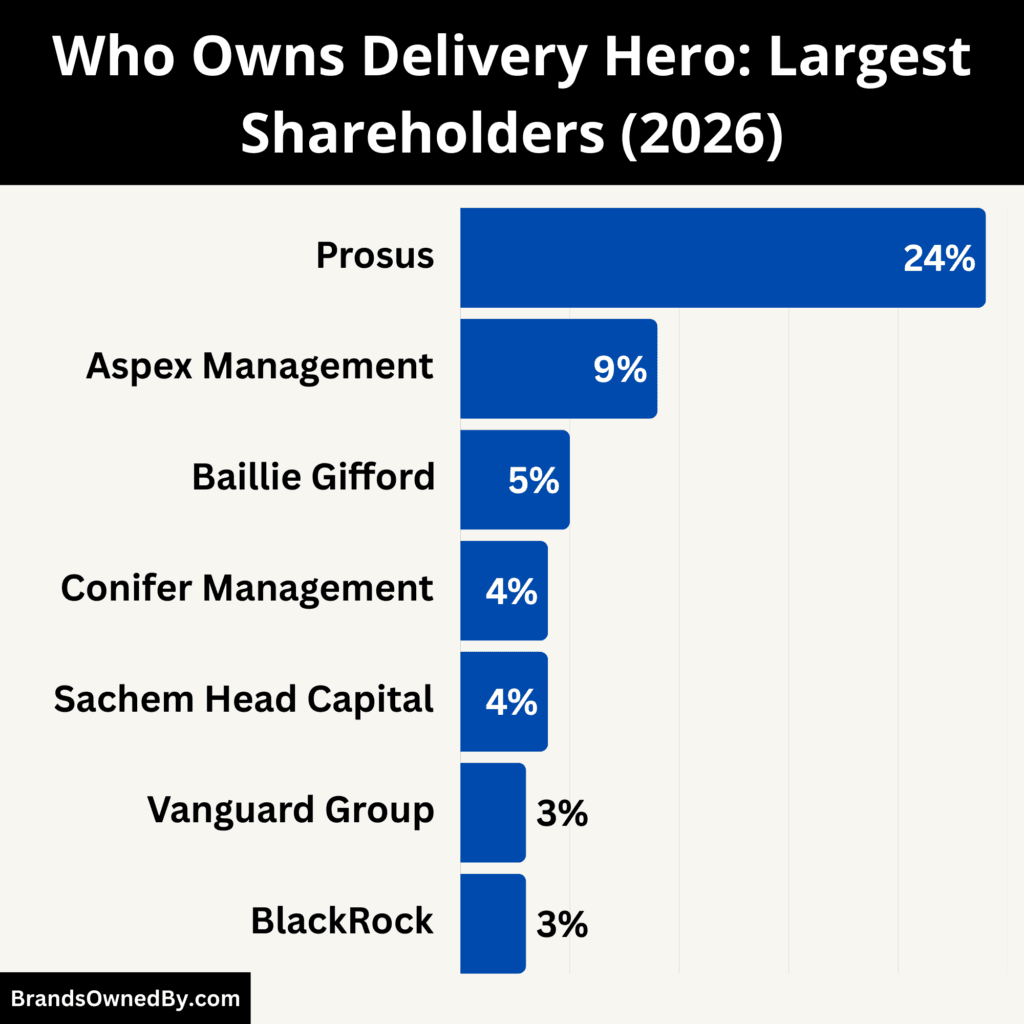

- Delivery Hero is a publicly listed company on the Frankfurt Stock Exchange (ticker: DHER) with no majority owner; its shareholding is institutionally dominated, led by Prosus, which holds 24% of the company.

- Ownership influence is concentrated but not controlling, with major shareholders including Aspex Management holding 9%, Baillie Gifford holding 5%, and Conifer Management holding 4%, all shaping governance through voting rights rather than direct operational control.

- Day-to-day control sits with professional management, led by CEO Niklas Östberg, while shareholders influence long-term strategy through supervisory board oversight and formal governance mechanisms.

- Delivery Hero operates as an institutionally governed global platform, where passive investors such as Vanguard and BlackRock each hold 3%, reinforcing dispersed ownership and preventing any single shareholder from exercising outright control.

Delivery Hero SE is a global online food delivery company headquartered in Berlin, Germany. The company was founded in 2011 and quickly expanded through acquisitions and market entries across Europe, Asia, the Middle East, and Latin America.

Delivery Hero operates a platform model. It connects customers with restaurants and riders. In several markets, it also runs its own logistics and delivery fleets. Over the years, Delivery Hero has shifted from a growth-at-all-costs strategy to a more disciplined focus on profitability, market exits, and regional consolidation.

The company is publicly listed on the Frankfurt Stock Exchange and is part of Germany’s DAX index. This listing plays a major role in how ownership is structured.

Delivery Hero Founders

Delivery Hero was founded in 2011 by Niklas Östberg, Kolja Hebenstreit, Markus Fuhrmann, and Lukasz Gadowski. The company was built with the goal of creating a scalable online food ordering platform that could expand globally through local brands and acquisitions. Among the founders, Niklas Östberg emerged as the key long-term leader and continues to serve as CEO.

Niklas Östberg

Niklas Östberg is the most prominent co-founder of Delivery Hero and the driving force behind its global growth strategy. From the beginning, he focused on building a scalable platform rather than a single-country business. His leadership emphasized rapid market entry, acquisitions, and long-term dominance in emerging delivery markets.

Östberg has remained CEO since the company’s early years. This continuity has given Delivery Hero strategic stability despite frequent market exits, restructurings, and regulatory challenges. His role as both founder and CEO gives him significant influence over company culture, execution, and long-term vision.

Kolja Hebenstreit

Kolja Hebenstreit played an important role in shaping Delivery Hero’s early product development and platform structure. He was closely involved in building the technical and operational foundation during the startup phase.

His contributions were most impactful in the early years when Delivery Hero was focused on launching country-specific platforms and refining its online ordering systems. Over time, his involvement became less visible as the company transitioned into a large multinational organization.

Markus Fuhrmann

Markus Fuhrmann was involved in the company’s formation and early business development. He contributed to strategic planning, partnerships, and initial expansion efforts.

Fuhrmann’s role was particularly relevant during Delivery Hero’s transition from a local startup into a multi-market operator. As the company scaled, operational leadership shifted toward centralized management under the CEO.

Lukasz Gadowski

Lukasz Gadowski brought entrepreneurial experience and early-stage investment insight to Delivery Hero. He was instrumental in the company’s formation and early funding mindset.

His influence helped establish Delivery Hero’s aggressive expansion philosophy, which later became a defining feature of the company’s global strategy. Like other early founders, his direct involvement reduced as the company matured and institutional governance took over.

This founder structure explains why Delivery Hero is often viewed as founder-led in vision but institutionally controlled in ownership and governance. Niklas Östberg remains the central figure linking the company’s startup origins to its current global scale.

Ownership History

Delivery Hero’s ownership history is closely tied to its aggressive expansion strategy and capital-intensive business model. Over time, ownership moved through clear phases, from founder control to venture capital backing, then to public markets, and finally to dominance by a strategic global investor.

2011–2012: Founder-Controlled Startup Phase

Delivery Hero was founded in 2011 in Berlin by Niklas Östberg, Kolja Hebenstreit, Markus Fuhrmann, and Lukasz Gadowski. During this period, ownership was almost entirely held by the founders.

The company operated as a startup focused on building online food ordering platforms in European cities. All major decisions were made by the founders, and there were no large external shareholders with governance influence.

2012–2014: Early Venture Capital Entry

Between 2012 and 2014, Delivery Hero raised multiple funding rounds from venture capital firms. These rounds marked the first major ownership dilution for the founders.

Investors entered to fund rapid geographic expansion across Europe and early moves into emerging markets. Founder ownership declined but remained dominant, especially through management control. At this stage, Delivery Hero was still privately held, but no longer fully founder-owned.

2014–2016: Strategic Investors and Aggressive Expansion

From 2014 onward, Delivery Hero accelerated acquisitions, including PedidosYa in Latin America and Yemeksepeti in Turkey. These deals required substantial capital.

During this phase, strategic investors became more prominent in the shareholder structure. Ownership became more fragmented, and the founders’ combined stake fell further. Control increasingly shifted toward a board-driven governance model, although founders remained central to operations.

By 2016, Delivery Hero had one of the most complex ownership structures among European tech startups, with multiple institutional investors holding meaningful stakes.

2017: Initial Public Offering

In June 2017, Delivery Hero completed its initial public offering on the Frankfurt Stock Exchange. This was a major turning point in its ownership history.

The IPO transformed Delivery Hero into a publicly owned company. Shares became widely held by institutional and retail investors. Founder ownership was significantly diluted as public shareholders entered the register.

After the IPO, no individual or founder held a controlling stake. Ownership was dispersed, with voting power spread across institutional investors.

2018–2019: Post-IPO Institutional Dominance

Following the IPO, global asset managers and institutional investors increased their exposure to Delivery Hero. Trading liquidity allowed early investors to partially exit or rebalance their holdings.

During this period, Delivery Hero also exited some markets, including selling its German food delivery operations. These strategic changes did not significantly alter ownership concentration but reinforced institutional influence over governance.

Founder ownership continued to decline in percentage terms, though Niklas Östberg retained strong influence as CEO.

2020–2021: Entry and Expansion of Prosus

A major ownership shift occurred between 2020 and 2021 with the growing involvement of Prosus. Prosus began building a substantial stake in Delivery Hero through a mix of strategic transactions and market purchases.

By 2021, Prosus had become the largest single shareholder. Its position reflected long-term strategic interest rather than short-term financial investment, given its broader exposure to global food delivery platforms.

This marked the first time Delivery Hero had a dominant anchor shareholder since its early founder days.

2022–2023: Consolidation Around a Strategic Shareholder

During 2022 and 2023, Prosus maintained its position as the largest shareholder while other institutional investors adjusted their holdings. No takeover occurred, but Prosus’ influence increased through its size and board-level engagement.

Ownership became more stable. Founder stakes were relatively small compared to institutional holdings, but leadership continuity ensured operational consistency.

2024–2026: Mature Public Ownership Structure

By 2024 and 2025, Delivery Hero’s ownership structure had largely settled. The shareholder base consisted mainly of large institutional investors, with Prosus as the leading strategic shareholder and retail investors holding a smaller portion through public markets.

Founder ownership was no longer material in percentage terms, but founder control remained visible through executive leadership. The company operated as a mature public entity, balancing shareholder expectations with long-term strategic planning.

Who Owns Delivery Hero: Top Shareholders

Delivery Hero SE is a publicly listed company headquartered in Berlin, Germany. It is listed on the Frankfurt Stock Exchange and trades under the ticker symbol DHER. The company is also a constituent of Germany’s DAX index, which places it among the country’s largest publicly traded corporations.

As of January 2026, Delivery Hero has no majority owner. Its shares are widely held, with ownership dominated by institutional investors, strategic shareholders, and global asset managers. The largest shareholder is Prosus, but it does not control the company outright. Founder ownership is limited, and management does not hold a controlling stake.

Delivery Hero is therefore institutionally owned and professionally governed. Strategic influence is exercised through shareholder voting rights, supervisory board oversight, and long-term institutional participation rather than through a single controlling individual or family.

Prosus

Prosus is the largest shareholder of Delivery Hero as of January 2026 and remains the most influential single investor in the company.

Prosus owns approximately 24% of Delivery Hero’s outstanding shares, making it the clear anchor shareholder. This position was built over several years as part of Prosus’ broader strategy to invest in global food delivery and online marketplace platforms. Although Prosus does not hold a majority stake, its ownership level gives it substantial voting power and strategic influence, particularly in matters involving board oversight, long-term capital allocation, and major corporate decisions. No other shareholder comes close to matching Prosus’ level of influence.

Aspex Management

Aspex Management is the second-largest shareholder of Delivery Hero as of January 2026 and represents one of the most powerful non-strategic investors in the company.

Aspex controls close to 9% of Delivery Hero’s shares, a position large enough to meaningfully influence shareholder votes. The firm is known for taking concentrated stakes and actively engaging with management teams. In Delivery Hero’s case, Aspex has been associated with pushing for stronger operational discipline, improved efficiency, and clearer paths toward sustainable profitability. While it does not control the company, its stake gives it leverage, especially when aligned with other institutional investors.

Baillie Gifford

Baillie Gifford is a major long-term institutional shareholder in Delivery Hero and holds roughly 5% of the company’s shares as of January 2026.

The firm follows a growth-focused investment approach and is known for supporting companies with global scale ambitions. Baillie Gifford’s stake reflects confidence in Delivery Hero’s long-term platform strategy rather than short-term restructuring. Unlike activist funds, it typically does not push aggressively for immediate changes, making it a stabilizing force within the shareholder base.

Conifer Management

Conifer Management owns an estimated 4% to 5% stake in Delivery Hero as of January 2026, placing it among the company’s most significant institutional shareholders.

Conifer operates as an engaged investor with a focus on governance quality and shareholder value creation. Although it maintains a lower public profile than activist hedge funds, its ownership position gives it meaningful influence in voting outcomes related to supervisory board appointments, executive compensation, and strategic resolutions.

Sachem Head Capital

Sachem Head Capital is another notable shareholder, holding approximately 3% to 4% of Delivery Hero’s shares as of January 2026.

The firm is widely recognized as an activist investor. Its presence in the shareholder register has increased pressure on Delivery Hero’s leadership to simplify operations, sharpen execution, and unlock value from regional assets. Despite owning a smaller percentage than some other institutions, Sachem Head’s influence is amplified by its activist approach and history of engaging directly with company leadership.

Vanguard Group

The Vanguard Group is one of the largest passive shareholders of Delivery Hero, with ownership in the range of about 3% as of January 2026.

Vanguard’s stake is held primarily through index funds and exchange-traded funds that track major European and global equity indices. While Vanguard does not engage in activism, its voting power is significant. Its governance decisions often play a decisive role in shareholder votes when combined with other institutional holders.

BlackRock

BlackRock holds a stake of roughly 3% in Delivery Hero as of January 2026, largely through passive and semi-passive investment vehicles.

Similar to Vanguard, BlackRock’s influence comes from proxy voting rather than direct strategic involvement. As one of the world’s largest asset managers, its voting policies on governance, board independence, and executive pay carry considerable weight in shareholder meetings.

Other Institutional Investors

Beyond the largest named shareholders, Delivery Hero’s ownership is further distributed among global investment firms such as UBS Asset Management, Morgan Stanley Investment Management, pension funds, and various hedge funds. Individually, these investors typically hold stakes below 3%, but collectively they represent a substantial portion of the company’s free float.

This broad institutional participation reinforces Delivery Hero’s status as an institutionally owned public company rather than a founder-controlled business.

Competitor Ownership Comparison

Delivery Hero’s ownership structure becomes clearer when compared with other major global food delivery platforms. While most leading players are publicly listed and institutionally owned, the degree of strategic control, founder influence, and presence of anchor shareholders varies significantly.

| Company | Ownership Structure | Largest Influencing Shareholder | Founder Control | Strategic Control Model |

|---|---|---|---|---|

| Delivery Hero SE | Publicly listed, institutionally dominated | Prosus (24%) | Limited | Strategic anchor investor combined with institutional governance |

| Uber Technologies (Uber Eats) | Publicly listed parent company | No dominant shareholder | Minimal | Parent-company control within a diversified global platform |

| DoorDash | Publicly listed, founder-influenced | Founder-led voting power | Strong | Founder-led governance with institutional backing |

| Just Eat Takeaway | Publicly listed, fragmented ownership | No single dominant shareholder | Very limited | Broad institutional ownership with dispersed control |

| Meituan | Publicly listed with strategic tech backing | Tencent (major strategic investor) | Limited | Strategic ecosystem-driven control with domestic dominance |

| Zomato | Publicly listed, mixed institutional ownership | Large institutional investors | Moderate | Institutionally guided with residual founder influence |

Delivery Hero vs Uber Eats

Uber Technologies owns and operates Uber Eats as part of its broader mobility and delivery ecosystem.

Uber Technologies is a publicly listed company with highly dispersed ownership. No single shareholder holds a dominant stake comparable to Prosus’ position in Delivery Hero. Ownership is spread across institutional investors, passive asset managers, and public shareholders. Founders and early executives no longer hold controlling positions.

Compared to Delivery Hero, Uber Eats operates under a parent company with diversified revenue streams. This reduces reliance on food delivery alone and gives Uber Eats strategic backing that Delivery Hero does not have. However, Delivery Hero benefits from having a dedicated strategic shareholder focused specifically on delivery and marketplaces rather than a conglomerate structure.

Delivery Hero vs DoorDash

DoorDash is a publicly traded company listed in the United States.

DoorDash’s ownership is dominated by institutional investors, but founder influence remains more visible than at Delivery Hero. Founder Tony Xu retains meaningful voting power through share ownership and leadership roles. While no single institutional investor controls DoorDash, founder-led governance plays a stronger role than at Delivery Hero.

In contrast, Delivery Hero has limited founder ownership and is more institutionally controlled. Strategic influence comes from Prosus and large funds rather than from a founder voting block. This makes Delivery Hero less founder-driven but more aligned with institutional governance norms.

Delivery Hero vs Just Eat Takeaway

Just Eat Takeaway is publicly listed in Europe and has a shareholder base similar in structure to Delivery Hero.

Just Eat Takeaway does not have a single dominant strategic shareholder. Its ownership is fragmented across institutional investors and public shareholders. Founder influence has significantly diminished following mergers and restructuring.

Compared to Just Eat Takeaway, Delivery Hero stands out due to the presence of Prosus as a large anchor investor. This gives Delivery Hero more concentrated strategic oversight, whereas Just Eat Takeaway’s governance is shaped by a broader and more fragmented investor base.

Delivery Hero vs Meituan

Meituan is one of the world’s largest food delivery and local services platforms and is listed in Hong Kong.

Meituan’s ownership structure is heavily influenced by Chinese technology investors and long-term institutional shareholders. Tencent is a major strategic shareholder, providing ecosystem integration and long-term backing.

This structure is comparable to Delivery Hero’s relationship with Prosus. Both companies benefit from having a powerful strategic investor with deep industry experience. However, Meituan operates with stronger domestic market dominance, while Delivery Hero is more geographically diversified but faces higher complexity across regions.

Delivery Hero vs Zomato

Zomato is a publicly listed company in India with a mixed ownership structure.

Zomato’s ownership includes large institutional investors, domestic funds, and strategic shareholders, but no single investor holds a stake as influential as Prosus’ holding in Delivery Hero. Founder ownership exists but is not controlling.

Compared to Zomato, Delivery Hero has a more concentrated top-tier ownership profile. This concentration can lead to clearer long-term strategic alignment but also increases sensitivity to decisions made by its largest shareholder.

Key Differences in Ownership Models

Across the global food delivery sector, Delivery Hero is unusual for having a single strategic shareholder with a stake approaching one-quarter of the company. Most competitors rely on either founder influence, diversified institutional ownership, or parent-company control.

Delivery Hero sits between these models. It is not founder-controlled like DoorDash, not subsidiary-driven like Uber Eats, and not fully fragmented like Just Eat Takeaway. Its ownership structure reflects a hybrid model where institutional governance is anchored by a powerful strategic investor.

This ownership comparison explains why Delivery Hero often takes a longer-term, portfolio-driven approach to markets. Prosus’ presence encourages strategic patience and selective consolidation, while institutional investors push for efficiency and returns.

Compared to its peers, Delivery Hero faces higher scrutiny but also benefits from strategic stability. This balance shapes how the company competes globally and responds to pressure in an increasingly competitive food delivery landscape.

Who Controls Delivery Hero?

Control at Delivery Hero is not determined by ownership alone. While large shareholders influence long-term strategy, day-to-day and strategic control is exercised through executive leadership, a formal governance structure, and board oversight. Delivery Hero follows a German two-tier governance model, which clearly separates management from supervision.

Management Control and Executive Leadership

Operational control of Delivery Hero SE sits with its Management Board. This board is responsible for running the company, setting strategy, executing expansion or exits, and managing regional businesses.

The most powerful individual within this structure is the Chief Executive Officer.

Role of the CEO

Niklas Östberg is the CEO of Delivery Hero and the central figure in controlling the company’s direction. He has held the CEO role since the company’s early years and is also one of its original founders.

As CEO, Östberg oversees global strategy, capital allocation, acquisitions, divestments, and operational priorities. His long tenure provides continuity and deep institutional knowledge. Even though his personal shareholding is small compared to institutional investors, his executive authority gives him substantial control over how the company operates.

In practice, Delivery Hero functions as a founder-led company from an operational standpoint, despite being institutionally owned from an equity perspective.

Management Board Structure

The Management Board consists of senior executives responsible for specific functions such as operations, technology, finance, and regional performance. These executives report to the CEO and collectively execute the company’s strategy.

This structure allows Delivery Hero to manage dozens of markets simultaneously while maintaining centralized decision-making. Major operational decisions, such as market exits, brand consolidations, and investment priorities, are approved at this level.

Supervisory Board Oversight

Delivery Hero operates under Germany’s two-tier board system. Above the Management Board sits the Supervisory Board.

The Supervisory Board does not run daily operations. Instead, it oversees management, approves major strategic decisions, appoints and removes Management Board members, and represents shareholder interests.

Large shareholders, particularly Prosus and major institutional investors, exert influence through their representation and voting power at the Supervisory Board level. This is where ownership translates into governance control rather than operational command.

Influence of Major Shareholders

While Prosus is the largest shareholder, it does not directly manage Delivery Hero. Its influence is exercised through board oversight, voting rights, and strategic alignment rather than executive control.

Other institutional investors, including activist and long-term funds, also shape governance outcomes through shareholder votes. When these investors align, they can influence board composition, executive compensation, and strategic direction.

This creates a balance of power. Management leads execution, while shareholders influence accountability and long-term priorities.

Past CEOs and Leadership Continuity

Unlike many fast-growing technology companies, Delivery Hero has not seen frequent CEO turnover. Niklas Östberg has remained the CEO throughout the company’s public life, including its IPO, global expansion, and restructuring phases.

This continuity has strengthened executive control and reduced leadership disruption. There have been no external CEOs replacing the founder, which reinforces the company’s founder-led operational culture.

How Control Works in Practice

In practical terms, Delivery Hero is controlled through a combination of strong executive leadership and institutional governance.

The CEO and Management Board control daily operations and strategic execution. The Supervisory Board, influenced by major shareholders, provides oversight and approval authority. Shareholders do not micromanage the business but can shape outcomes through governance mechanisms.

Delivery Hero Annual Revenue and Net Worth

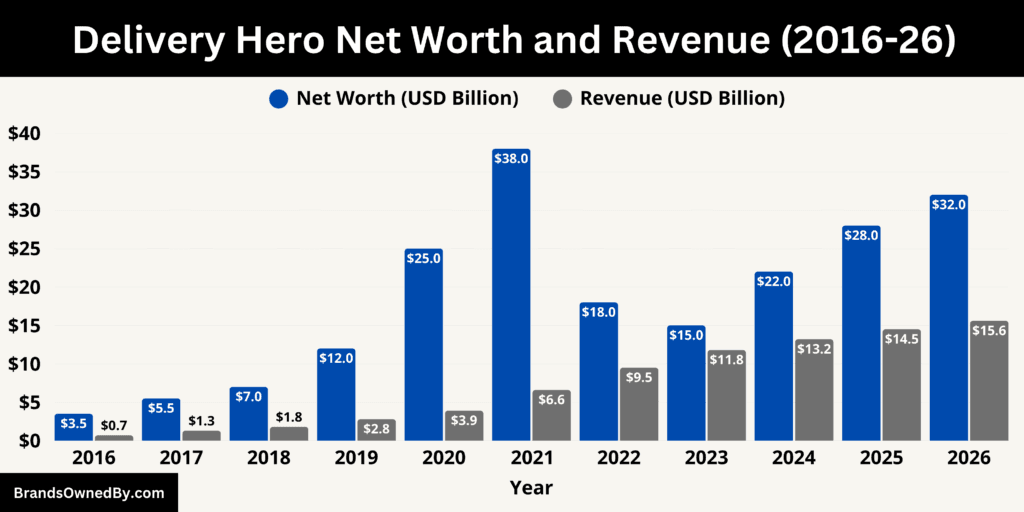

Delivery Hero SE continues to scale as one of the world’s largest food delivery platforms. As of January 2026, the company generates approximately $15.6 billion in annual revenue and has an estimated net worth (market capitalization) of about $32 billion. These figures reflect a more mature phase for Delivery Hero, marked by slower but more sustainable growth, tighter cost controls, and a stronger focus on profitable regions.

Revenue Breakdown

Delivery Hero’s 2026 revenue is diversified across multiple income streams rather than relying on a single source. This diversification has become a critical stabilizing factor for the business.

A large portion of revenue comes from restaurant and merchant commissions, which account for roughly $8.5 billion. These commissions are earned by charging partner restaurants a percentage fee for each order placed through Delivery Hero’s platforms. Commission rates vary by region, logistics involvement, and brand maturity.

Delivery and service fees paid by customers contribute approximately $4.1 billion. These fees are charged directly to users for order fulfillment, surge pricing during peak hours, and premium delivery options. Markets with in-house logistics, such as the Middle East and parts of Asia, contribute disproportionately to this category.

Advertising and sponsored listings generate an estimated $1.8 billion in 2026. Restaurants and merchants pay for higher visibility within apps like Talabat and foodpanda. This segment has grown rapidly and carries higher margins than core delivery revenue.

Quick commerce and non-food delivery, including groceries, convenience items, and dark-store fulfillment, contribute around $1.2 billion. While still margin-sensitive, this segment has become strategically important in dense urban markets.

Regionally, Asia and the Middle East together account for nearly half of total revenue, driven by high order density and logistics penetration. Europe contributes a smaller but more stable share, while Latin America continues to grow steadily through PedidosYa.

Net Worth and Valuation 2026

Delivery Hero’s estimated net worth of $32 billion as of January 2026 is driven by a combination of operational performance, asset portfolio value, and investor expectations rather than earnings alone.

Approximately $18–20 billion of the valuation is attributed to its core food delivery platforms, including Talabat, foodpanda, and PedidosYa. These brands are valued based on order volume, market leadership, and improving margin profiles.

Roughly $6–7 billion of market value is linked to growth assets such as quick commerce operations, proprietary logistics infrastructure, and technology platforms that support routing, pricing, and merchant tools.

The remaining $5–6 billion reflects strategic optionality. This includes the potential monetization of regional businesses, future spin-offs, or partial listings, as well as Delivery Hero’s ability to generate sustained free cash flow over time.

Unlike earlier years, Delivery Hero’s valuation in 2026 is less speculative. It is increasingly tied to cash flow visibility, regional profitability, and disciplined capital deployment.

Revenue vs Valuation Alignment

In previous years, Delivery Hero’s revenue growth and net worth moved out of sync, particularly during the 2021 valuation peak. In 2026, the relationship has become more balanced. Revenue growth remains steady, while valuation reflects execution quality rather than aggressive expansion assumptions.

This alignment suggests that Delivery Hero is transitioning from a high-risk growth stock to a more structurally valued global platform company.

Future Revenue Forecast (2027–2030)

Based on current operational trends, regional performance, and monetization improvements, Delivery Hero’s revenue outlook through 2030 can be projected as follows:

- 2027: Revenue expected to reach approximately $16.8 billion, driven by higher advertising penetration and improved order economics in core markets.

- 2028: Revenue projected at around $18.2 billion, supported by expanded non-food delivery and increased order frequency per user.

- 2029: Revenue forecast to approach $19.7 billion, assuming continued margin optimization and stable demand across Asia and the Middle East.

- 2030: Revenue could exceed $21 billion, with growth primarily coming from monetization improvements rather than new market entries.

By 2030, Delivery Hero is expected to operate as a more predictable and financially disciplined business. Revenue growth is likely to be incremental rather than explosive, but valuation stability should improve as profitability and cash flow become central to investor assessment.

This evolution positions Delivery Hero as a long-term global delivery infrastructure company rather than a short-term expansion-driven platform.

Companies Owned by Delivery Hero

Delivery Hero SE operates through a portfolio of regionally dominant brands rather than a single global consumer-facing name. This strategy allows the company to localize operations, comply with regional regulations, and maintain strong market leadership in diverse geographies.

As of 2026, Delivery Hero directly owns and operates the following companies, brands, and entities:

| Company / Brand Name | Entity Type | Primary Regions | Core Function | Ownership Status | Strategic Importance |

|---|---|---|---|---|---|

| foodpanda | Consumer delivery platform | Asia, Eastern Europe, Middle East | Restaurant delivery, groceries, quick commerce | Fully owned | Major growth engine with strong leadership in emerging markets |

| Talabat | Consumer delivery platform | Middle East | Restaurant delivery, groceries, quick commerce | Fully owned | Most profitable regional operation |

| PedidosYa | Consumer delivery platform | Latin America | Food delivery, groceries, courier services | Fully owned | Anchor brand for Latin America |

| Yemeksepeti | Consumer delivery platform | Turkey | Food delivery, groceries | Fully owned | Market leader in Turkey |

| Woowa Brothers (Baemin) | Operating company | South Korea | Food delivery, logistics | Fully owned | One of Delivery Hero’s largest acquisitions |

| foodora | Consumer delivery platform | Europe | Food delivery, groceries | Fully owned | Maintains European market presence |

| Glovo | Multi-category delivery platform | Southern Europe, Africa | Food, grocery, courier delivery | Majority-owned, fully consolidated | Expands reach into Southern Europe and Africa |

| pandamart | Quick commerce brand | Asia, Eastern Europe | Grocery and essentials delivery | Fully owned | Core dark-store grocery brand |

| Talabat Mart | Quick commerce brand | Middle East | Grocery and convenience delivery | Fully owned | High-frequency, high-margin unit |

| Yemeksepeti Banabi | Quick commerce brand | Turkey | Rapid grocery delivery | Fully owned | Expands non-food order frequency |

| PedidosYa Market | Quick commerce brand | Latin America | Grocery and essentials delivery | Fully owned | Strengthens local commerce offering |

| foodora Market | Quick commerce brand | Europe | Grocery and convenience delivery | Fully owned | Supports urban quick commerce |

| Delivery Hero Logistics | Logistics entity | Global | Rider fleets, dispatch, last-mile delivery | Fully owned | Core operational backbone across markets |

| foodpanda Logistics | Logistics entity | Asia | Rider operations and delivery infrastructure | Fully owned | Enables fast delivery and service quality |

| Talabat Logistics | Logistics entity | Middle East | Rider fleet and dispatch operations | Fully owned | Supports high-volume, high-margin markets |

| DH Tech | Technology entity | Global | Core apps, dispatch systems, merchant tools | Fully owned | Centralized technology backbone |

| DH Pay | Fintech entity | Global | Payments, wallets, settlements, refunds | Fully owned | Handles transaction processing and monetization |

| Delivery Hero Data & AI | Technology entity | Global | Forecasting, pricing, personalization | Fully owned | Drives efficiency, ads, and growth optimization |

Foodpanda

Foodpanda is one of Delivery Hero’s largest and most strategically important brands. It operates primarily across Asia, Eastern Europe, and selected Middle Eastern markets.

Foodpanda is a core growth engine for Delivery Hero. It combines restaurant delivery, grocery delivery, and quick commerce under one platform. The brand has deep logistics integration, including rider fleets and dark stores in high-density cities. In markets such as Pakistan, Bangladesh, Thailand, and Taiwan, foodpanda holds strong market leadership and plays a central role in Delivery Hero’s revenue generation.

Talabat

Talabat is Delivery Hero’s flagship brand in the Middle East and one of its most profitable operations globally.

Talabat operates across countries including the UAE, Saudi Arabia, Kuwait, Bahrain, Qatar, and Oman. The brand benefits from high order frequency, strong consumer spending, and advanced logistics penetration. Talabat has expanded beyond food into groceries, pharmacies, and convenience items, making it a cornerstone of Delivery Hero’s long-term profitability strategy.

PedidosYa

PedidosYa is Delivery Hero’s primary brand in Latin America.

The platform operates across multiple countries, including Argentina, Uruguay, Chile, Bolivia, and Paraguay. PedidosYa has evolved from a food-only marketplace into a broader delivery platform offering groceries, courier services, and local commerce. Latin America remains a competitive but strategically important region for Delivery Hero, with PedidosYa serving as its regional anchor.

Yemeksepeti

Yemeksepeti is the dominant food delivery brand in Turkey and one of Delivery Hero’s longest-held assets.

The company has a strong brand legacy and high market penetration. Yemeksepeti operates both restaurant delivery and quick commerce services. Despite economic volatility in Turkey, the brand remains strategically valuable due to its scale, user base, and entrenched market position.

Woowa Brothers (Baemin)

Woowa Brothers operates Baemin, commonly known as Baedal Minjok, in South Korea.

This acquisition represents one of Delivery Hero’s largest and most complex investments. South Korea is a highly competitive and mature delivery market with strong unit economics but intense rivalry. Woowa Brothers operates with significant autonomy while remaining fully consolidated within Delivery Hero’s financials. The brand is central to Delivery Hero’s presence in East Asia.

Foodora

Foodora is Delivery Hero’s key brand in parts of Europe.

Foodora operates in markets such as Austria, Sweden, Finland, and Norway. It focuses on urban logistics and fast delivery, often integrating quick commerce and grocery offerings. While Europe is no longer Delivery Hero’s main growth engine, foodora remains important for maintaining a strategic foothold in high-income urban markets.

Glovo

Glovo is majority-owned by Delivery Hero and fully consolidated into its operations as of 2026.

Glovo operates across Southern Europe, Africa, and parts of Eastern Europe. The platform offers food delivery, grocery delivery, and courier services. Glovo significantly expands Delivery Hero’s footprint in markets such as Spain, Italy, Morocco, and Nigeria. Its operational integration strengthens Delivery Hero’s presence in multi-category delivery.

Pandamart

Pandamart is Delivery Hero’s dedicated quick commerce and grocery delivery brand operated under the foodpanda ecosystem.

Pandamart runs a network of dark stores across Asia and selected European markets, including Pakistan, Bangladesh, Thailand, Taiwan, Malaysia, and parts of Eastern Europe. These stores are fully owned and operated by Delivery Hero and stock groceries, fresh produce, household essentials, and personal care items. Pandamart is tightly integrated with foodpanda’s rider fleet and app, enabling ultra-fast delivery windows in dense urban areas.

Talabat Mart

Talabat Mart is the quick commerce arm of Talabat and one of Delivery Hero’s most profitable non-food entities.

Talabat Mart operates dark stores across the UAE, Saudi Arabia, Kuwait, Qatar, and Bahrain. These stores specialize in groceries, snacks, beverages, and everyday essentials. Unlike restaurant delivery, Talabat Mart offers higher order frequency and stronger customer retention, making it a strategic growth and margin expansion driver within the Middle East region.

Yemeksepeti Banabi

Yemeksepeti Banabi is Delivery Hero’s rapid grocery and essentials delivery brand in Turkey.

Banabi operates a large network of dark stores across major Turkish cities and offers groceries, fresh food, and convenience items. It is deeply integrated into the Yemeksepeti app and leverages Delivery Hero’s logistics infrastructure. Banabi has become one of the most recognized quick commerce brands in Turkey and plays a key role in increasing order frequency beyond restaurant meals.

PedidosYa Market

PedidosYa Market is Delivery Hero’s quick commerce and grocery delivery operation in Latin America.

PedidosYa Market operates dark stores in countries such as Argentina, Uruguay, and Chile. It focuses on fast delivery of groceries, household goods, and daily essentials. The brand strengthens Delivery Hero’s position in Latin America by expanding beyond food delivery and improving customer lifetime value.

Foodora Market

Foodora Market is Delivery Hero’s grocery and convenience delivery brand in parts of Europe.

Foodora Market operates dark stores in markets including Austria and the Nordics. It complements foodora’s restaurant delivery service and allows Delivery Hero to maintain relevance in competitive European urban markets by offering rapid grocery delivery alongside meals.

Delivery Hero Logistics

Delivery Hero SE directly owns and operates logistics entities across multiple markets under centralized and local structures commonly referred to internally as Delivery Hero Logistics or DH Logistics.

These logistics operations are not a standalone consumer brand but are embedded within regional platforms such as foodpanda Logistics, Talabat Logistics, PedidosYa Logistics, and Yemeksepeti Delivery Services.

Delivery Hero owns rider fleet management systems, dispatch infrastructure, route optimization tools, and last-mile delivery operations in markets where it follows a logistics-led model. These entities manage courier onboarding, scheduling, performance tracking, and service quality. In high-density markets such as the Middle East and Asia, logistics operations are fully integrated and represent a core operational asset rather than a support function.

This direct ownership allows Delivery Hero to control delivery times, reliability, and cost structures, which is a major differentiator versus pure marketplace competitors.

Delivery Hero Technology Platforms

Delivery Hero owns and operates its proprietary global technology stack under centralized internal entities often referred to as Delivery Hero Tech or DH Tech.

These technology entities develop and maintain the core ordering platform, mobile applications, merchant dashboards, rider dispatch systems, pricing engines, and advertising tools used across all regional brands. The same underlying technology powers platforms such as foodpanda, Talabat, PedidosYa, Yemeksepeti, foodora, and Glovo, with localized adaptations layered on top.

Delivery Hero also owns internal payment and financial technology systems commonly referred to as DH Pay, which support in-app payments, wallet services, refunds, promotions, and merchant settlements. These systems are critical for handling large transaction volumes across multiple currencies and regulatory environments.

In addition, Delivery Hero operates centralized data, analytics, and machine-learning platforms that drive demand forecasting, dynamic pricing, personalized recommendations, and advertising placement. These technology entities are fully owned by Delivery Hero and represent long-term strategic infrastructure rather than market-facing brands.

Final Words

Delivery Hero operates as a globally scaled, publicly listed company with a clear separation between ownership and control. When people search who owns Delivery Hero, they are really asking how influence is distributed across shareholders, leadership, and governance.

The company’s structure reflects institutional ownership, professional management, and a strong portfolio of regional brands rather than reliance on a single owner or founder stake. This model has allowed Delivery Hero to grow, adapt, and compete across diverse markets while maintaining long-term strategic flexibility.

FAQs

Who are the main shareholders of Delivery Hero?

The main shareholders of Delivery Hero SE are institutional and strategic investors. Prosus is the largest shareholder with a 24% stake. Other major shareholders include Aspex Management (9%), Baillie Gifford (5%), Conifer Management (4%), and passive asset managers such as Vanguard (3%) and BlackRock (3%). No single shareholder has majority control.

What are the major Delivery Hero subsidiaries?

Major subsidiaries and operating brands owned by Delivery Hero include foodpanda, Talabat, PedidosYa, Yemeksepeti, Woowa Brothers (Baemin), foodora, and Glovo. The company also operates quick commerce brands such as pandamart, Talabat Mart, Yemeksepeti Banabi, PedidosYa Market, and foodora Market.

Where is the headquarters of Delivery Hero?

Delivery Hero is headquartered in Berlin, Germany. The company operates globally but is legally domiciled and managed from Germany.

Is Talabat owned by Delivery Hero?

Yes. Talabat is fully owned and operated by Delivery Hero. It is the company’s flagship brand in the Middle East and one of its most profitable businesses.

Does Delivery Hero own foodpanda?

Yes. foodpanda is fully owned by Delivery Hero. It operates across Asia, Eastern Europe, and selected Middle Eastern markets and is one of Delivery Hero’s largest global brands.

Who acquired Delivery Hero?

Delivery Hero has not been acquired. It is an independent, publicly listed company traded on the Frankfurt Stock Exchange. While Prosus is the largest shareholder, it does not own or control Delivery Hero outright.

Who is the CEO of Delivery Hero?

The CEO of Delivery Hero is Niklas Östberg. He is also one of the company’s co-founders and has led the business since its early years.

Which country owns Delivery Hero?

No country owns Delivery Hero. It is a German-headquartered public company with international shareholders. Ownership is distributed among global institutional and strategic investors.

Did Delivery Hero buy HungerStation?

Yes. Delivery Hero acquired HungerStation, a leading food delivery platform in Saudi Arabia. HungerStation operates as part of Delivery Hero’s Middle East portfolio alongside Talabat.