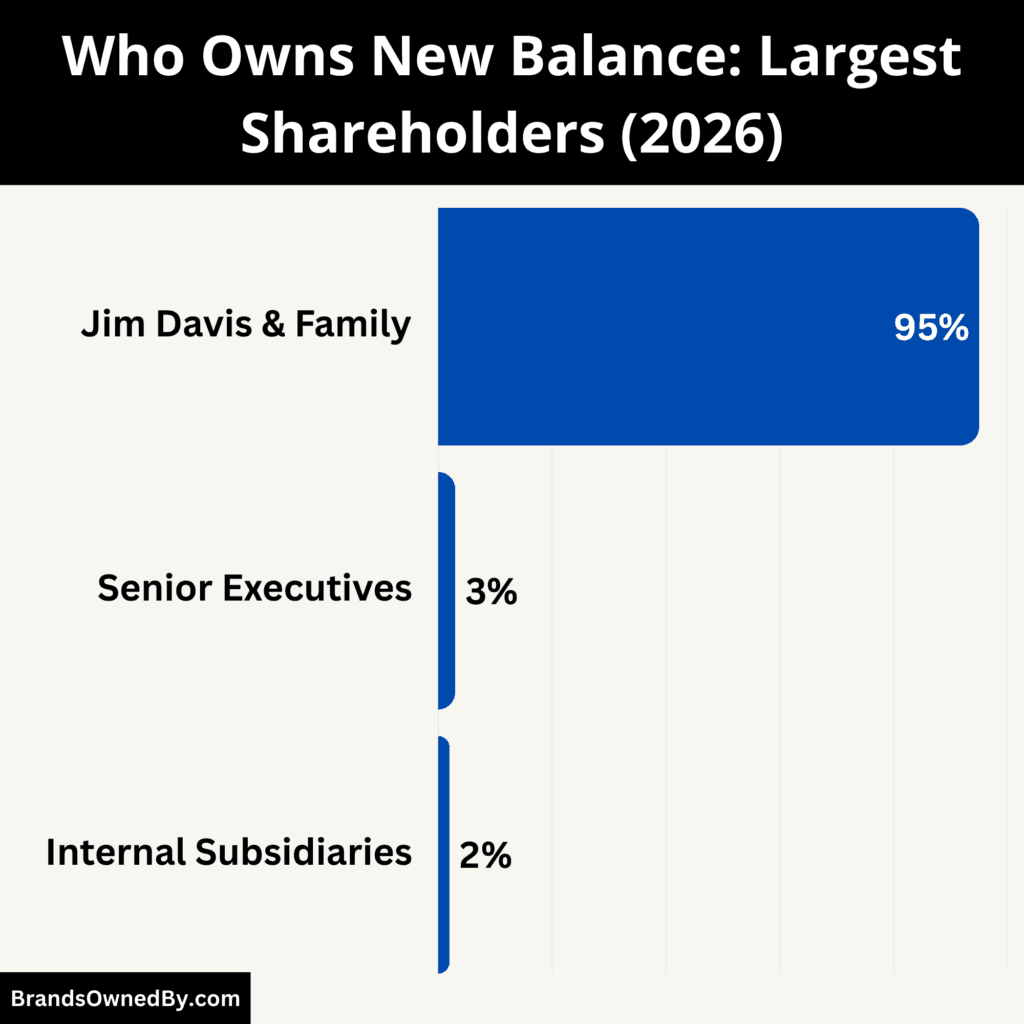

- New Balance is a privately owned company controlled by Jim Davis and the Davis family, with approximately 95% ownership and full voting authority.

- The remaining ownership is held internally through family trusts, select family members, and a small group of senior executives, with no public or institutional investors involved.

- Because it is not publicly traded, New Balance makes long-term strategic decisions without pressure from quarterly earnings or activist shareholders.

- This concentrated, family-led ownership structure explains the brand’s consistent leadership, independent strategy, and focus on quality over rapid expansion.

New Balance is an American athletic footwear and apparel company known for performance-oriented products and a strong heritage in running. The brand emphasizes fit, function, and high quality. New Balance products span shoes, apparel, and accessories for running, training, lifestyle, and team sports. The company operates globally with retail stores, wholesale partners, and direct-to-consumer channels.

New Balance stands out for its commitment to domestic manufacturing. It maintains production facilities in the United States and the United Kingdom, a rarity among major athletic brands. This allows greater control over craftsmanship and supports local jobs.

It also maintains design, marketing, and innovation centers that guide product development. New Balance’s brand identity combines technical performance with cultural relevance, including collaborations with designers, artists, and subculture communities.

New Balance Founder

New Balance was founded by William J. Riley in 1906 in Boston, Massachusetts. Riley was an engineer with an interest in biomechanics. He started the company as the New Balance Arch Support Company. Riley sought to create better arch supports for shoes based on the way animals balanced on three points. His products aimed to improve comfort and support for workers and daily walkers.

Riley’s early designs featured a distinctive three-point balance concept. This reflected his belief that proper balance could reduce fatigue and strain on feet. The business began with simple, handcrafted supports sold locally. Riley focused on product quality and practical benefits rather than mass marketing.

In the early decades, New Balance remained a small, niche operation. It supplied arch supports and corrective inserts to shoe stores and consumers. The company’s identity was rooted in functional innovation, not athletic sponsorship or advertising. Its customer base grew gradually as word spread about product effectiveness.

The modern era of New Balance began in the early 1970s. In 1972, Jim Davis acquired the company. Davis was a businessman with retail experience. He saw potential in expanding from corrective supports into full footwear. Davis retained the company’s emphasis on quality and fit but reimagined its mission. Under his leadership, New Balance focused on running shoes and technical footwear for serious athletes. The brand opened new markets at a time when running was gaining popularity in the United States.

Ownership History

The ownership history of New Balance explains why the company operates differently from most global sportswear brands. Instead of shifting between investors or public shareholders, control has remained private for more than a century. This long-term ownership approach has shaped New Balance’s culture, leadership structure, and strategic independence.

Early Ownership and Foundation Years (1906–1950s)

New Balance was founded in 1906 in Boston by William J. Riley. Riley started the business as the New Balance Arch Support Company. Ownership during this period was simple and founder-led. Riley personally controlled product development, sales, and operations.

The company focused on arch supports and corrective footwear. It did not pursue mass production. Ownership decisions were conservative. Growth was organic and localized. Riley reinvested profits back into product improvements rather than expansion. This period established New Balance as a functional, quality-driven business rather than a fashion brand.

Transition Period and Small-Scale Private Ownership (1950s–1971)

After Riley’s active years, ownership passed through a small group of private hands. These owners continued operating the company as a niche footwear and support brand. There were no institutional investors or external financiers involved. The company remained small, private, and regionally focused.

During this era, New Balance slowly transitioned from arch supports into full footwear. Running shoes began to emerge as a core product. However, the company lacked scale and global ambition. Ownership remained fragmented but aligned around maintaining product quality and specialty retail relationships.

Jim Davis Acquisition and Strategic Shift (1972)

A defining moment came in 1972 when Jim Davis acquired New Balance. At the time, the company employed only a handful of people and produced limited footwear volumes. Davis purchased the business outright, making him the controlling owner.

This acquisition transformed New Balance’s ownership structure. Control became centralized under a single individual and later his family. Davis introduced a clear long-term strategy. He positioned New Balance as a performance-focused running brand. Importantly, he chose to keep the company private rather than seek outside capital.

Establishment of Family Ownership Model (1970s–1990s)

Following the acquisition, New Balance evolved into a family-controlled company. Jim Davis retained majority ownership and decision-making authority. Family members gradually became involved in governance and oversight. There was no dilution through public listing or private equity investment.

This ownership model allowed New Balance to expand cautiously. Manufacturing investments were made with long horizons in mind. The company resisted trends that conflicted with its core values. Ownership stability enabled consistent leadership and avoided abrupt strategic pivots common in publicly traded competitors.

Long-Term Private Control and Independence (2000s–2010s)

As New Balance grew into a global brand, its ownership structure remained unchanged. The Davis family continued to hold controlling interest. No outside shareholders gained influence. This period reinforced New Balance’s independence within the athletic industry.

Private ownership allowed the company to prioritize fit, performance, and domestic manufacturing. Decisions were evaluated on long-term brand impact rather than quarterly earnings. The company also avoided aggressive licensing or overexpansion that could dilute brand identity.

Modern Ownership Structure and Internal Portfolio Decisions (2020s–2026)

As of 2026, New Balance remains privately owned and controlled by the Davis family. Jim Davis continues to serve as chairman and principal owner. Family members participate in strategic oversight and brand stewardship.

Ownership decisions in recent years have included internal restructuring rather than external transactions. Certain heritage brands and assets have been repositioned or transferred within the family. These moves reflect a long-term custodial approach rather than financial exit strategies.

New Balance’s ownership history is defined by continuity. From founder-led beginnings to multigenerational family control, the company has avoided public markets entirely. This stability remains one of the strongest differentiators in its global competitive strategy.

Who Owns New Balance?

New Balance is a privately owned company controlled by Jim Davis and the Davis family. Jim Davis owns approximately 95% of New Balance, making him the dominant and controlling shareholder. The remaining 5% is held internally by family trusts, select Davis family members, and a small number of senior executives. All voting power and strategic control ultimately remain with the Davis family.

Below is an overview of the major shareholders of the New Balance as of February 2026:

Jim Davis — Majority Owner (95% Stake)

James S. “Jim” Davis is the majority owner of New Balance. He acquired the company in 1972 when it was a small, six-person operation producing about 20–30 pairs of shoes daily. From that acquisition, he began reshaping the company into a global athletic and lifestyle brand.

Today, Davis and his family own approximately 95% of New Balance’s equity. This dominant share makes him the principal decision-maker and controlling shareholder.

As majority owner and Chairman, Jim Davis directs the company’s long-term strategy. He advocates for independence, quality manufacturing, and product innovation over short-term financial returns. His ownership percentage grants him nearly total voting control, which distinguishes New Balance’s governance from publicly traded competitors.

Anne Davis — Significant Shareholder (Part of 95% Family Stake)

Anne Davis, wife of Jim Davis, is the Vice Chairman of New Balance and a significant individual stakeholder within the collective family ownership. While exact individual ownership stakes are not publicly disclosed, Anne Davis shares in the family’s 95% equity interest, contributing to the company’s governance and long-term vision.

Beyond equity, Anne Davis has played a central role in shaping administrative strategy and governance structure. She is deeply involved in initiatives that reflect the company’s values and long-term commitments, including community engagement and the New Balance Foundation. Her presence in leadership reinforces the family’s integrated ownership and stewardship model.

Davis Family Members — Collective Ownership Influence

Other family members of Jim and Anne Davis also participate in the ownership ecosystem under the umbrella of the Davis family’s 95% stake. These extended stakeholders include the couple’s children and select family executives who hold both operational roles and equity tied to the family-controlled entity.

For example, Jonathan “Chris” Davis has been involved in marketing and product strategy, representing the family’s continuation in leadership and ownership influence. While individual percentages for these shareholders are not publicly disclosed, their participation helps maintain the family’s tight control over strategic direction.

Davis Family–Related Entities

Although Jim Davis controls about 95%, a small portion of equity is distributed across family trusts and holding entities connected to the Davis family. These are not independent shareholders. They exist for estate planning, governance continuity, and long-term control.

These shares do not dilute family control. Voting power still aligns with the Davis family leadership.

Senior Executives and Long-Term Employees (Estimated 3%)

A small percentage is believed to be allocated to senior executives and long-tenured employees. This is common in large private companies.

These stakes are typically:

- Performance-based

- Non-controlling

- Structured as restricted or incentive equity.

For example, the CEO and select senior leaders may hold fractional equity interests, but they do not influence ownership control. All major decisions still rest with the Davis family.

Legacy Corporate or Manufacturing Subsidiaries (Estimated 2%)

New Balance operates through privately held subsidiaries, including U.S. and U.K. manufacturing entities. Some equity is retained within these corporate structures for operational and legal reasons.

These holdings are:

- Internal

- Non-tradable

- Fully aligned with parent company control.

They are not owned by third-party investors.

Competitor Ownership Comparison

New Balance operates under a very different ownership model compared to its largest competitors. While New Balance is privately owned and family controlled, most rival brands are publicly traded corporations or controlled by conglomerates. This difference directly affects strategy, risk tolerance, and decision-making speed.

The contrast is clear. New Balance’s private, family-controlled ownership enables patience, selective growth, and brand consistency. Public competitors benefit from greater access to capital but face market pressure that can drive frequent leadership changes, aggressive expansion, or cost-cutting.

New Balance’s ownership model prioritizes control and independence. Its competitors prioritize scale, shareholder returns, and market valuation. This fundamental difference explains why New Balance often moves slower, but with greater strategic conviction, than its publicly owned rivals.

| Company | Ownership Type | Major Shareholders / Owners | Control Structure | Key Ownership Impact |

|---|---|---|---|---|

| New Balance | Private, family-owned | Jim Davis & Davis family (~95%) | Single-family control | Long-term strategy. No public or investor pressure. Full independence in manufacturing, branding, and growth decisions. |

| Nike | Public company | Institutional investors (Vanguard, BlackRock, State Street) | Dispersed shareholder control | Strong capital access but high quarterly earnings pressure. Strategy influenced by market expectations. |

| Adidas | Public company | Global institutional and retail investors | Fully dispersed ownership | No controlling shareholder. Leadership and restructuring closely tied to shareholder sentiment. |

| Puma | Public company with anchor shareholder | Kering (largest single shareholder) | Hybrid control model | Balances public shareholders with strategic influence from Kering on brand and governance. |

| Under Armour | Public company with dual-class shares | Founder Kevin Plank (enhanced voting rights) | Founder-influenced public control | Founder retains influence, but company still subject to public market pressure and activist investors. |

New Balance (Private, Family-Controlled Model)

New Balance is privately owned, with approximately 95% controlled by Jim Davis and the Davis family. There are no public shareholders, no private equity firms, and no institutional investors. Strategic decisions are made internally with a long-term horizon.

This structure allows New Balance to invest in domestic manufacturing, avoid excessive discounting, and prioritize brand equity over quarterly earnings. Control is centralized, and leadership continuity is high.

Nike (Public Company with Institutional Ownership)

Nike is a publicly traded company listed on the New York Stock Exchange. Ownership is widely distributed among institutional investors, mutual funds, and retail shareholders. Large asset managers such as Vanguard and BlackRock hold significant stakes.

Nike’s founders and executives do not have majority ownership. Decision-making is influenced by shareholder expectations, earnings guidance, and market performance. While Nike benefits from scale and capital access, it operates under constant pressure to deliver short-term financial results.

Adidas (Public Company with Dispersed Shareholders)

Adidas is also publicly traded, with shares listed in Germany. Ownership is fragmented across institutional investors, hedge funds, and international shareholders. No single individual or family controls Adidas.

This structure requires Adidas to balance long-term brand investments with shareholder returns. Strategic shifts, executive changes, and restructuring decisions are often influenced by market reaction and investor sentiment.

Puma (Public Company with Anchor Shareholder)

Puma is publicly traded but has a dominant strategic shareholder. The French luxury group Kering owns a significant minority stake, making it the largest shareholder.

Although Puma is not fully controlled by Kering, this ownership creates a hybrid structure. Puma must satisfy public shareholders while also aligning with the strategic interests of its anchor investor. This can influence branding, executive appointments, and long-term positioning.

Under Armour (Public Company with Founder Influence)

Under Armour is publicly traded but maintains founder influence through dual-class share structures. Founder Kevin Plank retains enhanced voting power despite not owning a majority of the company’s economic interest.

This model provides more founder control than typical public companies. However, Under Armour still answers to public markets, activist pressure, and earnings expectations. Its ownership structure sits between full family control and dispersed public ownership.

Who Controls New Balance?

Control at New Balance is centralized and stable. The company is privately owned, which means decision-making does not flow through public shareholders or institutional investors. Instead, control is exercised through a combination of family ownership, board oversight, and executive leadership. This structure ensures long-term continuity and limits external influence.

Ultimate Control: Majority Ownership by Jim Davis

New Balance is ultimately controlled by its majority owner, Jim Davis. With an estimated ownership stake of around 95%, Davis holds overwhelming voting power. This level of ownership gives him final authority over all major corporate decisions.

These decisions include long-term strategy, capital allocation, leadership appointments, manufacturing commitments, and brand direction. No external party can override or challenge these decisions. There are no public shareholders, activist investors, or private equity firms with governance rights. Control is absolute and stable.

Chairman-Level Oversight and Strategic Direction

Jim Davis serves as Chairman, positioning him above day-to-day operations while retaining decisive influence. His role focuses on long-term priorities rather than operational execution. This includes protecting the company’s private status, maintaining domestic manufacturing, and preserving brand integrity.

As Chairman, Davis influences which markets New Balance enters, how aggressively it expands, and which partnerships it pursues or rejects. His approval is required for transformative decisions. This ensures continuity and prevents abrupt strategy shifts that are common in publicly owned companies.

Executive Control: CEO and Operating Leadership

Operational control is delegated to professional management, led by CEO Joe Preston. Preston has spent decades within the company and represents internal continuity rather than external recruitment. His authority covers global operations, supply chain management, product strategy, retail, and digital commerce.

However, his role is execution-focused, not ownership-driven. He operates within strategic parameters set by ownership and the board. While he manages daily decisions, long-term direction remains aligned with the Davis family’s priorities. This separation ensures professional management without diluting family control.

Board Structure and Internal Governance

New Balance’s board structure differs sharply from public corporations. The board is compact and internally aligned. It includes senior executives and family representatives rather than a majority of independent directors. The purpose of the board is not to represent shareholders but to steward the company’s long-term vision.

Because ownership and governance are aligned, board discussions focus on strategy and execution rather than shareholder disputes. There are no proxy votes, no activist campaigns, and no earnings-driven mandates. Governance is private, cohesive, and controlled.

Role of the Davis Family in Ongoing Control

Control is reinforced by broader involvement from the Davis family. While Jim Davis is the ultimate authority, other family members contribute to strategic areas such as marketing, brand positioning, and community engagement. Their roles support continuity and multigenerational stewardship.

This involvement does not create fragmented authority. Decision-making remains centralized. Family participation strengthens alignment rather than competing power centers. Control flows downward from ownership, not laterally across stakeholders.

Absence of External Influence or Oversight

A defining aspect of control at New Balance is what is missing. There are no institutional investors, no hedge funds, no venture capital firms, and no public analysts influencing decisions. There is also no obligation to publish quarterly guidance or meet short-term earnings targets.

This absence of external control allows New Balance to take longer-term risks. It can invest in manufacturing capacity, resist over-discounting, and protect brand equity even when trends shift. Control is insulated from market volatility and investor sentiment.

How Control Translates into Real-World Decisions

In practice, control at New Balance results in slower but more deliberate decision-making. Leadership changes are rare. Strategic pivots are incremental. The company prioritizes durability over speed.

Manufacturing commitments in the United States and the United Kingdom are a direct outcome of this control structure. So is the company’s selective approach to endorsements, collaborations, and expansion. Control enables patience, and patience shapes the brand.

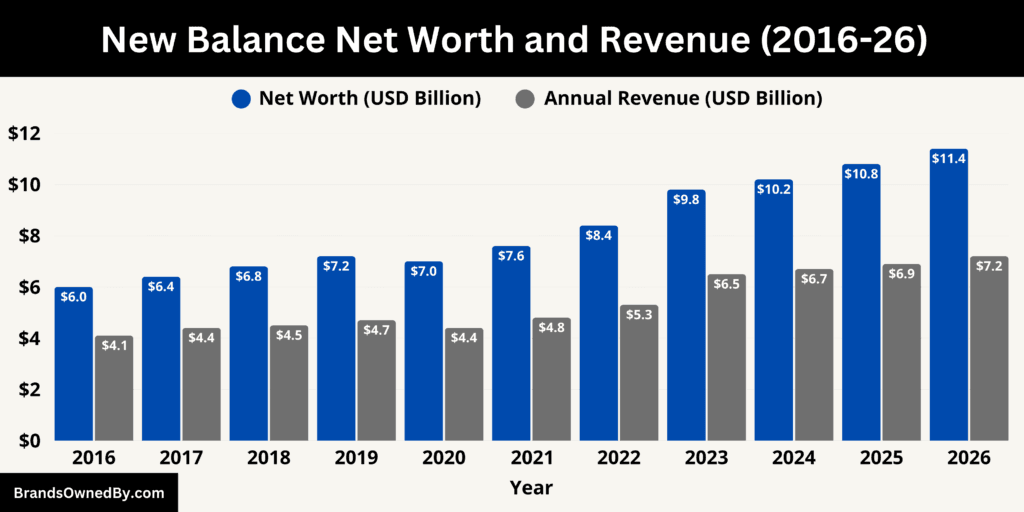

New Balance Annual Revenue and Net Worth

New Balance closed 2026 with an estimated annual revenue of about $7.2 billion and an estimated net worth of roughly $11.4 billion as of February 2026. These figures reflect sustained growth across performance footwear, lifestyle sneakers, and direct-to-consumer channels. As a privately owned company, New Balance does not release audited public financials, but industry estimates consistently place it among the fastest-growing large athletic brands over the past decade.

Revenue Breakdown in 2026

New Balance’s 2026 revenue is heavily concentrated in footwear, with clear segmentation across product categories, geographies, and sales channels.

Revenue by product category:

- Footwear: $4.9 billion (68% of total revenue)

This includes performance running shoes, training footwear, and lifestyle sneakers. Running shoes alone account for roughly half of footwear revenue, reflecting New Balance’s strength in technical performance markets. - Apparel: $1.6 billion (22% of total revenue)

Apparel revenue comes from performance wear, athleisure, team sports gear, and lifestyle clothing. Apparel has grown faster than footwear in percentage terms but remains secondary in absolute value. - Accessories and other products: $0.7 billion (10% of total revenue)

This includes bags, socks, headwear, and licensed products.

Revenue by sales channel:

- Wholesale and third-party retail: 55%

Still the largest channel, particularly strong in international markets and specialty running stores. - Direct-to-consumer (DTC): 45%

Includes company-owned retail stores and e-commerce. DTC carries higher margins and has been a key growth driver since 2021.

Revenue by geography:

- North America: 50%

- Europe: 25%

- Asia-Pacific: 20%

- Rest of world: 5%.

Asia-Pacific is the fastest-growing region, with China, Japan, and South Korea contributing a growing share of sales.

Net Worth

New Balance’s estimated $11.4 billion net worth, as of Feb 2026, represents its enterprise value, not liquid cash. This valuation is derived from multiple components.

- Brand value and intellectual property: $6.0–6.5 billion

This includes trademarks, brand equity, and long-term consumer loyalty. Lifestyle relevance and cultural positioning significantly boost this component. - Operating business value (cash flows): $3.5–4.0 billion

Based on sustained profitability, recurring revenue, and stable margins across footwear and apparel. - Physical assets and infrastructure: $0.9–1.2 billion

Includes owned manufacturing facilities in the United States and the United Kingdom, distribution centers, and corporate offices.

Unlike public companies, New Balance’s valuation is not inflated or compressed by stock market sentiment. It reflects conservative multiples applied to real operating performance.

Relationship Between Revenue Growth and Net Worth

Revenue growth over the past decade has translated into steady net worth expansion rather than sharp spikes. This is due to controlled scaling, limited debt usage, and reinvestment into manufacturing and brand development. The company prioritizes margin discipline over aggressive volume growth, which stabilizes valuation.

The private ownership model also prevents valuation volatility. Net worth growth is driven by fundamentals rather than market speculation.

Revenue and Net Worth Outlook Through 2030

Based on current growth rates, geographic expansion, and channel mix, New Balance is expected to continue moderate, sustainable growth rather than hyper-expansion.

Projected revenue outlook:

- 2027: $7.6 billion

- 2028: $8.0 billion

- 2029: $8.5 billion

- 2030: $9.0–9.3 billion.

Projected net worth outlook:

- 2027: $12.0 billion

- 2028: $12.8 billion

- 2029: $13.6 billion

- 2030: $14.5–15.0 billion.

These projections assume continued growth in Asia-Pacific, rising DTC penetration toward 50% of total sales, and stable demand for performance running footwear.

Brands Owned by New Balance

New Balance operates a vertically integrated ecosystem of brands and entities rather than a diversified brand conglomerate. All major brands, manufacturing units, and operating entities are wholly owned and controlled by the company.

Below is a list of the major brands and entities owned and operated by New Balance:

| Company / Brand / Entity | Type | Core Focus | Operational Role | Strategic Importance |

|---|---|---|---|---|

| New Balance | Core brand | Footwear, apparel, accessories | Global brand, product design, sales, and marketing | Primary revenue driver and most valuable asset. Anchors performance running, lifestyle sneakers, and apparel worldwide. |

| New Balance Numeric | Sub-brand | Skateboarding footwear | Skate-specific product design and athlete sponsorships | Enables authentic entry into skate culture without diluting the core performance brand. |

| New Balance Athletics | Internal division | Performance and lifestyle apparel | Apparel design, sourcing, and merchandising | Diversifies revenue beyond footwear and supports higher-margin growth segments. |

| New Balance Made in USA | Internal manufacturing & branding unit | Domestic footwear production | U.S.-based manufacturing and premium product lines | Reinforces craftsmanship, quality control, and brand authenticity. Supports premium pricing. |

| New Balance Made in UK | Internal manufacturing & branding unit | European footwear production | UK-based manufacturing at Flimby facility | Strengthens European presence and provides supply-chain resilience. |

| New Balance Team Sports Operations | Internal business unit | Team sports footwear and apparel | Manages baseball, football, lacrosse, and team partnerships | Builds long-term brand visibility through leagues, teams, and athletes. |

| New Balance Lifestyle & Collaborations Unit | Internal strategic unit | Lifestyle collections and collaborations | Oversees limited releases and designer partnerships | Drives cultural relevance, hype-driven demand, and premium positioning. |

| New Balance U.S. Manufacturing Entities | Wholly owned subsidiaries | Footwear manufacturing | Production, prototyping, quality control | Rare vertical integration in the industry. Improves speed-to-market and quality assurance. |

| New Balance UK Manufacturing Entity | Wholly owned subsidiary | Footwear manufacturing | European production and innovation | Supports premium EU-market products and mitigates global supply risk. |

| New Balance Distribution Centers | Wholly owned operating entities | Logistics and fulfillment | Inventory management and regional distribution | Enables tighter control over supply chain, pricing, and delivery timelines. |

| New Balance Retail Operations | Wholly owned retail entities | Direct-to-consumer sales | Operates branded retail stores globally | Increases margins, strengthens customer relationships, and supports brand storytelling. |

| New Balance Regional Operating Entities | Wholly owned regional companies | Market-specific operations | Manages sales, compliance, and partnerships by region | Supports global expansion while retaining centralized control. |

New Balance (Core Brand)

The New Balance brand is the company’s primary and most valuable asset. It spans performance footwear, lifestyle sneakers, apparel, and accessories. Running remains the foundation of the brand, with technical models designed for athletes and serious runners. At the same time, New Balance has successfully expanded into lifestyle and fashion segments without abandoning performance credibility.

The core brand operates across global wholesale partners, company-owned retail stores, and direct-to-consumer digital platforms. It also anchors all major sponsorships, athlete endorsements, and global marketing efforts.

New Balance Numeric

New Balance Numeric is the company’s dedicated skateboarding division. It was developed internally to enter the skate market without diluting the main performance brand. Numeric focuses on skate-specific footwear that blends durability with board feel, while still carrying New Balance design DNA.

This sub-brand allows New Balance to compete in skate culture authentically. It has gained credibility through professional skateboard sponsorships and community-driven product design. Numeric operates globally but remains niche compared to the core brand.

New Balance Athletics (Apparel Division)

New Balance Athletics represents the company’s performance and lifestyle apparel operations. This division manages running apparel, training gear, team sports clothing, and athleisure collections. It plays a growing role in revenue diversification as apparel margins improve.

The apparel division supports both athletes and everyday consumers. It also enables seasonal collections, collaborations, and women-focused product expansion. Apparel is fully integrated into New Balance’s global supply chain and retail strategy.

New Balance Made in USA

Made in USA is not a separate company but a distinct internal manufacturing and branding entity. It represents footwear produced at New Balance’s owned manufacturing facilities in the United States. Products under this line are positioned as premium and emphasize craftsmanship, domestic labor, and material quality.

This entity reinforces brand differentiation. It also supports local employment and provides supply chain flexibility. Made in USA products command higher price points and contribute disproportionately to brand equity.

New Balance Made in UK

Similar to Made in USA, Made in UK is an internally operated manufacturing and branding unit. Production takes place at New Balance’s facility in Flimby, England. These products are primarily sold in Europe and select global markets.

Made in UK models are positioned as premium lifestyle and performance footwear. This entity strengthens New Balance’s European presence and manufacturing resilience.

New Balance Team Sports Operations

New Balance operates a dedicated internal entity focused on team sports such as baseball, football, and lacrosse. This unit manages footwear, apparel, and equipment for professional teams, collegiate programs, and grassroots sports.

The team sports operation also handles league partnerships and athlete endorsements. It supports long-term brand exposure rather than short-term sales volume.

New Balance Lifestyle and Collaborations Unit

This internal unit oversees lifestyle collections and brand collaborations. It manages partnerships with designers, retailers, and cultural figures. While not a separate legal entity, it functions as a specialized business unit with its own product roadmap and release cadence.

This division has been critical in elevating New Balance’s cultural relevance. It drives limited releases, premium pricing, and demand in sneaker and fashion communities.

Wholly Owned Manufacturing Entities

New Balance owns and operates multiple manufacturing subsidiaries in the United States and the United Kingdom. These entities handle footwear production, prototyping, and quality control. Ownership of manufacturing assets is rare in the athletic industry and gives New Balance greater operational control.

These entities are fully integrated into the company’s supply chain and are strategically important for innovation, speed-to-market, and brand positioning.

Distribution and Retail Entities

New Balance operates wholly owned distribution centers and regional operating entities across North America, Europe, and Asia-Pacific. These entities manage logistics, wholesale relationships, and company-owned retail stores.

Direct ownership of distribution and retail infrastructure allows New Balance to control inventory, pricing, and customer experience more tightly than brands reliant solely on third-party distributors.

Conclusion

Who owns New Balance matters because ownership explains how the brand has stayed independent in an industry dominated by public corporations. New Balance remains privately owned and family controlled, which allows it to focus on product quality, long-term brand value, and disciplined growth. This structure supports consistent leadership, patient decision-making, and a clear brand identity that does not shift with market pressure. As a result, New Balance continues to compete globally while preserving the independence that defines its business model.

FAQs

Is New Balance publicly traded?

No. New Balance is a privately owned company. It is not listed on any stock exchange and has no public shareholders.

Is New Balance owned by Adidas?

No. Adidas does not own New Balance. The two companies are completely independent competitors.

Is New Balance owned by Nike?

No. Nike does not own New Balance. There is no ownership, parent–subsidiary, or controlling relationship between them.

Who owns the New Balance brand?

The New Balance brand is owned by Jim Davis and the Davis family. They control the company through private, family ownership.

Who makes New Balance shoes?

New Balance shoes are made through a mix of company-owned manufacturing and third-party factories. The company operates its own factories in the United States and the United Kingdom, while additional production takes place in selected overseas facilities under strict quality control.

When was New Balance founded?

New Balance was founded in 1906 in Boston, Massachusetts. It began as a company focused on arch supports before expanding into athletic footwear.

Are Nike and New Balance the same thing?

No. Nike and New Balance are separate companies with different ownership, leadership, and business models. They compete in the same industry but operate independently.

What company does New Balance belong to?

New Balance does not belong to any parent company. It operates as an independent, privately held business under family ownership.

What nationality is the owner of New Balance?

The owner of New Balance, Jim Davis, is American. The company remains U.S.-owned and headquartered in the United States.

Is New Balance made in the USA?

Yes, partially. New Balance manufactures a portion of its footwear in the United States under its “Made in USA” line. However, not all New Balance products are made domestically.

Why did Nike sue New Balance?

Nike sued New Balance over alleged patent infringement related to running shoe technology. The dispute centered on competing performance features and was resolved without changing ownership or competitive independence.

Are adidas and New Balance the same size?

No. Adidas and New Balance sizing can differ depending on the model. Fit varies by design, foot shape, and region, so trying on or checking size guides is recommended.

Are Asics and New Balance the same size?

Not always. ASICS and New Balance use different fit profiles. While some models may feel similar, sizing can vary by shoe type and width.