What companies does PayPal own? This question often comes up when discussing the reach and influence of one of the world’s most well-known digital payment platforms. PayPal has expanded significantly since its early days. The company has acquired several major businesses that support its mission to offer fast, secure, and innovative financial services to individuals and businesses worldwide.

PayPal Company Profile

PayPal is one of the world’s leading financial technology companies, known for revolutionizing digital payments. It provides a secure platform for online money transfers, e-commerce transactions, and peer-to-peer payments. With operations in over 200 markets, PayPal supports more than 400 million active users worldwide as of 2025.

Company Details

PayPal Holdings, Inc. is headquartered in San Jose, California, and operates under the stock ticker PYPL on the NASDAQ. The company generates revenue primarily through transaction fees charged to merchants and currency conversion fees. Its suite of services includes online checkout solutions, digital wallets, credit offerings, and person-to-person transfers through apps like Venmo.

Founders of PayPal

PayPal’s origins date back to December 1998, when it was founded as Confinity by:

- Max Levchin, a computer scientist

- Peter Thiel, a venture capitalist and entrepreneur

- Luke Nosek, an engineer and investor.

In 2000, Confinity merged with X.com, an online banking company launched by Elon Musk. Though Musk was a key figure in shaping the future of the merged entity, he was eventually replaced as CEO. In 2001, the company was officially rebranded as PayPal.

The founding team is part of what later became known as the “PayPal Mafia,” a group of early PayPal employees who went on to found or fund major tech companies like Tesla, YouTube, LinkedIn, and Palantir.

Major Milestones

2002 – PayPal went public through an IPO and was quickly acquired by eBay for $1.5 billion. It became the primary payment solution for eBay transactions.

2008–2012 – PayPal expanded globally and introduced new services like PayPal Credit and mobile apps. It also began acquiring companies to strengthen its infrastructure.

2013 – PayPal acquired Braintree, gaining access to Venmo, a fast-growing peer-to-peer payment app in the U.S.

2015 – PayPal was spun off from eBay and became an independent publicly traded company. This marked a new era of innovation and aggressive expansion.

2018 – Acquired several companies including iZettle, Hyperwallet, and Simility, reinforcing its global and merchant services reach.

2020 – Bought Honey Science Corporation for $4 billion, stepping into the e-commerce and deal-finding space.

2021 – Acquired Paidy, a Japanese Buy Now, Pay Later (BNPL) firm, to grow its presence in Asia.

2023–2025 – Under new CEO Alex Chriss, PayPal began restructuring and focusing on AI integration, cost efficiency, and enhanced user experience across its ecosystem.

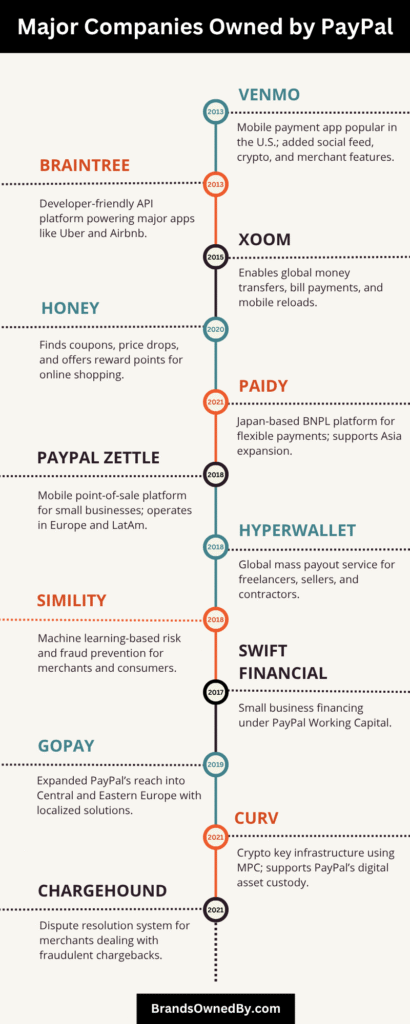

List of Companies Owned by PayPal

As of 2025, PayPal owns and operates several companies, brands, and platforms that support its goal of building a complete digital financial ecosystem. These entities span across peer-to-peer payments, global remittances, point-of-sale systems, fraud prevention, and e-commerce tools.

Below is a list of the major companies and brands owned by PayPal as of August 2025:

| Company/Brand | Acquisition Year | Type | Role in PayPal’s Ecosystem | Status (2025) |

|---|---|---|---|---|

| Venmo | 2013 (via Braintree) | Peer-to-peer payment app | Mobile payment app popular in the U.S.; added social feed, crypto, and merchant features | Active, standalone brand |

| Braintree | 2013 | Payment gateway | Developer-friendly API platform powering major apps like Uber and Airbnb | Active, integrated |

| Xoom | 2015 | Remittance service | Enables global money transfers, bill payments, and mobile reloads | Active, under PayPal |

| Honey | 2020 | Shopping tool & browser app | Finds coupons, price drops, and offers reward points for online shopping | Active, standalone brand |

| Paidy | 2021 | Buy Now, Pay Later (BNPL) | Japan-based BNPL platform for flexible payments; supports Asia expansion | Active, regional brand |

| iZettle (PayPal Zettle) | 2018 | POS system | Mobile point-of-sale platform for small businesses; operates in Europe and LatAm | Active, branded as PayPal Zettle |

| Hyperwallet | 2018 | Payout platform | Global mass payout service for freelancers, sellers, and contractors | Active, integrated into backend |

| Simility | 2018 | Fraud detection platform | Machine learning-based risk and fraud prevention for merchants and consumers | Active, security backend |

| Jetlore | 2018 | AI personalization engine | Predictive shopping experience and content personalization for merchants | Integrated, brand retired |

| Swift Financial | 2017 | Lending platform | Small business financing under PayPal Working Capital | Active, under PayPal |

| TIO Networks | 2017 | Bill payment services | Enabled in-person and digital bill payments for utilities and other services | Inactive (operations ceased) |

| Modest | 2015 | Contextual commerce startup | Enabled buy buttons within apps and content; merged into Braintree | Integrated, brand retired |

| GoPay | 2019 | Payment platform (Czech) | Expanded PayPal’s reach into Central and Eastern Europe with localized solutions | Active, regional integration |

| PayPal Credit | 2008 (as Bill Me Later) | Digital credit line | Short-term financing for online purchases through PayPal checkout | Active, under PayPal |

| Curv | 2021 | Crypto security platform | Crypto key infrastructure using MPC; supports PayPal’s digital asset custody | Integrated, brand retired |

| Chargehound | 2021 | Chargeback automation | Dispute resolution system for merchants dealing with fraudulent chargebacks | Integrated, backend service |

| Happy Returns | 2021 (sold in 2023) | Returns logistics | Offered return drop-off locations for e-commerce products; sold to UPS | No longer owned (sold) |

| Paydiant | 2015 | Mobile wallet infrastructure | Powered in-store and loyalty wallet features for partners and PayPal app | Integrated, brand retired |

| AI Startup (Undisclosed) | 2024 | AI + Crypto Infrastructure | Enhances AI personalization, checkout, and crypto capabilities | Active, integrated into AI tools |

Venmo

Venmo is one of PayPal’s most successful acquisitions and operates as a standalone brand. It is a mobile payment platform popular for peer-to-peer money transfers, particularly among millennials and Gen Z users in the United States. Venmo allows users to send and receive money with a social feed component. In recent years, PayPal expanded Venmo’s features to include direct deposit, crypto trading, and merchant payments through QR codes. Despite being part of PayPal, Venmo maintains its own app and branding.

Braintree

Braintree is a payment gateway company that provides tools for mobile and web payment systems. PayPal acquired Braintree in 2013 for $800 million. Through Braintree, PayPal extended its reach into mobile commerce and gained control of Venmo. Braintree powers transactions for many global companies, including Uber and Airbnb. It specializes in developer-friendly APIs, global payment support, and recurring billing for subscription-based businesses.

Xoom

Xoom is a digital money transfer service that focuses on cross-border remittances, bill payments, and mobile top-ups. PayPal purchased Xoom in 2015 for $890 million. It enables users in the United States and select other countries to send money to friends and family abroad, typically within minutes. Xoom supports transactions in dozens of countries and offers both online and mobile platforms. It plays a crucial role in PayPal’s international money movement strategy.

Honey Science Corporation

Honey is a browser extension and mobile app that automatically finds and applies discount codes at checkout. PayPal acquired Honey in 2020 for $4 billion to expand into the e-commerce enablement space. Honey also provides features like price tracking, rewards, and deal alerts. It helps merchants acquire new customers and increases checkout conversion rates. Honey operates independently but integrates with PayPal’s checkout and wallet features.

Paidy

Paidy is a Japanese fintech company that offers buy now, pay later (BNPL) services. PayPal completed the acquisition of Paidy in 2021 for approximately $2.7 billion. Paidy allows consumers to shop online without a credit card and pay in monthly installments. It is one of the largest BNPL players in Japan and a major part of PayPal’s expansion into the Asian market. Paidy continues to operate under its own name and management team.

iZettle (Now PayPal Zettle)

iZettle, now rebranded as PayPal Zettle, is a mobile point-of-sale (mPOS) solution for small businesses. Acquired in 2018 for $2.2 billion, iZettle offers card readers, invoicing, sales analytics, and inventory management tools. It competes with platforms like Square and serves merchants across Europe, Latin America, and other regions. Zettle is fully integrated into the PayPal business suite and supports both in-store and online payments.

Hyperwallet

Hyperwallet is a global payout platform used to send mass payments to individuals, especially freelancers, contractors, and sellers on marketplaces. PayPal acquired Hyperwallet in 2018 for $400 million. It enables fast, local-currency payouts in more than 200 countries through multiple delivery options including bank deposit, prepaid cards, and mobile wallets. Hyperwallet is a key part of PayPal’s B2B and marketplace infrastructure.

Simility

Simility is a fraud detection and risk management company acquired by PayPal in 2018 for $120 million. It uses machine learning and data analytics to identify suspicious behavior and prevent fraud in real-time. Simility helps secure transactions across PayPal, Venmo, Braintree, and other services. Its technology is also offered as a service to merchants using PayPal’s platforms.

Jetlore (Integrated)

Jetlore was a predictive retail platform that helped brands personalize customer experiences based on behavioral data. PayPal acquired Jetlore in 2018 and integrated its technology into PayPal’s merchant services. While Jetlore no longer operates as a standalone brand, its machine learning tools are embedded into PayPal’s marketing solutions to help merchants deliver personalized offers and content.

Happy Returns

Happy Returns is a reverse logistics company focused on simplifying product returns for online shoppers and retailers. PayPal acquired Happy Returns in 2021. It offers in-person drop-off locations where customers can return items without printing labels or boxes. The service enhances the post-purchase experience and has been integrated with PayPal’s e-commerce solutions to offer seamless returns and improve customer satisfaction.

Chargehound (Integrated)

Chargehound is a chargeback automation company that helps merchants fight fraudulent chargebacks more efficiently. It was quietly acquired and absorbed into PayPal’s risk management division. Chargehound’s features are now part of PayPal’s dispute resolution systems, enabling faster handling of transaction disputes for merchants.

Curv (Integrated)

Curv was a digital asset custody company focused on cryptocurrency security and infrastructure. PayPal acquired Curv in 2021 to strengthen its crypto-related services. While Curv no longer operates independently, its multi-party computation (MPC) technology now underpins PayPal’s crypto wallet and trading features. This has helped PayPal securely manage and expand its cryptocurrency offerings.

Paydiant (Integrated into PayPal Wallet)

Paydiant, acquired in 2015, was a mobile wallet platform that provided white-label digital wallet solutions for banks and retailers. Its technology now powers the backend of PayPal’s own digital wallet features, including loyalty integration, in-store payment options, and partnerships with retailers. Paydiant’s original brand has been retired, but its tools live on within PayPal’s mobile ecosystem.

Bill Me Later (Now PayPal Credit)

Bill Me Later was a digital credit line service acquired by PayPal in 2008. It was rebranded as PayPal Credit and allows users to buy now and pay later through short-term financing options directly within PayPal. The service offers promotional financing and is widely used by online shoppers in the United States. PayPal Credit continues to be a core feature for both consumers and merchants.

Swift Financial

Swift Financial was acquired in 2017. It provides small business loans and financing solutions, particularly under the PayPal Working Capital program. The deal expanded PayPal’s business lending capabilities.

TIO Networks

TIO Networks was purchased in 2017 for about $238 million. It specialized in bill‑payment solutions, allowing consumers to pay utilities and other services via cash or digital channels. TIO’s capabilities were integrated into PayPal’s network, although operations later wound down due to security concerns.

Modest

Modest was a Chicago‑based contextual commerce startup acquired by PayPal in 2015 and integrated into Braintree. It enabled embedding buy buttons within content, improving checkout conversion across platforms.

GoPay

GoPay is a Czech payment platform acquired in 2019. It expands PayPal’s presence in Central Europe by enabling merchant and e‑commerce payment services in that region.

Who Owns PayPal?

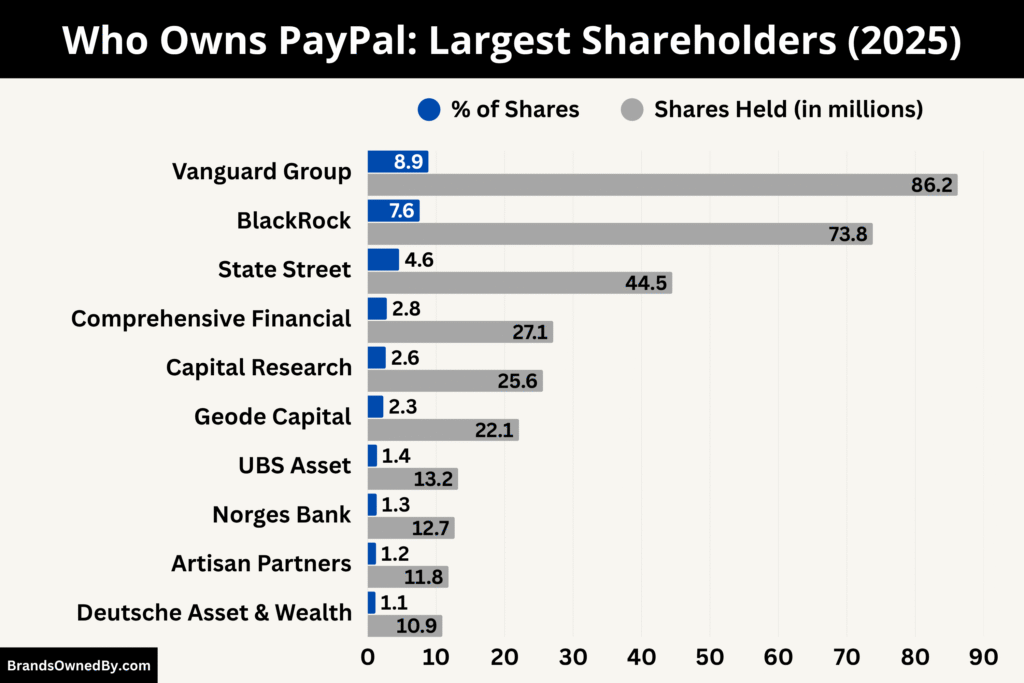

PayPal Holdings Inc. is a publicly traded company listed on NASDAQ under the ticker symbol PYPL. It is not owned by a single individual or company but by various institutional and retail investors.

Below is a list of the major shareholders of PayPal as of August 2025:

Vanguard Group, Inc.

Vanguard is the largest shareholder of PayPal in 2025, owning approximately 8.4% to 8.9% of the company’s outstanding shares. This equates to tens of millions of shares valued in the billions of dollars.

Vanguard is known for its long-term, passive investment approach, with most of its holdings managed through index funds and ETFs. Its major funds invested in PayPal include:

- Vanguard Total Stock Market Index Fund

- Vanguard 500 Index Fund.

Vanguard’s significant stake gives it major influence in shareholder votes and corporate governance decisions.

BlackRock, Inc.

BlackRock is PayPal’s second-largest shareholder, with ownership estimated between 6.8% and 7.6% in 2025. As the world’s largest asset manager, BlackRock manages investments through its iShares ETF range and institutional portfolios.

BlackRock’s interest in PayPal is part of its strategy to hold major stakes in high-performing technology and fintech companies. Though it rarely intervenes in operational management, it participates in shareholder governance and proxy voting.

State Street Global Advisors

State Street owns around 4.1% to 4.6% of PayPal’s shares in 2025. It ranks among the top three institutional investors in the company.

State Street manages large-scale passive investments for pension funds, insurance companies, and sovereign wealth funds. Its SPDR ETFs often include PayPal as part of broad-market or technology-focused indexes. State Street is also active in ESG-related governance.

Comprehensive Financial Management LLC

Comprehensive Financial Management holds roughly 2.6% to 2.8% of PayPal shares. While not as large or well-known as Vanguard or BlackRock, its stake is significant given its size. The firm is notable for having a concentrated position in PayPal relative to the rest of its portfolio.

This kind of focused investment indicates a strong belief in PayPal’s long-term performance. The firm is less involved in governance but is a key long-term investor.

Capital Research and Management Company

Capital Research owns about 2.6% of PayPal. It operates under the umbrella of Capital Group and is best known for actively managed mutual funds like the Growth Fund of America.

Its stake in PayPal reflects a long-term investment strategy in growth-oriented large-cap technology companies. Capital Research typically takes a low-profile role in shareholder governance.

Geode Capital Management, LLC

Geode Capital owns about 2.3% of PayPal stock in 2025. Geode acts as a sub-advisor for many Fidelity index funds, meaning its investments represent indirect exposure through products like the Fidelity 500 Index Fund.

Geode is known for passive investment strategies and typically tracks benchmark indexes like the S&P 500. It does not usually influence strategic decisions directly but contributes to long-term shareholder stability.

UBS Asset Management

UBS Asset Management holds an estimated 1.2% to 1.4% stake in PayPal. It is the investment arm of Swiss-based UBS Group and manages a mix of active and passive funds globally.

UBS’s ownership reflects institutional interest in PayPal’s position as a leading fintech platform. While not a top influencer, it participates in corporate voting and governance through standard institutional practices.

Norges Bank Investment Management

Norges Bank, the manager of Norway’s sovereign wealth fund, owns about 1.1% to 1.3% of PayPal. It is one of the largest global institutional investors and often takes ESG (Environmental, Social, and Governance) factors into account.

Norges is known for transparency in its investments and supports long-term corporate governance best practices. Its involvement with PayPal reflects its interest in stable, scalable digital companies.

Artisan Partners

Artisan Partners holds a stake in the range of 1.1% to 1.3%. It is an active asset manager that invests in high-quality, undervalued companies. Artisan focuses on long-term growth and innovation.

Its position in PayPal aligns with its strategy of identifying financially solid and scalable companies in the digital economy.

Deutsche Asset & Wealth Management

Deutsche Asset & Wealth Management, part of Deutsche Bank Group, owns approximately 1.2% of PayPal in 2025. The firm provides institutional and retail investment services across global markets.

Its stake in PayPal is generally held through technology-oriented mutual funds and large-cap growth portfolios.

Who is the CEO of PayPal?

As of 2025, Alex Chriss serves as President and Chief Executive Officer of PayPal Holdings, Inc. He assumed the role on September 27, 2023, succeeding Dan Schulman.

Here’s a quick summary of PayPal’s CEO:

- Position: President & CEO of PayPal

- Start Date: September 27, 2023

- Background: Nearly two decades at Intuit with leadership in the QuickBooks and Mailchimp divisions

- Vision: Transition PayPal from payments into a full commerce platform for consumers and merchants

- Strategic Priorities: AI, guest checkout (Fastlane), crypto and stablecoins, profitability over growth volume, small business enablement

- Financial Impact: Q2 2025 earnings beat expectations, raised outlook with stronger margins and EPS growth.

Early Career and Path to PayPal

Alex Chriss spent nearly 20 years at Intuit, where he held roles of increasing responsibility. He led the Small Business and Self‑Employed Group as Executive Vice President and General Manager. In that capacity, he oversaw products including QuickBooks and Mailchimp, helping drive growth from innovation and customer-first strategies.

Leadership Vision and Business Transformation

Chriss was chosen by PayPal’s board to reposition the company from a legacy payments provider into a broader commerce platform. He advocates for a model where PayPal connects merchants and consumers in a seamless, personalized ecosystem.

He emphasizes technology-driven value and long-term profitability over mere volume growth. To this end, pricing reforms in services like Braintree have been implemented to boost margins, even if transaction volume slows in the short term.

Key Strategies Under His Tenure

- Fastlane Guest Checkout: A one-click checkout option requiring no account login, aimed at improving user experience and conversion speed.

- AI Integration: Deploying AI tools for fraud detection, personalization, and Smart Receipts to assist merchants at scale.

- Stablecoin Innovation: Rolling out PayPal USD (PYUSD) and “Pay with Crypto” services, enabling US merchants to accept crypto payments and expanding PayPal’s presence in digital currency domains.

- PayPal World Platform: Spearheading global wallet interoperability through partnerships with Mercado Pago, UPI, Tenpay Global, and others to support seamless international payments.

Financial Results and Market Outlook

Under Chriss’s leadership, PayPal achieved strong profitability improvements. In Q2 2025, branded checkout and Venmo showed solid growth—Venmo’s revenue increased 20% and transaction margins rose 7%, while adjusted EPS rose to $1.40. The company raised its full-year profit forecast to $5.15–$5.30 per share, signaling investor confidence in the turnaround strategy.

Small Business and Merchant Focus

Chriss deeply prioritizes PayPal’s support for small- and medium-sized businesses. He has spoken publicly about how new tariff threats and operational costs may hurt these businesses. Under his leadership, PayPal has rolled out tools and finance options like Venmo expansion and AI-driven insights to empower merchant success.

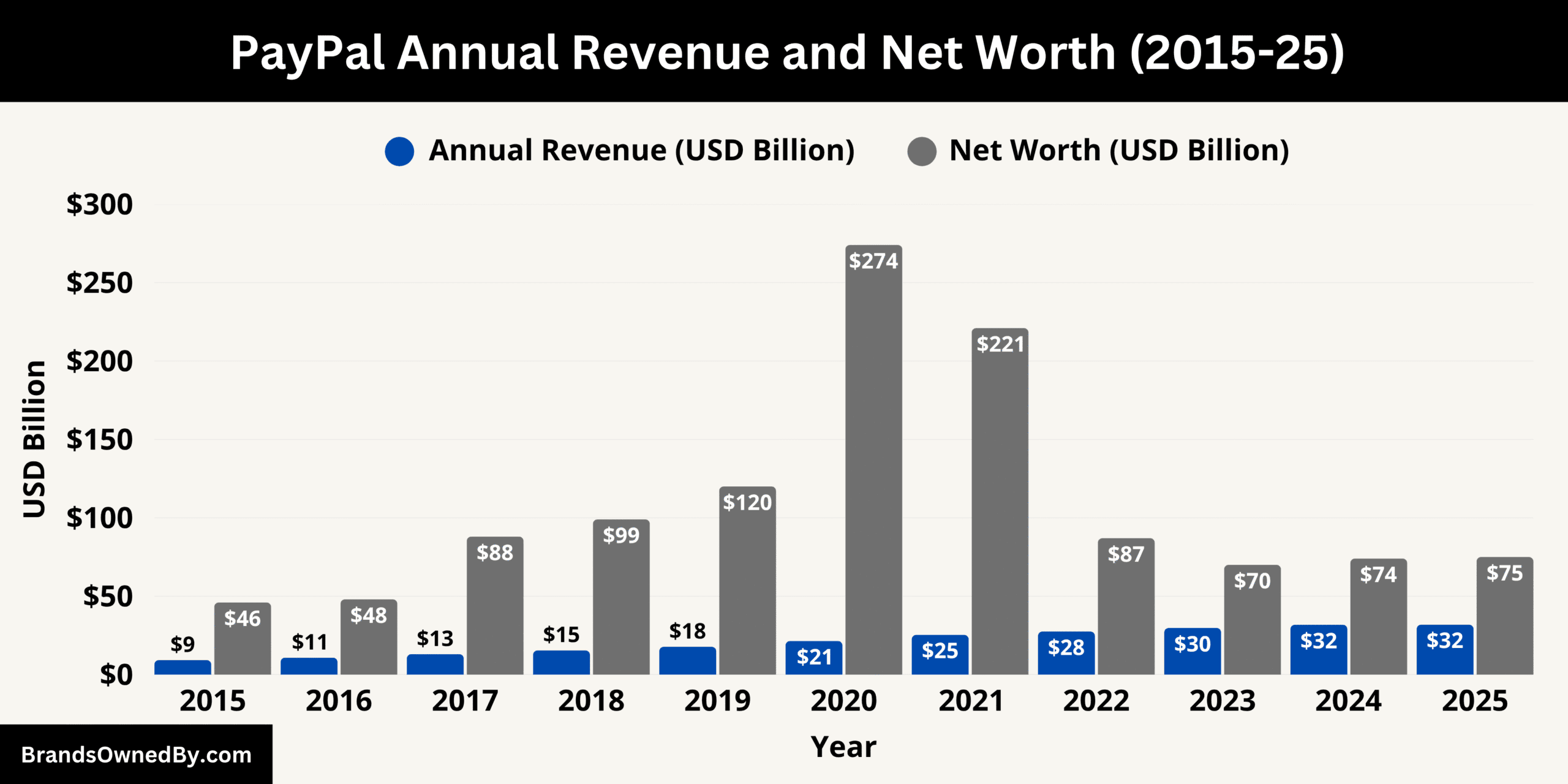

PayPal Annual Revenue and Net Worth

PayPal Holdings, Inc. has maintained a strong financial position in 2025, continuing its growth trajectory in digital payments. With strategic shifts toward AI integration, branded checkout optimization, and expanding Venmo features, the company delivered steady financial results in 2025.

2025 Revenue Performance

PayPal’s revenue for the trailing twelve months ending March 31, 2025, reached approximately $31.89 billion. This marks a 4.8% increase compared to the same period in the previous year.

The company had closed 2024 with full-year revenue of about $31.80 billion, which was a 6.8% rise from 2023’s $29.77 billion. These results reflect PayPal’s resilience and consistent performance, particularly in branded checkout and merchant solutions.

Growth was primarily fueled by higher transaction volumes and greater merchant adoption of PayPal’s tools across small and medium businesses globally.

Quarter-on-Quarter Highlights

In Q2 2025 alone, PayPal generated $8.29 billion in revenue. This figure not only exceeded Wall Street expectations but also demonstrated a 5% year-over-year increase. One standout performer during this period was Venmo, which saw an estimated 20% year-over-year growth, driven by its expanding set of payment and transfer features, including crypto transfers, debit card usage, and deeper merchant integration. Although PayPal does not publish Venmo’s revenue as a standalone figure, it remains a core engine of growth.

Net Worth and Market Capitalization

As of August 2025, PayPal’s net worth is around $75 billion. On July 18, 2025, its value was estimated at around $72.13 billion, while earlier in July, it had crossed $74 billion.

This reflects a modest but positive market sentiment, driven by operational efficiency and improving investor confidence under the leadership of CEO Alex Chriss. While PayPal’s market cap still trails legacy players like Visa and Mastercard, it remains one of the most valuable standalone fintech firms in the world.

Here is PayPal’s historical revenue and estimated net worth (market capitalization) for the past 10 years, from 2015 through 2025:

| Year | Annual Revenue (USD) | Year-End Market Cap / Net Worth (USD) |

|---|---|---|

| 2015 | $9.25 billion | ~$46 billion |

| 2016 | $10.84 billion | ~$48 billion |

| 2017 | $13.09 billion | ~$88 billion |

| 2018 | $15.45 billion | ~$99 billion |

| 2019 | $17.77 billion | ~$120 billion |

| 2020 | $21.45 billion | ~$274 billion |

| 2021 | $25.37 billion | ~$221 billion |

| 2022 | $27.52 billion | ~$87 billion |

| 2023 | $29.77 billion | ~$70 billion |

| 2024 | $31.80 billion | ~$74 billion |

| 2025 | $31.89 billion* | ~$72–75 billion (mid-year estimate) |

Payment Volume and Margin Expansion

In addition to revenue growth, PayPal’s total payment volume (TPV) in Q2 2025 hit $443.6 billion, a 6% increase from the same quarter in 2024. This rise indicates continued demand from users and merchants alike, especially in international markets. Moreover, transaction margin dollars—the amount PayPal earns after covering direct transaction costs—reached $3.8 billion in Q2, up 7% year-over-year. These gains underscore PayPal’s focus on maintaining strong profitability even amid changing consumer payment habits.

Profitability and Forward Outlook

PayPal’s improving profitability has led the company to revise its full-year 2025 adjusted earnings per share (EPS) guidance. Originally projected at $4.95 to $5.10 per share, the new forecast now stands between $5.15 and $5.30. This upward revision shows that the company expects to sustain healthy earnings even as it continues to invest in AI, risk management tools, and a simplified merchant experience. Growth in branded checkout and higher engagement across its core platform contributed heavily to this positive financial outlook.

Final Words

PayPal has grown far beyond being just an online payment tool. The list of companies PayPal owns shows how diversified and global its operations have become. From peer-to-peer apps like Venmo to e-commerce platforms like Honey and international services like Xoom and Paidy, PayPal has strategically built an ecosystem that touches nearly every aspect of digital finance. With strong leadership and major shareholders backing its growth, PayPal remains a dominant force in the fintech world.

FAQs

Which payment processing companies are owned by PayPal?

PayPal owns several payment processing companies. The most notable include Braintree, Hyperwallet, iZettle, and Paydiant. These companies provide a variety of services including merchant payment solutions, global payout systems, and mobile point-of-sale technology.

What companies are affiliated with PayPal?

Affiliated companies include those that operate under PayPal or in partnership with it. These include Venmo, Xoom, Honey, Braintree, Hyperwallet, and iZettle. While not subsidiaries, PayPal also maintains partnerships with companies like Visa, Mastercard, Meta, and Shopify.

How many companies has PayPal acquired?

As of 2025, PayPal has acquired over 20 companies since its spin-off from eBay in 2015. Major acquisitions include Braintree, iZettle, Xoom, Honey, Hyperwallet, and a newer AI startup in 2024 focused on payments and personalization.

Does PayPal own Venmo?

Yes, PayPal owns Venmo. Venmo was originally acquired by Braintree in 2012. When PayPal acquired Braintree in 2013, Venmo became a part of the PayPal family. It now serves as one of PayPal’s fastest-growing consumer-facing brands.

Is Cash App owned by PayPal?

No, Cash App is not owned by PayPal. It is owned and operated by Block, Inc., formerly known as Square, Inc., a major competitor in the peer-to-peer payments and fintech space.

Is Xoom part of PayPal?

Yes, Xoom is a subsidiary of PayPal. PayPal acquired Xoom in 2015 for about $890 million. Xoom specializes in international money transfers and digital remittances.

Does PayPal own Braintree?

Yes, PayPal owns Braintree. It acquired the company in 2013 for $800 million. Braintree provides payment gateway solutions for major brands and powers PayPal’s backend for many enterprise clients.

Does PayPal own eBay?

No, PayPal does not own eBay. The two companies were once linked, but eBay spun off PayPal into a separate, independent publicly traded company in 2015. They maintain some operational ties but are no longer under the same ownership.

Does PayPal own Zelle?

No, Zelle is not owned by PayPal. It is a competing digital payment service owned by Early Warning Services, LLC, which is owned by a consortium of major U.S. banks including Bank of America, Wells Fargo, and JPMorgan Chase.

Is Elon Musk the owner of PayPal?

No, Elon Musk is not the owner of PayPal. He was one of the original co-founders of X.com, which later merged with Confinity to form PayPal. Musk exited the company in the early 2000s when PayPal was sold to eBay. He currently holds no ownership or executive role in PayPal.

Is PayPal owned by Google?

No, Google does not own PayPal. PayPal is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol PYPL, and it operates independently.

Is PayPal owned by Amazon?

No, Amazon does not own PayPal. In fact, Amazon has its own payment services, including Amazon Pay, which competes directly with PayPal in the digital payments space.

Who owns PayPal company?

PayPal is a public company, so it is owned by its shareholders. The company has no single private owner. Its largest shareholders are a mix of institutional investors including mutual funds, asset managers, and index funds.

Does eBay own PayPal?

No, eBay does not own PayPal anymore. While eBay acquired PayPal in 2002, it spun it off as a separate company in 2015. Since then, PayPal has operated independently on the stock market.

Who owns the most shares of PayPal?

As of 2025, the largest shareholders of PayPal are institutional investors. The top three are:

- Vanguard Group Inc. – approximately 8.7% ownership

- BlackRock Inc. – approximately 7.3% ownership

- State Street Corp. – around 4.0% ownership

These institutions hold the most voting power in PayPal’s corporate decisions.