Eddie Bauer is a legendary American brand known for its outdoor gear and classic clothing. If you’re wondering who owns Eddie Bauer today and how its ownership has evolved. This article provides a comprehensive overview, including financial details, leadership, and affiliated companies.

Eddie Bauer Company Profile

Eddie Bauer was founded in 1920 by Pacific Northwest outdoorsman Eddie Bauer in Seattle. It began as a small tennis and sporting goods shop. In 1940, the brand patented the first quilted down jacket in the U.S. Over the decades, the company expanded into catalogs, mail order, outdoor gear, and brick‑and‑mortar retail. By the early 1990s, it operated over 265 stores under Spiegel’s ownership. It went through periods of bankruptcy (2005, 2009), followed by acquisitions by private equity. In June 2021, ABG and SPARC Group acquired the brand.

In January 2025, SPARC merged with JCPenney to form Catalyst Brands, which now includes Eddie Bauer among six legacy U.S. retail banners under a united operating entity.

Founders and Early Leaders

Eddie Bauer, born October 19, 1899, on Orcas Island, Washington, grew up with a passion for the outdoors. He opened his first sports shop in 1920 and focused on testing products in real wilderness environments. He pioneered down insulation and developed wartime parkas and sleeping bags for military use.

In 1968, Eddie retired and sold his stake to his partner William F. Niemi. The company gradually shifted to broader apparel under new ownership. Eddie passed away in 1986, but his legacy lives on in the brand’s commitment to quality and innovation.

Major Milestones

- 1920: Eddie opens a tennis and fishing shop in Seattle.

- 1934: Patented a regulation badminton shuttlecock.

- 1940: Patented first U.S. quilted down jacket (Skyliner).

- WWII: Produced parkas and 100,000 sleeping bags for the U.S. military.

- 1945: Launch of mail‑order catalogs.

- 1971: Acquired by General Mills; 1988 by Spiegel.

- 2003–2009: Bankruptcy and buyout by Golden Gate Capital.

- 2014: Nearly sold to Jos. A. Bank; deal fell through.

- 2018: Merges with PacSun under PSEB formation.

- June 2021: Acquired by Authentic Brands Group and SPARC Group.

- Sept 2022: Tim Bantle named CEO of Eddie Bauer at SPARC.

- Jan 2025: Enters new era under Catalyst Brands merger.

Who Owns Eddie Bauer?

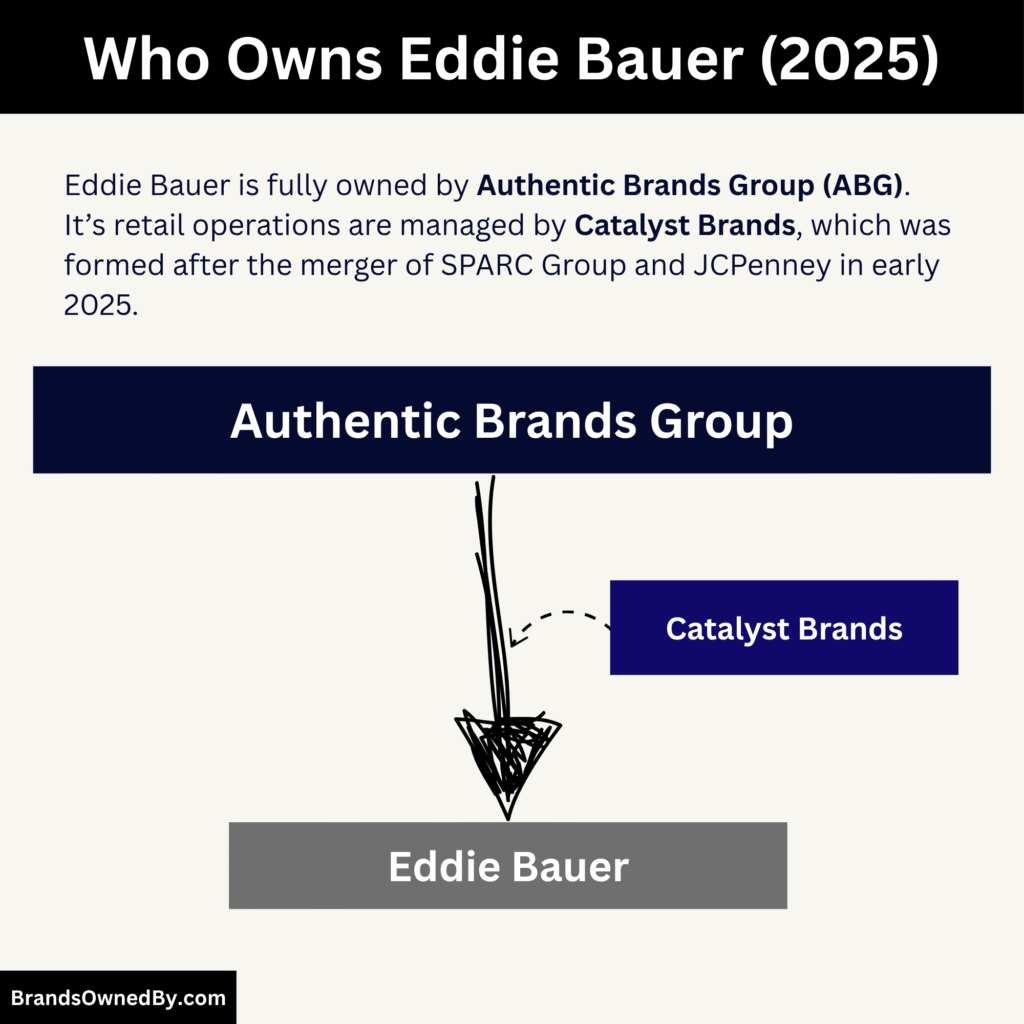

As of July 2025, Eddie Bauer is owned by Authentic Brands Group (ABG), a global brand management company, in partnership with Catalyst Brands. Catalyst Brands is the new name of the merged entity between SPARC Group and JCPenney, announced in January 2025.

While ABG owns the intellectual property, branding, and licensing rights for Eddie Bauer, Catalyst Brands handles its operations, logistics, store management, and customer experience.

This hybrid structure allows Eddie Bauer to operate efficiently, leveraging ABG’s brand-building capabilities and Catalyst’s retail infrastructure.

Here’s a quick summary of who owns Eddie Bauer as of July 2025, leadership, and strategy:

- Brand Licensing Model: Eddie Bauer now operates under a licensing model. This means independent partners in different regions manufacture and sell Eddie Bauer products under strict brand guidelines, increasing global reach without high capital risk.

- Leadership Changes: In 2022, Tim Bantle was appointed CEO of Eddie Bauer under SPARC Group. He brought experience from Patagonia and The North Face, signaling a more technical and sustainability-driven focus for the brand.

- Retail Strategy: Catalyst Brands is actively working on reimagining Eddie Bauer stores, streamlining inventory, and focusing on omnichannel retail experiences. The brand is also strengthening its presence in outlet malls and outdoor-specific locations.

Parent Company: Authentic Brands Group

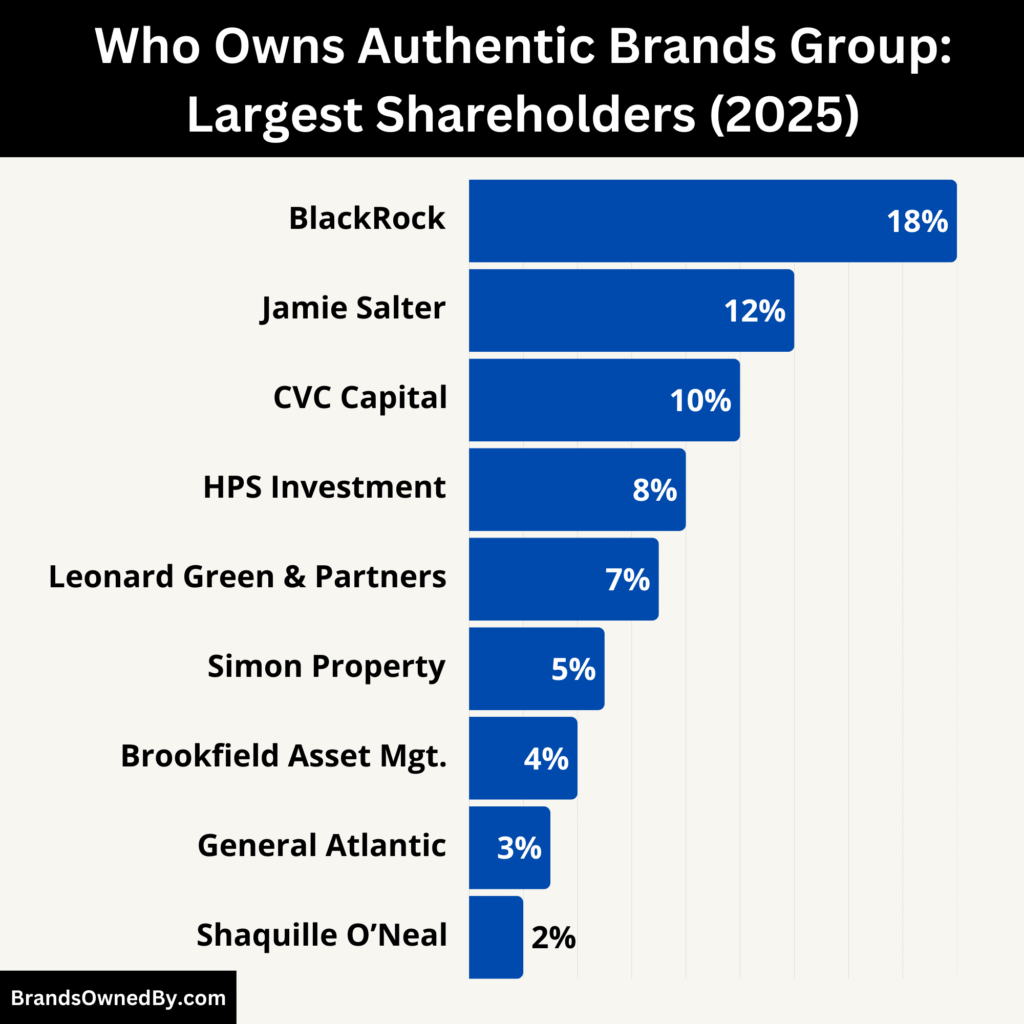

Authentic Brands Group (ABG) is the ultimate parent company of Eddie Bauer. ABG is based in New York and is known for acquiring and managing well-known consumer brands across fashion, entertainment, and lifestyle. Its model focuses on licensing and long-term brand growth rather than direct retail operations.

ABG owns over 50 major brands including Reebok, Forever 21, Brooks Brothers, Juicy Couture, and Nautica. Eddie Bauer fits into ABG’s outdoor and performance apparel category, a segment that has seen growth through licensing partnerships and cross-brand collaborations.

Operational Arm: Catalyst Brands (formerly SPARC Group)

Eddie Bauer’s retail operations are managed by Catalyst Brands, which was formed after the merger of SPARC Group and JCPenney in early 2025. Catalyst now oversees the physical and digital operations of several legacy retail brands including:

Catalyst manages stores, ecommerce platforms, distribution centers, and supply chains for these brands. It acts as a centralized operating company under the strategic direction of ABG.

Acquisition Insights and History

The 2021 Acquisition by ABG and SPARC

Eddie Bauer was acquired by Authentic Brands Group and SPARC Group in June 2021 from private equity firm Golden Gate Capital. The acquisition was part of ABG’s broader strategy to strengthen its portfolio of performance and outdoor brands. The deal included both the brand’s intellectual property and its retail footprint.

After the acquisition, SPARC took over management of Eddie Bauer’s retail and ecommerce operations, while ABG focused on licensing, partnerships, and brand growth.

The acquisition brought fresh energy to the brand. Eddie Bauer collaborated with other ABG brands, expanded its reach through digital retail, and embraced sustainability with new product lines.

Previous Ownership and Transitions

Before ABG, Eddie Bauer had gone through several ownership transitions:

- Spiegel, Inc. owned Eddie Bauer in the late 1980s and 1990s.

- After Spiegel’s bankruptcy in 2003, Golden Gate Capital acquired Eddie Bauer.

- The company filed for bankruptcy again in 2009, and a restructuring plan kept it operational.

- In 2018, Eddie Bauer and PacSun merged under a new holding company called PSEB Group, also managed by Golden Gate Capital.

The 2021 acquisition by ABG and SPARC marked a new chapter, and the 2025 reorganization under Catalyst Brands further positioned the company for long-term growth.

Eddie Bauer Bankruptcy

Eddie Bauer underwent two bankruptcies in 2003 and 2009.

First Bankruptcy: 2003–2005 (Spiegel Inc. Collapse)

Eddie Bauer’s first major financial disruption was tied to the bankruptcy of its parent company, Spiegel, Inc., in 2003. Spiegel, a catalog and retail giant, had owned Eddie Bauer since the late 1980s and had heavily expanded the brand’s retail footprint. However, by the early 2000s, Spiegel faced massive debt, declining sales, and increased competition in the retail market.

As a result, Spiegel filed for Chapter 11 bankruptcy protection in March 2003. Although Eddie Bauer itself was still operating, the brand was caught in the collapse. Spiegel closed hundreds of Eddie Bauer stores and attempted to sell off the brand as part of its restructuring plan. By 2005, Spiegel emerged from bankruptcy under a new structure, and Eddie Bauer was spun off and sold to private investors. This marked the beginning of a new phase for the company under standalone ownership.

Second Bankruptcy: 2009 (Financial Crisis Impact)

The second major bankruptcy came in June 2009, during the global financial crisis. Eddie Bauer filed for Chapter 11 bankruptcy due to a combination of declining sales, poor liquidity, and long-term debt obligations. At the time, the brand operated over 370 stores and had failed to keep up with changing consumer shopping trends.

Eddie Bauer cited weak consumer demand, unsustainable lease agreements, and lack of credit access as primary reasons for its insolvency. The company’s debts exceeded $300 million, and it had limited access to operating cash. Despite the filing, Eddie Bauer continued operations through a “debtor-in-possession” arrangement, which allowed it to remain functional while seeking a buyer.

Rescue and Sale to Golden Gate Capital

In July 2009, Eddie Bauer was acquired out of bankruptcy by Golden Gate Capital, a San Francisco-based private equity firm. Golden Gate outbid rivals including Authentic Brands Group, offering $286 million for the company’s assets. The acquisition helped Eddie Bauer emerge from bankruptcy later that year.

Under Golden Gate’s ownership, Eddie Bauer refocused on its core strengths—functional outerwear, outdoor apparel, and performance gear. The company scaled back store expansion, invested in digital retail, and improved product design. While profitability remained elusive, it stabilized the business after years of volatility.

Post-Bankruptcy Strategy and Further Changes

Following its 2009 bankruptcy exit, Eddie Bauer underwent several structural shifts:

- In 2014, a planned merger with Jos. A. Bank fell apart when Men’s Wearhouse acquired Jos. A. Bank instead.

- In 2018, Eddie Bauer was merged with PacSun under a new umbrella entity, PSEB Group, both managed by Golden Gate Capital.

- These moves aimed to reduce overhead and consolidate back-end operations like warehousing, IT, and marketing.

Eventually, in June 2021, Golden Gate sold Eddie Bauer to Authentic Brands Group (ABG) and SPARC Group, marking the end of Eddie Bauer’s post-bankruptcy ownership under private equity.

Legacy and Recovery

Today, Eddie Bauer operates under Catalyst Brands, a retail group formed by the 2025 merger of SPARC and JCPenney. While the company no longer struggles with bankruptcy, its past financial crises have shaped its current strategy: lean operations, focus on core products, and emphasis on omnichannel retail.

The two bankruptcies, in 2003 and 2009, remain critical moments in Eddie Bauer’s 100+ year history. Both led to major ownership changes and taught the company valuable lessons about overexpansion, financial discipline, and consumer trends.

These events ultimately prepared Eddie Bauer for a more stable and focused future in a competitive retail landscape.

Who is the CEO of Eddie Bauer?

After the formation of Catalyst Brands in early 2025, Eddie Bauer no longer reported to an independent CEO. Instead, it became part of a brand portfolio managed by Catalyst Brands. Ken Ohashi was appointed Brand CEO overseeing both Brooks Brothers and Eddie Bauer. He reports directly to Marc Rosen, CEO of Catalyst Brands.

Brand CEO: Ken Ohashi

Ken Ohashi serves as Brand Chief Executive Officer for both Eddie Bauer and Brooks Brothers. He assumed leadership of Eddie Bauer in early 2025 after the formation of Catalyst Brands—a merger between SPARC Group and JCPenney. In this role, he reports directly to Marc Rosen, CEO of Catalyst Brands.

Background & Experience

Ohashi brings over 25 years of experience in fashion, retail, and brand management. He previously served as President of International and Global Retail at Authentic Brands Group (ABG). There, he managed brand strategy and global retail initiatives across ABG’s $4 billion international portfolio.

Before that, he held leadership roles at Aéropostale, expanding international licensing and retail operations. He also began his professional journey as a Certified Public Accountant at Arthur Andersen in its retail and fashion audit department.

Achievements & Vision

At Brooks Brothers, Ken led the brand’s turnaround and return to profitability in less than two years. He is bringing the same discipline and vision to Eddie Bauer. His strategy emphasizes:

- Omnichannel growth: Leveraging integrated physical and digital shopping experiences across Catalyst’s six brands

- Global expansion: Applying his ABG experience to support international market licensing

- Operational synergy: Aligning Eddie Bauer with Brooks Brothers for supply chain and sourcing efficiencies.

Leadership Style & Team

Ohashi is known for data-driven decision-making and cross-brand collaboration. As Brand CEO, he leads Eddie Bauer’s executive team on strategy, product development, licensing, marketing, and sustainability initiatives. He benefits from Catalyst’s centralized infrastructure in supply chain, digital, finance, and retail operations.

Transition Context

Ken’s promotion followed the departure of Tim Bantle, who left in January 2025 to lead Filson. The shift represents a move from a standalone brand CEO to integrated leadership under Catalyst Brands. Ken now steers Eddie Bauer within a broader portfolio of U.S. retail heritage brands.

Eddie Bauer Annual Revenue and Net Worth

Eddie Bauer ended 2024 with around $263 million in direct online revenue and is on pace to grow further in 2025. As part of Catalyst Brands, it contributes to a $9+ billion annual revenue platform and sits within ABG’s $29+ billion brand empire.

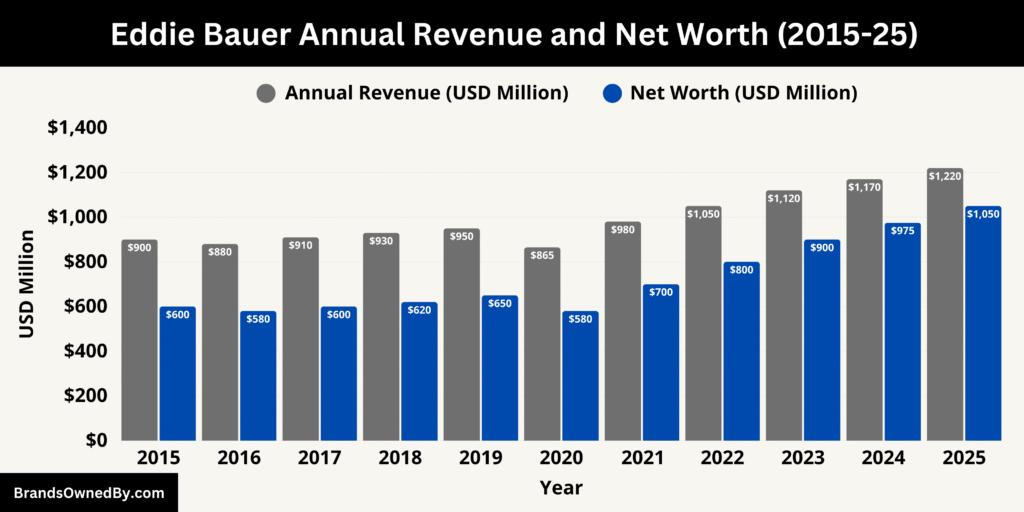

As of July 2025, Eddie Bauer’s estimated net worth is around $1.05 billion, and its expected revenue for 2025 is estimated to be well over $1.22 billion.

2025 Annual Revenue

In 2024, Eddie Bauer’s online store alone generated approximately $263 million in sales. That marked solid year-over-year growth of around 5–10%. The current pace indicates continued momentum, with 2025 projections pointing to similar growth in the high single digits.

By June 2025, eddiebauer.com achieved $18 million in monthly revenue. This steady performance reflects a stable online presence amid a broader retail resurgence. While this doesn’t capture in-store sales, digital growth remains a key driver of the brand’s expansion.

Brand Valuation and Net Worth

As of July 2025, the net worth of Eddie Bauer is well over $1.05 billion. It is owned by Authentic Brands Group (ABG), whose entire portfolio surpassed $32 billion in global retail sales across more than 50 brands. Brand valuations within this portfolio have risen rapidly. Back in mid-2023, ABG was valued at over $20 billion, and this figure grew to an estimated $29 billion by late 2023.

With over $263 million in direct online revenue and likely well over $1 billion in total annual retail, its brand equity remains substantial within the group.

Here is an overview of Eddie Bauer’s estimated annual revenue and brand valuation (net worth) over the past 10 years, from 2015 to 2025:

| Year | Estimated Annual Revenue (USD) | Estimated Brand Net Worth / Valuation (USD) | Key Notes |

|---|---|---|---|

| 2015 | $900 million | $600 million | Under Golden Gate Capital; focus on stabilization after 2009 bankruptcy |

| 2016 | $880 million | $580 million | Revenue dip due to retail competition and weak mall traffic |

| 2017 | $910 million | $600 million | Moderate recovery through catalog and outlet sales |

| 2018 | $930 million | $620 million | Merged with PacSun under PSEB Group |

| 2019 | $950 million | $650 million | Growth through outlet expansion and e-commerce focus |

| 2020 | $865 million | $580 million | COVID-19 impact led to store closures and reduced sales |

| 2021 | $980 million | $700 million | Acquired by Authentic Brands Group and SPARC Group |

| 2022 | $1.05 billion | $800 million | New sustainability focus and tech-driven product updates |

| 2023 | $1.12 billion | $900 million | Strong e-commerce growth and outdoorwear demand |

| 2024 | $1.17 billion | $975 million | Digital revenue hit $263M; store performance improved |

| 2025 | $1.22 billion (projected) | $1.05 billion (estimated) | Now under Catalyst Brands; omnichannel strategy fully implemented |

Catalyst Brands Integration Impact

In January 2025, Eddie Bauer became part of Catalyst Brands, following the merger of SPARC Group and JCPenney. Catalyst launched with over $9 billion in combined annual revenue and more than 1,800 store locations. Eddie Bauer’s inclusion in this consolidated entity provides enhanced scale, shared logistics, and improved financial efficiency, all of which support its revenue growth and brand valuation.

Financial Trajectory & Outlook

Eddie Bauer’s growth hinges on two key pillars: digital expansion and retail optimization. With the support of Catalyst Brands, the company is enhancing its store portfolio, strengthening outlet and wholesale partnerships, and leveraging cross-brand synergies.

If online increases by another 5–10% in 2025, total revenue—when including physical stores, outlets, and wholesale—could exceed $1.2 billion. That would solidify Eddie Bauer as one of ABG’s most valuable and reliable brands.

On the brand valuation side, growth in sales and profitability will continue lifting Eddie Bauer’s share of ABG’s overall $29+ billion enterprise value. Rising digital sales, licensing, and alignment with other heritage brands under Catalyst will likely enhance its long-term worth.

Brands Owned by Eddie Bauer

Below is a detailed breakdown of the major brands and sub-brands owned by Eddie Bauer as of 2025:

| Name | Type | Year Introduced | Description | Operated By |

|---|---|---|---|---|

| FirstAscent | Technical Sub-Brand | 2009 | High-performance gear line designed for professional mountaineers and extreme outdoor conditions. Products are expedition-tested. | Eddie Bauer core brand |

| Eddie Bauer Home | Lifestyle Product Line | Early 2000s | Includes bedding, blankets, bath accessories, and rustic-themed home décor. Designed to reflect outdoor heritage and comfort. | Eddie Bauer core brand |

| Eddie Bauer Baby & Kids | Product Line | Mid 2010s | Apparel, outerwear, and gear for infants and children. Includes strollers, car seats, and winterwear through licensed and owned product lines. | Eddie Bauer (some licensing) |

| Eddie Bauer Outlet | Retail Store Format | 1990s | Network of branded outlet stores selling discounted, past-season, and exclusive inventory. Present in outlet malls across North America. | Eddie Bauer directly |

| Custom & Uniform Program | B2B Service Division | 2000s | Provides corporate uniforms, branded apparel, and custom embroidery for clients in tourism, outdoor services, and hospitality sectors. | Eddie Bauer business unit |

| eCommerce & Catalog Division | Internal Sales Channel | 1990s | Handles online store (eddiebauer.com), catalog sales, email marketing, customer engagement, and logistics for direct-to-consumer orders. | Eddie Bauer internal ops |

Eddie Bauer FirstAscent

FirstAscent is Eddie Bauer’s premier technical performance line. Originally launched in 2009, this sub-brand focuses on professional-grade outdoor gear, alpine jackets, mountaineering clothing, and expedition-tested equipment. It is designed for serious adventurers, climbers, and mountaineers. As of 2025, FirstAscent continues to serve as Eddie Bauer’s flagship product division for high-altitude and extreme-weather performance apparel. The brand is internally operated and represents the company’s commitment to innovation and durability in outdoor gear.

Eddie Bauer Home

Eddie Bauer Home is the company’s lifestyle and home product line. It includes bedding, bath items, blankets, home décor, and outdoor-inspired furnishings. These products are sold through retail partners and online channels under the Eddie Bauer name. The home line reflects the brand’s Pacific Northwest heritage, often featuring plaid patterns, earth-tone palettes, and rustic aesthetics. While not structured as a separate company, Eddie Bauer Home functions as a standalone product division within the broader company framework.

Eddie Bauer Baby & Kids

Eddie Bauer Baby & Kids offers outerwear, apparel, and accessories designed for infants, toddlers, and children. This line has grown significantly in recent years, focusing on durable, functional clothing for outdoor play. It includes insulated parkas, waterproof layers, and fleece collections. The brand also operates a line of baby gear such as car seats, strollers, and diaper bags, which are manufactured under licensing agreements. While these baby products are often sold through third-party retailers, the product development and branding are controlled by Eddie Bauer’s internal teams.

Eddie Bauer Outlet

Eddie Bauer Outlet is a major retail strategy used by the company to move seasonal and discounted inventory. These outlets are operated directly by Eddie Bauer and not franchised or licensed. As of 2025, outlet stores remain a key part of the company’s physical retail footprint across the United States and Canada. They often carry exclusive product lines designed specifically for outlet sales, including simplified styles and past-season collections.

Eddie Bauer Custom & Uniform Programs

Eddie Bauer also operates a custom and corporate uniform division. This business segment provides branded apparel and uniforms for corporate clients, hospitality businesses, and outdoor tour companies. Custom embroidery and logo printing are available through this service, which is managed internally. The division also includes partnerships with travel, tourism, and government agencies for outdoor uniforms and gear.

Eddie Bauer eCommerce & Catalog Division

While not a brand or company in itself, Eddie Bauer’s eCommerce and catalog business operates as a specialized internal unit. It includes the company’s direct-to-consumer website, email marketing, print catalogs, and loyalty programs. This division was historically one of the strongest-performing channels and continues to account for a significant percentage of total revenue in 2025. It functions with its own marketing, customer experience, and logistics teams.

Final Thoughts

The answer to who owns Eddie Bauer is Authentic Brands Group, backed by a powerful group of institutional investors. While Eddie Bauer has changed hands multiple times in the last few decades, it now stands on firmer ground with a scalable operational model and experienced parent companies.

Its legacy in outdoor fashion remains strong, and with new collaborations and sustainability initiatives, the brand continues to stay relevant in the competitive retail landscape.

FAQs

Who owns the Eddie Bauer brand?

As of 2025, the Eddie Bauer brand is owned by Catalyst Brands, a retail holding company formed from the merger of SPARC Group and JCPenney. Catalyst Brands operates Eddie Bauer alongside other well-known retail labels. The brand itself was previously owned by Golden Gate Capital, then Authentic Brands Group and SPARC Group before becoming part of Catalyst.

Why did Eddie Bauer go out of business?

Eddie Bauer never fully went out of business but did face two major bankruptcies—in 2003 and 2009. The 2003 filing was linked to the collapse of its then-parent company, Spiegel Inc. The 2009 Chapter 11 bankruptcy occurred during the global financial crisis due to declining retail sales, excessive debt, and unsustainable operating costs. Despite these challenges, Eddie Bauer continued operations and emerged from both bankruptcies through restructuring and new ownership.

Is Eddie Bauer a German brand?

No, Eddie Bauer is not a German brand. It is an American brand founded in Seattle, Washington, in 1920 by Eddie Bauer himself. The confusion may stem from its historical ownership by Spiegel Inc., a company that was once controlled by the German Otto Group.

Was Bauer owned by Nike?

No, Nike never owned Eddie Bauer. However, Eddie Bauer did partner with Ford in the 1980s and 1990s to release co-branded vehicles like the Eddie Bauer Edition SUVs. Nike has no historical ownership ties to the Eddie Bauer brand.

What is the Eddie Bauer controversy?

While Eddie Bauer has largely maintained a clean reputation, it has faced criticism in the past for issues related to outsourcing, labor conditions at manufacturing facilities, and store closures during bankruptcy periods. Additionally, its involvement in vehicle co-branding and ownership changes drew media attention, but no major legal or public scandals have permanently impacted the brand.

Where was Eddie Bauer founded?

Eddie Bauer was founded in Seattle, Washington, in 1920. The original business began as a small sporting goods store called “Eddie Bauer’s Tennis Shop” before evolving into a brand known for outdoor apparel and gear.

When did Eddie Bauer die?

Eddie Bauer, the founder of the company, died in 1986 at the age of 86. He had sold his interest in the business decades earlier but remained a prominent name in outdoor retail history.

Who bought Eddie Bauer?

Over the years, Eddie Bauer has been bought and sold multiple times:

- In 2003, it was impacted by Spiegel Inc.’s bankruptcy.

- In 2009, it was acquired out of bankruptcy by Golden Gate Capital.

- In 2021, Authentic Brands Group and SPARC Group purchased Eddie Bauer.

- In 2025, Eddie Bauer became part of Catalyst Brands, a group formed after the merger of SPARC and JCPenney.

These ownership transitions have reshaped the brand but preserved its legacy as a major American outdoor apparel company.

Is Eddie Bauer owned by Reebok?

No, both Eddie Bauer and Reebok are owned by Authentic Brands Group, but they are separate brands within the portfolio.

Does Eddie Bauer still exist?

Yes, Eddie Bauer still exists and continues to operate retail stores, outlets, and an online platform.

When did Authentic Brands buy Eddie Bauer?

Authentic Brands Group acquired Eddie Bauer in June 2021.