DoorDash is a leading name in the food delivery industry, but many people still wonder: who owns DoorDash? As the company grows, so does interest in its leadership, shareholders, and corporate structure. This article explores the full ownership details, key executives, and the brands owned by DoorDash.

History of DoorDash

DoorDash was founded in June 2013 by Stanford students Tony Xu, Stanley Tang, Andy Fang, and Evan Moore. Initially called PaloAltoDelivery.com, the company was created to help small businesses reach more customers. It started with food delivery but later expanded into groceries and convenience items.

By 2015, DoorDash had reached 18 U.S. cities. It rapidly grew to become one of the top delivery platforms in North America.

In December 2020, DoorDash went public on the New York Stock Exchange under the ticker symbol DASH.

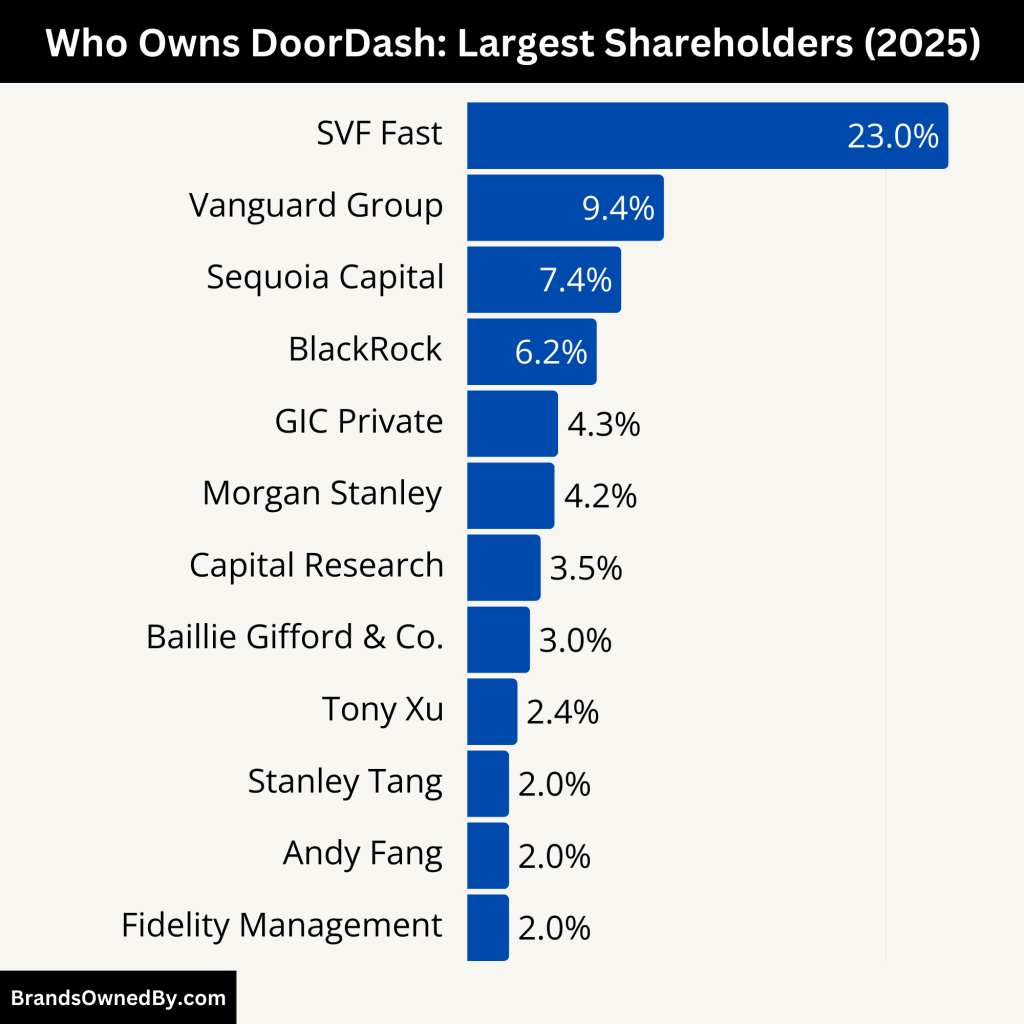

Who Owns DoorDash: List of Shareholders

DoorDash is a publicly traded company. This means it is owned by individual and institutional shareholders who own its stock. The largest shareholder is Tony Xu, the co-founder and CEO. Xu has maintained a strong leadership role and controls significant voting power.

Institutional investors, such as venture capital firms and asset managers, also hold large stakes in the company. These firms helped fund DoorDash’s early growth and still influence company decisions through their shareholding and board presence.

Below is an overview of the major shareholders of DoorDash as of 2025:

| Shareholder Name | Ownership (%) | Type | Notes |

|---|---|---|---|

| Tony Xu | ~2.4% | Individual (Founder/CEO) | Holds over 60% voting power via Class B shares. Most influential figure. |

| SVF Fast (Cayman) Ltd. (SoftBank) | 22.78% | Institutional | Largest shareholder by equity. No super-voting rights. |

| The Vanguard Group, Inc. | ~9.4% | Institutional | Major passive investor via index funds. |

| Sequoia Capital Operations LLC | ~7.36% | Venture Capital | Early investor in DoorDash. Long-term strategic backer. |

| BlackRock, Inc. | ~6.19% | Institutional | Large asset manager with significant voting rights. |

| GIC Private Ltd. (Singapore) | ~4.34% | Sovereign Wealth Fund | Global investor. Signals international confidence. |

| Morgan Stanley Investment Management | ~4.17% | Institutional | Investment via managed funds and indices. |

| Capital Research & Management Co. | ~3.51% | Institutional | Long-term investment firm. Focuses on growth companies. |

| Baillie Gifford & Co. | ~2–3% (est.) | Institutional | Noted for backing long-term innovators. |

| Fidelity Management & Research | <2% | Institutional | Participates via mutual and retirement funds. |

| Stanley Tang | ~1.5–2% (est.) | Individual (Co-founder) | Holds Class B shares. Has enhanced voting rights. |

| Andy Fang | ~1.5–2% (est.) | Individual (Co-founder) | Holds Class B shares. Also retains voting control. |

Tony Xu (CEO and Co-founder)

Tony Xu is DoorDash’s most influential figure. While he owns approximately 2.4% of the company’s total shares, he holds over 60% of the voting power through Class B super-voting shares. This dual-class share structure gives him long-term control over corporate decisions. As co-founder and CEO, his vision has shaped the company since its beginning. Despite a relatively small equity stake, his voting dominance ensures he remains the final decision-maker on major strategic issues.

SVF Fast (Cayman) Ltd. – SoftBank Vision Fund

SoftBank’s Vision Fund, through SVF Fast (Cayman) Ltd., is the largest single shareholder in DoorDash. As of 2025, it owns approximately 96.55 million shares, which translates to 22.78% of total outstanding shares. SoftBank was a key investor in DoorDash’s private funding rounds. Their continued large stake gives them considerable financial interest, although they do not have the same voting power as the founders due to Class A shares.

The Vanguard Group, Inc.

Vanguard is one of the top institutional shareholders in DoorDash. It holds approximately 9.4% of the company’s stock. Vanguard manages this investment across its index and mutual funds. While Vanguard does not actively manage operations, it can influence corporate governance decisions through its proxy voting rights and policy engagement with the board.

Sequoia Capital Operations LLC

Sequoia Capital, a major venture capital firm, was one of DoorDash’s earliest backers. As of 2025, it holds about 7.36% of the company. Sequoia supported DoorDash through multiple funding rounds pre-IPO and continues to be a strategic shareholder. While Sequoia no longer holds board seats, its early support and current stake make it a significant part of the company’s story.

BlackRock, Inc.

BlackRock, the world’s largest asset manager, holds around 6.19% of DoorDash’s shares. Like Vanguard, BlackRock manages large passive investment funds. Its stake reflects institutional confidence in DoorDash’s long-term business model. Through ESG and governance engagement programs, BlackRock may indirectly influence strategic matters, particularly those related to sustainability and risk management.

GIC Private Ltd. (Singapore Sovereign Wealth Fund)

GIC, Singapore’s sovereign wealth fund, owns approximately 4.34% of DoorDash’s equity. GIC’s participation shows growing global institutional interest in U.S. tech-driven delivery platforms. Though it doesn’t actively participate in operations, its investment adds international credibility to DoorDash’s investor base.

Morgan Stanley Investment Management

Morgan Stanley manages about 4.17% of DoorDash’s total shares. This stake is held through various actively managed and index funds. The firm has significant research and analysis capabilities, which influence its investment choices. As with other institutions, it plays a role in corporate governance through voting rights and public accountability expectations.

Capital Research and Management Company

Capital Group, through its subsidiary Capital Research and Management, holds roughly 3.51% of DoorDash. Capital Group typically focuses on long-term investments in growth-oriented companies. Their ongoing investment signals confidence in DoorDash’s market position and future profitability.

Baillie Gifford & Co.

Baillie Gifford, a Scottish investment firm known for backing long-term innovators, also holds a notable minority stake. While the exact percentage as of 2025 is not disclosed, historical data shows they previously owned between 2% and 3%. The firm has supported other high-growth companies such as Tesla and Shopify, making their backing a positive indicator for DoorDash’s innovation prospects.

Fidelity Management & Research

Fidelity, a major mutual fund operator, is among the top 15 shareholders of DoorDash. Though it owns under 2%, Fidelity’s presence adds retail investor access to DoorDash through its actively managed portfolios. It plays a passive but meaningful role in investor sentiment.

Stanley Tang and Andy Fang (Co-founders)

Stanley Tang and Andy Fang, two other co-founders of DoorDash, each own approximately 1.5% to 2% of the company’s shares. They also hold Class B shares, giving them enhanced voting power. Though they are not as publicly visible as Tony Xu, their equity and governance roles remain important in maintaining continuity in leadership and direction.

Who is the CEO of DoorDash?

As of 2025, Tony Xu remains the CEO and co-founder of DoorDash, a position he has held since the company’s inception in 2013. Under his leadership, DoorDash has evolved from a local delivery startup into a global logistics powerhouse, now operating in over 45 countries following its recent acquisition of Deliveroo.

Early Life and Education

Tony Xu was born in Nanjing, China, in 1983/1984. At the age of four, he immigrated to the United States with his parents, settling in Champaign, Illinois. His mother, a doctor in China, worked multiple jobs in the U.S., including as a restaurant server, to support the family. Xu himself worked as a dishwasher in the same restaurant, an experience that later inspired the creation of DoorDash.

Xu earned a Bachelor of Science degree in Industrial Engineering and Operations Research from the University of California, Berkeley. He later obtained an MBA from Stanford University’s Graduate School of Business.

Career and Leadership at DoorDash

Before founding DoorDash, Xu gained experience at several prominent companies, including Square, eBay, PayPal, and McKinsey & Company. In 2013, he co-founded DoorDash with Stanford classmates Stanley Tang and Andy Fang. The company started as PaloAltoDelivery.com and quickly expanded, receiving seed funding from Y Combinator.

Under Xu’s leadership, DoorDash went public in December 2020, raising $3.37 billion in its IPO. He owns approximately 4.6% of the company, with additional options, and holds significant voting power through Class B shares.

In recent years, Xu has overseen major acquisitions to expand DoorDash’s global footprint. Notably, the company acquired Finnish delivery startup Wolt in 2022 and agreed to purchase UK-based Deliveroo for $3.9 billion in 2025.

Personal Life and Philanthropy

Tony Xu is married to Patti Xu, whom he met while they were undergraduates at Berkeley. The couple has two children and resides in San Francisco. They are signatories of the Giving Pledge, committing to donate the majority of their wealth to philanthropic causes.

Xu serves on the boards of several organizations, including Meta Platforms and the Silicon Valley Chinese Association Foundation. He is also an angel investor in various startups, reflecting his commitment to innovation and entrepreneurship.

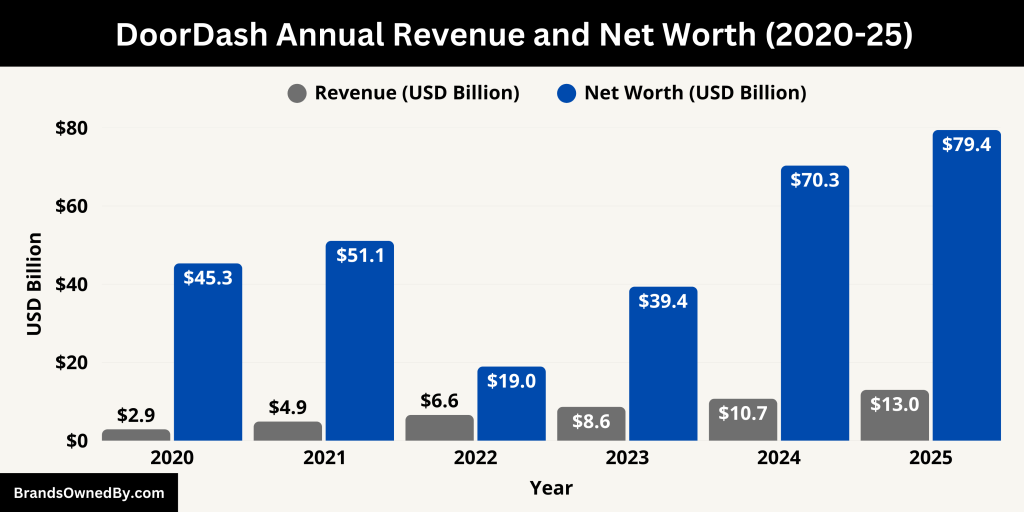

Annual Revenue and Net Worth of DoorDash

In 2024, DoorDash reported an annual revenue of $10.72 billion, marking a 24.2% increase from the previous year. This growth was driven by a 19% year-over-year increase in total orders, reaching 685 million, and a 21% rise in marketplace gross order value (GOV) to $21.3 billion in Q4 2024.

Looking ahead, DoorDash projects continued revenue growth in 2025, with forecasts estimating annual revenues to reach approximately $12.97 billion.

As of May 2025, DoorDash’s market capitalization stands at $82.28 billion, reflecting investor confidence in the company’s sustained growth and profitability.

Below is an overview of the revenue and net worth of DoorDash from 2020-25:

| Year | Revenue (USD) | Market Capitalization (USD) |

|---|---|---|

| 2020 | $2.89 billion | $45.34 billion |

| 2021 | $4.89 billion | $51.08 billion |

| 2022 | $6.58 billion | $18.95 billion |

| 2023 | $8.63 billion | $39.37 billion |

| 2024 | $10.72 billion | $70.34 billion |

| 2025 | $12.97 billion (est.) | $79.44 billion |

Companies Owned by DoorDash

As of 2025, DoorDash has strategically expanded its portfolio through a series of acquisitions and partnerships, enhancing its capabilities in food delivery, hospitality technology, and retail services.

Below is a detailed overview of the major companies and brands under DoorDash’s ownership:

| Company/Brand | Acquisition Year | Purchase Price | Category | Key Details |

|---|---|---|---|---|

| Deliveroo | 2025 | ~$3.9 billion | Food delivery (International) | UK-based; adds presence in 9 new markets; strengthens global expansion |

| SevenRooms | Expected late 2025 | $1.2 billion | Hospitality tech platform | Manages reservations, waitlists, CRM; enhances restaurant tools |

| Wolt | 2022 | $8.1 billion+ | Food & merchandise delivery | Based in Finland; operates in 25 countries and 300+ cities |

| Caviar | 2019 | $410 million | Premium food delivery | Focus on upscale restaurants in urban areas |

| Chowbotics | 2021 | Undisclosed | Food robotics | Known for “Sally” salad robot; brings automation to meal prep |

| Scotty Labs | 2019 | Undisclosed | Autonomous/tele-operations tech | Focus on self-driving and remote delivery vehicle technology |

Deliveroo

In May 2025, DoorDash acquired U.K.-based food delivery company Deliveroo for approximately $3.9 billion. This acquisition significantly expanded DoorDash’s international presence, adding operations in nine countries across Europe, Asia, and the Middle East. Deliveroo’s network of 180,000 riders and its recent profitability made it an attractive addition to DoorDash’s global operations.

SevenRooms

DoorDash announced its agreement to acquire SevenRooms, a New York-based hospitality technology platform, for $1.2 billion. SevenRooms provides tools for restaurant reservations, waitlist management, and customer relationship management, aiming to enhance DoorDash’s merchant services and in-store sales capabilities. The acquisition is expected to close in the latter half of 2025, pending regulatory approvals.

Wolt

In May 2022, DoorDash completed its acquisition of Finnish food delivery company Wolt for over $8.1 billion. Wolt operates in 25 countries and over 300 cities, offering food and merchandise delivery services. Post-acquisition, Wolt continues to operate as a sub-brand of DoorDash in Europe and Asia, maintaining its distinct branding and operations.

Caviar

DoorDash acquired Caviar, a food delivery service specializing in upscale urban-area restaurants, from Square, Inc. for $410 million in October 2019. This acquisition allowed DoorDash to diversify its restaurant offerings and cater to a more premium market segment.

Chowbotics

In February 2021, DoorDash acquired Chowbotics, a robotics company known for its salad-making robot, Sally. This technology enables the preparation of customizable salads and other meals in a compact, automated format, enhancing DoorDash’s capabilities in providing fresh, on-demand meals in various settings.

Scotty Labs

In August 2019, DoorDash acquired Scotty Labs, a tele-operations startup focusing on self-driving and remote-controlled vehicle technology. This acquisition was part of DoorDash’s efforts to explore autonomous delivery solutions and improve logistics efficiency.

Conclusion

So, who owns DoorDash?

The company is publicly owned, with its founders and institutional investors holding the largest shares. Tony Xu, the CEO, remains the most influential figure due to his high voting power.

DoorDash has evolved from a food delivery startup to a multi-service platform with a global footprint. Its growth is backed by strong leadership and strategic acquisitions.

FAQs

Was DoorDash on Shark Tank?

No, DoorDash was never featured on Shark Tank. Although it shares similarities with other startups pitched on the show, DoorDash followed a different path. It was founded in 2013 by Stanford students Tony Xu, Stanley Tang, Andy Fang, and Evan Moore. The company received early support from startup accelerator Y Combinator, not from Shark Tank investors.

Who did DoorDash merge with?

DoorDash has not merged with another company in the traditional sense, but it has made several major acquisitions, including:

- Wolt (2022), a Finnish delivery platform.

- Deliveroo (2025), a UK-based food delivery firm.

- SevenRooms (announced 2025), a hospitality tech platform.

These acquisitions have significantly expanded DoorDash’s global footprint and capabilities.

Does DoorDash own Uber?

No, DoorDash does not own Uber. Uber is a separate, publicly traded company (NYSE: UBER) with its own food delivery service, Uber Eats. In fact, Uber and DoorDash are fierce competitors in the on-demand delivery market.

Who are the largest shareholders of DoorDash?

As of 2025, the largest shareholders of DoorDash include:

- Tony Xu (CEO & Co-founder): ~4.6% ownership with over 69% voting power via Class B shares.

- Stanley Tang (Co-founder): ~1.6% ownership.

- Andy Fang (Co-founder): ~1.5% ownership.

- SoftBank Vision Fund: Significant institutional investor.

- Vanguard Group: ~5.3% ownership.

- BlackRock Inc.: ~4.5% ownership.

- Morgan Stanley and Fidelity (FMR LLC) also hold substantial stakes.

These stakeholders include both founders and institutional investors, with Tony Xu maintaining control through high-voting Class B shares.

What countries is DoorDash in?

As of 2025, DoorDash operates in over 45 countries, including:

- United States (its home market)

- Canada

- Australia

- Germany

- Finland

- Japan

- UK (via Deliveroo acquisition)

- UAE

- France, and more.

Its expansion has been accelerated by acquisitions like Wolt and Deliveroo, both of which had existing international operations.

Is DoorDash owned by Uber?

No, DoorDash is not owned by Uber. They are two independent, publicly traded companies. Both compete in the same space—food and package delivery—but are run separately with different leadership, shareholders, and strategies.

What is the net worth of Evan Moore (DoorDash)?

Evan Moore was one of the original co-founders of DoorDash, but he left the company in its early stages. As of 2025, his net worth is not publicly available. Unlike other co-founders, he did not stay on in an executive or board-level role, and thus, holds far less equity. While he may have benefited financially from the early success, his current holdings and financial status remain private.

What is DoorDash founders’ net worth?

As of 2025:

- Tony Xu (CEO & Co-founder): Estimated net worth is over $2.5 billion. His wealth primarily comes from his equity in DoorDash and other investments. He also owns high-voting Class B shares.

- Stanley Tang: Estimated net worth is around $900 million–$1 billion.

- Andy Fang: Similar to Tang, with a net worth of around $900 million–$1 billion.

These figures are based on DoorDash’s market capitalization and public filings.

Who owns Grubhub and DoorDash?

Grubhub and DoorDash are owned by different companies:

- DoorDash is an independent, publicly traded company (NYSE: DASH).

- Grubhub is owned by Just Eat Takeaway, a European food delivery company based in the Netherlands. Just Eat Takeaway acquired Grubhub in 2021.

They are competitors, not partners.

Is DoorDash a public or private company?

DoorDash is a public company. It trades on the New York Stock Exchange under the ticker symbol DASH.

Who founded DoorDash?

DoorDash was founded by Tony Xu, Stanley Tang, Andy Fang, and Evan Moore in 2013 at Stanford University.

Does Tony Xu still run DoorDash?

Yes, Tony Xu remains the CEO and is actively involved in leading the company.