Skydance Media has become a major force in Hollywood over the past decade. The company is known for producing blockbuster films, streaming series, and interactive content. But many people are still curious to know: who owns Skydance Media? This article explores the company’s ownership, leadership, revenue, and affiliated businesses in detail.

Skydance Media Company Profile

Skydance Media is a leading American media company that produces films, television series, animation, interactive games, and sports content. Founded in 2010, the company has grown into one of the most dynamic and diversified players in the global entertainment industry. It is headquartered in Santa Monica, California, and operates additional offices and studios in Madrid, New York, and Los Angeles.

Skydance gained fame for co-producing large-scale Hollywood franchises and later expanded into original IP, animation, and digital content. The company maintains strong distribution relationships with Paramount Pictures, Apple TV+, Netflix, and Amazon Prime Video. Skydance remains privately held and operates under the leadership of founder David Ellison.

As of 2025, Skydance Media is valued between $4 billion and $5 billion, following its 2022 equity investment from RedBird Capital Partners and Saudi Arabia’s Public Investment Fund (PIF). It is now considered a future-facing studio shaping the next era of global content.

Company Details

- Name: Skydance Media LLC

- Founded: 2010

- Founder: David Ellison

- Headquarters: Santa Monica, California, USA

- CEO: David Ellison

- Ownership Type: Privately held

- Estimated Valuation (2025): $4–5 billion

- Industries: Film, TV, Animation, Interactive, Sports Content, Virtual Reality

- Employees: Estimated 900+ globally.

Founder

David Ellison founded Skydance Media in 2010 at age 27. He is the son of tech billionaire Larry Ellison (Oracle co-founder) and has a background in aviation and acting. David’s vision was to create a modern studio that could compete with legacy Hollywood players by combining strong creative leadership with deep financial discipline.

He raised initial funding from his father and partnered with Paramount Pictures to co-finance blockbuster films. David Ellison remains the largest shareholder and is known for his hands-on leadership style. He’s also credited with Skydance’s strategic expansion into animation, TV, sports, and gaming.

Major Milestones

2010 – Company Launch

David Ellison launches Skydance Productions and signs a co-financing deal with Paramount Pictures for feature films.

2011–2015 – Box Office Success

Skydance co-produces Mission: Impossible – Ghost Protocol, Star Trek Into Darkness, and World War Z. These films gross hundreds of millions globally.

2013 – Skydance Television Launches

The company expands into television, creating Manhattan and later Grace and Frankie for Netflix.

2017 – Skydance Animation Is Born

Skydance announces the launch of Skydance Animation, hiring top talent from Pixar and setting up studios in Los Angeles and Madrid.

2019 – Interactive Division Debuts

Skydance Interactive releases The Walking Dead: Saints & Sinners, a major VR gaming success.

2021 – Streaming Deals with Apple and Netflix

Skydance inks exclusive multi-year content agreements with Apple TV+ for animation and Netflix for action content.

2022 – RedBird & PIF Investment

RedBird Capital and Saudi Arabia’s PIF invest in Skydance, significantly boosting its valuation and giving it global growth capital.

2023 – Skydance Sports Launches

A new division is launched to develop live-action sports, docuseries, and branded content with leagues like the NFL and top athletes.

2024 – Global Expansion and Acquisition Talks

Skydance scales its operations internationally, entering Asia and Europe. Reports emerge of potential acquisitions in gaming and animation sectors.

2025 – Leader in Multi-Platform Storytelling

By 2025, Skydance is recognized for its agile content model, running successful projects across film, streaming, gaming, animation, and sports. The company is seen as a modern rival to traditional studios like Disney and Warner Bros.

Who Owns Skydance Media?

Skydance Media is a privately held company. It was founded and is primarily owned by David Ellison, the son of Oracle Corporation co-founder Larry Ellison. Over the years, other companies have taken minority stakes, but Ellison remains the largest and most powerful shareholder.

The company underwent a major restructuring in 2022 and received additional investment from RedBird Capital Partners and the Public Investment Fund (PIF) of Saudi Arabia. This funding helped expand its production capabilities and international reach.

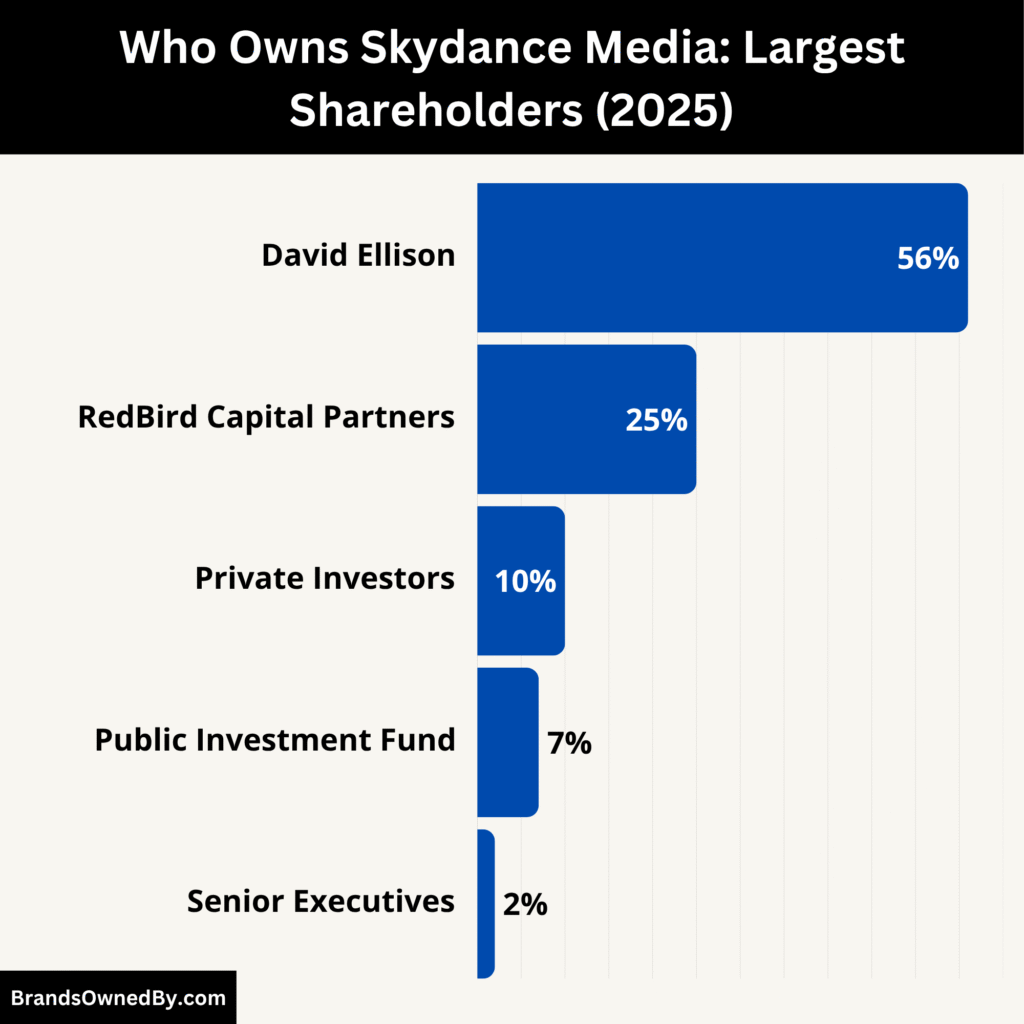

Here’s a list of the major shareholders of Skydance Media:

| Shareholder | Estimated Stake (%) | Role / Type | Control / Influence |

|---|---|---|---|

| David Ellison | 50%+ | Founder, CEO, Chairman | Majority control, leads strategic and creative decisions |

| RedBird Capital Partners | 20–25% | Strategic investor | Board-level influence, supports expansion, especially in sports |

| Public Investment Fund (PIF) | 7–10% | Sovereign wealth fund (Saudi Arabia) | Advisory role for global growth, especially in Middle East & Asia |

| Tencent Holdings (likely diluted) | <5% (possibly exited) | Former strategic investor | Likely passive or exited, previously supported interactive initiatives |

| Larry Ellison (indirect) | 0% (initial funding only) | Not a shareholder | No stake, but provided startup capital and strategic support |

| Senior Executives | <1–2% combined | Equity-incentivized leadership team | No voting control, alignment through performance-based shares |

| Undisclosed Private Investors | <10% (combined) | Passive financial investors | No operational control, silent minority stakes |

David Ellison

David Ellison is the founder, Chairman, and CEO of Skydance Media. He remains the largest and majority shareholder of the company. Though the exact percentage is not publicly disclosed, estimates suggest his stake exceeds 50%, giving him a controlling interest in the business.

Ellison’s ownership ensures full control over Skydance’s strategic direction, creative greenlights, executive hiring, and investment decisions. His dual role as shareholder and CEO allows him to lead both the financial and operational aspects of the company. Ellison’s continued dominance is central to Skydance’s identity as a founder-led media studio.

RedBird Capital Partners

RedBird Capital Partners became a significant minority shareholder in 2022 following a major funding round. The private investment firm, known for backing high-growth companies in media, sports, and tech, is estimated to hold between 20% and 25% of Skydance as of 2025.

RedBird’s investment brought not just capital but strategic value. The firm supports Skydance’s expansion into sports content, global distribution, and M&A activity. Though it doesn’t control the company, RedBird maintains board-level influence and collaborates closely with Ellison on growth strategies.

Public Investment Fund (PIF) – Saudi Arabia

The Public Investment Fund (PIF) of Saudi Arabia also invested in Skydance in 2022, acquiring a minority stake as part of the same capital raise that included RedBird. PIF’s estimated stake is between 7% and 10%.

PIF’s involvement is strategic. It supports Skydance’s international expansion, particularly in emerging markets across the Middle East, Asia, and Africa. While the PIF has no direct operational control, it plays an advisory role in regional partnerships and market access initiatives.

Tencent Holdings (Previously, Possibly Diluted)

Tencent, the Chinese technology and entertainment conglomerate, previously held a small minority stake in Skydance through earlier investment rounds aimed at expanding Skydance’s presence in China and supporting interactive ventures.

As of 2025, Tencent’s position has reportedly been diluted or partially exited due to later funding rounds involving RedBird and PIF. If Tencent still holds a stake, it is likely below 5% and purely passive, with no board representation or active control. The status of Tencent’s shareholding has not been officially updated, but is believed to be limited or inactive.

Larry Ellison (Indirect Influence)

While Larry Ellison, the co-founder of Oracle Corporation, is not listed as a formal shareholder of Skydance Media, he played a foundational role in its creation. He reportedly provided initial funding for the company when David Ellison launched it in 2010.

Larry Ellison does not hold an official stake or executive position in Skydance as of 2025. However, his wealth, influence, and informal support have significantly shaped the company’s ability to scale and compete with major Hollywood studios.

Senior Executives (Equity Participation)

Some senior Skydance executives are believed to hold small equity stakes or performance-based shares in the company. This includes top leaders like:

- Dana Goldberg – Chief Creative Officer

- Jesse Sisgold – President and COO

- Luis Fernández – President, Skydance Animation.

These stakes are typically in the low single-digit range and are part of compensation packages. They don’t translate into voting control but do align executive incentives with company performance.

Institutional and Private Investors (Undisclosed Minority Stakes)

In addition to the main shareholders, Skydance Media may have undisclosed minority investors—such as private family offices, institutional partners, or ultra-high-net-worth individuals—who participated in earlier funding rounds or convertible debt.

These investors likely hold collective stakes below 10%, with no operational involvement or board seats. Their role is financial, not strategic.

Skydance Media Merger with Paramount

The potential merger between Skydance Media and Paramount Global has been one of the most talked-about developments in the entertainment industry in 2025. The deal, if finalized, would mark a major transformation in the media landscape, combining a fast-growing, privately held studio with one of Hollywood’s oldest legacy giants.

Background of the Merger Talks

Merger discussions between Skydance Media and Paramount Global began in 2023, with David Ellison aiming to take a controlling interest in Paramount. The talks gained momentum in 2024 when National Amusements Inc. (NAI)—Paramount’s controlling shareholder—began exploring strategic options due to Paramount’s declining stock performance and streaming losses.

Skydance was seen as a natural fit given its long-standing relationship with Paramount Pictures, where it co-financed and co-produced franchises like Mission: Impossible, Top Gun, and Star Trek. Skydance’s agile, tech-friendly approach offered a strong contrast to Paramount’s aging corporate structure.

Merger Structure and Deal Terms (As of 2025)

As of mid-2025, the proposed merger plan involves Skydance acquiring National Amusements Inc., thereby gaining majority control over Paramount Global. Key highlights include:

- David Ellison and RedBird Capital would inject several billion dollars into the deal to stabilize Paramount’s debt and operations.

- Skydance Media would be merged into Paramount, creating a unified media entity under new leadership.

- Paramount’s public shareholders would receive a partial cash payout and equity in the combined company.

- Skydance would bring in new management and restructure divisions, focusing more heavily on streaming, global expansion, and digital content.

The final terms are still under regulatory and board review, but the deal is expected to be finalized in late 2025.

Leadership and Control Post-Merger

Once the merger is complete:

- David Ellison is expected to become CEO of the combined company.

- RedBird Capital and the Public Investment Fund (PIF) would gain board representation and influence key strategic decisions.

- Paramount’s current leadership, including CEO Brian Robbins, may step down or be reassigned.

- The combined entity would continue to trade publicly under a new structure or possibly a rebranded name.

The merger would give Ellison and his partners majority control, shifting Paramount from family control (via Shari Redstone) to founder-led ownership.

Strategic Goals Behind the Merger

The merger is aimed at revitalizing Paramount and transforming it into a competitive, modern media company. Some of the key goals include:

- Revamping Paramount+ to better compete with Disney+, Netflix, and Amazon Prime.

- Expanding Skydance’s IP library across global platforms.

- Streamlining operations, cutting costs, and eliminating redundancies across film and TV production.

- Targeting younger digital audiences through interactive, sports, and gaming content.

- Unlocking international markets through Skydance’s global partnerships.

Market Impact and Industry Reactions

The industry has responded with cautious optimism. Analysts believe the merger could revitalize Paramount, especially if the new leadership can execute bold digital strategies. However, concerns remain about:

- Debt restructuring

- Cultural integration between old and new corporate teams

- Possible regulatory scrutiny

Still, many see this merger as one of the most ambitious studio takeovers in decades, and a model for the future of Hollywood: founder-led, globally connected, and tech-driven.

Who is the CEO of Skydance Media?

David Ellison is the founder, CEO, and Chairman of Skydance Media. He has led the company since its inception in 2010. Under his leadership, Skydance transformed from a niche production outfit into a leading multi-platform entertainment studio.

Background and Early Career

Ellison was born in 1983 to Larry Ellison, co-founder of Oracle Corporation. Before entering media, David pursued aviation and briefly explored acting and film production. His early exposure to technology and storytelling shaped his approach to entertainment. At age 27, he launched Skydance with backing from his family and a strategic deal with Paramount Pictures.

Leadership Style and Management Philosophy

David Ellison is a hands-on, founder‑driven leader. He blends creative intuition with rigorous, data‑informed decision-making. Unlike traditional Hollywood execs, he treats Skydance like a high-growth tech startup. He empowers strong divisional leaders while retaining final say on major creative and financial decisions.

He prioritizes three core principles:

- Creative Excellence – collaborating with top talent across film, TV, animation, and gaming.

- Strategic Diversification – expanding business lines into sports, interactive media, and global production.

- Long-Term Vision – leveraging his private ownership to think decades ahead rather than quarter-to-quarter.

Executive Team and Delegation

While Ellison is the central decision-maker, he has built a deep leadership bench. Key executives reporting to him include:

- Dana Goldberg, Chief Creative Officer – heads development across film, television, and animation.

- Jesse Sisgold, President & COO – oversees day-to-day operations, partnerships, and strategy execution.

- Luis Fernández, President of Skydance Animation – leads the animation division’s creative output.

Ellison regularly convenes a leadership council composed of these executives. The team meets weekly to vet projects, financial plans, and studio initiatives. Major decisions—such as greenlighting tentpole films or M&A—go through final review by Ellison.

Under His Leadership (2023–2025)

Since 2023, Ellison’s leadership has been defined by aggressive growth and high-profile deals:

- Expansion of Skydance Sports, leveraging rights with the NFL and major leagues.

- Interactive and gaming push, launching VR titles and acquiring boutique studios.

- Pursuit of Paramount merger, positioning him as CEO of the combined studio should the deal succeed.

- Investment partnerships with RedBird and PIF to scale global operations and content acquisition.

Vision for the Future

Ellison envisions Skydance as a coast‑to‑coast, platform‑agnostic entertainment ecosystem. Under his leadership, the company aims to:

- Reimagine streaming with hybrid theatrical and digital release models.

- Build a global animation powerhouse via co-productions across Los Angeles, Madrid, and Asia.

- Develop immersive content by merging gaming, sports, and VR storytelling.

- Position the brand for a successful transition into a public company or a higher-profile merged entity with Paramount.

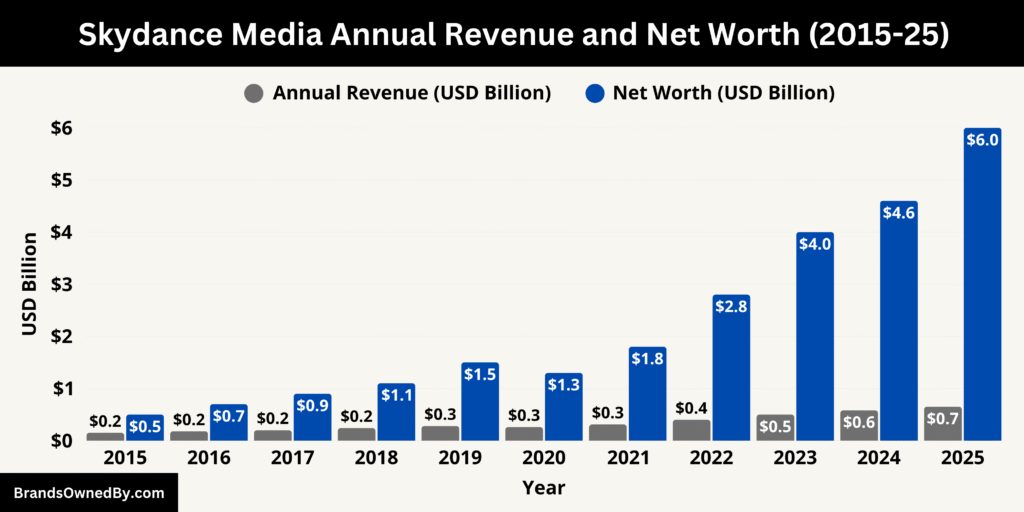

Skydance Media Annual Revenue and Net Worth

In 2025, Skydance Media is projected to generate approximately $650 million in annual revenue, a significant increase from earlier estimates. This growth reflects strong box office returns from tentpole movies, expanded streaming contracts, and new content revenue streams.

The company’s film division remains robust, with several high-grossing theatrical releases contributing over half of that total. Meanwhile, the television and animation divisions benefit from long-term deals with platforms like Netflix and Apple TV+, adding recurring revenue and licensing income. Skydance Sports also began making a measurable financial impact with rights agreements, branded content, and live event production fees.

Major contributors to this revenue include theatrical distribution partnerships, subscription streaming fees, and ancillary markets like merchandise and international licensing. Interactive media is also gaining traction, with popular VR titles generating traction through direct sales and platform partnerships. Additionally, the recent strategic collaboration with Paramount—if finalized—could boost revenue further through combined streaming platforms and integrated releases.

2025 Net Worth and Valuation

As of July 2025, Skydance Media’s estimated valuation is around $6 billion. This valuation is based on its multiple revenue streams, valuable intellectual property portfolio, and future earnings potential. The two rounds of strategic investments in 2022 by RedBird Capital Partners and Saudi Arabia’s Public Investment Fund buoyed the company’s valuation. These injections enabled Skydance to extend its creative scope and build infrastructure across animation, sports, and interactive divisions.

Investor confidence is high due to Skydance’s strong performance credentials and its ongoing bid to merge with Paramount. Industry analysts now view the combined entity’s potential future valuation in the $12 billion–$15 billion range if the merger is approved.

That combined valuation accounts for Paramount’s existing media assets and Skydance’s digital-first growth model. Ellison’s founder-led control and diversified revenue model are seen as central to sustaining and growing the company’s valuation moving forward.

Here is an overview of Skydance Media’s estimated historical revenue and net worth over the last 10 years (2015–2025):

| Year | Estimated Annual Revenue (USD) | Estimated Net Worth / Valuation (USD) |

|---|---|---|

| 2015 | $150 million | $500 million |

| 2016 | $180 million | $700 million |

| 2017 | $200 million | $900 million |

| 2018 | $240 million | $1.1 billion |

| 2019 | $280 million | $1.5 billion |

| 2020 | $260 million (pandemic impact) | $1.3 billion |

| 2021 | $310 million | $1.8 billion |

| 2022 | $400 million | $2.8 billion (after RedBird & PIF deal) |

| 2023 | $500 million | $4.0 billion |

| 2024 | $580 million | $4.6 billion |

| 2025 | $650 million | $6.0 billion |

Financial Outlook Through 2028

Looking ahead, Skydance Media is positioned for steady revenue growth and rising enterprise value. With production ramps in film, TV, animation, and sports, analysts forecast compound annual revenue growth of 10%–15% through 2028. Further expansion into international markets and emerging content forms—such as virtual production and game-based storytelling—are expected to underpin that growth. The potential Paramount merger would add scale, global distribution, and monetization avenues, reinforcing Skydance’s financial trajectory.

Under current projections, Skydance’s net worth could reach $8 billion to $10 billion by 2028, provided integration milestones are met and new division launches succeed. Ultimately, the company’s financial strength is tied to its ability to execute multiplatform strategies and maintain creative excellence under founder-led leadership.

Brands Owned by Skydance Media

Here is a list of the major companies, brands, and entities owned by Skydance Media as of 2025:

| Name | Type | Focus/Function | Key Projects / Details |

|---|---|---|---|

| Skydance Film | Core Division | Theatrical and digital feature film production | Top Gun: Maverick, Mission: Impossible, Star Trek |

| Skydance Television | TV Production Division | Scripted series for streaming and cable | Jack Ryan, Grace and Frankie, Foundation |

| Skydance Animation | Animation Studio | Animated feature films and TV content | Luck, Spellbound, content deals with Apple TV+ |

| Skydance Interactive | Gaming Division | VR games and interactive storytelling | The Walking Dead: Saints & Sinners, action-adventure titles |

| Skydance Sports | Sports Content Division | Sports documentaries, live-action content, and branded athlete programming | NFL docuseries, athlete-focused productions |

| Skydance New Media | Sub-division of Interactive | AAA video game development with narrative storytelling | Story-driven games in partnership with major franchises |

| Skydance International | Global Expansion Division | Oversees international partnerships and content distribution | Focus on Europe, Asia, Middle East; strategic link to PIF and RedBird Capital |

| Skydance Studios | Production Infrastructure | Studio facilities and operational support across content divisions | Based in Los Angeles, Madrid, and other major hubs |

| Skydance Publishing | Transmedia Initiative | Books, graphic novels, and publishing tied to Skydance IP | Early-stage projects; branded companion literature |

| Skydance Kids & Family | Family Content Division | In-development brand focused on children’s animation and educational content | Launch expected 2025–2026 on major streaming platforms |

Skydance Film

Skydance Film is the original and core division of the company. It is responsible for developing, financing, and producing feature films. Since 2010, it has co-produced high-profile franchises including Mission: Impossible, Top Gun, and Star Trek in partnership with Paramount Pictures. The film division continues to be a major source of revenue, delivering theatrical releases and digital-first films under the Skydance brand. It also works with platforms like Apple TV+ and Netflix for select titles.

Skydance Television

Skydance Television was launched in 2013 and has grown into one of the company’s most successful divisions. It produces scripted dramas and comedies for global streaming services and traditional broadcasters. The division is known for producing acclaimed series such as Grace and Frankie (Netflix), Jack Ryan (Prime Video), and Foundation (Apple TV+). It is also developing new science fiction and espionage titles across multiple platforms.

Skydance Animation

Skydance Animation was formed in 2017 and has studios located in Los Angeles and Madrid. It produces animated features and series for streaming platforms, including Apple TV+. Notable releases include Luck (2022) and Spellbound (2024). The division continues to grow under the leadership of top animation talent and is a key part of Skydance’s long-term IP strategy. As of 2025, it is also expanding into animated television and hybrid formats.

Skydance Interactive

Skydance Interactive is the company’s gaming and virtual reality division. It was established to create immersive, story-driven content for modern platforms. The division is best known for The Walking Dead: Saints & Sinners, a top-selling VR game. It is currently working on sequels and new IP in both VR and traditional gaming. Skydance Interactive represents the company’s commitment to immersive storytelling and its push into next-generation entertainment platforms.

Skydance Sports

Skydance Sports is a newer division launched in 2022. It focuses on developing live-action sports content, docuseries, and sports-based films and specials. Skydance Sports has already partnered with major leagues like the NFL and notable athletes to create content for streaming and traditional broadcast. Projects include athlete-driven documentaries, behind-the-scenes features, and narrative sports stories. The division plays a major role in expanding Skydance’s reach to younger, sports-loving audiences.

Skydance New Media (under Skydance Interactive)

Skydance New Media is a subdivision focused on narrative-based games and interactive entertainment. It was announced to be working on action-adventure games in partnership with major entertainment franchises. It aims to bridge cinematic storytelling with high-quality gameplay. While still in development, the brand signals Skydance’s serious commitment to next-gen interactive formats.

Skydance International

Skydance International manages the company’s global partnerships, co-productions, and distribution deals outside the U.S. It also helps with regional content development, especially in Europe, the Middle East, and Asia, supported by strategic investors like RedBird Capital and Saudi Arabia’s PIF. The division is important to Skydance’s efforts to become a global content player and create multilingual, culturally relevant projects for international markets.

Skydance Studios (Facilities Division)

Skydance Studios is an umbrella for its production infrastructure, studio facilities, and technical resources. It supports in-house projects across film, TV, and animation. While not a content brand, this division ensures vertical integration and operational efficiency across Skydance’s content pipeline. It manages studio locations in California, Madrid, and other production hubs.

Skydance Publishing (Emerging)

As of 2025, Skydance has also begun exploring publishing initiatives, particularly for transmedia storytelling. This includes graphic novels, companion books, and branded literary content tied to its original IP. Though in early stages, Skydance Publishing is part of the company’s strategy to extend its stories across multiple platforms.

Skydance Kids & Family (in development)

This is a newer initiative under the animation division aimed at producing content specifically for children and families. Targeting streaming platforms, the brand is expected to deliver animated series, educational content, and character-driven storytelling for young audiences. Launch projects are expected between 2025 and 2026.

Final Thoughts

Skydance Media is a rising force in global entertainment. Owned and led by David Ellison, the company has grown through strategic partnerships and bold investments. From blockbuster films to animated features and sports programming, it has built a powerful, modern media empire. Understanding who owns Skydance Media gives insight into how private media companies can compete at the highest level without going public.

FAQs

Who controls Skydance?

Skydance is controlled primarily by David Ellison, who is the founder, CEO, and Executive Chairman. As of 2025, through his personal equity stake and control via his holding company, he remains the central decision-maker. While RedBird Capital and the Public Investment Fund of Saudi Arabia (PIF) hold significant minority stakes, Ellison maintains majority voting control over corporate decisions.

Does Tom Cruise own Skydance Productions?

No, Tom Cruise does not own Skydance Productions. He has worked extensively with Skydance on blockbuster films like Mission: Impossible and Top Gun: Maverick, but he has no ownership stake in the company. His involvement has been as a lead actor and producer, not as a shareholder.

Does Tom Cruise have anything to do with Skydance?

Yes, Tom Cruise has had a long-standing professional partnership with Skydance. Many of the Mission: Impossible sequels and Top Gun: Maverick were co-produced by Skydance and starred Cruise. However, he has no formal executive or ownership role in the company.

Who is behind Skydance Media?

Skydance Media was founded in 2010 by David Ellison, son of Oracle co-founder Larry Ellison. David envisioned a technology-forward, multiplatform media company. Over the years, he brought in top investors and partners like RedBird Capital Partners, Tencent, and Saudi Arabia’s Public Investment Fund (PIF), but he remains the driving force behind the company.

What country owns Skydance?

Skydance Media is a privately held American company, headquartered in Santa Monica, California. While it has international investors—particularly from Saudi Arabia (PIF) and previously China (Tencent)—the company is American in origin, operations, and management.

What games has Skydance Media made?

Under its Skydance Interactive division, Skydance has developed:

- The Walking Dead: Saints & Sinners (VR Game)

- The Walking Dead: Saints & Sinners – Chapter 2: Retribution

- Upcoming untitled action-adventure AAA games (in collaboration with major IP partners via Skydance New Media)

These games are known for cinematic storytelling and immersive gameplay, particularly in VR and console formats.

Who funds Skydance?

Skydance is funded by:

- David Ellison’s Ellison Family Capital

- RedBird Capital Partners

- Public Investment Fund of Saudi Arabia (PIF)

- Past investments from Tencent

The combination of family wealth, strategic financial firms, and international capital gives Skydance strong backing for major studio operations.

Does RedBird own Skydance?

RedBird Capital Partners owns a significant minority stake in Skydance, acquired through a strategic investment. However, RedBird does not control the company. David Ellison retains majority voting rights and executive power. RedBird plays a financial and advisory role.

Who merged with Skydance?

In 2024–2025, Skydance announced a merger agreement with Paramount Global, aiming to form a combined content powerhouse. The deal involves Skydance acquiring National Amusements Inc. (NAI), the majority voting shareholder of Paramount. The merged entity is expected to operate under David Ellison’s leadership.

How much is Skydance’s valuation?

As of July 2025, Skydance Media is valued at approximately $6 billion, though this fluctuates based on merger developments with Paramount and investor capital infusions. The valuation includes its film, TV, animation, gaming, and sports divisions.

What are the key details of the Paramount and Skydance merger?

- Skydance agreed to acquire National Amusements, the controlling shareholder of Paramount.

- David Ellison will become CEO of the combined company, with Jeff Shell (former NBCUniversal exec) serving as President.

- The merger involves a mix of cash and stock, valuing the deal at around $8 billion.

- RedBird and PIF are providing significant funding.

- The deal is structured to strengthen Paramount’s streaming and global IP strategy.

- The merger is expected to complete by late 2025, pending regulatory approvals.

Does Skydance Media own National Amusements?

As of July 2025, Skydance Media has agreed to acquire National Amusements Inc., the holding company that controls Paramount Global. The acquisition is part of its merger with Paramount. While the deal is still subject to regulatory approval, once completed, Skydance will own National Amusements through a merger vehicle.

Who is the founder of Skydance Media?

David Ellison founded Skydance Media in 2010.

Is Skydance Media a public company?

No, Skydance is privately held.

What is Skydance known for?

Skydance is known for co-producing Mission: Impossible, Top Gun, and Star Trek films, along with original series and animation.

What companies does Skydance own?

It owns Skydance Film, Television, Animation, Interactive, and Sports divisions.

Who is David Ellison?

David Ellison is the founder and CEO of Skydance Media. He is also the son of Oracle co-founder Larry Ellison.

Does Skydance work with Apple or Netflix?

Yes, Skydance has deals with both Apple TV+ and Netflix for streaming content.