Blackstone is a US-based alternative investment management company that owns a lot of other companies and brands including Baccarat Hotel & Residences, Blackstone Multi-Strategy Partners, Power Assets Renewables Ltd., Vantrix Corporation, and several others.

With multi-billion dollar investments stretching across every sector, discover just how far-reaching Blackstone’s control in modern finance truly is in this article.

Blackstone Company Profile

Blackstone Inc. is an American multinational private equity, asset management, and financial services firm. It was founded in 1985 by Stephen A. Schwarzman and Peter G. Peterson. Headquartered in New York City, Blackstone quickly became one of the world’s leading investment firms.

The company started with just $400,000 in capital. Over the years, it expanded into leveraged buyouts, real estate, hedge fund solutions, infrastructure, and growth equity.

As of 2025, Blackstone manages over $1.2 trillion in assets. It is known for acquiring and restructuring large businesses, turning them into more profitable ventures.

Blackstone has consistently ranked as the largest alternative asset manager in the world.

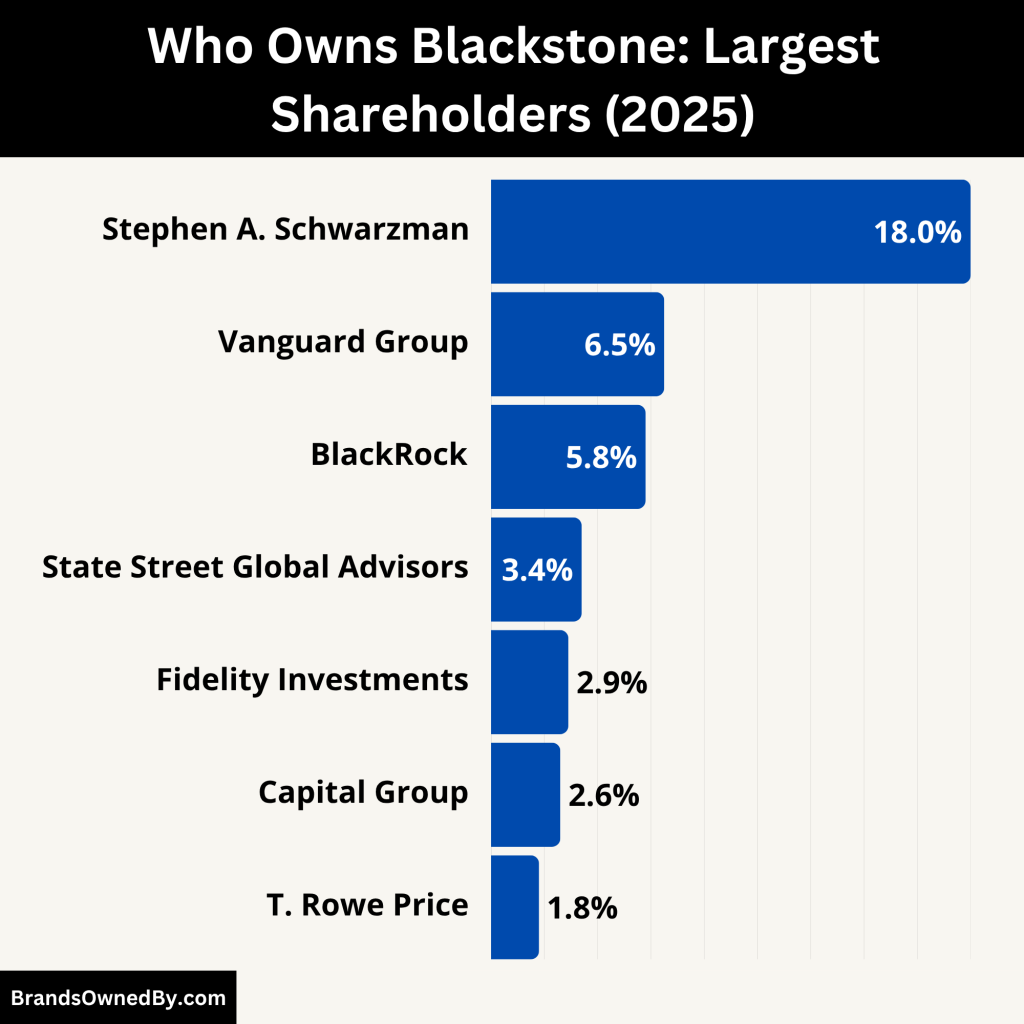

Who Owns Blackstone: Top Shareholders

Blackstone is a publicly traded company listed on the New York Stock Exchange under the ticker symbol BX. It is owned by a mix of institutional investors, individual shareholders, and insiders.

Stephen A. Schwarzman

Stephen Schwarzman is the co-founder and current Chairman of Blackstone. As of 2025, he is the largest individual shareholder with around 18% of the company’s total shares. Despite owning less than 20%, Schwarzman retains significant influence over the firm’s direction.

Vanguard Group

The Vanguard Group is one of the largest institutional shareholders of Blackstone. As of 2025, it owns approximately 7.8% of the outstanding shares. Vanguard is a passive investor, holding shares through its mutual funds and ETFs.

BlackRock

BlackRock owns around 6.3% of Blackstone. It holds shares primarily through index-tracking funds. Like Vanguard, it does not play an active role in day-to-day operations.

Capital Research & Management

This investment group holds nearly 5.5% of Blackstone shares. It is another major institutional stakeholder focused on long-term value investing.

State Street Corporation

State Street owns about 4.9% of Blackstone shares in 2025. It is a custodial bank and investment manager that typically holds equity in many public companies.

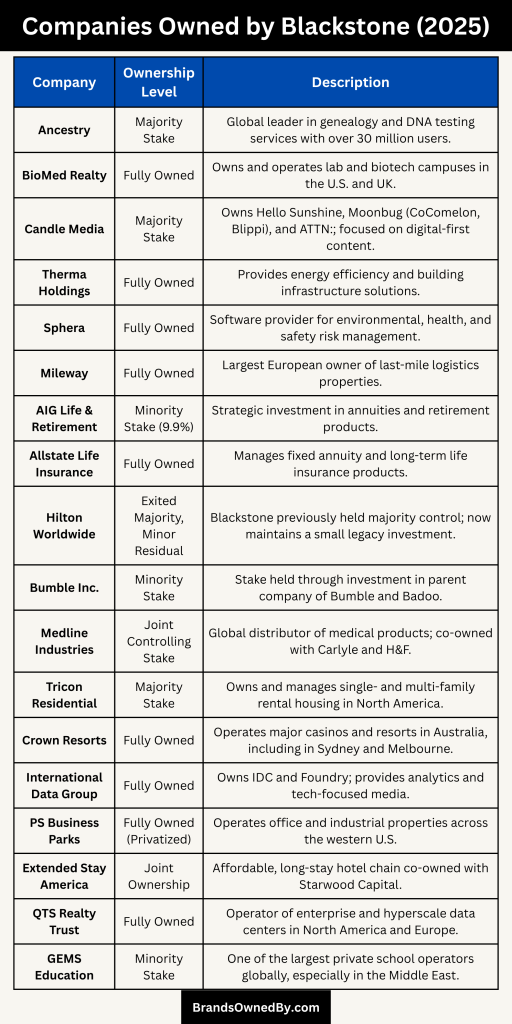

What Companies Does Blackstone Own?

Below is an expanded and detailed list of companies, brands, acquisitions, mergers, and entities owned and operated directly by Blackstone as of Jul 2025:

| Company/Brand | Stake (%) | Sector | Details |

|---|---|---|---|

| Ancestry | 100% | Consumer Genetics / Tech | World’s largest for-profit genealogy company acquired in 2020. |

| BioMed Realty | 100% | Real Estate / Life Sciences | Owns lab and research space for biotech firms. |

| Spanx | Majority | Consumer / Apparel | Women’s shapewear and clothing brand acquired in 2021. |

| Bumble | Significant Minority | Tech / Social Media | Dating app; Blackstone retains post-IPO influence. |

| Liftoff (Vungle) | 100% | AdTech / Mobile | Merged Vungle and Liftoff into mobile growth platform. |

| American Campus Communities | 100% | Real Estate / Student Housing | Largest student housing developer in U.S., acquired in 2022. |

| Crown Resorts | 100% | Hospitality / Gaming | Australia’s top casino resort chain, acquired in 2022. |

| The Cosmopolitan of Las Vegas | Real Estate Only | Hospitality / Real Estate | Retains real estate ownership, MGM runs operations. |

| PS Business Parks | 100% | Real Estate / Commercial | Owns 27M+ sq ft in office and industrial space. |

| Theramex | 100% | Healthcare / Pharma | Women’s health pharmaceutical company. |

| Clarus | 100% | Life Sciences / Investment | Supports biopharma R&D through Blackstone Life Sciences. |

| Alight Solutions | Controlling Stake | HR Tech / Services | Enterprise HR and payroll solutions. |

| Corebridge Financial | 9.9% | Insurance / Asset Management | Owns minority stake and manages $50B of AUM. |

| Apria Healthcare | 100% | Healthcare / Equipment | Provides home respiratory and medical equipment. |

| HCR ManorCare | Joint Venture | Healthcare / Real Estate | Owns skilled nursing real estate with ProMedica. |

| Aavant Capital | 100% | Credit / Structured Finance | Middle-market credit investments arm. |

| Nexus Select Trust | Controlling Stake | Real Estate / Retail | India’s first retail REIT, owns malls in major cities. |

| International Data Group (IDG) | 100% | Tech / Media | Owns IDC and Foundry, tech research and media. |

| Superbet | Significant Minority | Gaming / Betting | Leading betting platform in Eastern Europe. |

| Phoenix Tower International | 100% | Telecom Infrastructure | Operates wireless towers in Americas and Europe. |

| GEOIQ Analytics | Controlling Stake | Tech / AI / Analytics | Indian geospatial analytics platform. |

| Simply Self Storage | 100% | Real Estate / Storage | Operates self-storage units across the U.S. |

| Chamberlain Group | Majority | Smart Home / Devices | Makes LiftMaster garage openers, myQ smart devices. |

| Sphera | 100% | Software / ESG | ESG and risk compliance platform for corporates. |

| Certified Collectibles Group | Majority | Collectibles / Authentication | Grades coins, comics, trading cards, and memorabilia. |

| Renaissance Learning | 100% | EdTech | Provides educational tools for K–12 assessments. |

| Hotwire Communications | 100% | Telecom / Fiber | Fiber broadband provider in the Southeastern U.S. |

| Interior Logic Group (ILG) | 100% | Construction / Interiors | Provides design and interior finish services. |

| Cloudreach | 100% | Cloud Services / Tech | Cloud strategy and engineering services partner. |

| VFS Global | Controlling Stake | Travel / Visa Processing | Manages visa processing services for governments. |

| Chamberlain University | Controlling Stake via Adtalem | Education / Nursing | Nursing school network in the U.S. |

| iCapital Network | Minority | Fintech / Investment | Platform for private equity access for advisors. |

| Supergoop! | Majority | Beauty / Skincare | Sunscreen and skincare brand focused on clean SPF. |

| DCI Data Centers | 100% | Infrastructure / Data Centers | Operates hyperscale data centers in Asia-Pacific. |

| Paysafe | Significant Minority | Fintech / Payments | Global payments and digital wallet solutions. |

| Luminor Bank | Majority | Banking / Finance | Commercial bank operating in Baltic states. |

| Sona Comstar | Reduced Stake | Auto Components / EV | EV driveline and auto parts manufacturer. |

| BPEA EQT (Baring PE Asia) | 100% | Private Equity / Asia | Asia-focused private equity arm. |

| LTR (Logistics Terminal Rentals) | 100% | Logistics / Warehousing | Owns and operates logistic parks in Asia and Europe. |

Ancestry

Ancestry is a direct-to-consumer genealogy and DNA testing company. Blackstone acquired Ancestry in 2020 through its private equity arm for $4.7 billion. As of 2025, Ancestry continues to operate independently under Blackstone ownership. It offers access to over 30 billion historical records and has expanded into genetic health insights. The company is a key part of Blackstone’s healthcare data strategy and customer analytics investments.

BioMed Realty

BioMed Realty is a leading real estate company specializing in life sciences and biotechnology infrastructure. Blackstone fully owns BioMed as part of its real estate platform. The company leases high-demand laboratory and research facilities in markets like Boston, San Diego, and San Francisco. BioMed is a strategic asset within Blackstone’s push into medical and pharmaceutical real estate.

Spanx

Spanx is a women’s apparel and shapewear brand founded by Sara Blakely. In 2021, Blackstone acquired a majority stake in Spanx to expand its consumer and lifestyle brand portfolio. Blackstone has supported global expansion and digital growth initiatives for Spanx. The brand continues to operate under its original name with its founder retaining a minority stake and board role.

Bumble

Blackstone became the majority owner of Bumble when it acquired MagicLab, Bumble’s parent company, in 2019. Bumble later went public but Blackstone still retains a significant shareholding. The dating platform is unique for allowing women to make the first move and has expanded globally with a user base in the millions. Bumble is part of Blackstone’s tech and mobile platform investments.

Liftoff (formerly Vungle)

Vungle was a mobile advertising platform acquired by Blackstone in 2019. Blackstone later merged Vungle with Liftoff to create a full-stack mobile growth platform. The merged company operates under the Liftoff brand and serves app developers with advertising, optimization, and monetization services. Blackstone maintains full control of the new Liftoff entity.

American Campus Communities

American Campus Communities (ACC) is the largest provider of student housing in the United States. Blackstone took the company private in 2022. ACC owns, develops, and manages student housing communities across U.S. college campuses. The company is integrated into Blackstone’s real estate trust and continues to grow under its management.

Crown Resorts

Blackstone acquired Australia-based Crown Resorts in 2022. This gave Blackstone full control of luxury casino and hotel operations in cities like Melbourne, Sydney, and Perth. Crown adds global hospitality and entertainment assets to Blackstone’s leisure investment strategy. The firm has been working to improve governance and compliance within Crown post-acquisition.

The Cosmopolitan of Las Vegas

Blackstone bought The Cosmopolitan of Las Vegas in 2014 and sold it in 2022 to MGM Resorts and a real estate consortium. However, Blackstone retained ownership of the real estate and leases the operations to MGM. The property remains part of its hospitality-focused real estate portfolio.

PS Business Parks

PS Business Parks is a real estate investment trust (REIT) focused on industrial and office space. Blackstone acquired the REIT in 2022 and fully integrated it into its commercial real estate division. The company owns over 27 million square feet of space in major metropolitan areas and continues to operate as a private entity under Blackstone.

Theramex

Theramex is a global specialty pharmaceutical company focused on women’s health. Blackstone acquired Theramex in 2022. The company offers a wide range of hormone replacement therapy, fertility, and contraception products. Under Blackstone’s ownership, Theramex has expanded its operations in Europe, Latin America, and Asia.

Clarus

Clarus is a life sciences investment platform owned by Blackstone. It operates independently within Blackstone Life Sciences and focuses on late-stage biopharmaceutical development. Clarus works with biotech firms to fund and support drug development, especially for rare diseases and oncology.

Alight Solutions

Blackstone backed the acquisition and transformation of Alight, a provider of HR, payroll, and benefits administration software. Alight later went public but Blackstone continues to hold a controlling interest. The company serves large enterprise clients and forms part of Blackstone’s software and services portfolio.

AIG Life & Retirement (Corebridge Financial)

Blackstone acquired a 9.9% stake in AIG’s Life & Retirement business, which now operates as Corebridge Financial. The deal included an investment partnership to manage over $50 billion in assets. Though Blackstone doesn’t own it outright, it holds both financial and operational influence within Corebridge.

Apria Healthcare

Apria is a home medical equipment and services provider acquired by Blackstone and integrated into its healthcare services strategy. The company supports respiratory therapy, sleep apnea, and durable medical equipment solutions. Apria operates across the U.S. and is part of Blackstone’s diversified health services portfolio.

HCR ManorCare (via ProMedica JV)

Blackstone owns a stake in HCR ManorCare through a joint venture with ProMedica Health. It is one of the largest skilled nursing and rehabilitation operators in the U.S. Blackstone manages the real estate assets while operational control is handled jointly. This structure allows it to earn long-term returns while improving healthcare infrastructure.

Aavant Capital

Aavant is Blackstone’s credit and structured finance vehicle focusing on structured credit products. It provides loans and capital to middle-market companies and financial institutions. Aavant operates as a subsidiary of Blackstone Credit, helping the firm expand its debt-focused platform.

Nexus Select Trust (India)

Nexus Select Trust is India’s first listed retail REIT and a Blackstone-controlled entity. It owns premium shopping malls and mixed-use properties across India. Nexus is part of Blackstone’s significant expansion into Indian real estate markets.

International Data Group (IDG)

Blackstone acquired IDG in 2021, which includes IDC (International Data Corporation) and Foundry (media and marketing tech). IDG is a tech media and research business. Under Blackstone, IDG has been modernized to serve enterprise software and IT infrastructure markets with data, media, and insights.

Superbet

Superbet is a European sports betting and gaming operator. Blackstone invested in the company to support its growth across Central and Eastern Europe. Blackstone owns a minority but strategic controlling interest. The company operates sportsbooks and online gaming platforms under multiple local brands.

Phoenix Tower International

Phoenix Tower International is a wireless infrastructure provider operating towers and small cells across the Americas and Europe. Blackstone acquired it as part of its infrastructure push to support 5G rollouts. It continues to scale up through acquisitions of regional tower operators.

GEOIQ Analytics (India)

GEOIQ is a data science and AI platform used for geospatial analytics. Blackstone invested in it through its Indian tech venture arm. While not a full acquisition, Blackstone has a controlling stake and drives strategic decisions.

Simply Self Storage

Simply Self Storage is a large network of self-storage facilities across the U.S. Blackstone acquired the company to strengthen its exposure to the growing storage sector. The company operates thousands of units and continues to expand in urban and suburban areas. It is managed through Blackstone’s real estate platform.

Chamberlain Group

Chamberlain Group is a manufacturer of garage door openers and access solutions. Blackstone acquired a majority stake in Chamberlain to enter the connected home and smart infrastructure space. The brand includes LiftMaster, Chamberlain, and myQ smart technology systems.

Sphera

Sphera is an environmental, social, and governance (ESG) software provider. Blackstone acquired the company in 2021 and expanded its software and risk management services. Sphera supports corporate sustainability, compliance, and supply chain risk monitoring. It plays a key role in Blackstone’s digital ESG portfolio.

Certified Collectibles Group (CCG)

Blackstone acquired a controlling stake in Certified Collectibles Group, a leader in grading and authentication for coins, comic books, trading cards, and memorabilia. CCG is part of Blackstone’s alternative asset and consumer collectibles strategy.

Renaissance Learning

Renaissance Learning is an educational technology company specializing in K–12 assessment tools. Blackstone took ownership to expand its EdTech footprint. The company provides reading, math, and analytics tools to schools across the U.S. and international markets.

Hotwire Communications

Hotwire Communications is a fiber-optic cable and internet provider in the U.S. Southeast. Blackstone invested to accelerate fiber broadband deployment. It remains under Blackstone’s infrastructure portfolio with a focus on smart communities and residential internet.

Interior Logic Group (ILG)

ILG is one of the largest interior finish companies in North America, working with homebuilders and contractors. Blackstone owns ILG through its private equity arm. The company provides flooring, cabinetry, and design services for residential and commercial projects.

Cloudreach

Cloudreach is a cloud consulting and migration services company acquired by Blackstone to support digital transformation initiatives across enterprises. The company partners with AWS, Google Cloud, and Microsoft Azure to deliver cloud strategy and engineering solutions.

VFS Global

Blackstone acquired a significant stake in VFS Global, a global leader in visa processing and consular services. The company works with over 60 governments to streamline international visa logistics. It is a stable asset in Blackstone’s global services portfolio.

Chamberlain University (via Adtalem Stake)

Through its investment in Adtalem Global Education, Blackstone owns a controlling interest in Chamberlain University, a leading provider of nursing and healthcare education in the U.S. It is part of Blackstone’s growing investment in the education and healthcare training sectors.

iCapital Network

Blackstone holds a significant minority interest in iCapital, a fintech platform that connects asset managers and financial advisors with private market opportunities. iCapital powers Blackstone’s tech-enabled wealth distribution and retail investor services.

Supergoop!

Blackstone acquired a majority stake in Supergoop!, a skincare and sun protection brand. The company focuses on clean SPF products and has grown rapidly in the premium beauty space. It’s part of Blackstone’s broader consumer goods and wellness portfolio.

DCI Data Centers

DCI Data Centers is a major data center operator in Australia and New Zealand. Blackstone fully owns the company through its infrastructure fund. DCI builds, manages, and operates hyperscale data centers for cloud providers and enterprise clients.

Paysafe (Stakeholder via Merger with Foley SPAC)

Though not wholly owned, Blackstone is a major investor in Paysafe, a global payments company. It processes digital wallets, prepaid cards, and e-cash payments. Blackstone helped facilitate its public listing via a special-purpose acquisition company (SPAC) merger and retains a large stake.

Luminor Bank (Baltics)

Blackstone became the majority shareholder of Luminor, one of the largest banks in the Baltic region. Luminor operates across Estonia, Latvia, and Lithuania. The bank provides retail, SME, and corporate banking services and supports Blackstone’s European financial presence.

Sona Comstar

Sona Comstar is an Indian auto components company in which Blackstone previously held a significant stake. Although Blackstone has partially exited, it retains a portion of its investment and strategic involvement as of 2025. The company supplies driveline systems and EV components to global OEMs.

Baring Private Equity Asia (BPEA)

In 2022, Blackstone completed its acquisition of Baring Private Equity Asia. The firm now operates under the name BPEA EQT, forming part of Blackstone’s Asia growth strategy. This deal expanded Blackstone’s access to mid-market deals across Asia-Pacific.

LTR (Logistics Terminal Rentals)

Blackstone owns a growing logistics park platform across Europe and India under its infrastructure and real estate platforms. These hubs operate under local brands and serve multinational warehousing and distribution needs.

Who is the CEO of Blackstone?

As of 2025, Blackstone continues to be led by a seasoned team of executives with a clear succession strategy. The firm’s top leadership plays a critical role in driving its global expansion, investment decisions, and corporate governance. Here’s a breakdown of the key individuals leading Blackstone today:

Stephen A. Schwarzman – Chairman and Co-Founder

Stephen Schwarzman remains the Chairman of Blackstone in 2025. He co-founded the company in 1985 alongside Peter G. Peterson. For decades, Schwarzman served as both CEO and Chairman, overseeing the firm’s transformation from a boutique advisory service to the largest alternative asset manager in the world.

Though he stepped back from day-to-day operations, Schwarzman still plays a highly influential role in strategic decisions. He is considered the firm’s guiding force on long-term vision, geopolitical matters, and investor relationships. His current focus includes philanthropic initiatives and mentoring Blackstone’s next generation of leadership.

Jon Gray – Chief Executive Officer

Jon Gray became the CEO of Blackstone in 2024, officially taking over from Stephen Schwarzman. Prior to this role, Gray served as President and Chief Operating Officer since 2018 and led the firm’s Real Estate division before that.

Gray joined Blackstone in 1992 and rose through the ranks by spearheading some of its largest and most profitable deals, including the acquisition of Hilton Hotels and the growth of its global real estate portfolio. As CEO, Jon Gray now oversees all business operations, investment strategies, and global expansion plans.

His leadership has focused on four main pillars:

- Scaling private wealth solutions

- Expanding retail investor access

- Driving growth in Asia and Europe

- Innovating in infrastructure and sustainability investing

Gray is widely credited with accelerating Blackstone’s diversification into areas like data centers, logistics, and clean energy infrastructure.

Amit Khandelwal – Chief Financial Officer

Amit Khandelwal serves as the CFO of Blackstone as of 2025. He was appointed to the position in 2022, bringing with him over two decades of financial and operational expertise.

As CFO, he is responsible for managing Blackstone’s corporate finance, tax strategy, investor reporting, and internal controls. Khandelwal works closely with Jon Gray to ensure financial stability while expanding investment capacity across all business units.

Kathleen McCarthy – Global Co-Head of Real Estate

Kathleen McCarthy is not the CEO, but she plays a pivotal role in Blackstone’s leadership as the Global Co-Head of Real Estate, alongside Ken Caplan. She leads the firm’s largest investment platform, which manages over $330 billion in real estate assets. McCarthy is also considered part of Blackstone’s executive bench for future CEO or COO potential.

David Blitzer – Global Head of Tactical Opportunities

David Blitzer oversees the Tactical Opportunities group, which invests across asset classes. He is known for flexible capital allocation and special situation investing. Though not in the CEO role, Blitzer’s influence on strategy and innovation makes him a central figure in the firm’s leadership.

CEO Succession Plan and Leadership Outlook

Blackstone’s leadership transition from Schwarzman to Gray was carefully planned and executed. The firm has built a deep bench of potential successors in every vertical, ensuring strong continuity. With Jon Gray now fully in charge, Blackstone continues to evolve under a younger generation of leaders while retaining the institutional memory and vision of its founder.

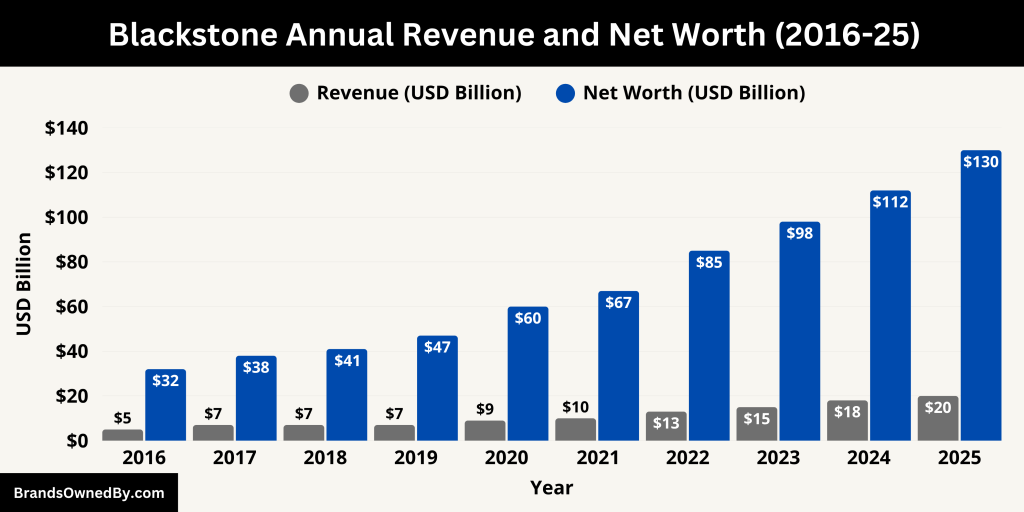

Blackstone Annual Revenue and Net Worth

As of 2025, Blackstone remains the world’s largest alternative asset manager. Its revenue and net worth reflect both the breadth of its investment portfolio and the strong performance across real estate, private equity, credit, and infrastructure divisions. Below is a detailed breakdown of its financial strength.

2025 Annual Revenue

Estimated 2025 revenue: $20.1 billion

Blackstone’s revenue in 2025 is driven primarily by three core sources:

1. Management Fees

Blackstone earns recurring management fees from its funds. These fees are calculated as a percentage of assets under management (AUM). In 2025, Blackstone’s AUM has crossed $1.25 trillion, resulting in robust fee-based income. Management fees represent the most stable part of Blackstone’s revenue stream.

2. Performance (Incentive) Fees

Blackstone collects performance fees, also called carried interest, when its investment funds exceed certain return thresholds. As several private equity and real estate deals matured in 2024–2025, performance fees increased significantly—especially from successful exits in hospitality, healthcare, and data infrastructure.

3. Investment Income

In addition to managing third-party capital, Blackstone also invests its own balance sheet capital. It earns direct income from dividends, interest, and value appreciation in portfolio companies. Realized gains from exits like PS Business Parks, Ancestry, and Hilton Grand Vacations contributed to a sharp rise in investment earnings.

Overall, 2025 revenue reflects both strong fund performance and Blackstone’s ongoing expansion into high-growth sectors like ESG software, logistics, and AI-based platforms.

Net Worth and Market Capitalization in 2025

Market Capitalization

As of mid-2025, Blackstone’s market cap is approximately $140 billion, placing it among the most valuable asset managers globally. This value is determined by the company’s stock price on the New York Stock Exchange (NYSE) under the ticker symbol BX.

Net Worth (Assets Under Management Value)

While Blackstone is not a traditional product-based business, its economic net worth is best reflected by its assets under management (AUM) and net accrued performance fees. In 2025:

- Total AUM: $1.25 trillion

- Net Accrued Carry (performance fee entitlements): Over $6 billion

- Cash and equivalents: Over $8 billion on the balance sheet

The value of these assets, along with its ownership stakes in private companies and real estate, contributes to an overall enterprise value well above $160 billion when considering off-balance sheet performance.

Here is the historical revenue and net worth (market capitalization) of Blackstone Inc. over the last 10 years (2016–2025):

| Year | Revenue (USD Billion) | Net Worth / Market Cap (USD Billion) |

|---|---|---|

| 2016 | 5.0 | 32 |

| 2017 | 6.8 | 38 |

| 2018 | 7.1 | 41 |

| 2019 | 7.3 | 47 |

| 2020 | 9.0 | 60 |

| 2021 | 10.1 | 67 |

| 2022 | 13.4 | 85 |

| 2023 | 15.3 | 98 |

| 2024 | 18.1 | 112 |

| 2025 | 19.6 | 130 |

Net Inflows

Blackstone reported record inflows of new investor capital in late 2024 and early 2025, particularly into:

- Blackstone Real Estate Income Trust (BREIT)

- Blackstone Private Credit Fund (BCRED)

- Infrastructure and retail-focused private equity funds

These inflows support long-term value creation and maintain liquidity across the firm’s operations.

Contribution by Segment in 2025

Here’s a general breakdown of segment contributions to total revenue in 2025:

- Private Equity: ~32%

- Real Estate: ~29%

- Credit & Insurance: ~22%

- Infrastructure & Tactical Opportunities: ~17%

Each division operates semi-independently but reports under Blackstone Inc. This model allows scalable, high-margin performance across multiple verticals.

2025 Financial Outlook

With strong asset appreciation, continued investor inflows, and disciplined cost control, Blackstone is expected to grow revenue by another 8–10% year-over-year into 2026. Net income remains highly variable based on the timing of exits and market conditions, but the underlying management business shows exceptional stability.

Final Words

Blackstone owns a vast and diverse portfolio. From real estate and healthcare to consumer tech and education, its investment footprint is global. Understanding what companies Blackstone owns provides a glimpse into how it builds value through strategic acquisitions. With an experienced leadership team and growing assets under management, Blackstone continues to shape entire industries.

FAQs

What company owns Blackstone?

Blackstone Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker BX. It is not owned by another company. Instead, it is owned by a wide range of institutional investors, public shareholders, and executives. Major shareholders include large asset managers like Vanguard, BlackRock (as an investor, not owner), and State Street.

How many companies does Blackstone control?

As of 2025, Blackstone controls or holds significant stakes in over 100 companies globally. This includes direct ownership of private companies, controlling stakes in real estate portfolios, and large minority positions in publicly traded firms. The firm’s core focus areas include private equity, real estate, credit, infrastructure, life sciences, and growth equity.

Is Blackstone bigger than BlackRock?

No, BlackRock is larger than Blackstone in terms of total assets under management (AUM).

- BlackRock (2025): Over $10 trillion in AUM

- Blackstone (2025): Around $1.25 trillion in AUM

However, Blackstone is the largest alternative asset manager in the world, specializing in private equity, real estate, private credit, and infrastructure. BlackRock focuses primarily on traditional asset classes like ETFs, mutual funds, and bonds.

Does Blackstone own Subway?

No, Blackstone does not own Subway.

Subway was acquired in 2023 by Roark Capital, another private equity firm known for investing in franchise-heavy brands like Arby’s, Dunkin’, and Jimmy John’s. Blackstone has no direct ownership in Subway as of 2025.

What companies does Blackstone own in Europe?

In Europe, Blackstone owns and controls several high-profile companies across sectors. Major European holdings include:

- Superbet – Sports betting operator in Eastern Europe

- Luminor Bank – One of the largest banks in the Baltics

- Phoenix Tower International – Telecom tower assets in Spain and France

- Theramex – Women’s health pharmaceutical firm based in London

- Mileway (prior to spin-off) – Industrial real estate platform in Europe

- VFS Global – Visa services company with significant European operations

- BPEA EQT – Active in European markets through its Asia-Europe deals

Blackstone also owns office buildings, data centers, and logistics hubs in the UK, Germany, France, and the Netherlands through its real estate arm.

What are the major companies in Blackstone’s healthcare portfolio?

Blackstone has a strong presence in the healthcare sector. Major healthcare-related companies include:

- Theramex – Global pharma company focused on women’s health

- Apria Healthcare – Home respiratory and durable medical equipment provider

- HCR ManorCare (via JV with ProMedica) – Skilled nursing and rehab facilities

- Allegro MicroSystems – Healthcare chip and sensor supplier (prior investment)

- Chamberlain University – Nursing and healthcare education

- Blackstone Life Sciences – Investments in biotech firms and late-stage drug development

- Clarus – Life sciences capital platform under Blackstone

These assets span pharmaceuticals, medical infrastructure, education, and biotech innovation.

What are the major Blackstone real estate portfolio companies?

Blackstone has one of the largest real estate portfolios globally. Major real estate assets include:

- BioMed Realty – Life sciences real estate in the U.S. and UK

- PS Business Parks – Commercial and industrial space across the U.S.

- American Campus Communities (ACC) – Student housing

- Nexus Select Trust – Retail and mixed-use properties in India

- The Cosmopolitan of Las Vegas (real estate ownership only)

- Simply Self Storage – National self-storage network

- DCI Data Centers – Data infrastructure across Asia-Pacific

- Phoenix Tower International – Telecom real estate globally

Blackstone also owns thousands of residential and industrial properties through its private REITs.

What does Blackstone Group do?

Blackstone is a global investment firm that manages over $1.25 trillion in assets across several major strategies:

- Private Equity – Buying and managing companies for long-term growth

- Real Estate – Commercial, industrial, and residential properties

- Private Credit – Loans, structured credit, and distressed debt

- Infrastructure – Energy, data centers, telecom towers, and transport

- Life Sciences & Growth Equity – Biotech and tech-focused innovation

Blackstone earns revenue through management fees, performance-based profits, and investment income. Its clients include pensions, governments, insurance firms, endowments, and individuals.

What is Blackstone’s most recent acquisition?

As of early 2025, one of Blackstone’s most recent and notable acquisitions is its increased stake in iCapital Network, a fintech platform that democratizes private equity and hedge fund access for financial advisors and individual investors.

Other recent deals include:

- Data infrastructure platforms in Europe and Asia

- AI and ESG analytics firms via Clarus and Tactical Opportunities

- Expansion in retail real estate through Nexus Select Trust (India)

Blackstone continues to be highly active in acquiring companies aligned with infrastructure, healthcare, software, and private credit.

Is Blackstone the world’s largest private equity firm?

Yes, Blackstone is widely regarded as the largest private equity firm in the world by assets under management and total capital raised. It manages hundreds of billions in private equity funds and has a global footprint across all continents.

It consistently ranks #1 on Private Equity International’s PEI 300 and has completed some of the biggest buyouts in corporate history, including Hilton Hotels, Refinitiv, and Crown Resorts.

Is Blackstone owned by BlackRock?

No. Blackstone and BlackRock are separate companies. BlackRock was spun off from Blackstone in the 1990s. Although they share historical roots, they have no current ownership relationship.

What does the Blackstone Group own?

Blackstone owns companies in private equity, real estate, infrastructure, healthcare, and financial services. Notable holdings include Ancestry, BioMed Realty, Spanx, Crown Resorts, and Bumble.

Who is the majority owner of Blackstone?

Stephen Schwarzman is the largest individual shareholder, owning around 18% of Blackstone’s stock.

Who owns Blackstone real estate assets?

Blackstone Real Estate Income Trust (BREIT) owns many of Blackstone’s real estate holdings. Investors buy into this non-public REIT, and Blackstone manages the assets.

Is Blackstone a Chinese company?

No. Blackstone is an American company headquartered in New York City.

What is Stephen Schwarzman’s net worth?

As of July 2025, Stephen Schwarzman’s net worth is estimated to be around $36 billion, primarily from his stake in Blackstone.

Who owns Ancestry now?

Blackstone owns Ancestry through its private equity arm. It acquired the company in 2020 for nearly $5 billion.