-sales service.

Mademsa

Mademsa is a Chilean manufacturer and brand in Electrolux’s regional stable. It supplies a range of household appliances adapted to local consumer needs. Electrolux integrates Mademsa into its Latin American channel strategy, using the brand to sustain market share where local production and distribution partnerships are important.

Somela

Somela is another Chilean brand in the Electrolux family used across Latin America. It typically covers entry to mid-market appliances. The brand benefits from Electrolux’s regional platform for sourcing, logistics and product development while preserving local marketing and retail relationships.

Volta

Volta is a vacuum and small-appliance brand that Electrolux retains in selected markets. The brand is often used where legacy recognition supports a separate positioning from the Electrolux or AEG names. Volta products tend to be simple, reliable and cost-effective, aimed at price-sensitive segments.

Zanker

Zanker is a Central European brand in the Electrolux portfolio. It covers kitchen appliances like cookers, hobs and ovens, often sold through regional retailers. Electrolux maintains Zanker to serve specific national markets with local preferences and to leverage existing distribution and service networks.

Arthur Martin

Arthur Martin is a historic European brand that Electrolux manages for specific markets. It is often used for washing machines and other laundry appliances where the Arthur Martin name retains recognition and trust among older consumer segments.

Faure

Faure is a French brand under Electrolux that serves the French market and francophone regions with a range of household appliances. The label is positioned to meet local regulatory, energy and consumer requirements while benefiting from group-level engineering and sourcing.

Rex-Electrolux

REX-Electrolux is the Italian brand variant used for kitchen appliances in Italy and adjacent markets. It combines Electrolux technical standards with Italian styling cues. The brand helps Electrolux maintain shelf space and dealer relationships in Italy’s competitive kitchen sector.

Voss

Voss is a premium regional cooking appliance brand used in Denmark and nearby countries. Electrolux deploys Voss where its premium kitchen equipment can meet local design expectations and where a regional luxury label helps capture higher margins.

Progress

Progress is a vacuum cleaner and small-appliance brand operated by Electrolux in parts of Europe. It is positioned as dependable household equipment for cost-conscious buyers. Electrolux leverages Progress for market segments where a lower price point is required without diluting its main brands.

Tornado

Tornado is a consumer vacuum cleaner brand in some markets. Electrolux keeps Tornado within its portfolio to cover different legacy price and distribution segments for floor-care products. It allows separate marketing initiatives targeted at regional preferences or retailer demands.

Beam

Beam refers to Electrolux’s central vacuum systems in markets where those products are relevant. The brand targets a niche but durable segment: built-in home vacuum systems. Electrolux uses Beam to address specialty channels such as builders, installers and higher-end renovation projects.

Juno

Juno is a premium kitchen appliance label offered by Electrolux in selected markets. It is aimed at consumers who want refined styling and higher-end features without necessarily buying into the highest-tier brands. Juno models often appear in designer kitchens and boutique retail settings.

Molteni

Molteni is a specialist professional and high-end cooking brand that remains associated with Electrolux in specific product lines. It is used for high-temperature professional stoves and niche professional kitchen equipment that require specialized distribution and service.

Kelvinator

Electrolux’s brand map has changed in recent years. Some legacy or regional brands have been divested or licensed. For example, the Kelvinator brand — historically part of Electrolux’s global stable — was divested in certain markets in 2025 where local buyers took ownership or licensing control. Electrolux may still hold rights to brand names in other jurisdictions, or maintain licensing agreements, but it has been actively pruning and rationalizing brands to focus on core global and regional labels.

Regional and legacy labels

Electrolux also owns and operates many smaller, regional and legacy labels that are active only in one or a few countries. These labels include household names with long local histories.

The company keeps them in the portfolio when local brand equity and distribution advantage outweigh the costs of consolidation. Over time, Electrolux evaluates each label for consolidation, licensing, or sale as part of its global brand strategy.

Final Thoughts

Electrolux remains a Swedish company with global reach, shaped by Investor AB and other major shareholders. The answer to who owns Electrolux lies in its public ownership, guided by long-term investors and strong leadership. With brands like AEG, Frigidaire, and Zanussi, it continues to hold a leading place in the appliance market.

FAQs

Who does Electrolux belong to?

Electrolux belongs to its shareholders, as it is a publicly traded company listed on the Nasdaq Stockholm exchange. No single entity owns Electrolux outright. The largest shareholder is Investor AB, along with other institutional and individual investors.

Who is the largest shareholder of Electrolux?

The largest shareholder of Electrolux is Investor AB, the investment company controlled by the Wallenberg family in Sweden. Investor AB holds the most voting power due to its ownership of A-shares, which carry stronger voting rights than B-shares.

Who is Electrolux owned by?

Electrolux is owned by a mix of institutional investors, foundations, and private shareholders. The majority are Swedish and European investment firms, with Investor AB being the dominant shareholder.

Is Electrolux owned by Whirlpool?

No, Electrolux is not owned by Whirlpool. Both companies are competitors in the global home appliance industry.

What companies are owned by Electrolux?

Electrolux owns a wide range of brands and subsidiaries, including Electrolux (core brand), AEG, Frigidaire, Zanussi, Electrolux ICON, Anova, Fensa, Gafa, Mademsa, Somela, Volta, Zanker, Arthur Martin, Faure, Rex-Electrolux, Voss, Progress, Tornado, Beam, Juno, and Molteni.

Who is Electrolux made by?

Electrolux products are made by AB Electrolux, the Swedish multinational home appliance manufacturer headquartered in Stockholm.

Which country makes Electrolux products?

Electrolux is a Swedish company. Its headquarters is in Stockholm, Sweden, and it operates manufacturing facilities across Europe, North America, Latin America, and Asia to serve global markets.

Who does Electrolux own?

Electrolux owns several global and regional brands such as AEG, Frigidaire, Zanussi, Anova, Fensa, Gafa, Mademsa, Volta, and many others.

Does Electrolux have a parent company?

Electrolux does not have a parent company. It is an independent, publicly traded corporation.

Are Electrolux and GE the same company?

No, Electrolux and General Electric (GE) are not the same company. Electrolux attempted to acquire GE Appliances in 2014, but the deal was blocked by regulators. GE Appliances is now owned by Haier, a Chinese multinational.

Is Westinghouse owned by Electrolux?

Electrolux previously licensed the Westinghouse brand for some appliances, but it does not own Westinghouse. The Westinghouse brand remains separate.

Is AEG owned by Electrolux?

Yes, AEG is fully owned by Electrolux. The German-founded brand was acquired in the 1990s and now serves as Electrolux’s premium label in Europe.

Is Electrolux a Japanese brand?

No, Electrolux is not a Japanese brand. It is a Swedish company.

Is Electrolux a French company?

No, Electrolux is not a French company. It is a Swedish company headquartered in Stockholm.

Who owns Zanussi?

Zanussi, the Italian appliance brand, is owned by Electrolux. It was acquired in 1984 and continues to operate under the Electrolux Group.