Comcast is one of the largest telecommunications companies in the world, known for revolutionizing cable, internet, and media services. But have you ever wondered who owns Comcast?

This blog post covers Comcast’s ownership, control, financials, market share, and competitors, along with the brands it operates.

Let’s take a detailed look.

The History of Comcast

Comcast Corporation, founded in 1963, originally started as a small cable operation in Tupelo, Mississippi. It was established by Ralph J. Roberts, Daniel Aaron, and Julian A. Brodsky with the goal of delivering high-quality cable services.

Over the years, Comcast progressively expanded its reach through acquisitions, partnerships, and technological advancements.

Today, Comcast is a multinational conglomerate with operations in telecommunications, media, and entertainment.

Notable milestones include its acquisition of NBCUniversal in 2011 and Sky Group in 2018 which significantly boosted its global presence.

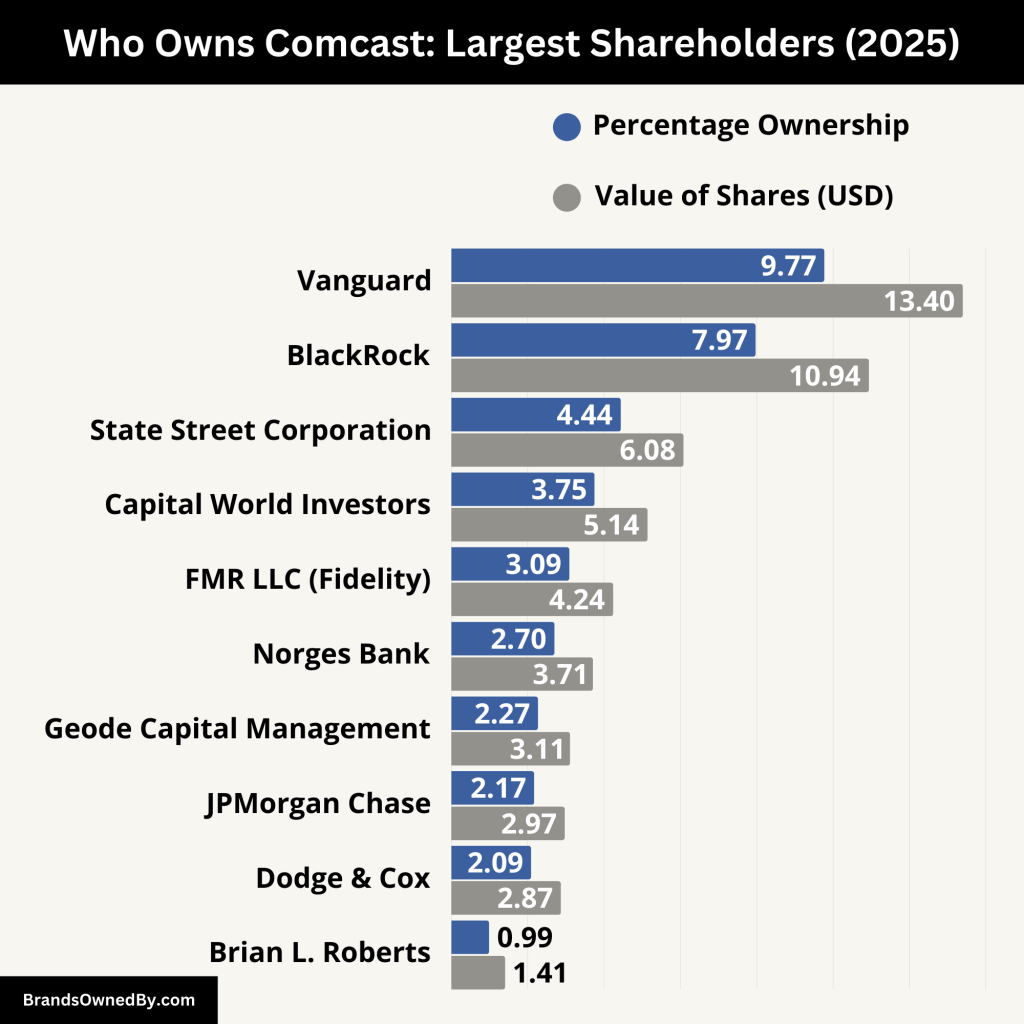

Who Owns Comcast: Largest Shareholders

Comcast is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol CMCSA.

However, its ownership is somewhat concentrated, with a majority of its voting shares controlled by one prominent family.

The Roberts family, led by Comcast’s CEO and Chairman Brian L. Roberts, holds the largest share of the company’s voting rights. Through a dual-class stock structure, the family exerts significant control over the company despite owning less than a majority of its total shares.

The special Class B shares controlled by the Roberts family grant them about 33% of the voting power within Comcast, enabling them to make key decisions and influence the company’s direction.

Below is a summary of Comcast’s top shareholders as of the latest available data:

| Shareholder | Percentage Ownership | Number of Shares | Value of Shares (Approx.) |

|---|---|---|---|

| Brian L. Roberts | 0.99% | 33.9 million | $1.41 billion |

| Vanguard Group, Inc. | 9.77% | 369.5 million | $13.4 billion |

| BlackRock, Inc. | 7.97% | 301.5 million | $10.94 billion |

| State Street Corporation | 4.44% | 167.7 million | $6.08 billion |

| Capital World Investors | 3.75% | 141.7 million | $5.14 billion |

| FMR LLC (Fidelity) | 3.09% | 116.9 million | $4.24 billion |

| Norges Bank Investment Management | 2.70% | 102.2 million | $3.71 billion |

| Geode Capital Management LLC | 2.27% | 85.8 million | $3.11 billion |

| JPMorgan Chase & Co. | 2.17% | 81.9 million | $2.97 billion |

| Dodge & Cox | 2.09% | 79.1 million | $2.87 billion |

| Public Shareholders | 14.05% | N/A | N/A |

| Insider Ownership | 1.46% | N/A | N/A |

Brian L. Roberts

Brian L. Roberts, the chairman and CEO of Comcast, is the largest individual shareholder. He owns approximately 33.9 million shares, representing about 0.99% of the company. These shares are valued at approximately $1.41 billion. Despite holding a smaller percentage of total shares, Roberts maintains significant influence over the company due to his role and the control associated with his holdings.

The Vanguard Group, Inc.

The Vanguard Group is the largest institutional shareholder, holding around 9.77% of Comcast’s total shares. This equates to approximately 369.5 million shares, valued at $13.4 billion. Vanguard’s investment strategy focuses on long-term growth, and its significant stake reflects confidence in Comcast’s prospects.

BlackRock, Inc.

BlackRock holds about 7.97% of Comcast’s shares, translating to approximately 301.5 million shares valued at $10.94 billion. As a leading global asset management firm, BlackRock’s investment in Comcast underscores its belief in the company’s growth potential.

State Street Corporation

State Street holds approximately 4.44% of Comcast’s shares, or around 167.7 million shares valued at $6.08 billion. State Street is one of the world’s largest asset managers, and its investment in Comcast reflects its strategy of investing in large-cap, stable companies.

Capital World Investors

Capital World Investors owns about 3.75% of Comcast’s shares, equating to approximately 141.7 million shares valued at $5.14 billion. This investment firm is known for its long-term investment approach, and its stake in Comcast indicates confidence in the company’s future.

FMR LLC (Fidelity)

FMR LLC holds approximately 3.09% of Comcast’s shares, or around 116.9 million shares valued at $4.24 billion. Fidelity’s investment in Comcast is part of its diversified portfolio strategy, focusing on companies with strong growth prospects.

Norges Bank Investment Management

Norges Bank holds about 2.70% of Comcast’s shares, translating to approximately 102.2 million shares valued at $3.71 billion. As the central bank of Norway, Norges Bank’s investment in Comcast reflects its strategy of investing in large, stable companies globally.

Geode Capital Management LLC

Geode Capital Management owns approximately 2.27% of Comcast’s shares, or around 85.8 million shares valued at $3.11 billion. Geode’s investment in Comcast is part of its quantitative investment strategy, focusing on large-cap U.S. companies.

JPMorgan Chase & Co.

JPMorgan Chase holds about 2.17% of Comcast’s shares, equating to approximately 81.9 million shares valued at $2.97 billion. As one of the largest financial institutions globally, JPMorgan’s investment in Comcast reflects its strategy of investing in leading companies across various sectors.

Dodge & Cox

Dodge & Cox owns approximately 2.09% of Comcast’s shares, or around 79.1 million shares valued at $2.87 billion. This investment firm is known for its value-oriented investment approach, and its stake in Comcast indicates confidence in the company’s long-term prospects.

Public Shareholders

The remaining shares of Comcast are owned by public shareholders, including individual investors and smaller institutional investors. These shareholders collectively own approximately 14.05% of the company. While individual stakes are smaller, public shareholders play a crucial role in the company’s ownership structure.

Insider Ownership

Insiders, including executives and board members, own about 1.46% of Comcast’s shares. This ownership aligns the interests of the company’s leadership with those of shareholders, promoting decisions that aim to enhance shareholder value.

Who Controls Comcast?

The control of Comcast falls largely into the hands of the Roberts family due to their Class B shares, which carry significantly higher voting rights compared to Class A shares owned by the public.

This structure allows Brian L. Roberts and his family to retain decision-making authority over matters such as board appointments and corporate strategy.

Brian L. Roberts – Chairman and CEO

Brian L. Roberts, as the Chairman and CEO of Comcast, holds the most significant control over the company. With the largest stake in the company, especially through Class B shares, Roberts has the power to influence key decisions, including the selection of board members and corporate strategy. His role is crucial in maintaining Comcast’s direction and growth.

Roberts has been instrumental in expanding Comcast’s business over the years, overseeing major acquisitions such as NBCUniversal and Sky Group. His leadership has positioned Comcast as a dominant player in the media and telecommunications industries. Even though other institutional investors hold substantial shares, Roberts’ control through voting rights gives him substantial influence over Comcast’s decision-making.

The Role of the Board of Directors

While Brian Roberts holds significant power, Comcast’s board of directors plays an essential role in the company’s governance. The board is responsible for making high-level decisions, approving strategic initiatives, and overseeing management. However, the influence of Roberts through his Class B shares ensures that he has a considerable say in the board’s decisions. The board consists of individuals from various backgrounds, including finance, media, and technology, all of whom provide valuable perspectives.

The current board members include executives from other major corporations, as well as individuals with expertise in business development, media, and technology. While their role is crucial in decision-making, Roberts’ control ensures that the company’s trajectory remains aligned with his vision for Comcast’s future.

Key Institutional Investors

As a publicly traded company, Comcast’s institutional investors, such as Vanguard Group, BlackRock, and State Street, hold significant stakes in the company. These investors, while not directly involved in the day-to-day management, have substantial influence through their voting rights at shareholder meetings. They can influence key decisions, including mergers and acquisitions, executive compensation, and overall corporate policy. However, given that Comcast’s Class B shares give Roberts superior voting rights, these institutional investors have limited control in comparison to the CEO.

Institutional investors are particularly important in terms of providing the company with capital and ensuring the company remains attractive to shareholders. Their support for Roberts’ leadership is crucial for maintaining the company’s stability and growth trajectory.

Comcast’s Executive Team

The executive team at Comcast, led by Brian Roberts, includes senior leaders responsible for managing various aspects of the company. This includes executives overseeing Xfinity (Comcast’s broadband, cable, and internet division), NBCUniversal (Comcast’s media subsidiary), and Sky Group (the European media company Comcast owns). These executives, including the Chief Financial Officer, Chief Marketing Officer, and others, work closely with Roberts to ensure the company’s strategy is executed effectively.

The executive team’s role is critical for overseeing daily operations, from network infrastructure and customer service to content creation and distribution. These executives are responsible for implementing the vision set by Roberts and the board while ensuring the company remains competitive in the global market.

CEO’s Leadership Style and Influence

Brian Roberts’ leadership style is often described as visionary and strategic. Under his leadership, Comcast has grown from a regional cable company to one of the largest telecommunications and media companies in the world. His ability to lead complex acquisitions and integrations, such as the purchase of NBCUniversal and the acquisition of Sky, highlights his long-term vision for the company.

Roberts has shown a keen focus on diversification, pushing Comcast to expand its footprint beyond traditional cable services and into content creation, media distribution, and international markets. His leadership has helped Comcast adapt to rapidly changing technologies, including the shift toward digital content consumption and broadband internet.

While Roberts remains the dominant figure in terms of control, his executive team’s ability to manage day-to-day operations and execute strategic initiatives ensures that the company operates smoothly and remains competitive.

Revenue and Net Worth of Comcast Corporation

Comcast generated approximately $123.7 billion in revenue in 2024 showcasing its immense scale and profitability in the telecommunications and media industries.

As of April 2025, Comcast has a net worth of around $130 billion.

Here is a table summarizing Comcast’s annual revenues and net assets:

| Year | Revenue (in billion USD) | Net Assets (in billion USD) |

|---|---|---|

| 2015 | $74.51 | $55.19 |

| 2016 | $80.40 | $57.62 |

| 2017 | $84.86 | $70.81 |

| 2018 | $94.51 | $73.81 |

| 2019 | $108.94 | $85.24 |

| 2020 | $103.56 | $93.01 |

| 2021 | $116.39 | $98.00 |

| 2022 | $121.43 | $82.03 |

| 2023 | $121.57 | $83.46 |

| 2024 | $123.73 | $86.27 |

Comcast’s Market Share and Competitors

Comcast dominates the U.S. telecommunications and cable markets, holding a significant portion of market share in different service categories.

Market Share

Internet Services: Comcast’s Xfinity brand controls approximately 40% of the U.S. broadband market.

Cable Services: Holding over 25% market share, Comcast is a leading cable provider in the country.

Media/Entertainment: Through NBCUniversal, Comcast is a key player in television broadcasting and film production.

Top Competitors

Comcast faces fierce competition in its primary industries. Here’s a look at its main competitors:

| Competitor | Market Share | Industry/Role | Key Details |

|---|---|---|---|

| AT&T Inc. | ~18% | Telecommunications and Media | Direct competitor, offers similar broadband, wireless, and media services. |

| The Walt Disney Company | ~15% | Entertainment and Media Conglomerate | Competes via its extensive content library and streaming services. |

| Charter Communications | ~12% | Telecommunications | Rivals Comcast in broadband and cable markets with competitive pricing. |

| Netflix, Inc. | ~10% | Streaming Services | Disruptive player in streaming, focuses heavily on original content. |

| Verizon Communications Inc. | ~9% | Telecommunications and Media | Competes in broadband and wireless services, expanding media footprint. |

| Amazon (Prime Video) | ~6% | E-commerce and Streaming Services | Growth in streaming challenges Comcast’s traditional media offerings. |

| Discovery, Inc. | ~5% | Media and Entertainment | Competes via broadcasting and digital content across international markets. |

| CBS (Paramount Global) | ~4% | Media and Streaming Services | Focuses on content creation and digital platforms to rival Comcast services. |

| Sony Corporation | ~3% | Media and Entertainment | Competes with content production and gaming integration. |

| T-Mobile US, Inc. | ~2% | Telecommunications | Competes in wireless services and expanding its home internet solutions. |

Companies Owned by Comcast

Comcast has expanded significantly over the years, acquiring major companies across various sectors in the media, telecommunications, and entertainment industries. These acquisitions have played a crucial role in the company’s strategy to diversify its revenue streams and maintain a competitive edge in the rapidly evolving market.

Below are the major companies owned by Comcast, each contributing to the overall growth and direction of the business:

| Company | Details |

|---|---|

| NBCUniversal | A global media and entertainment conglomerate, including networks like NBC, Universal Pictures, Telemundo, and Universal Parks & Resorts. Acquired in 2011, it encompasses film, TV, digital content, and theme parks. |

| Sky Group | A British telecommunications company offering satellite TV, broadband, and phone services in Europe. Acquired in 2018, it operates Sky Sports, Sky News, and other networks across several European countries. |

| Xfinity | Comcast’s flagship brand for its broadband and cable services, offering internet, cable TV, phone, and home security services in the U.S. It is the largest cable TV provider in North America. |

| Universal Filmed Entertainment | A division of NBCUniversal responsible for film production and distribution, including major franchises like “Fast & Furious” and “Minions.” It encompasses Universal Pictures and Focus Features. |

| Telemundo | A major Spanish-language television network in the U.S., providing telenovelas, reality shows, sports programming, and news. It’s one of the largest providers of Spanish-language content in the U.S. |

| Fandango | An online movie ticketing service, offering ticket sales, film rentals, reviews, and streaming services. Acquired in 2007, it is a key player in online ticketing and digital media. |

| DreamWorks Animation | Known for producing animated films like “Shrek,” “Kung Fu Panda,” and “How to Train Your Dragon.” Acquired in 2016, it is a major player in family-friendly entertainment and animation. |

| Sky News | A 24-hour news channel owned by Sky Group, offering global and regional news coverage with a focus on politics, economics, and current affairs. It is one of the most-watched news channels in the UK. |

| Sky Sports | A leading sports broadcasting network in the UK, covering major events like Premier League football, Formula 1, rugby, and golf. Owned by Sky Group, it is a key contributor to Comcast’s European operations. |

| Comcast Ventures | Comcast’s venture capital division, investing in emerging technologies and startups in fields such as digital media, software, and AI. It allows Comcast to stay ahead in the tech and media industries. |

NBCUniversal

NBCUniversal is one of the most significant assets under Comcast’s portfolio. Acquired in 2011 for $30 billion, NBCUniversal includes a broad range of media operations, from TV networks to movie studios, and even theme parks. NBCUniversal is responsible for a variety of popular media brands such as NBC, Universal Pictures, Telemundo, and Universal Parks & Resorts.

The company owns numerous iconic film franchises, including “Jurassic Park,” “Fast & Furious,” and “Despicable Me.” NBCUniversal’s television networks, including CNBC, MSNBC, and USA Network, provide significant revenue streams for Comcast. Universal theme parks, including locations in Orlando, Hollywood, and Singapore, contribute billions in revenue each year. NBCUniversal also owns a significant share of Hulu, one of the leading streaming services, further solidifying Comcast’s place in the digital media landscape.

Sky Group

Comcast acquired Sky Group, a British telecommunications company, in a $40 billion deal in 2018. Sky is a major player in the European media and telecommunications market, with a strong presence in the UK, Ireland, Germany, Austria, and Italy. Sky provides satellite television, broadband, and phone services, and it operates some of Europe’s largest pay-TV networks.

Sky’s acquisition was seen as a strategic move for Comcast to expand its presence in Europe and strengthen its content offerings. The company operates Sky Sports, which broadcasts a wide range of sporting events, including Premier League football, Formula 1, and golf. Sky also operates Sky News and Sky Cinema, which are key players in the European media space.

Xfinity

Xfinity is Comcast’s residential broadband and cable television service, and it is one of the company’s most well-known brands in North America. Xfinity offers internet, cable TV, phone, and home security services to millions of customers across the U.S. The brand has become synonymous with high-speed internet access, and it has a significant footprint in both urban and rural markets.

Xfinity is the nation’s largest cable TV provider and also holds a significant share of the broadband market. The company has been working on expanding its services into mobile technology, offering Xfinity Mobile, which combines cellular service with its broadband infrastructure. Additionally, Xfinity’s home security division, Xfinity Home, competes in the smart home market, offering customers security systems that integrate with other smart devices.

Universal Filmed Entertainment Group

Universal Filmed Entertainment Group (UFEG) is another key asset under Comcast’s NBCUniversal umbrella. UFEG includes Universal Pictures, which is one of the top movie studios globally. Universal Pictures has produced blockbuster films such as “The Mummy,” “Minions,” and “The Secret Life of Pets.” It also owns Focus Features, a studio known for producing independent films, including Academy Award-winning titles like “Brokeback Mountain” and “Atonement.”

UFEG also operates Universal Pictures Home Entertainment, which is responsible for distributing movies via digital, Blu-ray, and DVD formats. The group’s vast portfolio of films and entertainment properties adds significant revenue through global box office sales, home video, and streaming services.

Telemundo

Telemundo is Comcast’s Spanish-language broadcast television network, and it serves as one of the largest providers of Spanish-language programming in the United States. Acquired by Comcast in 2011 as part of the NBCUniversal deal, Telemundo operates a variety of channels, including the Telemundo Network, Telemundo Deportes, and Telemundo Digital, offering a range of programming from telenovelas and reality shows to news and sports.

Telemundo is a key player in the Latinx entertainment market, with its reach extending far beyond the U.S. into Latin America. The network also produces Spanish-language adaptations of popular English-language content, such as “The Voice” and “The Masked Singer.”

Fandango

Fandango, acquired by Comcast in 2007, is a leading online ticketing service for movies in the U.S. The service allows users to purchase movie tickets in advance, stream films, and read reviews. Fandango owns Flixster, a social media platform for film lovers, and has expanded its services by acquiring MovieTickets.com.

Fandango is a significant player in the online entertainment space, partnering with major cinema chains to provide users with a seamless moviegoing experience. It also owns Vudu, a video-on-demand platform, which has been integrated with Fandango’s core operations to offer a broad selection of films for digital rental or purchase.

DreamWorks Animation

In 2016, Comcast acquired DreamWorks Animation for approximately $3.8 billion. DreamWorks is known for producing animated films like “Shrek,” “Kung Fu Panda,” “How to Train Your Dragon,” and “Madagascar.” It has a well-established global brand in family entertainment and continues to generate significant revenue through film production, TV shows, and merchandise.

DreamWorks Animation is integrated into NBCUniversal’s film and television division, providing valuable content for both theaters and streaming platforms. The acquisition of DreamWorks was part of Comcast’s broader strategy to solidify its position in the animated film market and diversify its content offerings across various entertainment platforms.

Sky News and Sky Sports

Under its ownership of Sky Group, Comcast also controls two of the most significant broadcasting entities in the UK and Europe: Sky News and Sky Sports. Sky News is a leading 24-hour news channel that provides global and regional news coverage. It is one of the most-watched news channels in the UK, providing real-time news reporting on a variety of topics, including politics, economics, and international affairs.

Sky Sports, on the other hand, is a major player in the sports broadcasting industry. It holds broadcasting rights to top-tier sports, including English Premier League football, Formula 1, rugby, and golf. Sky Sports generates significant revenue through subscriptions and advertising, and it plays an integral role in Comcast’s European operations.

Comcast Ventures

Comcast Ventures is the investment arm of Comcast, focused on investing in emerging technologies and startups. The firm typically invests in companies that align with Comcast’s broader strategic goals in technology, media, and telecommunications. Some of its notable investments include companies in areas like digital media, software, artificial intelligence, and content creation.

Comcast Ventures has helped the company keep pace with industry trends and innovations, providing it with early access to new technologies and growth opportunities in various sectors. Its portfolio includes a range of tech companies that complement Comcast’s existing services, expanding the company’s footprint in Silicon Valley and beyond.

Final Words

Comcast isn’t just another corporation; it’s a conglomerate shaping how we connect, consume media, and stay entertained. Its dual-class ownership structure, market dominance, and vast range of subsidiaries make it a unique case in the corporate world.

Frequently Asked Questions

What is Comcast’s voting share structure?

Comcast’s voting power is significantly influenced by its dual-class share structure. Brian L. Roberts holds all Class B supervoting shares, granting him approximately 33% of the company’s voting power, despite owning a smaller percentage of total shares.

How did Comcast acquire Sky?

Comcast acquired Sky Group in 2018 for approximately $40 billion, after a competitive bidding process with 21st Century Fox. The acquisition allowed Comcast to expand its presence in Europe and strengthen its media and broadband services.

What is NBCUniversal’s role within Comcast?

NBCUniversal is a key subsidiary of Comcast, contributing significantly to the company’s revenue. It includes film studios like Universal Pictures, TV networks such as NBC and Telemundo, and Universal theme parks. NBCUniversal helps Comcast dominate the media and entertainment sectors.

Is Comcast a cable company?

Yes, Comcast is a cable company through its Xfinity brand, offering cable TV, broadband internet, phone services, and home security. It is the largest cable TV provider in the U.S. and one of the top broadband providers.

Does Comcast own Universal Studios?

Yes, Comcast owns Universal Studios through its NBCUniversal division. Universal Studios includes Universal Pictures and a variety of entertainment properties, including theme parks and film franchises like “Jurassic Park” and “Fast & Furious.”

Is Comcast owned by AT&T?

No, Comcast is not owned by AT&T. However, in 2002, Comcast acquired AT&T’s broadband cable division, merging the two companies’ cable assets to create the largest cable company in the U.S. at that time.

When did Comcast split off from AT&T?

Comcast and AT&T Broadband merged in 2002, resulting in the formation of AT&T Comcast Corporation. This merger combined Comcast’s and AT&T’s cable assets, creating the largest cable company in the U.S.

Are Comcast and Xfinity the same company?

Yes, Xfinity is the brand name used by Comcast for its consumer services, including cable television, internet, and phone services. The Xfinity brand was introduced in 2010 to unify Comcast’s service offerings under a single name.

Is Comcast the largest cable company?

Yes, Comcast is the largest cable company in the United States, serving millions of customers across the country. This status was solidified following its merger with AT&T Broadband in 2002.

Who audits Comcast?

Comcast’s internal audit function is led by Lisa Bonnell, who serves as the Executive Vice President of Comcast Global Audit & General Auditor. She oversees financial, operational, and systems audits within the company.

What is Comcast’s new name?

Comcast continues to operate under the name Comcast Corporation. However, it markets its consumer services under the Xfinity brand, which was introduced in 2010 to encompass its cable, internet, and phone offerings.

Who owns Comcast and NBC?

Comcast owns NBC through its subsidiary, NBCUniversal. Comcast acquired a controlling interest in NBCUniversal in 2011 and completed the acquisition in 2013, integrating NBC’s broadcast operations into its media and entertainment portfolio.

How many companies does Comcast own?

Comcast owns a diverse portfolio of companies, including NBCUniversal, Sky Group, Xfinity, Universal Filmed Entertainment, Telemundo, Fandango, DreamWorks Animation, and others. These acquisitions span various sectors in media, telecommunications, and entertainment.

Who owns Comcast in the United States?

Comcast is a publicly traded company listed on the Nasdaq stock exchange under the ticker symbols CMCSA and CMCSK. Its ownership is distributed among institutional investors, retail investors, and company insiders. Major institutional shareholders include investment firms such as The Vanguard Group and BlackRock.