- The Daily Mail is owned by Daily Mail and General Trust and is ultimately controlled by the Harmsworth family through family-controlled holding entities, giving them decisive voting power and long-term authority over the business.

- Jonathan Harmsworth, 4th Viscount Rothermere, is the controlling individual and chairman, with ultimate influence over strategy, governance, and major decisions affecting the Daily Mail.

- Although the company previously had public shareholders, ownership is now fully private, with no external equity holders able to influence editorial or corporate control.

- This concentrated, family-led ownership structure has provided stability, protected the brand from hostile takeovers, and enabled long-term digital and commercial expansion.

The Daily Mail is a British news outlet and media brand known for its mass-market appeal. It publishes print editions and operates a global digital platform that attracts tens of millions of readers daily. The brand covers a wide range of content. It reports on politics, world events, celebrity culture, lifestyle, health, and human-interest stories. The Daily Mail’s editorial tone is often described as populist with a focus on engaging headlines.

The Daily Mail is part of a larger corporate group, DMGT (Daily Mail and General Trust). The group manages both traditional media and digital businesses. It also owns data and information services outside of journalism. The Daily Mail’s digital arm, MailOnline, is one of the most visited English-language news websites in the world.

The newspaper’s influence extends beyond the United Kingdom. It has a significant readership in the United States and Australia. The brand’s global reach stems largely from its digital strategy. This strategy emphasizes rapid publication, shareable content, and localized editions.

Daily Mail Founder

The Daily Mail was founded in 1896 by Alfred Harmsworth, with significant support from his brother Harold Harmsworth.

Alfred Harmsworth, born in 1865, was a pioneering newspaper publisher who believed news should be affordable and easy to read. At a time when most newspapers targeted elites, he designed the Daily Mail for mass audiences. The paper launched on May 4, 1896, using short articles, bold headlines, and human-interest stories. This approach reshaped British journalism.

Harold Harmsworth, born in 1868, focused on the business and financial side. He helped scale the newspaper into a profitable operation and supported its expansion. After Alfred’s death in 1922, Harold took full control and led the company’s long-term growth.

Together, the Harmsworth brothers built the foundation of a media brand that remains influential and family-controlled in 2026.

Ownership History

The ownership history of the Daily Mail is defined by continuity rather than frequent change. Since its founding in 1896, control has remained with the Harmsworth family despite shifts in corporate structure, public listings, and industry disruption. Over time, ownership evolved from direct private control to a publicly listed group model, while preserving decisive family authority through voting rights and governance arrangements.

| Period | Ownership Structure | Key Owners / Controllers | Key Developments |

|---|---|---|---|

| 1896–1922 | Privately owned | Alfred Harmsworth and Harold Harmsworth | Daily Mail founded in 1896. Family holds full ownership and control. |

| 1922–1950s | Private family control | Harold Harmsworth | Control consolidates after Alfred’s death. Expansion of publishing interests. |

| 1960s–1970s | Group ownership structure | Harmsworth family | Newspaper assets reorganized under a broader media group framework. |

| 1970s–1990s | Publicly listed with family control | Harmsworth family and public shareholders | Shares listed. Dual-class structure preserves family voting power. |

| 2000s–2010s | Modern DMGT structure | Harmsworth family | Focus shifts to digital growth and global expansion. |

| 2010s–2026 | Public company with dominant family voting rights | Jonathan Harmsworth | Ownership streamlined. Family retains decisive control despite minority economic stake. |

Founding Era and Private Family Ownership (1896–1920s)

The Daily Mail was founded in 1896 by Alfred Harmsworth and his brother Harold Harmsworth. In its early decades, the newspaper was entirely privately owned and controlled by the Harmsworth family.

During this period, ownership and management were closely linked. Alfred Harmsworth focused on editorial innovation and market positioning. Harold Harmsworth managed business operations and expansion. The Daily Mail quickly became one of the most widely read newspapers in Britain, firmly establishing the family as major media proprietors.

After Alfred Harmsworth’s death in 1922, ownership and control consolidated under Harold Harmsworth. This marked the beginning of long-term single-family dominance over the newspaper.

Formation of a Media Group Structure (1920s–1960s)

As the business expanded beyond a single newspaper, the Harmsworth family reorganized its holdings into a broader corporate structure. This laid the groundwork for what would later become DMGT.

The Daily Mail remained the flagship asset, but ownership now sat within a group that included multiple publishing and media interests. Despite this structural evolution, the Harmsworth family retained full control. There were no external shareholders with influence over editorial or strategic decisions.

This era established a key principle that still defines ownership today. The company could grow and restructure, but family control would not be diluted.

Public Listing With Retained Family Control (1970s–1990s)

In the mid-to-late 20th century, the group moved toward a public company model. Shares were listed on the stock exchange, allowing outside investors to participate in the business.

However, the Harmsworth family implemented a dual-class share structure. This ensured that voting control remained firmly in family hands, even as public shareholders acquired economic interests.

The Daily Mail continued to operate as a core asset within the group. Ownership was now split between family-controlled voting shares and publicly traded shares with limited influence.

This structure balanced access to public capital with long-term control.

Transition to Modern DMGT Ownership (2000s–2010s)

As digital media disrupted traditional newspapers, ownership strategy shifted toward long-term resilience rather than short-term market pressure. The Daily Mail’s ownership under DMGT allowed management to invest heavily in digital platforms without surrendering control.

During this period, the Harmsworth family increased its effective voting power. This reinforced its ability to guide strategy during industry-wide disruption.

The Daily Mail benefited from this stability. While many competitors faced ownership changes or financial distress, its ownership structure remained consistent.

Consolidation Under Jonathan Harmsworth (2010s–2026)

In recent decades, ownership control has been led by Jonathan Harmsworth, representing the fourth generation of family leadership.

Under his oversight, the family maintained majority voting rights while DMGT simplified its corporate structure. Non-core assets were reduced, and focus sharpened around media and information services.

As of 2026, the Daily Mail remains owned by DMGT and controlled by the Harmsworth family. Public shareholders continue to hold minority economic stakes, but they do not influence control or direction.

The ownership history of the Daily Mail is defined by continuity. From its founding in 1896 to today, control has never left the founding family. This makes it one of the longest continuously family-controlled major newspapers in the world.

Who Owns Daily Mail?

The ownership of the Daily Mail is anchored in its parent company, Daily Mail and General Trust (DMGT).

Unlike many legacy newspaper groups, DMGT is no longer publicly traded. It was taken private after a long history on the London Stock Exchange. Control rests firmly with a family investment vehicle that holds all the voting rights and ultimate authority over strategic decisions.

This structure means that despite any external economic investors or bondholders, definitive control remains concentrated in a core group aligned with the Harmsworth family’s interests.

| Shareholder / Entity | Ownership Type | Ownership / Control Level | Role and Influence |

|---|---|---|---|

| Rothermere Continuation Holdings Limited | Ultimate parent company | 100% voting control of DMGT | Serves as the top-level holding company. Exercises full strategic, governance, and voting authority over DMGT and all its subsidiaries, including the Daily Mail. |

| Rothermere Continuation Limited | Family holding vehicle | Majority economic and historical controlling interest | Previously the controlling shareholder of DMGT before privatization. Central to consolidating family ownership and enabling the company’s transition to private ownership. |

| Jonathan Harmsworth (4th Viscount Rothermere) | Controlling individual | Ultimate decision-making authority | Chairman of DMGT. Controls ownership vehicles and directs long-term strategy, governance decisions, and major corporate actions affecting the Daily Mail. |

| Harmsworth Family Interests | Family ownership group | Indirect full control | Represents multi-generational ownership. Maintains continuity, editorial influence, and long-term strategic direction through family-controlled entities. |

| Institutional Bondholders | Debt holders | No ownership or voting rights | Hold DMGT-issued bonds and fixed-income instruments. Have financial exposure only, with no influence over editorial or corporate decisions. |

| Former Public Shareholders | Bought-out equity holders | No remaining stake | Held minority economic interests prior to the 2022 privatization. Fully exited following the company’s delisting and ownership consolidation. |

Rothermere Continuation Holdings Limited (Parent Company)

Rothermere Continuation Holdings Limited (RCHL) is the ultimate parent company of DMGT, established in October 2025 to replace DMGT plc as the group’s primary holding entity.

RCHL is domiciled in Jersey and was created to streamline the group’s ownership structure following the 2022 delisting from the London Stock Exchange. The formation of RCHL reflects a strategic effort to align corporate governance, preserve long-term control, and support existing bond and financing arrangements without public market pressures. RCHL holds 100% of DMGT’s voting rights through its subsidiary holding structure.

As the parent holding company, RCHL has full control of the Daily Mail, Mail on Sunday, Metro, the i newspaper, DMG Media digital platforms, and other media and information assets under the DMGT umbrella.

While nominally a corporate entity, RCHL functions as the key ownership vehicle for the Harmsworth family’s media interests.

Rothermere Continuation Limited (Major Shareholder)

Rothermere Continuation Limited (RCL) was the principal controlling shareholder of DMGT prior to the 2025 reorganization and remains central within the group’s governance. RCL owned the majority of DMGT’s voting shares and was responsible for taking the company private in January 2022 following a successful acquisition of all shares not previously held. This effectively ended DMGT’s nearly 90-year history as a public company.

Under RCL’s ownership, the Harmsworth family’s influence over editorial direction, strategic investments, and long-term planning was preserved without the need to satisfy public equity markets. RCL’s stake was used to consolidate voting control, maintain continuity, and ensure alignment with the family’s vision for the group.

Jonathan Harmsworth, 4th Viscount Rothermere (Controlling Individual)

Jonathan Harmsworth, 4th Viscount Rothermere, is the central individual behind the ownership structure. He serves as chairman of DMGT and exercises ultimate decision-making authority through his controlling position in RCL and RCHL. Jonathan Harmsworth is a direct descendant of the co-founder family and has been instrumental in maintaining family control across multiple generations.

He increased his effective voting power significantly in past transactions, including the consolidation of voting shares that enabled the privatization in 2022. This consolidation ensured that no external shareholder could outvote the family on critical governance matters.

Jonathan’s role extends beyond mere ownership. He influences strategic decisions such as major acquisitions, digital transformation priorities, and portfolio realignments. As chairman, his authority shapes how DMGT and its media assets evolve, including moves into new markets or adjacent sectors.

Other Economic Shareholders and Bondholders

While the key controlling interests lie within RCHL and RCL, economic shareholders and bondholders have financial stakes in the group through various instruments. Although DMGT is no longer publicly listed, the company has issued bonds and other fixed-income securities that are held by institutional investors.

Bondholders do not exert control over editorial or board decisions, but they do have financial interests tied to DMGT’s performance and creditworthiness. For example, certain fixed-rate bonds maturing in 2027 are traded in financial markets, and holders of those bonds have exposure to the company’s credit risk but no governance rights.

These economic stakeholders can include pension funds, asset managers, and global fixed-income investors with exposure to DMGT debt instruments. Their influence is limited to financial matters rather than direct strategic control.

Non-Controlling Minority Interests in Legacy Holdings

Before the 2022 privatization, DMGT had external institutional investors owning a minority of its publicly traded shares. Some investment funds, wealth managers, and international asset holders possessed small economic stakes but lacked meaningful voting power due to the dual-class structure that favored voting control by the Harmsworth family.

Since privatization, those minority economic interests have been effectively bought out or dissolved as DMGT transitioned to 100% control under RCHL. This eliminated external public equity and concentrated ownership entirely within the family’s corporate vehicles.

Competitor Ownership Comparison

Major UK newspapers operate under very different ownership models, each shaping how decisions are made, how editorial independence is protected, and how long-term strategy is defined. Comparing these structures helps explain why some publishers prioritize public-interest journalism, others focus on commercial scale, and some remain tightly controlled by individuals or families. The Daily Mail’s ownership approach becomes clearer when viewed alongside its closest competitors.

| Newspaper | Owner / Controlling Entity | Ownership Model | Key Characteristics |

|---|---|---|---|

| Daily Mail | Harmsworth family via DMGT | Family-controlled private group | Long-term family control, strong commercial focus, centralized decision-making |

| The Guardian | Scott Trust | Trust-owned | Editorial independence prioritized over profits, no individual owner |

| The Times | News UK (Murdoch family) | Privately owned conglomerate | Centralized control within a global media empire |

| The Sun | News UK (Murdoch family) | Privately owned conglomerate | Tabloid-focused, aligned with broader multinational strategy |

| The Daily Telegraph | Investor and lender-led ownership | Transitional / investor-controlled | Ownership instability, shifting strategic direction |

Daily Mail vs The Guardian

The The Guardian operates under a completely different ownership philosophy.

The Guardian is owned by the Scott Trust. This trust structure is designed to protect editorial independence rather than generate profits for shareholders. There is no single individual owner. Profits are reinvested into journalism instead of distributed.

In contrast, the Daily Mail is owned through a family-controlled corporate structure under DMGT. Decision-making authority rests with the Harmsworth family. Commercial performance and profitability are core priorities alongside editorial direction.

This difference explains why the Guardian often prioritizes investigative journalism, while the Daily Mail focuses on mass readership and digital scale.

Daily Mail vs The Times

The Times is owned by News UK, which is part of Rupert Murdoch’s privately held media group.

Ownership of The Times is centralized under one global media proprietor. Strategic decisions are often aligned with Murdoch’s broader international media interests, including television and publishing.

The Daily Mail, while also family-controlled, is not part of a global cross-media empire of the same scale. Its ownership is more focused on publishing and digital information services rather than broadcasting.

Both papers share strong centralized control, but the Daily Mail operates with greater independence from global political and broadcasting interests.

Daily Mail vs The Sun

The Sun is also owned by News UK and shares ownership with The Times.

The Sun’s ownership structure emphasizes aggressive tabloid journalism within a wider multinational media strategy. Editorial decisions can be influenced by corporate priorities across Murdoch-owned assets.

The Daily Mail, although similarly tabloid in style, benefits from a single-family ownership model that is not tied to television networks or international political ambitions. This allows a more consistent editorial identity over decades.

Daily Mail vs The Telegraph

The The Daily Telegraph has experienced ownership uncertainty in recent years, including debt-driven control and transitional ownership arrangements.

Unlike the Daily Mail’s stable multi-generational control, The Telegraph’s ownership has shifted between investors, lenders, and holding entities. This has resulted in strategic uncertainty and leadership changes.

The Daily Mail’s ownership stability has allowed uninterrupted long-term planning, especially in digital expansion and global audience growth.

Key Ownership Differences at a Glance

The Daily Mail stands out for continuity. Control has remained with the founding family since 1896. Many competitors have either trust-based ownership, corporate conglomerate control, or fluctuating investor-led structures.

This stability has insulated the Daily Mail from hostile takeovers and short-term market pressure. It has also allowed faster decision-making during industry disruption.

Among major UK newspapers, the Daily Mail’s ownership model is one of the most commercially driven yet structurally consistent. That balance explains its resilience and sustained influence in the modern media landscape.

Who Controls Daily Mail?

Control of the Daily Mail is shaped by a clear hierarchy that separates ownership authority, corporate leadership, and editorial management. While the newspaper operates within a large media group, ultimate control remains concentrated rather than dispersed.

Ultimate Control and Governance Structure

The Daily Mail sits within DMGT’s media division, but strategic control flows from the top of the group rather than from the newsroom alone.

At the highest level, control is exercised through the Harmsworth family’s ownership vehicles. These entities hold decisive voting power and appoint the board that governs the group. This means major decisions such as acquisitions, divestments, leadership appointments, and long-term strategy are not subject to public shareholder pressure.

The board of the parent group sets the overall direction. It approves investment priorities, risk appetite, and structural changes. The Daily Mail operates within these boundaries.

Role of the Chairman

The central controlling figure is Jonathan Harmsworth, who serves as chairman.

As chairman, he does not manage day-to-day operations. Instead, he influences long-term strategy, governance standards, and senior leadership appointments. His role ensures continuity of family control and alignment with the group’s long-term vision.

Because of his position within the ownership structure, his authority outweighs that of any single executive. This makes him the most powerful individual connected to the Daily Mail.

Chief Executive and Corporate Management

Day-to-day corporate management of the group is led by the CEO of DMGT, Timothy Collier.

The CEO oversees group-wide operations, including media, digital platforms, and information services. His responsibilities include operational performance, digital growth strategy, talent management, and execution of board-approved plans.

While the CEO does not control editorial content directly, corporate priorities such as expansion into new markets, technology investment, and platform development directly affect how the Daily Mail operates.

Editorial Control and Newsroom Leadership

Editorial control of the Daily Mail is exercised by its senior editors. Editors are responsible for content direction, tone, headline strategy, and daily news judgment.

They operate with significant autonomy in editorial matters. However, they work within the broader cultural and strategic framework set by ownership and corporate leadership.

This model allows strong editorial consistency over time. It also ensures that editorial leadership aligns with the publication’s brand identity and audience expectations.

Decision-Making Structure in Practice

Control of the Daily Mail follows a layered structure.

- Ownership determines long-term direction and safeguards control.

- The board and chairman oversee governance and strategy.

- The CEO manages execution and operations.

- Editors control daily journalism and content output.

This separation allows efficiency while preserving centralized authority at the top.

Past Leadership and Control Evolution

Over time, control has passed through several phases of leadership within the same family framework.

Earlier generations of the Harmsworth family exercised direct operational influence. As the business grew, control shifted toward a modern corporate governance model with professional executives running daily operations.

Former CEOs such as Paul Zwillenberg played key roles in reshaping the group for the digital era. However, none displaced family control at the ownership level.

Daily Mail Annual Revenue and Net Worth

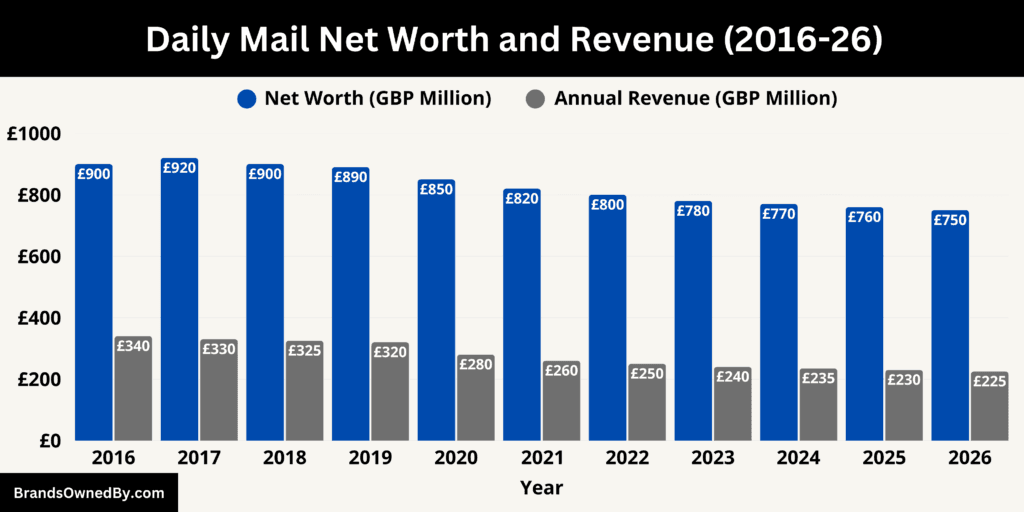

The Daily Mail’s estimated total revenue for 2026 is $225 million, and its estimated standalone brand net worth is $750 million as of January 2026.

These figures represent the combined commercial performance of the print title and its primary digital platform (MailOnline/Mail+), expressed as a standalone media business separate from the parent group.

Revenue 2026

Print sales and print advertising remain an important revenue source, but they are now the smallest growth component. In 2026, print circulation, cover price and legacy advertising together are estimated to produce $79 million of revenue. This line reflects physical newspaper sales, weekend and special edition supplements, and long-standing print advertising relationships. Although declining in volume, print still contributes a meaningful margin due to lower digital variable costs.

Digital advertising is the single largest revenue stream in 2026. Display advertising, native and sponsored content, programmatic inventory, and video ad monetization on MailOnline together are estimated to generate $101 million. This figure includes revenue from global desktop and mobile advertising sold both directly and programmatically, as well as higher-yield formats such as video and branded content that have been expanded in recent years.

Paid digital products and subscriptions (including Mail+ and localized paid offerings) contributed $34 million in 2026. This includes recurring subscription revenue, one-off paywall receipts for premium packages, and ancillary paid services such as ad-free experiences or subscriber-only newsletters and events. Subscriptions continue to grow, but start from a smaller base compared with advertising.

Other commercial activities account for the remaining $11 million. This category covers licensing, syndication, event revenues, e-commerce partnerships, and limited B2B data or content licensing directly attributable to the Daily Mail brand. While relatively small, these channels are strategically valuable for diversification and margin improvement.

Together these components sum to the estimated 2026 total revenue of $225 million.

Net Worth 2026

The estimated standalone net worth of the Daily Mail brand as of January 2026 is $750 million. That estimate reflects an aggregation of brand value, content and intellectual property, platform and technology assets, and goodwill/working capital attributable to the title as a discrete business unit.

The breakdown is as follows. The brand value and audience franchise, which captures name recognition, global reach of MailOnline, and long-term advertiser relationships, is estimated at $450 million. This portion recognizes the premium advertisers pay for scale and the unique audience demographics the Daily Mail commands.

Content libraries, editorial IP, and proprietary reporting assets (including archives, syndicated columns and photo libraries) are valued at $150 million. These assets support recurring licensing income and lower content acquisition costs relative to new entrants.

Platform and technology assets — the digital publishing stack, analytics and ad-tech integrations, video production capability, and subscriber management systems — are valued at $100 million. This reflects replacement cost and the strategic value of a high-traffic, revenue-generating digital infrastructure.

Working capital, goodwill tied to existing commercial contracts, and other intangible operational value are estimated at $50 million. This item captures short-term liquidity benefits, existing commercial contracts with advertisers and partners, and the operational know-how that underpins revenue conversion efficiency.

These components together produce the total estimated brand net worth of $750 million, reflecting the Daily Mail’s transition from a print-centric asset to a digitally anchored, monetizable global brand.

Future Forecast

Under a base-case scenario that assumes modest subscription growth, steady digital ad pricing, and continued print erosion, the Daily Mail’s standalone revenue is forecast to rise gradually from the 2026 baseline.

- 2027: Estimated revenue of $230 million. Growth is expected to come from continued expansion of paid digital subscriptions, higher adoption of Mail+, and incremental gains in digital video advertising. Print revenue is projected to decline further, but not enough to offset digital growth.

- 2028: Estimated revenue of $240 million. Subscription revenue is forecast to represent a larger share of total income as conversion rates improve and churn stabilizes. Digital advertising is expected to benefit from better yield management and branded content formats.

- 2029: Estimated revenue of $255 million. This projection assumes maturity of the subscription model, stronger monetization of international audiences, and expanded commercial formats such as video, newsletters, and premium partnerships.

- Long-term outlook: The forecast implies a compound annual growth rate of approximately 4.3% from 2026 onward, driven primarily by recurring digital revenue rather than print circulation or legacy advertising.

Brands Owned by Daily Mail

The Daily Mail operates through its media division, commonly referred to as DMG Media, which manages newspaper publishing, digital platforms, and related consumer-facing brands. The entities below represent brands and operations directly owned and run within the Daily Mail media business:

| Company / Brand | Type | Primary Market | Core Function | Strategic Role |

|---|---|---|---|---|

| Daily Mail | National newspaper (print & digital) | United Kingdom | News, politics, lifestyle, entertainment | Core flagship brand and primary identity of the business |

| The Mail on Sunday | Sunday newspaper | United Kingdom | Long-form journalism, investigations, opinion | Strengthens weekend readership and premium advertising |

| MailOnline | Digital news platform | UK, US, Australia | High-volume digital news, video, branded content | Largest global traffic and digital advertising driver |

| Mail+ | Digital subscription service | UK, international | Paid articles, opinion, podcasts, puzzles | Recurring revenue and audience monetization |

| Metro | Free daily newspaper | UK and Ireland | Commuter-focused news and lifestyle | Access to younger, urban audiences through ad-only model |

| i Newspaper | Compact daily newspaper | United Kingdom | Concise, neutral news reporting | Expands reach into quality-news segment |

| MailOnline US Edition | Digital edition | United States | Localized news, entertainment, celebrity | Drives international traffic and US ad revenue |

| MailOnline Australia Edition | Digital edition | Australia | Regional news and lifestyle content | Diversifies audience and advertiser base |

| Content Licensing & Syndication Unit | Internal commercial unit | Global | Content reuse and licensing | Incremental revenue and global content distribution |

Daily Mail (Print Edition)

The Daily Mail remains the core and founding asset. It is published six days a week in tabloid format and targets a broad mass-market audience in the United Kingdom. The print edition continues to focus on national news, politics, crime, lifestyle, health, and celebrity coverage.

Despite long-term circulation decline across the industry, the print Daily Mail remains one of the highest-selling newspapers in the UK. It also serves as a key brand anchor that supports digital trust, advertiser relationships, and cross-platform audience engagement.

The Mail on Sunday

The Mail on Sunday is the Sunday sister publication of the Daily Mail. It operates as a distinct title with its own editorial structure while remaining fully integrated into the Daily Mail brand ecosystem.

The Mail on Sunday emphasizes long-form investigations, exclusives, political commentary, and expanded lifestyle coverage. It plays an important role in weekend print revenue and premium advertising, and it also feeds content into the broader digital publishing operation.

MailOnline

MailOnline is the Daily Mail’s primary digital publishing arm and one of the most visited English-language news websites globally.

MailOnline operates with international editions tailored for the UK, US, and Australia. It focuses on fast-moving news, entertainment, celebrity reporting, sports, and viral content. The platform is optimized for mobile and social distribution, making it the largest revenue driver within the Daily Mail’s digital operations through advertising, video, and branded content.

Mail+

Mail+ is the Daily Mail’s paid digital subscription product. It was launched to diversify revenue beyond advertising and to monetize loyal readers.

Mail+ offers exclusive articles, opinion columns, podcasts, puzzles, and an ad-reduced experience. By 2026, it operates across multiple markets and forms the backbone of the Daily Mail’s recurring subscription revenue strategy. While smaller than advertising in absolute terms, it is strategically important for long-term sustainability.

Metro (UK and Ireland)

Metro is a free daily newspaper distributed in major urban areas, primarily targeting commuters.

Metro was acquired by the Daily Mail’s media operations and is managed alongside other newspaper brands. It has a younger readership profile and a strong presence in public transport hubs. Its free-to-read model relies entirely on advertising and provides the Daily Mail group with reach into a different demographic segment.

i Newspaper

The i newspaper is a compact daily newspaper positioned between tabloids and broadsheets.

It focuses on concise, neutral reporting and appeals to time-conscious readers. Since its acquisition, the i newspaper has been operated within the Daily Mail’s publishing portfolio while maintaining editorial independence. It strengthens the group’s presence in the quality-news segment without overlapping directly with the Daily Mail’s editorial tone.

Digital Editions and International Operations

The Daily Mail operates multiple localized digital editions under the MailOnline umbrella. These include dedicated US and Australian operations with local editorial teams, advertisers, and commercial partnerships.

These international entities are not separate companies but function as integrated operational units. They are critical to global traffic growth, international advertising revenue, and diversification away from UK-only exposure.

Final Words

In conclusion, understanding who owns Daily Mail provides clear insight into how the publication has maintained long-term stability, editorial consistency, and commercial resilience in a rapidly changing media landscape. The Daily Mail operates within a tightly controlled ownership structure that prioritizes continuity, decisive leadership, and scalable digital growth.

This model has allowed the brand to expand globally, diversify its revenue streams, and retain influence well beyond its print origins. As the media industry continues to evolve, the Daily Mail’s ownership and operational structure position it to adapt while preserving the identity that has defined it for more than a century.

FAQs

Who owns Daily Mail?

The Daily Mail is owned by Daily Mail and General Trust. Control ultimately rests with the Harmsworth family through family-owned holding entities, giving them decisive voting power over the business and its media operations.

Who runs the Daily Mail?

Day-to-day editorial operations are led by Ted Verity, who serves as editor of the Daily Mail. Corporate oversight and strategic direction sit at group level under DMGT’s leadership, with board authority aligned to family ownership.

Is the Daily Mail left or right?

The Daily Mail is generally described as right-leaning in its political stance. It has historically supported conservative policies, traditional social values, and right-of-centre political parties, particularly in the UK.

Is Daily Mail a Murdoch paper?

No. The Daily Mail is not part of Rupert Murdoch’s media empire. It is owned and controlled by the Harmsworth family and operates independently of News Corp or News UK.

Is Daily Mail British or American?

The Daily Mail is a British newspaper. It was founded in the United Kingdom and is headquartered there. While it has a large American readership through its digital platforms, it remains a UK-based publication.

Is the Daily Mail owned by Rupert Murdoch?

No. Rupert Murdoch has no ownership stake in the Daily Mail. His media interests are separate and include titles such as The Sun and The Times through News UK.

Where is the Daily Mail registered for tax?

The Daily Mail’s main operating companies are registered in the United Kingdom and are subject to UK tax rules. Some top-level holding entities within the ownership structure are registered in jurisdictions such as Jersey, which is common for corporate structuring, but core publishing operations are UK-based.