Amazon’s relentless drive for innovation and expansion has led to the acquisition and development of a diverse portfolio of companies. In this article, we explore the list of Amazon owned companies—detailing their functions, acquisition history, market impact, revenue contributions, and more.

Whether it’s revolutionizing retail with Whole Foods Market or reshaping digital entertainment with Twitch, Amazon’s strategic moves have created a vast ecosystem that spans e-commerce, technology, entertainment, healthcare, and logistics.

What is Amazon and Its History

Founded in 1994 by Jeff Bezos as an online bookstore, Amazon quickly evolved into a global e-commerce powerhouse. Over time, the company diversified into cloud computing, digital streaming, smart home devices, and more.

Strategic acquisitions have played a significant role in this evolution, enabling Amazon to enter new markets and innovate continuously.

Amazon is synonymous with both technological prowess and consumer-centric services, reshaping how people shop, consume media, and manage everyday tasks.

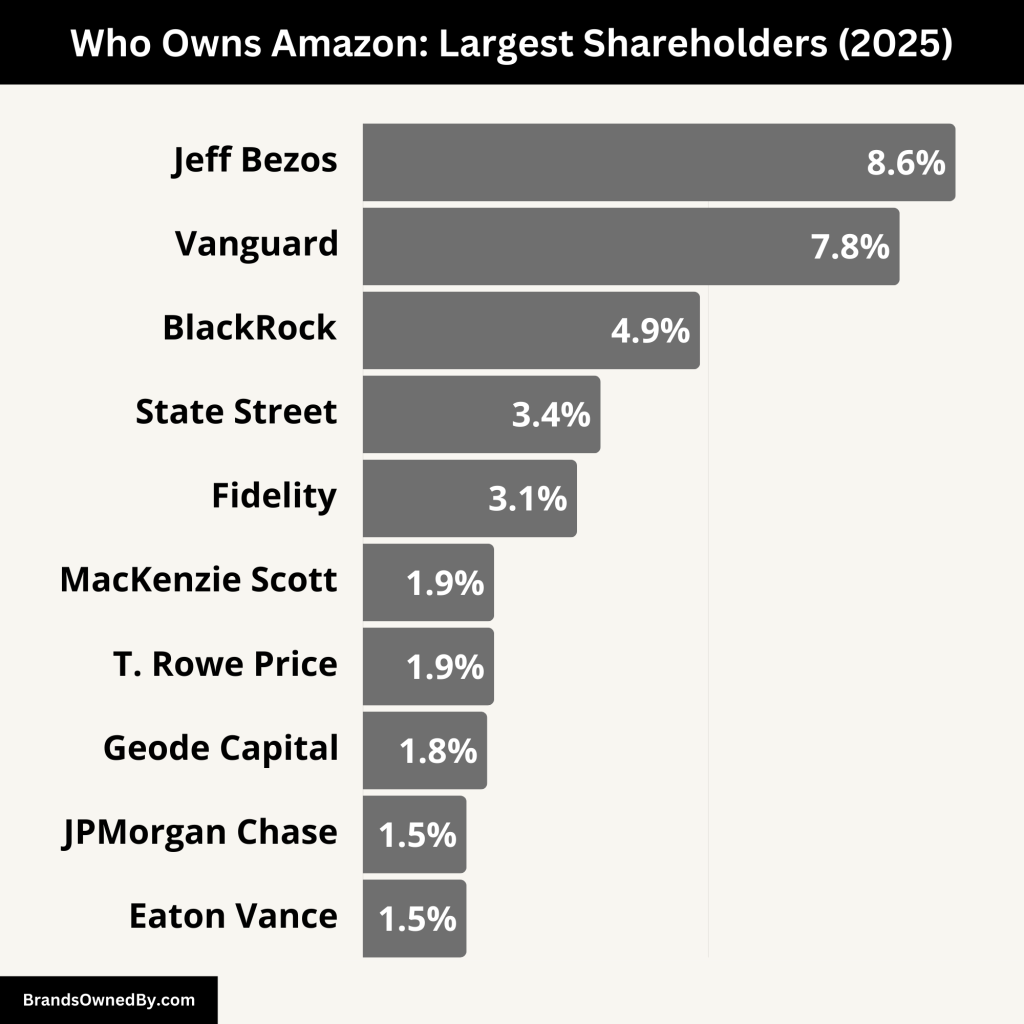

Who Owns Amazon: Major Shareholders

Amazon is a publicly traded company, meaning its ownership is distributed among millions of shareholders.

While institutional investors such as Vanguard Group and BlackRock hold significant stakes, Jeff Bezos remains one of the most influential figures behind the company—even after stepping down as CEO. Despite being publicly owned, Amazon’s strategic vision is closely tied to its founder’s philosophy of innovation and long-term growth.

Below is a list of the largest shareholders of Amazon as of May 2025:

Jeff Bezos

Jeff Bezos, the founder and executive chair of Amazon, remains the largest individual shareholder. As of 2025, he owns approximately 909 million shares, which account for around 8.57% of Amazon’s total shares outstanding. This stake is valued at nearly $174.7 billion based on Amazon’s recent stock price.

Over the years, Bezos has gradually reduced his stake in the company to fund other ventures, notably his aerospace company Blue Origin. In 2025, he announced plans to sell up to 25 million additional Amazon shares, worth about $4.75 billion. Despite these sales, Bezos retains considerable influence over Amazon due to his legacy status and substantial equity holding.

Andy Jassy

Andy Jassy, who succeeded Jeff Bezos as CEO in 2021, holds approximately 2.1 million shares of Amazon stock. This translates to an estimated value of around $360 million. Jassy has been with Amazon since the late 1990s and was instrumental in the creation and success of Amazon Web Services (AWS), the company’s cloud computing arm.

While his ownership stake is significantly smaller than Bezos’s, Jassy’s role as CEO gives him considerable operational control and influence over Amazon’s strategic direction.

The Vanguard Group

The Vanguard Group is Amazon’s largest institutional shareholder. As of 2025, Vanguard owns roughly 832 million shares, which represent about 7.76% of Amazon’s total shares. This massive stake is valued at approximately $155 billion. Vanguard’s holdings in Amazon are spread across a variety of its mutual funds and exchange-traded funds (ETFs), reflecting its strategy as a passive investment manager.

While Vanguard does not typically engage in day-to-day corporate governance, its voting power on shareholder proposals makes it a significant force in influencing Amazon’s policies and leadership decisions.

BlackRock Inc.

BlackRock Inc., another major institutional investor, owns around 689 million Amazon shares, amounting to approximately 6.49% of the company. This stake is valued at about $132.3 billion. Like Vanguard, BlackRock holds these shares across a broad range of investment funds and ETFs.

As one of the world’s largest asset managers, BlackRock uses its ownership stake to advocate for long-term shareholder value, often pushing for corporate responsibility and sustainability in the companies it invests in.

State Street Corporation

State Street Corporation holds about 365 million Amazon shares, giving it a 3.44% ownership stake. The value of these shares is estimated to be around $70 billion. State Street, through its SPDR family of ETFs and other institutional investment funds, plays a passive investment role. Despite not being an activist investor, State Street has substantial influence in corporate governance due to the size of its holdings and its voting power during shareholder meetings.

Fidelity Investments (FMR LLC)

Fidelity Investments, officially known as FMR LLC, owns approximately 328 million shares of Amazon, which represents about 3.09% of the total. These shares are valued at roughly $63 billion. Fidelity manages Amazon stock through various actively managed mutual funds, and while it does not typically take aggressive activist positions, it can influence the company through its fund manager decisions and shareholder voting.

Geode Capital Management

Geode Capital Management, an investment firm that works closely with Fidelity to manage index funds, owns around 205 million shares of Amazon, accounting for approximately 1.93% of the company. The value of its Amazon holdings is about $39.4 billion. Although Geode operates primarily in a passive management capacity, its role in handling large volumes of assets makes it an important institutional player in Amazon’s shareholder ecosystem.

List of Amazon Owned Companies

Below is an expanded list of major companies and brands owned by Amazon as of May 2025. Amazon owns several brands and companies, we have added only the most popular ones in this list:

| Company/Brand | Sector | Description | Acquisition/Launch Year | Acquisition Cost |

| Whole Foods Market | Grocery/Retail | Organic supermarket chain with over 500 locations in the U.S., Canada, and the U.K. | 2017 | $13.7 billion |

| Zappos | E-commerce | Online retailer specializing in shoes and apparel. | 2009 | $1.2 billion |

| Twitch | Media/Streaming | Live-streaming platform popular among gamers and e-sports enthusiasts. | 2014 | $970 million |

| MGM Holdings | Media/Entertainment | Film and television studio, including MGM Studios, Orion Pictures, and United Artists. | 2021 | $8.45 billion |

| Ring | Smart Home/Security | Home security company known for video doorbells and security cameras. | 2018 | $840 million |

| PillPack | Healthcare/Pharmacy | Online pharmacy offering pre-sorted medication packages for home delivery. | 2018 | $753 million |

| One Medical | Healthcare | Primary care provider offering in-person and virtual healthcare services. | 2023 | $3.9 billion |

| iRobot | Robotics | Manufacturer of consumer robots, including the Roomba vacuum cleaner. | 2022 | $1.7 billion |

| Zoox | Autonomous Vehicles | Develops autonomous vehicles and mobility solutions. | 2020 | $1.2 billion |

| Audible | Media/Audiobooks | Producer and seller of audiobooks and spoken-word entertainment. | 2008 | Undisclosed |

| Goodreads | Media/Social | Social cataloging website for book recommendations and reviews. | 2013 | Undisclosed |

| IMDb | Media/Database | Online database of information related to films, television programs, and video games. | 1998 | Undisclosed |

| Eero | Technology/Networking | Company specializing in mesh Wi-Fi systems for home networking. | 2019 | $97 million |

| Annapurna Labs | Technology/Semiconductors | Israeli microelectronics company developing semiconductor solutions. | 2015 | $350–370 million |

| Amazon Web Services (AWS) | Cloud Computing | Comprehensive cloud computing platform offering a wide range of services. | 2006 (launched) | N/A |

| Amazon Fresh | Grocery Delivery | Grocery delivery and pickup service available in select cities. | 2007 (launched) | N/A |

| Amazon Go | Retail | Convenience stores offering checkout-free shopping experience. | 2018 (launched) | N/A |

| Amazon Basics | Consumer Goods | Private-label brand offering a wide range of everyday products. | 2009 (launched) | N/A |

| Happy Belly | Food & Beverage | Private-label brand offering snacks and pantry staples. | 2016 (launched) | N/A |

| Solimo | Consumer Goods | Private-label brand offering health and household products. | 2018 (launched) | N/A |

| Wag | Pet Supplies | Private-label brand offering pet food and supplies. | 2018 (launched) | N/A |

| Amazon Elements | Consumer Goods | Private-label brand offering vitamins and baby products. | 2014 (launched) | N/A |

| Amazon Essentials | Apparel | Private-label brand offering everyday clothing and accessories. | 2017 (launched) | N/A |

| Blink | Smart Home/Security | Manufacturer of home security cameras and systems. | 2017 | $90 million |

| Pinzon | Home Goods | Amazon’s original private label for home textiles and kitchen items. | 2005 (launched) | N/A |

| Mama Bear | Baby Products | Private-label brand offering baby wipes, diapers, and other baby essentials. | 2018 (launched) | N/A |

| Goodthreads | Apparel | Men’s clothing line offering casual and professional attire. | 2017 (launched) | N/A |

| 206 Collective | Footwear | Amazon’s private-label shoe line for men and women. | 2017 (launched) | N/A |

| Arabella | Lingerie | Private-label brand offering women’s lingerie. | 2017 (launched) | N/A |

| Buttoned Down | Apparel | Premium men’s dress shirts and apparel line. | 2017 (launched) | N/A |

| Ella Moon | Apparel | Women’s clothing line featuring bohemian styles. | 2017 (launched) | N/A |

| Franklin & Freeman | Footwear | Men’s shoe line offering formal footwear. | 2017 (launched) | N/A |

| James & Erin | Apparel | Women’s clothing line with a focus on modern styles. | 2017 (launched) | N/A |

| Lark & Ro | Apparel | Women’s fashion line offering contemporary clothing. | 2017 (launched) | N/A |

| North Eleven | Apparel | Women’s clothing line with a focus on casual wear. | 2017 (launched) | N/A |

| Pike Street | Home Goods | Private-label brand offering home textiles and goods. | 2017 (launched) | N/A |

| Presto! | Household Supplies | Brand offering household cleaning products and paper goods. | 2017 (launched) | N/A |

| Scout + Ro | Children’s Apparel | Clothing line for children offering stylish options. | 2017 (launched) | N/A |

| Single Cow Burger | Food | Private-label brand offering frozen beef patties. | 2017 (launched) | N/A |

| Small Parts | Industrial Supplies | Supplier of industrial and scientific components. | 2005 (acquired) | Undisclosed |

| Strathwood | Furniture | Brand offering outdoor and indoor furniture. | 2004 (launched) | N/A |

| Wickedly Prime | Food & Beverage | Snack food line available exclusively to Prime members. | 2016 (launched) | N/A |

| Belei | Beauty | Amazon’s skincare line offering a range of products. | 2019 (launched) | N/A |

| Amazon Academy | Education | Online learning platform for engineering students in India. | 2021 (launched) | N/A |

| Amazon Pharmacy | Healthcare | Online pharmacy service offering prescription medications. | 2020 (launched) | N/A |

| Amazon Maritime | Logistics | Manages Amazon’s shipments from China to the U.S. | 2016 (launched) | N/A |

| Amazon Robotics | Robotics | Develops robotic systems for warehouse automation. | 2012 (acquired) | $775 million |

| Amazon Drive | Cloud Storage | Cloud storage service for photos and files. | 2011 (launched) | N/A |

| Amazon Luna | Gaming | Cloud gaming platform offering streaming of video games. | 2020 (launched) | N/A |

| Amazon Halo | Health & Wellness | Health and wellness band and subscription service. | 2020 (launched) | N/A |

| Astro | Robotics | Household robot integrating Alexa and advanced AI. | 2021 (launched) | N/A |

| Kuiper Systems | Satellite Internet | Subsidiary developing a satellite internet constellation to provide broadband connectivity. | 2019 (founded) | N/A |

| Amazon Publishing | Publishing | Book publishing unit of Amazon, encompassing various imprints. | 2009 (launched) | N/A |

| Amazon Home Services | Home Services | Platform connecting customers with local service professionals. | 2015 (launched) | N/A |

| Neighbors App | Social Networking | App that allows users to share safety information and updates with neighbors. | 2018 (launched) | N/A |

| Amazon Appstore | Digital Distribution | App store for Android devices offering a wide range of applications. | 2011 (launched) | N/A |

| Alexa | Smart Home | Voice-controlled intelligent personal assistant service. | 2014 (launched) | N/A |

| Fire TV | Media/Streaming | Digital media player and microconsole for streaming digital audio/video content. | 2014 (launched) | N/A |

| Kindle | E-reader | Series of e-readers designed and marketed by Amazon. | 2007 (launched) | N/A |

| Amazon Music | Media/Streaming | Music streaming platform offering a vast library of songs and playlists. | 2007 (launched) | N/A |

| Kindle Direct Publishing | Publishing | Platform for authors to self-publish eBooks and paperbacks. | 2007 (launched) | N/A |

| ComiXology | Media/Comics | Digital comics platform offering a wide selection of comic books and graphic novels. | 2014 (acquired) | Undisclosed |

| Amazon Studios | Media/Production | Television and film production company developing original content. | 2010 (launched) | N/A |

| Amazon Prime Video | Media/Streaming | Subscription-based streaming service offering movies and TV shows. | 2006 (launched) | N/A |

| Amazon Prime Air | Logistics | Drone delivery service aiming to deliver packages quickly. | 2016 (announced) | N/A |

| Amazon Logistics | Logistics | Delivery and shipping service managing Amazon’s transportation network. | 2015 (launched) | N/A |

| Amazon Pay | Payments | Online payment processing service for third-party websites and apps. | 2007 (launched) | N/A |

| Amazon Cash | Payments | Service allowing customers to add cash to their Amazon account balance. |

1. Whole Foods Market

Acquired: 2017 for $13.7 billion

Whole Foods Market marked Amazon’s bold entry into the physical retail and grocery sector. With more than 500 stores across the U.S., Whole Foods is known for its focus on organic and high-quality food products.

- Estimated Annual Revenue (2023): ~$16 billion

- Estimated Net Worth (2023): ~$20 billion

- Market Position: Dominates the organic and natural foods market.

- Revenue Contribution: Generates billions in annual sales; its integration with Amazon Prime has boosted both in-store and online grocery sales.

- Strategic Role: Serves as the backbone for Amazon’s grocery delivery services, enhancing its logistics network.

2. Ring

Acquired: 2018 for $1 billion

Ring is a leading home security company that specializes in smart doorbells, security cameras, and other connected devices.

- Estimated Annual Revenue (2023): ~$500 million

- Estimated Net Worth (2023): ~$1.2 billion

- Market Share: A major player in the smart home security market, integrated with Alexa for voice-activated features.

- Revenue & Growth: Has seen rapid adoption globally, contributing significantly to Amazon’s smart home ecosystem.

- Strategic Role: Enhances consumer security offerings and bridges physical and digital home experiences.

3. Zappos

Acquired: 2009 for $1.2 billion

Zappos is an online retailer primarily focused on shoes, clothing, and accessories. Known for its customer-first approach, Zappos maintains a strong independent brand identity within Amazon’s portfolio.

- Estimated Annual Revenue (2023): ~$1.5 billion

- Estimated Net Worth (2023): ~$2 billion

- Market Niche: A leader in online fashion and footwear, especially noted for exceptional customer service.

- Revenue Impact: Continues to generate robust sales while fostering strong brand loyalty.

- Strategic Role: Expand Amazon’s reach in the competitive fashion market and strengthen its retail diversity.

4. Twitch

Acquired: 2014 for $970 million

Twitch is the premier live-streaming platform primarily focused on gaming, though it has since diversified into music, talk shows, and esports.

- Estimated Annual Revenue (2023): ~$250 million

- Estimated Net Worth (2023): ~$1.5 billion

- User Base: Boasts millions of active users and has become a cultural phenomenon in digital entertainment.

- Revenue & Monetization: Generates revenue through subscriptions, ads, and partnerships with major brands.

- Strategic Role: Solidifies Amazon’s foothold in the digital content and gaming industries, driving engagement and brand loyalty.

5. Audible

Acquired: 2008 for $300 million

Audible is a leading provider of audiobooks, podcasts, and spoken-word entertainment.

- Estimated Annual Revenue (2023): ~$500 million

- Estimated Net Worth (2023): ~$800 million

- Market Leadership: Dominates the audiobook market with an extensive library and exclusive content.

- Revenue Contribution: Generates steady subscription revenue and enhances Amazon’s digital media ecosystem.

- Strategic Role: Complements Amazon’s e-commerce and Kindle platforms, offering a seamless content consumption experience.

6. Kiva Systems

Acquired: 2012 for $775 million

Kiva Systems specializes in robotics and automation for warehouse operations.

- Estimated Annual Impact (2023): Technology-driven efficiency delivering cost savings valued at ~$300 million annually

- Estimated Net Worth (2023): ~$1 billion

- Operational Efficiency: Revolutionized fulfillment centers by automating order picking and packaging processes.

- Market Impact: Increased Amazon’s operational efficiency, reducing order processing times significantly.

- Strategic Role: Key to Amazon’s logistics and supply chain management, enabling rapid and reliable deliveries worldwide.

7. PillPack

Acquired: 2018 for $1 billion

PillPack is an online pharmacy that streamlines the process of managing prescriptions by delivering pre-sorted medications directly to consumers.

- Estimated Annual Revenue (2023): ~$400 million

- Estimated Net Worth (2023): ~$1 billion

- Market Disruption: Challenges traditional brick-and-mortar pharmacies with its user-friendly, digitally integrated model.

- Revenue Potential: Positioned to tap into the growing demand for convenient healthcare services.

- Strategic Role: Enhances Amazon’s entry into the healthcare sector, paving the way for broader pharmaceutical and telehealth innovations.

8. Eero

Acquired: 2019 for $97 million

Eero produces state-of-the-art mesh Wi-Fi systems that ensure seamless connectivity across smart homes.

- Estimated Annual Revenue (2023): ~$100 million

- Estimated Net Worth (2023): ~$150 million

- Market Share: A prominent player in the home networking space, improving internet coverage and reliability.

- Revenue Impact: Contributes to Amazon’s broader smart home ecosystem by enhancing device connectivity.

- Strategic Role: Strengthens the technical backbone for Alexa and other Amazon smart home products.

9. AbeBooks

Acquired: 2008

AbeBooks is an online marketplace that specializes in rare, used, and out-of-print books.

- Estimated Annual Revenue (2023): ~$75 million

- Estimated Net Worth (2023): ~$150 million

- Niche Market: Serves collectors and bibliophiles, offering a unique selection beyond mainstream titles.

- Revenue Contribution: Adds depth to Amazon’s overall book-selling capabilities, complementing the Kindle platform.

- Strategic Role: Enhances customer choice and cements Amazon’s status as a comprehensive book retailer.

10. IMDb

Acquired: 1998

IMDb (Internet Movie Database) is the world’s largest online database for movies, TV shows, celebrities, and related content.

- Estimated Annual Revenue (2023): ~$350 million

- Estimated Net Worth (2023): ~$2 billion

- Market Influence: A go-to resource for film enthusiasts and professionals alike, integrated with Prime Video.

- Revenue & Traffic: Generates substantial traffic and supports advertising and data-driven insights for Amazon’s media ventures.

- Strategic Role: Bolsters Amazon’s entertainment offerings, providing valuable content for streaming and digital media platforms.

11. Woot

Acquired: 2010

Woot is known for its daily deals and limited-time flash sales on a variety of consumer products.

- Estimated Annual Revenue (2023): ~$50 million

- Estimated Net Worth (2023): ~$100 million

- Market Niche: Caters to bargain hunters, creating a sense of urgency and excitement around discounted products.

- Revenue Impact: Generates high-volume sales during flash events, complementing Amazon’s broader retail strategy.

- Strategic Role: Diversifies Amazon’s e-commerce model by capturing a unique segment of the discount retail market.

12. Goodreads

Acquired: 2013

Goodreads is a social network for book lovers that allows users to share reviews, ratings, and recommendations.

- Estimated Annual Revenue (2023): ~$30 million

- Estimated Net Worth (2023): ~$100 million

- Community Engagement: Provides an interactive platform that drives reader engagement and promotes book discovery.

- Revenue Potential: Enhances cross-selling opportunities for Amazon’s book and Kindle products through targeted recommendations.

- Strategic Role: Strengthens Amazon’s dominance in the literary market while fostering a vibrant community of readers.

13. Zoox

Acquired: 2020 for $1.2 billion

Zoox is an autonomous vehicle startup focused on developing self-driving technologies.

- Estimated Annual Revenue (2023): Currently minimal as it is in development

- Estimated Net Worth (2023): Valued at ~$1.2 billion based on acquisition

- Market Disruption: Pioneers innovations in urban mobility and automated transportation, with potential applications in last-mile delivery.

- Revenue & Growth: While still in the development phase, Zoox represents a significant future revenue stream for Amazon’s logistics innovations.

- Strategic Role: Positions Amazon at the forefront of transportation technology, enhancing its long-term delivery and mobility solutions.

14. Elemental Technologies

Acquired: 2015 for $296 million

Elemental Technologies specializes in video processing and encoding solutions.

- Estimated Annual Revenue (2023): ~$100 million

- Estimated Net Worth (2023): ~$300 million

- Technical Capabilities: Enhances Amazon Web Services (AWS) with advanced video streaming and content delivery solutions.

- Revenue Contribution: Provides scalable technology that supports streaming services like Prime Video, driving ad revenue and subscriptions.

- Strategic Role: Strengthens Amazon’s media infrastructure, ensuring high-quality video experiences across devices and platforms.

15. Souq.com

Acquired: 2017 for $580 million

Souq.com was the largest e-commerce platform in the Middle East before its integration into the Amazon family.

- Estimated Annual Revenue (2023): ~$900 million

- Estimated Net Worth (2023): ~$1.5 billion

- Regional Dominance: Opened the door for Amazon to enter the Middle Eastern market, competing with local e-commerce leaders.

- Revenue Impact: Has contributed significantly to Amazon’s global sales by tapping into emerging markets.

- Strategic Role: Serves as the foundation for expanding Amazon’s international presence and localizing its e-commerce strategy.

16. Amazon Studios

Amazon Studios is the creative arm of Amazon, responsible for developing original movies, television series, and digital content for Prime Video.

- Estimated Annual Contribution: Integrated into Prime Video’s multi-billion-dollar revenue stream (content value estimated at ~$2 billion)

- Estimated Net Worth: Considered a multi-billion-dollar asset in intellectual property

- Cultural Influence: Produced award-winning series such as The Marvelous Mrs. Maisel and The Boys, enhancing Amazon’s brand in entertainment.

- Revenue & Growth: Contributes to the growing subscriber base of Prime Video, driving advertising and licensing revenue.

- Strategic Role: Reinforces Amazon’s commitment to high-quality original content, positioning it as a major player in global entertainment.

17. Alexa Internet

Acquired: 1999

Alexa Internet is an analytics company that provides web traffic data, competitive insights, and other online metrics.

- Estimated Annual Revenue (2023): ~$50 million

- Estimated Net Worth (2023): ~$150 million

- Data Analytics: Offers valuable insights that have helped optimize Amazon’s e-commerce strategies and AWS offerings.

- Revenue & Integration: While primarily a data tool, its analytics capabilities support better decision-making across Amazon’s digital businesses.

- Strategic Role: Enhances Amazon’s competitive intelligence, ensuring the company remains agile in the rapidly changing digital landscape.

18. Amazon Fresh

Amazon Fresh is a grocery delivery and pickup service that complements both Whole Foods Market and online grocery offerings.

- Estimated Annual Revenue (2023): ~$500 million

- Estimated Net Worth (2023): ~$1 billion

- Market Penetration: Provides fresh produce, dairy, and everyday essentials delivered directly to consumers’ doors.

- Revenue & Growth: Helps drive recurring revenue through Prime memberships and increases customer retention in the grocery sector.

- Strategic Role: Strengthens Amazon’s overall retail ecosystem by seamlessly integrating physical and digital shopping experiences.

19. Quidsi

Acquired: 2010 (Parent company of Diapers.com)

Quidsi was an e-commerce company best known for its Diapers.com platform, which specialized in baby products and household essentials.

- Estimated Annual Revenue at Peak (2023): ~$300 million

- Estimated Net Worth at Acquisition (2023): ~$500 million

- Market Impact: Disrupted the traditional retail model for baby care products with a focus on convenience and competitive pricing.

- Revenue Contribution: At its peak, Diapers.com generated significant sales before being integrated and eventually phased out by Amazon.

- Strategic Role: Although now defunct, Quidsi’s acquisition underscored Amazon’s willingness to innovate in niche markets and laid the groundwork for its later ventures in subscription-based retail.

20. Amazon Game Studios

Launched by Amazon: 2012

Amazon Game Studios is dedicated to developing and publishing video games across various platforms, from PC to mobile and console.

- Estimated Annual Revenue (2023): ~$100 million

- Estimated Net Worth (2023): ~$500 million (as a strategic asset within Amazon’s digital media ecosystem)

- Creative Ambition: Aims to tap into the lucrative gaming industry by creating immersive gaming experiences and leveraging cloud-based technologies.

- Revenue Potential: While still growing, its projects contribute to Amazon’s broader media and digital content strategy.

- Strategic Role: Strengthens Amazon’s ecosystem by connecting gaming with other services such as Twitch and AWS, enhancing cross-platform engagement.

Brands Owned by Amazon

In addition to acquisitions, Amazon has developed several in-house brands that have become integral to its ecosystem:

Amazon Web Services (AWS)

AWS is the cloud computing division offering scalable services—from computing power to storage—that power businesses worldwide.

- Estimated Annual Revenue (2023): ~$80 billion

- Strategic Value: A key profit driver for Amazon and a market leader in cloud infrastructure, contributing an estimated value of ~$300 billion to Amazon’s portfolio.

Amazon Prime

More than just a loyalty program, Prime offers fast shipping, streaming media, exclusive deals, and more.

- Estimated Annual Subscription Revenue (2023): ~$25 billion

- Strategic Value: A cornerstone of customer retention and engagement, valued as an intangible asset worth tens of billions.

Kindle

Amazon’s e-reader and e-book platform that revolutionized digital reading.

- Estimated Annual Revenue (2023): ~$2 billion

- Strategic Value: An essential part of Amazon’s digital media ecosystem, with an estimated value of ~$3 billion.

Echo (Alexa Devices)

A series of smart speakers and home devices powered by Alexa, Amazon’s virtual assistant.

- Estimated Annual Revenue (2023): ~$3 billion

- Strategic Value: Integral to Amazon’s smart home ecosystem, with devices collectively valued at around ~$5 billion.

AmazonBasics

A private-label brand offering everyday consumer goods—from electronics accessories to home products—at competitive prices.

- Estimated Annual Revenue (2023): ~$2 billion

- Strategic Value: A key profit center that reinforces Amazon’s value proposition in cost-effective quality.

Fire TV

Amazon’s digital media player that powers streaming services and integrates with Prime Video.

- Estimated Annual Revenue (2023): ~$2 billion

- Strategic Value: An important component of Amazon’s digital entertainment strategy, contributing an estimated value of ~$3 billion.

Who is the CEO of Amazon?

As of 2025, Andy Jassy serves as the President and Chief Executive Officer (CEO) of Amazon.com Inc., having succeeded Jeff Bezos in July 2021. Jassy’s tenure marks a significant evolution in Amazon’s strategic direction, emphasizing artificial intelligence (AI), cloud computing, and long-term innovation.

Early Life and Education

Born on January 13, 1968, in Scarsdale, New York, Andy Jassy is the son of Margery and Everett L. Jassy. He graduated cum laude from Harvard College with a degree in government and later earned an MBA from Harvard Business School. Before joining Amazon, Jassy worked as a project manager at MBI, a collectibles company.

Career at Amazon

Jassy joined Amazon in 1997 as a marketing manager. In 2003, he and Jeff Bezos conceptualized Amazon Web Services (AWS), which launched in 2006. Under Jassy’s leadership, AWS grew into a $100 billion annual revenue business by 2024, becoming Amazon’s most profitable division.

Leadership as CEO

Since becoming CEO, Jassy has steered Amazon towards significant investments in AI and cloud infrastructure. In 2025, Amazon announced plans to invest over $100 billion in capital expenditures, with the majority allocated to AWS and AI capabilities. Jassy emphasized AI as a transformative technology, likening its impact to the early days of AWS.

Strategic Initiatives

Under Jassy’s leadership, Amazon has launched several AI-driven initiatives, including:

- Trainium2 Chips: Custom AI chips offering 30-40% better price-performance, reducing reliance on external chip providers.

- Anthropic Investment: An $8 billion investment in AI startup Anthropic, integrating its technology into Amazon’s Alexa voice assistant, now branded as Alexa+.

- Project Kuiper: A satellite internet initiative aimed at providing broadband connectivity, particularly in underserved areas.

- Amazon Health Hub: A healthcare platform combining online pharmacies, telemedicine, and AI diagnostics, positioning Amazon as a competitor to established healthcare providers.

Leadership Philosophy

Jassy is known for his data-driven and customer-obsessed leadership style. He describes Amazon as a “Why company,” constantly questioning and innovating to meet customer needs. His approach emphasizes long-term investments in ideas and people, fostering a culture of continuous improvement and innovation.

Personal Life

Andy Jassy is married to Elana Caplan, and they have two children. The family resides in Seattle, Washington. Jassy is also a minority owner of the NHL team Seattle Kraken.

Final Words

The diversified list of Amazon-owned companies reflects the company’s far-reaching vision and strategic approach to growth.

Each acquisition and internal development not only reinforces Amazon’s dominance in its core e-commerce operations but also paves the way for innovation in entertainment, technology, logistics, and even healthcare. Through this robust ecosystem, Amazon continues to set industry standards, redefine consumer experiences, and secure its place as one of the world’s most influential companies.

FAQs

How many brands are under Amazon?

Amazon owns over 50 major brands and companies, including in-house brands like Amazon Basics and acquired companies such as Whole Foods Market, Twitch, and Ring. These span across sectors like retail, tech, logistics, media, and cloud services.

Who owns 100% of Amazon?

No single person or entity owns 100% of Amazon. Amazon is a publicly traded company listed on the NASDAQ under the ticker AMZN. Ownership is divided among institutional investors (like Vanguard and BlackRock), retail investors, and Amazon insiders, including founder Jeff Bezos and current executives.

Does Amazon own Google?

No, Amazon does not own Google. Google is a subsidiary of Alphabet Inc., a separate technology conglomerate. Amazon and Google are independent companies and major competitors in areas like cloud computing (AWS vs. Google Cloud), AI, and smart devices.

Does Mark Zuckerberg own Amazon?

No, Mark Zuckerberg does not own Amazon. Zuckerberg is the co-founder and CEO of Meta Platforms (formerly Facebook). He has no ownership or leadership role in Amazon.

How many companies has Amazon?

As of 2025, Amazon has acquired over 100 companies since its founding. This includes major acquisitions like MGM, Zoox, and PillPack. It also includes smaller tech startups, logistics firms, and media platforms.

Who legally owns Amazon?

Amazon.com, Inc. is legally owned by its shareholders. These include institutional investors like The Vanguard Group and BlackRock, insiders like Jeff Bezos and Andy Jassy, and millions of public retail investors around the world.

Which country owns Amazon?

Amazon is an American company. It was founded in Seattle, Washington, in 1994 and is headquartered in Arlington, Virginia (HQ2) and Seattle. It is subject to U.S. corporate laws and regulations.

What is Amazon’s biggest business?

Amazon Web Services (AWS) is Amazon’s most profitable and fastest-growing business segment. It provides cloud computing services and contributes a significant share of the company’s total operating income.

How many companies has Amazon bought?

By 2025, Amazon has purchased over 110 companies, spanning e-commerce, cloud computing, robotics, AI, media, and logistics. Notable deals include MGM ($8.45B), Whole Foods Market ($13.7B), and iRobot ($1.7B).

What are the Top 10 Amazon-owned companies?

Here are the top 10 by strategic value and revenue impact:

- Amazon Web Services (AWS) – Cloud computing giant.

- Whole Foods Market – Premium grocery retailer.

- Twitch – Leading video game streaming platform.

- Zappos – Online shoe and apparel retailer.

- Ring – Smart home security systems.

- Audible – Audiobook and podcast platform.

- PillPack – Online pharmacy service.

- MGM – Media and entertainment studio.

- Zoox – Autonomous vehicle development.

- Amazon Robotics – Fulfillment center automation.

Is Amazon Flex an Amazon subsidiary?

Yes, Amazon Flex is a subsidiary program of Amazon. It is part of Amazon Logistics and enables independent contractors to deliver Amazon packages using their own vehicles via an app-based platform. It is fully managed and owned by Amazon.

What is considered one of Amazon’s most valuable acquisitions?

Whole Foods Market, acquired for $13.7 billion, is often cited as one of Amazon’s most strategic and transformative acquisitions, greatly enhancing its presence in the physical retail and grocery sectors.