When we think about Boeing, one of the largest aerospace companies in the world, it’s essential to understand who owns Boeing.

The ownership structure has evolved over time, and today, it includes a mix of institutional investors and private entities. This article will explore the ownership details, control structure, and more about Boeing.

History of Boeing

Boeing was founded in 1916 by William E. Boeing in Seattle, Washington. Initially known for producing seaplanes, the company quickly expanded into commercial aviation.

Over the years, Boeing became a global leader in aircraft manufacturing and defense systems. Today, it stands as one of the two major players in the aerospace industry, alongside Airbus.

Boeing’s history has been marked by numerous milestones, including the introduction of iconic aircraft like the 747, the first wide-body airliner, and the 737, the best-selling commercial aircraft in history. Throughout its evolution, Boeing has navigated challenges in both the commercial and military sectors, cementing its place in aerospace history.

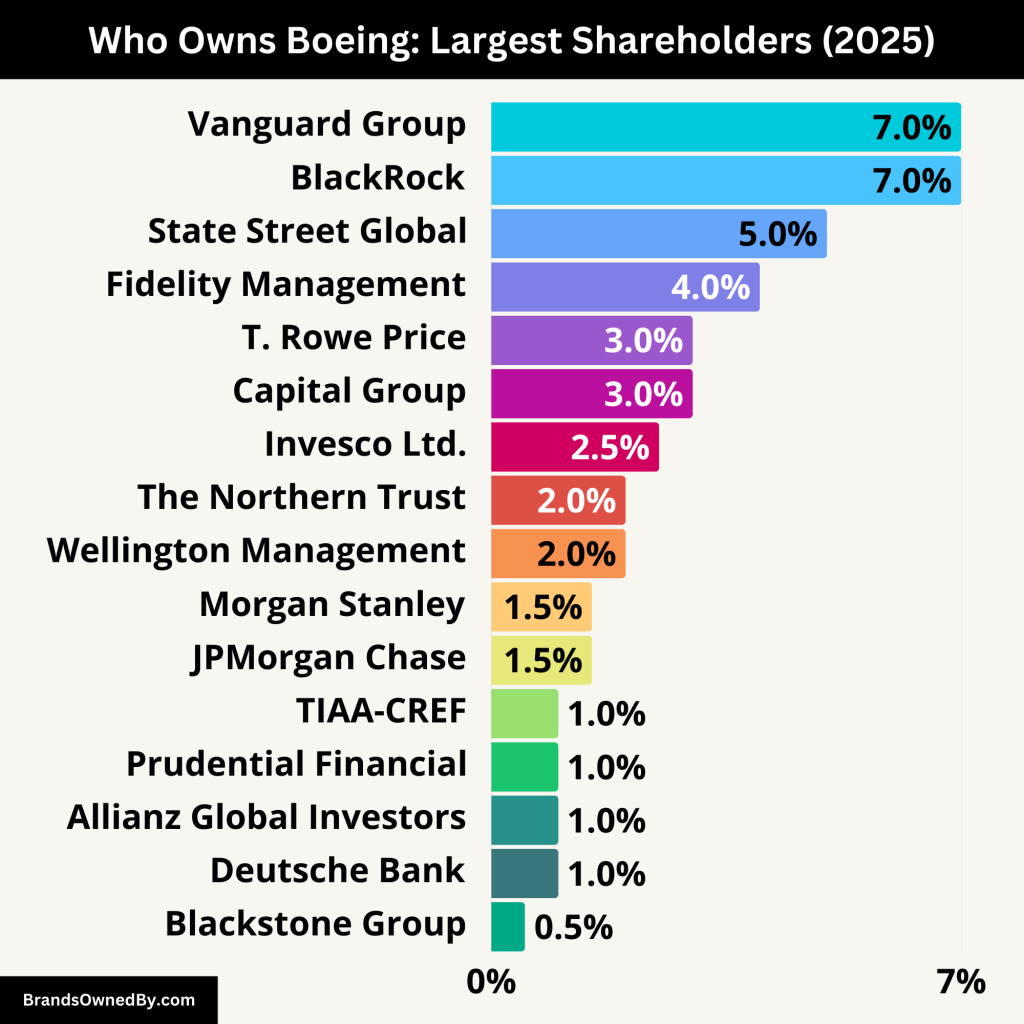

Who Owns Boeing: Largest Shareholders

As of now, Boeing is a publicly traded company listed on the New York Stock Exchange under the ticker symbol BA. The ownership of Boeing is primarily held by institutional investors, with a substantial portion of its shares being owned by large asset management firms, mutual funds, and pension funds. The largest shareholder is Vanguard Group, followed closely by BlackRock, both of which are major institutional investors with stakes in many prominent companies. These institutions control a significant portion of Boeing’s shares, giving them considerable influence over the company’s decisions.

Boeing’s shares are also publicly available for individual investors to buy and sell. However, the largest influence on the company’s direction remains with its institutional investors as discussed below:

| Shareholder | Approximate Ownership (%) | Role/Focus |

|---|---|---|

| Vanguard Group | 7% | Investment management firm, long-term growth strategy, corporate governance advocacy |

| BlackRock | 7% | Global asset management firm, focuses on ESG initiatives, corporate governance involvement |

| State Street Global Advisors | 5% | Asset management, long-term growth, shareholder engagement, and sustainability focus |

| Fidelity Management & Research | 4% | Asset management, long-term investment, shareholder advocacy in corporate governance |

| T. Rowe Price | 3% | Global investment management, long-term growth, and portfolio diversification |

| Capital Group | 3% | Investment management, conservative growth, focus on stability and sustainability |

| Invesco Ltd. | 2.5% | Global investment management, shareholder value maximization, corporate governance |

| The Northern Trust | 2% | Investment management, long-term strategy, sustainability and shareholder-friendly policies |

| Wellington Management | 2% | Institutional investment management, active corporate governance involvement |

| Morgan Stanley | 1.5% | Financial services, asset management, investment banking, and shareholder advocacy |

| JPMorgan Chase & Co. | 1.5% | Global financial services, asset management, investment banking, financial advisory |

| TIAA-CREF | 1% | Retirement services, socially responsible investing, corporate governance focus |

| Prudential Financial | 1% | Financial services, asset management, long-term growth, shareholder value maximization |

| Blackstone Group | 0.5% | Private equity, public equity investment, strategic operational changes and financial returns |

| Allianz Global Investors | 1% | Asset management, long-term value creation, operational efficiency, and sustainability |

| Deutsche Bank | 1% | Global investment bank, financial services, shareholder advocacy, risk management |

Vanguard Group

Vanguard Group is one of the largest shareholders of Boeing, holding around 7% of the company’s shares. As an investment management company, Vanguard oversees a wide range of mutual funds, ETFs, and institutional asset management services.

Their stake in Boeing is part of its diversified portfolio, and Vanguard’s influence extends to several key decisions within the company. Vanguard focuses on long-term, passive investments, and its involvement in Boeing allows it to contribute to decisions at the corporate governance level. It is known for advocating for shareholder-friendly policies and sustainability, often pushing for better transparency and management practices.

BlackRock

BlackRock holds approximately 7% of Boeing, making it another major institutional shareholder. BlackRock is one of the largest investment management firms globally, with an expansive portfolio that includes investments in both public and private sectors.

Its role in Boeing is significant, and as a major shareholder, BlackRock has a voice in the company’s annual meetings and on key decisions, particularly those concerning corporate governance, executive compensation, and strategic direction.

BlackRock has been active in pushing for environmental, social, and governance (ESG) initiatives, and its involvement with Boeing extends to advocating for sustainable business practices.

State Street Global Advisors

State Street Global Advisors owns about 5% of Boeing’s shares, contributing to its influence in the company. State Street is another top asset management firm, and it manages assets for institutional investors, such as pension funds and endowments. Its investment in Boeing aligns with its strategy of long-term growth and stability.

Like Vanguard and BlackRock, State Street Global Advisors is involved in corporate governance issues and has frequently pushed for improvements in sustainability and diversity within major corporations. State Street has also been active in shareholder engagement, working to influence corporate behavior in the best interest of shareholders.

Fidelity Management & Research

Fidelity Management & Research, part of Fidelity Investments, is a significant institutional shareholder in Boeing, owning approximately 4% of the company. As one of the leading asset managers in the United States, Fidelity’s role in Boeing’s shareholder structure is noteworthy.

Fidelity often emphasizes long-term investments and actively engages in shareholder meetings to influence key decisions. Its involvement with Boeing focuses on ensuring the company’s continued growth and stability, especially within the competitive aerospace and defense sectors.

T. Rowe Price

T. Rowe Price owns around 3% of Boeing’s shares. This global investment management firm manages portfolios for institutional and individual investors and holds a significant position in many major companies. T. Rowe Price’s involvement with Boeing is centered on maximizing shareholder value, and it often plays a role in voting on key matters during shareholder meetings. Its strategy includes a mix of value and growth investing, and it closely monitors Boeing’s performance, particularly regarding profitability and innovation.

Capital Group

Capital Group, another major institutional investor, holds approximately 3% of Boeing’s shares. As one of the oldest and largest investment management firms, Capital Group has significant sway in corporate governance across a wide range of industries.

Its stake in Boeing reflects its broader investment philosophy of holding large, stable companies with solid growth prospects. Capital Group is known for its long-term approach to investing, and its role in Boeing involves advocating for strategies that will ensure the company’s sustained financial health and industry leadership.

Invesco Ltd.

Invesco Ltd. is another institutional investor with an approximate stake of 2.5% in Boeing. As a global investment management firm, Invesco provides a wide range of investment solutions to individuals, institutions, and governments.

Its influence in Boeing comes from its sizable shareholding, giving it voting power during annual meetings and a voice in the company’s decision-making processes. Invesco is involved in advocating for improvements in shareholder value and pushing for effective corporate governance practices within Boeing.

The Northern Trust

The Northern Trust is a global investment management firm that holds approximately 2% of Boeing’s shares. The Northern Trust focuses on asset management, wealth management, and banking services for individuals, institutions, and foundations. Its stake in Boeing is part of its large portfolio of diversified investments.

As an institutional investor, Northern Trust participates in Boeing’s shareholder meetings and is involved in shaping decisions that affect corporate governance and financial performance. The firm is particularly known for its conservative, long-term investment strategy and has been an advocate for sustainable business practices across its portfolio.

Wellington Management

Wellington Management, a prominent investment management company, owns around 2% of Boeing. The company serves institutional clients such as pension funds, endowments, and foundations, with a focus on long-term investment strategies. Wellington Management plays an active role in influencing Boeing’s policies by voting on matters of corporate governance during shareholder meetings.

The firm is known for its deep research and analysis in selecting investments that have strong growth potential, and it has supported Boeing’s efforts to recover and innovate, particularly in the wake of the 737 Max crisis.

Morgan Stanley

Morgan Stanley, a major global financial services firm, holds about 1.5% of Boeing’s shares. As one of the leading investment banks, Morgan Stanley offers a wide range of financial services, including asset management, wealth management, and investment banking.

Its stake in Boeing is part of its broader portfolio of holdings across various sectors, and its influence within Boeing comes from its active involvement in financial markets. Morgan Stanley engages in shareholder meetings and has been a vocal advocate for robust financial performance, especially as Boeing looks to grow its market share in the aerospace and defense sectors.

JPMorgan Chase & Co.

JPMorgan Chase & Co., one of the largest banks in the world, holds approximately 1.5% of Boeing’s shares. Through its asset management division, JPMorgan Chase invests in a wide array of public companies, including Boeing. JPMorgan’s influence over Boeing’s corporate decisions stems from its role as both a major shareholder and a financial services provider.

The bank has frequently been involved in structuring large financing deals and providing advisory services to Boeing, particularly during times of financial strain, such as after the 737 Max grounding and the COVID-19 pandemic. JPMorgan’s investment strategy tends to focus on companies with long-term growth potential, such as Boeing.

TIAA-CREF

TIAA-CREF (Teachers Insurance and Annuity Association of America – College Retirement Equities Fund), a leading retirement services firm, owns approximately 1% of Boeing’s shares. TIAA-CREF is known for its focus on socially responsible investing and sustainability.

As a major institutional investor, it uses its position to advocate for corporate governance practices that align with its ethical investment criteria. TIAA-CREF’s influence on Boeing includes promoting the company’s efforts in areas such as environmental sustainability, executive compensation, and diversity.

Prudential Financial

Prudential Financial, a multinational financial services firm, holds an estimated 1% of Boeing’s shares. Prudential is involved in a variety of financial products, including life insurance, annuities, retirement-related services, and asset management.

Its stake in Boeing is held through its institutional investment portfolio, contributing to its overall strategy of long-term growth and value creation. Prudential actively engages in shareholder meetings and has a strong interest in ensuring that Boeing’s financial health and governance standards align with the interests of its beneficiaries and institutional clients.

Blackstone Group

Blackstone Group, primarily known as a private equity firm, owns around 0.5% of Boeing’s shares. Although Blackstone typically focuses on private investments and large-scale buyouts, it also holds substantial public equity stakes as part of its diversified investment strategy.

Blackstone’s involvement with Boeing provides it with a voice in key corporate governance matters, and as an investor, Blackstone is known for pushing for strategic operational changes that maximize returns. Blackstone’s active management approach means that it is often involved in influencing decisions related to corporate restructuring and market positioning.

Allianz Global Investors

Allianz Global Investors holds around 1% of Boeing’s shares. Allianz is a global asset management company that operates investment solutions across equity, fixed-income, and alternative investments. Allianz’s investment strategy focuses on long-term value creation and financial sustainability.

Through its stake in Boeing, Allianz is active in promoting strong governance practices, especially in areas like climate change, business ethics, and innovation. Its involvement in Boeing underscores its commitment to ensuring companies in its portfolio maintain high standards of operational efficiency and sustainability.

Deutsche Bank

Deutsche Bank, a global investment bank, owns approximately 1% of Boeing. Deutsche Bank provides financial services across investment banking, asset management, and corporate banking sectors.

As a shareholder in Boeing, Deutsche Bank plays an active role in influencing the company’s financial and strategic decisions, particularly in areas like capital raising and mergers and acquisitions.

Deutsche Bank is known for its focus on financial stability and risk management, and its stake in Boeing reflects a broader strategy of maintaining a well-rounded portfolio of high-growth assets.

Who Controls Boeing?

Control of Boeing lies with its board of directors and executive leadership. While the company’s ownership is largely in the hands of institutional investors, the day-to-day decisions and strategic direction are primarily overseen by the company’s leadership team. The control structure includes the CEO, the executive leadership team, and the board, all of whom play distinct roles in steering the company.

The Board of Directors

Boeing’s Board of Directors is ultimately responsible for overseeing the company’s operations and ensuring that it adheres to the interests of shareholders. The board is composed of several independent members, as well as key executives from within Boeing. They provide governance, approve major decisions such as mergers and acquisitions, and ensure that Boeing remains financially sound. They also ensure that the company complies with corporate governance standards and that shareholders’ interests are taken into consideration during significant decisions.

Boeing’s Board of Directors is involved in evaluating the company’s performance and making decisions on leadership changes. The board frequently meets with institutional investors to ensure their concerns are addressed and works alongside management to set strategic priorities. Key committees within the board, such as the Audit Committee, Compensation Committee, and Governance Committee, ensure that different aspects of the company’s operations are carefully managed.

CEO Control: Kelly Ortberg

The CEO and President of Boeing, Kelly Ortberg, plays a central role in controlling the day-to-day operations and long-term strategy of the company. Since taking the helm in August 2024, Ortberg has been focused on steering Boeing through its recovery from the 737 MAX crisis and strengthening the company’s operational and corporate culture. Ortberg holds ultimate decision-making authority over Boeing’s direction, including strategic decisions, corporate governance, and high-level operational policies.

Ortberg, with over 35 years of experience in aerospace, took on the CEO role after a period of significant challenges for Boeing. He is now driving efforts to improve Boeing’s quality control, accelerate production, and restore shareholder confidence. He also works closely with the Board of Directors to make strategic decisions and ensure that the company’s long-term goals are met.

The Executive Leadership Team

Boeing’s executive leadership team works alongside the CEO to manage the company’s various divisions, including commercial aircraft, defense, space, and services. The team is responsible for implementing the strategies and decisions made by the board and CEO. Key members of the executive team include:

- Stanley A. Deal – President and CEO of Boeing Commercial Airplanes. He oversees all aspects of Boeing’s commercial aircraft business, including the design, production, and sales of passenger jets.

- Leanne Caret – Executive Vice President, Boeing and President of Boeing Defense, Space & Security. Caret leads Boeing’s defense and aerospace division, which includes military aircraft, satellites, and space systems.

- Brian West – Chief Financial Officer. West is responsible for managing Boeing’s financial strategy and ensuring that the company remains financially stable.

- Greg Hyslop – Chief Engineer and Executive Vice President, Boeing Engineering, Test, and Technology. Hyslop manages the technological and engineering aspects of Boeing’s operations, ensuring that its aircraft remain at the forefront of innovation and safety.

These executives work together to ensure that Boeing can meet its strategic objectives, address shareholder concerns, and enhance the company’s standing in the global aerospace industry.

Influence of Institutional Shareholders

While Boeing’s day-to-day operations are controlled by the executive team, institutional shareholders wield significant influence over major decisions through their voting power at annual meetings. Shareholders like Vanguard, BlackRock, and State Street hold a large portion of the company’s stock, which gives them considerable sway over Boeing’s future direction. These institutional investors often engage with the board of directors and executive team to advocate for changes in corporate governance, sustainability practices, and operational efficiencies.

Although they don’t directly control day-to-day management, the large institutional shareholders play an influential role in steering the company’s governance policies, and they actively participate in shaping long-term strategic decisions. They are often involved in approving significant transactions, such as mergers, acquisitions, and restructuring efforts, and push for better financial returns and responsible corporate behavior.

Boeing’s Governance Structure

The control of Boeing also extends to the company’s governance policies. The board of directors, in collaboration with the executive leadership team, works to uphold the company’s principles of integrity, transparency, and shareholder engagement. Boeing has several internal committees, including the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee, that ensure the company adheres to the best practices in corporate governance.

Boeing’s governance is also shaped by external factors, such as regulatory requirements from aviation authorities like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These authorities impose standards that Boeing must follow, particularly regarding the safety of its aircraft and its operations in the aerospace industry. As such, Boeing’s management often works closely with regulatory bodies to ensure compliance and to restore customer confidence, particularly after the 737 Max crisis.

Annual Revenue and Net Worth of Boeing

Boeing is one of the largest companies in the world, with annual revenues reaching around $76 billion in 2024. The company has a substantial presence in both commercial and defense sectors. Its net worth is valued at over $121 billion as of April 2025 with its stock performance reflecting the fluctuations in the global aerospace market.

Boeing’s revenue largely comes from two major segments: Commercial Airplanes and Defense, Space & Security. The company has experienced periods of strong growth, particularly during times when the global airline industry was expanding. However, revenue has also been significantly impacted by external challenges, such as the 737 Max crisis (2019) and the global economic downturn during the COVID-19 pandemic.

Here is Boeing’s historical revenue and net worth:

| Year | Revenue (in billions) | Net Worth (in billions) | Key Events/Impact |

|---|---|---|---|

| 2015 | $96.1 | $72.5 | Continued strong demand for commercial airplanes. |

| 2016 | $94.6 | $74.5 | Record commercial aircraft deliveries, stable defense sales. |

| 2017 | $93.4 | $80.5 | Increased aircraft deliveries, strong performance in defense. |

| 2018 | $101.1 | $93.7 | Growth driven by Boeing 737, strong defense contracts. |

| 2019 | $76.6 | $55.0 | 737 Max grounding severely impacted revenue and net worth. |

| 2020 | $58.2 | $42.0 | Pandemic and 737 Max crisis caused major revenue decline. |

| 2021 | $62.3 | $61.5 | Recovery from 737 Max crisis and pandemic, though still lower than pre-2019 levels. |

| 2022 | $66.0 | $68.0 | Gradual recovery in commercial aerospace and strong defense sales. |

| 2023 | $79.0 | $74.5 | Continued recovery in air travel, strong government defense contracts. |

| 2024 | $76.0 | $121.0 | Boeing’s sustained recovery as airline industry demand increases and production ramps up. |

Brands and Companies Owned by Boeing

Boeing is not just a major player in the commercial and defense aviation sectors; it also owns several subsidiaries and brands across various aerospace, defense, and technology industries. These subsidiaries enable Boeing to maintain a diversified business model, expand into new markets, and leverage synergies within its different divisions.

Below are the major brands and companies owned by Boeing:

Boeing Commercial Airplanes (BCA)

Boeing Commercial Airplanes (BCA) is a major division of Boeing and one of the company’s primary subsidiaries. BCA is responsible for designing, manufacturing, and selling commercial aircraft. It produces a wide range of aircraft, including the Boeing 737, 747, 767, 777, and 787 Dreamliner series. BCA has been a global leader in commercial aircraft manufacturing for decades, competing primarily with Airbus. The division handles all aspects of commercial aviation, from aircraft design and engineering to production and support services for airlines around the world.

Boeing Commercial Airplanes has historically driven the majority of Boeing’s revenue, and it remains central to the company’s overall success. In recent years, the division has also expanded its offerings to include digital aviation solutions, connected aircraft technologies, and eco-friendly initiatives, including sustainable aviation fuel.

Boeing Defense, Space & Security (BDS)

Boeing Defense, Space & Security (BDS) is one of the largest defense contractors in the world, designing and producing military aircraft, space systems, satellite technologies, and defense electronics. This division serves governments, primarily the U.S. Department of Defense, as well as other global defense agencies.

Some of Boeing’s well-known products in this division include:

- F/A-18 Super Hornet – a carrier-capable fighter jet.

- AH-64 Apache Helicopter – a widely used attack helicopter.

- KC-46 Tanker – a refueling aircraft.

- Boeing’s Satellites – both military and commercial satellite systems for communication, surveillance, and data analysis.

Boeing BDS also develops advanced electronic systems, including cybersecurity technologies, and works on classified projects that have long-term contracts, providing stable revenue streams for the company.

Boeing Global Services (BGS)

Boeing Global Services (BGS) is the division responsible for providing aftermarket support and services to both commercial and military customers. BGS offers a wide range of services, including maintenance, repair, and overhaul (MRO), training, and digital solutions that help improve the operational efficiency of customers’ fleets. This division plays a critical role in ensuring that Boeing aircraft, both commercial and defense, remain operational over the long term.

Boeing Global Services includes the management of spare parts, logistics support, engineering, and software for both commercial airlines and military forces. It also works closely with airlines to offer training programs, simulation technology, and digital solutions to improve operational efficiency. BGS’s focus on long-term service agreements with airlines and defense contractors makes it an essential component of Boeing’s overall business strategy.

Aurora Flight Sciences

Aurora Flight Sciences, a subsidiary of Boeing, specializes in the development and manufacturing of unmanned aerial systems (UAS) and autonomous vehicles. Aurora focuses on creating innovative technologies in the field of aviation, particularly for military, commercial, and defense applications. The company is at the forefront of developing next-generation drones, autonomous air vehicles, and electric vertical takeoff and landing (eVTOL) aircraft.

Aurora’s work on unmanned systems complements Boeing’s broader strategy of expanding its defense and space capabilities. The company’s drones are used in surveillance, reconnaissance, and transport roles, and its autonomous flight technologies are paving the way for a future where aircraft operate without human pilots. Aurora’s advanced aerospace technologies continue to drive innovation within Boeing’s aerospace portfolio.

Jeppesen

Jeppesen, a subsidiary of Boeing, provides navigation software, flight planning tools, and aviation data solutions to commercial and military aviation customers. Founded in 1934, Jeppesen is a leading provider of digital navigation services, and its products are used by airlines, pilots, and air traffic control to ensure safe and efficient air travel.

Jeppesen’s software helps pilots and flight crews plan their routes, optimize fuel usage, and comply with international regulations. The company is also involved in providing data for flight charts, weather information, and air traffic management. Jeppesen’s innovative solutions are critical to maintaining the operational efficiency and safety of Boeing’s commercial and military aircraft.

Insitu

Insitu, a subsidiary of Boeing, specializes in the development of unmanned aircraft systems (UAS) for military, defense, and commercial applications. Insitu’s unmanned systems are used for surveillance, reconnaissance, and intelligence-gathering missions. The company also provides comprehensive training and support services for unmanned aircraft systems.

Insitu is renowned for its pioneering work in the field of small and medium-sized UAVs. These aircraft are increasingly used by the military and government agencies for missions in difficult-to-reach areas, as well as in commercial applications such as environmental monitoring, border surveillance, and infrastructure inspection. Insitu is an integral part of Boeing’s defense and space strategy, helping expand the company’s capabilities in unmanned aviation.

Phantom Works

Phantom Works is Boeing’s advanced research and development division that works on cutting-edge technology and next-generation aircraft and defense systems. Phantom Works focuses on developing prototypes, conducting research, and testing new technologies that could become future products for Boeing.

The division’s projects span various industries, including military aircraft, space exploration, cybersecurity, and advanced materials. It is known for creating the Boeing X-37B, a reusable spaceplane used by the U.S. Air Force, and for developing experimental aircraft such as the Boeing YAL-1 Airborne Laser Testbed. Phantom Works collaborates with Boeing’s commercial and defense divisions to push the boundaries of aerospace technology.

Boeing Space and Launch

Boeing Space and Launch is a key division within Boeing that focuses on space exploration, satellite systems, and launch vehicles. Boeing Space and Launch provides solutions for a variety of space missions, including satellite deployment, space exploration, and commercial space transportation.

Boeing is a key player in NASA’s Artemis Program, which aims to return humans to the Moon, and the company also manufactures the Delta IV and Atlas V launch vehicles in collaboration with United Launch Alliance (ULA), a joint venture with Lockheed Martin. Boeing’s space division has been integral to building satellite systems used by governments and private companies worldwide, including telecommunications satellites and weather-monitoring satellites.

Boeing Capital Corporation (BCC)

Boeing Capital Corporation (BCC) is the financial services division of Boeing, specializing in providing financing for commercial aircraft and equipment leasing. BCC works with airlines and leasing companies to help them finance the purchase of Boeing’s aircraft and provide flexible financing options for customers.

BCC’s primary function is to facilitate the sale of Boeing aircraft by providing various financial solutions, including leasing options and asset-backed financing. It plays a key role in supporting the global sales network for Boeing’s commercial aircraft. This division allows Boeing to maintain strong customer relationships and ensures that airlines have access to the necessary financing to purchase and operate Boeing’s products.

Aviall

Aviall, a wholly owned subsidiary of Boeing, is a global leader in the distribution of aviation parts and services. Aviall provides aftermarket support for a wide range of aviation products, including engines, landing gear, and other critical components used by both commercial and military customers.

The company offers extensive repair services, logistics, and inventory management solutions. Aviall’s expertise in supply chain management helps Boeing customers maintain their fleets and ensure operational continuity. Its global distribution network serves more than 200 manufacturers and thousands of customers, making it a crucial player in the aerospace aftermarket industry.

Boeing Fabrication

Boeing Fabrication is a division that produces major components for Boeing’s aircraft, including metallic and composite structures, propulsion systems, and landing gear. The division’s products play a critical role in the manufacturing of commercial, defense, and space vehicles.

This division ensures that Boeing’s aircraft are built to the highest quality standards, working with suppliers and in-house teams to create essential parts and systems for all Boeing products. The fabrication division is integral to maintaining Boeing’s manufacturing efficiency and scalability.

Tapestry Solutions

Tapestry Solutions is a Boeing subsidiary that provides logistics, mission planning, and management solutions for both the defense and commercial sectors. Tapestry specializes in software solutions that enhance operational efficiency and support military operations, including combat and logistics management systems.

The company’s products are used by the U.S. Department of Defense and international defense agencies to manage large-scale operations, including battlefield management, asset tracking, and personnel management. Tapestry also provides mission planning tools for defense contractors and commercial businesses, ensuring the optimal execution of complex operations.

Boeing Research & Technology (BR&T)

Boeing Research & Technology (BR&T) is the company’s innovation arm, responsible for advancing research in aerospace and defense technologies. BR&T is involved in exploring the latest developments in artificial intelligence, aerospace materials, autonomous systems, and renewable energy for aviation.

BR&T works across multiple Boeing divisions, including commercial airplanes, defense, and space, to push the boundaries of what is possible in aviation technology. The team at BR&T plays a key role in developing the next generation of aerospace technologies and ensuring that Boeing remains a global leader in innovation.

HorizonX

Boeing HorizonX is Boeing’s innovation and venture capital arm, focused on identifying and investing in breakthrough technologies and start-up companies that have the potential to disrupt the aerospace industry. HorizonX has invested in a variety of areas, including autonomous flight, aerospace manufacturing, and digital technologies.

Through HorizonX, Boeing has gained access to a wide range of new technologies and partnerships, allowing the company to stay ahead of the curve in developing future solutions for aviation and space exploration. This division enables Boeing to tap into new ideas and innovations that can potentially transform the aerospace industry.

Final Words

Boeing, a leader in the aerospace and defense sectors, is owned primarily by institutional investors such as Vanguard, BlackRock, and State Street Global Advisors. The company is controlled by its board of directors, with decisions guided by its executive leadership. Boeing’s portfolio includes several prominent companies in commercial aviation, defense, and space exploration, underscoring its significance in the global aerospace industry.

FAQs

Who owns the majority of Boeing’s shares?

The majority of Boeing’s shares are owned by institutional investors like Vanguard Group and BlackRock, each holding around 7% of the company’s shares.

What percentage of Boeing does the U.S. government own?

The U.S. government does not directly own a large portion of Boeing’s stock. However, the government plays a key role as a customer through contracts with Boeing’s defense and aerospace divisions. Boeing does not have significant government ownership in its equity, but government contracts, particularly in the defense sector, are a major source of its revenue.

Who is the CEO of Boeing?

Kelly Ortberg serves as the President and Chief Executive Officer (CEO) of The Boeing Company, bringing over 35 years of aerospace leadership to the role. He officially assumed the position on August 8, 2024, succeeding Dave Calhoun.

What brands are owned by Boeing?

Boeing owns several brands, including Jeppesen, Aurora Flight Sciences, and Boeing Global Services, among others. These subsidiaries contribute to its diverse portfolio in aviation, defense, and space industries.

Is Boeing owned by Airbus?

No, Boeing is not owned by Airbus. Boeing and Airbus are two major competitors in the commercial aircraft manufacturing industry. Boeing is an American company, while Airbus is based in Europe. Both companies design, manufacture, and sell aircraft, but they are separate entities and operate independently from each other.

How many employees does Boeing have?

As of 2024, Boeing employs approximately 150,000 people worldwide. These employees work across various divisions, including commercial airplanes, defense, space exploration, and support services. Boeing has a large global presence with facilities in the United States, Europe, Asia, and other regions.

What is Boeing’s main business?

Boeing’s main business areas are commercial aircraft manufacturing, defense, space exploration, and aviation services. The company is one of the largest manufacturers of commercial airliners in the world, competing mainly with Airbus. Additionally, Boeing is a leading defense contractor, providing advanced aerospace systems, military aircraft, and satellite technologies.

Where is Boeing’s headquarters?

Boeing’s corporate headquarters is located in Chicago, Illinois, USA. The company has additional facilities in major cities around the world, including Washington D.C., Seattle, and regions across Europe and Asia. Boeing operates a global business with research and manufacturing sites spread across many countries.

Is Boeing a public company?

Yes, Boeing is a publicly traded company listed on the New York Stock Exchange (NYSE) under the ticker symbol BA. As a public company, Boeing is owned by shareholders who purchase its stock through the exchange, and it is required to disclose its financial performance and other business activities in public filings.

Does Boeing own Boeing Field?

Yes, Boeing Field, officially known as King County International Airport, is owned by the Boeing Company. Located in Seattle, Washington, Boeing Field serves as a major base for Boeing’s aircraft manufacturing and testing operations. The airport is used primarily for cargo and business flights, as well as by Boeing for flight testing of its new aircraft models before they are delivered to customers.

Can Boeing be sued by shareholders?

Yes, as with any publicly traded company, Boeing can be subject to lawsuits from shareholders. Shareholders may file lawsuits if they believe there has been financial mismanagement, fraud, or violations of securities laws. For example, Boeing faced several lawsuits related to the 737 Max crisis, where shareholders accused the company of misleading investors about the safety of the aircraft. However, the outcome of such lawsuits depends on various legal factors and the specifics of each case.