What companies does Home Depot own? This question is often asked by those interested in understanding the scale and reach of one of America’s biggest home improvement retailers. Home Depot is more than just a store that sells tools and building materials.

Over the years, it has acquired several companies to support its services, logistics, and technology infrastructure. These acquisitions have helped Home Depot become a leader in retail innovation, professional contractor support, and home improvement services.

Home Depot Profile

Home Depot is the world’s largest home improvement retailer. It serves both individual homeowners and professional contractors with a vast selection of building materials, tools, appliances, and home services. The company operates over 2,300 stores across the United States, Canada, and Mexico. In addition to its physical stores, Home Depot has a strong digital presence, offering online shopping, curbside pickup, and delivery services.

Company Details

Home Depot is headquartered in Atlanta, Georgia. It trades on the New York Stock Exchange under the ticker symbol HD. The company employs over 470,000 people and has built a reputation for customer service, product selection, and competitive pricing. Its business is divided into several segments, including DIY retail, Pro services, online sales, tool rental, and home services.

As of 2025, Home Depot remains a Fortune 20 company, generating more than $160 billion in annual revenue. It has maintained steady financial growth and regularly returns capital to shareholders through dividends and stock buybacks.

Founders of Home Depot

Home Depot was founded by Bernie Marcus, Arthur Blank, Ron Brill, and Pat Farrah in 1978. Marcus and Blank are the most well-known of the group. They were fired from Handy Dan Home Improvement Centers and decided to create a new kind of hardware store — one that offered low prices, a massive selection, and excellent customer service all under one roof.

Pat Farrah brought retail expertise, while Ron Brill helped establish the business framework. Together, they opened the first two Home Depot stores in Atlanta, Georgia, in 1979.

Major Milestones

1978–1979: Home Depot is founded and opens its first two stores in Atlanta.

1981: The company goes public on the NASDAQ, raising capital to fuel expansion.

1984–1990: Rapid growth across the U.S. with more than 100 stores opened.

1994: Home Depot enters the Mexican market with stores in Monterrey.

2002: Launch of Home Depot Supply, later renamed HD Supply, to serve professional contractors.

2006: Opens its first store in China (which was later exited due to poor demand).

2007: Spins off HD Supply to focus more on core retail operations.

2014–2017: Acquires Blinds.com, Redbeacon, and Compact Power Equipment to boost service offerings.

2020: Reacquires HD Supply for $8 billion to support the Pro segment.

2022: Ted Decker becomes CEO, emphasizing supply chain and technology investments.

2023–2025: Expands fulfillment network, improves online shopping features, and invests in AI-driven logistics to enhance customer and contractor experiences.

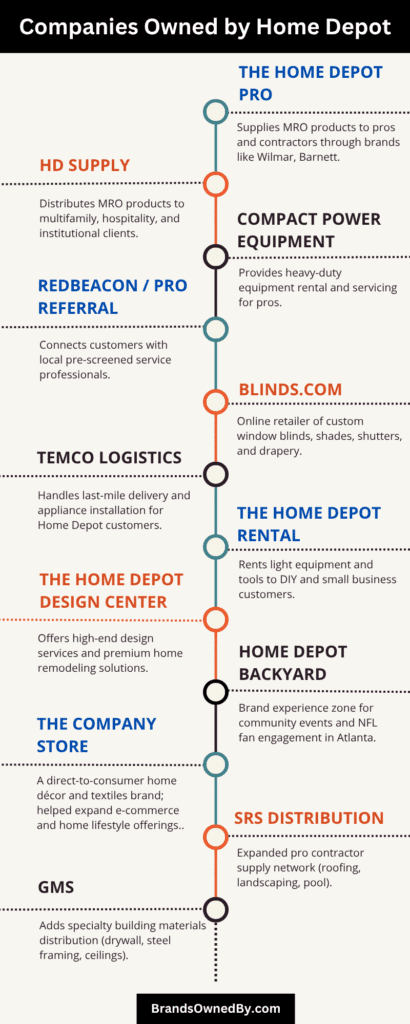

List of Companies Owned by Home Depot

As of 2025, Home Depot owns and operates several companies, brands, and subsidiaries that support its retail, logistics, and service ecosystem. These entities were either developed internally or acquired to strengthen the company’s position in the home improvement and professional contractor markets.

Below is a detailed list of the major companies and brands owned by Home Depot as of 2025:

| Company/Brand | Type | Year Acquired/Launched | Key Function |

|---|---|---|---|

| The Home Depot Pro | B2B Division | 2015 (via Interline Brands) | Supplies MRO products to pros and contractors through brands like Wilmar, Barnett |

| HD Supply | B2B Distributor | 2020 (Reacquired) | Distributes MRO products to multifamily, hospitality, and institutional clients |

| Compact Power Equipment | Equipment Rental | 2017 | Provides heavy-duty equipment rental and servicing for pros |

| Redbeacon / Pro Referral | Home Services Platform | 2012 | Connects customers with local pre-screened service professionals |

| Blinds.com | E-commerce Retail | 2014 | Online retailer of custom window blinds, shades, shutters, and drapery |

| Temco Logistics | Logistics/Delivery | Internal Acquisition | Handles last-mile delivery and appliance installation for Home Depot customers |

| The Home Depot Rental | Rental Services Brand | Internal Brand | Rents light equipment and tools to DIY and small business customers |

| The Home Depot Design Center | Premium Retail Concept | 2019 | Offers high-end design services and premium home remodeling solutions |

| Home Depot Backyard | Branded Community Space | 2018 | Brand experience zone for community events and NFL fan engagement in Atlanta |

The Home Depot Pro (formerly Interline Brands)

Home Depot Pro is the company’s business-to-business (B2B) division. It caters to professionals such as maintenance managers, contractors, plumbers, electricians, and facility operators. The brand was formed after the acquisition of Interline Brands in 2015 for $1.6 billion.

This division provides professional customers with a wide range of products, including janitorial supplies, electrical components, plumbing fixtures, HVAC products, and maintenance tools. Home Depot Pro operates under several regional and segment-specific names, including:

- SupplyWorks – Focuses on janitorial and facility maintenance.

- Wilmar – Specializes in multifamily housing and property management.

- Barnett – Serves plumbing and electrical professionals.

These brands allow Home Depot to serve different customer segments under tailored solutions, while benefiting from centralized logistics and procurement systems.

HD Supply

HD Supply is one of the largest distributors of MRO (maintenance, repair, and operations) products in the U.S. Home Depot originally owned the brand before spinning it off in 2007. In 2020, the company reacquired HD Supply for $8 billion to strengthen its position in the Pro customer market.

HD Supply focuses on institutional customers, such as:

- Multi-family housing providers

- Hospitality businesses

- Healthcare institutions

- Government organizations

Its product lines include building materials, plumbing parts, lighting, and janitorial supplies. HD Supply operates as part of the Home Depot Pro platform but retains its own operational structure and customer relationships.

Compact Power Equipment

Home Depot acquired Compact Power Equipment in 2017 for $265 million. The company rents and services equipment such as skid steers, trenchers, mini-excavators, and aerial lifts. This acquisition expanded Home Depot’s rental division, giving customers access to both DIY and professional-grade tools.

Compact Power Equipment operates rental centers inside Home Depot locations across the U.S. It is also involved in equipment maintenance and servicing, especially for heavy-duty tools and construction gear. The brand helps Home Depot compete with standalone rental companies and enhances its offerings for contractors.

Redbeacon (now integrated into Pro Referral)

Redbeacon was acquired by Home Depot in 2012. It started as a tech platform that matched homeowners with local service professionals for home projects such as plumbing, painting, or renovations.

While the Redbeacon brand has been retired, its technology and concept live on through Home Depot Pro Referral. This service connects customers with pre-screened local pros for over 400 categories of home services. It is integrated into Home Depot’s website and mobile app, making it easy for users to find help after purchasing products.

Blinds.com

Blinds.com is an e-commerce leader in custom window treatments. Home Depot acquired the company in 2014 to strengthen its online décor offerings. The brand offers:

- Custom blinds

- Shades

- Shutters

- Drapery

Blinds.com operates as an independent brand under the Home Depot umbrella. It enhances the retailer’s ability to serve customers looking for made-to-order solutions and has its own customer service and design consultation team.

Temco Logistics

Temco is a last-mile delivery and appliance installation company acquired by Home Depot to improve its delivery capabilities. While not a retail brand, Temco plays a key role in Home Depot’s fulfillment strategy.

Temco specializes in:

- Delivery of large appliances

- Professional in-home installation

- White-glove delivery service

It helps Home Depot offer a seamless post-purchase experience, especially for items that require setup, like refrigerators, washers, dryers, and water heaters.

The Home Depot Rental

The Home Depot Rental is an internal brand offering tools and equipment for rent to DIY customers and professionals. It complements Compact Power Equipment and focuses on lighter tools such as:

- Power drills and saws

- Carpet cleaners

- Lawn and garden equipment

- Concrete mixers

This service is available in-store and online and allows customers to rent tools by the hour, day, or week. It also supports small contractors who may not have the budget to purchase high-end tools outright.

The Home Depot Design Center

This is a specialized retail concept by Home Depot focused on high-end home improvement, interior design, and remodeling. These centers are located in select cities and cater to customers looking for custom cabinetry, premium appliances, and designer finishes.

The Home Depot Design Center offers:

- One-on-one appointments with interior designers

- Interactive product displays

- Tailored solutions for kitchen, bath, and flooring

It represents Home Depot’s effort to target higher-income homeowners and capture the remodeling segment more deeply.

Home Depot Backyard

Although not a for-profit business, the Home Depot Backyard is a branded experience space next to Mercedes-Benz Stadium in Atlanta. It is used for:

- Brand marketing

- Community events

- Fan engagement during NFL games

This branded property helps Home Depot build stronger community ties and brand awareness beyond retail.

Home Depot Acquisition History

Over the years, Home Depot has strategically acquired several companies to strengthen its core retail operations, expand its professional services, and enhance logistics and digital capabilities. These acquisitions have played a key role in shaping the company’s growth and helping it remain competitive in the home improvement industry.

Below is a breakdown of Home Depot’s major acquisitions as of July 2025:

| Acquisition | Year | Estimated Cost | Description and Strategic Purpose |

|---|---|---|---|

| Interline Brands | 2015 | $1.6 billion | A large MRO distributor; formed the foundation of The Home Depot Pro. Gave access to institutional clients. |

| Compact Power Equipment | 2017 | $265 million | Provided rental and maintenance services for heavy equipment; expanded Home Depot’s tool rental business. |

| The Company Store | 2017 | Undisclosed | A direct-to-consumer home décor and textiles brand; helped expand e-commerce and home lifestyle offerings. |

| HD Supply | 2020 | $8 billion | Reacquired to strengthen the Pro business and MRO distribution; previously spun off in 2007. |

| Blinds.com | 2014 | Undisclosed | Leading custom window treatments e-commerce platform; enhanced Home Depot’s digital sales capabilities. |

| Redbeacon / Pro Referral | 2012 | Undisclosed | A home services marketplace connecting customers with local contractors; helped build Pro Referral services. |

| Temco Logistics (Integration) | Ongoing | N/A (Logistics Partnership) | Logistics provider for appliance delivery; integrated deeper for large-format last-mile delivery services. |

| International Designs Group | 2023 | Undisclosed | Enhances architectural and remodeling product offerings for pro and high-end customers |

| SRS Distribution, Inc. | 2024 | ~$18.25B | Expanded pro contractor supply network (roofing, landscaping, pool) |

| GMS Inc. | 2025 (via SRS) | ~$4.3B equity / $5.5B incl debt | Adds specialty building materials distribution (drywall, steel framing, ceilings) |

Early Acquisitions: Establishing B2B Presence

In its early years, Home Depot focused primarily on organic growth. However, the company began expanding into the professional contractor and maintenance sector through acquisitions in the 2000s. This included investments in companies that could help scale its commercial sales and distribution networks.

Interline Brands (2015)

One of Home Depot’s most important acquisitions was Interline Brands, purchased in 2015 for approximately $1.6 billion. Interline was a leading distributor of maintenance, repair, and operations (MRO) products to institutional and multifamily housing customers.

This acquisition laid the foundation for what would later become The Home Depot Pro. Through Interline, Home Depot gained access to a large network of professional customers, warehouses, and a suite of sub-brands like Wilmar, Barnett, and SupplyWorks.

Compact Power Equipment (2017)

In 2017, Home Depot acquired Compact Power Equipment for $265 million. This company specialized in equipment rental, repair, and maintenance services for large machinery and tools.

The acquisition allowed Home Depot to expand its rental services, catering to both professional contractors and do-it-yourself customers who needed temporary access to heavy-duty tools and construction equipment. It strengthened Home Depot’s in-store rental departments and added scale to its repair and field support services.

The Company Store (2017)

Later in 2017, Home Depot acquired The Company Store, a direct-to-consumer online retailer known for bedding, textiles, and home décor. While this was a smaller acquisition, it aligned with Home Depot’s strategy to grow its online home décor offerings and improve its competitive position in soft home furnishings.

This move helped diversify Home Depot’s portfolio by appealing to customers interested in lifestyle and design, complementing its traditional focus on hard home improvement goods.

HD Supply (Reacquired in 2020)

In a landmark move, Home Depot reacquired HD Supply in 2020 for about $8 billion. Originally spun off from Home Depot in 2007, HD Supply was a major player in the MRO distribution market.

The reacquisition helped reestablish Home Depot as a dominant force in the B2B and MRO distribution sector. It reinforced the company’s commitment to serving professional customers like facility managers, contractors, and institutional buyers. HD Supply operates under The Home Depot Pro banner and works in parallel with Interline’s legacy brands.

Blinds.com (2014)

Home Depot acquired Blinds.com in 2014, an e-commerce leader in custom window treatments. This acquisition strengthened Home Depot’s online capabilities and gave the company access to an established logistics and customer service model for selling made-to-order products.

Blinds.com continues to operate as a subsidiary of Home Depot, serving customers across the U.S. through a user-friendly digital interface and consultation services.

Redbeacon / Pro Referral (2012)

Home Depot acquired Redbeacon, a home services marketplace, in 2012. It was later rebranded as Pro Referral. The platform connects homeowners with local service professionals for installation and repair work.

This acquisition enabled Home Depot to enter the home services market in a scalable way. By integrating Pro Referral into its store network and online checkout process, Home Depot created a more seamless end-to-end customer experience—from purchase to installation.

Temco Logistics (Date: Internal Transition)

While not a formal acquisition, Temco Logistics, which had previously partnered with Home Depot for delivery services, was integrated more deeply into the company’s logistics strategy. Temco now handles large-format delivery and installation for appliances and bulky goods. This move enhanced Home Depot’s last-mile delivery capabilities, improving customer satisfaction and fulfillment efficiency.

The Company Store Brand Integration

Though The Company Store continued operating as a separate brand initially, its designs and product lines were gradually integrated into Home Depot’s main e-commerce platform. This hybrid model allowed for brand recognition while centralizing inventory and logistics.

SRS Distribution, Inc.

Home Depot acquired SRS Distribution in March 2024 for approximately $18.25 billion. SRS Distribution is one of the largest building–products distribution companies in the U.S., serving roofing, landscaping, and pool contractors through a network of over 780 branches, thousands of professionals, and its own fleet of delivery trucks. It greatly expanded Home Depot’s reach in the professional construction supply market.

SRS now operates under the Home Depot Pro/B2B umbrella and serves a complex “pro” customer base by supplying specialized materials beyond what typical home improvement stores carry. It complements Home Depot’s existing supplier network and allows for large-volume, job-site deliveries.

GMS Inc.

In mid-2025, Home Depot—via its subsidiary SRS Distribution—announced the acquisition of GMS Inc. for around $4.3 billion in equity value (approximately $5.5 billion including debt). The deal was structured as a stock tender offer and is expected to close by fiscal year-end 2025.

GMS is a leading distributor of specialty building materials like drywall, steel framing, and ceilings, with over 300 locations across the U.S. Once combined with SRS, the unified network will boast 1,200+ branch locations and over 8,000 delivery trucks, reinforcing Home Depot’s dominance in pro-oriented building-supply distribution.

International Designs Group (IDG)

Home Depot made a smaller but strategic acquisition of International Designs Group in late 2023. IDG is a holding company that owns specialized distributors of architectural-grade products such as countertops, faucets, and garage doors. The acquisition strengthens Home Depot’s ability to serve higher-end remodeling and interior design professionals with curated product lines and design-focused inventory.

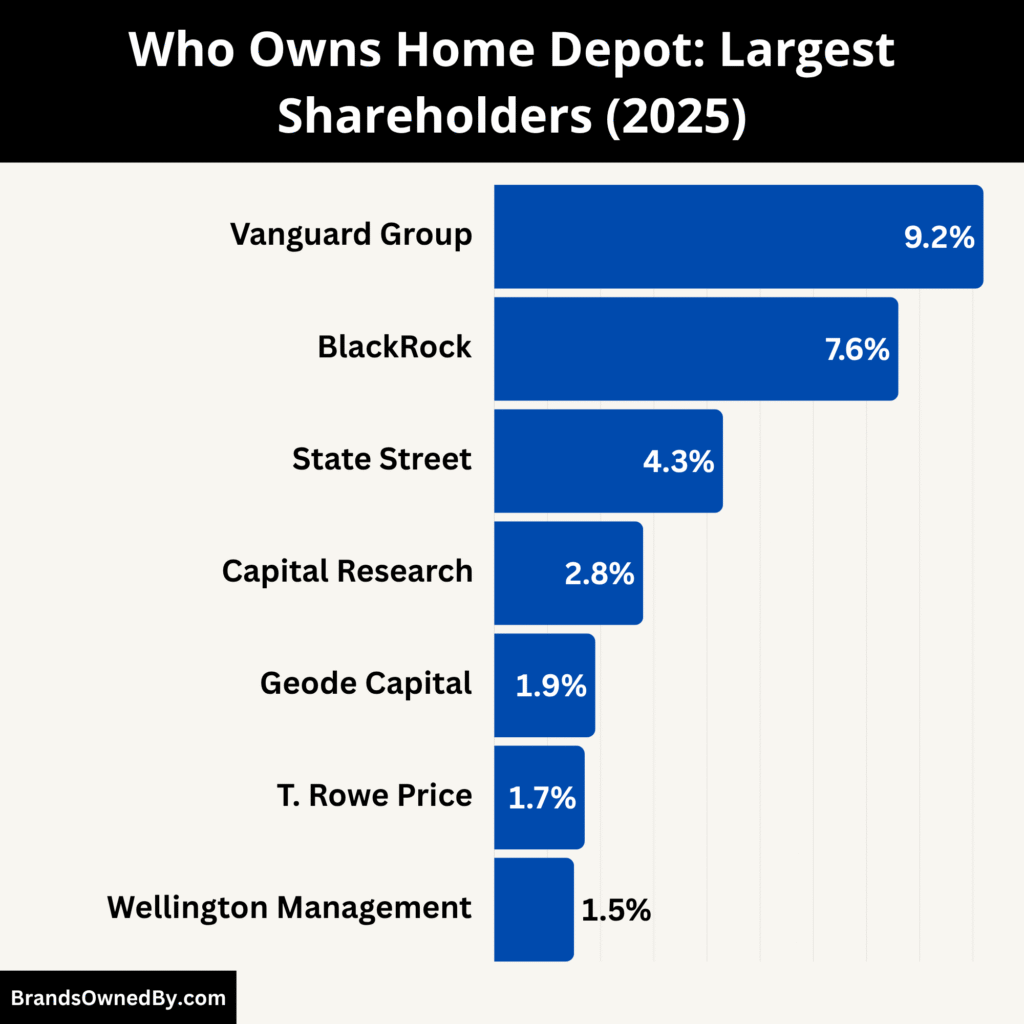

Who Owns Home Depot?

Home Depot is a publicly traded company listed on the NYSE under the ticker HD. It is owned collectively by institutional investors, company insiders, and retail shareholders. No single entity holds a controlling majority. Institutional ownership accounts for approximately 70‑73% of total shares.

Here’s a list of the major shareholders of Home Depot as of July 2025:

Vanguard Group – Owns ~9.7%

The Vanguard Group, Inc. is Home Depot’s largest single shareholder, owning approximately 9.7% of the total outstanding shares.

Vanguard is one of the world’s largest asset managers, overseeing trillions in assets through its mutual funds and ETFs. Its holdings in Home Depot are mostly passive, meaning it does not interfere in the daily operations of the business. However, as a large institutional investor, Vanguard has voting rights in shareholder meetings and can influence corporate governance decisions such as board appointments and executive compensation.

Vanguard’s significant stake reflects long-term confidence in Home Depot’s financial strength, consistent dividends, and market dominance.

BlackRock, Inc. – Owns ~7.5% to 7.8%

BlackRock is the second-largest shareholder in Home Depot, with a stake between 7.5% and 7.8% as of mid-2025.

BlackRock manages funds across various financial instruments including index funds, iShares ETFs, and retirement portfolios. Similar to Vanguard, its investment in Home Depot is largely passive. Still, the company can exercise voting power on key shareholder proposals and company policies.

BlackRock’s investment highlights Home Depot’s position as a reliable, large-cap stock with strong fundamentals. Its inclusion in many major indices, like the S&P 500, makes it a top holding for BlackRock funds.

State Street Corporation – Owns ~4.3% to 4.6%

State Street Global Advisors, the asset management arm of State Street Corporation, holds about 4.3% to 4.6% of Home Depot.

State Street is a major institutional investor and the third-largest shareholder of Home Depot. Its stake is spread across multiple exchange-traded funds (ETFs), including the popular SPDR S&P 500 ETF.

Like Vanguard and BlackRock, State Street is a passive investor but plays an active role in corporate governance. The firm promotes long-term sustainability, diversity, and risk management policies in companies it invests in.

Kenneth G. Langone – Owns ~1.66%

Kenneth G. Langone is one of Home Depot’s co-founders and the largest individual shareholder, owning around 1.66% of the company as of 2025.

Langone was instrumental in funding Home Depot during its startup phase and has remained deeply involved with the company ever since. Though he no longer manages the company’s day-to-day operations, he continues to influence its direction as a key investor and board member emeritus.

His substantial stake represents both a financial interest and a personal legacy in the company’s success.

Capital World Investors – Owns ~3.8%

Capital World Investors, a division of Capital Group, holds about 3.8% of Home Depot shares.

Capital World is an active institutional investor with a long-term approach to investing in stable, dividend-paying companies. Their interest in Home Depot reflects confidence in its business model, cash flow, and ability to withstand economic cycles.

Their voting power and engagement in governance help shape company policies, especially concerning growth strategy and financial discipline.

Geode Capital Management – Owns ~2.0%

Geode Capital Management owns approximately 2.0% of Home Depot. The firm primarily manages assets on behalf of Fidelity Investments, especially for index funds.

Geode is considered a “silent giant” in the investment world. It follows a passive investment strategy but holds substantial influence through the sheer volume of assets. Its stake in Home Depot reflects its indexing approach and demand for large, stable stocks with strong fundamentals.

Morgan Stanley – Owns ~1.9%

Morgan Stanley holds a smaller yet significant stake of around 1.9% in Home Depot through various funds and managed portfolios.

The financial services firm has exposure to Home Depot through both active equity strategies and ETFs. Although not a top-3 holder, Morgan Stanley has influence in shareholder votes and engagement when needed.

Capital Research Global Investors – Owns ~1.5%

Capital Research Global Investors is another division of Capital Group and manages global equity portfolios. It owns approximately 1.5% of Home Depot shares.

As a long-term investor in blue-chip companies, it supports management teams that consistently perform and deliver shareholder returns. Home Depot’s steady dividend payouts and operating margins align well with Capital’s conservative strategy.

Bank of America – Owns ~1.45%

Bank of America, through its investment and wealth management arms, owns around 1.45% of Home Depot.

This stake is distributed across client portfolios, retirement funds, and high-net-worth individual accounts. Although smaller than other institutions, Bank of America’s investment supports the company’s profile among conservative and dividend-focused investors.

Charles Schwab Investment Management – Owns ~1.33%

Charles Schwab Investment Management controls about 1.33% of Home Depot stock. The firm manages retail and institutional investments, offering access to Home Depot through index funds, IRAs, and ETFs.

Its investment indicates retail investor confidence, as Schwab serves a large base of individual clients who favor reliable, large-cap companies.

Norges Bank – Owns ~1.25%

Norges Bank, which manages Norway’s sovereign wealth fund, holds roughly 1.25% of Home Depot shares.

As one of the largest sovereign wealth funds globally, Norges Bank invests in stable, large-cap companies around the world. Its stake in Home Depot is part of its U.S. equity portfolio and highlights the company’s appeal as a low-risk, high-yield investment.

Who is the CEO of Home Depot?

As of July 2025, Ted Decker holds the combined titles of Chairman of the Board, President, and Chief Executive Officer of Home Depot. He assumed the roles of CEO and President in early 2022 and began serving as Chairman later that year.

Ted Decker joined Home Depot in 2000. His rise through the ranks included roles in finance, merchandising, operations, and supply chain, showcasing his deep and broad experience across the company.

Early Career and Internal Journey

- Ted began as Director of Business Valuation.

- He then led strategic planning, retail finance divisions, and merchandising functions.

- From 2020 to 2022, he served as President and Chief Operating Officer, overseeing global store operations, supply chain, merchandising, marketing, and e‑commerce strategy.

Leadership Style and Strategic Focus

Ted is known for blending operational discipline with digital innovation. His leadership emphasizes:

- Enhancing the integration between online and in-store shopping.

- Improving supply chain resilience and expanding fulfillment capabilities.

- Elevating customer and contractor service experiences using technology.

- Fostering a culture of associate empowerment and community engagement.

Challenges and Vision in 2025

Under Decker’s leadership, Home Depot has navigated economic headwinds like high interest rates and softening home renovation demand. To counteract these challenges, he is steering the company toward growth through:

- Major acquisitions aimed at expanding professional contractor offerings (e.g., SRS Distribution and GMS).

- Opening new store locations and investing in distribution infrastructure.

- Maintaining profitability by driving operational efficiencies and maintaining margins despite macro pressures.

Compensation and Recognition

Ted Decker’s total compensation in recent years reflects his impact and leadership, typically surpassing $10 million annually when including salary, bonuses, and equity awards. He is widely regarded as a forward-thinking executive in retail, balancing growth strategies with associate welfare, sustainability initiatives, and digital transformation.

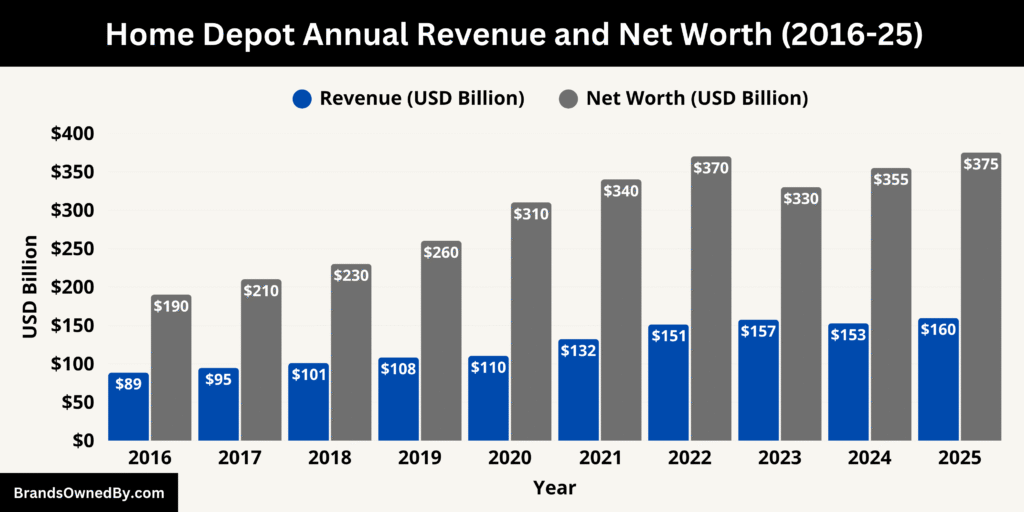

Home Depot Annual Revenue and Net Worth

The financial performance in 2025 cements Home Depot’s place as a retail powerhouse. With approximately $160 billion in revenue and a market cap near $375 billion, Home Depot blends scale, innovation, and operational efficiency. Its diversified portfolio, service offerings, and digital-forward execution position it well for sustained growth and resilience.

2025 Annual Revenue

Home Depot generated approximately $160 billion in total revenue in fiscal year 2025. This reflects a modest but healthy increase compared to 2024. The rise is primarily driven by steady demand in the professional contractor segment, improved inventory flow, and better customer service through advanced delivery and fulfillment systems.

The Home Depot Pro business remains a key contributor to revenue, as professional customers account for a significant portion of total sales. In addition, the company’s ability to enhance digital experiences—such as curbside pickup, one-day delivery, and mobile shopping—has helped maintain consumer spending across both DIY and professional channels. Despite housing market slowdowns in some regions, Home Depot’s diversified offerings across tools, appliances, rental services, and installation helped stabilize overall sales.

2025 Net Worth (Market Capitalization)

As of July 2025, Home Depot’s market capitalization stands at approximately $375 billion. This valuation reflects the company’s strong stock performance, consistent earnings, and investor confidence. Home Depot’s stock has remained resilient due to its history of generating high returns on invested capital and maintaining strong operating margins, even during periods of macroeconomic uncertainty.

The company’s net worth is further supported by its reliable dividend payouts and ongoing share repurchase programs. Home Depot continues to return significant value to shareholders, reinforcing its position as one of the most financially sound and trusted names in the U.S. retail sector.

Key Financial Drivers

Home Depot’s financial growth in 2025 is supported by its expansion in high-margin business areas. The integration of services like Compact Power Equipment and HD Supply into a unified Pro ecosystem helped increase average transaction sizes and repeat business from commercial customers. Additionally, enhanced logistics through Temco and in-house fulfillment centers improved delivery times and reduced last-mile costs, positively impacting profitability.

Strong brand loyalty, strategic pricing, and continued investments in technology also contributed to sustainable growth. While discretionary spending remained flat in certain product categories, Home Depot’s ability to serve both individual consumers and large organizations helped balance overall performance.

Overall Financial Outlook

With a solid revenue base of $165 billion and a market value approaching $360 billion, Home Depot remains one of the largest and most valuable retailers in the world. Its ability to adapt to shifting consumer habits and business needs—while maintaining operational excellence—makes it well-positioned for long-term growth. As of 2025, Home Depot continues to be a model of financial stability and market dominance in the home improvement industry.

Final Words

Home Depot owns a powerful mix of logistics, rental, supply, and service companies. These brands don’t just complement the core retail business — they give Home Depot a competitive edge. Understanding what companies Home Depot owns offers insight into how it operates, serves customers, and stays ahead in the competitive home improvement industry. With smart leadership, a strong portfolio, and continuous innovation, Home Depot remains a dominant force in retail and supply chain management.

FAQs

What are the major Home Depot owned brands?

Home Depot owns several proprietary brands that cater to both DIY customers and professional contractors. Major brands include Husky (tools and tool storage), HDX (household and utility products), Hampton Bay (lighting and ceiling fans), Glacier Bay (kitchen and bath fixtures), Everbilt (hardware and fasteners), LifeProof (flooring), and Rigid (plumbing and tools, under license). These brands are exclusive to Home Depot and designed to offer quality at competitive prices.

Who owns Home Depot stores?

Home Depot stores are owned and operated by The Home Depot, Inc., a publicly traded company listed on the New York Stock Exchange under the ticker symbol HD. The company operates its own stores in the U.S., Canada, and Mexico. It does not franchise its stores.

What brands are owned by Home Depot?

Home Depot owns a range of in-house and exclusive brands such as Husky, HDX, Hampton Bay, Glacier Bay, LifeProof, Defiant, Everbilt, and Workforce. Additionally, it owns several service-related subsidiaries like Blinds.com, Pro Referral, and The Company Store.

What are Home Depot proprietary brands?

Home Depot’s proprietary brands are exclusive product lines that it develops and sells only through its stores. These include:

- Husky: Hand tools, tool storage, and air tools

- HDX: Storage solutions, household supplies

- Hampton Bay: Indoor/outdoor lighting, ceiling fans, patio furniture

- Glacier Bay: Faucets, sinks, and bathroom accessories

- Everbilt: Hardware, plumbing, and fasteners

- LifeProof: Durable flooring

- Defiant: Door hardware and security products

These brands offer Home Depot more control over pricing, quality, and margins.

What are the major Home Depot mergers and acquisitions?

Key mergers and acquisitions by Home Depot include:

- Interline Brands (2015): MRO distributor

- Compact Power Equipment (2017): Equipment rental and service

- The Company Store (2017): Bedding and textiles e-commerce

- HD Supply (2020): MRO distributor reacquired for Pro market dominance

- Blinds.com (2014): Online custom window treatment retailer

- Redbeacon/Pro Referral (2012): Home services matchmaking platform

These moves enhanced its logistics, digital presence, and professional customer base.

Does Home Depot own HD Supply?

Yes, as of 2020, Home Depot reacquired HD Supply, a major distributor of maintenance, repair, and operations (MRO) products. The company had previously owned HD Supply but spun it off in 2007. The reacquisition strengthened Home Depot’s offerings for professional contractors and institutional clients under The Home Depot Pro brand.

Who owns Home Depot & Lowe’s?

Home Depot and Lowe’s are two separate companies and competitors in the home improvement sector.

- Home Depot, Inc. is publicly traded with institutional investors like Vanguard and BlackRock as top shareholders.

- Lowe’s Companies, Inc. is also publicly traded with its own independent shareholder base.

There is no shared ownership or corporate connection between the two.

Is Home Depot a multinational company?

Yes, Home Depot is a multinational company. While its primary market is the United States, it also operates in Canada and Mexico. It previously had a presence in China and South America but exited those markets to focus on North America. Its global supply chain and vendor relationships span several countries.

What company did Home Depot buy?

Over the years, Home Depot has acquired multiple companies including:

- HD Supply

- Interline Brands

- Blinds.com

- The Company Store

- Compact Power Equipment

- Redbeacon (Pro Referral)

These acquisitions have been aimed at strengthening its digital, logistics, and pro customer divisions.

Did Home Depot buy The Company Store?

Yes, Home Depot acquired The Company Store in 2017. It is an online retailer known for high-quality bedding, bath, and home décor products. This acquisition allowed Home Depot to expand into soft home furnishings and compete more broadly in the home goods market.

Did Lowe’s buy Home Depot?

No, Lowe’s did not buy Home Depot. Both are independent, publicly traded competitors in the home improvement retail market. They operate separately and have no direct ownership relationship.

Why did Home Depot buy GMS?

As of 2025, Home Depot has not acquired GMS Inc. (Gypsum Management and Supply). GMS is a separate company specializing in building materials like drywall and ceilings. While there has been speculation about such a move, no public acquisition has taken place by Home Depot.

What companies does Home Depot own in the USA?

In the U.S., Home Depot owns and operates several subsidiaries and brands, including:

- Interline Brands / Home Depot Pro

- Blinds.com

- Compact Power Equipment

- The Company Store

- HD Supply

- Pro Referral

These companies operate in both retail and B2B service domains, expanding Home Depot’s reach beyond physical stores.

Does Home Depot own Milwaukee?

No, Home Depot does not own Milwaukee Tool. Milwaukee is owned by Techtronic Industries (TTI), a Hong Kong-based company. While Milwaukee tools are sold at Home Depot, they are not a Home Depot brand. The company does, however, maintain an exclusive retail relationship for some Milwaukee products in its stores.

Is Home Depot a publicly traded company?

Yes, Home Depot is publicly traded on the New York Stock Exchange under the symbol HD.

Who founded Home Depot?

Home Depot was founded in 1978 by Bernie Marcus and Arthur Blank.

Where is Home Depot headquartered?

Home Depot is headquartered in Atlanta, Georgia, United States.

Does Home Depot own other retail chains?

No, Home Depot does not own other retail chains. It owns companies that support its supply, service, and rental operations.

Who is Home Depot’s biggest shareholder?

Vanguard Group is the largest shareholder of Home Depot, owning over 9% of the company’s stock as of 2025.

How many companies does Home Depot own?

Home Depot owns and operates several subsidiaries, including Home Depot Pro, HD Supply, Redbeacon, Compact Power Equipment, and Blinds.com.