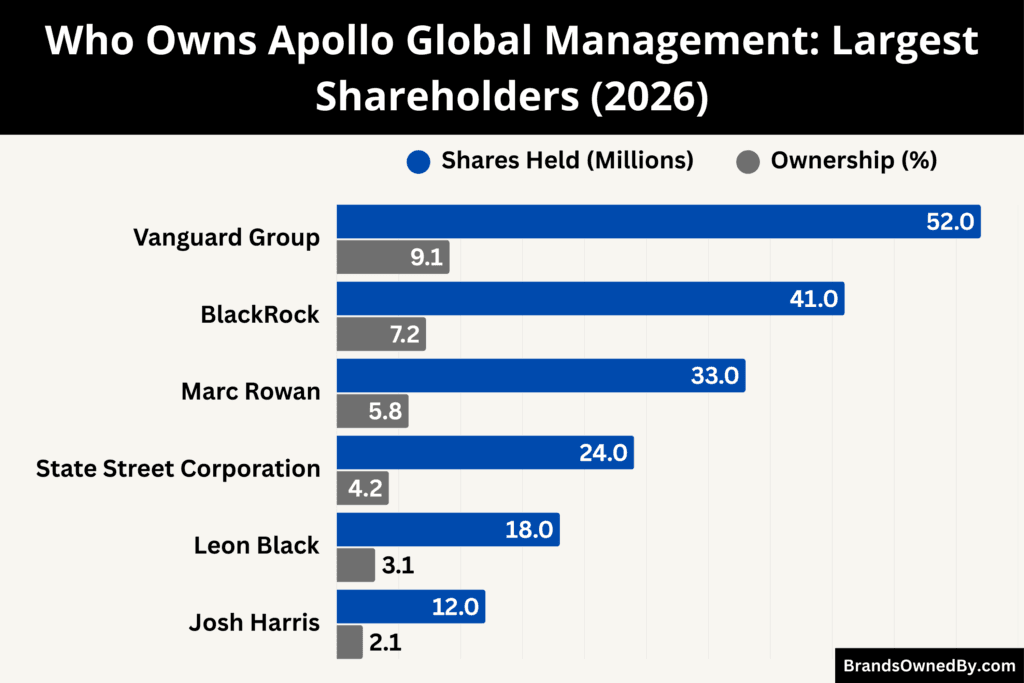

- Apollo Global Management is publicly traded and mainly owned by institutional investors who together hold about 70–72% of total shares, making them the dominant ownership group.

- The largest shareholders are The Vanguard Group (9.1%), BlackRock (7.2%), and State Street (4.2%), followed by other pension funds, sovereign funds, and global institutions with smaller stakes.

- Leadership retains meaningful influence. CEO Marc Rowan owns about 5.8%, while co-founders Leon Black (3.1%) and Josh Harris (2.1%) remain key insider shareholders, keeping management aligned with long-term performance.

- Control is balanced between institutional ownership, insider leadership, and board governance, which explains who owns Apollo Global Management and why the firm operates with stable governance, long-term investment focus, and no dominant controlling shareholder.

Apollo Global Management is a global alternative asset manager headquartered in New York, United States. The firm focuses on private equity, credit, and retirement services. Its strategy centers on long-term capital deployment and value-oriented investing. Apollo serves institutional investors, pension funds, sovereign wealth funds, insurance clients, and individual investors across global markets.

The company operates through integrated investment platforms. These include private equity investments, credit and lending solutions, infrastructure, and insurance-linked capital. Apollo is known for acquiring undervalued businesses, restructuring them, and improving long-term cash flow. The firm has built a strong reputation in opportunistic investing and large-scale buyouts.

Apollo operates worldwide with offices across North America, Europe, and Asia. Its structure combines asset management with permanent capital from insurance operations. This allows Apollo to invest across market cycles and maintain long-term strategic control over its portfolio companies.

Apollo Global Management Founders

Apollo Global Management was founded in 1990 by Leon Black, Josh Harris, and Marc Rowan. Each founder played a critical role in shaping the firm’s strategy and growth.

Leon Black was the driving force behind Apollo’s early expansion. He previously worked at Drexel Burnham Lambert, where he specialized in leveraged finance and buyouts. Black focused on distressed investing and large acquisitions. Under his leadership, Apollo became one of the most aggressive and successful private equity firms. He served as CEO until 2021 and later stepped down from leadership roles.

Josh Harris played a key role in deal structuring and investment strategy. He helped expand Apollo into sports, infrastructure, and global investments. Harris later became known for major sports ownership stakes and strategic investments outside Apollo. Despite stepping back from daily operations, he remains one of the influential co-founders.

Marc Rowan focused on credit investing and long-term capital strategy. He helped build Apollo’s credit business into one of the largest in the world. Rowan played a central role in merging Athene with Apollo, transforming the firm into a permanent capital powerhouse. He became CEO in 2021 and continues to lead the company’s global strategy.

Together, the three founders built Apollo into one of the most influential alternative asset managers globally. Their combined expertise in leveraged finance, credit, and private equity shaped the firm’s investment philosophy.

Ownership History

Apollo Global Management’s ownership history explains how the firm moved from a tightly controlled private partnership to a publicly traded, institutionally dominated global investment company.

Founded in 1990 by Leon Black, Josh Harris, and Marc Rowan, Apollo was originally owned by its founders and senior partners. Over time, public listing, institutional investment, and the Athene merger reshaped its ownership.

Today, ownership is widely distributed, with institutional investors holding the majority while leadership retains meaningful influence.

Early Private Partnership Structure (1990–2011)

Apollo Global Management started as a private partnership in 1990. Ownership was concentrated among founders Leon Black, Josh Harris, and Marc Rowan, along with a small circle of senior partners. This structure gave the founders full control over capital allocation, investment decisions, and long-term strategy.

The firm used a partnership model similar to early private equity firms. Profits were shared internally. Voting control remained within the founding group. This allowed Apollo to move quickly on distressed investment opportunities during the 1990s and early 2000s. The founders reinvested profits into new funds, which strengthened their ownership and control.

During this period, Apollo built its core identity as a value-driven private equity firm focused on distressed assets and leveraged buyouts. Since the company was private, ownership did not include public shareholders or institutional investors. Governance remained centralized and founder-led.

Public Listing and Ownership Shift (2011)

Apollo Global Management went public in 2011. The company listed on the New York Stock Exchange under the ticker APO. This marked a major transition from private ownership to public shareholding. The initial public offering introduced institutional investors, hedge funds, and retail investors into the ownership base.

Despite becoming public, the founders maintained strong control. They retained large equity positions and voting influence. The company also preserved elements of its partnership governance structure. This ensured continuity in investment philosophy and decision-making.

The public listing allowed Apollo to raise long-term capital. It increased transparency and regulatory oversight. It also positioned the firm alongside other publicly traded alternative asset managers such as Blackstone and KKR.

Growth of Institutional Ownership

After the IPO, institutional ownership increased steadily. Major global asset managers began acquiring significant stakes in Apollo Global Management. Firms such as Vanguard Group, BlackRock, and State Street became among the largest shareholders. These institutions invested through index funds, retirement portfolios, and long-term strategies.

Institutional investors gradually became the dominant owners. Their holdings represented a large portion of total shares outstanding. However, they typically did not participate in day-to-day management. Instead, they influenced governance through voting rights, board oversight, and shareholder policies.

As institutional ownership expanded, founder ownership declined in percentage terms. This shift mirrored the evolution seen across the alternative asset management industry. Still, insider ownership remained important for strategic alignment and long-term planning.

Athene Integration and Structural Transformation (2022)

A major turning point in Apollo Global Management ownership came in 2022 with the full merger of Athene Holding. Athene was originally created by Apollo to provide retirement and insurance solutions. Over time, it became a primary source of long-term capital for Apollo’s investment platform.

The merger combined asset management and insurance into one unified corporate structure. Athene shareholders became part of Apollo’s broader ownership base. This expanded the company’s capital foundation and changed the internal ownership composition.

The integration strengthened Apollo’s permanent capital strategy. Insurance-linked capital allowed the firm to invest across longer time horizons. It also increased financial stability during market cycles. The merger marked a structural transformation rather than a simple ownership change.

Founder Ownership Evolution

Founder ownership has gradually evolved over time. Leon Black stepped down from his leadership roles in 2021 and reduced his direct involvement. Josh Harris also shifted focus toward external investments, including sports and infrastructure, while maintaining historical ties to Apollo.

Marc Rowan continued to hold a significant ownership stake. As CEO, his shareholding aligns executive leadership with shareholder interests. Insider ownership among senior executives and partners remains an important part of Apollo’s governance model.

Although founders no longer control the majority of shares, their long-term influence shaped Apollo’s culture, strategy, and investment philosophy.

Modern Ownership Structure

As of 2026, Apollo Global Management has a diversified ownership structure. Institutional investors hold the majority of shares. The largest shareholders include major global asset managers that invest on behalf of millions of clients worldwide.

Insiders, led by CEO Marc Rowan and senior leadership, retain meaningful equity stakes. This ensures alignment between management and shareholders. Governance is balanced between institutional oversight and executive leadership.

Apollo’s modern ownership reflects its transformation from a founder-led partnership to a globally owned public investment firm. This structure supports long-term capital deployment, stable governance, and continued expansion across global markets.

Who Owns Apollo Global Management: Top Shareholders

As of February 2026, Apollo Global Management’s ownership is dominated by institutional investors holding the majority of shares. Its ownership is mostly institutional, with large asset managers holding the majority of shares while insiders maintain meaningful stakes.

As a publicly traded company, Apollo’s shares are widely distributed across index funds, pension portfolios, and long-term investors. The largest shareholders include Vanguard, BlackRock, and State Street. Among individuals, CEO Marc Rowan is the biggest insider shareholder.

This ownership mix combines institutional capital with executive alignment, supporting stable governance and long-term strategy.

The Vanguard Group

The Vanguard Group is the largest shareholder of Apollo Global Management as of 2026. Vanguard holds approximately 52 million shares, representing about 9.1% of the company. Its stake comes mainly through index funds such as the Vanguard Total Stock Market Index Fund and the Vanguard Institutional portfolios.

Vanguard is a passive investor. It does not take part in daily operations. However, its large ownership gives it significant voting power in board elections and shareholder resolutions. Vanguard focuses on long-term value and governance standards. Its position reflects Apollo’s inclusion in major global equity indices.

BlackRock

BlackRock is the second-largest shareholder of Apollo Global Management. As of 2026, BlackRock owns around 41 million shares, equal to roughly 7.2% of total outstanding shares. Its holdings are spread across ETFs, mutual funds, and institutional mandates.

BlackRock’s role is primarily strategic and governance-focused. Through proxy voting and stewardship policies, it influences executive accountability, risk oversight, and shareholder protection. Its investment signals strong institutional confidence in Apollo’s long-term business model and global expansion strategy.

State Street Corporation

State Street Corporation is another major institutional shareholder. It holds approximately 24 million shares, representing about 4.2% of Apollo Global Management. State Street’s ownership comes through index funds managed by State Street Global Advisors.

State Street is a passive long-term investor. It does not participate in operational management. However, it plays a role in corporate governance, transparency, and shareholder rights. Its steady ownership contributes to the stability of Apollo’s shareholder base.

Marc Rowan

Marc Rowan is the largest individual shareholder of Apollo Global Management. As of 2026, he owns roughly 33 million shares, representing about 5.8% of the company. Rowan is the Chief Executive Officer and a founding partner.

His ownership aligns management with shareholder interests. Rowan has been central to Apollo’s transformation, especially in expanding credit investments and integrating Athene into the firm. His equity stake gives him strong influence over long-term strategy and corporate direction.

Leon Black

Leon Black, co-founder of Apollo Global Management, historically held one of the largest stakes in the company. As of 2026, he owns approximately 18 million shares, equal to about 3.1% of the company. His ownership has declined over time as shares were diversified and institutional investors increased holdings.

Although no longer involved in daily leadership, Black remains an important historical shareholder. His early leadership helped shape Apollo’s investment strategy, distressed investing focus, and global expansion.

Josh Harris

Josh Harris, another co-founder, also remains a notable shareholder. As of 2026, he holds roughly 12 million shares, representing around 2.1% of Apollo Global Management. Harris has reduced operational involvement but maintains long-term ownership.

He played a major role in building Apollo’s private equity platform and global investment operations. His continued shareholding reflects the founder-driven origins of the firm.

Athene-Linked Shareholders

Following the full integration of Athene into Apollo, insurance-linked investors became indirect shareholders. These investors collectively represent a meaningful portion of Apollo’s broader ownership base. While they do not hold direct controlling stakes individually, their combined exposure supports Apollo’s long-term permanent capital strategy.

Athene-linked ownership strengthens the company’s ability to invest across long time horizons. It also adds stability compared to traditional asset management firms dependent on external capital flows.

Other Institutional Investors

Beyond the largest shareholders, a wide group of institutional investors owns Apollo Global Management shares. These include pension funds, sovereign wealth funds, hedge funds, and mutual funds. Collectively, these investors hold more than 60% of total shares outstanding.

Most of these investors are passive owners. They focus on long-term returns rather than operational control. Their broad participation improves liquidity and supports market confidence in Apollo’s business model.

Insider and Executive Ownership

Apollo’s senior executives and partners collectively hold a significant number of shares. Combined insider ownership represents approximately 10–12% of the company as of 2026. This includes equity-based compensation, long-term incentive plans, and partner holdings.

Insider ownership ensures management interests remain aligned with shareholders. It promotes long-term decision-making and reinforces Apollo’s founder-influenced culture within a modern public company structure.

Historical Ownership Change (2011–2026)

The table below shows how Apollo Global Management’s ownership structure evolved after becoming a public company. It highlights the gradual shift from founder-dominated ownership to institutional majority, along with key structural changes such as the Athene integration and insider dilution.

| Year | Founder / Insider Ownership | Institutional Ownership | Public / Other Investors | Key Ownership Change |

|---|---|---|---|---|

| 2011 | 65% | 25% | 10% | Apollo Global Management went public. Founders retained majority control with strong voting power after IPO. |

| 2012 | 63% | 27% | 10% | Institutional investors began increasing stakes through index funds and long-term portfolios. |

| 2013 | 61% | 29% | 10% | Expansion of institutional participation following growth in global asset management visibility. |

| 2014 | 59% | 31% | 10% | Gradual dilution of founder ownership as new shares entered public markets. |

| 2015 | 56% | 34% | 10% | Increasing ownership from major asset managers such as Vanguard and BlackRock. |

| 2016 | 53% | 37% | 10% | Institutional investors became a stronger influence in governance and proxy voting. |

| 2017 | 50% | 40% | 10% | Founder ownership fell below majority for the first time. Ownership structure became more balanced. |

| 2018 | 47% | 43% | 10% | Continued growth in passive index fund ownership and global institutional demand. |

| 2019 | 44% | 46% | 10% | Institutional investors became the largest ownership group. |

| 2020 | 41% | 49% | 10% | Ongoing insider dilution and growth in pension and sovereign wealth fund participation. |

| 2021 | 38% | 52% | 10% | Leadership transition. Marc Rowan became CEO. Founder Leon Black stepped down, reducing direct control influence. |

| 2022 | 30% | 60% | 10% | Full merger with Athene. Insurance-linked investors entered ownership structure. Permanent capital base strengthened. |

| 2023 | 27% | 63% | 10% | Institutional ownership expanded further through retirement and insurance-linked investment exposure. |

| 2024 | 24% | 66% | 10% | Continued dilution of founder ownership. Insider control shifted toward executive leadership rather than founders. |

| 2025 | 21% | 69% | 10% | Institutional investors dominated ownership. Large asset managers became primary shareholders. |

| 2026 | 19% | 72% | 9% | Modern ownership structure. Institutional majority with meaningful insider alignment led by CEO Marc Rowan. |

Competitor Ownership Comparison

Competitor ownership comparison helps explain how Apollo Global Management is structured relative to other leading alternative asset managers. The industry is dominated by publicly traded firms where institutional investors hold large stakes, while founders and executives retain influence through insider ownership and governance control.

Below is a detailed comparison of ownership structures across Apollo and its main competitors:

| Company | Institutional Ownership | Insider / Executive Ownership | Founder Influence Level | Ownership Structure Type | Key Ownership Characteristics |

|---|---|---|---|---|---|

| Apollo Global Management | 70–72% | 10–12% | Moderate (CEO-led) | Institutional majority with insider alignment | Largest shareholders include Vanguard, BlackRock, and State Street. CEO Marc Rowan is the largest insider shareholder. Insurance-linked capital adds long-term ownership stability. |

| Blackstone | 68–70% | 18–20% | High (Founder-driven) | Institutional majority with strong founder control | Stephen Schwarzman remains a major shareholder. Founder influence is stronger than Apollo. Institutional investors still dominate total shares. |

| KKR | 65–68% | 16–18% | Moderate–High | Hybrid institutional and insider ownership | Strong insider ownership through founding partners. Institutional investors remain the majority owners. Governance balances insiders and institutions. |

| Carlyle Group | 72–75% | 6–8% | Low–Moderate | Widely dispersed institutional ownership | Less founder influence compared to peers. Governance is more institutionally driven. Insider ownership is smaller than Apollo and KKR. |

| Ares Management | 60–63% | 20–22% | Moderate | Institutional majority with strong insider participation | Higher insider ownership than Apollo. Permanent capital strategy similar through long-term investment vehicles. |

Apollo Global Management Ownership Structure

Apollo Global Management has a predominantly institutional ownership structure. As of 2026, institutional investors hold more than two-thirds of total shares. The largest shareholders include Vanguard, BlackRock, and State Street. These investors hold shares through index funds, pension portfolios, and long-term investment vehicles.

Insider ownership remains meaningful. CEO Marc Rowan is the largest individual shareholder and plays a central role in strategy and governance. Founder ownership has declined over time, but still contributes to long-term alignment. Apollo’s ownership reflects a balance between institutional capital and executive influence, supported by permanent capital from its insurance platform.

Blackstone Ownership Structure

Blackstone is one of Apollo’s largest competitors and the world’s biggest alternative asset manager. Its ownership is also dominated by institutional investors. Major shareholders include Vanguard, BlackRock, and State Street, similar to Apollo.

However, Blackstone has a stronger founder influence compared to Apollo. Stephen Schwarzman, co-founder and long-time CEO, remains one of the largest individual shareholders. His ownership provides significant strategic control. Despite institutional majority ownership, founder leadership remains highly influential in Blackstone’s governance and long-term direction.

KKR Ownership Structure

KKR operates with a hybrid ownership model combining institutional dominance and strong insider participation. Institutional investors hold the majority of shares through global index funds and pension portfolios. Like Apollo, its largest shareholders include Vanguard and BlackRock.

KKR maintains notable insider ownership through its founding partners and senior leadership. This gives executives influence over investment decisions and corporate strategy. Compared to Apollo, KKR has slightly stronger insider alignment but a similar institutional base.

Carlyle Group Ownership Structure

Carlyle Group has a more widely dispersed ownership structure compared to Apollo, Blackstone, and KKR. Institutional investors dominate ownership, but insider stakes are smaller relative to competitors. Major shareholders include global asset managers and investment funds.

Unlike Apollo, Carlyle has less founder-driven influence today. Leadership transitions over time reduced insider ownership concentration. Governance is more institutionally driven, with less reliance on founder-led strategy.

Ares Management Ownership Structure

Ares Management is another key competitor in the alternative asset management space. Its ownership includes a large institutional base alongside meaningful insider ownership. Ares has maintained strong executive shareholding, which supports strategic continuity.

Compared to Apollo, Ares has a slightly higher proportion of insider ownership. However, both firms rely heavily on institutional capital. Ares also benefits from permanent capital sources, similar to Apollo’s insurance-backed structure.

Key Differences Between Apollo and Competitors

Apollo differs from competitors through its strong integration of insurance-backed capital and asset management. The Athene merger created a permanent capital model not fully replicated by all competitors. This structure influences ownership by introducing insurance-linked investors into the broader shareholder base.

Compared to Blackstone, Apollo has slightly less founder dominance. Compared to KKR, insider ownership is similar but more CEO-centered under Marc Rowan. Compared to Carlyle, Apollo maintains stronger insider alignment. Compared to Ares, Apollo operates at a larger scale with deeper insurance integration.

Overall, ownership across the alternative asset management industry follows a similar pattern. Institutional investors dominate shareholding, while insiders maintain strategic influence. Apollo’s ownership stands out for its balance between institutional capital, executive leadership, and a permanent insurance-backed investment structure.

Who Controls Apollo Global Management?

Apollo Global Management is controlled by its executive leadership, led by CEO Marc Rowan, with oversight from the board of directors and governance committees. Although institutional investors own most of the company, they do not run daily operations. Strategic control comes from senior management, investment committees, and board supervision.

This structure ensures disciplined investment decisions, strong risk management, and long-term strategic direction across Apollo’s global asset management and insurance platform.

Chief Executive Officer Leadership

Marc Rowan serves as Chief Executive Officer and is the most influential decision maker at Apollo Global Management. He became CEO in 2021 after co-founder Leon Black stepped down. Rowan has been with Apollo since its founding in 1990 and helped build the firm’s credit and long-term capital strategy.

As CEO, Rowan directs corporate strategy, capital allocation, and global investment priorities. He oversees integration between asset management and insurance-backed capital through Athene. Under his leadership, Apollo expanded credit markets, retirement solutions, and permanent capital strategies. Rowan also works closely with investment leaders and the board to approve major acquisitions, large capital deployments, and structural changes.

His role combines operational leadership with strategic influence. As a major shareholder, Rowan’s equity stake aligns his decisions with long-term shareholder value.

Executive Leadership Team

Apollo’s executive leadership team manages the company’s major business divisions. Senior executives lead private equity, credit, real assets, infrastructure, insurance solutions, and global operations. Each division operates with defined authority but reports to the CEO and senior leadership.

The leadership team manages deal execution, capital deployment, portfolio performance, and operational risk. Executives also coordinate cross-platform strategy, especially between credit investments and insurance capital. This integrated approach allows Apollo to deploy capital efficiently across market cycles.

The executive committee regularly reviews performance, risk exposure, and strategic priorities. This ensures decisions remain aligned with long-term institutional investment goals.

Board of Directors Oversight

The board of directors provides governance oversight and plays a critical role in controlling Apollo Global Management. The board approves major corporate actions, including mergers, acquisitions, strategic investments, and leadership appointments. It also monitors risk management, compliance, and shareholder value creation.

Independent directors form a significant portion of the board. This strengthens accountability and ensures balanced decision-making. The board evaluates CEO performance, sets executive compensation, and reviews long-term strategic plans. Committees within the board handle audit, governance, and risk oversight responsibilities.

While management runs daily operations, the board ensures decisions align with shareholder interests and long-term stability.

Investment Committees and Capital Control

Apollo uses structured investment committees to control capital deployment. Separate committees oversee private equity, credit, and large strategic transactions. These committees review risk, return potential, and long-term value before approving investments.

Major deals require multiple layers of approval. This includes senior investment leaders, risk teams, and executive oversight. The process ensures disciplined capital allocation and prevents excessive risk concentration. It also supports consistent investment standards across global markets.

Final approval authority often rests with senior leadership and the CEO, especially for large-scale or strategic investments.

Role of Institutional Shareholders

Institutional investors such as Vanguard, BlackRock, and State Street hold a majority of Apollo shares. However, they do not directly control operations. Their influence is exercised through shareholder voting, governance engagement, and oversight of board accountability.

These investors influence board composition, governance standards, and executive compensation policies. They promote transparency, long-term value creation, and risk discipline. While they shape governance indirectly, operational and strategic control remain with management.

Evolution of Leadership Control

Apollo’s control structure has evolved over time. During its early decades, Leon Black exercised strong founder-driven leadership. He led the company through major private equity expansions and public listing. Control was highly centralized under the founding partners.

In 2021, Marc Rowan became CEO, marking a transition toward institutionalized governance. Leadership shifted from founder-dominant control to structured executive management supported by governance systems. This transition strengthened stability and long-term planning.

Insurance Integration and Strategic Influence

The full integration of Athene into Apollo changed the firm’s control dynamics. Insurance-linked capital provides long-term funding stability and reduces reliance on short-term market flows. This allows management to make long-horizon investment decisions.

Athene operates as a core strategic partner within Apollo’s structure. Executive leadership coordinates capital deployment between asset management and insurance operations. This integration strengthens centralized strategic control and supports long-term investment execution.

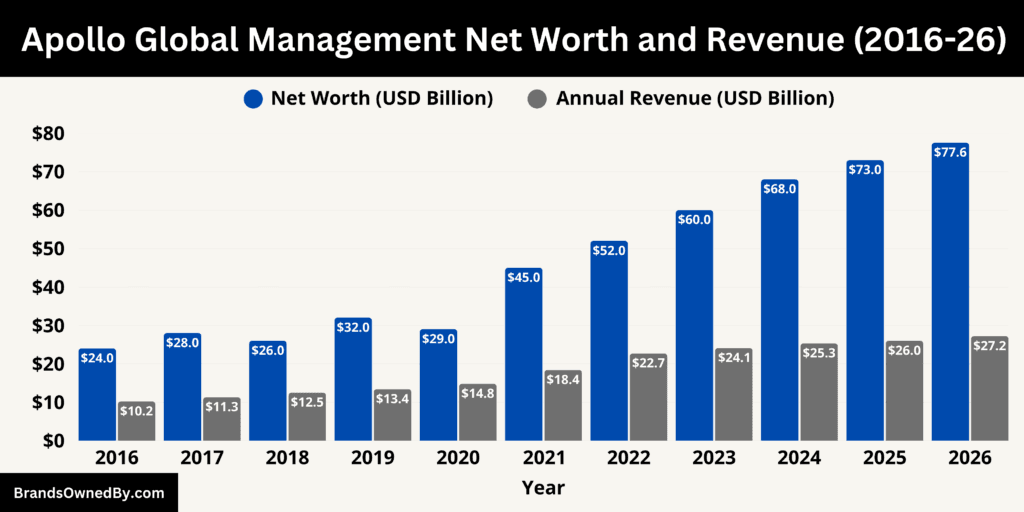

Apollo Global Management Annual Revenue and Net Worth

As of February 2026, the company produces approximately $27.2 billion in annual revenue and has a market capitalization of $77.55 billion. Revenue is driven primarily by fee-related earnings, spread income from insurance capital, and performance income from investments. The firm’s valuation reflects stable recurring income, long-duration capital, and continued expansion across global private markets.

2026 Revenue Composition and Segment Analysis

Apollo’s 2026 revenue of $27.2 billion is divided across three core income streams.

Fee-related earnings contribute approximately $8.6 billion, representing about 32% of total revenue. These fees are generated from managing private equity funds, credit strategies, institutional mandates, and retirement assets. This portion is recurring and predictable because it is linked to long-term assets under management rather than market timing.

Spread-related earnings account for roughly $14.9 billion, or about 55% of total revenue. This is the largest contributor. It comes from Apollo’s insurance and retirement platform, where the firm earns the difference between investment returns and policyholder obligations. This income is stable and long-duration, supported by permanent capital.

Performance income contributes around $3.7 billion, representing about 13% of total revenue. This includes carried interest, realized investment gains, and performance-based fees from private equity exits and credit investments. This segment fluctuates based on market conditions and investment cycles but significantly boosts profitability during strong investment periods.

From a geographic perspective, approximately 72% of revenue comes from North America, 18% from Europe, and 10% from Asia and other regions. Institutional clients, retirement accounts, and insurance-linked capital form the largest revenue base.

Net Worth and Market Capitalization Analysis (2026)

As of February 2026, Apollo Global Management has a market capitalization of $77.55 billion. This valuation reflects the company’s earnings strength, stable cash flow, and long-term capital model. The firm’s valuation is supported by consistent fee-related income and dominant spread-based earnings from insurance operations.

Apollo’s enterprise value is driven by growth in assets under management, which exceeds hundreds of billions globally. The insurance platform adds valuation stability because it provides predictable long-term capital rather than volatile external funding. Institutional ownership also supports valuation through long-term investor confidence.

Compared to traditional asset managers, Apollo’s valuation is more stable because a large portion of earnings is recurring. Market capitalization fluctuates with share price, interest rates, and capital market conditions, but Apollo remains among the largest alternative asset managers globally.

Revenue and Profitability Efficiency

Apollo’s revenue structure shows strong efficiency. More than half of the total revenue comes from spread-related earnings, which are stable and long-term. Fee-related earnings provide a predictable base income, while performance income adds upside during strong investment cycles.

Operating margins benefit from scale and an integrated capital structure. The combination of asset management and insurance-backed capital reduces earnings volatility and supports consistent profitability. Growth in credit markets and retirement solutions continues to improve operating efficiency and income stability.

Net Worth Growth Drivers

Apollo’s valuation growth is supported by several measurable factors. Expansion in assets under management increases fee-related revenue. Growth in insurance and retirement assets expands spread income, which is the firm’s largest earnings source. Institutional capital inflows improve liquidity and valuation stability.

Strategic acquisitions and expansion into infrastructure, credit, and hybrid capital markets contribute to long-term value creation. The company’s integrated investment and insurance model provides durable earnings, which supports market capitalization growth over time.

Revenue Forecast Outlook (2027–2030)

Apollo Global Management is expected to continue expanding revenue through long-term capital growth, insurance expansion, and credit market dominance. Based on the current trajectory and earnings structure, the following outlook reflects projected revenue growth through 2030.

- 2027: Estimated $28.8–$29.5 billion. Growth driven by retirement platform expansion and institutional capital inflows.

- 2028: Estimated $30.5–$31.5 billion. Credit markets and infrastructure investments are expected to increase income scale.

- 2029: Estimated $32.5–$33.8 billion. Expansion of permanent capital and global investment footprint strengthens revenue.

- 2030: Projected $35–$37 billion. Long-term insurance-linked capital and global alternative investment demand drive sustained growth.

Overall, Apollo’s financial structure is built on recurring earnings, permanent capital, and diversified investment income. This positions the firm for steady revenue growth and strong valuation stability through 2030.

Companies Owned by Apollo Global Management

As of 2026, Apollo Global Management operates a diversified portfolio across insurance, credit, private equity, digital media, infrastructure, and financial services. Many of its holdings generate recurring cash flow, while others provide long-term capital appreciation.

Below is a list of the major brands, businesses, and companies owned by Apollo Global Management as of Feb 2026:

| Company | Apollo Ownership | Industry | Business Type | Strategic Role in Apollo Portfolio |

|---|---|---|---|---|

| Athene Holding | 100% | Insurance & Retirement Services | Operating Company | Core permanent capital engine. Generates spread income and long-term investment capital. |

| Yahoo | 90% | Digital Media & Technology | Operating Company | Digital advertising, media platforms, and subscription revenue growth. |

| ADT Inc. | 75% | Home Security & Smart Technology | Operating Company | Recurring subscription-based security and smart home services. |

| The Venetian Resort Las Vegas | 100% (Operations) | Hospitality & Gaming | Operating Asset | Stable cash flow from tourism, gaming, and luxury hospitality. |

| Shutterfly | 100% | E-commerce & Consumer Services | Operating Company | Personalized products and digital commerce platform. |

| Rackspace Technology | 65% | Cloud & Enterprise IT | Operating Company | Hybrid cloud and managed enterprise technology services. |

| Cox Media Group | 70% | Broadcasting & Digital Media | Operating Company | Regional media and advertising revenue platform. |

| CareerBuilder + Monster | 80% | Digital Recruitment & HR Tech | Operating Company | AI-driven hiring and employment platform. |

| University of Phoenix | 100% | Education & Online Learning | Operating Company | Online education and career-focused degree programs. |

| Smart & Final | 60% | Retail & Food Distribution | Operating Company | Warehouse-style grocery and foodservice retail chain. |

| Athora | 35% | Insurance & Retirement (Europe) | Strategic Investment | Expands Apollo’s global insurance capital platform. |

| MidCap Financial | 100% | Private Credit & Lending | Financial Platform | Direct lending and structured finance to middle-market companies. |

| PK AirFinance | 100% | Aviation Finance | Financial Platform | Aircraft financing and transportation credit platform. |

| Atlas SP | 80% | Structured Finance & Securitization | Financial Platform | Structured credit and asset-backed financing engine. |

| Ingenico | 100% | Payment Technology & Fintech | Operating Company | Global payment infrastructure and digital transaction platform. |

| Tenneco | 85% | Automotive Manufacturing | Operating Company | Global automotive parts and industrial manufacturing platform. |

| Univar Solutions | 100% | Chemical Distribution | Operating Company | Global specialty and industrial chemical supply chain network. |

| Michaels Companies | 100% | Retail & E-commerce | Operating Company | Arts and crafts retail and digital commerce platform. |

| West Technology Group | 75% | Cloud Communications & CX Technology | Operating Company | Enterprise communication and customer engagement solutions. |

| Evri | 55% | Logistics & Parcel Delivery | Operating Company | Last-mile delivery and e-commerce logistics network. |

| Intrado | 85% | Telecom & Emergency Communications | Operating Company | Critical communication and public safety infrastructure services. |

| Coinstar (Outerwall) | 100% | Automated Retail & Financial Services | Operating Company | Coin-counting and automated financial kiosk network. |

| Great Canadian Entertainment | 90% | Gaming & Hospitality | Operating Company | Casino resorts and entertainment venues generating tourism cash flow. |

Athene Holding

Athene is Apollo’s most important operating platform and its primary source of long-term permanent capital. It is a retirement services and insurance company focused on annuities, pension risk transfer, and fixed-income investment solutions. Athene generates spread-related earnings by investing insurance premiums into long-duration credit and structured finance assets managed by Apollo.

The full integration of Athene transformed Apollo into a hybrid asset manager with insurance-backed capital, strengthening revenue stability and long-term investment capacity.

Yahoo

Apollo acquired Yahoo in a multi-billion-dollar transaction from Verizon and operates it as a major digital media and technology platform. Yahoo includes brands such as Yahoo Finance, Yahoo Sports, Yahoo Mail, and Yahoo News.

The company generates revenue through digital advertising, subscriptions, and media services. Apollo’s strategy focuses on restructuring operations, improving profitability, and expanding advertising technology capabilities.

ADT Inc.

Apollo holds a major ownership stake in ADT, a leading provider of home security and smart home solutions. ADT operates subscription-based monitoring services and connected home technology across North America. The company produces recurring cash flow through long-term customer contracts. Apollo supports ADT’s expansion into smart automation and integrated home security ecosystems.

The Venetian Resort Las Vegas

Apollo acquired the operations of The Venetian Resort in Las Vegas, one of the largest luxury hospitality and gaming properties in the United States. The resort includes hotels, convention centers, retail space, and casino operations. Apollo’s investment focuses on long-term tourism demand, hospitality cash flow, and property value growth. The asset generates steady revenue from gaming, entertainment, and hospitality services.

Shutterfly

Shutterfly is a digital photography and personalized product platform acquired and taken private by Apollo. The company specializes in custom photo printing, gifts, and e-commerce services. Apollo restructured Shutterfly to improve profitability, streamline operations, and expand its digital consumer business. The platform operates through multiple brands in the personalized products market.

Rackspace Technology

Apollo owns Rackspace Technology, a managed cloud and enterprise IT services company. Rackspace provides hybrid cloud, multi-cloud, and data infrastructure solutions to businesses globally. Apollo acquired the company through a leveraged buyout and repositioned it toward enterprise cloud services and managed infrastructure support. The company generates recurring revenue from long-term enterprise contracts.

Cox Media Group

Apollo holds a controlling stake in Cox Media Group, a large broadcasting and media company. Cox Media operates television stations, radio networks, digital media platforms, and advertising services across the United States. The investment focuses on stable media cash flow, digital transformation, and regional media dominance. The company generates revenue from advertising, broadcasting rights, and digital media operations.

CareerBuilder + Monster

Apollo merged CareerBuilder and Monster into a combined digital employment platform. This entity focuses on recruitment technology, job matching, and AI-driven hiring solutions. The platform serves employers, recruiters, and job seekers globally. Apollo’s strategy is to modernize recruitment technology and strengthen the company’s position in digital workforce solutions.

University of Phoenix

Apollo owns the University of Phoenix through its education investment platform. The university focuses on adult education, online degree programs, and career-focused learning. It serves working professionals and non-traditional students. Apollo restructured operations to improve academic performance, regulatory compliance, and long-term sustainability in the education sector.

Smart & Final

Smart & Final is a warehouse-style grocery and foodservice retailer owned by Apollo through private equity investment. The company serves both retail consumers and small businesses. It operates large-format stores across the United States. Apollo focuses on operational efficiency, supply chain improvements, and long-term retail cash flow.

Athora

Athora is a European insurance and retirement services platform backed by Apollo. It operates across multiple European markets, providing pension, life insurance, and retirement investment solutions. Athora supports Apollo’s global insurance strategy and provides additional long-term investment capital through regulated insurance structures.

MidCap Financial

MidCap Financial is a specialty finance and lending platform owned by Apollo. It provides credit solutions to middle-market companies, healthcare businesses, and real estate investors. The platform focuses on direct lending, asset-backed finance, and structured credit investments. It supports Apollo’s expansion in private credit markets.

PK AirFinance

PK AirFinance is an aviation lending and aircraft financing platform owned by Apollo. It provides structured financing to airlines, leasing companies, and aviation investors globally. The platform supports Apollo’s expansion into asset-backed credit and transportation finance markets.

Bridge Investment Group

Apollo holds a significant investment stake in Bridge Investment Group, a real estate and infrastructure investment platform. The company focuses on property investment, housing, logistics, and real estate credit. Apollo benefits from exposure to long-term real asset income through this partnership.

Aspen Insurance

Apollo holds a major investment in Aspen Insurance, a global specialty insurance and reinsurance company. The investment supports Apollo’s broader insurance and risk capital strategy. Aspen provides underwriting, risk transfer, and reinsurance capabilities, expanding Apollo’s insurance-linked capital ecosystem.

Atlas SP

Atlas SP is Apollo’s structured products and asset-backed finance platform. It focuses on securitization, structured credit, and capital markets financing. The platform supports Apollo’s fixed-income and credit investment strategy and generates fee-based and spread-related income.

Apollo Global Securities and Investment Entities

Apollo operates multiple internal investment entities, funds, and operating platforms under its global structure. These include private equity funds, credit funds, infrastructure vehicles, and retirement investment platforms. These entities deploy capital across global markets and form the core of Apollo’s asset management business.

Ingenico

Ingenico is a global payment technology company owned by Apollo. It provides payment terminals, digital payment software, and transaction processing solutions to merchants worldwide. Apollo acquired Ingenico from Worldline in a major carve-out transaction. The company operates across Europe, North America, and emerging markets, focusing on integrated payment ecosystems and fintech infrastructure.

Tenneco

Tenneco is a global automotive parts manufacturer controlled by Apollo. The company produces engine components, emission control systems, suspension products, and performance automotive parts. Apollo acquired Tenneco to restructure operations, improve profitability, and strengthen its position in industrial and automotive manufacturing. The company operates through major automotive supply chains worldwide.

Univar Solutions

Univar Solutions is a global chemical distribution company owned by Apollo. It supplies specialty chemicals, industrial chemicals, and ingredient solutions to manufacturing, pharmaceuticals, and consumer industries. Apollo acquired Univar in a multi-billion-dollar transaction and focuses on operational efficiency, supply chain optimization, and margin improvement.

Michaels Companies

Michaels is a leading arts and crafts retail chain owned by Apollo. The company operates hundreds of retail stores across North America and a large e-commerce platform. Apollo took Michaels private to improve digital transformation, operational efficiency, and long-term profitability in the specialty retail sector.

West Technology Group

West Technology Group is a global communication and customer engagement technology company owned by Apollo. It provides cloud-based communication, digital interaction, and customer experience solutions. The company serves enterprises across healthcare, financial services, and technology sectors.

Evri (UK Logistics Company)

Evri, formerly Hermes UK, is a parcel delivery and logistics company backed by Apollo. It provides last-mile delivery, e-commerce logistics, and parcel distribution services across the United Kingdom. Apollo supports its growth in the fast-expanding e-commerce delivery sector.

Intrado

Intrado is a technology and communications infrastructure company owned by Apollo. It provides emergency communication systems, cloud-based communications, and public safety network services. The company operates critical infrastructure supporting telecom and emergency response systems.

Coinstar (Outerwall)

Apollo owns Coinstar through its acquisition of Outerwall. Coinstar operates automated coin-counting kiosks and financial service machines across retail locations. The business generates recurring service-based revenue through retail partnerships and transaction fees.

Great Canadian Entertainment

Great Canadian Entertainment is a casino and hospitality company owned by Apollo. It operates gaming resorts, casinos, and entertainment facilities across Canada. The company generates revenue from gaming operations, hospitality services, and tourism-related entertainment.

Diamond Resorts

Apollo previously acquired Diamond Resorts, a global vacation ownership and hospitality company. The investment focused on restructuring and improving long-term value in the travel and leisure sector. The company was later integrated into broader hospitality investment strategies.

Final Words

The ownership structure behind Apollo Global Management reflects a mix of institutional capital and strong executive alignment. Large asset managers hold most shares, while leadership continues to guide long-term strategy and investment direction. This structure supports stability, disciplined capital deployment, and consistent value creation across market cycles. The answer to who owns Apollo Global Management lies in this balance between global investors and insider leadership, which enables the firm to maintain its position as a leading force in alternative asset management.