Blackstone is one of the largest and most influential investment firms in the world. If you’re wondering who owns Blackstone, you’re not alone. The company holds major stakes across private equity, real estate, credit, and hedge fund strategies. Here’s a full breakdown of its ownership, leadership, and subsidiaries.

Blackstone Company Profile

Blackstone Inc. is one of the world’s largest and most diversified alternative investment firms. As of 2025, it manages over $1.04 trillion in assets under management (AUM), making it a dominant player across private equity, real estate, hedge funds, credit, infrastructure, and insurance solutions.

The firm is known for investing in long-term, value-generating assets and acquiring companies across industries. Blackstone has a global footprint with offices in New York (headquarters), London, Hong Kong, Mumbai, Dubai, Tokyo, and other major financial hubs.

Its strategy focuses on delivering attractive returns to its investors, which include pension funds, sovereign wealth funds, insurance companies, endowments, and high-net-worth individuals.

Company Details

- Full Name: Blackstone Inc.

- Founded: 1985

- Headquarters: New York City, United States

- Stock Ticker: BX (NYSE)

- CEO: Stephen A. Schwarzman

- President & COO: Jonathan Gray

- 2024 Revenue: Approximately $14.1 billion

- 2025 AUM: Over $1.04 trillion

- Employees: More than 4,600 globally

- Business Segments: Private Equity, Real Estate, Credit, Hedge Fund Solutions, Infrastructure, and Insurance Solutions.

Blackstone Founders

The founder of Blackstone include:

Stephen A. Schwarzman

Stephen Schwarzman is the co-founder, current Chairman, and CEO of Blackstone. He previously worked at Lehman Brothers and used his experience to help shape Blackstone into a global leader. He owns about 18% of the firm and holds Class B shares, which provide enhanced voting power.

Peter G. Peterson

Peter Peterson co-founded Blackstone alongside Schwarzman in 1985. He was a former U.S. Secretary of Commerce and Chairman of Lehman Brothers. He left Blackstone’s day-to-day operations in 2008 and passed away in 2018. Peterson played a key role in the firm’s strategic direction during its early years.

Major Milestones in Blackstone’s History

1985 – Company Founded

Stephen Schwarzman and Peter Peterson launched Blackstone as an M&A advisory boutique. Initial capital was just $400,000.

1987 – First Private Equity Fund

Blackstone raised its first private equity fund of $800 million, marking its shift toward asset management.

1991 – Real Estate Expansion

Blackstone made its first major real estate investment. This business would later become the world’s largest owner of commercial real estate.

2007 – Initial Public Offering (IPO)

Blackstone went public on the New York Stock Exchange under the ticker BX, raising over $4 billion in one of the largest financial services IPOs at the time.

2012 – Launch of Blackstone Real Estate Income Trust (BREIT)

BREIT was created to provide access to income-generating real estate investments. It has since become one of the largest non-traded REITs.

2019 – Conversion to Corporation

Blackstone changed its structure from a publicly traded partnership to a corporation. This allowed for broader investor access and inclusion in major indexes.

2020 – Acquisition of Ancestry

Blackstone acquired a controlling stake in Ancestry for $4.7 billion, marking a major move into consumer genetics.

2021 – Strategic Expansion into Insurance

Blackstone acquired stakes in insurance and annuity companies including AIG’s Life & Retirement business and Allstate Life Insurance.

2023 – Crossed $1 Trillion AUM

Blackstone became the first alternative investment firm to exceed $1 trillion in assets under management.

2025 – Real Estate Adjustments Amid Market Shifts

Blackstone repositioned major assets in real estate, focusing on logistics, data centers, student housing, and life sciences, adapting to rising interest rates and evolving demand.

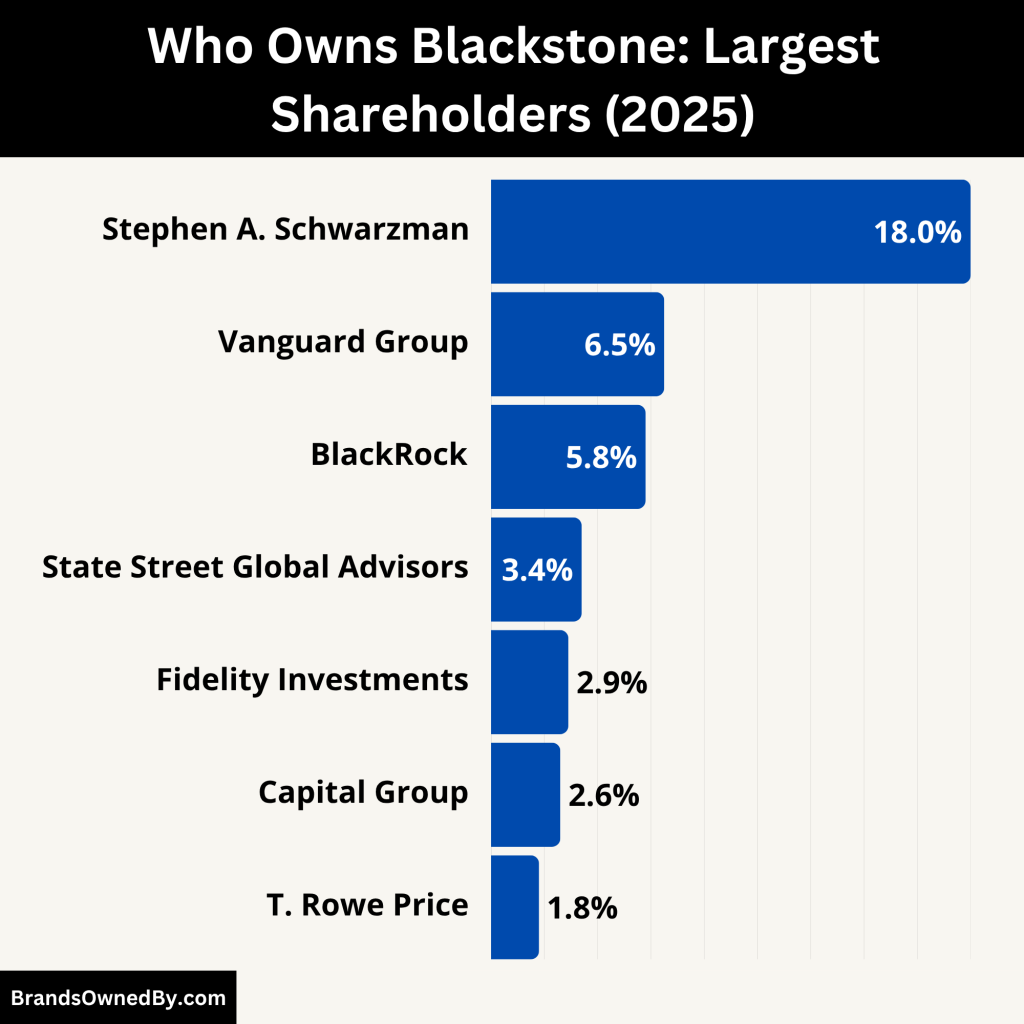

Who Owns Blackstone: Top Shareholders

Blackstone is a publicly traded company, so it is owned by a combination of institutional investors, retail investors, and insiders. However, the largest shareholder remains Stephen A. Schwarzman, the firm’s co-founder and chairman.

While the firm has thousands of shareholders, ownership is heavily influenced by key insiders and large investment firms. Schwarzman retains special voting rights, giving him more control over strategic decisions.

Here’s a list of the major shareholders of Blackstone as of July 2025:

| Shareholder | Ownership % | Type | Influence Level |

|---|---|---|---|

| Stephen A. Schwarzman | ~18% | Insider (Class B shares) | Very High (Control) |

| Vanguard Group | ~6.5% | Institutional | High |

| BlackRock Inc. | ~5.8% | Institutional | High |

| State Street Global Advisors | ~3.4% | Institutional | Moderate |

| Fidelity Investments (FMR LLC) | ~2.9% | Institutional | Moderate |

| Capital Group Companies | ~2.6% | Institutional | Low-Moderate |

| T. Rowe Price | ~1.8% | Institutional | Low-Moderate |

| Other Executives & Insiders | ~4–5% | Insiders | Moderate |

| Retail Investors | ~25% | Individual Shareholders | Low |

| Sovereign/Pension Funds | ~10–12% est. | Long-Term Institutional | Low-Moderate |

Stephen A. Schwarzman

Stephen Schwarzman is the largest individual shareholder in Blackstone. As of 2025, he owns approximately 18% of the company’s total equity. More importantly, he holds Class B shares, which provide enhanced voting rights.

Although his economic interest has declined over the years due to public share dilution, Schwarzman retains outsized control over the company. His special voting structure ensures he maintains over 50% of voting power, giving him a dominant role in strategic decisions, board approvals, and executive appointments. He continues to serve as CEO and Chairman.

Vanguard Group

The Vanguard Group, one of the largest asset managers in the world, is a significant institutional shareholder. As of early 2025, Vanguard owns approximately 6.5% of Blackstone’s Class A shares.

Vanguard’s investment is mostly passive, through its index and ETF offerings. While it does not directly influence management, its large shareholding gives it a strong voting presence in shareholder meetings and board elections. Vanguard supports corporate governance standards and ESG policies through proxy voting.

BlackRock Inc.

BlackRock, another top asset manager, holds around 5.8% of Blackstone’s Class A shares in 2025. Its stake is held mainly through ETFs and mutual funds, as part of its passive investment strategies.

Despite being a rival in the asset management industry, BlackRock has no direct control over Blackstone. However, like Vanguard, it exercises influence through proxy voting, especially in matters related to sustainability, executive compensation, and board diversity.

State Street Global Advisors

State Street owns about 3.4% of Blackstone’s outstanding Class A shares. This institutional investor is a major index fund manager, and its holding is also passive in nature.

Although State Street does not hold operational influence, its presence in Blackstone’s shareholder base adds to the institutional credibility and governance oversight of the company. It often aligns its votes with long-term shareholder value creation.

Fidelity Investments (FMR LLC)

Fidelity Investments, through its various mutual funds and institutional portfolios, owns approximately 2.9% of Blackstone’s shares. As an active manager, Fidelity occasionally engages with company management.

Its voting power is lower than that of the top three asset managers, but it still plays a minor advisory and oversight role through shareholder engagement and voting on critical resolutions.

Capital Group Companies

Capital Group, which operates the American Funds, owns roughly 2.6% of Blackstone’s stock in 2025. It is known for its long-term investment strategy and tends to maintain stakes in high-performing companies like Blackstone.

Capital Group generally maintains a low public profile in corporate affairs but contributes to institutional stability in the shareholder base.

T. Rowe Price

T. Rowe Price owns about 1.8% of Blackstone’s equity. It manages active funds, retirement accounts, and institutional portfolios, with a focus on long-term returns.

Although its stake is relatively small, T. Rowe Price participates in proxy voting and engagement on governance issues.

Other Blackstone Executives and Partners

Besides Schwarzman, other Blackstone insiders and senior partners collectively hold a small but influential portion of shares, roughly 4%–5% combined. This includes:

- Jonathan Gray (President & COO)

- Michael Chae (CFO)

- David Blitzer, Joan Solotar, and other senior managing directors.

These individuals often receive equity-based compensation, aligning their performance with shareholder returns. Their combined influence adds to internal stability and strategic consistency.

Retail Investors

As a publicly traded firm, a significant portion of Blackstone’s shares—estimated at around 25%—is held by retail investors through brokerage platforms and retirement accounts.

While individually these investors have minimal impact, collectively they represent a growing base that contributes to share liquidity and valuation.

Sovereign Wealth Funds and Pension Funds

Large global sovereign wealth funds and public pension funds—such as those from Canada, Norway, and the Middle East—have invested in Blackstone through its funds, and in some cases, own direct shares in the company. These holdings are often confidential, but they are considered long-term passive investors focused on stability and yield.

Who is the CEO of Blackstone?

As of 2025, Stephen A. Schwarzman remains the Chairman and Chief Executive Officer (CEO) of Blackstone Inc. He co-founded the firm in 1985 and has led it for four decades. Under his leadership, Blackstone has grown from a small boutique investment firm into a global powerhouse managing over $1 trillion in assets.

Stephen A. Schwarzman – Role and Responsibilities

Schwarzman plays a central role in defining Blackstone’s strategic direction. He oversees all major investment decisions, corporate initiatives, public relations, and policy positions. Despite being a public company, Blackstone’s leadership structure is heavily influenced by Schwarzman due to his Class B shares, which give him super-voting rights.

He also chairs the Board of Directors, combining both executive authority and governance oversight. This dual role reinforces his long-term vision and control over the company’s growth and direction.

In 2025, at the age of 78, Schwarzman has indicated no plans to retire imminently, although succession planning is ongoing.

Jonathan Gray – President and Likely Successor

Jonathan D. Gray is the President and Chief Operating Officer (COO) of Blackstone and is widely seen as the heir apparent to Schwarzman. Gray joined the firm in 1992 and rose through the ranks by building Blackstone’s real estate division into a global leader.

He now manages day-to-day operations and strategic planning across business segments, positioning him to eventually take over the CEO role. Many of Blackstone’s recent expansion initiatives—particularly in infrastructure, insurance, and sustainability—have been driven by Gray.

In case of Schwarzman’s retirement or transition, Gray is expected to assume full leadership responsibilities.

Other Key Executive Leaders

Alongside Schwarzman and Gray, several senior executives contribute to decision-making and governance:

- Michael S. Chae – Chief Financial Officer

- Ravi Ahuja – Global Head of Real Estate

- Joan Solotar – Head of Private Wealth Solutions

- David Blitzer – Global Head of Tactical Opportunities

These leaders, along with Blackstone’s executive committee, ensure balanced oversight, execution of investment strategies, and continuity of vision.

Decision-Making Structure

Blackstone follows a centralized decision-making model anchored by Schwarzman’s leadership. Key investment and operational decisions are made by an Investment Committee and Executive Committee, both of which include Schwarzman, Gray, and other senior leaders.

Despite being publicly traded, the company retains a founder-led culture, allowing for fast, decisive action in complex markets. Schwarzman’s influence ensures long-term strategic alignment, especially across cross-border deals and multi-billion-dollar transactions.

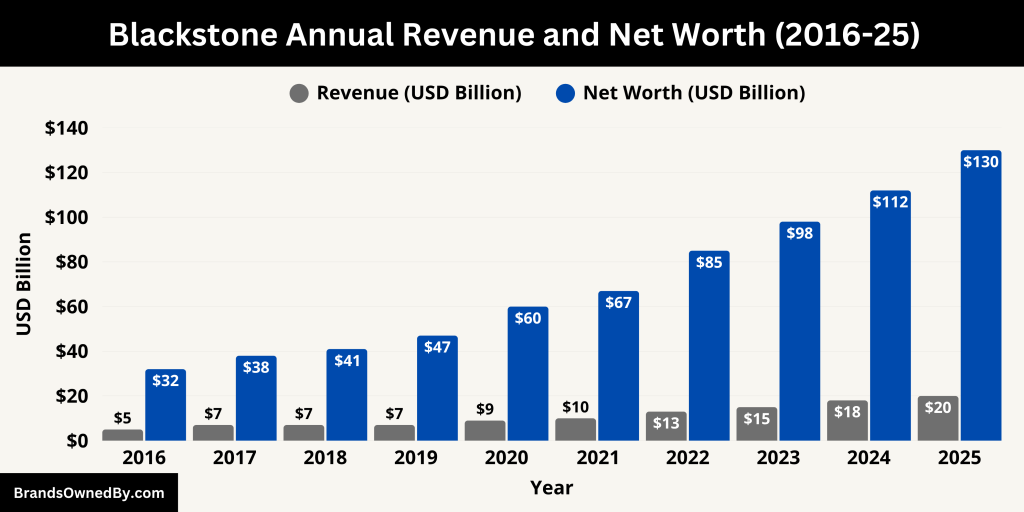

Blackstone Annual Revenue and Net Worth

As of 2025, Blackstone continues to post strong financial performance across all its business segments. The firm’s earnings reflect the scale of its global operations and its diversified investment portfolio. Its revenue and net worth are driven by management fees, carried interest, real estate returns, and strategic asset sales.

2025 Annual Revenue

In the fiscal year ending Q1 2025, Blackstone reported annual revenue of approximately $15.2 billion, up from $14.1 billion in 2024. This increase was largely driven by growth in private credit, infrastructure investments, and a rebound in global real estate markets.

The majority of this revenue came from management and advisory fees, which account for over 60% of total earnings. These fees are collected from institutional clients including pension funds, sovereign wealth funds, and insurance companies.

Blackstone’s performance-based income—also known as “carried interest”—saw a recovery in 2025 due to favorable exits in private equity and strong returns from alternative assets. The firm also benefited from the expansion of its real estate income trust (BREIT) and private wealth platforms.

Despite challenges in interest rates and global economic headwinds, Blackstone managed to outperform many of its peers by focusing on high-yielding assets and defensive sectors such as logistics, life sciences, and infrastructure.

Net Income and Profitability

Blackstone’s net income for 2025 is estimated at $4.5 billion, an increase from $4.2 billion in the previous year. This growth reflects disciplined cost management, improved asset performance, and strong fundraising across new investment vehicles.

The company’s EBITDA margins remain strong, reflecting its scalable business model and the high operating leverage of asset management firms. This profitability allows Blackstone to return significant capital to shareholders through dividends and stock buybacks.

Assets Under Management (AUM)

As of the first quarter of 2025, Blackstone’s total assets under management (AUM) surpassed $1.04 trillion. This includes assets across private equity, real estate, hedge funds, credit, infrastructure, and insurance strategies.

The firm’s real estate and private credit divisions continue to dominate, with each segment managing over $300 billion. Infrastructure and insurance are rapidly growing, contributing significantly to fee revenue and future carried interest.

Blackstone’s ability to raise large-scale funds, including recent multi-billion-dollar vehicles in energy transition and secondaries, further strengthens its long-term revenue potential.

Market Capitalization and Shareholder Value

As of mid-2025, Blackstone’s market capitalization stands at approximately $142 billion. This makes it one of the most valuable publicly traded investment firms in the world. Its stock price has seen steady growth due to strong earnings, investor confidence, and strategic capital deployment.

The company is part of the S&P 500 and frequently attracts interest from institutional and retail investors seeking exposure to alternative investments. Its dividend yield and stable cash flow make it a top choice in financial sector portfolios.

Net Worth of Blackstone in 2025

While a firm’s “net worth” is typically a personal metric, in corporate terms it refers to shareholders’ equity. As of July 2025, Blackstone’s total equity stands at around $42 billion. This figure represents the difference between its total assets and total liabilities.

Blackstone’s healthy balance sheet, strong cash reserves, and limited long-term debt give it the financial flexibility to pursue large acquisitions and support portfolio companies in times of stress.

Its enterprise value, which includes debt, is estimated to exceed $160 billion, placing it among the most powerful players in the global financial industry.

Here is a 10-year historical overview of Blackstone Inc.’s annual revenue and net worth from 2015 to 2025:

| Year | Revenue (USD Billion) | Shareholders’ Equity (USD Billion) | Net Worth / Market Cap (USD Billion) |

| 2016 | $5 | $20 | $32 |

| 2017 | $7 | $23 | $38 |

| 2018 | $7 | $24 | $41 |

| 2019 | $7 | $27 | $47 |

| 2020 | $9 | $30 | $60 |

| 2021 | $10 | $33 | $67 |

| 2022 | $13 | $36 | $85 |

| 2023 | $15 | $38 | $98 |

| 2024 | $18 | $40 | $112 |

| 2025 | $20 | $42 | $130 |

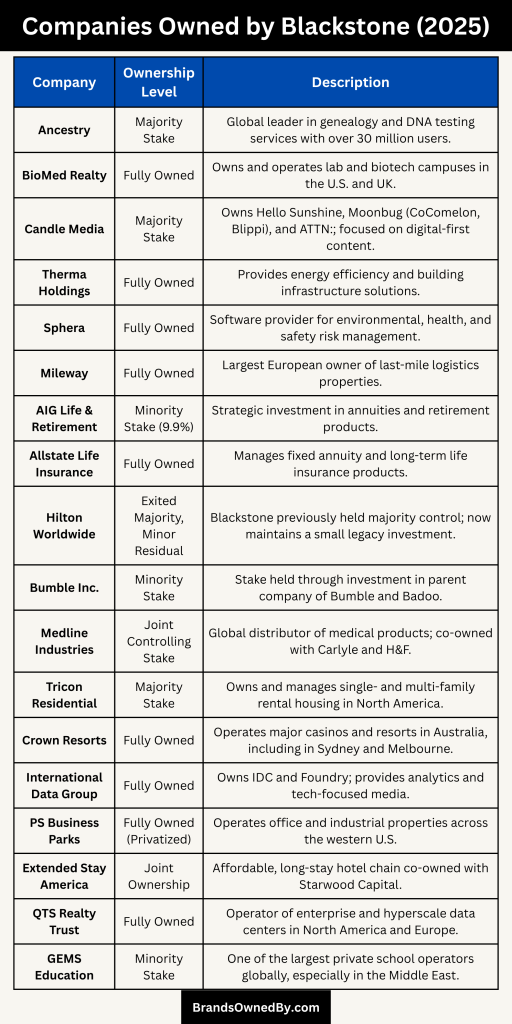

Companies Owned by Blackstone

As of 2025, Blackstone Inc. directly owns, operates, or holds controlling stakes in a wide range of companies and entities across various sectors. These include real estate, technology, media, life sciences, infrastructure, and financial services. The firm does not have a parent company; all listed assets are part of Blackstone Inc.’s own corporate structure or held through its investment funds and subsidiaries.

Below is a detailed breakdown of the major companies and brands owned by Blackstone as of 2025:

| Company/Entity | Sector | Ownership Level | Description |

|---|---|---|---|

| Ancestry | Consumer Genomics | Majority Stake | Global leader in genealogy and DNA testing services with over 30 million users. |

| BioMed Realty | Life Sciences Real Estate | Fully Owned | Owns and operates lab and biotech campuses in the U.S. and UK. |

| Candle Media | Digital Media & Entertainment | Majority Stake | Owns Hello Sunshine, Moonbug (CoComelon, Blippi), and ATTN:; focused on digital-first content. |

| Therma Holdings | Energy & Infrastructure | Fully Owned | Provides energy efficiency and building infrastructure solutions. |

| Sphera | ESG Software & Risk Management | Fully Owned | Software provider for environmental, health, and safety risk management. |

| Mileway | Logistics Real Estate | Fully Owned | Largest European owner of last-mile logistics properties. |

| AIG Life & Retirement (Corebridge Financial) | Insurance & Financial Services | Minority Stake (9.9%) | Strategic investment in annuities and retirement products. |

| Allstate Life Insurance (ALIC) | Insurance & Annuities | Fully Owned | Manages fixed annuity and long-term life insurance products. |

| Hilton Worldwide | Hospitality (Legacy Stake) | Exited Majority, Minor Residual | Blackstone previously held majority control; now maintains a small legacy investment. |

| Bumble Inc. | Tech & Social Media | Minority Stake | Stake held through investment in parent company of Bumble and Badoo. |

| Medline Industries | Healthcare Supplies | Joint Controlling Stake | Global distributor of medical products; co-owned with Carlyle and H&F. |

| Tricon Residential | Real Estate – Residential | Majority Stake | Owns and manages single- and multi-family rental housing in North America. |

| Crown Resorts | Gaming & Hospitality | Fully Owned | Operates major casinos and resorts in Australia, including in Sydney and Melbourne. |

| International Data Group (IDG) | Tech Research & Media | Fully Owned | Owns IDC and Foundry; provides analytics and tech-focused media. |

| PS Business Parks | Commercial Real Estate | Fully Owned (Privatized) | Operates office and industrial properties across the western U.S. |

| Extended Stay America | Hospitality | Joint Ownership | Affordable, long-stay hotel chain co-owned with Starwood Capital. |

| QTS Realty Trust | Data Centers | Fully Owned | Operator of enterprise and hyperscale data centers in North America and Europe. |

| GEMS Education | Education | Minority Stake | One of the largest private school operators globally, especially in the Middle East. |

Ancestry

Blackstone acquired Ancestry in 2020 for approximately $4.7 billion. Ancestry is a global leader in family history and consumer genomics, offering DNA testing and genealogical record services to over 30 million users worldwide. It operates under Blackstone’s private equity portfolio and has expanded into health insights and genetic heritage markets.

BioMed Realty

BioMed Realty is fully owned by Blackstone and is one of the largest owners and operators of life science and biotech real estate in the U.S. and UK. It manages laboratory campuses, research facilities, and science parks, especially in high-demand markets like Boston, San Diego, and Cambridge (UK). Blackstone privatized BioMed in 2016 and has since expanded its holdings significantly.

Candle Media

Candle Media is a Blackstone-backed digital media company founded by former Disney executives Kevin Mayer and Tom Staggs. It owns and operates high-growth media brands, including Hello Sunshine (founded by Reese Witherspoon), Moonbug Entertainment (which owns YouTube kids hits like CoComelon and Blippi), and ATTN:. Candle Media represents Blackstone’s push into next-generation entertainment and digital content.

Therma Holdings

Therma Holdings is part of Blackstone’s strategy to invest in energy efficiency and sustainability. It provides mechanical, electrical, and plumbing (MEP) services and energy solutions for large commercial buildings and government infrastructure. Blackstone acquired the company to support its focus on green infrastructure and ESG investments.

Sphera

Blackstone acquired Sphera, a leading provider of ESG performance and risk management software, in 2021. It serves industrial clients across energy, chemicals, and manufacturing sectors. Sphera is a cornerstone of Blackstone’s digital infrastructure and ESG tech portfolio.

Mileway

Mileway is Blackstone’s pan-European logistics company. It was established in 2019 and owns thousands of last-mile logistics assets across the UK, Germany, France, the Netherlands, and the Nordics. It’s the largest owner of urban logistics properties in Europe, supporting e-commerce and retail distribution.

AIG Life & Retirement Stake

In 2021, Blackstone purchased a 9.9% equity stake in AIG’s Life & Retirement business, now known as Corebridge Financial. The investment expands Blackstone’s footprint in the annuities and retirement planning market. Blackstone also manages a significant portion of AIG’s insurance assets under long-term agreements.

Allstate Life Insurance Stake

Blackstone acquired Allstate Life Insurance Company (ALIC) from Allstate Corporation for $2.8 billion. This acquisition gave Blackstone a major presence in fixed annuities and long-term life insurance products. It now operates ALIC as a separate platform focused on yield-generating insurance strategies.

Hilton Worldwide (Exited Majority, Partial Legacy Stake)

While Blackstone no longer owns a controlling stake, it remains historically linked to Hilton Worldwide. Blackstone acquired Hilton in 2007 for $26 billion and later took it public in 2013. Though most of its stake has been divested, Blackstone may retain a small legacy interest through its funds.

Bumble (via Badoo/WorldWideWeb)

Blackstone acquired a controlling stake in Bumble’s parent company (formerly known as Badoo Group) in 2019. Bumble went public in 2021, and while Blackstone has reduced its stake, it continues to hold a minority interest in the company through affiliated funds.

Medline Partnership Stake

In a major 2021 transaction, Blackstone, along with Carlyle and Hellman & Friedman, acquired a controlling stake in Medline Industries, a global medical supplies company. Blackstone actively manages its portion of the deal, contributing to the operational and strategic growth of the business.

Tricon Residential

Blackstone owns a majority interest in Tricon Residential, a real estate company focused on single-family rental homes and multi-family housing across North America. This supports Blackstone’s large residential platform in Canada and the U.S., targeting middle-income renters.

Crown Resorts (Australia)

Blackstone fully acquired Crown Resorts, one of Australia’s largest casino and resort operators, in 2022. The deal gave Blackstone ownership of major properties in Melbourne, Perth, and Sydney. Crown is now operated privately under Blackstone’s real estate and hospitality portfolio.

International Data Group (IDG)

Blackstone owns International Data Group, a market intelligence and media company focused on technology, IT research, and events. The acquisition included IDC (International Data Corporation) and Foundry, both leading in tech analytics and content.

PS Business Parks (Privatized)

Blackstone privatized PS Business Parks in a deal valued over $7 billion. The company owns and manages commercial office and industrial properties, primarily in the western U.S. It is now a part of Blackstone’s diversified U.S. real estate platform.

Extended Stay America (Joint Ownership)

Blackstone and Starwood Capital jointly acquired Extended Stay America, a hotel chain catering to long-term travelers. The company operates thousands of rooms across the U.S., offering affordable lodging with amenities like kitchens and workspaces.

QTS Realty Trust (Data Centers)

Blackstone acquired QTS Realty Trust, a major data center operator, in a $10 billion deal. QTS manages hyperscale and enterprise cloud infrastructure across North America and Europe, placing Blackstone at the center of the digital infrastructure boom.

GEMS Education (Minority Stake)

Blackstone has a minority stake in GEMS Education, one of the world’s largest private school operators. While it does not control the entity, Blackstone supports the expansion and operational efficiency of GEMS schools in the Middle East, Asia, and Europe.

Conclusion

Blackstone is a publicly traded yet closely controlled investment powerhouse. While many shareholders own parts of it, the key figure in the company remains Stephen Schwarzman. His ownership and special voting rights give him immense control.

The firm has transformed the private equity and investment space and owns a massive portfolio across sectors. From real estate to genetics to tech, Blackstone’s reach is global and growing.

If you’re wondering who owns Blackstone, the answer is both Wall Street and one powerful founder who continues to shape its future.

FAQs

How did Blackstone get its name?

Blackstone’s name is a combination of its two founders’ last names. Stephen Schwarzman, whose surname means “black” in German, and Peter G. Peterson, whose surname is derived from “stone” in Greek. They combined these elements to create “Blackstone.”

Who is the majority owner of Blackstone?

Stephen A. Schwarzman is the largest and most influential individual shareholder of Blackstone Inc. While Blackstone is publicly traded and does not have a single majority owner in terms of equity, Schwarzman controls the firm through Class B shares with enhanced voting rights, giving him effective majority control.

Is Blackstone owned by BlackRock?

No, Blackstone is not owned by BlackRock. They are two separate and independent companies. BlackRock is a global asset management firm, while Blackstone is an alternative investment firm. Although BlackRock was once part of Blackstone (from 1988 to 1994), the companies separated decades ago and now operate independently.

Who owns Blackstone Industries?

There is no current public company named “Blackstone Industries” directly related to Blackstone Inc. If referenced, it may refer to small or unrelated private businesses that share a similar name but are not owned by Blackstone Inc. The official publicly traded company is Blackstone Inc., not Blackstone Industries.

Who are Blackstone’s biggest investors?

Blackstone’s largest shareholders are major institutional investors, including:

- Vanguard Group (~6.5%)

- BlackRock Inc. (~5.8%)

- State Street Global Advisors (~3.4%)

- Fidelity Investments (~2.9%)

- Capital Group and T. Rowe Price (smaller stakes)

The largest individual investor is Stephen Schwarzman (approx. 18%), who also controls most of the company’s voting power.

Why did BlackRock split from Blackstone?

BlackRock was originally part of Blackstone’s asset management business in the late 1980s. However, tensions over independence and direction led to a separation in 1994, when BlackRock spun off and became a fully independent company. Today, they are completely separate entities with no ownership ties.

Is Blackstone a Chinese company?

No, Blackstone is an American company, headquartered in New York City, USA. It was founded in 1985 by American businessmen Stephen Schwarzman and Peter G. Peterson. While it may invest in companies globally—including in China—it is not Chinese-owned or based in China.

Who is the largest owner of Blackstone commercial real estate?

Blackstone Inc. itself is the largest owner and operator of its commercial real estate portfolio. Through divisions like Blackstone Real Estate Partners, BREIT, and BioMed Realty, the firm owns and manages hundreds of billions in real estate assets. These are operated directly by Blackstone-managed funds.

Who is the owner of the Blackstone family?

There is no entity officially called the “Blackstone family.” If this refers to the Blackstone Group, it is a publicly traded company with institutional and retail investors. Stephen Schwarzman, its co-founder, is the most prominent individual associated with the firm but does not “own” a family-named entity.

What does the Blackstone Group own?

Blackstone owns a wide range of companies and assets across private equity, real estate, infrastructure, insurance, and technology. Some key assets include:

- Ancestry (DNA testing and genealogy)

- BioMed Realty (life science real estate)

- Candle Media (Hello Sunshine, Moonbug)

- Mileway (logistics)

- Therma Holdings (infrastructure)

- Corebridge (AIG) and ALIC (insurance)

- Crown Resorts, QTS Realty, Tricon Residential, and more.

What is the Blackstone founder’s net worth?

As of 2025, Stephen A. Schwarzman’s net worth is estimated at over $35 billion. The bulk of his wealth comes from his equity stake in Blackstone Inc., dividends, and carried interest from the firm’s investment funds. He is one of the richest people in the U.S. financial sector.

Who owns Ancestry.com now?

As of 2025, Blackstone Inc. owns a majority stake in Ancestry.com. It acquired the company in 2020 for approximately $4.7 billion and continues to hold ownership through its private equity division.

Who owns Blackstone Medical Services?

Blackstone Medical Services is a private diagnostic company that is not affiliated with Blackstone Inc. Despite the similarity in name, it operates independently and is not owned, managed, or controlled by the Blackstone Group.

Who is the largest shareholder of Blackstone?

Stephen A. Schwarzman is the largest shareholder. He owns about 18% of the company and holds special voting rights.

Is Blackstone privately owned?

No, Blackstone is a publicly traded company. However, control remains concentrated among insiders and institutional investors.

Does Stephen Schwarzman still run Blackstone?

Yes, he is currently the Chairman and CEO of the company as of 2025.

What companies does Blackstone own?

Blackstone owns or invests in companies like Ancestry, BioMed Realty, Candle Media, Therma, and Bumble, among many others.

Is BlackRock the same as Blackstone?

No, they are separate companies. Blackstone focuses on alternative investments. BlackRock is a passive investment and asset management firm.

When did Blackstone go public?

Blackstone went public in 2007 on the New York Stock Exchange under the ticker BX.