HomeGoods is a popular home décor and furniture store in the United States. Known for offering discounted, stylish pieces, many people wonder who owns HomeGoods and how the company operates behind the scenes. This article explores the ownership, leadership, and business structure of HomeGoods.

History of HomeGoods

HomeGoods was launched in 1992 as a single store. Its goal was to offer off-price home furnishings, décor, and accessories. The concept grew quickly due to its unique business model. HomeGoods didn’t manufacture products. Instead, it sourced high-quality goods at a discount from around the world.

Over time, it expanded into hundreds of locations across the U.S. Shoppers appreciated the ever-changing inventory and low prices. HomeGoods eventually became a part of a larger retail family. Today, it is one of the leading names in the home décor retail sector.

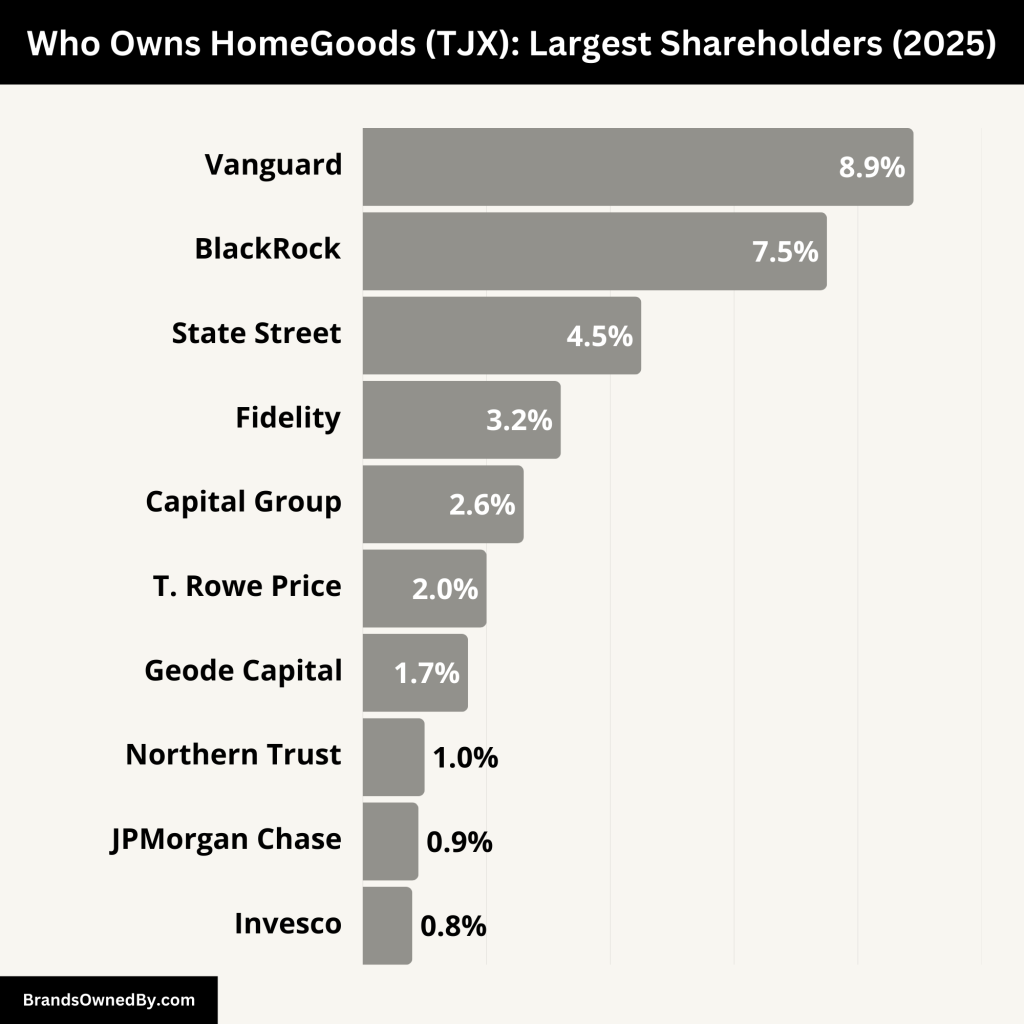

Who Owns HomeGoods: TJX Shareholder List

HomeGoods is owned by TJX Companies Inc., a multinational off-price department store corporation. TJX is a Fortune 100 company and owns several major retail brands. HomeGoods is one of its strongest divisions in the home segment.

TJX Companies operates as the parent company and has full ownership of HomeGoods. That means it manages HomeGoods’ branding, financial decisions, and operations.

TJX Companies is a publicly traded company listed on the New York Stock Exchange under the ticker symbol TJX. Its ownership is divided among public investors, mutual funds, and institutional shareholders as discussed below:

Here’s an overview of the major shareholders of TJX (the parent company that owns HomeGoods):

| Shareholder | Ownership % | Investment Type |

|---|---|---|

| Vanguard Group | 8.9% | Index Fund Manager |

| BlackRock Inc. | 7.5% | Institutional Holder |

| State Street Global | 4.5% | Passive Asset Manager |

| Fidelity (FMR LLC) | 3.2% | Active Mutual Fund |

| Capital Group | 2.6% | Long-Term Investor |

| T. Rowe Price | 2.0% | Mutual Fund Manager |

| Geode Capital | 1.7% | Sub-Advisor / Passive |

| Northern Trust | 1.0% | Institutional Custodian |

| JPMorgan Chase | 0.9% | Broad Asset Manager |

| Invesco Ltd. | 0.8% | ETF Provider |

| Ernie Herrman | <0.1% | Insider (CEO) |

| Carol Meyrowitz | <0.2% | Insider (Chairman) |

| Scott Goldenberg | <0.05% | Insider (CFO) |

| Rosemary Power | <0.02% | Insider (Group President) |

| Board & Executives | <1% (combined) | Corporate Insiders |

Vanguard Group

The largest shareholder of TJX Companies is Vanguard Group, one of the most influential asset managers globally. Vanguard controls approximately 8.9% of TJX’s outstanding shares. This stake is distributed across a wide range of passive index funds, such as the Vanguard Total Stock Market Index and the Vanguard 500 Index Fund.

Though Vanguard does not manage the company directly, its substantial ownership gives it powerful voting rights. This allows it to play a critical role in important decisions such as the election of directors and approval of corporate policies.

BlackRock Inc.

BlackRock ranks as the second-largest shareholder of TJX, with a holding of around 7.5%. The firm owns tens of millions of shares through its various funds, including iShares ETFs and other index-tracking portfolios.

As a passive investor, BlackRock does not engage in daily operations. However, it often pushes for responsible corporate governance and ESG practices, especially at companies where it holds significant stakes.

State Street Global Advisors

State Street, another giant in the index fund space, owns approximately 4.5% of TJX Companies. Its stake is typically held through funds like the SPDR S&P 500 ETF Trust.

State Street uses its voting power to influence decisions at shareholder meetings but generally does not get involved in management. Its long-term strategy aligns with the consistent, stable performance of TJX.

Fidelity Investments (FMR LLC)

Fidelity, a well-known mutual fund manager, owns an estimated 3.2% of TJX Companies. Unlike some other top shareholders, Fidelity actively manages its portfolios and often shifts positions based on market performance and strategic analysis.

This investment signals Fidelity’s confidence in TJX’s retail model, especially in the continued expansion of HomeGoods and its ability to attract value-focused consumers.

Capital Group (American Funds)

Capital Group, operating through its American Funds brand, holds close to 2.6% of TJX shares. The firm focuses on long-term value investing and typically maintains positions in companies with strong fundamentals and reliable performance.

Capital Group’s sustained interest in TJX reflects a positive outlook on the company’s future growth across all its retail brands.

T. Rowe Price Associates

T. Rowe Price, a global asset manager, has a stake of approximately 2.0% in TJX Companies. Its investment is held through various mutual funds aimed at capital appreciation and risk-adjusted growth.

T. Rowe Price favors companies with stable leadership, steady earnings, and long-term potential—traits that align well with TJX and its ownership of HomeGoods.

Geode Capital Management

Geode Capital, a less visible but significant institutional investor, owns around 1.7% of TJX shares. The firm acts as a sub-advisor to Vanguard and helps manage many of its index-based funds.

Although it doesn’t play an active role in governance, Geode contributes to the overall institutional voting bloc, influencing decisions through aggregated shares.

Northern Trust

With a holding of roughly 1.0%, Northern Trust is another institutional investor with a presence in TJX’s shareholder base. The firm primarily manages money for pension funds, corporations, and high-net-worth clients.

Its investment approach is usually conservative and focused on generating long-term value rather than speculative growth.

JPMorgan Chase

JPMorgan, one of the world’s largest financial institutions, holds an estimated 0.9% of TJX shares. These shares are managed across a wide spectrum of funds and institutional portfolios.

JPMorgan contributes market insights and liquidity, although its voting power is modest compared to the largest shareholders.

Invesco Ltd.

Invesco controls about 0.8% of the company, primarily through its ETF offerings such as the Invesco QQQ Trust. While not among the top three shareholders, it remains a notable player in the institutional ownership structure.

Insiders and Executives

Although institutional investors hold most of TJX’s equity, company insiders—executives and directors—also own a portion of the company. While small in percentage, these insider holdings are important because they tie leadership compensation to shareholder value.

Ernie Herrman, President and CEO of TJX Companies, holds over 700,000 shares. His equity-based compensation links his financial interests directly to the performance of the company, including HomeGoods.

Carol Meyrowitz, Executive Chairman and former CEO owns more than 1 million shares. She has been instrumental in shaping TJX’s brand portfolio and is a key figure in the company’s leadership structure.

Scott Goldenberg, the company’s CFO, holds around 400,000 shares, while Rosemary Power, Group President overseeing several business segments including HomeGoods, owns roughly 150,000 shares.

Other board members and senior executives also hold smaller stakes. Collectively, insider ownership is under 1%, but it reinforces leadership alignment with long-term shareholder goals.

Who Controls HomeGoods?

HomeGoods is a standalone brand with its own stores, it is not a separate company. It operates as a subsidiary of TJX Companies, which owns several off-price retail chains. As a result, control over HomeGoods is exercised through TJX’s centralized leadership structure and its corporate headquarters in Framingham, Massachusetts.

Oversight by TJX Executive Team

HomeGoods falls under the direct strategic and operational control of TJX Companies’ executive leadership, especially those overseeing the U.S. home and apparel segments. The executive team at TJX sets HomeGoods’ direction in areas like expansion, pricing, merchandising strategy, and supply chain operations.

Key decisions about HomeGoods are not made in isolation. Instead, they are part of a larger strategy that aligns with the company’s overall off-price retail model, which also includes T.J. Maxx, Marshalls, and HomeSense. All business units share centralized logistics and buying teams, giving TJX scale advantages across its banners.

Group President Overseeing HomeGoods: Rosemary Power

The day-to-day operations and strategy of HomeGoods are managed by Rosemary Power, who serves as Group President at TJX Companies. She is directly responsible for the HomeGoods and HomeSense divisions in the U.S., overseeing everything from store performance to merchandising strategies.

Under her leadership, HomeGoods has expanded its store count, revamped its customer experience, and pushed deeper into home décor and seasonal categories. Power has played a major role in brand differentiation—positioning HomeGoods as the go-to destination for unique, value-priced home items that change frequently.

Rosemary Power brings decades of experience in retail and is regarded as a detail-oriented, consumer-driven executive. She reports directly to the CEO, ensuring that HomeGoods’ strategy is fully aligned with TJX’s goals.

CEO Oversight: Ernie Herrman

While Rosemary Power manages HomeGoods day-to-day, ultimate oversight comes from Ernie Herrman, the President and CEO of TJX Companies. He is responsible for the performance of all TJX brands, including HomeGoods.

Herrman personally reviews brand-specific strategies, financial targets, and store expansion plans. He regularly communicates with group presidents, including Power, to ensure each brand remains profitable and in line with TJX’s off-price identity.

His experience in merchandising and brand growth has helped turn HomeGoods into one of the fastest-growing home retail chains in the U.S.

Coordination with Other Business Units

HomeGoods does not function in a silo. It shares systems and infrastructure with other TJX brands, including:

- Centralized buying and sourcing teams who select merchandise across brands.

- Unified supply chain and logistics, managed at the corporate level.

- Marketing and branding strategies, which are adapted from TJX’s broader playbook.

This integration means that while HomeGoods has unique leadership through Rosemary Power, its operations are closely tied to the broader strategic priorities of TJX Companies.

Board-Level Influence

The TJX board of directors, led by Carol Meyrowitz as Executive Chairman, also has influence over HomeGoods. While they don’t make direct decisions about the brand, they approve major corporate initiatives that affect HomeGoods, such as capital investments, real estate expansion, and leadership appointments.

Board-level oversight ensures that HomeGoods remains consistent with TJX’s long-term vision and delivers returns for shareholders.

Annual Revenue and Net Worth of HomeGoods

In fiscal year 2024, HomeGoods, a division of TJX Companies, reported significant growth:

Segment Profit: HomeGoods reported a segment profit of $861 million, reflecting a 10.3% profit margin, up from 8.9% in the prior year.

Annual Net Sales: HomeGoods achieved net sales of $8.99 billion, marking a 9% increase from the previous year’s $8.26 billion.

Comparable Store Sales: The brand experienced a 3% rise in comparable store sales, driven by increased customer traffic.

The net worth of HomeGoods is not publicly reported separately since it is not a standalone company. But its success helps drive TJX’s market valuation which stands at $134.33 billion as of April 2025.

Here is a historical revenue and segment profit table for HomeGoods:

| Year | Revenue (in Billions USD) | Segment Profit (in Millions USD) | Growth (Revenue) |

|---|---|---|---|

| 2014 | 4.26 | 330 | – |

| 2015 | 4.66 | 360 | 9.4% |

| 2016 | 5.14 | 400 | 10.3% |

| 2017 | 5.64 | 430 | 9.7% |

| 2018 | 6.11 | 470 | 8.4% |

| 2019 | 6.58 | 510 | 7.7% |

| 2020 | 7.04 | 550 | 7.0% |

| 2021 | 7.68 | 580 | 9.1% |

| 2022 | 8.26 | 600 | 7.5% |

| 2023 | 8.99 | 861 | 8.9% |

| 2024 | 9.386 | 1,021 | 4.3% |

Brands Owned by HomeGoods

HomeGoods, as a leading off-price home retailer, operates several key brands within its portfolio. These brands cater to different aspects of home furnishings, décor, and seasonal items. Here are the major brands under HomeGoods’ direct operations:

HomeGoods Store Brand

The HomeGoods store brand is itself the flagship retail brand under TJX Companies’ home division. It is renowned for offering a wide array of high-quality, value-priced products that include:

- Home décor: From furniture to wall art, lighting, rugs, and curtains, HomeGoods offers a curated collection of home décor from both well-known designers and lesser-known local and global manufacturers.

- Kitchen and dining: Offering everything from dinnerware to storage, cookware, and small appliances.

- Bedding and furniture: With unique items ranging from luxury bedding sets to budget-friendly furniture, HomeGoods meets the needs of various customer segments.

- Seasonal collections: HomeGoods is known for its ever-changing seasonal inventory, including decorations for holidays and special events.

The brand thrives by providing customers with new arrivals and limited-time offers, fostering an exciting shopping environment. HomeGoods does not manufacture all of its products but instead sources them from various manufacturers, often overstock and discontinued lines, providing savings to customers.

Homesense

Homesense is a retail concept that operates under the HomeGoods brand in specific markets, particularly in the United States and Canada. Homesense is similar to HomeGoods, but it focuses more on larger furniture items and a broader range of home furnishings.

- Product Offering: Homesense stores typically feature higher-end furniture such as sofas, tables, and other large items. They also carry home accessories like vases, rugs, and decorative pieces.

- Exclusive Partnerships: The Homesense brand frequently collaborates with high-end brands and designers, offering exclusive pieces that are often not found in HomeGoods locations.

- Store Experience: Homesense offers a more spacious layout than HomeGoods stores, providing a distinct shopping experience focused on larger furniture and decor items. Many stores also include a separate section for outdoor furniture, plants, and other garden-related items.

Homesense operates in select locations and is growing in popularity, with a model that adapts to both urban and suburban areas. It serves as a complementary brand to HomeGoods, often carrying items that are too large or specialized for HomeGoods’ typical product range.

PureHome by HomeGoods

PureHome is a private-label brand offered exclusively in HomeGoods stores. It focuses on delivering affordable luxury in home furnishings, with an emphasis on timeless designs and premium materials.

- Product Range: PureHome’s offerings include luxury bedding, furniture, wall art, and textiles. The brand is designed to cater to consumers looking for a more upscale shopping experience at a fraction of the price of traditional high-end brands.

- Material Quality: Many PureHome products use sustainable and high-quality materials such as organic cotton, wool, and solid wood, aiming to deliver better value without compromising on craftsmanship.

- Design Aesthetic: The style of PureHome products is inspired by modern and contemporary trends, often integrating minimalist, Scandinavian, or industrial design elements.

This brand allows HomeGoods to offer its customers a more exclusive and refined shopping experience while maintaining its commitment to affordability.

TK Maxx (International)

While TK Maxx is more commonly associated with the UK and Europe, it operates similarly to HomeGoods, with a strong presence in international markets. TK Maxx (called TJ Maxx in the U.S.) carries a mix of both fashion and home items, including furniture, décor, and bedding.

- Distinctive Offerings: TK Maxx’s home offerings are tailored to international preferences and often include unique, locally sourced pieces. Its international appeal lies in the broad mix of home décor and furniture available at competitive prices.

- Collaborations and Designer Brands: Similar to HomeGoods, TK Maxx offers merchandise from designer brands at discounted prices, often sourcing overstock and exclusive collections directly from renowned designers.

Though it operates separately from HomeGoods in terms of branding, TK Maxx provides an integrated experience in markets outside of the U.S. for customers seeking both fashion and home goods at discounted rates.

Final Words on Who Owns HomeGoods

The answer is TJX Companies Inc.

This retail giant manages a portfolio of successful brands across the globe. While individual shareholders like Vanguard and BlackRock hold large stakes in TJX, they don’t directly control HomeGoods. Instead, corporate executives manage the brand’s operations.

HomeGoods continues to thrive under TJX, offering high-quality home products at affordable prices. With a loyal customer base and strong parent company, it remains a major player in the home décor market.

FAQs

What company owns HomeGoods?

HomeGoods is owned by TJX Companies Inc., which also owns TJ Maxx, Marshalls, and other discount retailers.

Is HomeGoods publicly traded?

HomeGoods itself is not publicly traded. However, its parent company, TJX Companies, is listed on the New York Stock Exchange under the ticker symbol TJX.

Who is the CEO of HomeGoods?

HomeGoods does not have a separate CEO. It is managed under TJX Companies, led by CEO Ernie Herrman.

Does TJ Maxx own HomeGoods?

No, TJ Maxx and HomeGoods are sister brands. Both are owned by TJX Companies but operate as separate entities under the same corporate umbrella.

Are HomeGoods and HomeSense the same?

They are similar but not the same. HomeGoods operates mainly in the U.S., while HomeSense serves markets in Canada and Europe. Both are owned by TJX Companies.