- Dave Portnoy is the sole owner and controlling shareholder of Barstool Sports as of 2026, holding 100% private ownership with full decision-making authority.

- Barstool Sports has no public shareholders, institutional investors, or venture capital firms, making it one of the few major sports media brands that is fully founder-owned.

- Ownership is centralized, allowing faster strategic decisions, creative independence, and direct alignment between leadership, content, and audience.

Barstool Sports is a digital media and entertainment company focused on sports, pop culture, lifestyle, and internet commentary. The company operates primarily online through blogs, podcasts, video shows, and social media platforms. Its brand identity is built on personality-driven content, humor, and strong audience engagement. Barstool produces daily multimedia content across multiple formats. These include long-form podcasts, short video clips, live shows, and written commentary.

The company has a highly loyal fan base. It targets young and middle-aged sports fans, especially in the United States. Barstool is known for blending sports analysis with entertainment and storytelling. Its content often reflects internet culture and trending topics. The brand also organizes live tours, fan events, and college sports shows. As of 2026, Barstool operates as a privately owned, founder-led media company with a strong influence in digital sports media.

Barstool Sports Founder

Barstool Sports was founded in 2003 by Dave Portnoy. He started the company as a small print newspaper distributed in the Boston area. The early publication focused on sports betting picks, fantasy sports advice, and advertisements. Portnoy built the brand independently in its early years. He handled writing, distribution, and operations himself.

Dave Portnoy played a central role in shaping Barstool’s tone and identity. His outspoken personality became a major part of the brand. He later transitioned the company from print to digital. This shift allowed Barstool to expand nationally and grow its audience rapidly. Portnoy is widely recognized as the driving force behind Barstool’s growth, culture, and loyal fan community.

Although Dave Portnoy is the sole founder, several early contributors helped expand the brand. Early writers and content creators helped build Barstool’s blog network and regional presence. Over time, the company evolved into a multi-platform media organization led by Portnoy’s vision.

Ownership History

Barstool Sports has one of the most unusual ownership journeys in modern media. The company moved from full founder control to corporate ownership and then back to its founder again. Each phase shaped its growth, brand identity, and strategic direction. From early bootstrap days to major media and gaming partnerships, the ownership timeline explains how Barstool evolved into a powerful independent digital media company.

| Period | Owner / Majority Shareholder | Ownership Structure | Key Notes |

|---|---|---|---|

| 2003–2016 | Dave Portnoy | 100% Founder-Owned | Independent startup phase. Built brand, audience, and digital presence. |

| 2016–2020 | The Chernin Group (Majority) | Majority Corporate Ownership | First external investment. Expanded podcasts, media production, and national reach. |

| 2020–2023 | Penn National Gaming / Penn Entertainment | Strategic Stake → Full Ownership | Entered sports betting media space. Penn gradually acquired 100% by 2023. |

| Aug 2023–Present | Dave Portnoy | 100% Private Ownership | Founder bought back company. Penn retained right to 50% of any future sale. |

Founder Ownership Era (2003–2016)

Barstool Sports was founded in 2003 by Dave Portnoy. In the beginning, he owned 100% of the company. Barstool started as a small print newspaper distributed in the Boston area. It focused on sports betting picks, fantasy sports, and local advertising.

During this period, Portnoy controlled every part of the business. He managed writing, publishing, marketing, and distribution. As the website launched and traffic grew, Barstool slowly transitioned into a digital media company. By the early 2010s, the brand had built a strong online audience and began expanding beyond Boston. Despite growth, ownership remained fully with Portnoy until 2016.

The Chernin Group Investment (2016–2020)

In January 2016, The Chernin Group acquired a majority stake in Barstool Sports. This marked the first major ownership change in company history. Dave Portnoy sold controlling interest but remained deeply involved in operations and content.

The Chernin Group brought capital, media expertise, and strategic direction. This investment helped Barstool expand nationally. The company scaled its podcast network, video production, and advertising business. It also professionalized operations and strengthened brand partnerships.

Even though The Chernin Group held majority ownership, Portnoy remained the public face of Barstool and continued influencing company direction.

Penn National Gaming Partnership and Stake Purchase (2020–2023)

In January 2020, Penn National Gaming purchased a 36% stake in Barstool Sports. This deal created a strategic partnership between sports media and sports betting. Barstool became a major media brand tied to betting entertainment.

Penn later increased its ownership through staged acquisitions. By early 2023, Penn National Gaming acquired 100% of Barstool Sports. This made Barstool a fully owned subsidiary of a publicly traded gaming company.

During this period, Barstool expanded into betting-related content, live shows, and branded sportsbooks. The company continued growing its digital audience while operating under Penn’s corporate structure.

Dave Portnoy Buyback and Return to Independent Ownership (2023–Present)

In August 2023, Penn Entertainment sold Barstool Sports back to founder Dave Portnoy. The deal price was symbolic at $1. However, the agreement included an important clause. Penn would receive 50% of any future sale of Barstool Sports.

This transaction returned Barstool to private, founder-led ownership. Dave Portnoy regained full control of the company. The buyback allowed Barstool to operate independently again. It also separated the brand from Penn’s betting business, which Penn later rebranded under a different sportsbook identity.

Since 2023, Barstool Sports has remained privately owned by Dave Portnoy. The company operates independently with centralized founder control. Penn retains only a future financial interest tied to any potential sale.

Who Owns Barstool Sports?

Barstool Sports has a simple but unusual ownership structure. Unlike most major media companies, it is privately owned and controlled by its founder. The company moved through corporate ownership in the past, but it returned to founder control after the 2023 buyback.

As of 2026, Barstool Sports does not have traditional public shareholders. There are no institutional investors, public equity holders, or venture funds on its cap table. However, one former owner still holds a financial stake tied to any future sale of the company. Below is the full and updated shareholder structure.

Dave Portnoy — Founder, Sole Owner, Controlling Shareholder (100%)

Dave Portnoy is the sole owner of Barstool Sports as of 2026. He reacquired the company in August 2023 after buying it back from Penn Entertainment. Since then, he has held 100% equity ownership. This makes Barstool a privately owned, founder-controlled media company.

Portnoy has full decision-making authority. He controls corporate strategy, content direction, leadership appointments, and business expansion. Unlike publicly traded media firms, there is no board pressure from institutional investors. This gives Portnoy complete operational and creative control.

His ownership is both financial and cultural. He remains the face of the brand and a central figure in its growth. Under his control, Barstool operates independently without outside equity investors.

Penn Entertainment — Former Owner with Future Sale Participation Rights

Penn Entertainment no longer owns equity in Barstool Sports. It sold 100% of the company back to Dave Portnoy in 2023. However, the deal included a long-term financial clause. Penn is entitled to receive 50% of the value if Barstool Sports is sold in the future.

This does not make Penn a current shareholder. It holds no voting rights, no operational control, and no board representation. However, it retains a contingent financial interest. This structure is uncommon in media ownership. It keeps Penn economically connected to Barstool’s long-term valuation without holding equity.

Penn previously owned Barstool fully after gradually acquiring stakes between 2020 and 2023. After the separation, Penn focused on its own branded sportsbook operations, while Barstool returned to independent media ownership.

Competitor Ownership Comparison

Barstool Sports operates under a unique founder-owned structure. Most of its major competitors are controlled by large public corporations or media conglomerates. This difference affects strategy, content style, decision speed, and creative freedom.

Below is a detailed comparison of how key competitors are owned and controlled:

| Company | Parent Owner | Ownership Type | Control Structure | Key Strategic Influence |

|---|---|---|---|---|

| Barstool Sports | Dave Portnoy | Private, Founder-Owned | Centralized founder control | Independent strategy, fast decisions, strong brand personality |

| ESPN | The Walt Disney Company | Public Corporate Ownership | Corporate board and executive leadership | Global media strategy, premium sports rights, brand regulation |

| Bleacher Report | Warner Bros. Discovery | Public Corporate Ownership | Multi-layer corporate structure | Streaming growth, digital media expansion, advertising performance |

| The Athletic | The New York Times Company | Public Corporate Ownership | Editorial and corporate governance | Subscription journalism, reporting depth, long-term media strategy |

| OutKick | Fox Corporation | Public Corporate Ownership | Corporate-controlled digital media division | Broadcasting integration, brand alignment, media network distribution |

ESPN — Owned by The Walt Disney Company

ESPN is owned and controlled by The Walt Disney Company, one of the largest media conglomerates in the world. Disney operates ESPN as part of its global sports and entertainment division. Strategic decisions are made at the corporate level. Leadership must align with Disney’s broader media, streaming, and advertising strategy.

This ownership provides ESPN with massive resources, global distribution, and premium sports rights. However, it also means content and branding follow strict corporate standards. Compared to Barstool Sports, ESPN operates in a highly structured and regulated environment with less creative flexibility.

Bleacher Report — Owned by Warner Bros. Discovery

Bleacher Report is owned by Warner Bros. Discovery, a major global media company formed through a large corporate merger. It functions as a digital sports media arm within a larger entertainment portfolio that includes television, streaming, and film.

Ownership by a large corporation allows Bleacher Report to leverage technology, production infrastructure, and global reach. However, strategic direction is influenced by corporate priorities such as streaming growth and advertising performance. Unlike Barstool’s founder-led model, Bleacher Report operates within a multi-layered corporate structure with centralized oversight.

The Athletic — Owned by The New York Times Company

The Athletic is owned by The New York Times Company, a publicly traded media organization focused on journalism and subscription content. The Athletic operates as a premium sports journalism platform rather than an entertainment-driven media brand.

Ownership under a major news organization shapes its editorial standards, business model, and long-term strategy. Decisions emphasize credibility, reporting depth, and subscriber growth. Compared to Barstool Sports, The Athletic follows a traditional newsroom-style governance structure with less personality-driven content.

OutKick — Owned by Fox Corporation

OutKick is owned by Fox Corporation, a large publicly traded media company. It operates as part of Fox’s digital and sports commentary network. Strategic direction is influenced by Fox’s broader media and broadcasting operations.

Corporate ownership gives OutKick strong distribution through television and digital platforms. However, decision-making is aligned with Fox’s brand positioning and corporate governance. In contrast, Barstool Sports maintains independent control with faster and more flexible strategic execution.

How Barstool Sports Differs from Its Competitors

Barstool Sports stands apart because it is privately owned by its founder rather than a large corporation. This structure allows rapid decision-making, strong brand personality, and creative freedom. There is no pressure from public shareholders or corporate boards. Content strategy can evolve quickly based on audience response and cultural trends.

While competitors benefit from corporate funding, infrastructure, and global distribution, Barstool benefits from independence and a loyal audience community. This ownership difference is a major reason why Barstool’s brand identity, tone, and business approach remain distinct within the sports media industry.

Who Controls Barstool Sports?

Control of Barstool Sports is centralized under its founder-led structure. As a privately owned company, authority is not distributed among public shareholders or a corporate board. Strategic, operational, and creative control sits primarily with the founder and executive leadership. Below is a detailed breakdown of who runs Barstool Sports and how decisions are made.

Dave Portnoy — Founder, CEO, and Primary Decision Maker

Dave Portnoy is the Chief Executive Officer of Barstool Sports as of 2026. He is also the sole owner of the company. This gives him complete authority over business operations and long-term strategy. Unlike corporate-owned media companies, there is no external shareholder pressure influencing decisions.

Portnoy controls major company functions. These include strategic direction, partnerships, brand positioning, expansion initiatives, and executive leadership. He also remains actively involved in content and public communication. His personality continues to shape Barstool’s identity and audience engagement. Under his leadership, Barstool operates with a fast and flexible decision-making style.

Executive Leadership and Operational Management

While Dave Portnoy holds ultimate control, day-to-day business operations are supported by an executive leadership team. Senior executives oversee areas such as content production, marketing, partnerships, talent management, and business development.

This structure allows Barstool to function efficiently while maintaining a founder-driven strategy. Department leaders manage execution, but major decisions still require founder approval. The company operates with a centralized command model rather than a layered corporate governance system.

Content Creators and Talent Influence

Barstool Sports has a personality-driven media model. Top content creators and podcast hosts hold influence within the organization. While they do not control corporate strategy, they play a key role in shaping content direction and audience engagement.

Successful shows and personalities often impact programming priorities and brand expansion. This gives Barstool a hybrid control structure where creative influence comes from talent, while corporate authority remains with leadership.

Past CEOs of Barstool Sports

Barstool Sports has had very few CEOs in its history. Leadership has largely remained stable and founder-driven.

Dave Portnoy (2003–2016): Portnoy served as the original CEO from the company’s founding. He led Barstool from a small print publication into a growing digital media platform.

Erika Nardini, now Erika Ayers Badan (2016–2023): She became CEO after outside investment entered the company. She professionalized operations, expanded revenue channels, and led major partnerships. She also oversaw the company during its corporate ownership phase and growth into a national media brand.

Dave Portnoy (2023–Present): After reacquiring the company, Portnoy returned as CEO. He restored founder-led leadership and centralized control. The company now operates under his direct authority again.

Decision-Making Structure

Barstool Sports follows a centralized leadership model. Strategic decisions originate from the CEO. Execution is handled by senior leadership and department heads. Creative direction is influenced by talent and audience response. There is no traditional corporate board controlling management.

This structure enables quick execution and strong brand consistency. It also allows Barstool to adapt rapidly to digital media trends, audience behavior, and cultural shifts. The combination of founder authority, executive management, and talent-driven content defines how Barstool Sports is controlled today.

Barstool Sports Annual Revenue and Net Worth

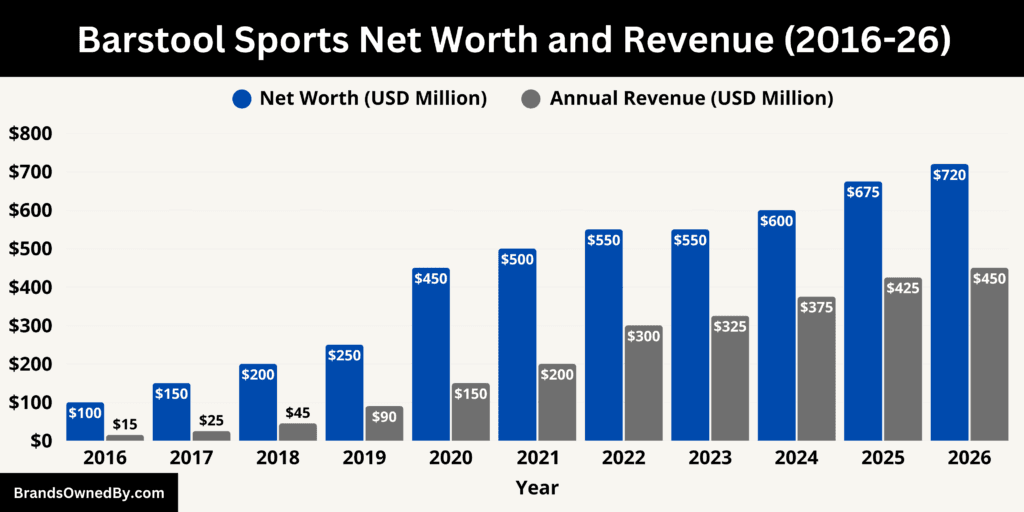

Barstool Sports continues to grow as a major independent digital media company. As of 2026, the company generates approximately $450 million in annual revenue and holds an estimated net worth of about $720 million.

2026 Revenue Breakdown and Business Performance

Barstool Sports recorded an estimated $450 million in revenue in 2026. The company’s earnings come from multiple diversified streams across its digital media ecosystem. Advertising and sponsorships remain the largest revenue driver. These contribute roughly $200 million annually. Brand partnerships, integrated advertising, and podcast sponsorships generate consistent recurring income.

Podcasting is one of the company’s most profitable segments. The Barstool podcast network contributes approximately $95 million in annual revenue. High-performing shows attract large audiences and premium advertisers. Merchandise is another major contributor. Barstool’s e-commerce and branded apparel business generates around $80 million per year through direct-to-consumer sales and limited product drops.

Content licensing, video monetization, and live events collectively contribute nearly $50 million. These include YouTube monetization, digital distribution partnerships, and touring shows. Additional revenue of about $25 million comes from content collaborations, branded productions, and other media activities. This diversified structure reduces reliance on a single income stream and supports long-term financial stability.

2026 Net Worth and Valuation Analysis

As of February 2026, Barstool Sports holds an estimated valuation of approximately $720 million. The company’s net worth reflects its strong digital media presence, loyal audience base, and consistent revenue growth. Unlike public companies, Barstool’s valuation is influenced by private market estimates, brand value, and potential future sale scenarios.

The company’s intellectual property, media network, and podcast portfolio represent significant intangible assets. Brand equity and audience loyalty also contribute heavily to valuation. Barstool’s ability to monetize across advertising, commerce, and content platforms strengthens its overall financial position. Continued independence under founder ownership also allows strategic flexibility, which supports long-term value growth.

Revenue Growth Trend and Financial Expansion

Barstool’s financial growth has been consistent over the past decade. Early revenue growth came primarily from digital advertising and blog traffic. As the company evolved, podcasts became a major monetization engine. Merchandise, licensing, and live content further expanded revenue streams.

The transition back to independent ownership helped stabilize business operations and improve profit margins. The company focused on high-margin media products and direct audience monetization. This strategy contributed to steady increases in both revenue and company valuation through 2024, 2025, and now 2026.

Future Revenue Forecast (2027–2030)

Barstool Sports is expected to maintain steady financial growth over the next several years. Continued expansion of its podcast network, advertising business, merchandise sales, and digital media ecosystem will likely support long-term revenue increases. Below is the projected revenue outlook through 2030.

- 2027: Projected revenue of about $500 million. Growth is expected to come from stronger podcast monetization, premium advertising partnerships, and improved digital video revenue across major platforms. Merchandise sales and direct-to-consumer channels are also likely to expand.

- 2028: Projected revenue of about $550 million. Live content and touring events are expected to scale further. Brand-sponsored experiences, licensing deals, and wider content distribution should contribute more significantly to overall revenue.

- 2029: Projected revenue of about $600 million. Growth will likely be driven by higher advertising yields, deeper digital integration, and expanding audience reach. High-margin content formats such as podcasts and video programming are expected to strengthen profitability.

- 2030: Projected revenue of about $650 million. Continued growth in media monetization, brand partnerships, and global audience engagement could support long-term expansion. If these trends continue, Barstool Sports’ valuation may approach the $1 billion level, supported by strong brand equity and stable founder-led control.

Brands Owned by Barstool Sports

Barstool Sports operates a broad portfolio of media brands, content divisions, and business units. These entities form the core of its digital media ecosystem. Below is a list of the major brands owned by Barstool Sports as of February 2026:

| Company / Brand | Type | Core Focus | Key Operations | Strategic Role |

|---|---|---|---|---|

| Barstool Sports Media Network | Digital Media Network | Sports, culture, and entertainment publishing | Blogs, daily articles, social distribution, branded content, homepage promotion | Core audience engine, traffic generation, and advertising monetization |

| Barstool Podcasts Network | Podcast Network | Sports, comedy, and lifestyle audio content | Flagship shows, ad inventory management, dynamic ad insertion, live podcast tours | Major revenue driver and audience retention platform |

| Barstool Video and Digital Content Studios | Video Production Division | Long-form and short-form video programming | Studio shows, live streams, documentaries, social video, branded video production | Expands reach, drives video monetization, and supports sponsor integrations |

| Barstool Merch (Barstool Store) | E-commerce / Retail | Branded apparel and merchandise | Product design, limited drops, storefront, fulfillment, event merchandise sales | Direct-to-consumer revenue and brand loyalty builder |

| Barstool Events and Live Experiences | Live Media & Events | Touring shows and fan experiences | College Football Show, live podcast tours, ticketed events, sponsorship activations | Extends digital brand into physical audience engagement |

| Barstool Sports Advisors | Betting Entertainment Show | Sports picks and betting commentary | Weekly studio shows, sponsored segments, cross-show integrations | Maintains brand presence in sports betting culture |

| Barstool Chicago | Regional Media Division | Chicago sports and local culture | Regional podcasts, blogs, local events, team-focused coverage | Strengthens regional audience and local advertising |

| Barstool Nashville | Regional Content Hub | College sports and Southern culture | Podcasts, live recordings, event coverage, regional video production | Expands regional influence and live content production |

| Barstool Bites | Food and Consumer Brand | Branded food products and licensing | Food partnerships, product launches, content-driven promotion | Diversifies revenue into consumer products |

| Barstool Local Media Brands | Regional Digital Pages | City-specific sports and fan communities | Local blogs, short-form video, regional promotions, localized ads | Builds loyal regional communities and local monetization |

| Barstool Personality and Creator Network | Talent & Content Ecosystem | Personality-driven content and show franchises | Talent development, show incubation, cross-platform expansion, creator-led merchandise | Core content engine and scalable audience growth driver |

Barstool Sports Media Network

This is the company’s core publishing and distribution engine. It runs Barstool.com and manages daily output across blogs, short-form video, long-form video, and social platforms.

The network covers major U.S. sports, gambling culture, college sports, internet trends, and lifestyle topics. It operates a high-frequency publishing model with continuous content cycles tied to live games, breaking news, and viral moments. The division coordinates editorial calendars, homepage promotion, social amplification, and cross-show integrations.

It also manages branded content production for sponsors, including integrated storytelling within shows and native ad placements across articles and video. Audience acquisition, retention, and traffic monetization are centralized here.

Barstool Podcasts Network

The podcast network is a primary revenue and audience driver. It produces dozens of shows across sports, comedy, and culture, with flagship titles such as Pardon My Take, Spittin’ Chiclets, KFC Radio, The Yak, and Bussin’ With The Boys. The network operates in-season and year-round programming, delivering consistent weekly episode volumes and live-recorded specials.

It manages host contracts, ad inventory, dynamic ad insertion, and cross-promotion across the Barstool ecosystem. Many shows extend into live tours, merchandise lines, and video simulcasts.

The network’s scale enables premium sponsorship packages, category exclusivity deals, and long-term brand integrations tied to specific shows and hosts.

Barstool Video and Digital Content Studios

This unit produces long-form series, live streams, studio shows, documentaries, and social-first video. It operates in-house studios and mobile production for on-location shoots at games, events, and college campuses.

Core programs include live reaction shows, sports analysis formats, and personality-led series that convert into YouTube and social distribution. The studio manages pre-production, editing, graphics, and distribution scheduling. It also produces sponsor-funded video series and branded mini-documentaries tied to athletes, teams, and cultural events.

Video monetization comes from platform ads, sponsorships, and integrated brand segments embedded within recurring shows.

Barstool Merch (Barstool Store)

Barstool Merch is the direct-to-consumer commerce arm. It develops and sells apparel and accessories linked to specific shows, slogans, and personalities. The unit runs a drop-based model with limited releases tied to sports moments, viral clips, and seasonal campaigns.

It handles product design, sourcing, inventory, storefront operations, and fulfillment. High-performing lines include show-branded collections from Pardon My Take, Spittin’ Chiclets, and Bussin’ With The Boys. The store integrates with content by launching products during live streams, podcast reads, and social promotions, driving conversion from engaged audiences.

Merchandise also supports live events with on-site sales and exclusive tour items.

Barstool Events and Live Experiences

This division produces ticketed tours, campus shows, and fan events anchored around major sports calendars. Flagship properties include the Barstool College Football Show, live podcast tours for top shows, and large-scale watch parties during playoffs and championships.

The unit manages venue booking, ticketing, sponsorship activations, and live production. Events are designed to extend digital brands into physical experiences, increasing fan loyalty and creating additional sponsorship inventory.

Live recordings often feed back into podcasts and video channels, creating a closed-loop content cycle around events.

Barstool Sports Advisors

Barstool Sports Advisors is a long-running sports betting entertainment show featuring Barstool personalities delivering game picks, commentary, and comedic segments around weekly NFL and major sports slates.

The program blends analysis with personality-driven storytelling and runs in-season studio episodes and special broadcasts. It generates revenue through show sponsorships, integrated brand segments, and cross-promotion with other Barstool properties.

While Barstool does not operate a sportsbook, this show maintains the brand’s presence in betting culture and drives audience engagement during peak sports cycles.

Barstool Chicago

Barstool Chicago is a regional content hub producing city-focused podcasts, blogs, and video tied to Chicago teams and local culture. Core shows include regional sports talk formats and personality-driven programs that cover the Bears, Bulls, Cubs, White Sox, and Blackhawks.

The unit runs local live events, meetups, and merchandise tied to Chicago-centric branding. It maintains strong local advertiser relationships and leverages regional fandom to drive consistent engagement. Content frequently integrates with the national network during major games and league events.

Barstool Nashville

Barstool Nashville functions as a Southern content and production base. It produces podcasts and video around college sports, SEC football culture, and regional lifestyle topics. The hub supports on-location shoots, live recordings, and touring logistics across the South.

Nashville-based shows often collaborate with the national network and participate in college football road events. The unit also contributes to live music and culture content tied to the city’s entertainment scene, expanding Barstool’s reach beyond traditional sports coverage.

Barstool Bites

Barstool Bites is the company’s food and consumer products brand focused on comfort-style offerings and branded menu items. It operates through licensing and distribution partnerships with foodservice operators and retailers. Products are promoted through Barstool shows, reviews, and social campaigns, often tied to sports events and watch-party culture.

The brand uses Barstool personalities for product launches and marketing, converting audience engagement into consumer product sales. Barstool Bites extends the company’s monetization beyond media into physical consumer goods.

Barstool Local Media Brands

Beyond Chicago and Nashville, Barstool operates smaller regional pages and creator-led local feeds that produce city-specific blogs, short-form video, and podcasts.

These local brands activate around team news, rivalries, and regional fan culture. They support localized advertising, event promotion, and merchandise tied to city identity. Regional outputs feed into the national distribution system during major sports moments, creating cross-market amplification.

Barstool Personality and Creator Network

This is the internal talent ecosystem that powers Barstool’s content. It includes writers, hosts, and on-air personalities who build show franchises, recurring segments, and audience communities.

The network manages talent development, show incubation, and cross-platform expansion from blog to podcast to video to live events. Successful personalities often launch standalone merchandise lines and touring shows, creating vertically integrated revenue around individual brands.

This creator-led structure enables rapid content iteration and direct audience monetization across the Barstool platform.

Conclusion

Barstool Sports stands out as a rare founder-owned media company with a strong, personality-driven brand. For those asking who owns Barstool Sports, the answer remains simple. The company is fully controlled by its founder, which allows fast decisions, creative freedom, and direct audience connection. Its strength comes from loyal communities, scalable digital content, and diversified monetization.

As the media landscape evolves, Barstool’s independent structure and focused execution position it to remain influential and adaptable for the long term.

FAQs

What is Barstool Sports?

Barstool Sports is a digital media and entertainment company focused on sports, pop culture, and lifestyle content. It is known for personality-driven shows, podcasts, blogs, and strong audience engagement.

What does Barstool Sports do?

Barstool produces sports commentary, podcasts, videos, live shows, and digital media content. It also runs merchandise, live events, and branded entertainment across multiple platforms.

Does Dave Portnoy still own Barstool?

Yes. Dave Portnoy still owns Barstool Sports as of 2026. He regained full ownership after buying the company back in 2023.

Does Portnoy own 100% of Barstool?

Yes. Dave Portnoy holds 100% equity ownership and is the sole controlling shareholder of Barstool Sports.

When was Barstool Sports sold and bought?

Barstool Sports was fully acquired by Penn Entertainment in February 2023. Dave Portnoy bought it back in August 2023.

Who bought Barstool Sports?

Penn Entertainment bought Barstool Sports through staged investments between 2020 and 2023, eventually acquiring full ownership before selling it back to Dave Portnoy.

Why did Penn sell Barstool?

Penn sold Barstool Sports to focus on its new sports betting partnership with ESPN and to shift its long-term betting strategy. The company moved away from the Barstool-branded sportsbook model.

Who owns Barstool Sportsbook?

Barstool Sports no longer owns the sportsbook. It is owned and operated by Penn Entertainment, which rebranded its betting platform to ESPN Bet.

Who created Barstool Sports?

Barstool Sports was created in 2003 by Dave Portnoy as a small print sports and betting newspaper in Massachusetts.

How did Dave Portnoy buy Barstool for $1?

Dave Portnoy reacquired Barstool Sports for a symbolic $1 as part of a strategic agreement. Penn retained the right to receive 50% of any future sale, which reduced the upfront purchase price.

Who is the CEO of Barstool Sports?

Dave Portnoy is the Chief Executive Officer of Barstool Sports as of 2026.

What is Dave Portnoy’s net worth?

Dave Portnoy’s estimated net worth is around $150 million as of 2026, primarily from Barstool Sports, media ventures, and investments.

How much is Netflix paying Barstool?

There is no confirmed public deal showing Netflix paying Barstool Sports. No official financial agreement between Netflix and Barstool has been disclosed.

Who is Dave Portnoy’s wife?

Dave Portnoy was previously married to Renee Portnoy. They later divorced. As of 2026, he is not publicly known to be married.