- Harley-Davidson is a publicly traded company with no controlling owner, meaning no individual, family, or entity owns a majority stake in the business.

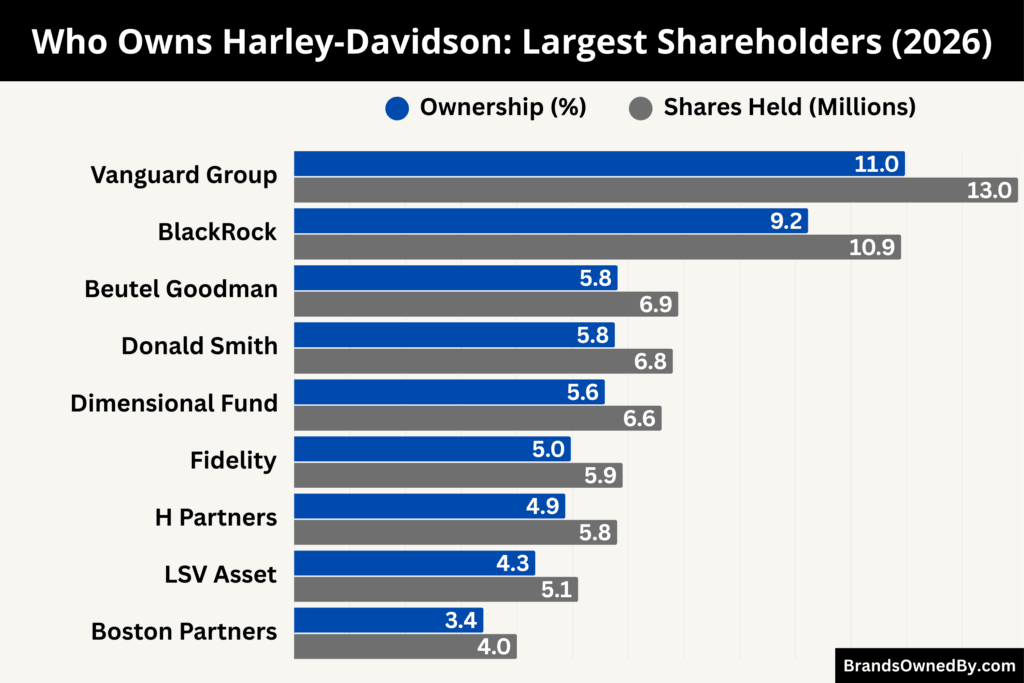

- Institutional investors collectively own about 90%–92% of outstanding shares, led by Vanguard Group (11%), BlackRock (9%), Beutel Goodman (5.8%), Donald Smith & Co. (~5.7%), Dimensional Fund Advisors (5.6%), Fidelity (5%), and other institutional holders.

- Retail investors hold roughly 7%–9% of shares, while company insiders, including executives and board members, own less than 1%, limiting insider control through equity ownership.

- Harley-Davidson is controlled through corporate governance, where strategic authority rests with the board of directors and executive leadership, and shareholders influence decisions indirectly through voting rather than direct management.

Harley-Davidson is an American motorcycle manufacturer known worldwide for heavyweight motorcycles with distinctive design, deep-rumbling engines, and a passionate community of riders. The company’s motorcycles are symbols of personal freedom, culture, and self-expression. Harley-Davidson builds bikes across multiple segments including touring, cruiser, trike, and adventure. The brand also extends into apparel, riding gear, licensed merchandise, and experiences for riders.

The company operates a global dealer network. Its products and services serve riders in North America, Europe, Asia, Latin America, and other regions. Harley-Davidson emphasizes craftsmanship, tradition, and innovation. In recent years, the company has broadened its portfolio to include electric motorcycles and new rider programs.

Headquartered in Milwaukee, Wisconsin, Harley-Davidson maintains a strong cultural presence. It hosts rallies and events that draw riders internationally.

Founders

Harley-Davidson was founded by William S. Harley and Arthur Davidson, along with Arthur’s brothers Walter and William A. Davidson. The founders were young, mechanically inclined men from Milwaukee with a shared passion for engineering and motorized bicycles.

William S. Harley had drafting and design experience. He conceptualized an engine that could attach to a bicycle frame. Arthur Davidson had sales and organizational skills. He helped build early prototype bikes and managed early customer interactions. Walter Davidson focused on production and quality. William A. Davidson supported operations and dealer relationships.

The founders worked in a small shed on Juneau Avenue in Milwaukee. In 1903, they completed their first successful prototype. This machine laid the foundation for what would become one of the most enduring motorcycle brands.

The early partnership combined design ingenuity, practical mechanical skills, and an entrepreneurial drive to build a new kind of machine. Their collaboration shaped Harley-Davidson’s identity as a rider-centric company.

Ownership History

Understanding the ownership history of Harley-Davidson is essential to understanding how the company evolved into its current structure. Unlike many legacy brands that remained family-controlled or became permanent subsidiaries, Harley-Davidson went through multiple ownership phases. Each phase reshaped governance, strategy, and brand direction. The company’s journey from founder ownership to public markets, through corporate acquisition, and back to independence is central to its identity today.

| Ownership Phase | Time Period | Ownership Structure | Key Details and Impact |

|---|---|---|---|

| Founder-Owned Private Company | 1903–1965 | Privately held by founders and families | Harley-Davidson was owned and controlled by William S. Harley and the Davidson brothers. Decision-making was internal and long-term focused. The company emphasized engineering, racing, dealer relationships, and brand identity without public shareholder pressure. |

| First Public Ownership Phase | 1965–1969 | Publicly traded, independent | Harley-Davidson became a public company for the first time. Ownership expanded to institutional and retail investors. The company gained access to capital markets while remaining independent, but governance and shareholder accountability increased. |

| AMF Corporate Ownership | 1969–1981 | Wholly owned subsidiary of AMF | Harley-Davidson lost independence after being acquired by American Machine and Foundry. AMF exercised full ownership and strategic control. Production increased, but quality issues emerged, damaging brand perception and internal culture. |

| Management Buyout | 1981–1986 | Privately owned by executive group | Senior executives repurchased the company from AMF. Ownership returned to brand-focused leadership. This phase restored independence, improved quality standards, restructured operations, and rebuilt rider trust. |

| Second Public Listing | 1986–1990s | Publicly traded, independent | Harley-Davidson returned to public markets with stronger governance. Ownership became widely dispersed among shareholders. No controlling shareholder existed, preserving strategic independence. |

| Institutional Ownership Growth | 1990s–2010s | Public with rising institutional dominance | Large asset managers and index funds accumulated significant stakes. Ownership became institutionally dominated, though control remained with the board and executives rather than shareholders directly. |

| Modern Ownership Structure | 2020s–Present | Public, institutionally held, no parent | Harley-Davidson remains independent with no controlling shareholder. Institutional investors hold the majority of shares, retail investors and insiders hold smaller portions, and governance is driven by board oversight and shareholder voting. |

Founder-Owned and Privately Held Era (1903–1965)

Harley-Davidson began as a privately owned company in 1903. Ownership was concentrated among the founders, William S. Harley and the Davidson brothers. During this period, the company was run as a closely held enterprise. Strategic decisions were made internally by founders and senior managers. There were no public shareholders and no external pressure from financial markets.

This ownership structure allowed Harley-Davidson to focus on engineering, racing, and dealer relationships. Growth was organic. Control remained stable for decades. The founders emphasized long-term brand building rather than short-term returns. This era established Harley-Davidson’s core identity, manufacturing culture, and loyal customer base.

Initial Public Offering and Shareholder Ownership (1965–1969)

In 1965, Harley-Davidson transitioned from a privately held company to a publicly traded one. This move introduced a new ownership model based on shareholders. By listing its shares on the stock market, the company gained access to public capital. Ownership expanded beyond founders and insiders to institutional and retail investors.

Although Harley-Davidson was now public, it remained independent. There was no parent company at this stage. The board of directors became more formalized, and shareholder accountability increased. This shift marked the beginning of modern corporate governance at Harley-Davidson.

Acquisition by AMF and Loss of Independence (1969–1981)

In 1969, Harley-Davidson was acquired by American Machine and Foundry, commonly known as AMF. This acquisition significantly changed ownership and control. Harley-Davidson ceased to operate as an independent company and became a subsidiary within a larger industrial conglomerate.

AMF owned the company outright. Strategic decisions were influenced by corporate priorities rather than rider culture. While production volumes increased, the focus on scale and cost efficiency led to quality concerns. Brand perception suffered. Internally, many employees and executives felt disconnected from the company’s heritage.

This period is widely viewed as the most challenging chapter in Harley-Davidson’s ownership history. Although the brand survived, its independence and identity were weakened under corporate ownership.

Management Buyout and Restoration of Independence (1981)

In 1981, a group of senior Harley-Davidson executives led a management buyout to purchase the company from AMF. This transaction restored Harley-Davidson’s independence. Ownership shifted back to leaders who were deeply connected to the brand, workforce, and dealer network.

This buyout was a turning point. Control returned to insiders who prioritized quality, operational discipline, and long-term brand value. The company restructured manufacturing, improved processes, and rebuilt trust with riders. The ownership model once again supported cultural alignment rather than corporate distance.

Return to Public Markets as an Independent Company (1986)

In 1986, Harley-Davidson returned to public markets through a new public offering. This time, the company entered the market with stronger governance structures and clearer strategic discipline. Ownership became widely distributed among institutional investors, mutual funds, and individual shareholders.

Unlike the earlier public phase, Harley-Davidson remained firmly independent. No single shareholder held control. The board of directors maintained oversight, while executive leadership retained operational authority. This structure balanced market accountability with brand-focused leadership.

Institutional Ownership Expansion (1990s–2010s)

From the 1990s onward, institutional investors steadily increased their ownership stakes. Large asset managers, index funds, and pension funds accumulated shares as Harley-Davidson became a core holding in consumer and industrial portfolios.

Ownership became increasingly institutionalized. However, this did not translate into direct control. Institutions invested for long-term exposure rather than active management. Voting power became more concentrated, but decision-making authority remained with the board and executive team.

Present-Day Ownership Structure

Today, Harley-Davidson operates as an independent, publicly traded company with no controlling shareholder. Institutional investors hold the majority of outstanding shares. Retail investors and insiders hold smaller portions. There is no parent corporation and no family ownership.

This ownership history reflects a company that has experienced nearly every major ownership model. Founder-led private ownership. Public markets. Corporate acquisition. Management buyout. Institutional dominance. Each phase shaped Harley-Davidson’s governance and strategic resilience, resulting in the independent structure it maintains today.

Who Owns Harley-Davidson: Top Shareholders

Harley-Davidson is a publicly traded corporation with its stock listed on the New York Stock Exchange under the ticker HOG. Its ownership is diversified across institutional investors, smaller investment funds, and individual shareholders. No single entity controls a majority of the company, which supports broad accountability to all stakeholders.

The ownership structure of Harley-Davidson is heavily weighted toward institutional investors. Together, these entities own roughly 80% to 90% of the company’s outstanding shares, while insiders and retail investors hold smaller proportions.

Vanguard Group, Inc.

Vanguard Group is the largest single shareholder of Harley-Davidson. As of the latest filings reported in 2025, Vanguard owns approximately 10.97% of outstanding shares.

Vanguard is a major global asset manager that manages a wide range of index funds and mutual funds on behalf of retail and institutional investors. Its significant ownership reflects long-term investment strategies rather than direct management involvement. Vanguard’s stake gives it meaningful voting influence at shareholder meetings, including on board elections and executive compensation, but does not confer control over company operations.

The firm’s passive investment approach means it holds shares for performance tied to broader market trends, and its voting power helps guide governance without day-to-day operational involvement.

BlackRock, Inc.

BlackRock is the second largest institutional holder of Harley-Davidson shares, owning around 9.23% of the company.

BlackRock is one of the world’s largest asset managers. It holds shares on behalf of index funds, pension funds, and other investment vehicles. Like Vanguard, BlackRock’s ownership is driven by investor demand for diversified exposure to large public companies. Its stake places it among the most influential shareholders in corporate governance matters, such as board composition and shareholder proposals.

BlackRock’s voting participation is a key part of how institutional investors influence public companies, though it does not directly manage Harley-Davidson’s strategic initiatives.

Beutel, Goodman & Co., Ltd.

Beutel, Goodman & Co., Ltd. holds approximately 5.81% of Harley-Davidson’s outstanding shares.

This Canadian investment management firm focuses on value-oriented investing and holds shares across a variety of sectors. Its stake in Harley-Davidson confirms institutional confidence in the company’s long-term prospects. Beutel Goodman’s involvement reflects active management of concentrated portfolios rather than passive indexing.

Even with a sizeable stake, this investor is not a controlling shareholder, but its position contributes to the institutional ownership majority.

Donald Smith & Co., Inc.

Donald Smith & Co., Inc. is another significant institutional investor in Harley-Davidson, with about 5.76% ownership.

This investment firm operates long/short equity funds and other strategies. Its significant stake often places it among the top institutional shareholders, granting it voting rights on key governance issues. Like other institutional holders, the firm does not manage daily company operations but can influence strategic decisions through voting and dialogue with the board.

Dimensional Fund Advisors LP

Dimensional Fund Advisors holds a meaningful stake as well, owning about 5.58% of Harley-Davidson shares.

Dimensional is known for its systematic investment approach, blending academic research with broad diversification. Its holdings reflect long-term exposure to large public companies. While it is a notable shareholder, it does not exercise control over corporate strategy and governance beyond its voting authority.

DFA Australia Ltd.

DFA Australia Ltd. holds approximately 5.375% of outstanding shares.

This reflects international institutional interest in Harley-Davidson as part of diversified global portfolios. DFA Australia is part of the broader Dimensional Fund Advisors group. Its investment stance supports index-linked exposure with a broader risk profile.

Fidelity Management & Research Co. LLC

Fidelity Management & Research Co. LLC owns about 5.012% of Harley-Davidson’s shares.

Fidelity is a well-established asset manager that offers mutual funds, retirement accounts, and institutional accounts. Its stake reinforces the trend of large American investment firms holding significant positions in established public corporations.

Insider and Retail Shareholders

Insiders — including executives, board members, and other company leaders — typically hold a small percentage of shares. According to available data, insiders own roughly 3% to 4% of outstanding shares.

Retail shareholders — individual investors who hold stock through brokerage accounts — own the remainder of the shares, typically around 7% to 10%. These investors range from long-term brand supporters to individual traders seeking capital appreciation.

Competitor Ownership Comparison

Harley-Davidson stands apart from most major competitors. It is one of the few globally recognized motorcycle brands that is both publicly traded and operationally independent. Competitors are either diversified conglomerates, corporate subsidiaries, or strategically controlled entities.

This independence allows Harley-Davidson to focus exclusively on motorcycles, brand culture, and rider identity. At the same time, it places greater pressure on management to deliver performance without the safety net of a larger parent company. This ownership distinction remains a defining characteristic of Harley-Davidson’s competitive position.

| Company | Ownership Type | Parent Company | Ownership Structure | Level of Independence | Strategic Impact |

|---|---|---|---|---|---|

| Harley-Davidson | Public company | None | Publicly traded with institutionally dominated shareholding | High | Fully independent strategy. Decisions driven by board and management. Strong focus on brand, rider culture, and motorcycles only. |

| Honda Motor Company | Public conglomerate | None | Public ownership with Japanese institutional and cross-shareholding influence | Medium | Motorcycles are one segment of a large industrial portfolio. Strategy emphasizes scale, efficiency, and global volume. |

| Yamaha Motor | Public with strategic shareholder | Yamaha Corporation | Publicly traded but influenced by parent shareholder | Medium | Benefits from group stability and shared technology, but reduced strategic autonomy compared to Harley-Davidson. |

| BMW Motorrad | Business division | BMW Group | Fully owned division of a public automotive group | Low | Motorcycle strategy aligned with BMW Group priorities. Capital allocation competes with automotive investments. |

| Indian Motorcycle | Subsidiary | Polaris Inc. | Wholly owned brand under parent corporation | Low | No separate shareholders. Strategic control rests entirely with Polaris leadership. |

| Ducati | Subsidiary | Audi (Volkswagen Group) | Fully owned premium brand within global auto group | Low | Strong funding and engineering support, but strategy aligned with group-level objectives. |

| Kawasaki Heavy Industries | Public conglomerate | None | Publicly traded industrial group with multiple business segments | Medium | Motorcycles represent one business unit within a diversified industrial portfolio. |

Harley-Davidson: Independent and Institutionally Owned

Harley-Davidson operates as an independent, publicly traded company. Ownership is dominated by institutional investors, but no shareholder holds a controlling stake. The company has no automotive parent, no family control, and no government influence.

Strategic decisions are made by executive leadership and approved by the board of directors. Shareholders influence governance primarily through voting rights rather than direct operational involvement. This structure gives Harley-Davidson flexibility but also places strong accountability on management performance.

Honda Motor Company: Diversified Industrial Giant

Honda Motor Company is a publicly traded multinational corporation with a highly diversified business model. Its ownership is widely distributed among institutional investors, financial institutions, and cross-shareholding partners, common in Japan.

Unlike Harley-Davidson, Honda is not motorcycle-focused. Motorcycles represent only one segment of a much larger automotive, power equipment, and mobility ecosystem. Decision-making is centralized within a large corporate structure, which prioritizes scale, global volume, and technological efficiency over brand lifestyle positioning.

Yamaha Motor: Strategic Shareholder Influence

Yamaha Motor is also publicly traded but operates under a different ownership dynamic. Yamaha Corporation, the musical instrument and electronics company, remains a major strategic shareholder.

This relationship creates long-term stability but limits full independence. Yamaha Motor benefits from group support, shared technology, and financial backing. However, strategic autonomy is narrower compared to Harley-Davidson’s board-led independence.

BMW Motorrad: Division of a Parent Group

BMW Motorrad is not an independent company. It operates as a division of BMW Group. Ownership and control rest entirely with the BMW parent entity, which is publicly traded but influenced by large family shareholders and long-term strategic investors.

Motorcycles are a secondary business within BMW Group. Capital allocation, product strategy, and innovation priorities are aligned with broader automotive objectives. This structure provides financial strength but limits standalone motorcycle brand autonomy.

Indian Motorcycle: Subsidiary Ownership Model

Indian Motorcycle is owned by Polaris Inc. Indian does not have its own shareholders. All strategic decisions flow through Polaris’s executive leadership and board.

This subsidiary model contrasts sharply with Harley-Davidson’s public independence. While Polaris provides capital and operational support, Indian Motorcycle lacks separate governance and direct shareholder accountability. Brand direction is ultimately shaped by Polaris’s broader powersports strategy.

Ducati: Performance Brand Under Corporate Control

Ducati is owned by Audi, which itself is part of the Volkswagen Group. Ducati operates as a premium motorcycle brand within a large global automotive conglomerate.

Ownership by Audi ensures strong funding and engineering resources. However, Ducati’s strategic direction aligns with group-level priorities. Unlike Harley-Davidson, Ducati does not answer directly to public shareholders focused solely on motorcycles.

Who Controls Harley-Davidson?

Harley-Davidson is controlled through a professional corporate governance system. Shareholders own the company but do not manage it. The board of directors provides oversight and strategic approval. Executive leadership, led by the CEO, controls daily operations. No single shareholder, family, or corporation dominates decision-making. This structure defines Harley-Davidson as an independent, board-governed public company.

Public Company Governance Structure

Harley-Davidson is a publicly traded corporation. Control ultimately flows from shareholders, but only indirectly. Shareholders do not manage daily operations. Their primary powers include electing board members, approving certain governance matters, and voting on executive compensation plans.

Because no shareholder owns a majority stake, control is collective rather than individual. This prevents any single investor from dictating strategy. Instead, governance relies on institutional checks and balances.

Role of the Board of Directors

The board of directors is the highest governing authority within Harley-Davidson. It represents shareholder interests and oversees the company’s long-term strategy, risk management, and executive performance.

The board appoints and can remove the CEO. It approves major strategic initiatives, leadership changes, acquisitions, restructurings, and capital allocation priorities. Board members are elected by shareholders and typically include a mix of independent directors and company executives.

Given the company’s high institutional ownership, board elections are heavily influenced by large asset managers. However, the board operates independently from day-to-day shareholders and focuses on long-term corporate stability.

Executive Leadership and Day-to-Day Control

Day-to-day control of Harley-Davidson rests with the executive leadership team, led by the Chief Executive Officer.

The current CEO is Jochen Zeitz. He assumed the role in 2020 and is responsible for overall strategic direction, operational execution, and leadership culture. Under his leadership, the company introduced major restructuring initiatives, refined its product focus, and emphasized brand discipline.

The CEO works alongside senior executives who oversee manufacturing, product development, global markets, supply chain, marketing, and financial operations. Together, this leadership team controls operational decisions within the strategic framework approved by the board.

Separation of Ownership and Control

A defining feature of Harley-Davidson’s control structure is the separation between ownership and management. Institutional investors own most of the shares, but they do not run the company.

This separation means executives are evaluated on performance rather than ownership power. Control is exercised through professional management rather than founder authority, family dominance, or parent-company oversight.

Shareholders influence control indirectly through proxy voting, shareholder proposals, and board elections rather than direct intervention.

Influence of Institutional Shareholders

Although institutional investors do not manage operations, they exert meaningful influence over governance. Large shareholders such as Vanguard and BlackRock vote on board appointments, executive pay, and governance reforms.

If management performance declines or strategy fails, institutional investors can pressure the board to act. This pressure may result in leadership changes, strategic reviews, or governance reforms. However, these actions occur through formal processes rather than direct control.

Absence of a Parent Company or Founder Control

Unlike many competitors, Harley-Davidson does not operate under a parent corporation. It is not a subsidiary, and it is not controlled by a founding family.

This absence of external control gives management greater autonomy but also places full accountability on leadership and the board. Success or failure rests entirely within the company’s own governance framework.

Harley-Davidson Annual Revenue and Net Worth

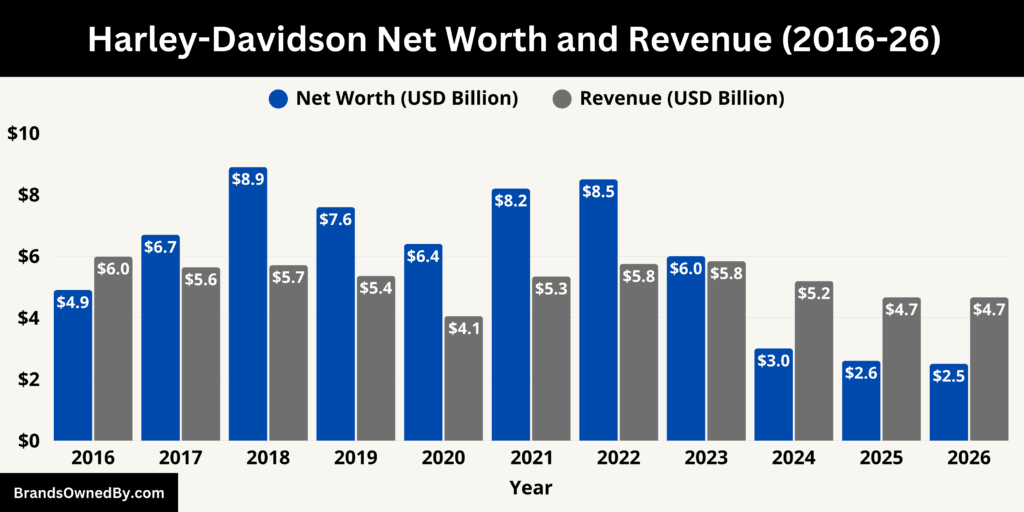

Harley-Davidson enters 2026 with $4.66 billion in trailing-twelve-month (TTM) revenue and an estimated market capitalization of $2.5 billion as of January 2026. These figures reflect a company with substantial operating scale but a more conservative equity valuation than in prior cycles. Revenue remains anchored in motorcycle sales, while market value reflects investor caution around growth, margins, and long-term demand trends.

2026 Revenue

Harley-Davidson’s most recent revenue figure is $4.66 billion (TTM). This represents the latest twelve months of reported performance and is used because a full-year 2026 financial statement is not yet available.

Motorcycles continue to be the dominant source of income. Approximately 68% of total revenue, or about $3.17 billion, comes from motorcycle sales. This includes touring, cruiser, trike, and adventure models sold through the global dealer network.

Parts and accessories generate roughly 16% of revenue, equaling about $740 million. This segment benefits from repeat purchases, customization demand, and the large installed base of Harley-Davidson motorcycles already on the road.

General merchandise and licensing contribute around 8%, or $370 million. This includes apparel, riding gear, branded lifestyle products, and licensing arrangements tied to the Harley-Davidson name.

Financial services account for the remaining 8%, also close to $370 million. This revenue comes from dealer financing, retail motorcycle loans, insurance-related products, and support services that facilitate motorcycle sales.

Net Worth (Market Capitalization)

Harley-Davidson has an estimated net worth of $2.5 billion in early 2026, measured by its market capitalization. This value represents the total equity markets assign to the company based on its share price and outstanding shares.

The largest portion of this net worth comes from Harley-Davidson’s core motorcycle business. Touring, cruiser, and related models generate the majority of revenue and cash flow, which forms the foundation of the company’s equity value. The long-standing installed base of motorcycles also supports residual value through repeat demand.

A second layer of value is derived from parts, accessories, and general merchandise. These segments provide recurring, brand-driven revenue tied to customization and lifestyle products. Markets factor this recurring demand into overall valuation, supporting the company’s equity beyond one-time vehicle sales.

Financial services contribute additional stability to net worth. Dealer and retail financing operations support motorcycle sales and generate consistent income, which strengthens the overall equity profile.

Finally, a meaningful portion of Harley-Davidson’s market capitalization reflects brand equity and intangible value. The global recognition of the Harley-Davidson name, customer loyalty, and cultural relevance are embedded in the share price and therefore in the company’s net worth.

Together, these components explain how Harley-Davidson’s $2.5 billion market capitalization is formed and sustained.

Revenue Forecast

Harley-Davidson’s most realistic and sustainable revenue outlook is a moderate-growth trajectory built on pricing discipline, stable core demand, and gradual expansion of higher-margin segments. This forecast assumes no aggressive volume spikes and no severe demand shocks. Instead, it reflects execution consistency under the current strategic framework.

- 2027: Revenue is projected at $4.78 billion, supported by steady motorcycle shipments, improved dealer inventory balance, and continued strength in parts and accessories.

- 2028: Revenue is expected to rise to $4.90 billion as incremental gains from new model refreshes and international markets offset slower growth in mature regions.

- 2029: Revenue is forecast to reach $5.03 billion, driven by higher average selling prices, deeper accessory attachment rates, and expanded merchandise penetration.

- 2030: Revenue is projected at approximately $5.16 billion, reflecting ongoing brand monetization, stable financial services contribution, and controlled operating scale.

This outlook implies an average annual growth rate of about 2.5%, which aligns with Harley-Davidson’s historical performance in non-expansionary cycles. Growth is expected to come more from value per customer than from significant increases in unit volume.

Brands Owned by Harley-Davidson

Harley-Davidson operates through a focused portfolio of wholly owned businesses, majority-owned entities, and brand-controlled divisions. It owns and operates businesses that directly support motorcycle manufacturing, brand expansion, financing, and lifestyle monetization.

Below is a list of the companies, brands, and entities owned by Harley-Davidson as of January 2026:

| Company / Brand | Ownership Status | Entity Type | Primary Function | Strategic Role |

|---|---|---|---|---|

| Harley-Davidson Motor Company | Wholly owned | Core operating company | Design, engineering, manufacturing, and global distribution of motorcycles | Core revenue engine and brand foundation |

| Harley-Davidson Financial Services | Wholly owned subsidiary | Financial services | Dealer floorplan financing, retail loans, insurance-related products | Supports motorcycle sales, dealer stability, and customer affordability |

| LiveWire | Majority owned | Public electric motorcycle company | Electric motorcycles, EV platforms, charging ecosystem | Long-term electric mobility strategy and technology development |

| Harley-Davidson Parts & Accessories | Wholly owned | Internal division | Genuine parts, performance upgrades, customization accessories | High-margin recurring revenue tied to installed motorcycle base |

| Harley-Davidson General Merchandise & Apparel | Wholly owned (licensed manufacturing) | Brand division | Apparel, riding gear, footwear, lifestyle merchandise | Brand monetization beyond motorcycle sales |

| Harley Owners Group (H.O.G.) | Wholly owned | Membership organization | Rider community, events, rallies, loyalty programs | Customer retention, brand loyalty, lifetime value expansion |

| Harley-Davidson Museum & Brand Experiences | Wholly owned | Brand experience operations | Museum, archives, exhibitions, experiential marketing | Heritage preservation and brand equity reinforcement |

Harley-Davidson Motor Company

Harley-Davidson Motor Company is the core operating entity of the group. It is responsible for the design, engineering, manufacturing, and distribution of Harley-Davidson motorcycles worldwide. This entity oversees product development across touring, cruiser, trike, sport, and adventure categories.

Manufacturing operations, global dealer relationships, quality control, and product lifecycle management all sit within this business. It is the primary revenue generator and the foundation of the Harley-Davidson brand and ecosystem.

Harley-Davidson Financial Services

Harley-Davidson Financial Services is a wholly owned subsidiary that provides financial products to dealers and retail customers. Its primary role is to support motorcycle sales through wholesale floorplan financing for dealers and retail loans for customers.

The business also offers insurance-related products and extended service plans. Financial Services plays a strategic role by stabilizing dealer liquidity, improving customer affordability, and smoothing sales cycles during economic slowdowns. It operates as an integrated support arm rather than a standalone financial institution.

LiveWire Group (Majority-Owned)

LiveWire is Harley-Davidson’s electric motorcycle brand and technology platform. LiveWire was developed internally and later spun off as a publicly traded company. Harley-Davidson retains a majority ownership stake, making LiveWire a controlled but separately listed entity.

LiveWire focuses exclusively on electric motorcycles, software-enabled riding experiences, and charging ecosystem partnerships. While operationally independent, LiveWire remains strategically linked to Harley-Davidson through shared technology development, brand heritage, and long-term mobility strategy.

Harley-Davidson Parts and Accessories Division

This division manages the development and sale of genuine Harley-Davidson parts and accessories. It includes performance upgrades, customization kits, replacement components, and riding enhancements designed specifically for Harley-Davidson motorcycles.

The division is critical to the company’s recurring revenue model. It leverages the large installed base of motorcycles and the brand’s strong customization culture. Products are sold through authorized dealers and select digital channels.

Harley-Davidson General Merchandise and Apparel

Harley-Davidson owns and controls its global merchandise and apparel business. This includes riding gear, helmets, jackets, casual wear, footwear, and branded lifestyle products.

While some manufacturing and distribution functions are licensed, brand control remains with Harley-Davidson. The merchandise business extends the brand beyond motorcycles and contributes to year-round revenue independent of vehicle sales cycles.

Harley Owners Group (H.O.G.)

Harley Owners Group, commonly known as H.O.G., is an owned and operated membership organization within Harley-Davidson. It is not a separate company but functions as a formal entity under the corporate structure.

H.O.G. manages rider communities, global events, rallies, and exclusive member benefits. It strengthens customer retention, brand loyalty, and repeat purchasing behavior. The organization plays a long-term strategic role in maintaining Harley-Davidson’s lifestyle positioning.

Harley-Davidson Museum and Brand Experience Operations

Harley-Davidson owns and operates the Harley-Davidson Museum and associated brand experience assets. These include physical locations, archives, exhibitions, and experiential marketing platforms.

These operations are designed to preserve brand heritage, educate customers, and reinforce Harley-Davidson’s cultural identity. While not revenue-dominant, they contribute to brand equity and long-term customer engagement.

Conclusion

Ultimately, exploring who owns Harley-Davidson shows that the iconic motorcycle brand is shaped by a broad base of public shareholders rather than a single controlling owner. The company’s independence, institutionally driven ownership, and well-defined operating entities allow it to balance tradition with modernization. This structure supports long-term decision-making while enabling Harley-Davidson to evolve its products, expand its brand reach, and remain competitive in a changing global motorcycle market.

FAQs

Who owns the Harley-Davidson company?

Harley-Davidson is owned by its public shareholders. It is a publicly traded company listed on the New York Stock Exchange. Ownership is spread across institutional investors, retail shareholders, and company insiders. No single person, family, or corporation owns or controls Harley-Davidson.

Does Kawasaki own Harley-Davidson?

No. Kawasaki does not own Harley-Davidson. The two companies are completely independent competitors with no ownership, partnership, or corporate control relationship.

Who bought out Harley-Davidson?

Harley-Davidson was acquired by American Machine and Foundry (AMF) in 1969. In 1981, the company was bought back from AMF through a management-led buyout by Harley-Davidson executives. Since returning to public markets in 1986, Harley-Davidson has not been bought out again.

Where are Harley-Davidson made?

Harley-Davidson motorcycles are primarily manufactured in the United States, with major production facilities in Wisconsin, Pennsylvania, and Missouri. Some components and certain models also involve international manufacturing and assembly to support global operations.

Where was Harley-Davidson founded?

Harley-Davidson was founded in Milwaukee, Wisconsin, United States. The company traces its origins to a small shed on Juneau Avenue, where the first prototype motorcycle was developed in 1903.

Is Harley-Davidson American-owned?

Yes. Harley-Davidson is an American company headquartered in the United States and publicly traded on a U.S. stock exchange. While its shareholders include global institutional investors, the company itself is American-owned and American-based.

Who is the major shareholder of Harley-Davidson?

The largest shareholder of Harley-Davidson is Vanguard Group, which owns approximately 11% of the company’s outstanding shares. Other major shareholders include BlackRock and several large institutional investment firms, but none holds a controlling stake.

How much of Harley-Davidson is owned by BlackRock?

BlackRock owns approximately 9% of Harley-Davidson’s outstanding shares. BlackRock holds this stake on behalf of funds and institutional clients and does not manage the company’s day-to-day operations.

Does Porsche make Harley engines?

No. Porsche does not manufacture Harley-Davidson engines. Harley-Davidson designs and builds its own motorcycle engines in-house. While Porsche has collaborated with other motorcycle brands in the past, it has no engine production role with Harley-Davidson.