Authentic Brands Group has made headlines for acquiring iconic brands across industries. But who owns Authentic Brands Group? Let’s explore the ownership, company profile, and all the businesses under its umbrella.

Authentic Brands Group Profile

Authentic Brands Group (ABG) is a private brand management company based in New York City. As of 2025, it is considered one of the world’s largest brand owners, managing a portfolio of more than 60 iconic consumer brands. These include names in fashion, activewear, entertainment, media, and even celebrity estates.

ABG does not operate like traditional retail companies. Instead, it licenses the intellectual property of its brands to partners and earns revenue through royalties. This asset-light model allows it to scale globally without owning factories, retail stores, or direct-to-consumer channels.

In 2025, ABG continues to grow aggressively through acquisitions and joint ventures across Europe, Asia, and the Middle East. It currently partners with SPARC Group (a joint venture with Simon Property Group) to run several retail operations for its major brands in the U.S.

Company Details

- Name: Authentic Brands Group LLC

- Founded: 2010

- Headquarters: New York City, United States

- Ownership: Privately held

- Valuation (2025): Estimated over $14 billion

- Retail Footprint (Licensed): Over 100,000 points of sale in 150+ countries

- Annual Retail Sales (2025): Exceeds $27 billion globally

- Core Business: Brand licensing, development, and marketing

- Key Sectors: Fashion, activewear, retail, media, entertainment, celebrity IP.

Founder and Leadership

Jamie Salter is the founder and CEO of Authentic Brands Group. A Canadian entrepreneur with deep experience in retail, licensing, and brand development, Salter launched ABG in 2010 with a vision to acquire distressed or underperforming consumer brands and revitalize them through licensing.

Prior to ABG, he co-founded Hilco Consumer Capital and served as CEO of Ride Inc., a snowboard and equipment company.

Salter is still the CEO as of 2025 and holds a significant equity stake. Under his leadership, ABG has become a dominant player in the brand licensing world.

Major Milestones

- 2010: ABG is founded by Jamie Salter in New York with financial backing from Leonard Green & Partners.

- 2013: Acquires Juicy Couture, one of its first high-profile fashion brands.

- 2016: Rescues Aeropostale from bankruptcy along with mall operators.

- 2019: Buys Sports Illustrated for $110 million and licenses its media operations.

- 2019: BlackRock leads an $875 million investment round, becoming the largest shareholder.

- 2020: Acquires Forever 21 through a joint deal with Simon Property Group and Brookfield.

- 2020–2021: Acquires Brooks Brothers, Lucky Brand, and Barneys New York following pandemic-driven retail bankruptcies.

- 2021: Announces plans for an IPO but later delays it to focus on expanding the brand portfolio.

- 2022: Completes the $2.5 billion acquisition of Reebok from Adidas, one of the largest deals in ABG’s history.

- 2023: Enters the Middle Eastern and Southeast Asian markets with localized joint ventures and licensing deals.

- 2024: Expands its entertainment portfolio with rights to James Dean, Andy Warhol, and additional music icons.

- 2025: Surpasses $27 billion in annual global retail sales from its brands; valuation exceeds $14 billion; begins discussions for a possible IPO in 2026 or beyond.

Authentic Brands Group is widely regarded as a powerhouse in brand licensing, controlling and monetizing some of the most recognizable names without directly manufacturing or selling anything. Its strategy in 2025 continues to focus on acquiring undervalued brands, optimizing royalty streams, and expanding into digital and international markets.

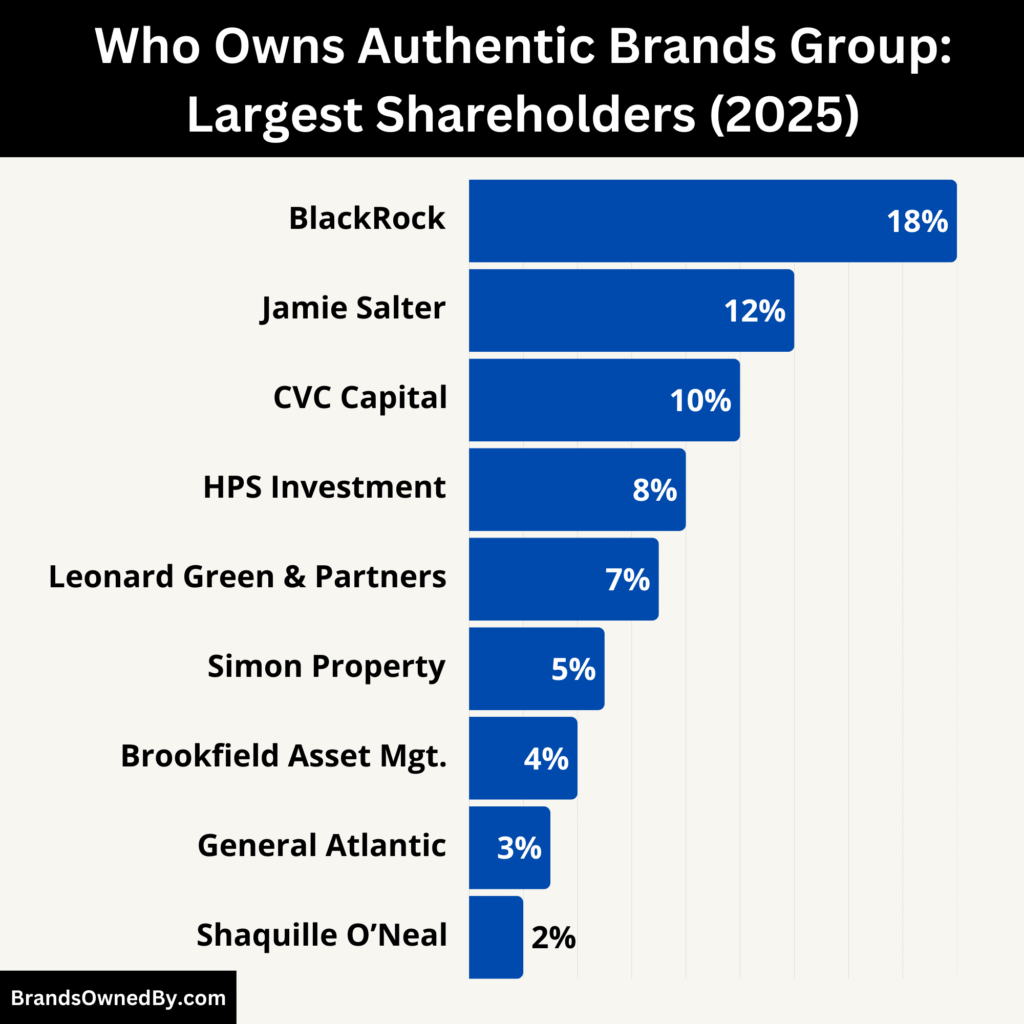

Who Owns Authentic Brands Group: List of Shareholders

Authentic Brands Group is privately owned. Its largest shareholder is BlackRock, the global investment management corporation. Several other institutional investors and private equity firms also hold stakes.

Founder Jamie Salter remains the company’s driving force and owns a significant minority stake. His leadership and vision have helped turn ABG into one of the biggest brand management companies in the world.

Here’s a list of the top shareholders of Authentic Brands Group as of July 2025:

| Shareholder | Estimated Ownership (%) | Role/Contribution | Level of Control/Influence |

|---|---|---|---|

| BlackRock | 15%–18% | Lead institutional investor; provides strategic financial oversight | High – board representation and advisory power |

| Jamie Salter | 10%–12% | Founder & CEO; drives vision, strategy, and acquisitions | High – operational and executive control |

| CVC Capital Partners | 8%–10% | Private equity firm; supports global M&A and expansion strategy | Medium – strategic advisory role |

| HPS Investment Partners | 6%–8% | Growth capital and financing partner | Medium – financial structuring input |

| Leonard Green & Partners | 5%–7% | Founding investor; helped build ABG’s early brand portfolio | Medium – historical investor, board presence |

| Shaquille O’Neal | 1%–2% | Celebrity partner; brand under ABG; advisory and marketing role | Low – active in branding decisions |

| Simon Property Group | 3%–5% | Retail real estate partner; operates joint venture (SPARC Group) | Medium – control over in-store retail strategy |

| Brookfield Asset Management | 2%–4% | Retail real estate partner; joint brand ownership (e.g., Forever 21) | Low to medium – real estate and leasing input |

| General Atlantic | ~3% | Early investor; supports international expansion | Low – minor shareholding, strategic input |

BlackRock

BlackRock remains the largest institutional shareholder in Authentic Brands Group as of 2025. It first invested in ABG in 2019, leading an $875 million round that significantly boosted the company’s valuation. BlackRock’s stake gives it strong influence over financial strategy and corporate governance.

While the exact percentage is not publicly disclosed, industry analysts estimate that BlackRock holds between 15% to 18% equity in ABG. The firm does not manage daily operations but plays a vital advisory role in investment strategy, expansion, and risk management.

Jamie Salter

Jamie Salter, the founder and CEO of ABG, remains one of the most influential shareholders. As of 2025, he is estimated to own around 10% to 12% of the company. Although not the majority shareholder, Salter holds significant voting power due to his role as CEO and board member.

His equity stake aligns with his long-term vision for the company. He has also secured special decision-making rights and veto powers over major brand acquisitions and licensing deals, ensuring his control over ABG’s strategic direction.

CVC Capital Partners

CVC Capital Partners joined as a shareholder in 2021 during a major investment round that valued ABG at $12.7 billion. The private equity firm currently owns an estimated 8% to 10% stake. CVC plays a strategic advisory role in expanding ABG’s European and Asian market presence.

They also provide M&A support, helping ABG evaluate and structure future acquisitions. CVC has appointed at least one board representative at ABG.

HPS Investment Partners

HPS Investment Partners also became a shareholder in the 2021 funding round, acquiring a stake estimated at 6% to 8%. The firm specializes in credit and growth capital and supports ABG with financing strategies, especially for large acquisitions like Reebok and Eddie Bauer.

HPS has strong representation in financial decision-making but does not interfere with brand operations or licensing terms.

Leonard Green & Partners

Leonard Green & Partners is a founding investor in ABG and remains a long-term stakeholder. Though its original stake has been diluted, it still holds approximately 5% to 7% equity. The firm supported ABG’s early brand acquisitions and expansion into fashion and celebrity estates.

Leonard Green continues to have board-level insight and remains aligned with ABG’s long-term vision, especially in portfolio growth and monetization.

Shaquille O’Neal

Basketball icon Shaquille O’Neal is both a shareholder and a brand under ABG’s portfolio. He sold the rights to his name and likeness to ABG in exchange for an equity stake, believed to be around 1% to 2%.

He is also an active brand ambassador and strategic partner. His ownership includes licensing rights to all products, endorsements, and digital likeness. Shaq sits on ABG’s advisory board and is a key figure in sports and entertainment initiatives.

Simon Property Group

Simon Property Group, one of the largest mall operators in the U.S., owns an estimated 3% to 5% stake in ABG. The company is part of SPARC Group (now merged with Catalyst Brands), a joint venture with ABG to operate physical stores for brands like Forever 21, Brooks Brothers, and Aeropostale.

Simon’s stake helps secure premium retail space for ABG’s brands. It also aligns both companies’ interests in retail traffic, lease structures, and in-store brand visibility.

Brookfield Asset Management

Brookfield Asset Management, another major retail property owner, joined ABG’s investor circle in 2020. Its stake is estimated at 2% to 4%. Brookfield has also partnered with ABG in joint brand recoveries, such as Forever 21 and Aeropostale.

Its ownership gives ABG a strong retail partner for real estate strategy and offline brand activations. Brookfield plays a background but influential role in shaping ABG’s physical retail expansion strategy.

General Atlantic

General Atlantic, a global growth equity firm, has been a long-time investor in ABG. It holds an estimated 3% stake. The firm initially invested in ABG during its earlier growth rounds and has since provided capital for international licensing rollouts.

Though no longer a lead investor, General Atlantic continues to offer expansion support in Latin America, India, and Southeast Asia.

Who is the CEO of Authentic Brands Group?

Jamie Salter is the CEO and founder of Authentic Brands Group. He has held this role since 2010 and has been instrumental in shaping ABG’s unique licensing model.

Profile: Jamie Salter, Founder and Chief Executive Officer

Jamie Salter is the founder and CEO of Authentic Brands Group (ABG). A Canadian-born entrepreneur, Salter started ABG in 2010 with a clear vision: acquire undervalued brands and revitalize them through a licensing-led model. He remains in the top executive role as of 2025, driving the company’s strategic direction and overseeing its major deals. His leadership style blends brand-focused vision with financial discipline.

Background and Experience

Before ABG, Salter co-founded Hilco Consumer Capital. He also led GSI Commerce’s retail brands unit and helped found Ride Inc., a well-known snowboarding company. These roles gave him deep expertise in brand turnaround, consumer marketing, and strategic acquisitions—skills he brought into building ABG’s empire.

Role in Day-to-Day Operations

As CEO, Salter is involved in all high-level decisions:

- Leading brand acquisition negotiations

- Structuring licensing and royalty frameworks

- Appointing and overseeing senior leadership

- Managing investor relations with institutions like BlackRock, CVC, and HPS

- Shaping ABG’s global expansion, especially in Asia and the Middle East.

Although ABG’s model is asset‑light, Salter ensures internal teams and external partners stay aligned with brand identity and growth targets.

Decision‑Making Structure at ABG

ABG operates with a centralized executive structure:

- Jamie Salter chairs the executive leadership team

- A small board includes representatives from institutional investors

- Major corporate changes—like acquisitions, IPO discussions, or global ventures—require board approval

- Salter often holds veto power on large-scale deals, due to his founder CEO status and equity stake

This structure enables swift decisions while maintaining investor oversight.

Past Leadership and Continuity

Since its founding in 2010, ABG has been led solely by Jamie Salter. There have been no CEO transitions. Executive continuity has been a key strength: Salter’s consistent leadership ensures steady brand strategy and aligned investor support. A small but stable executive team supports him in critical functions—licensing, brand marketing, finance, and global partnerships.

Strategic Vision and Future Focus

Under Salter’s leadership in 2025, ABG continues to elevate its licensing model and global footprint. Key priorities include:

- Executing further acquisitions of distressed brands with reboot potential

- Expanding in emerging markets through joint ventures and local partnerships

- Launching digital-first brand experiences and direct-to-consumer initiatives

- Preparing the company for a potential IPO by 2026, while maintaining private governance flexibility.

More than a CEO, Salter remains the face and strategic architect of ABG—a visionary leading one of the world’s largest brand platforms.

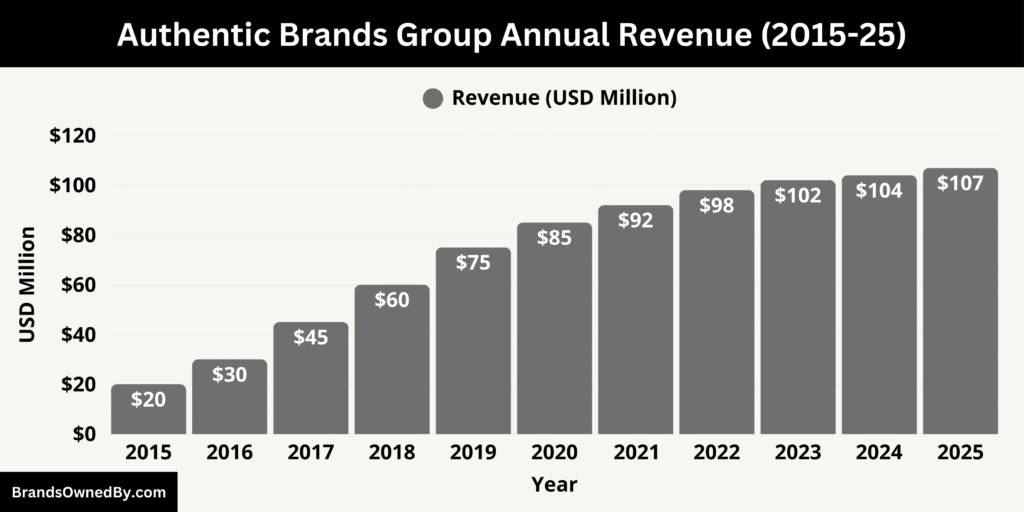

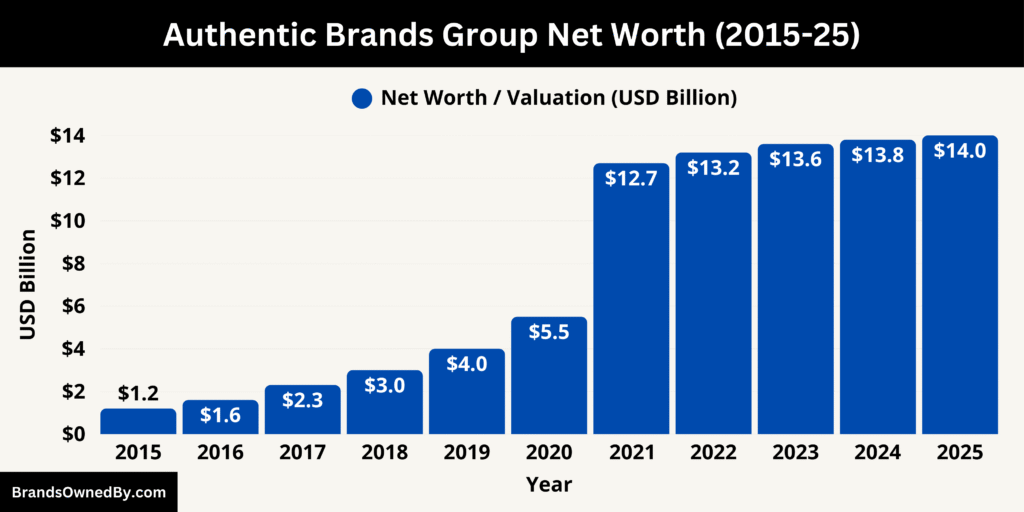

Authentic Brands Group Annual Revenue and Net Worth

While its own revenue appears modest compared to retail giants, Authentic Brands Group thrives on the multiplier of its licensing portfolio. Here’s a quick summary of its revenue and net worth as of July 2025:

- Direct 2025 revenue: ~$106.9 million

- Total global retail sales: Over $32 billion annually

- Estimated equity valuation (net worth): ~$14 billion.

Annual Revenue (2025)

As of 2025, Authentic Brands Group reports approximately $106.9 million in direct annual revenue. This figure represents the company’s earnings from licensing fees, royalties, and brand partnerships—not total retail sales. Despite controlling brands with over $32 billion in global retail sales, ABG’s own revenue reflects the profits flowing through its asset-light licensing model.

This revenue stream is bolstered by ABG’s strategic structure. The company licenses its intellectual property to retail partners worldwide. Unlike traditional retailers, ABG avoids costs like manufacturing, inventory, and store operations. This model empowers high-margin profitability and scalability.

In 2025, ABG continues to benefit from its most recent major acquisitions—Reebok, Champion, Dockers, and Sperry—which have broadened its royalty base.

Portfolio Retail Sales (2025)

Though ABG’s internal revenue is relatively modest, its franchise portfolio generates over $32 billion in global retail sales. This total, referred to as system-wide retail sales, measures the annual consumer spend on ABG-managed brands at physical and online retail points.

The company operates with more than 13,000 standalone stores, thousands of shop-in-shops, and approximately 400,000 points of sale across more than 150 countries.

This level of retail presence underscores ABG’s expansive influence in global consumer markets and solidifies its position as a licensing powerhouse.

Net Worth (2025)

Industry analysts value Authentic Brands Group at around $14 billion in July 2025. This marks a meaningful rise from the $12.7 billion valuation tied to the private equity investment round in November 2021. The growth in valuation reflects ABG’s continued brand acquisitions, expanded licensing deals, and rising system-wide retail sales.

With each new property—such as Champion, Sperry, and Dockers—ABG strengthens its earnings base and brand portfolio value. The company is also actively preparing for a potential IPO, which could further increase its valuation in 2026 or later.

Here is an overview of the historical revenue and net worth of Authentic Brands Group from 2015 to 2025:

| Year | Estimated Revenue (USD) | Estimated Net Worth / Valuation (USD) |

|---|---|---|

| 2015 | $20 million | $1.2 billion |

| 2016 | $30 million | $1.6 billion |

| 2017 | $45 million | $2.3 billion |

| 2018 | $60 million | $3.0 billion |

| 2019 | $75 million | $4.0 billion (post BlackRock investment) |

| 2020 | $85 million | $5.5 billion |

| 2021 | $92 million | $12.7 billion (CVC & HPS funding round) |

| 2022 | $98 million | $13.2 billion |

| 2023 | $102 million | $13.6 billion |

| 2024 | $104 million | $13.8 billion |

| 2025 | $106.9 million | $14 billion |

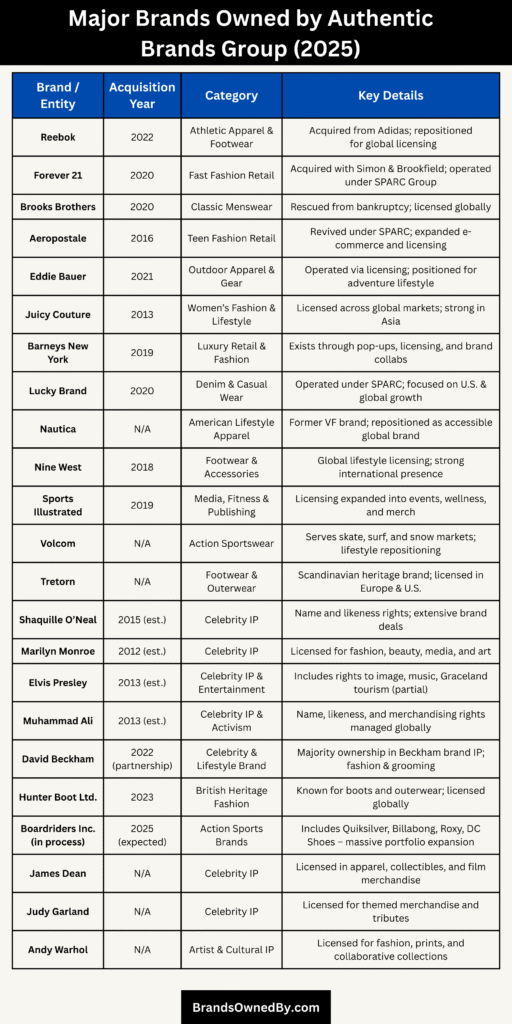

Brands Owned by Authentic Brands Group

Authentic Brands Group’s business strategy is centered around acquiring iconic yet undervalued brands and revitalizing them through global licensing. By 2025, its portfolio has grown into one of the largest collections of intellectual property assets in the fashion, media, and celebrity sectors—each managed to maximize long-term brand equity and international reach.

Here’s an overview of the major and iconic brands and companies owned by Authentic Brands Group as of July 2025:

| Brand/Entity | Acquisition Year | Category | Key Details |

|---|---|---|---|

| Reebok | 2022 | Athletic Apparel & Footwear | Acquired from Adidas; repositioned for global licensing |

| Forever 21 | 2020 | Fast Fashion Retail | Acquired with Simon & Brookfield; operated under SPARC Group |

| Brooks Brothers | 2020 | Classic Menswear | Rescued from bankruptcy; licensed globally |

| Aeropostale | 2016 | Teen Fashion Retail | Revived under SPARC; expanded e-commerce and licensing |

| Eddie Bauer | 2021 | Outdoor Apparel & Gear | Operated via licensing; positioned for adventure lifestyle |

| Juicy Couture | 2013 | Women’s Fashion & Lifestyle | Licensed across global markets; strong in Asia |

| Barneys New York | 2019 | Luxury Retail & Fashion | Exists through pop-ups, licensing, and brand collabs |

| Lucky Brand | 2020 | Denim & Casual Wear | Operated under SPARC; focused on U.S. & global growth |

| Nautica | N/A (date not disclosed) | American Lifestyle Apparel | Former VF brand; repositioned as accessible global brand |

| Nine West | 2018 | Footwear & Accessories | Global lifestyle licensing; strong international presence |

| Sports Illustrated | 2019 | Media, Fitness & Publishing | Licensing expanded into events, wellness, and merch |

| Volcom | N/A | Action Sportswear | Serves skate, surf, and snow markets; lifestyle repositioning |

| Tretorn | N/A | Footwear & Outerwear | Scandinavian heritage brand; licensed in Europe & U.S. |

| Shaquille O’Neal | 2015 (est.) | Celebrity IP | Name and likeness rights; extensive brand deals |

| Marilyn Monroe | 2012 (est.) | Celebrity IP | Licensed for fashion, beauty, media, and art |

| Elvis Presley | 2013 (est.) | Celebrity IP & Entertainment | Includes rights to image, music, Graceland tourism (partial) |

| Muhammad Ali | 2013 (est.) | Celebrity IP & Activism | Name, likeness, and merchandising rights managed globally |

| David Beckham | 2022 (partnership) | Celebrity & Lifestyle Brand | Majority ownership in Beckham brand IP; fashion & grooming |

| Hunter Boot Ltd. | 2023 | British Heritage Fashion | Known for boots and outerwear; licensed globally |

| Boardriders Inc. (in process) | 2025 (expected) | Action Sports Brands | Includes Quiksilver, Billabong, Roxy, DC Shoes – massive portfolio expansion |

| James Dean | N/A | Celebrity IP | Licensed in apparel, collectibles, and film merchandise |

| Judy Garland | N/A | Celebrity IP | Licensed for themed merchandise and tributes |

| Andy Warhol | N/A | Artist & Cultural IP | Licensed for fashion, prints, and collaborative collections |

Reebok

Acquired from Adidas in 2022 for $2.5 billion, Reebok is one of ABG’s largest and most high-profile assets. ABG manages Reebok through licensing agreements with manufacturers and distributors worldwide. The brand operates in over 90 countries and focuses on athletic footwear, apparel, and fitness lifestyle categories.

Since the acquisition, ABG has repositioned Reebok as a standalone fitness and performance brand, with regional partners driving distribution.

Forever 21

ABG acquired Forever 21 in 2020 in partnership with Simon Property Group and Brookfield. The brand was rescued from bankruptcy and restructured through the SPARC Group, which operates its physical stores. ABG controls the brand identity, marketing, and licensing rights. Forever 21 remains a key player in youth fashion and fast fashion retail.

Brooks Brothers

One of America’s oldest menswear brands, Brooks Brothers was acquired by ABG in 2020 after its bankruptcy. ABG licenses the brand to manufacturers and retail operators in North America, Europe, and Asia. The brand has since been repositioned as a modern classic menswear label with global appeal.

Aeropostale

ABG led a group that acquired Aeropostale in 2016 after its bankruptcy. The brand now operates under the SPARC Group, with ABG managing brand positioning and design licensing. It remains focused on teen and young adult fashion and has grown its e-commerce and international footprint significantly since the acquisition.

Eddie Bauer

Acquired in 2021, Eddie Bauer is a premium outdoor apparel and gear brand. ABG runs it through licensing agreements and joint ventures. The brand maintains its identity around rugged outdoor performance, and ABG has expanded its retail and digital reach while entering new international markets.

Juicy Couture

Juicy Couture, once a cultural phenomenon, was acquired by ABG in 2013. It has since been repositioned as a lifestyle brand focused on casual glam fashion. Juicy Couture now thrives through licensing across apparel, accessories, fragrance, and footwear categories globally, with a strong retail presence in Asia and the Middle East.

Barneys New York

ABG acquired the iconic luxury retailer Barneys New York in 2019. The brand’s physical stores were closed, but its name and identity live on through pop-up collaborations, digital fashion platforms, and select high-end product lines. ABG licenses the Barney’s name to various luxury initiatives and retail experiences.

Lucky Brand

ABG added Lucky Brand to its portfolio in 2020 following a Chapter 11 bankruptcy filing. Known for its vintage-inspired denim and bohemian apparel, Lucky Brand operates as a licensed fashion label with distribution in North America, Europe, and Australia. ABG oversees the brand’s creative direction and marketing.

Nautica

Acquired from VF Corporation, Nautica is a global lifestyle brand focusing on classic American sportswear with nautical themes. ABG has successfully restructured Nautica’s distribution and expanded its retail licensing into Latin America, Europe, and Asia.

Nine West

ABG owns Nine West, a global footwear and accessories brand. Acquired in 2018, it has since been developed into a full lifestyle label offering apparel, handbags, sunglasses, and fragrance. The brand is now licensed in over 70 countries.

Sports Illustrated

ABG purchased Sports Illustrated in 2019. While it no longer operates the magazine directly, ABG retains control of the brand and licenses editorial and digital publishing rights. It has expanded Sports Illustrated into events, fitness products, branded content, and streaming initiatives.

Volcom

Authentic Brands acquired Volcom, the action sports brand, to expand into the skate, surf, and snow apparel markets. ABG has focused on repositioning Volcom for both lifestyle and performance markets, with global licensing agreements driving its distribution.

Tretorn

Tretorn is a Swedish footwear and outerwear brand owned by ABG. Known for its tennis shoes and rubber boots, the brand has seen a resurgence under ABG through Scandinavian-style marketing and specialty retail partnerships.

Shaquille O’Neal Brand

ABG owns the name and likeness rights to Shaquille O’Neal, managing all licensing and commercial use of the basketball legend’s identity. This includes branded apparel, footwear, endorsements, and digital campaigns, all coordinated through ABG.

Marilyn Monroe

ABG owns the global intellectual property rights to Marilyn Monroe. The company licenses her image and likeness for fashion, media, art, and advertising. The Monroe estate remains one of the top-earning posthumous celebrity brands.

Elvis Presley

ABG acquired a controlling interest in Elvis Presley’s estate, including licensing rights to his image, merchandise, and Graceland tourism operations (through a partnership). The brand is actively managed through media, music releases, themed experiences, and merchandise.

Muhammad Ali

ABG also owns the rights to Muhammad Ali’s name and likeness. The estate is licensed across educational platforms, social justice initiatives, and branded merchandise in collaboration with global partners.

David Beckham

ABG entered a long-term partnership with David Beckham in which it owns a majority stake in his global brand rights. ABG manages licensing deals, advertising campaigns, and Beckham-branded fashion and grooming lines globally.

Hunter Boot Ltd.

ABG acquired the iconic British brand Hunter Boots in 2023. The company manages the heritage outerwear label through licensed manufacturing and global distribution, targeting premium and festival fashion markets.

Boardriders Inc.

As of 2025, ABG is in the final stages of completing its acquisition of Boardriders, the parent company of surf and action sports brands like Quiksilver, Billabong, Roxy, and DC Shoes. This will mark one of ABG’s largest acquisitions, further strengthening its position in youth and action lifestyle apparel.

Other Celebrity Estates

ABG owns or partially controls the brand rights to numerous celebrity names and estates, including James Dean, Judy Garland, and Andy Warhol. These are managed through licensing deals in fashion, media, and collectible merchandising.

Final Thoughts

Authentic Brands Group has become one of the most powerful forces in global brand management. With its unique licensing model and aggressive acquisition strategy, the company controls dozens of well-known names across fashion, sports, and entertainment.

Understanding who owns Authentic Brands Group offers insights into its strategy and leadership. With major stakeholders like BlackRock and Jamie Salter, the company is positioned for continued growth.

FAQs

Who is the majority owner of Authentic Brands Group?

Authentic Brands Group does not have a single majority owner. The company is privately held and its ownership is distributed among several institutional investors. BlackRock is the largest shareholder with an estimated 15%–18% stake, but it does not hold a majority. Founder and CEO Jamie Salter also owns around 10%–12%, making him one of the most influential figures in the company despite not being the majority owner.

Does Shaq own the Authentic Brands Group?

Shaquille O’Neal does not own Authentic Brands Group, but he is a minor shareholder. He sold the rights to his name and likeness to ABG in exchange for equity in the company. His estimated stake is between 1% and 2%. While he is not a decision-maker in corporate matters, he serves as a brand ambassador and sits on ABG’s advisory board.

Who are the investors in Authentic Brands Group?

The major investors in Authentic Brands Group include:

- BlackRock (the largest institutional shareholder)

- CVC Capital Partners

- HPS Investment Partners

- Leonard Green & Partners (founding investor)

- General Atlantic

- Simon Property Group

- Brookfield Asset Management

- Jamie Salter (founder and CEO)

- Shaquille O’Neal (minority stakeholder)

These investors support ABG’s growth through capital, strategic partnerships, and brand expansion across global markets.

What is the Authentic Brands Group’s net worth?

As of July 2025, Authentic Brands Group is valued at approximately $14 billion. This valuation reflects its large and growing portfolio of over 60 global brands and celebrity estates, along with more than $32 billion in annual retail sales generated through licensing agreements and partnerships.

Who are the Authentic Brands Group owners?

Authentic Brands Group is owned by a mix of private equity firms, institutional investors, and individual stakeholders. The key owners include:

- BlackRock

- CVC Capital Partners

- HPS Investment Partners

- Leonard Green & Partners

- Jamie Salter (Founder & CEO)

- Simon Property Group

- Brookfield Asset Management

- Shaquille O’Neal

Ownership is divided among these stakeholders, with no single majority holder, making ABG a privately held, multi-investor entity.

Is Authentic Brands Group a public company?

No. ABG is still privately held. It postponed its IPO in 2021 to focus on strategic growth.

What companies does Authentic Brands Group own?

ABG owns or manages brands like Reebok, Forever 21, Juicy Couture, Brooks Brothers, Barneys New York, Sports Illustrated, and the rights to several celebrity estates.

Who founded Authentic Brands Group?

ABG was founded by Jamie Salter in 2010.

How does ABG make money?

The company earns money through licensing deals and royalty payments from partners who use its brand names.