Meta is one of the most influential tech companies in the world. With Facebook, Instagram, and WhatsApp under its umbrella, many wonder who owns Meta and how its leadership and control are structured. Here’s a closer look at Meta’s ownership, financials, and the companies it owns.

History of Meta

Meta Platforms, Inc. has evolved dramatically since its inception. Originally launched as Facebook in 2004, the company has since expanded to encompass several social media platforms, virtual reality technologies, and a broader vision for the future known as the “metaverse.” Let’s break down the company’s journey through the years.

The Founding of Facebook (2004)

Facebook was founded by Mark Zuckerberg, Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes while they were students at Harvard University. Initially created to help college students connect, Facebook rapidly grew beyond university campuses. The platform’s success was built on its ability to connect people, allowing them to share content and communicate with friends.

Early Growth and Expansion (2004-2010)

By 2005, Facebook had become a popular social networking site, and it quickly surpassed other platforms like Friendster and MySpace. Facebook raised its first major round of venture capital funding in 2005, which allowed it to grow rapidly. By 2008, Facebook had reached 100 million users, and it began to monetize its platform through advertising.

In 2006, Facebook opened its doors to anyone with an email address, vastly expanding its user base and transforming it into a global social network.

IPO and Going Public (2012)

Facebook went public on May 18, 2012, with an initial public offering (IPO) that valued the company at $104 billion. Mark Zuckerberg, along with other company insiders, made significant gains from the IPO, cementing Facebook’s place as one of the largest tech companies globally.

This period also saw Facebook acquire several smaller companies, notably Instagram in 2012 and WhatsApp in 2014, both of which were integral to Meta’s strategy of diversifying its portfolio and growing its user base.

Rebranding to Meta (2021)

In October 2021, Facebook, Inc. officially rebranded to Meta Platforms, Inc. The rebrand was part of a strategic shift toward the development of the “metaverse,” a collective virtual shared space. Mark Zuckerberg emphasized the company’s focus on building technologies that would enable immersive experiences and allow users to interact in new digital spaces. Meta’s vision for the metaverse includes virtual and augmented reality platforms, social experiences, and immersive gaming.

This rebrand marked a new phase in the company’s identity, moving beyond its roots in social media to encompass broader technological ambitions.

Expansion into Virtual Reality and the Metaverse (2014-Present)

Meta’s venture into virtual reality began with the acquisition of Oculus VR in 2014 for $2 billion. Oculus was a pioneer in the VR space and is now the foundation for Meta’s Reality Labs division, which develops virtual reality hardware and software.

The company’s metaverse initiatives gained momentum with the launch of Horizon Worlds, a social virtual reality space, and the Meta Quest VR headsets. Meta’s push into the metaverse has been a central part of its growth strategy, although it has faced challenges, including financial losses in its VR and AR division.

Major Acquisitions (2005-2021)

Over the years, Meta has acquired a number of companies to strengthen its product offerings and expand into new areas. These acquisitions include:

- Instagram (2012): A photo and video-sharing platform that grew to become one of the largest social networks globally.

- WhatsApp (2014): A messaging service with over 2 billion active users.

- Oculus VR (2014): A virtual reality company that became the basis for Meta’s Reality Labs division.

- Kustomer (2020): A customer service platform that integrates with Meta’s messaging services.

- Giphy (2020): A platform for GIFs and stickers, which Meta later sold in 2023 due to regulatory concerns.

These acquisitions played a key role in Meta’s expansion beyond its flagship social media platform, Facebook.

Controversies and Challenges (2010-Present)

Despite its success, Meta has faced numerous controversies over the years, including privacy concerns, the spread of misinformation, and issues related to data security. One of the most notable controversies was the Cambridge Analytica scandal in 2018, which led to significant public scrutiny and calls for tighter regulation of Facebook’s data practices.

Meta has also faced scrutiny for its role in political discourse, particularly around elections, and its ability to curb harmful content on its platforms. These issues have prompted Meta to invest in new systems for content moderation, transparency, and user safety.

Focus on the Future: The Metaverse and Beyond (2021-Present)

In recent years, Meta has increasingly focused on the future of digital interaction, with a particular emphasis on the metaverse. This includes large investments in virtual and augmented reality technologies, including the development of the Meta Quest headsets, Horizon Worlds, and other immersive platforms.

The transition into the metaverse is a significant part of Meta’s long-term strategy, with Zuckerberg positioning the company to be a leader in the emerging virtual economy. However, this strategy is still in its early stages and has faced challenges, particularly with the cost of developing metaverse technologies and the reception from users and investors.

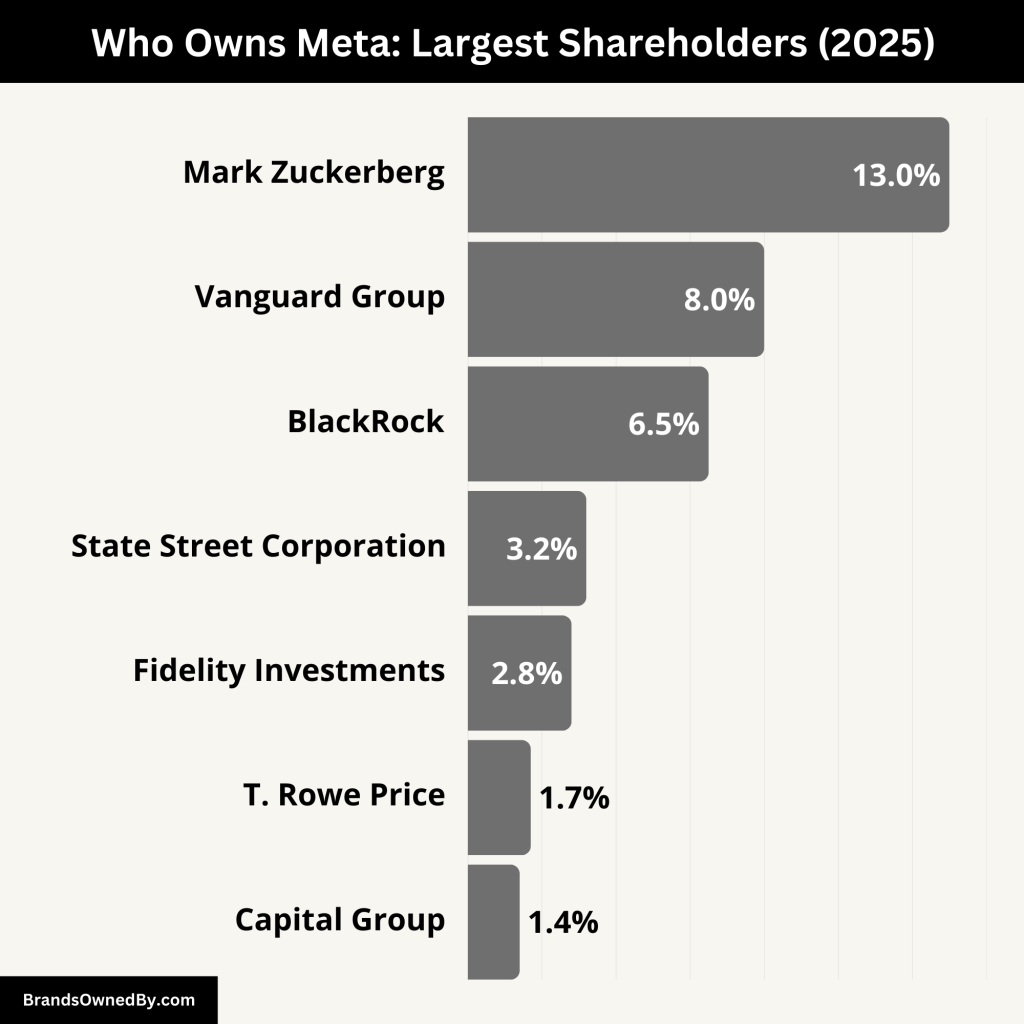

Who Owns Meta: Major Shareholders

Meta is a publicly traded company, but control lies heavily in the hands of its founder, Mark Zuckerberg. Through a dual-class share structure, Zuckerberg holds a dominant voting power despite owning a smaller percentage of total equity. This setup allows him to steer the company’s direction and long-term vision.

Below is an overview of the largest shareholders of Meta:

| Shareholder | Estimated Ownership (%) | Type | Voting Power/Influence | Role |

|---|---|---|---|---|

| Mark Zuckerberg | ~13% (equity) | Individual | Over 55% voting control via Class B shares | Founder, CEO, and controlling shareholder with full strategic authority. |

| Vanguard Group | ~8% | Institutional (Passive) | Influential in proxy voting and corporate governance | Largest institutional shareholder; advocates for governance standards. |

| BlackRock | ~6.5% | Institutional (Passive) | Participates in shareholder votes | Major global asset manager with long-term investment in Meta. |

| State Street Corporation | ~3.2% | Institutional (Passive) | Engaged in ESG-focused voting | Promotes board diversity and transparency. |

| Fidelity Investments | ~2.8% | Institutional (Active) | Votes in shareholder meetings | Supports accountability and AI/data privacy oversight. |

| T. Rowe Price | ~1.7% | Institutional (Active) | Participates in ESG and strategic voting | Long-term investor with an active investment strategy. |

| Capital Group | ~1.4% | Institutional (Active) | Minor influence; long-term focus | Holds Meta shares through American Funds portfolios. |

| Retail/Public Shareholders | ~20–25% (combined) | Individual/Institutional | Very limited voting power individually | Collectively influence stock price and participate in voting. |

Mark Zuckerberg – Founder and Controlling Shareholder

Mark Zuckerberg is the co-founder, CEO, and largest individual shareholder of Meta Platforms. As of 2025, he owns approximately 13% of Meta’s total Class A and Class B shares combined. However, due to the dual-class share structure, Zuckerberg holds over 55% of the company’s total voting power. This structure gives him the ability to unilaterally approve or reject any major corporate decision, including mergers, acquisitions, board appointments, and policy changes.

His Class B shares carry 10 votes per share, compared to Class A shares, which carry only one. Even if Zuckerberg sells a significant portion of his Class A shares, his control remains intact as long as he retains the Class B voting rights. This structure is common among tech founders and has helped him maintain long-term control over Meta’s vision, including its transition into the metaverse.

Vanguard Group – Largest Institutional Shareholder

The Vanguard Group is one of the largest asset management firms globally and holds about 8% of Meta’s Class A common stock. Vanguard’s stake is held on behalf of millions of investors through index funds and mutual funds.

While Vanguard does not have board-level influence or direct control, it plays a key role in shareholder voting during annual meetings. It advocates for governance standards, executive compensation policies, and long-term performance but generally does not interfere in daily operations.

BlackRock – Major Institutional Shareholder

BlackRock owns close to 6.5% of Meta’s outstanding shares, making it one of the top institutional investors. Similar to Vanguard, BlackRock manages this investment across its exchange-traded funds (ETFs), retirement accounts, and institutional portfolios.

BlackRock actively participates in corporate governance and proxy voting. While it supports long-term shareholder value, it does not influence Meta’s leadership decisions directly. Its primary role is advisory and financial oversight from an investor perspective.

Fidelity Investments

Fidelity holds around 2.8% of Meta’s outstanding shares through various mutual funds and retirement investment vehicles. While smaller in comparison to Vanguard and BlackRock, Fidelity is still a significant shareholder and participates in shareholder meetings and proxy votes.

Fidelity generally supports founder-led companies but promotes transparency and accountability in areas like data privacy, AI ethics, and environmental policies.

T. Rowe Price

T. Rowe Price is another large mutual fund investor, with a stake of roughly 1.7% in Meta. The firm is known for its active investment strategies and long-term focus. While it does not control any board seats, T. Rowe Price supports governance resolutions and ESG (Environmental, Social, and Governance) practices during voting sessions.

State Street Corporation

State Street holds about 3.2% of Meta shares. Like Vanguard and BlackRock, it is a passive investor that tracks indices like the S&P 500. State Street casts votes during shareholder meetings and advocates for ethical business practices and gender diversity on corporate boards.

Capital Group (American Funds)

Capital Group owns an estimated 1.4% of Meta shares through its various investment funds. It is known for investing in large-cap tech companies and often holds long-term positions. While it plays no direct governance role, its size makes it an influential financial stakeholder.

Retail and Public Shareholders

Aside from institutional investors and Mark Zuckerberg, a large portion of Meta’s ownership is spread across millions of retail investors worldwide. These shareholders purchase Meta shares through brokerage platforms like Robinhood, Charles Schwab, and E*TRADE.

Although individually they lack influence, collectively retail investors can impact the stock’s price, participate in shareholder meetings, and propose resolutions. However, due to Zuckerberg’s voting control, they have limited ability to influence major decisions.

Who is the CEO of Meta?

Mark Zuckerberg is the current CEO and chairman of Meta Platforms. He co-founded the company in 2004 while attending Harvard University and has remained its chief executive since day one. As of 2025, Zuckerberg is still actively leading Meta’s transformation from a social media company into a metaverse and artificial intelligence powerhouse.

He is known for his hands-on approach and long-term strategic thinking. Under his leadership, Meta has grown from a dorm-room startup into one of the world’s most valuable tech firms. He oversaw major acquisitions like Instagram, WhatsApp, and Oculus (now Meta Quest), and spearheaded the company’s rebranding in 2021.

Thanks to Meta’s dual-class share structure, Zuckerberg maintains over 55% of the voting power, giving him effective control over all major company decisions, including mergers, product direction, and executive appointments.

Executive Leadership Team

While Zuckerberg holds most of the control, he is supported by a robust executive leadership team that includes:

- Javier Olivan – Chief Operating Officer (COO), replacing Sheryl Sandberg in 2022. He oversees business operations and monetization.

- Susan Li – Chief Financial Officer (CFO), responsible for Meta’s financial planning and reporting.

- Andrew Bosworth – Chief Technology Officer (CTO), leading Reality Labs and Meta’s AR/VR initiatives.

- Nick Clegg – President, Global Affairs, managing policy and regulatory issues across markets.

These executives manage day-to-day operations, innovation, public policy, and internal development. However, final decisions typically go through Zuckerberg.

Decision-Making Structure at Meta

Meta operates with a centralized leadership model. Most strategic and high-level decisions are either made directly by Zuckerberg or shaped heavily by him. The company’s board of directors includes other prominent names, but due to his voting control, Zuckerberg’s vision typically dominates boardroom discussions.

This structure allows for long-term planning and consistency in leadership, but has also drawn criticism from corporate governance experts. Some investors have raised concerns about the lack of checks and balances at the top of Meta’s hierarchy.

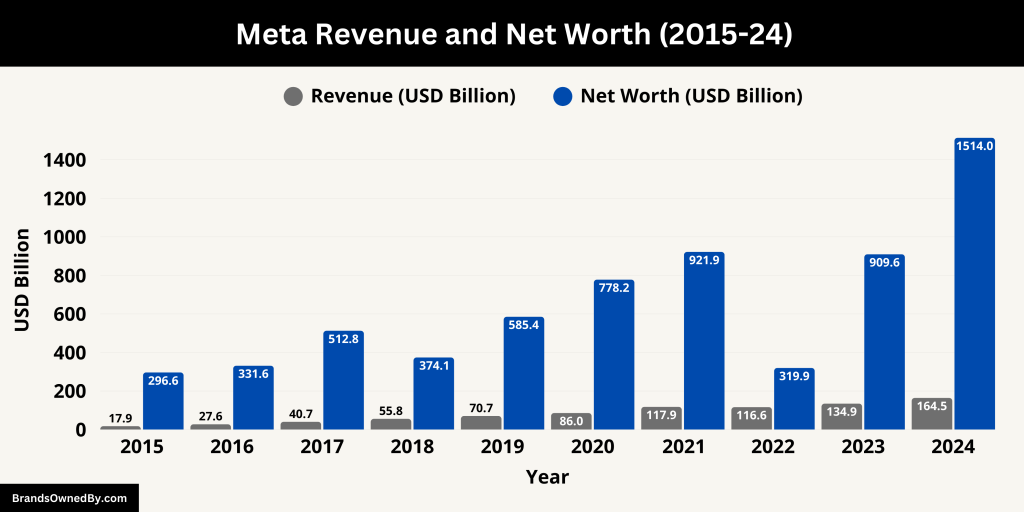

Annual Revenue and Net Worth of Meta

In 2024, Meta Platforms achieved a record-breaking annual revenue of $164.5 billion, marking a 21.94% increase from the previous year.

This growth was primarily driven by the company’s core segment, the Family of Apps—which includes Facebook, Instagram, WhatsApp, and Messenger—contributing approximately $162.36 billion, or 98.7% of the total revenue.

The remaining $2.15 billion was generated by Reality Labs, Meta’s division focused on virtual and augmented reality, reflecting a 13% year-over-year increase.

Meta’s net income for 2024 stood at $62.36 billion, with diluted earnings per share (EPS) of $23.86. The company also reported substantial cash reserves, holding $77.81 billion in cash, cash equivalents, and marketable securities by the end of the year.

Capital expenditures, including principal payments on finance leases, totaled $39.23 billion, while share repurchases amounted to $29.75 billion, and dividend payments reached $5.07 billion.

Meta Net Worth

As of April 2025, Meta Platforms’ net worth reached $1.569 trillion, positioning it as the seventh most valuable company globally.

This valuation reflects a 3.67% increase from the end of 2024, when the company’s market cap was $1.514 trillion. The growth in market capitalization underscores investor confidence in Meta’s strategic direction, particularly its investments in artificial intelligence and the metaverse.

The table below shows the historical revenue and net worth of Meta:

| Year | Revenue (USD) | Net Income (USD) | Market Cap (USD) |

|---|---|---|---|

| 2024 | $164.50 billion | $62.3 billion | $1.514 trillion |

| 2023 | $134.90 billion | $39.10 billion | $909.62 billion |

| 2022 | $116.61 billion | $23.20 billion | $319.88 billion |

| 2021 | $117.93 billion | $39.37 billion | $921.93 billion |

| 2020 | $85.97 billion | $29.15 billion | $778.23 billion |

| 2019 | $70.70 billion | $18.49 billion | $585.37 billion |

| 2018 | $55.84 billion | $22.11 billion | $374.13 billion |

| 2017 | $40.65 billion | $15.93 billion | $512.75 billion |

| 2016 | $27.64 billion | $10.22 billion | $331.59 billion |

| 2015 | $17.93 billion | $3.69 billion | $296.60 billion |

Brands and Companies Owned by Meta

Meta Platforms, Inc. owns a diverse portfolio of companies and brands that span social media, messaging, virtual reality, and artificial intelligence. Below is an overview of the major brands, companies, subsidiaries, and products owned by Meta:

| Company/Brand | Acquisition Date | Acquisition Cost | Notes |

|---|---|---|---|

| N/A | N/A | Founded by Mark Zuckerberg in 2004; core social media platform. | |

| April 2012 | $1 billion | Photo and video sharing platform; acquired to expand social media presence. | |

| February 2014 | $19 billion | Messaging service; acquired to enhance communication offerings. | |

| Messenger | N/A | N/A | Developed in-house; standalone messaging app derived from Facebook chat. |

| Threads | July 2023 | N/A | Text-based social networking app; developed internally. |

| Reality Labs | March 2014 | $2 billion (Oculus) | VR and AR division; originated from Oculus acquisition. |

| Meta AI | N/A | N/A | In-house AI research division; focuses on AI advancements. |

| Kustomer | November 2020 | ~$1 billion | Customer service platform; enhances business communication tools. |

| Beluga | March 2011 | Undisclosed | Group messaging app; technology integrated into Messenger. |

| Mapillary | June 2020 | Undisclosed | Street-level imagery platform; supports mapping and AR initiatives. |

| Ready at Dawn | June 2020 | Undisclosed | VR game developer; contributes to VR content for Meta’s platforms. |

| Downpour Interactive | April 2021 | Undisclosed | VR game developer; known for the game “Onward.” |

| BigBox VR | June 2021 | Undisclosed | VR game developer; creator of “Population: One.” |

| Within | October 2021 | Undisclosed | VR fitness app developer; known for “Supernatural.” |

| AI.Reverie | October 2021 | Undisclosed | Synthetic data company; aids in AI model training. |

| Presize | April 2022 | ~$100 million | AI-driven body measurement technology; enhances virtual try-on experiences. |

Launched in 2004, Facebook is Meta’s flagship social media platform. It offers features like News Feed, Groups, Marketplace, and Facebook Watch. Facebook remains a central hub for personal connections, community building, and digital advertising.

Acquired by Meta in 2012 for $1 billion, Instagram has grown into a leading photo and video-sharing platform. It boasts over 2 billion active users and generates significant advertising revenue. Recent updates include AI-powered content discovery, augmented reality shopping features, and enhanced monetization tools for creators.

Meta acquired WhatsApp in 2014 for $19 billion. This messaging app offers end-to-end encryption, voice and video calls, and business communication tools. Recent features include AI-powered chat assistance, multi-device support, and the introduction of WhatsApp Channels for following public figures and organizations.

Messenger

Originally part of Facebook, Messenger became a standalone app in 2011 following Meta’s acquisition of Beluga. It provides instant messaging, voice and video calls, and integrates with Instagram and WhatsApp for cross-platform communication. Messenger also features AI-powered chatbots and end-to-end encryption.

Threads

Launched in July 2023, Threads is Meta’s text-based social networking service integrated with Instagram. It allows users to share short posts and engage in public conversations. Threads rapidly gained popularity, reaching over 100 million users within its first five days.

Reality Labs

Formerly known as Oculus VR, Reality Labs is Meta’s division dedicated to virtual and augmented reality. It produces hardware like the Meta Quest series and develops platforms such as Horizon Worlds. Reality Labs also focuses on advanced technologies like neural interfaces and mixed reality experiences.

Meta AI

Established in 2015, Meta AI is the company’s research division for artificial intelligence. It works on projects related to machine learning, natural language processing, and computer vision. Meta AI has developed models like LLaMA and contributes to open-source AI research.

Kustomer

Acquired in 2020, Kustomer is a customer service platform that integrates with Meta’s messaging apps. It enables businesses to manage customer interactions across various channels, providing tools for support and engagement.

Beluga

Beluga was a group messaging app acquired by Meta in 2011. Its technology and team played a crucial role in developing Facebook Messenger, enhancing Meta’s messaging capabilities.

Giphy

Meta acquired Giphy in 2020 for approximately $400 million, aiming to integrate its vast GIF library into platforms like Instagram. However, due to regulatory concerns, Meta sold Giphy to Shutterstock in 2023 for $53 million.

Mapillary

Acquired in 2020, Mapillary is a street-level imagery platform that enhances Meta’s mapping and augmented reality capabilities. It contributes to the development of detailed maps for navigation and AR applications.

Ready at Dawn

In 2020, Meta acquired Ready at Dawn, a game development studio known for creating immersive VR experiences. The studio develops games for the Meta Quest platform, contributing to the expansion of Meta’s VR content library.

Downpour Interactive

Acquired in 2021, Downpour Interactive is the developer behind the popular VR game “Onward.” The acquisition bolstered Meta’s portfolio of VR gaming experiences available on the Meta Quest platform.

BigBox VR

Meta acquired BigBox VR in 2021, the studio behind the VR battle royale game “Population: One.” This acquisition aimed to enhance social gaming experiences within Meta’s VR ecosystem.

Within

In 2023, Meta acquired Within, a company specializing in immersive VR experiences. Within is known for developing the VR fitness app “Supernatural,” which combines workouts with virtual environments, aligning with Meta’s focus on health and wellness in VR.

AI.Reverie

Acquired in 2021, AI.Reverie is a synthetic data company that aids in training AI models. Its technology supports Meta’s efforts in improving computer vision and machine learning applications.

Presize

In 2022, Meta acquired Presize, a company specializing in AI-driven body measurement technology. This acquisition supports Meta’s e-commerce initiatives by enhancing virtual try-on experiences for online shoppers.

Final Words

Meta is a publicly traded company, but Mark Zuckerberg’s unique voting power gives him almost complete control. The company has grown from a college project into a global tech empire, driving social interaction, virtual reality, and AI. With strong revenues and ownership of major platforms like Facebook and Instagram, Meta continues to be a dominant force in the digital world.

FAQs

Who owns the most shares in Meta?

Mark Zuckerberg owns the most shares individually and controls the majority of voting power through special stock.

Is Meta a private company?

No, Meta is a public company traded on NASDAQ under the ticker symbol META.

Does Mark Zuckerberg control Meta?

Yes. He controls over 55% of the voting power, giving him effective control over the company’s direction.

What companies does Meta own?

Meta owns Facebook, Instagram, WhatsApp, Meta Quest, Threads, and others like Reality Labs and Meta AI.

What is Meta’s net worth?

As of 2025, Meta’s market value is estimated at around $950 billion.

What does Meta stand for?

Meta is a rebranding of Facebook, Inc., which was announced in October 2021. The name “Meta” is derived from the Greek word “μετά” (meta), meaning “beyond.” The rebrand reflects the company’s focus on developing the “metaverse,” a virtual reality space where people can interact with each other and the digital world in immersive ways.

Who owns the Meta app?

The Meta app, along with other major platforms such as Facebook, Instagram, and WhatsApp, is owned by Meta Platforms, Inc., which is a publicly traded company. Meta Platforms was founded by Mark Zuckerberg, and he holds a majority of the voting shares, giving him substantial control over the company.

Is Meta owned by Microsoft?

No, Meta is not owned by Microsoft. Meta Platforms, Inc. is a separate company founded by Mark Zuckerberg. While Microsoft and Meta are competitors in certain areas, such as virtual reality (Microsoft has the HoloLens), Meta is an independent entity.

Who owns Meta stock?

Meta’s stock is publicly traded on the NASDAQ under the ticker symbol “META.” It is owned by individual and institutional investors, including major investment firms, mutual funds, and retail investors. The largest shareholders are typically institutional investors such as Vanguard Group, BlackRock, and others, but Mark Zuckerberg, the CEO, holds a significant portion of the voting shares.

Is Snapchat owned by Meta?

No, Snapchat is not owned by Meta. Snapchat is owned by Snap Inc., which is a separate publicly traded company. Snap Inc. was founded by Evan Spiegel, Bobby Murphy, and Reggie Brown.

Who is the CEO of Meta?

The CEO of Meta is Mark Zuckerberg, who co-founded Facebook in 2004. He has remained the CEO since the company’s inception and continues to lead its transformation into the metaverse with a strong focus on virtual reality and social media.

Who owns and controls Meta?

Meta is a publicly traded company, so it is owned by its shareholders. Mark Zuckerberg, the CEO, controls Meta through a special class of voting shares, allowing him to maintain significant decision-making power despite owning a smaller portion of the total stock. Major institutional shareholders, like Vanguard and BlackRock, also own a large portion of the stock.

Is Meta owned by Facebook?

Meta is the parent company of Facebook. In October 2021, Facebook, Inc. changed its corporate name to Meta Platforms, Inc. to reflect its shift in focus toward the metaverse, a digital environment where people interact in virtual spaces. Facebook remains one of the key products under the Meta umbrella.

Who owns most of Meta?

Mark Zuckerberg, Meta’s CEO, is the largest individual shareholder and controls most of the voting shares of Meta, allowing him to maintain significant control over the company. While institutional investors such as Vanguard Group and BlackRock own large stakes, Zuckerberg’s voting power ensures he has the most influence over decision-making.

Is YouTube owned by Meta?

No, YouTube is not owned by Meta. YouTube is owned by Google’s parent company, Alphabet Inc. Meta, on the other hand, owns platforms like Facebook, Instagram, WhatsApp, and Messenger.

Who owned WhatsApp?

WhatsApp is owned by Meta Platforms, Inc. It was acquired by Meta in 2014 for approximately $19 billion. WhatsApp is one of Meta’s major messaging platforms, offering secure communication services for both individuals and businesses.

How does Meta make money?

Meta makes money primarily through advertising. It generates revenue by offering targeted advertising services on its social media platforms, such as Facebook, Instagram, and Messenger. Additionally, Meta earns revenue through virtual reality hardware sales (e.g., Meta Quest) and other services within its metaverse-related business lines.

What is the salary of Mark Zuckerberg?

Mark Zuckerberg’s base salary as the CEO of Meta is relatively modest at $1 per year, which is a symbolic salary. However, his wealth comes primarily from his substantial ownership stake in the company, as well as performance-based bonuses and other incentives tied to Meta’s stock price and business performance.

What does Meta own?

Meta owns several major platforms and technologies, including:

- Facebook: The core social media platform.

- Instagram: A photo and video-sharing app.

- WhatsApp: A messaging app.

- Messenger: A messaging service connected to Facebook.

- Threads: A text-based social media platform.

- Reality Labs: A division focused on virtual and augmented reality technologies.

- Meta AI: The company’s artificial intelligence division.

- Kustomer: A customer service platform.

- Giphy (until 2023): A GIF and animated sticker platform.

- Oculus VR: Now part of Reality Labs, focusing on virtual reality hardware and software.

- Other acquisitions: Including Mapillary, Ready at Dawn, Downpour Interactive, and more.