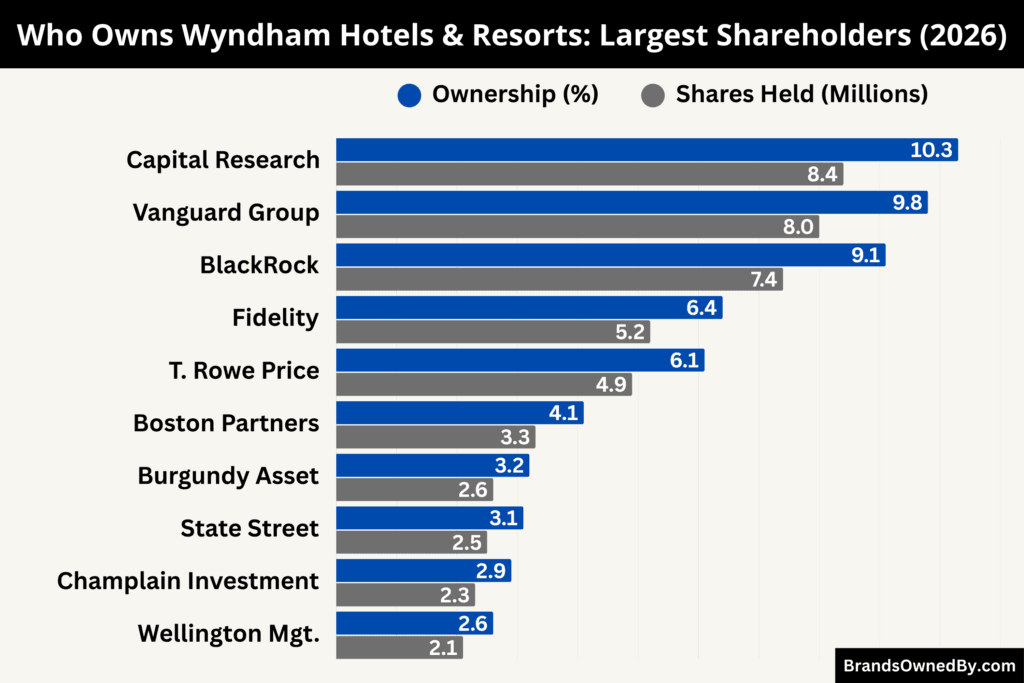

- Wyndham Hotels & Resorts is publicly traded, with ownership led by institutional investors; Capital Research & Management Company is the largest shareholder, holding about 10.3% of the company’s outstanding shares as of January 2026.

- The Vanguard Group owns around 9.8% and BlackRock holds approximately 9.1%, making them the second and third-largest shareholders with significant combined voting power.

- Together, large institutional investors control the majority of Wyndham’s shares, shaping governance and strategic oversight through proxy voting, while day-to-day control remains with the board of directors and executive leadership.

Wyndham Hotels & Resorts is a major global hospitality company. It is recognized as the largest hotel franchisor by property count in the world. Wyndham operates a vast network of franchised hotels across more than 95 countries. It serves millions of travellers with a range of brands from economy to upper-midscale lodging.

Its business model centres on franchising and brand management rather than owning real estate. This asset-light approach supports broad international expansion and operational flexibility. Wyndham’s footprint is built on long-term relationships with franchise owners that operate hotels under its brand standards.

Founder of Wyndham Hotels & Resorts

Wyndham Hotels & Resorts traces its origins to Trammell Crow, one of the most influential real estate developers in the United States. He founded the original Wyndham Hotel Corporation in 1981 in Dallas, Texas.

Crow was already well known for shaping modern commercial real estate through the Trammell Crow Company. His decision to enter the hospitality sector was driven by a vision to create upscale yet approachable hotels that catered to business and leisure travelers alike.

The name “Wyndham” was inspired by Wyndham Robertson, a respected figure featured in Fortune magazine, reflecting Crow’s intention to associate the brand with prestige and professionalism. While Trammell Crow did not remain directly involved in long-term hotel operations, his foundational role established the Wyndham brand identity that later expanded through franchising, mergers, and acquisitions.

The modern Wyndham Hotels & Resorts operating today is the result of decades of corporate evolution rather than direct founder control. However, Crow’s original concept laid the groundwork for what would become one of the largest hotel franchising platforms in the world.

Major Milestones

- 1981: Trammell Crow founded Wyndham Hotel Corporation and opened the first Wyndham hotel in Dallas, Texas, establishing the brand’s upscale positioning.

- 1985: Wyndham expanded beyond its original property, beginning early brand recognition within the U.S. hospitality market.

- 1990: Hospitality Franchise Systems (HFS) was formed, creating a large-scale hotel franchising platform that later became central to Wyndham’s growth.

- 1993: HFS went public, accelerating acquisitions of well-known economy and midscale hotel brands.

- 1995: HFS acquired Days Inn, marking one of the most important expansions in the economy hotel segment.

- 1997: HFS merged with CUC International to form Cendant Corporation, consolidating travel, real estate, and hospitality brands under one umbrella.

- 1998: Cendant expanded aggressively into global hotel franchising, laying the groundwork for Wyndham’s future international presence.

- 2001: Following accounting scandals at Cendant, the company underwent major restructuring while retaining its hotel franchise assets.

- 2005: Cendant acquired the Wyndham hotel brand, bringing the upscale Wyndham name fully into its lodging portfolio.

- 2006: Cendant Corporation split into four independent companies, one of which became Wyndham Worldwide, combining hotel franchising, vacation ownership, and exchange services.

- 2009: Wyndham Worldwide strengthened its loyalty platform by expanding the Wyndham Rewards program across more hotel brands.

- 2013: Wyndham accelerated international expansion, particularly in China, Latin America, and Eastern Europe.

- 2015: The company surpassed major global hotel-count milestones, reinforcing its dominance in franchising rather than ownership.

- 2018: Wyndham Hotels & Resorts became an independent, publicly traded company following its spin-off from Wyndham Worldwide.

- 2019: The newly independent company streamlined its brand architecture and focused solely on hotel franchising and management services.

- 2020: Wyndham reinforced its asset-light model, distancing itself completely from hotel real estate ownership.

- 2021: The company expanded extended-stay and midscale offerings to adapt to changing travel patterns.

- 2022: Wyndham increased development activity in emerging markets such as India, Southeast Asia, and the Middle East.

- 2023: Strategic partnerships helped introduce Wyndham brands into secondary and tertiary cities globally.

- 2024: Wyndham crossed new global property-count milestones, maintaining its position as the world’s largest hotel franchisor by hotel count.

- 2025: The company continued portfolio optimization, focusing on brand consistency, franchisee returns, and loyalty growth.

- 2026: Wyndham Hotels & Resorts operates as a mature, standalone hospitality company with a globally diversified franchise network and long-term brand-led strategy.

Who Owns Wyndham Hotels & Resorts: Top Shareholders

Wyndham Hotels & Resorts is a publicly traded hospitality company listed on the New York Stock Exchange. Its ownership is dominated by large institutional investors that collectively control the majority of outstanding shares.

The shareholder base is led by Capital Research, Vanguard, and BlackRock, followed by other long-term asset managers such as Fidelity and T. Rowe Price. These investors hold substantial equity positions and exert influence through proxy voting, board oversight, and governance engagement.

Strategic and operational control remains with the board of directors and executive leadership, while institutional shareholders shape long-term expectations around growth, capital allocation, and shareholder returns.

Below is a list of the largest shareholders of Wyndham Hotels & Resorts as of January 2026:

Capital Research & Management Company

Capital Research & Management Company is the largest shareholder of Wyndham Hotels & Resorts. As of January 2026, it holds approximately 8.4 million shares, representing about 10.3% of the company’s outstanding stock.

Capital Research is known for taking long-term positions in companies with durable business models. Its investment in Wyndham reflects confidence in the company’s asset-light franchising strategy and global scale. While Capital Research does not participate in daily operations, its voting power gives it influence over board elections, executive compensation, and major corporate decisions. The firm typically supports management teams focused on sustainable growth and disciplined brand expansion.

The Vanguard Group

The Vanguard Group is the second-largest shareholder, holding roughly 8.0 million shares as of January 2026. This represents close to 9.8% ownership.

Vanguard’s stake is largely held through index and exchange-traded funds. As a passive investor, Vanguard does not seek operational involvement. However, it plays an important governance role through proxy voting and shareholder engagement. Vanguard’s continued ownership signals stability in Wyndham’s investor base and aligns the company with long-term institutional capital rather than short-term trading activity.

BlackRock

BlackRock owns approximately 7.4 million shares, equating to about 9.1% of Wyndham Hotels & Resorts as of January 2026.

BlackRock’s investment spans multiple funds and portfolios. The firm regularly engages with Wyndham’s leadership on governance standards, board independence, and long-term value creation. BlackRock’s presence reinforces institutional confidence in Wyndham’s franchise-driven earnings model and global brand portfolio.

Fidelity Management & Research Company (FMR LLC)

Fidelity Management & Research holds an estimated 5.2 million shares, or roughly 6.4% ownership.

Fidelity is an active manager that evaluates performance, competitive positioning, and management execution. Its position in Wyndham reflects a belief in consistent franchise revenue streams and the company’s ability to adapt to evolving travel patterns. Fidelity’s voting power contributes meaningfully to shareholder decisions, especially on strategic direction and leadership performance.

T. Rowe Price Investment Management

T. Rowe Price Investment Management owns about 4.9 million shares, representing approximately 6.1% of the company.

T. Rowe Price is known for growth-oriented investing and long holding periods. Its stake in Wyndham indicates confidence in brand scalability and international development pipelines. While not an activist investor, T. Rowe Price actively participates in governance discussions and performance reviews.

Boston Partners Global Investors

Boston Partners Global Investors holds roughly 3.3 million shares, or about 4.1% ownership.

Boston Partners typically focuses on valuation and long-term return potential. Its position suggests it views Wyndham as undervalued relative to its brand strength and franchise reach. Although smaller than the top three shareholders, this stake still provides material influence through voting rights.

Burgundy Asset Management

Burgundy Asset Management owns approximately 2.6 million shares, representing around 3.2% of Wyndham Hotels & Resorts.

Burgundy tends to invest in companies with strong competitive moats and predictable cash generation. Its ownership aligns with Wyndham’s recurring royalty-based revenue model. Burgundy’s role is primarily governance-focused rather than operational.

State Street Global Advisors

State Street Global Advisors holds an estimated 2.5 million shares, equating to about 3.1% ownership.

State Street manages large index funds and institutional mandates. Its influence is exercised through proxy voting and corporate governance frameworks. State Street’s continued stake adds to the depth of institutional oversight at Wyndham.

Champlain Investment Partners

Champlain Investment Partners owns approximately 2.3 million shares, or close to 2.9% of the company.

Champlain is known for concentrated, high-conviction investments. Its stake reflects confidence in Wyndham’s long-term growth potential and management execution. Though not a controlling shareholder, Champlain’s position is meaningful within the broader institutional base.

Wellington Management Group

Wellington Management Group holds around 2.1 million shares, representing roughly 2.6% ownership.

Wellington manages global institutional portfolios and often emphasizes stability and governance quality. Its investment in Wyndham supports the view that the company is a mature, well-managed franchisor with predictable earnings.

Insider and Executive Ownership

Company executives and board members collectively own a relatively small portion of Wyndham Hotels & Resorts, estimated at under 2% combined. While these holdings do not provide control, they align leadership incentives with shareholder outcomes.

Insider ownership supports long-term decision-making focused on brand integrity, franchisee performance, and shareholder value.

Who is the CEO of Wyndham Hotels & Resorts?

Wyndham Hotels & Resorts is led by Geoff Ballotti, who serves as the company’s President and Chief Executive Officer.

As of January 2026, Ballotti continues to guide Wyndham’s strategic direction. His leadership shapes global expansion, brand development, franchise relations, and long-term growth initiatives. Under his tenure, Wyndham has maintained strong franchising momentum, expanded internationally, and reinforced its position as one of the world’s largest hotel franchisors.

Early Leadership and Career of Geoff Ballotti

Geoff Ballotti began his career in the hospitality industry more than three decades ago. He gained deep operational and executive experience with leading hotel companies before joining Wyndham. His background includes senior roles with major hotel brands and extensive work in both domestic and international markets.

Before becoming CEO, Ballotti served in several executive capacities at Wyndham’s predecessor entities. He held leadership roles in operations, brand management, and corporate strategy. This breadth of experience prepared him to navigate the complexities of a globally franchised hotel portfolio.

Appointment as CEO and Leadership Style

Ballotti was appointed CEO of Wyndham Hotels & Resorts when the company became an independent, publicly traded entity following its spin-off in 2018. His leadership emphasizes asset-light growth, strong franchisee partnerships, and disciplined brand strategies. He focuses on aligning corporate goals with franchise owners’ needs to build sustainable revenue streams.

His management style is collaborative and performance-oriented. He engages closely with senior leadership, regional presidents, and brand executives. Decision-making includes input from franchise owners, operational experts, and market analysts.

Responsibilities and Strategic Priorities

As CEO, Ballotti is responsible for:

- Setting and executing Wyndham’s long-term strategic plan.

- Overseeing global brand growth and portfolio development.

- Strengthening franchisee relationships and loyalty program engagement.

- Driving efficiency through technology platforms and centralized services.

- Leading executive leadership development and corporate governance initiatives.

Ballotti’s role includes regular interaction with investors, analysts, and the board of directors. He presents quarterly performance updates, strategic outlooks, and responses to market conditions.

Salary and Compensation

As of 2026, Geoff Ballotti’s compensation reflects a mix of base salary, performance bonuses, equity awards, and long-term incentive plans. His total annual compensation package is roughly $14.8 million. This figure includes:

- A base salary of approximately $1.3 million.

- Annual performance-based cash incentives.

- Stock-based compensation tied to long-term performance goals.

- Other benefits such as retirement contributions and limited perquisites.

The compensation structure aligns with shareholder interests by rewarding performance, operational achievements, and value creation over time. A significant portion of his pay comes from equity awards that vest over multiple years, encouraging long-term stewardship.

Past Wyndham Leadership and Succession Planning

Before Ballotti’s tenure, senior leadership roles at Wyndham were held by executives responsible for segments of the business during Wyndham Worldwide’s integrated operations. With the separation in 2018, the CEO role became solely focused on hotel franchising and growth.

Succession planning is part of Wyndham’s corporate governance framework. The board of directors works with the CEO and compensation committee to identify and develop future leaders. This ensures continuity and strategic consistency in leadership as the company evolves.

CEO Engagement with Stakeholders

Ballotti actively engages with shareholders, analysts, and the investment community. He participates in earnings calls, investor presentations, and industry conferences. His communication emphasizes transparency, measured growth expectations, and responsiveness to industry trends.

In addition to external engagement, he prioritizes internal leadership development and franchisee feedback mechanisms. This dual emphasis supports aligned execution of brand standards, operational excellence, and global market responsiveness.

Wyndham Hotels & Resorts Annual Revenue and Net Worth

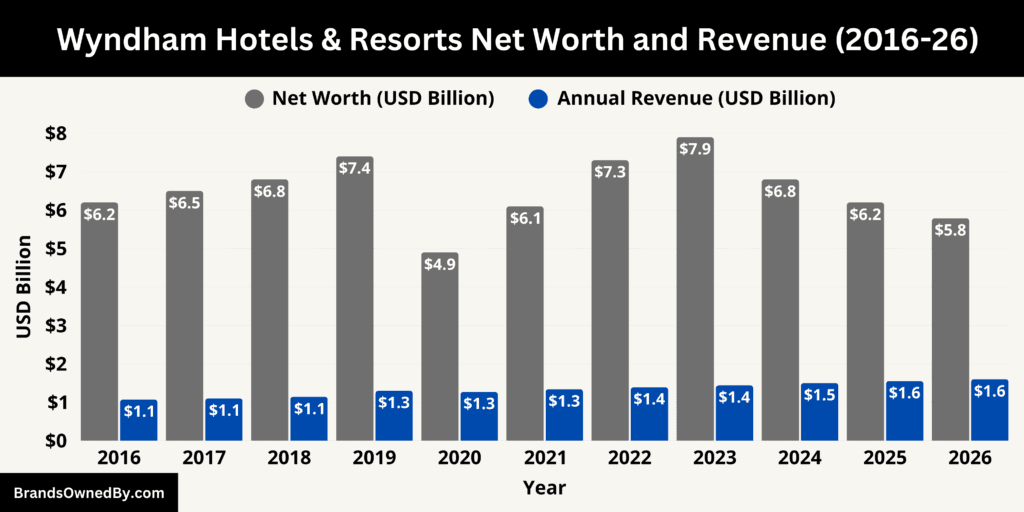

As of January 2026, Wyndham Hotels & Resorts generated approximately $1.6 billion in annual revenue and had a net worth (market capitalization) of about $5.79 billion. These figures reflect Wyndham’s position as a pure-play hotel franchising company with limited asset ownership and a highly scalable revenue model. The valuation is driven less by physical assets and more by brand strength, franchise contracts, and recurring fee-based income.

Revenue Breakdown by Source (2026)

Wyndham’s revenue in 2026 is concentrated in three primary fee-based streams, each tied directly to franchised hotel activity.

Franchise Royalties and License Fees

The largest revenue contributor is franchise royalty income. In 2026, this segment generated approximately $950–$1,000 million, accounting for roughly 60–62% of total revenue. These fees are charged as a percentage of room revenue generated by franchised hotels across Wyndham’s global system. The scale of this revenue is driven by Wyndham’s large footprint in economy and midscale segments, where room-night volume is high even if individual room rates are lower.

Marketing, Reservation, and Technology Fees

The second-largest revenue stream comes from mandatory marketing, reservation, and system fees paid by franchisees. In 2026, this category generated approximately $430–$460 million, representing about 27–29% of total revenue. This revenue is tied to Wyndham’s centralized reservation systems, brand marketing funds, digital booking platforms, and distribution infrastructure. These fees are contractually required and recur regardless of hotel ownership changes, making them one of the most stable revenue sources.

Ancillary Franchise Services and Other Fees

The remaining $150–$180 million in revenue came from ancillary services. These include training programs, brand transition fees, loyalty program participation fees, and other support services provided to franchisees. While smaller in absolute terms, this segment benefits from new hotel openings, brand conversions, and international expansion activity.

Importantly, zero revenue is derived from owned hotel operations or room sales. This differentiates Wyndham from asset-heavy hotel operators and explains why revenue growth closely tracks franchise expansion rather than capital investment.

Net Worth and Market Capitalization (January 2026)

Wyndham Hotels & Resorts’ net worth of $5.79 billion in January 2026 reflects the total market value of its outstanding shares. At that time, the company had approximately 81–82 million shares outstanding, implying an average share price in the low $70 range.

This valuation is primarily supported by:

- Contracted franchise agreements with long durations.

- Predictable, recurring royalty income.

- Low capital expenditure requirements.

- High conversion of revenue to operating income.

Unlike hotel owners, Wyndham’s valuation is not tied to property values or real estate appreciation. Instead, the market prices the company based on expected future cash flows from franchise fees and systemwide room revenue growth.

Relationship Between Revenue and Valuation

In 2026, Wyndham’s $1.6 billion revenue base supported a $5.79 billion market capitalization, implying a revenue multiple of roughly 3.6x. This multiple is consistent with asset-light franchising businesses rather than hotel operators that own physical properties.

The valuation reflects moderate growth expectations rather than aggressive expansion assumptions. While Wyndham continues to add hotels globally, the economy and midscale focus results in steady but incremental revenue growth. Investors value the predictability of the revenue streams more than rapid top-line acceleration.

Because operating costs scale slowly relative to revenue, a large portion of incremental revenue flows through to operating income. This structural efficiency is the core reason Wyndham maintains a multi-billion-dollar valuation despite not owning hotel real estate.

Financial Position in Practical Terms

In practical terms, Wyndham’s financial model in 2026 can be summarized as follows. Every new franchised hotel adds royalty and system fee revenue with minimal incremental cost. The company does not fund construction, renovations, or hotel staffing. Capital is instead allocated to technology platforms, brand marketing, and loyalty systems.

The $5.79 billion net worth, therefore, represents the market’s assessment of Wyndham’s franchise contracts, brand portfolio, and long-term fee generation capacity rather than tangible assets. This makes Wyndham less exposed to property market volatility but more sensitive to travel demand trends and franchisee performance.

Brands Owned by Wyndham Hotels & Resorts

As of 2026, Wyndham Hotels & Resorts owns and operates a broad portfolio of hotel brands, loyalty platforms, and franchising entities that span economy, midscale, upper-midscale, upscale, extended-stay, and soft-brand segments.

Below is a list of the major brands owned by Wyndham Hotels & Resorts:

| Brand / Entity | Segment | Primary Target Guests | Geographic Presence | Strategic Role Within Wyndham |

|---|---|---|---|---|

| Wyndham Hotels & Resorts (Core Brand) | Upper-midscale / Upscale | Business travelers, conference guests, leisure travelers | Global | Flagship brand that anchors Wyndham’s higher-end positioning while remaining franchise-driven. |

| Wyndham Grand | Upscale | Premium leisure travelers, destination stays | International gateway cities and resorts | Enables participation in upscale markets without hotel ownership or luxury real estate exposure. |

| Ramada by Wyndham | Midscale / Upper-midscale | Business and leisure travelers | Strong international footprint | One of Wyndham’s most recognized global brands; key driver of overseas expansion and conversions. |

| Days Inn by Wyndham | Economy | Value-focused travelers, families | North America and select global markets | High-volume economy brand contributing significantly to systemwide room count and royalty income. |

| Super 8 by Wyndham | Economy | Roadside travelers, budget guests | North America, China, Europe | Highly standardized, cost-efficient brand supporting rapid franchise scalability. |

| La Quinta by Wyndham | Upper-midscale | Business travelers and families | Primarily North America, expanding globally | Strengthens Wyndham’s higher-quality midscale offering with strong brand recognition. |

| Wingate by Wyndham | Midscale | Corporate and weekday business travelers | North America and select markets | Focuses on work-friendly amenities and business-centric locations. |

| Microtel by Wyndham | Midscale (compact) | Urban and value-oriented travelers | North America and international markets | Efficient design lowers development costs and supports dense urban expansion. |

| Baymont by Wyndham | Midscale | Families and leisure travelers | United States | Bridges the gap between economy and upper-midscale brands in suburban and highway locations. |

| Hawthorn Suites by Wyndham | Extended stay | Long-term business travelers, relocations | Global | Addresses stable long-stay demand with residential-style accommodations. |

| ECHO Suites Extended Stay by Wyndham | Extended stay (value) | Workforce housing, long-term guests | Primarily North America | Newer brand targeting affordable extended-stay demand with simplified operations. |

| AmericInn by Wyndham | Midscale | Regional and domestic travelers | United States (Midwest-focused) | Strong regional brand with loyal customer base and consistent performance. |

| Travelodge by Wyndham (Licensed Markets) | Economy | Budget travelers | UK, Europe, parts of Asia | Expands Wyndham’s economy presence through licensing without asset ownership. |

| Trademark Collection by Wyndham | Soft brand | Independent hotel guests | Global | Conversion-focused brand allowing independents to access Wyndham systems while retaining identity. |

| Registry Collection Hotels | Upscale soft brand | Boutique and experiential travelers | Global resorts and lifestyle destinations | Enables entry into boutique and lifestyle segments without standardized branding constraints. |

| Wyndham Rewards | Loyalty platform | Repeat and multi-brand travelers | Global | Core retention engine driving direct bookings, repeat stays, and cross-brand demand. |

| Central Reservation & Technology Platforms | Franchise infrastructure | Franchisees and hotel operators | Global | Powers bookings, distribution, loyalty integration, and operational efficiency across all brands. |

| Franchise & Brand Management Entities | Operating units | Franchise owners and developers | Global | Enforces brand standards, training, marketing, and franchise compliance. |

Wyndham Hotels & Resorts (Core Brand)

The Wyndham Hotels & Resorts core brand operates in the upper-midscale to upscale segment and serves as the company’s namesake offering. Properties under this brand are typically located in urban centers, resort destinations, and key business hubs.

The brand emphasizes full-service accommodations, meeting and event spaces, upgraded room standards, and on-site dining options. It plays a strategic role in anchoring Wyndham’s higher-end brand perception while remaining franchise-driven rather than owner-operated.

Wyndham Grand

Wyndham Grand represents the company’s premium hospitality tier. These hotels are positioned as destination properties and are often located in major international cities, resort areas, and high-profile travel markets. The brand focuses on elevated design, experiential stays, and personalized service. Wyndham Grand allows the company to compete in upscale markets without transitioning into luxury ownership, preserving its asset-light strategy.

Ramada by Wyndham

Ramada is one of Wyndham’s most globally distributed brands. It operates primarily in the midscale and upper-midscale segments and has a particularly strong presence outside North America. Ramada hotels are positioned as reliable, full-service accommodations for business and leisure travelers. The brand’s international recognition makes it a preferred choice for conversions in emerging and secondary markets.

Days Inn by Wyndham

Days Inn is a cornerstone economy brand within Wyndham’s portfolio. It focuses on affordability, consistency, and wide geographic availability. Properties are commonly found along highways, suburban areas, and regional travel corridors. Days Inn generates high room-night volumes and contributes significantly to Wyndham’s overall system size, making it a key driver of royalty revenue.

Super 8 by Wyndham

Super 8 is designed for budget-conscious travelers and roadside lodging demand. The brand is known for standardized design, simple amenities, and cost-efficient development. Super 8 has a substantial footprint in North America and China, where it has become one of the most recognized international economy hotel brands. Its scalability makes it attractive to franchisees seeking lower investment thresholds.

La Quinta by Wyndham

La Quinta operates in the upper-midscale segment and appeals to both business and leisure travelers. The brand emphasizes modern design, complimentary breakfast, and convenient access to commercial and travel corridors. La Quinta strengthens Wyndham’s presence in higher-quality midscale lodging and plays a central role in domestic expansion and brand upgrades.

Wingate by Wyndham

Wingate is a business-focused midscale brand. It caters to corporate travelers who prioritize work-friendly amenities such as meeting rooms, enhanced connectivity, and functional room layouts. Wingate hotels are often located near office parks, airports, and regional business centers. The brand supports Wyndham’s strategy to capture weekday business demand.

Microtel by Wyndham

Microtel is built around efficient space utilization and modern, compact room design. The brand targets urban markets and price-sensitive travelers who value functionality over size. Development costs are lower compared to traditional midscale hotels, making Microtel a strategic option in dense cities and international markets.

Baymont by Wyndham

Baymont serves the midscale leisure and family travel segment. The brand emphasizes comfort, approachable pricing, and accessible locations. Properties are typically located near highways, suburban areas, and secondary markets. Baymont complements Wyndham’s economy brands by offering an upgraded experience without entering upper-midscale pricing.

Hawthorn Suites by Wyndham

Hawthorn Suites is Wyndham’s established extended-stay brand. It targets guests staying for longer durations, including business travelers, consultants, and relocating families. Properties offer larger rooms, kitchen facilities, and residential-style amenities. Hawthorn strengthens Wyndham’s exposure to long-stay demand, which tends to be more stable than short-term leisure travel.

ECHO Suites Extended Stay by Wyndham

ECHO Suites is a newer extended-stay concept introduced to address demand for affordable long-term accommodations. The brand focuses on simplicity, standardized layouts, and cost control. It is designed for workforce housing, project-based stays, and value-oriented long-term guests. ECHO Suites reflects Wyndham’s strategic response to extended-stay market growth.

AmericInn by Wyndham

AmericInn is a midscale brand with strong regional roots in the United States, particularly in the Midwest. The brand emphasizes quiet comfort, solid construction, and dependable service. AmericInn appeals to regional travelers and franchise owners seeking strong brand recognition in local markets.

Travelodge by Wyndham (Licensed Markets)

Travelodge operates under the Wyndham portfolio in select international markets. The brand is positioned in the economy segment and is especially recognized in the United Kingdom and parts of Europe. Wyndham uses licensing and brand management arrangements to expand Travelodge without owning physical assets.

Trademark Collection by Wyndham

Trademark Collection is a soft-brand designed for independent hotels. It allows properties to retain their individual character while accessing Wyndham’s reservation systems, loyalty program, and distribution channels. This brand supports rapid portfolio expansion through conversions rather than new construction.

Registry Collection Hotels

Registry Collection is Wyndham’s boutique and lifestyle soft-brand offering. It targets upscale independent resorts and hotels with distinctive identities. Properties maintain local design and service concepts while benefiting from Wyndham’s global infrastructure. Registry Collection helps Wyndham participate in experiential and lifestyle travel trends.

Wyndham Rewards

Wyndham Rewards is wholly owned and operated by Wyndham Hotels & Resorts. It is one of the largest hotel loyalty programs globally by property count. The program drives direct bookings, repeat stays, and cross-brand guest engagement. Wyndham Rewards is a core strategic asset that supports revenue stability and brand loyalty.

Franchise, Technology, and Brand Management Entities

Wyndham owns and operates internal entities responsible for franchise services, technology platforms, brand standards, training, and marketing. These entities manage reservations, digital systems, loyalty integration, and franchise compliance. While not separate public companies, they form the operational backbone of Wyndham’s franchising ecosystem.

Final Thoughts

Wyndham Hotels & Resorts operates in a way that reflects its size, history, and long-term strategy rather than the presence of a single controlling owner. For readers asking who owns Wyndham Hotels & Resorts, the answer lies in its public ownership and the influence of large institutional shareholders that shape governance through voting power and oversight.

The company itself is built around brand ownership, franchising, and centralized platforms, not hotel real estate. That structure has allowed Wyndham to scale globally, adapt to changing travel patterns, and maintain consistency across dozens of brands.

Ownership, leadership, and operations work together to support a business designed for steady growth and durability rather than short-term control or asset accumulation.

FAQs

Who are Wyndham Hotels owned by?

Wyndham Hotels & Resorts is publicly owned. Its shares are held primarily by large institutional investors, led by Capital Research & Management Company, The Vanguard Group, and BlackRock. No single shareholder owns or controls the company outright.

Who owns Wyndham Hotels chain?

The Wyndham Hotels chain is owned by Wyndham Hotels & Resorts, a publicly traded hotel franchising company. Individual hotels are typically owned and operated by independent franchisees, not by Wyndham itself.

Who is Wyndham Hotel affiliated with?

Wyndham Hotels & Resorts operates independently. It is not affiliated with Marriott, Hilton, Hyatt, or IHG. Wyndham maintains its own brand portfolio, loyalty program, and franchising platform.

What are the major brands owned by Wyndham Hotels?

Major Wyndham-owned brands include Wyndham Hotels & Resorts, Wyndham Grand, Ramada, Days Inn, Super 8, La Quinta, Wingate, Microtel, Baymont, AmericInn, Hawthorn Suites, ECHO Suites Extended Stay, Trademark Collection, Registry Collection Hotels, and Travelodge in select markets.

When was Wyndham Hotels & Resorts founded?

Wyndham Hotels & Resorts traces its origins to 1981, when the first Wyndham hotel was established. The company became an independent, standalone public entity in 2018 following a corporate spin-off.

Which country is Wyndham from?

Wyndham Hotels & Resorts is an American company. It is headquartered in the United States and operates globally through franchised hotels in dozens of countries.

Who is the chairman of Wyndham?

The chairman of Wyndham Hotels & Resorts is Stephen P. Holmes, who also previously served as CEO during earlier phases of the company’s corporate evolution.

Is Wyndham bigger than Hilton?

By hotel count, Wyndham is larger than Hilton. Wyndham is the world’s largest hotel franchisor by number of properties. Hilton, however, generates higher revenue and operates more hotels in the luxury and upper-upscale segments.

What is Wyndham called now?

The company is officially called Wyndham Hotels & Resorts. This name has been in use since the hotel business became a standalone company in 2018.

Is Wyndham part of Hyatt or Hilton?

No. Wyndham Hotels & Resorts is not part of Hyatt or Hilton. It is a separate hospitality company with its own brands, management, and ownership structure.

Who did Wyndham merge with?

Wyndham’s corporate history includes earlier mergers through predecessor companies, most notably the formation of Cendant Corporation in the 1990s. However, Wyndham Hotels & Resorts itself did not merge with another hotel group in recent years and has operated independently since 2018.

Is Wyndham owned by Marriott?

No. Wyndham Hotels & Resorts is not owned by Marriott. The two companies are direct competitors in the global hotel industry.

Is Wyndham owned by Hilton?

No. Wyndham Hotels & Resorts is not owned by Hilton and operates independently.

What hotels are part of Wyndham?

Hotels under the Wyndham portfolio include Wyndham Hotels & Resorts, Wyndham Grand, Ramada, Days Inn, Super 8, La Quinta, Wingate, Microtel, Baymont, AmericInn, Hawthorn Suites, ECHO Suites, Travelodge (licensed markets), Trademark Collection, and Registry Collection Hotels.

Is Wyndham part of IHG?

No. Wyndham Hotels & Resorts is not part of IHG. Both companies operate separate hotel brand portfolios and loyalty programs and compete independently in the global hospitality market.