Who owns Block has become an increasingly important question as the company expands its role in digital payments and cryptocurrency. From its origins as Square to its growth into a global fintech powerhouse, Block now influences how millions handle money. Its ownership story blends visionary leadership from Jack Dorsey with strong backing from major institutional investors.

Key Takeaways

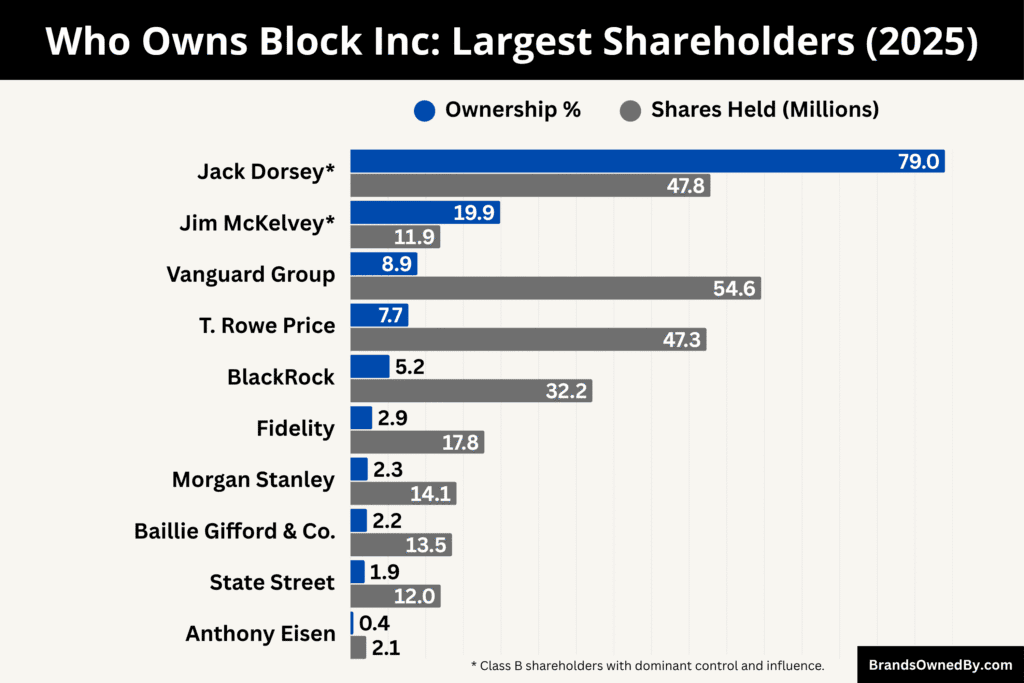

- Block Inc. is publicly traded, but co-founders Jack Dorsey (79% of Class B shares) and Jim McKelvey (19.9% of Class B shares) control the company through Class B shares, giving them dominant voting power despite holding a minority of total equity.

- Institutional investors like Vanguard (8.9% of Class A), T. Rowe Price (7.7% of Class A), and BlackRock (5.2% of Class A) hold significant stakes, influencing governance, board elections, and major corporate decisions.

- Anthony Eisen (0.4% of Class A) and other insiders contribute strategic expertise, particularly in consumer finance, crypto, and merchant services, complementing the co-founders’ control.

- Retail investors collectively own roughly 30% of total shares, but have limited individual influence, making Block’s governance largely shaped by insiders and top institutional shareholders.

Block, Inc. Company Profile

Block, Inc. is a global financial technology company best known for its ecosystem of payment solutions, peer-to-peer platforms, and blockchain initiatives. Headquartered in San Francisco, the company provides services for both individuals and businesses, ranging from point-of-sale systems to music streaming and decentralized finance tools.

Originally founded as Square in 2009, Block started with the simple goal of enabling small merchants to accept card payments using a mobile device. Over time, it evolved into a multifaceted tech company with multiple business units. The rebrand to Block in 2021 signaled its shift beyond payments and into blockchain-driven innovation.

Founders

Block was co-founded in 2009 by Jack Dorsey and Jim McKelvey, with Tristan O’Tierney joining as an early technical co-founder.

- Jack Dorsey – Best known as the co-founder and former CEO of Twitter, Dorsey envisioned Square (now Block) as a way to democratize financial services. His background in software engineering and product design shaped Block’s technology-first approach. Today, he remains the chairman of Block and is its most influential leader, particularly in its Bitcoin-focused strategy.

- Jim McKelvey – A glassblower and entrepreneur, McKelvey originally struggled to sell his handmade glass products because he couldn’t accept card payments. This frustration inspired the idea for Square. McKelvey’s entrepreneurial spirit and persistence helped turn the concept into a company that would change digital commerce.

- Tristan O’Tierney – A software engineer who contributed significantly to the early technical development of Square’s mobile applications. Though he later departed from the company, his role in shaping the first versions of Square’s app was crucial to its early adoption.

Together, the founders combined vision, problem-solving, and technical expertise to create a company that reshaped how individuals and businesses handle money.

Major Milestones

- 2009 – Square (later Block) was founded by Jack Dorsey and Jim McKelvey.

- 2010 – Launch of the Square Reader, allowing small merchants to accept card payments on mobile devices.

- 2011 – Square Register, a point-of-sale app, was introduced to expand services for businesses.

- 2012 – Square launched in Canada, its first international market.

- 2013 – Starbucks invested $25 million in Square and began using its payment system in stores.

- 2015 – Square went public with its IPO on the New York Stock Exchange.

- 2017 – Square introduced Bitcoin trading within Cash App, marking its first major step into cryptocurrency.

- 2018 – Square launched Square Terminal, a sleek point-of-sale device for merchants.

- 2019 – The company introduced Square Card, a debit card for businesses, and expanded further into financial services.

- 2020 – Cash App experienced massive growth during the COVID-19 pandemic as digital payments surged.

- 2021 – Square rebranded as Block, Inc. to reflect its broader portfolio, including blockchain initiatives. That same year, it acquired a majority stake in TIDAL.

- 2022 – Block acquired Afterpay, one of the leading “buy now, pay later” platforms, expanding its consumer finance offerings.

- 2023 – Spiral and TBD became more prominent arms of Block, focusing on Bitcoin development and decentralized finance infrastructure.

- 2024 – Block updated its stock ticker from SQ to XYZ and expanded further into Bitcoin infrastructure, including mining hardware and wallets through Bitkey.

- 2025 – Block was added to the S&P 500 index, cementing its role as one of the most important tech and fintech companies globally.

Who Owns Block Inc: Largest Shareholders

Block is a publicly traded company. Its shares are distributed among insiders (founders, executives), institutional investors, and retail investors.

Institutional investors control a large share of the stock—around two-thirds of it. The top 21 shareholders alone hold a majority stake.

Vanguard is often cited as the largest institutional owner, with about 9% of shares. Insiders like Jack Dorsey retain special influence through dual-class stock structures, holding substantial voting power even when their economic share seems smaller.

Below are the most notable shareholders of Block, Inc. as of September 2025:

| Shareholder | Share Class Held | Ownership (Approx.) | Voting Power & Influence | Role / Relevance |

|---|---|---|---|---|

| Jack Dorsey | Class B + Class A | ~47.84M Class B (79% of Class B) + ~1M Class A (<1%) | Dominant control through super-voting Class B shares | Co-founder, Chairman – guides strategy, Bitcoin focus, and innovation |

| Jim McKelvey | Class B + Class A | ~11.94M Class B (19.9% of Class B) + small Class A stake | High influence via Class B voting power | Co-founder, Board member – strategic role, supports long-term vision |

| Anthony Eisen | Class A | ~2.1M shares (<0.4% of Class A) | Limited equity control, but strategic influence | Co-founder of Afterpay, Block board member, BNPL expertise |

| Vanguard Group | Class A | ~54.58M shares (8.9% of Class A) | Largest institutional voting power | Passive fund manager, major say in governance |

| T. Rowe Price | Class A | ~47.31M shares (7.7% of Class A) | Significant institutional influence | Actively engages for long-term growth and governance |

| BlackRock, Inc. | Class A | ~32.15M shares (5.2% of Class A) | Large institutional voting block, ESG-focused | World’s largest asset manager, votes on sustainability and governance |

| Fidelity Management & Research | Class A | ~17.8M shares (2.9% of Class A) | Moderate influence, often aligns with other institutions | Mutual fund giant, growth-focused investor |

| Baillie Gifford & Co. | Class A | ~13.5M shares (2.2% of Class A) | Smaller stake, but long-term innovation-focused | UK-based global investment firm, backs disruptive companies |

| Morgan Stanley Investment Management | Class A | ~14.1M shares (2.3% of Class A) | Moderate influence, more dynamic voting stance | Balances short-term performance with long-term growth |

| State Street Global Advisors | Class A | ~12M shares (~1.9% of Class A) | Part of the “Big Three” passive managers, strong governance influence | Index fund powerhouse, votes alongside other large institutions |

| Retail Investors | Class A | ~30% combined ownership | Limited collective influence compared to institutions | Millions of small shareholders, less impact on governance |

Jack Dorsey

Jack Dorsey, co-founder and current chairman, is Block’s most powerful individual shareholder.

He holds about 47.84 million Class B shares, equal to nearly 79% of the total Class B stock. He also owns a smaller stake of roughly 1 million Class A shares. Despite holding less than 10% of Block’s total equity, his voting power is magnified through the Class B structure, giving him a dominant say in company decisions.

Dorsey’s position as chairman allows him to guide the company’s strategic focus on Bitcoin, decentralized finance, and product innovation.

Jim McKelvey

Jim McKelvey, Block’s co-founder, owns about 11.94 million Class B shares, or 19.9% of that class, along with a smaller portion of Class A stock.

While he is not involved in day-to-day management, McKelvey’s significant voting power through Class B shares ensures he remains influential in high-level decisions. He also sits on the board of directors and supports Dorsey’s long-term vision, though his role is more strategic than operational.

Anthony Eisen

Anthony Eisen, the co-founder of Afterpay, became a significant shareholder when Block acquired Afterpay in 2022.

He owns more than 2.1 million Class A shares, representing less than 0.4% of that class. While his stake is smaller compared to Dorsey and McKelvey, Eisen’s influence comes from his experience in consumer finance and his role as a board member.

He continues to contribute expertise in “buy now, pay later” services, which remain an important part of Block’s consumer ecosystem.

Vanguard Group

Vanguard is the single largest institutional shareholder of Block. In 2025, it holds about 54.58 million Class A shares, or roughly 8.9% of that class.

As a passive investor managing trillions in assets globally, Vanguard does not directly intervene in Block’s operations. However, it has considerable voting power in board elections and governance matters. Vanguard’s support or opposition can shift the outcome of proposals related to leadership, corporate structure, or executive pay.

T. Rowe Price

T. Rowe Price owns around 47.31 million Class A shares, about 7.7% of that class. Known for its active investment strategies, T. Rowe Price often pushes for sustainable growth and long-term shareholder value.

Its influence lies in its ability to shape corporate governance through voting and engagement with management. The firm’s consistent investment in Block reflects confidence in its fintech and blockchain-focused future.

BlackRock, Inc.

BlackRock is another key shareholder, with about 32.15 million Class A shares, or just over 5.2% ownership. As the largest asset manager in the world, BlackRock’s voting stance is closely watched.

While it tends to vote in alignment with institutional priorities, it also promotes environmental, social, and governance (ESG) principles.

This means BlackRock could exert pressure on Block regarding sustainability, transparency, and ethical business practices.

Fidelity Management & Research

Fidelity holds roughly 2.9% of Block’s shares. It is one of the largest mutual fund companies in the world and invests heavily in tech and growth companies. Fidelity’s position in Block strengthens institutional influence, though its voting share is smaller compared to Vanguard and BlackRock.

Its role is largely financial, but it aligns with other institutions to shape governance outcomes.

Baillie Gifford & Co.

Baillie Gifford, a global investment firm based in Scotland, owns about 2.2% of Block’s shares. The firm is known for its long-term investment strategy in disruptive companies, often backing technology firms with strong innovation potential. Baillie Gifford’s presence as a shareholder underscores the confidence global investors place in Block’s ability to reshape finance.

Morgan Stanley Investment Management

Morgan Stanley owns around 2.3% of Block’s shares. Unlike purely passive investors, Morgan Stanley has a more dynamic approach, often balancing short-term performance with long-term growth. Its stake may seem modest, but combined with other institutions, it has enough influence to impact key votes during shareholder meetings.

State Street Global Advisors

State Street is another institutional investor with a measurable stake in Block, holding just under 2% of shares. Known for its large index funds and ETFs, State Street generally follows a passive strategy, but its voting power contributes to institutional alignment.

Together with Vanguard and BlackRock, State Street forms part of the “Big Three” asset managers that collectively hold major influence over U.S. public companies, including Block.

Block Inc. Leadership

Block’s leadership is built around its unique structure, which blends traditional corporate governance with visionary-driven control. The company’s leaders focus on technology, finance, and decentralized innovation while balancing the needs of shareholders and long-term growth.

Jack Dorsey – Block Head and Chairman

Jack Dorsey serves as the Block Head and Chairman, a title he assumed in 2022 when the company dropped the traditional “CEO” label.

Despite the title change, he functions as Block’s chief executive, setting strategy, vision, and culture. Dorsey drives the company’s Bitcoin-centered mission, pushes new infrastructure projects like Proto and Bitkey, and guides product expansion across Square, Cash App, Afterpay, and TIDAL.

As Chairman of the Board, Dorsey also aligns governance with his leadership style. His Class B shareholding grants him significant voting power, ensuring continuity of his vision. He is the central figure in both the strategic direction and the public representation of Block.

Amrita Ahuja – Chief Financial Officer and Chief Operating Officer

Amrita Ahuja holds the dual roles of CFO and COO at Block. She oversees financial performance, capital allocation, and internal operations. Ahuja plays a crucial role in balancing Block’s innovative ventures with shareholder expectations for profitability. Her operational oversight has been especially important during restructuring efforts in 2025, where Block streamlined its workforce and optimized resources.

Her background at Activision Blizzard and Fox Networks gives her strong experience in scaling large, complex organizations. At Block, she bridges financial discipline with Dorsey’s visionary direction.

Alyssa Henry – Former Head of Square (through 2023)

Alyssa Henry served as the Head of Square until 2023. She managed the point-of-sale ecosystem, merchant services, and small business tools. Under her leadership, Square expanded internationally and reinforced its dominance in digital commerce tools. Though she stepped down, her contributions shaped the Square ecosystem that remains Block’s backbone today.

Her departure underscored Block’s reliance on senior executives to maintain operational focus, especially while Dorsey drives the broader strategic vision.

Brian Grassadonia – Head of Cash App

Brian Grassadonia leads Cash App, one of Block’s fastest-growing and most profitable units. He joined Square early and played a pivotal role in launching Cash App in 2013. Today, Grassadonia oversees its evolution into a multi-product platform that includes peer-to-peer payments, banking services, investing, and Bitcoin trading.

In 2025, Cash App remains Block’s growth engine, and Grassadonia is seen as one of the most influential leaders after Dorsey. His role positions him as a potential successor or future top executive if leadership transitions occur.

Mike Brock – Head of TBD

Mike Brock leads TBD, Block’s decentralized finance and Bitcoin development arm. TBD is focused on building open-source financial infrastructure and advancing Bitcoin adoption globally. Brock works closely with Dorsey on crypto initiatives, including decentralized exchanges and Web3-inspired projects. His role reflects Block’s long-term bet on Bitcoin as the foundation for future financial systems.

Jesse Dorogusker – Head of Hardware & Bitkey

Jesse Dorogusker oversees Block’s hardware strategy, including payment devices, Square Terminal, and the company’s Bitcoin hardware wallet, Bitkey. His team develops secure, user-friendly devices that integrate Block’s payment and crypto systems. By leading Bitkey, Dorogusker contributes directly to Dorsey’s vision of empowering individuals with self-custody solutions.

Shawn “JAY-Z” Carter – Board Member and Partner in TIDAL

Block brought in JAY-Z as part of its acquisition of TIDAL in 2021. He joined the company’s Board of Directors and continues to advise on music, creator services, and artist-first innovation. While not a day-to-day executive, JAY-Z’s influence helps guide Block’s expansion into culture and entertainment.

Board of Directors

Block’s board is designed to provide both governance and strategic support for Dorsey’s vision. Alongside Dorsey, McKelvey, Ahuja, and JAY-Z, the board includes independent directors with backgrounds in finance, technology, and commerce. The board plays a key role in shareholder accountability, especially given the concentrated control of Class B shares held by Dorsey and McKelvey.

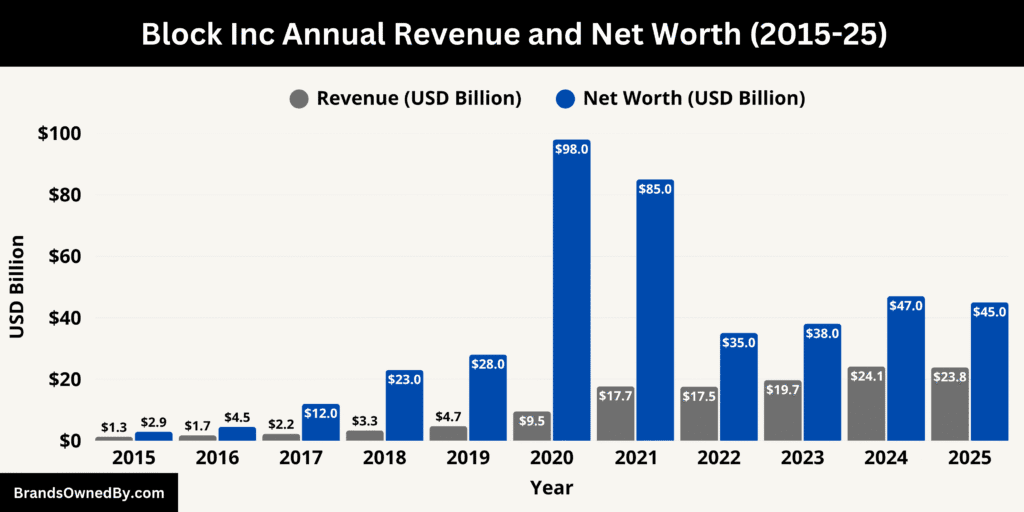

Block Inc. Annual Revenue and Net Worth

As of September 2025, Block reports annual revenue of around $23.8 billion and a market capitalization of roughly $45 billion. These figures highlight the company’s scale as a global fintech leader, combining steady growth with strong profitability.

Here’s an overview of the historical revenue and net worth of Block Inc:

| Year | Revenue (Approx.) | Net Worth / Market Cap (Approx.) |

|---|---|---|

| 2015 | $1.27 billion | ~$2.9 billion (post-IPO valuation) |

| 2016 | $1.71 billion | ~$4.5 billion |

| 2017 | $2.21 billion | ~$12 billion |

| 2018 | $3.30 billion | ~$23 billion |

| 2019 | $4.71 billion | ~$28 billion |

| 2020 | $9.50 billion | ~$98 billion (pandemic fintech surge) |

| 2021 | $17.66 billion | ~$85 billion (rebrand to Block, Bitcoin investments) |

| 2022 | $17.53 billion | ~$35 billion (post-tech market downturn) |

| 2023 | $19.68 billion | ~$38 billion |

| 2024 | $24.12 billion | ~$47 billion |

| 2025 (Sep) | $23.83 billion (TTM) | ~$45 billion |

Revenue

Over the twelve months ending mid-2025, Block’s trailing twelve-month (TTM) revenue reached about $23.83 billion.

This is a modest rise compared to prior periods and shows continued resilience. In the quarter ending June 30, 2025, Block recorded revenue of $6.054 billion, a slight decline year over year of approximately 1.64 %.

Despite that quarterly dip, the full-year total stayed healthy due to stronger performance earlier in the year.

In 2024, Block reported annual revenue of about $24.12 billion, which had been a solid increase from prior years. That year saw growth across its core businesses including Square (merchant services) and Cash App (consumer payments). The 2025 TTM revenue being slightly lower than 2024 suggests a more cautious environment and pressures in certain segments.

While revenue is the top line, profit performance also matters. For the trailing 12 months ending June 30, 2025, Block’s net income stood at approximately $2.958 billion, representing a sharp year-over-year increase.

In a single quarter (ending June 2025), its net income was about $538 million, which was substantially higher than the same quarter the prior year. This suggests that Block has been improving margin efficiency even as growth slows in some areas.

Net Worth

As of September 2025, Block’s market cap hovers around $45 billion, give or take depending on stock market fluctuations.

At times, it has been reported at $44.9 billion, $45.1 billion, or slightly higher, making it one of the more significant players in fintech.

Market capitalization is influenced not just by revenue and profit, but by investor sentiment, growth expectations, and risks tied to its Bitcoin investments and regulatory exposure. The fact that Block’s valuation remains in the tens of billions shows sustained market confidence.

The revenue of ~$23.8 billion, net income of nearly $3 billion, and $45 billion net worth indicate Block is no longer an early-stage venture; it is a mature firm with scale.

Yet growth is slowing, and margins are under pressure in some quarters. The market’s valuation reflects both what Block is earning today and what investors believe it can become tomorrow, especially through its blockchain and infrastructure bets.

Given its strong revenue base and solid profitability, Block’s valuation is supported—though it must continue to execute well, manage costs, and navigate risks to justify that market premium.

Companies Owned by Block

As of 2025, Block operates a diverse ecosystem of brands and subsidiaries that span payments, consumer finance, merchant services, music, and blockchain technology.

Below is a list of the major companies and brands owned by Block, Inc. as of 2025:

| Company / Brand | Description | Key Products / Services | Role within Block |

|---|---|---|---|

| Square | Core merchant-facing brand | POS software and hardware, Square Terminal, Square Online, Square Register, invoicing, payroll, seller analytics | Central to merchant services; backbone of Block’s payments ecosystem |

| Cash App | Consumer financial platform | Peer-to-peer payments, Cash Card, stock trading, Bitcoin buying/selling, business accounts | Main consumer-facing product; drives user engagement and fintech adoption |

| Afterpay | Buy-now-pay-later platform | Installment payments, merchant checkout integrations, Cash App BNPL | Expands consumer credit offerings; integrated into Square and Cash App ecosystems |

| TIDAL | Music streaming and creator platform | Artist-first streaming, subscription models, payout systems | Expands Block into media and creator monetization; enhances artist revenue tools |

| Spiral | Bitcoin and open-source development | Developer tools, protocols, reference implementations, educational resources | Supports Bitcoin ecosystem; drives long-term infrastructure innovation |

| TBD | Decentralized finance and crypto platform | Open exchange protocols, custody solutions, developer experiments | Explores DeFi infrastructure; guides crypto-related strategy |

| Bitkey | Crypto hardware and self-custody brand | Hardware wallets, secure private key devices, firmware | Bridges Block’s software ecosystem to secure crypto ownership for consumers |

| Proto | Mining and hardware initiative | Custom Bitcoin mining chips and systems | Supports decentralized Bitcoin mining; industrial hardware focus |

| Square Financial Services | Banking and deposit services for merchants | Business accounts, debit cards, lending | Provides regulated banking presence and embedded finance capabilities |

| Square Capital | Merchant lending and financing | Working capital loans, automated repayment through sales | Enables small business growth and financial integration within Square ecosystem |

| Square Hardware | Payment hardware development | Square Reader, Terminal, Register devices | Provides secure, integrated payment devices for merchants |

| Cash App Investing | Retail brokerage | Fractional shares, ETFs, mobile trading | Expands Cash App into investing; integrates banking, payments, and investing |

| Cash App Business Products | Merchant tools via Cash App | Payment acceptance, invoicing, receipts | Extends Cash App ecosystem to small businesses and entrepreneurs |

| Block Research & Incubators | Internal R&D and prototyping | APIs, SDKs, fraud tools, experimental finance products | Feeds innovation into Spiral, TBD, and core product lines |

| Block Commerce & Seller Ecosystem | Merchant services bundle | Online storefronts, appointment scheduling, customer engagement tools | Offers end-to-end solutions for merchant operations |

| Creator & Artist Tools | Monetization tools | Direct payments, tipping, subscriptions, payout flows | Supports creators across Cash App and TIDAL; integrated payment solutions |

| Integrated Acquisitions | Legacy acquired products | Afterpay, TIDAL, crypto startups | Strengthens core Block ecosystem through strategic acquisitions |

| International & Local Entities | Regional subsidiaries | Local payment processing, merchant and consumer services | Ensures regulatory compliance and localized operations |

| Platform Partnerships & Ecosystem Integrations | Third-party developer and ISV programs | APIs, SDKs, inventory/accounting integrations | Expands Block’s ecosystem through complementary external services |

Square

Square remains the core merchant-facing brand within Block.

Under this name, Block sells point-of-sale software and hardware for small and medium businesses, including mobile reader devices, Square Terminal, and integrated register solutions.

Square provides payment processing, invoicing, appointment and inventory tools, lending through Square Capital, payroll services, and seller analytics.

It also operates Square Online, which helps merchants build storefronts and process omnichannel sales. Square’s products are tightly integrated with Block’s ecosystem so merchants can accept payments, manage operations, and access financing in one place.

Cash App

Cash App is Block’s consumer-facing financial platform. It began as a peer-to-peer payments app and grew into a broader financial super-app. Cash App offers instant money transfers, direct deposit, a Cash Card debit product, stock trading, and Bitcoin buying and selling.

It also provides features like instant pay and business accounts for small sellers who use Cash App as a payment method.

In 2025, Cash App remains one of Block’s most widely used products and a major driver of user engagement across the company.

Afterpay

Afterpay is Block’s global buy-now-pay-later (BNPL) business. Acquired to expand Block’s consumer finance reach, Afterpay enables shoppers to split purchases into interest-free installments.

Block operates Afterpay primarily as a consumer payment option integrated into merchant checkouts and into Cash App, allowing users to access installment payment flows directly from the consumer wallet.

Afterpay’s merchant relationships and underwriting models broaden Block’s reach into retail commerce and consumer credit.

TIDAL

TIDAL is Block’s music and creator-centric streaming brand. Block acquired a majority interest in TIDAL with the stated aim of building better financial products for artists and creators.

Under Block, TIDAL has explored new monetization models, artist payouts, and integrations that connect streaming revenue to Block’s payments and creator tools.

In 2025, TIDAL operates as a distinct media and creator platform within Block’s portfolio, with a strategic focus on artist-first services and experimental commerce tie-ins.

Spiral

Spiral is Block’s internal initiative dedicated to Bitcoin development and open source contributions.

It focuses on building developer tools, reference implementations, and infrastructure that support Bitcoin’s broader ecosystem. Spiral’s teams work on libraries, protocols, and developer education aimed at making Bitcoin integration simpler and more robust for builders and merchants. Spiral represents Block’s long-term technical bet on Bitcoin as a foundational layer for new financial services.

TBD

TBD is Block’s effort to build decentralized finance primitives and an open exchange layer.

The unit explores protocols, developer platforms, and services that aim to enable decentralized trading, custody, and financial operations. TBD operates with a research and product focus, experimenting with new flows and standards while attempting to balance regulatory realities and open finance ambitions.

Its work informs many of Block’s crypto product decisions and partnerships.

Bitkey

Bitkey is Block’s hardware and self-custody brand for crypto. It focuses on secure devices and firmware that let users hold and transfer private keys with improved safety and inheritance features.

Bitkey develops hardware wallets and consumer-grade devices that integrate with Block’s software suites, aiming to make self-custody accessible to mainstream users. In 2025, Bitkey is positioned as Block’s bridge between consumer products and secure crypto ownership.

Proto

Proto is Block’s hardware and mining initiative that designs custom mining chips and systems. The goal is to enable more decentralized Bitcoin mining by offering energy-efficient and widely available hardware. Proto’s work includes chip design, reference hardware, and partnerships with data center operators and independent miners.

As of 2025, Proto represents Block’s industrial approach to supporting the Bitcoin network through hardware innovation.

Square Financial Services

Operating under the Square ecosystem, Square Financial Services (SFS) provides banking and deposit products tailored to merchants and small businesses. SFS issues business banking accounts, debit cards, and lending facilities. This arm gives Block a regulated banking presence to support its merchant financing and provides a route to expanded embedded finance offerings across its product suite.

Square Capital

Square Capital (merchant lending) provides loans and financing solutions to merchants using Square. The program uses transaction and operational data from Square’s point-of-sale systems to underwrite and offer advances to eligible sellers. Square Capital is integrated with merchant dashboards so owners can see financing options and repayment tied directly to sales, enabling more seamless access to working capital.

Square Hardware

The hardware division designs and ships Square Reader, Square Terminal, and Register devices. These devices are purpose-built to be simple for small merchants while integrating with Square’s software ecosystem. Hardware design emphasizes secure payments, minimal setup, and tight integration with analytics and inventory systems to give small businesses a modern in-store experience.

Cash App Investing and Brokerage Services

Within Cash App, Block operates retail brokerage services that allow users to buy fractional shares and ETFs. Cash App Investing provides a simplified, mobile-first trading experience aimed at first-time investors.

This unit is integrated with Cash App wallets and cards so users can move between banking, investing, and peer payments within one app.

Cash App Business Products

Cash App Business accounts enable merchants to accept payments, issue invoices, and manage receipts using the Cash App platform.

These business products blur the line between consumer and merchant services, letting small sellers leverage Cash App’s large user base to transact without adopting full Square hardware.

Block Commerce & Seller Ecosystem Services

This group bundles various commerce services: online storefront builders, appointment scheduling, customer engagement tools, and marketing integrations for merchants. These services are sold under the Square and Block brands and are intended to provide merchants with a full-stack solution for both online and offline sales.

Final Words

Block, Inc. is a powerhouse in the fintech and blockchain world. The question of who owns Block highlights its structure as a publicly traded company with large institutional and insider ownership. Jack Dorsey remains the key visionary, while institutional investors like Vanguard and BlackRock ensure stability.

With products like Cash App, Square, and Afterpay, Block continues to expand its influence in payments and digital finance.

FAQs

Who is the owner of Block, Inc.?

Block, Inc. is publicly traded, but its co-founders, Jack Dorsey and Jim McKelvey, are the primary owners in terms of control, holding Class B shares that give them dominant voting power.

Who owns the Block company?

Block is owned by a combination of insiders and institutional investors. Jack Dorsey and Jim McKelvey control the company through Class B shares, while large institutional shareholders like Vanguard, T. Rowe Price, and BlackRock hold significant Class A stakes. Retail investors also own a portion, but with limited voting influence.

What are the major companies owned by Block?

Block owns and operates several major brands and entities, including Square (merchant services and hardware), Cash App (consumer finance), Afterpay (buy-now-pay-later), TIDAL (music streaming), Spiral (Bitcoin development), TBD (DeFi infrastructure), and Bitkey (crypto hardware).

What does the Block company do?

Block provides payment processing, financial services, and fintech solutions for both merchants and consumers. Its products include POS hardware and software, peer-to-peer payments, digital banking, investing, Bitcoin services, buy-now-pay-later, creator tools, and music streaming through TIDAL.

Does Jay Z own Block?

No, Jay Z does not own Block, but he is a board member and strategic partner through Block’s acquisition of TIDAL, contributing to its music and creator-focused initiatives.

Who is the chairman of Block, Inc.?

The chairman of Block is Jack Dorsey, who also serves as Block’s Head and effectively functions as the company’s CEO, guiding strategy and operations.

Does Block, Inc. hold Bitcoin?

Yes, Block holds Bitcoin on its balance sheet and actively invests in Bitcoin infrastructure, including mining (via Proto) and decentralized finance projects.

Who is Square owned by?

Square is a subsidiary of Block, and it is ultimately controlled by the same shareholders of Block, primarily Jack Dorsey and Jim McKelvey, through Class B shares, along with institutional investors.

What is Jack Dorsey’s net worth?

As of October 2025, Jack Dorsey’s net worth is estimated at around $5.3 billion, largely tied to his holdings in Block (Class B and Class A shares) and other investments.