Bank of America is one of the largest financial institutions in the United States. With millions of customers and trillions in assets, people often wonder who owns the Bank of America.

In this article, we explore its history, ownership, and the corporations it owns.

Let’s get rolling…

History of Bank of America

Bank of America traces its roots back to 1904. It began as the Bank of Italy, founded in San Francisco by Amadeo Giannini. It was created to serve immigrants who were denied services from other banks.

In 1930, the Bank of Italy merged with Bank of America, Los Angeles. The resulting institution adopted the name Bank of America. Over the decades, it grew rapidly through acquisitions. It became one of the “Big Four” banks in the United States.

A major milestone came in 1998 when NationsBank acquired Bank of America. Although NationsBank was the buyer, the merged company retained the Bank of America name and moved its headquarters to Charlotte, North Carolina. Today, it is a global leader in consumer and corporate banking.

Who Owns the Bank of America?

Bank of America is a publicly traded company listed on the New York Stock Exchange under the ticker symbol BAC. That means its ownership is split among institutional investors, individual shareholders, and mutual funds. No single person owns the Bank of America. Instead, the largest shareholders are financial institutions.

The biggest shareholder is Berkshire Hathaway led by billionaire Warren Buffett. However, even Berkshire’s stake represents only a fraction of the total shares, so it doesn’t control the bank alone.

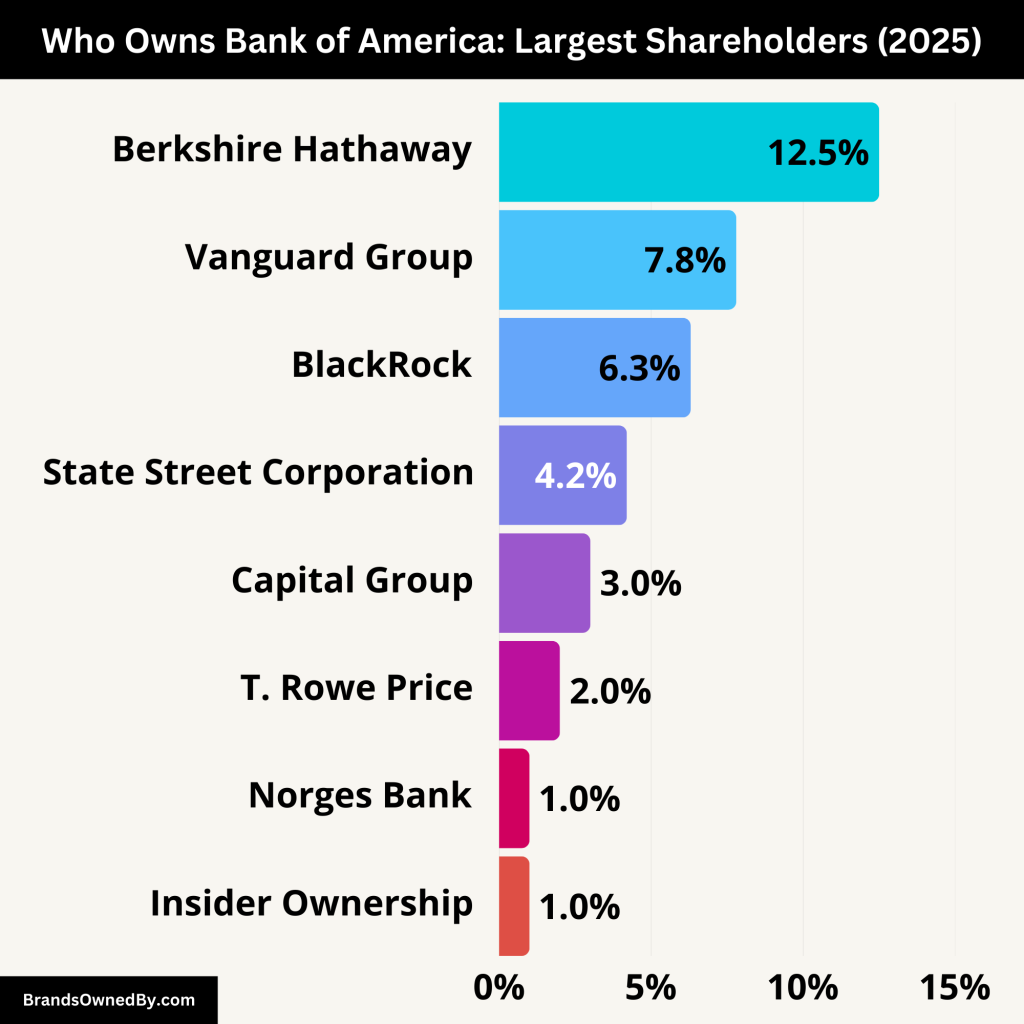

Below is an overview of the largest shareholders of the Bank of America:

| Shareholder | Estimated Ownership | Type | Role / Influence |

|---|---|---|---|

| Berkshire Hathaway Inc. | ~12.5% | Institutional (Active) | Largest shareholder, influential in investor sentiment but no operational control |

| Vanguard Group Inc. | ~7.8% | Institutional (Passive) | Significant voting power, influences corporate governance |

| BlackRock Inc. | ~6.3% | Institutional (Passive) | Major index fund investor, engages in proxy voting and governance advocacy |

| State Street Corporation | ~4.2% | Institutional (Passive) | ETF and retirement fund manager, votes on shareholder matters |

| Capital Group Companies | ~2.5% – 3% | Institutional (Active) | Engages in active investing and proxy voting |

| T. Rowe Price Associates | ~2% | Institutional (Active) | Mutual fund manager, participates in governance through active engagement |

| Norges Bank Investment Management | ~1% | Sovereign Wealth Fund | Long-term investor, active in corporate sustainability and governance discussions |

| Public Shareholders | ~15% – 20% (collective) | Individual Retail Investors | Fragmented ownership, limited influence, but significant in total |

| Mutual Fund Holders | Part of top 5 holders | Investment Funds | Represent millions of indirect investors, vote through fund managers |

| Insider Ownership | <1% | Executives & Directors | Direct influence through leadership roles, aligned with shareholder interests |

Berkshire Hathaway Inc.

Berkshire Hathaway is the largest single shareholder of Bank of America, holding approximately 12.5% of the outstanding shares. The company, led by Warren Buffett, initially invested in the bank during the 2008 financial crisis and later increased its position through warrant conversions.

While Berkshire Hathaway does not participate in the day-to-day operations of the bank, its substantial ownership makes it highly influential in shareholder matters. Buffett’s long-term investment strategy and reputation for value investing continue to reflect confidence in Bank of America’s stability and profitability.

Vanguard Group Inc.

The Vanguard Group is one of the largest institutional investors in Bank of America, with an ownership stake of around 7.8%. Vanguard is known for managing a wide array of index funds and ETFs, which include Bank of America stock across various portfolios.

\Though Vanguard takes a passive investment approach, its large voting power allows it to influence board elections and major policy decisions during annual shareholder meetings. However, it does not engage directly in managing the bank’s operations.

BlackRock Inc.

BlackRock holds roughly 6.3% of Bank of America’s shares through its global asset management business. Like Vanguard, BlackRock includes Bank of America in several index funds and institutional investment products.

The firm has substantial influence through proxy voting and often participates in shareholder governance matters. Despite its sizeable stake, BlackRock remains a passive investor and does not direct the bank’s corporate strategies or executive decisions.

State Street Corporation

State Street Corporation owns about 4.2% of Bank of America and ranks among the top institutional holders. It holds these shares primarily through ETFs and retirement funds.

As with other passive investors, State Street does not engage in active management but does participate in corporate governance by voting on shareholder proposals and board member elections. Its influence lies in the collective weight of the funds it manages on behalf of institutional and retail investors.

Capital Group Companies

Capital Group Companies, the parent of American Funds, is an active investment manager that owns an estimated 2.5% to 3% of Bank of America. Unlike passive funds, Capital Group actively selects companies based on fundamental analysis and long-term growth potential.

While it does not control the company, it can exercise meaningful influence through shareholder engagement and proxy votes, especially on issues related to performance and executive compensation.

T. Rowe Price Associates

T. Rowe Price Associates maintains a holding of approximately 2% in Bank of America through its actively managed mutual funds. The firm conducts in-depth research to guide its investment decisions and often engages with portfolio companies on strategic and governance-related topics.

While its ownership share is relatively modest compared to the top institutional holders, T. Rowe Price remains a respected voice in the shareholder community and participates actively in voting.

Norges Bank Investment Management

Norges Bank, which manages Norway’s sovereign wealth fund, holds about 1% of Bank of America’s outstanding shares. As a long-term global investor, Norges Bank follows a responsible investment philosophy and frequently engages with companies on issues like sustainability, diversity, and executive pay. It does not exert operational control but maintains influence through consistent shareholder activism and transparency standards.

Public Shareholders (Retail Investors)

Retail investors collectively hold an estimated 15% to 20% of Bank of America shares. These are individual shareholders who purchase stock through brokerage accounts or investment apps. While each investor’s stake is small, their combined ownership represents a meaningful portion of the bank’s equity base.

However, retail investors typically do not coordinate their votes, and their influence on governance or policy decisions is minimal unless organized through proxy advisory groups or advocacy platforms.

Mutual Fund Holders

Many mutual funds hold substantial stakes in Bank of America as part of their broader portfolio strategies. For example, the Vanguard Total Stock Market Index Fund, Fidelity Contrafund, and iShares Core S&P 500 ETF are among the top mutual fund holders.

These funds manage assets on behalf of millions of investors, including individuals, retirement plans, and institutions. Though they do not individually control the bank, the fund managers wield considerable voting power during annual meetings.

Insider Ownership

Executives and board members of Bank of America own less than 1% of the company’s shares. These insiders include CEO Brian Moynihan and other top officers, who receive equity-based compensation.

While their shareholding is relatively small, their strategic and operational decisions significantly influence the company’s direction. Insider ownership also aligns management interests with those of shareholders, especially in terms of long-term performance and shareholder value.

Who Controls Bank of America?

Control of Bank of America rests with its Board of Directors and executive leadership. The CEO and management team oversee day-to-day operations. The board is responsible for major strategic decisions and corporate governance.

Brian Moynihan is the Chairman and CEO. He has led the company since 2010. Under his leadership, the bank has expanded digital banking and recovered from the 2008 financial crisis.

Below are the key entities and individuals that control the bank:

Executive Leadership

The executive leadership team is responsible for running the company’s day-to-day operations. They oversee the bank’s major divisions, manage risk, allocate capital, and implement strategic plans approved by the board. Each executive reports to the CEO and plays a critical role in financial performance and compliance.

The executive team includes leaders from the banking, legal, technology, and risk management departments. Together, they ensure that Bank of America meets regulatory standards, serves clients effectively, and maintains competitiveness in global markets.

CEO: Brian Moynihan

Brian Moynihan is the Chairman and Chief Executive Officer of Bank of America. He has held the CEO position since January 1, 2010. Moynihan joined the company in 1993 following its acquisition of FleetBoston Financial, where he had held several senior positions. Over the years, he has led various departments, including global corporate and investment banking, wealth management, and consumer banking.

Under Moynihan’s leadership, Bank of America has undergone a significant transformation. He steered the bank through the aftermath of the financial crisis, streamlined operations, reduced risk exposure, and expanded digital banking. He has also emphasized sustainable finance and inclusive growth, making ESG (environmental, social, and governance) principles part of the company’s long-term strategy.

As both CEO and Chairman, Moynihan holds substantial authority over corporate direction, executive appointments, and long-term planning. He reports directly to the Board of Directors and represents the company in front of regulators, investors, and global stakeholders.

Board of Directors

The Board of Directors oversees corporate governance and provides oversight to the CEO and executive team. The board is composed of both internal and independent directors from diverse professional backgrounds, including finance, technology, law, academia, and government.

Their responsibilities include approving strategic plans, reviewing financial performance, managing executive compensation, and evaluating risk management frameworks. The board also ensures the bank complies with federal and international banking regulations.

Independent directors form the majority of the board, helping to ensure objectivity and accountability. The board is also responsible for selecting and evaluating the performance of the CEO.

Committees of the Board

The Board of Directors operates through specialized committees to address specific areas of oversight. These include:

- Audit Committee: Monitors financial reporting and compliance with legal requirements.

- Risk Committee: Oversees the bank’s risk profile and related governance.

- Compensation and Human Capital Committee: Reviews executive compensation and HR strategies.

- Corporate Governance Committee: Manages board structure, ethics policies, and governance matters.

These committees ensure that controls are in place to manage financial, operational, and reputational risk across the bank’s operations.

Annual Revenue and Net Worth of Bank of America

Bank of America reported a revenue of more than $98.6 billion in 2024. Its net income for the same year was approximately $27 billion.

As of April 2025, the bank’s market capitalization is around $280.4 billion. This makes it one of the most valuable banks globally. The bank also holds over $3.2 trillion in total assets, placing it among the top banks in the U.S.

Revenue consists mainly of net interest income (from loans, credit cards, and mortgages) and non-interest income (such as investment banking fees and service charges). Net worth, in terms of market capitalization, fluctuates with the company’s stock price and investor sentiment. Both figures reflect the health and scale of Bank of America’s business.

The table below shows the annual revenue and approximate market capitalization (net worth) of Bank of America from 2015 to 2024:

| Year | Revenue (USD Billion) | Net Worth / Market Cap (USD Billion) |

|---|---|---|

| 2024 | 98.6 | 280.4 |

| 2023 | 94.9 | 233.5 |

| 2022 | 92.4 | 233.7 |

| 2021 | 89.1 | 365.0 |

| 2020 | 85.5 | 267.4 |

| 2019 | 91.2 | 327.7 |

| 2018 | 91.2 | 263.0 |

| 2017 | 87.3 | 308.0 |

| 2016 | 83.7 | 231.0 |

| 2015 | 82.5 | 171.0 |

Companies Owned by the Bank of America

Bank of America operates through a complex network of subsidiaries and divisions that provide banking, investment, and financial services to individuals, corporations, and governments worldwide. These companies are fully or majority-owned and contribute to Bank of America’s revenue, customer base, and market dominance.

Here’s an overview of the major brands and companies owned by Bank of America including subsidiaries and joint ventures:

| Company / Division / Subsidiary | Type | Description |

|---|---|---|

| Bank of America, N.A. | Core Banking Subsidiary | Main U.S. banking arm handling consumer and commercial banking services. |

| Merrill Lynch Wealth Management (Merrill) | Wealth Management Division | Offers full-service financial planning, investment advice, and brokerage. |

| Bank of America Private Bank | Private Wealth Subsidiary | Serves ultra-high-net-worth individuals with estate and trust services. |

| BofA Securities | Investment Banking Division | Handles global M&A, underwriting, trading, and capital markets services. |

| FIA Card Services | Credit Card Subsidiary | Manages credit card operations, formerly part of MBNA. |

| Balboa Insurance Group (legacy) | Insurance Subsidiary | Provided lender-placed insurance; mostly sold off to QBE Insurance. |

| Bank of America Merrill Lynch International | Global Subsidiary | Oversees international investment banking, mainly in EMEA regions. |

| BAC North America Holding Company | Holding Company | Manages internal subsidiaries and structures for U.S. operations. |

| BANA Holdings Corporation | Holding Company | Oversees structured finance assets and legal entity control. |

| BA Continuum India Pvt. Ltd. | Technology & Ops Subsidiary | Offshore support for tech, compliance, and enterprise services. |

| Merrill Edge | Digital Investment Platform | Hybrid self-directed investing and advisor-assisted platform. |

| BofA Japan Co., Ltd. | International Subsidiary | Provides capital markets, research, and M&A services in Japan. |

| BofA Canada Bank | International Subsidiary | Commercial banking services for Canadian and cross-border clients. |

| Zelle (via Early Warning Services) | Joint Venture | Real-time peer-to-peer payments platform owned collectively by major U.S. banks. |

| Interbank Card Association (Mastercard) (historic) | Former Joint Venture | BofA helped found what became Mastercard; no current ownership. |

Merrill Lynch Wealth Management

Merrill Lynch, now formally known as Merrill (a division of Bank of America), is one of the most recognizable names in wealth management. Bank of America acquired Merrill Lynch in 2009 during the global financial crisis in a landmark $50 billion deal. The acquisition brought a vast network of financial advisors, investment products, and high-net-worth clients under the Bank of America umbrella.

Today, Merrill provides personalized financial planning, brokerage services, retirement solutions, and portfolio management. It serves both affluent individuals and institutional clients and contributes significantly to the bank’s non-interest income through fees and asset management.

Bank of America Private Bank

Formerly known as U.S. Trust, the Bank of America Private Bank caters to ultra-high-net-worth individuals, families, and institutions. The division offers highly customized services, including estate planning, philanthropy management, trust administration, tax strategies, and alternative investments.

This subsidiary is an important part of Bank of America’s Global Wealth and Investment Management division. It provides white-glove service for clients with complex financial needs and is a leader in trust services and legacy planning in the U.S.

BofA Securities

BofA Securities is Bank of America’s global investment banking and trading arm. It was created after the full integration of Merrill Lynch’s investment banking business. BofA Securities handles mergers and acquisitions (M&A), equity and debt underwriting, leveraged finance, and capital markets advisory.

It also operates in sales and trading across equities, fixed income, currencies, and commodities. This subsidiary plays a key role in Bank of America’s corporate and institutional client business and is a top-tier player on Wall Street.

Balboa Insurance Group

Balboa Insurance Group was once a wholly owned insurance subsidiary of Bank of America. It provided lender-placed insurance and risk management solutions, mainly for mortgage lenders. While it was an important business post-financial crisis, Bank of America sold much of this division to QBE Insurance in 2011.

Today, any remaining Balboa-related activities are minimal and mostly administrative. It’s no longer a core part of Bank of America’s operations, but it’s worth noting due to its historical role in the bank’s real estate and mortgage services.

FIA Card Services

FIA Card Services is the legal entity behind many of Bank of America’s credit card operations. Originally a legacy brand from MBNA (which BofA acquired in 2006), FIA is still used for issuing and servicing certain types of credit card products.

While the “FIA” branding is rarely seen by customers, it exists behind the scenes to manage compliance, regulatory filings, and contractual obligations related to BofA’s massive consumer credit portfolio. This unit is critical to the bank’s consumer banking and lending operations.

Bank of America Merrill Lynch International

This is the international arm of Bank of America’s investment banking operations, primarily based in London and operating under European and UK regulatory regimes. It manages cross-border deals, European trading operations, and services for multinational clients.

Following Brexit, Bank of America moved significant assets and staff to its European headquarters in Dublin to maintain seamless EU access. This division enables the bank to stay competitive in the global financial markets outside the U.S.

BAC North America Holding Company

BAC North America Holding Company is a holding entity used to manage several U.S.-based Bank of America subsidiaries. It helps consolidate the bank’s legal structure and streamline operations. This entity doesn’t offer services directly to customers but plays a vital organizational and regulatory role behind the scenes.

BANA Holdings Corporation

BANA Holdings Corporation is another internal holding company used for managing specific investment portfolios, structured finance assets, and regulatory reporting. Like BAC North America, it is designed to help organize Bank of America’s vast network of subsidiaries and obligations efficiently under U.S. and international law.

Bank of America, N.A. (National Association)

Bank of America, N.A. is the core banking subsidiary and the legal entity behind most of Bank of America’s consumer and commercial banking operations in the United States. It handles checking and savings accounts, loans, mortgages, credit cards, and business banking services.

This subsidiary is regulated by the Office of the Comptroller of the Currency (OCC) and is a member of the FDIC. It serves tens of millions of customers through thousands of branches and ATMs across the country. It also offers online and mobile banking platforms used by over 55 million digital customers.

BA Continuum India Pvt. Ltd.

BA Continuum India is a wholly owned subsidiary of Bank of America that provides technology, operations, and support services. It has offices in Hyderabad, Mumbai, and Gurgaon. The company is part of Bank of America’s Global Delivery Center and is critical in supporting risk management, data analytics, compliance operations, and IT services.

It functions as an offshore backbone for much of the bank’s infrastructure and enterprise-wide support systems. BA Continuum ensures round-the-clock service coverage and helps drive the bank’s digital and automation strategies.

Merrill Edge

Merrill Edge is Bank of America’s digital investment platform, created as a hybrid between self-directed online brokerage and professional financial guidance. It was launched after the acquisition of Merrill Lynch to serve mass-affluent customers who don’t necessarily require full-service wealth management.

Merrill Edge offers online stock and ETF trading, managed portfolios, retirement planning tools, and integration with BofA’s banking accounts. It targets customers who seek low-cost investment options with the added benefit of access to licensed advisors.

BofA Japan Co., Ltd.

BofA Japan is Bank of America’s primary subsidiary in Japan, delivering investment banking, capital markets, and research services to Japanese and multinational clients. It operates under Japan’s Financial Services Agency (FSA) regulations and offers M&A advisory, equity and fixed-income trading, and corporate finance services.

This subsidiary is important for BofA’s Asia-Pacific strategy and helps the bank maintain a strong regional presence among global competitors in Tokyo’s financial market.

BofA Canada Bank

Bank of America also operates a banking subsidiary in Canada, focusing on commercial and institutional clients. BofA Canada Bank provides corporate lending, treasury management, and trade finance solutions. Though smaller in scale compared to its U.S. operations, this subsidiary enables the bank to serve North American clients with cross-border needs.

It is regulated by the Office of the Superintendent of Financial Institutions (OSFI) and supports global multinational corporations and large Canadian enterprises.

Joint Venture: Zelle (via Early Warning Services)

Bank of America is one of the founding owners of Early Warning Services, LLC, which operates Zelle, a peer-to-peer payment network that allows users to send money instantly between U.S. bank accounts.

Early Warning is a private fintech consortium owned by a group of major banks, including Bank of America, JPMorgan Chase, Wells Fargo, and others. Zelle is deeply integrated into Bank of America’s mobile banking app, enhancing its competitiveness in real-time payments and digital finance.

Joint Venture: Interbank Card Association (Mastercard – Historic)

Bank of America was one of the original founders of the Interbank Card Association, the predecessor to Mastercard, during the early stages of modern credit card development in the 1960s. Although BofA later sold its interest, this joint initiative played a crucial role in shaping the global card payment industry.

While not a current JV, this legacy affiliation with Mastercard’s foundation underscores the long-term strategic partnerships BofA has built in the payments and fintech space.

Final Words

The Bank of America is primarily owned by large institutional investors like Berkshire Hathaway, Vanguard, and BlackRock. The bank is publicly traded, meaning anyone can buy its shares. Control remains with the board of directors and executive leadership, led by Brian Moynihan. As a massive financial institution, Bank of America also owns Merrill and BofA Securities, among other key brands.

FAQs

Who is the biggest shareholder of Bank of America?

Berkshire Hathaway is the largest shareholder with a stake of about 12.5%.

Does Warren Buffett own Bank of America?

Warren Buffett’s company, Berkshire Hathaway, owns a large stake in Bank of America but does not own it entirely.

Is Bank of America a private or public company?

Bank of America is a publicly traded company listed on the NYSE under the ticker BAC.

Who makes decisions at Bank of America?

Decisions are made by the board of directors and executive team. The CEO, Brian Moynihan, leads day-to-day operations.

Who founded Bank of America?

Bank of America was originally founded as the Bank of Italy in 1904 by Amadeo Pietro Giannini in San Francisco, California. It was later renamed Bank of America in 1930 after merging with other banks, including the Bank of America National Trust and Savings Association.

How many branches does Bank of America have?

As of 2024, Bank of America operates approximately 3,900 branches across the United States. It also has an extensive network of ATMs and provides online and mobile banking services.

What is Bank of America’s relationship with Merrill Lynch?

Bank of America acquired Merrill Lynch in 2009. Merrill Lynch is now a division of Bank of America, offering wealth management, investment advisory services, and brokerage services. Merrill provides services to high-net-worth individuals and institutional investors.