Crystal Palace FC has one of the most unusual multi-owner structures in English football. Many fans often search for who owns Crystal Palace because the club operates under a shared ownership model that blends American investment with British leadership.

Key Takeaways

- Crystal Palace is primarily owned by Woody Johnson (43%), making him the largest individual shareholder and the main financial force behind the club.

- David Blitzer (18%) and Josh Harris (18%) remain major minority investors, bringing extensive U.S. sports ownership experience and commercial expertise.

- Steve Parish (10%) continues as chairman and key decision-maker in football operations, ensuring strong local leadership alongside international investment.

- The remaining 10% is held by legacy CPFC2010 shareholders, preserving a small but meaningful link to the club’s supporter-led rescue era.

Crystal Palace FC Overview

Crystal Palace Football Club is a professional football club based in the Selhurst area of South London. The club plays in the English Premier League, having secured its status in the top tier for several seasons running.

Palace is known for its identity rooted in the local boroughs, a passionate fan base, and a distinctive red-and-blue kit. The club balances its historic roots—tracing back to amateur football in the 19th century—with modern ambitions, infrastructure development at Selhurst Park and a growing reputation in English football.

As of 2025, Crystal Palace continues to consolidate itself among the competitive mid-table and rising clubs in the Premier League.

Founders and Early History

While the professional incarnation of the club dates to 1905, Crystal Palace’s heritage goes back further. A football team associated with the original Crystal Palace exhibition grounds first played around March 1862.

The amateur link makes Palace one of the oldest football clubs in some form in England.

The professional club was formally established on 10 September 1905 under the guidance of Edmund Goodman, formerly assistant secretary at Aston Villa.

Goodman and a small group of enthusiasts worked with the Crystal Palace Company (which owned the exhibition building and its grounds) to set up a professional football club to exploit the sports venue and the growing popularity of football.

Following its founding, the club initially played at the sports field within the Crystal Palace grounds. When the First World War broke out, the club was forced to relocate because the Palace grounds were requisitioned.

Then the club moved on to The Nest (former home of Croydon Common) before finally settling at Selhurst Park in 1924, which remains its home.

Major Milestones

- 1862: A Crystal Palace–named football team plays its earliest recorded match, establishing the club’s earliest roots in organized football.

- 1905: The modern, professional Crystal Palace Football Club is formed and enters the Southern League, beginning competitive play immediately.

- 1906: Palace completes its debut Southern League season with strong performances and builds a growing supporter base in South London.

- 1915: World War I forces the closure of the Crystal Palace grounds, forcing the club to prepare for relocation.

- 1918: After the war, the club formally ends its connection with the original Crystal Palace Company and transitions toward Football League ambitions.

- 1920: Crystal Palace is elected to join the newly formed Football League Third Division, marking the beginning of a new competitive era.

- 1920–21: Palace wins the Football League Third Division in its first season, earning immediate promotion to the Second Division.

- 1924: Selhurst Park opens as the club’s permanent home. The stadium becomes central to the club’s identity.

- 1939: League play stops due to World War II, halting the club’s progression during a challenging national period.

- 1946: Crystal Palace resumes professional football in the post-war era with renewed stability and a reorganized squad.

- 1958: Major Football League restructuring places Palace in the newly formed Fourth Division, marking one of the lowest points in the club’s competitive history.

- 1961: Palace secures promotion to the Third Division, signaling the beginning of a rising era.

- 1964: The club earns another promotion, this time to the Second Division, restoring higher-level football to Selhurst Park.

- 1969: Crystal Palace achieves promotion to the First Division (top flight) for the first time, marking a major breakthrough in club history.

- 1973: Palace suffers relegation back to the Second Division and then begins a turbulent period of fluctuation.

- 1977: The club reaches the Second Division again after rebuilding a strong squad of homegrown talent.

- 1979: Palace earns promotion to the First Division and becomes known as the “Team of the Eighties.”

- 1981: Financial limitations force major player sales, creating instability that leads to relegation.

- 1990: Palace reaches the FA Cup Final for the first time, pushing Manchester United to a replay and gaining national recognition.

- 1991: Crystal Palace finishes 3rd in the First Division, one of its highest-ever league finishes.

- 1995: Relegation occurs again during a yo-yo period for the club.

- 1997: Palace earns promotion to the Premier League through the play-offs.

- 1998: Relegation from the Premier League leads to renewed financial strain.

- 2000: Simon Jordan purchases the club and becomes the youngest owner in the Football League, beginning a new era of investment.

- 2004: A dramatic play-off final win secures another Premier League promotion.

- 2005: Palace is relegated after one season but maintains strong Championship competitiveness.

- 2010: The club enters administration but is rescued by the CPFC2010 consortium led by Steve Parish, preventing collapse.

- 2013: Crystal Palace returns to the Premier League after a play-off win under manager Ian Holloway, beginning its longest top-flight spell.

- 2016: Palace reaches the FA Cup Final again, narrowly losing to Manchester United.

- 2018: Plans to modernize and expand Selhurst Park are unveiled, marking a commitment to long-term infrastructure development.

- 2020: The club begins major investment in its Category 1 Academy, strengthening youth development.

- 2021: Major American investors increase their share and reshape the board structure, bringing new capital into the club.

- 2023: Crystal Palace records its strongest mid-table finish of the decade, improving stability.

- 2024: Selhurst Park redevelopment planning moves forward with updated proposals and expanded commercial partnerships.

- 2025: Crystal Palace wins the FA Cup for the first time in its history, defeating Manchester City and securing its first major trophy.

- 2025: Palace qualifies for European competition for the first time, preparing to participate in the UEFA Conference League.

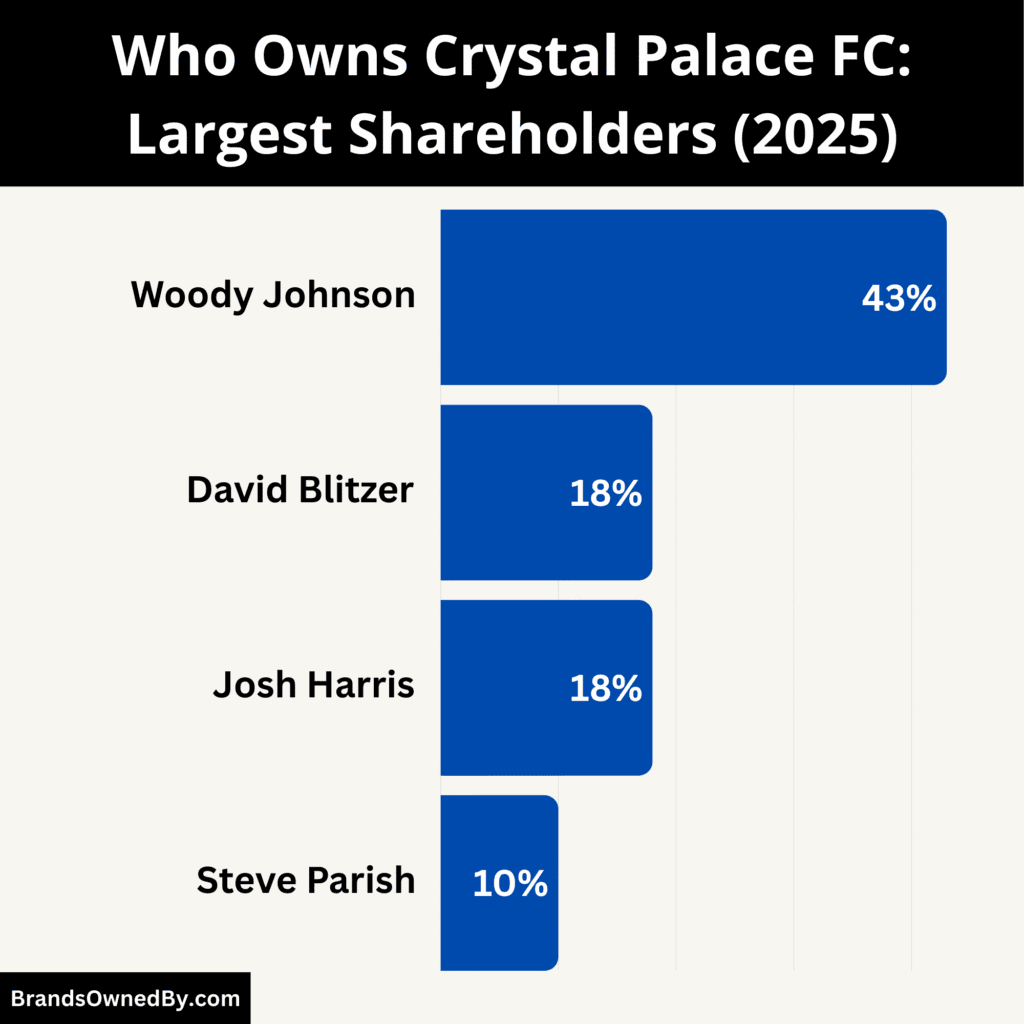

Who Owns Crystal Palace FC: Largest Shareholders

Crystal Palace’s ownership structure in late 2025 is led by four key shareholders: Woody Johnson with approximately 43%, David Blitzer with around 18%, Josh Harris with roughly 18%, and Steve Parish with an estimated 10%.

This blend of major American investment and long-standing local leadership forms a balanced governance model that drives the club’s financial strength, commercial growth and on-field continuity. With Johnson providing substantial capital, Blitzer and Harris contributing elite-level sports expertise and Parish guiding football operations, Crystal Palace benefits from a powerful and well-rounded ownership team equipped to advance the club’s long-term ambitions.

Woody Johnson(43%)

Woody Johnson became the largest individual shareholder in 2025 when he acquired the full Eagle Football stake previously held by John Textor. His estimated 43% shareholding gives him significant financial influence and board-level authority.

Johnson brings extensive ownership experience from the NFL’s New York Jets, major business operations in the United States and a long history of high-level corporate management. His arrival injects substantial capital strength into Crystal Palace and aligns the club with a globally recognised sports figure.

Johnson’s strategic focus includes raising the club’s international profile, modernising commercial partnerships and supporting long-term infrastructure plans, including stadium redevelopment and global brand expansion.

David Blitzer (18%)

David Blitzer remains one of Crystal Palace’s cornerstone investors. His reported 18% stake keeps him firmly positioned inside the club’s senior leadership group.

Blitzer brings deep sports-industry expertise through Harris Blitzer Sports & Entertainment, co-ownership of the Philadelphia 76ers and New Jersey Devils, and multiple sports-business ventures worldwide.

Within Crystal Palace, he supports governance, commercial development and strategic oversight. His long-term involvement provides continuity and stability, especially during major ownership transitions.

Josh Harris (18%)

Josh Harris holds another estimated 18% of the club. Harris is one of the most experienced sports investors in the world, with ownership stakes across the NBA, NHL, and NFL.

His financial influence, partnership with Blitzer and extensive business portfolio add weight to Palace’s boardroom. Harris plays a crucial role in commercial strategy, financial planning and long-term resource allocation.

His presence ensures Crystal Palace benefits from the systems, best practices and business models used by some of the largest sports organisations in North America.

Steve Parish (10%)

Steve Parish retains an estimated 10% stake, but more importantly, he remains the most influential operational figure at Crystal Palace.

As chairman, Parish leads football operations, managerial appointments, sporting direction, youth development strategy and the cultural identity of the club.

Parish has guided Palace since the CPFC2010 rescue, turning it into a stable Premier League club with an elite academy system. His continued presence ensures that—even with powerful American investors involved—the club maintains local leadership, emotional continuity and long-term football focus.

Remaining Shareholders

In addition to the major shareholders—Woody Johnson, David Blitzer, Josh Harris and Steve Parish—a small portion of Crystal Palace’s ownership is held by legacy investors and micro-shareholders who have been part of the club’s structure since the CPFC2010 rescue era. Their combined stake is estimated at 10%, and although individually small, these shareholders represent an important part of the club’s history.

Stephen Browett

Stephen Browett was one of the four founding members of the CPFC2010 consortium that saved Crystal Palace from administration in 2010. He played a crucial role in stabilising the club during its most vulnerable period by providing financial support, commercial guidance and strong fan-oriented leadership.

Today, Browett retains a small minority share that represents his ongoing connection to the club, even though he no longer has direct influence over board decisions. His presence reflects continuity and honours the group that kept Palace alive before the era of major U.S. investment.

Martin Long

Martin Long, another key member of the CPFC2010 rescue group, also continues to hold a small minority stake. His experience in business and his long-standing support for the club helped shape Crystal Palace during the transition from financial instability to Premier League stability.

While Long is no longer involved in governance or day-to-day operations, his symbolic shareholding recognises his role in protecting the club’s identity and providing essential backing during its recovery phase.

Jeremy Hosking

Jeremy Hosking was originally one of the significant investors in the CPFC2010 consortium, known for contributing substantial financial resources during Palace’s rebuild. Over time, his stake has been reduced to a small, passive shareholding, but it remains a nod to his influence during the club’s revival.

His continued involvement through a reduced position highlights the long-term loyalty of the supporters and businessmen who stepped in when the club needed them most.

Micro-Shareholders

A few micro-shareholders—individuals with very small fractional stakes—also remain from the CPFC2010 era. These holdings are non-influential in current board governance, but they represent community-driven ownership roots that predate the modern investment era.

Their shares collectively form the final portion of the club’s ownership structure, ensuring that Crystal Palace still retains a trace of its supporter-focused history even as it grows into a globally backed Premier League institution.

Crystal Palace FC Ownership History

Crystal Palace’s ownership journey reflects the club’s resilience, financial challenges, and gradual transformation into a stable Premier League institution. The club moved from early local control to turbulent private ownership, then to a fan-driven rescue consortium, and finally to today’s hybrid British-American structure. Each era shaped the club’s identity, finances and long-term direction.

| Ownership Era | Key Owners / Group | Time Period | Role & Key Details |

|---|---|---|---|

| Founding & Early Local Ownership | Local businessmen & Crystal Palace Company | 1905–1960s | Established the professional club; ownership rooted in local business figures; operated with modest finances and community-driven leadership. |

| Private Ownership Period | Various private owners | 1970s–1990s | Multiple owners with differing ambitions; periods of top-flight success mixed with financial instability; rising operational costs led to long-term financial pressure. |

| Simon Jordan Era | Simon Jordan | 2000–2010 | Purchased the club at age 32; invested heavily; achieved Premier League promotion in 2004; mounting financial losses led to administration in 2010. |

| CPFC2010 Consortium | Steve Parish, Stephen Browett, Martin Long, Jeremy Hosking | 2010–2021 | Rescued the club from administration; bought the club and Selhurst Park; stabilised finances; returned to the Premier League in 2013; modernised academy and operations. |

| Arrival of American Investors | David Blitzer & Josh Harris | 2016–2025 | Became significant minority shareholders; brought U.S. sports expertise; strengthened governance, commercial strategy and international growth. |

| Modern Ownership Model | Woody Johnson (43%), David Blitzer (18%), Josh Harris (18%), Steve Parish (10%), Legacy shareholders (10%) | 2025–Present | Johnson becomes largest individual shareholder; Blitzer and Harris remain key minority investors; Parish continues as chairman; legacy CPFC2010 members hold symbolic small stakes. |

Early Local and Company Ownership (1905–1930s)

When Crystal Palace was professionally founded in 1905, it was closely tied to the Crystal Palace Company, which operated the exhibition grounds. Local businessmen, club officials and community figures ran the team.

This period was marked by modest investment, community influence and a traditional English club governance structure. The club operated as a locally controlled institution with no major external investors.

Post-War Transitions and Mixed Private Ownership (1940s–1990s)

After World War II, ownership shifted through various private hands. These decades were defined by fluctuating financial performance and occasional instability. The club navigated multiple promotions and relegations but did not have wealthy benefactors capable of pushing significant investment.

Ownership during this period was typical of many mid-level English clubs—local business figures with limited capital and short-term visions.

The Simon Jordan Era (2000–2010)

In 2000, businessman Simon Jordan purchased the club, becoming the youngest owner in the Football League at the time. His takeover brought ambition, investment and a clear objective of returning Palace to the Premier League.

While Jordan initially stabilized the club and achieved promotion in 2004, heavy financial losses, managerial changes and economic pressures led to severe instability.

By 2010, Crystal Palace fell into administration, marking one of the most critical crises in its history.

CPFC2010 Rescue Consortium (2010–2021)

A group of lifelong Palace supporters—Steve Parish, Stephen Browett, Martin Long and Jeremy Hosking—formed the CPFC2010 consortium to save the club from collapse. They purchased both the club and Selhurst Park, unifying the ownership of the team and the stadium for the first time in decades.

Under CPFC2010:

- The club regained financial stability.

- Palace earned a historic promotion back to the Premier League in 2013.

- The academy system was rebuilt and later achieved Category 1 status.

- Long-term stadium expansion plans began.

Steve Parish emerged as the primary leader, becoming chairman and the public face of the club’s revival.

Growth of American Investment (2016–2025)

As the Premier League became more financially demanding, Crystal Palace sought additional investment. This led to the introduction of major American sports investors into the ownership structure.

David Blitzer and Josh Harris became key minority shareholders, bringing commercial expertise from major U.S. franchises. Their involvement strengthened the club’s governance, expanded international partnerships and supported strategic planning.

By the early 2020s, Palace operated under a hybrid ownership model—balancing strong American investment with Steve Parish’s local leadership.

The Arrival of Woody Johnson and the Modern Ownership Model (2025–Present)

In mid-2025, the club’s ownership landscape shifted significantly when Woody Johnson acquired approximately 43% of the club. His purchase of the previous Eagle Football stake instantly made him the largest individual shareholder and a major financial pillar of the club.

Johnson’s arrival introduced substantial capital strength and global sports-business credibility. Together with Blitzer, Harris and Parish, he forms the core of Crystal Palace’s modern ownership structure.

This blend of high-level American investment and reliable local leadership positions Crystal Palace for long-term growth—both on and off the pitch—as the club continues expanding commercially, competing internationally and modernising its infrastructure.

Woody Johnson Net Worth

Woody Johnson’s net worth is estimated at $3.9 billion as of November 2025, making him one of the wealthiest individual owners involved in Premier League football. His financial strength positions Crystal Palace among the more securely funded clubs outside the traditional “big six,” giving the team long-term stability and significant growth potential.

Family Fortune and Johnson & Johnson Legacy

Woody Johnson is an heir to the Johnson & Johnson empire, one of the largest and most influential healthcare companies in the world. Although he does not manage the corporation, the family’s generational wealth contributes significantly to his personal fortune.

The Johnson family’s long-established success provides Woody with financial security and substantial investment capabilities, including the ability to support long-term sports and business ventures without relying on external financing.

Diversified Business Portfolio

Alongside family wealth, Johnson has built a broad investment portfolio over several decades. His assets include:

- extensive real estate holdings across the U.S.

- private equity and investment vehicles

- commercial and financial ventures

- multi-decade business partnerships in hospitality, entertainment and services.

This diversified portfolio ensures stable annual returns and protects his wealth from market fluctuations, reinforcing his position as a billionaire investor.

Ownership of the New York Jets

Johnson is best known for owning the New York Jets, one of the major franchises in the NFL. The Jets franchise is valued in the multi-billion-dollar range and remains a major contributor to his overall financial strength.

NFL ownership enhances his credibility within global sports, providing access to elite management systems, commercial models and operational best practices that he can now leverage at Crystal Palace.

The Jets generate substantial yearly income through broadcasting, sponsorships, ticket sales and league revenue sharing, supporting Johnson’s continued long-term wealth growth.

Diplomatic and Global Network Influence

Johnson also served as the U.S. Ambassador to the United Kingdom, a role that broadened his international relationships and strengthened his business network.

This high-level diplomatic experience gives him unique access to global markets, investors and commercial partners. His network enhances Crystal Palace’s ability to expand internationally, especially in North America and emerging football markets.

Financial Impact on Crystal Palace

As the largest shareholder with around 43% ownership, Johnson’s financial weight directly influences Crystal Palace’s strategic direction. His backing supports:

- Selhurst Park redevelopment and infrastructure upgrades

- expansion of global sponsorship and commercial partnerships

- stronger financial planning and long-term investment strategy

- sustainability during high-cost Premier League seasons

- a growth-focused approach to recruitment and club development.

His arrival marks the beginning of a more ambitious commercial era for Crystal Palace.

Long-Term Outlook

With a net worth of $3.9 billion, Woody Johnson provides the strongest financial foundation Crystal Palace has ever had. His wealth, business experience and global influence position the club for long-term growth, competitive stability and greater international presence.

Whether in infrastructure investment, commercial deals or strategic planning, Johnson’s resources are a major asset as the club moves forward into a new phase of development.

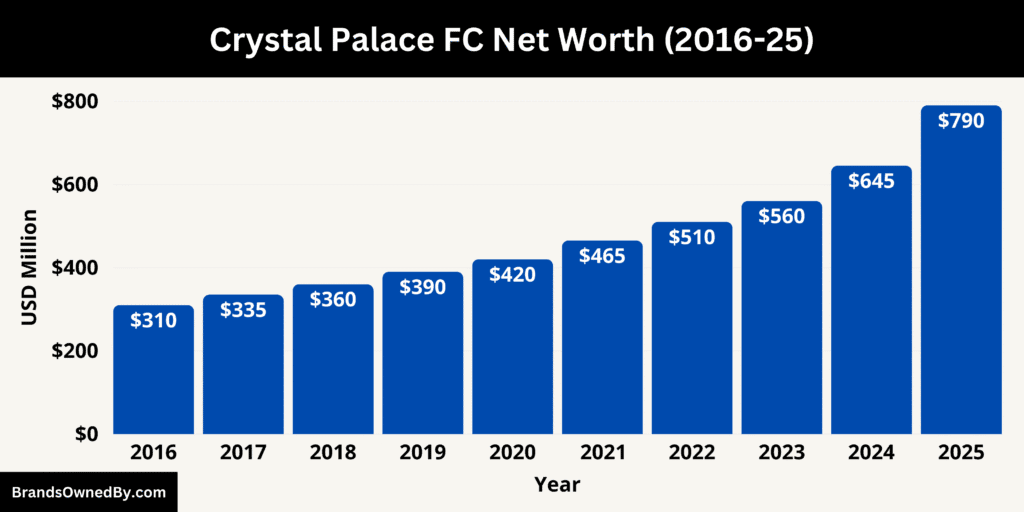

Crystal Palace FC Net Worth

As of November 2025, Crystal Palace’s estimated net worth stands at $790 million. This valuation reflects the club’s strengthened financial performance following its 2025 FA Cup win, improved commercial deals, enhanced squad valuation, and the monetary boost from European qualification.

Premier League Revenue and Financial Stability

One of the biggest contributors to Crystal Palace’s rising net worth is consistent Premier League revenue. In the 2024–25 cycle, Palace earned:

- $185–$200 million from broadcasting alone

- $35–$40 million from matchday revenue

- $28–$35 million from commercial deals and sponsorships.

These recurring revenue streams ensure predictable cash flow. The stability of Premier League membership for over a decade has driven year-on-year growth, making the club financially stronger than many domestic competitors outside the top six.

Squad Valuation and Player Assets

Player value is a critical factor in football club valuations. As of late 2025, Crystal Palace’s squad is valued at roughly $350–$380 million. The value increase is driven by:

- rising market prices for Premier League players

- successful academy graduates increasing long-term asset value

- smarter recruitment under a more data-driven structure.

Several players signed between 2023 and 2025 have appreciated significantly, boosting the club’s overall valuation.

Stadium and Infrastructure Assets

Selhurst Park remains one of the club’s largest physical assets. Although older, valuation estimates place the stadium at approximately $110–$130 million, depending on redevelopment progress.

Planned upgrades to the Main Stand, training ground improvements and the Category 1 Academy facility add additional asset value. The academy itself is estimated at $40–$55 million, factoring in construction cost, land value and long-term development potential.

Commercial Growth and Sponsorship Influence

Crystal Palace’s commercial valuation has risen due to improved branding, enhanced global visibility after the FA Cup triumph and strategic partnerships in North America and Asia.

Revenue from commercial deals reached a near-record level in 2025 through:

- a renewed front-of-shirt sponsorship agreement

- new global partnerships connected to multi-club networks

- increased digital marketing and merchandising

- stronger international presence following the European qualification.

This growth has increased the club’s commercial valuation to an estimated $120–$150 million.

Impact of the 2025 FA Cup Victory

Winning the FA Cup dramatically boosted Crystal Palace’s financial value. The trophy increased the club’s visibility worldwide and unlocked multiple revenue pathways:

- increased sponsorship value for the 2025–26 season

- higher merchandise sales

- greater brand prestige

- improved negotiating power with partners

- added prize money and broadcast bonuses.

This single achievement contributed an estimated $60–$70 million in direct and indirect value during the 2025 calendar year.

European Qualification and Future Earnings

Qualifying for European competition in 2025 added long-term financial upside. While Conference League prize money is modest compared to the Champions League, participation still provides:

- additional matchday revenue

- broadcasting bonuses

- European prize income

- increased player exposure, boosting resale values.

These factors further strengthened the club’s valuation leading into 2026.

Crystal Palace’s financial trajectory remains positive. With stronger infrastructure, a more valuable squad, a Premier League safety cushion and improved global positioning, the club is projected to surpass a valuation of $850 million–$900 million within two seasons if current performance levels are maintained.

Selhurst Park’s redevelopment is expected to push this figure even higher once completed.

Who is the CEO of Crystal Palace FC?

Sharon Lacey is the current Chief Executive Officer (CEO) of Crystal Palace Football Club. Appointed in September 2025, she leads all non-football operations and plays a central role in shaping the club’s commercial growth, infrastructure strategy and long-term business vision. Her appointment marks a significant moment for the club as it transitions into a new era of stability, expansion and global ambition following its historic 2025 FA Cup win.

Appointment and Role at the Club

Sharon Lacey officially became CEO on September 5, 2025. Her return to Crystal Palace followed years of executive experience both inside and outside the club. Compared to previous business structures, the appointment of a dedicated CEO signals Palace’s shift toward a more modern, commercially driven Premier League organization.

Her role places her directly below the chairman, Steve Parish, and she works closely with the board of directors and major shareholders. As CEO, she provides leadership across all business departments, ensuring that the club’s off-field operations match the ambitions of its football achievements.

Professional Background and Experience

Sharon Lacey has built a career across sports administration, business operations, and commercial strategy.

Before returning to Crystal Palace, she held senior positions in football clubs, worked with large corporate organizations and led projects focused on digital transformation, fan engagement and commercial expansion.

She previously served in senior roles within Crystal Palace’s executive structure, giving her a deep understanding of the club’s culture, challenges and long-term ambitions. This insider knowledge allows her to make informed decisions quickly and maintain continuity in strategic planning.

Key Responsibilities and Operational Focus

As CEO, Sharon Lacey oversees all business operations at Crystal Palace. Her responsibilities include:

Commercial Strategy and Revenue Growth

She leads the expansion of sponsorship deals, international partnerships and digital revenue streams. She also works on enhancing merchandise sales, hospitality offerings and global brand visibility.

Stadium and Infrastructure Development

Selhurst Park’s redevelopment is one of her most important responsibilities. She oversees planning, budgeting and long-term project management for the new Main Stand and broader matchday improvements. She also ensures the club’s Category 1 academy facilities continue to evolve and meet Premier League standards.

Financial Management and Stability

Lacey manages the club’s operational budgets, ensuring Crystal Palace remains financially sustainable while complying with Premier League and UEFA financial regulations. Her leadership focuses on balancing growth with responsible spending, especially during an era of rising player wages and infrastructure expenses.

Fan, Community, and Stakeholder Relations

Her role includes strengthening relationships with supporters, local authorities, community partners, and sponsors. She works alongside the chairman to improve fan experience and ensure the club maintains its identity as a community-rooted institution.

Long-Term Planning and Organizational Development

The CEO leads the vision for the club’s next growth phase, including international expansion, digital modernization and global fanbase building. She ensures that Palace’s business operations support the ambitions of the football side—especially with the club entering European competition.

Strategic Importance to Crystal Palace

Sharon Lacey’s leadership is crucial as Crystal Palace evolves from a stable Premier League club into a more competitive, commercially strong and globally recognized institution. Her experience in digital media, commercial partnerships and large-scale business operations aligns with the club’s need for growth beyond the pitch.

Her appointment comes at a time when Palace has:

- achieved its first major trophy

- qualified for Europe for the first time

- increased squad value

- expanded commercial income

- planned significant stadium upgrades.

The CEO’s role is to convert these sporting achievements into long-term financial success.

Current Challenges and Future Outlook

Despite the club’s positive trajectory, Sharon Lacey faces several challenges. These include managing the financial demands of stadium redevelopment, ensuring Premier League sustainability, maximizing the benefits of European participation and competing commercially with larger clubs.

However, her experience, familiarity with the club and strategic approach position Crystal Palace for long-term growth. Under her leadership, Palace aims to modernize its operations, strengthen its global presence and build on the momentum created in 2025.

Conclusion

Crystal Palace’s modern ownership model brings together substantial American investment and strong local leadership, giving the club the financial power, stability and governance needed to grow on and off the pitch. With Woody Johnson as the largest shareholder, supported by experienced investors like David Blitzer, Josh Harris and long-time chairman Steve Parish, the club is positioned for long-term success, deeper commercial expansion and continued Premier League competitiveness. Understanding who owns Crystal Palace today provides a clear view of the strategy, resources and leadership shaping the club’s future.

FAQs

Who owns Crystal Palace?

Crystal Palace is owned by a group of investors with the major shareholding held by Woody Johnson (approx. 43%), alongside David Blitzer (approx. 18%), Josh Harris (approx. 18%), and Steve Parish (approx. 10%). Legacy shareholders hold the remaining ~6–10%.

Who are the new owners of Crystal Palace?

The key new owner is Woody Johnson, who in 2025 acquired a ~43% stake in Crystal Palace, becoming the club’s largest individual shareholder. The other co-owners—Blitzer, Harris and Parish—remain in place.

How did Steve Parish become rich?

Steve Parish’s wealth stems from his business activities in communications, printing and business services, as well as his long-term involvement with Crystal Palace since 2010. As chairman and part-owner, he has grown his stake through club revival efforts and improved club valuation.

Did Simon Jordan own Crystal Palace?

Yes. Simon Jordan purchased Crystal Palace in 2000, became chairman and invested heavily in the club. His ownership lasted until the club entered administration in 2010, at which point the CPFC2010 group took over.

Does Floyd Mayweather own Crystal Palace?

No. Floyd Mayweather does not own Crystal Palace. Ownership resides with the group of investors led by Woody Johnson, David Blitzer, Josh Harris and Steve Parish.

How much of Crystal Palace does David Blitzer own?

David Blitzer owns an estimated 18% of Crystal Palace, making him a significant minority shareholder in the club’s current ownership structure.

When was Crystal Palace founded?

Crystal Palace Football Club was founded professionally in 1905, with its roots in an amateur team that played in the 19th century.